Of Tender Offers and Buybacks

Diageo tender offer kicks off as Centum's buyback gets shareholder approval

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the Diageo tender offer, and Centum's buyback, and a wrap-up from the capital markets.Our newsletter this week is brought to you by:

Branch Microfinance Bank. Branch Microfinance Bank was founded in 2015 by Daniel Jung and Matt Flannery and has operations in India, Nigeria, Kenya & Tanzania. It has disbursed over $600M to 5M borrowers with its app being downloaded over 21M times.

First off, enjoy a dose of our weekly business news in memes brought to you by Branch Microfinance Bank:

Diageo Tender Offer

Sell to Us: Diageo’s Tender Offer to East African Breweries (EABL) shareholders, announced on 14th October 2022, officially kicked off this week. Diageo, through its wholly-owned indirect subsidiary, Diageo Kenya Limited, is seeking to increase its stake in EABL from its current 50.03% to a maximum of 65%.

Mwango Explainer: A tender offer is a public bid to all shareholders of a company requesting them to sell their shares at a specific price over a certain period. The tender offer price has to be higher than the company’s prevailing stock price just before the tender offer is made in order to incentivize the shareholders to sell.

Offer Details: The tender is directed to all EABL shareholders with an offer price of KES 192 per share. The last time the share price traded at or near these levels was around February 2020. The maximum number of shares that are subject to the tender offer is 118.4M. There are 2 offer periods, with the first running from 6th February to 24th February and the second one running from 27th February to 17 March 2023.

“EABL shareholders who choose to tender shares during the first offer period will enjoy the benefit of having their shares included in the larger pool allocated for shares sold during the first closing. Should the Tender Offer be oversubscribed, these shareholders will likely be able to sell a greater proportion of their shares than those shareholders who only apply later, as part of the second offer period”

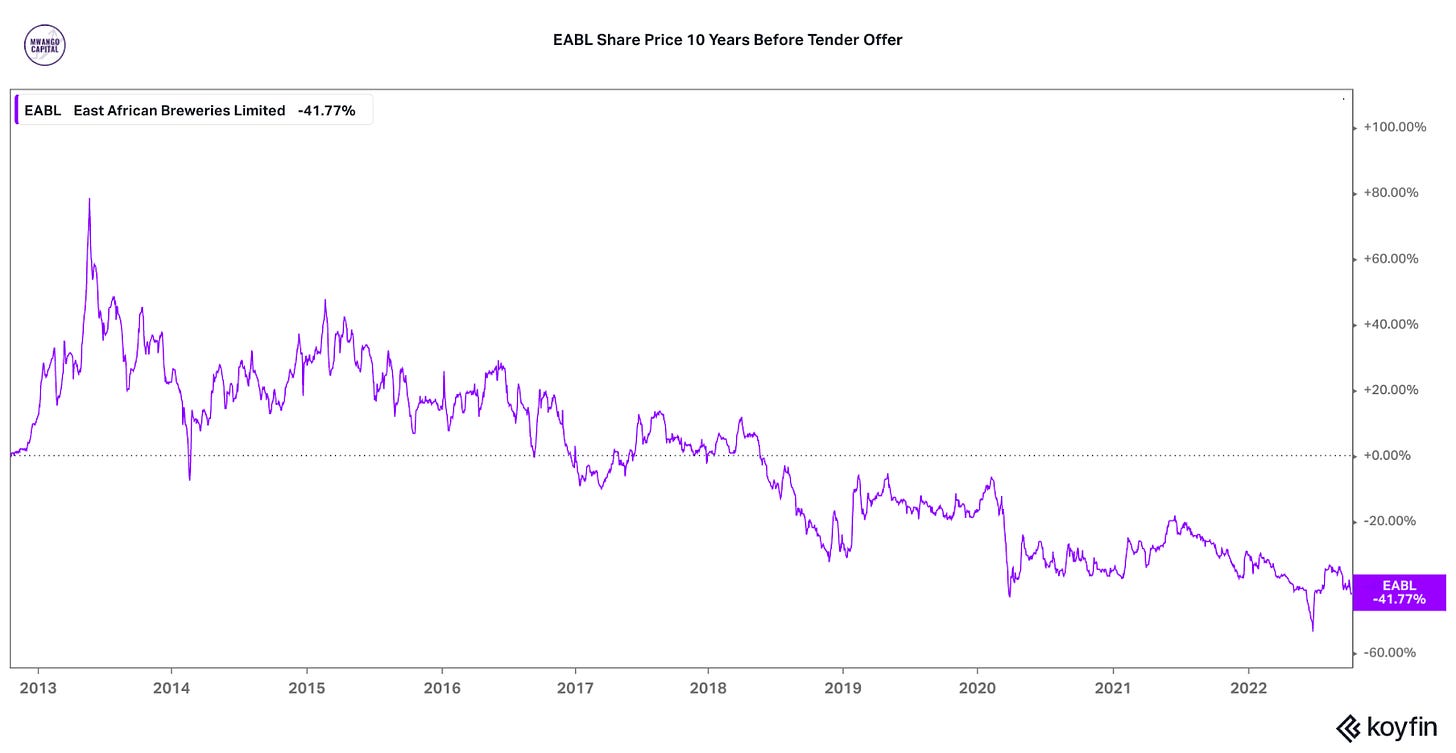

Share Price Reaction: The motivation is that Diageo sees the EABL as undervalued with the share price down a whopping 42% in the 10 years to the tabling of the tender offer last year. This is despite the company almost doubling its annual revenues, net income and dividends over the same period. The share price was up 1.12% last week as the tender offer period started.

Centum Buybacks

Share Repurchases: The company got 98.6% shareholder approval to conduct a buyback. The approval came after the company held an extraordinary general meeting on 3rd February 2023. The move will allow shareholders to cash in on their investment as the company’s listed ordinary share prices have been on a sustained deterioration over the last 3 years from a price of KES 31.50 per share in September 2019 to approximately KES 7.98 as of the buyback reference rate.

Details: The maximum number of shares to be acquired in the buyback will be 66,544,178 listed ordinary shares representing ~10% of the company’s issued share capital. All ordinary shares acquired will be held as treasury Ordinary shares. They will be financed out of profits available for distribution as per the company audited financial statements as of 31st March 2022 (retained earnings of KES 21.3 billion, cash and cash equivalents of KES 1.0 billion). This is a voluntary exercise and there is no obligation on shareholders to participate in the buyback. The minimum price will be KES 0.50 and a maximum of KES 9.03 per share.

Mwango Explainer: The Treasury Shares will remain admitted to trading on the relevant stock exchanges but will be dormant and not trading (and held in the Company’s CDSA) in accordance with the applicable regulations

So Far: With total trades on the stock this week being around 1.88M shares, Centum purchased around 1.22M shares. This represented 1.83% of the maximum 66M shares that the company wants to repurchase.

Boosting Holdings: One key shareholder who has been a happy buyer of Centum shares is Billionaire John Kibunga even as the share price has declined:

Capital Markets Wrap

The NSE: In Week 6 of 2023, HF Group was the top gainer, up 9.6%, while TransCentury was the top loser, down 10.2%. The NSE 20 and NSE 25 indices appreciated by a marginal 0.5% and 0.1% to 1,671.9 and 3,182.7 points, respectively while the NSE All Share Index fell 0.8% to 128.3 points. Equity turnover increased by 61.9% to KES 1.4B while bonds turnover was down by 11.3% to KES 10.2B.

T-Bills: In the short-term public debt markets last week, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.601%, 10.042%, and 10.603% respectively. The total amount on offer was KES 24B with the CBK accepting KES 40.6B of the received bids. The acceptance rate was 169.3%.

T-Bonds: Across re-opened FXD1/2017/1 and new Ten Year FXD1/2023/10 Treasury bonds, total bids received at cost were KES 8.3B and KES 11.5B. The CBK accepted KES 7.5B and KES 9.3B bringing the weighted average rate of accepted bids to 13.875% and 14.151%, respectively. On aggregate, the performance and acceptance rates were 39.09% and 33.5%, respectively.

Eurobonds: Last week, the yields edged higher week-on-week across all 6 outstanding papers.

KENINT 2034 recorded the largest gain, increasing by 25.4 basis points (bps) week-on-week to 9.78%.

All instruments except KENINT 2034 were down on a Year-To-Date basis. KENINT 2024 fell the most, by 141 bps to 11.191% while KENINT 2034 was up by 12.5 bps to 9.78%.

KENINT 2024 led price gains year-to-date, rising 2.3% to 94.669. On a week-on-week basis, prices fell across the board led by KENINT 2037 and KENINT 2048 at -1.8% in both cases.

Market Gleanings:

💵 Where Are The Dollars? | There is a problem in the market. There are not enough dollars to meet demand and the NCBA CEO acknowledged it this week in an interview on NTV’s Business Redefined. With the dollar demand-supply gap still an issue, one can only expect that banks will be feasting with high forex trading income when they report their Q4 and Full year 2022 results next month::

“So, I think there has been very strong sentiment about why the interbank is not working. The reality is the interbank is the golden pricing of the dollars, that’s what we call the official rate. The problem is today I have a very large customer book who are waiting to be supplied with dollars. I have no extra dollars to sell to my counterparts in the other bank and I’m sure they have the same problem where the demand book for their own customers is quite high and therefore, they don’t have dollars to sell to me to sell to my customers. So, until such a time that the supply of dollar stabilizes, until such a time that the demand book is met, it’s going to be very difficult to have an interbank market.”

NCBA CEO

🆕 New NSSF Rates | The Court of Appeal 2 weeks ago quashed a ruling by a lower court objecting to the new NSSF rates. After the ruling, the NSSF [ @NSSF_ke ] has moved swiftly to issue notices to employers to start complying with the new, higher NSSF rates effective immediately. Treasury CS had to say about this:

"The idea to increase NSSF savings out will accumulate savings & accelerate asset accumulation as soon as it is implemented. Once it is practically possible, it should urgently start."

💰 Saccos 2022 Results | A few Saccos have reported their 2022 results and here is a brief summary of them:

Harambee Sacco: Their Net interest income was up 23% to KES 2.4B while the net surplus was up an impressive 22.5% to KES 444.6M. The Sacco’s total assets were 7% to hit KES 37B. They are paying 8% as interest on member deposits of 8% [2021:7%] while paying 10% as dividends rates on members' share capital [2021: 8%].

Nation Sacco: Net interest income was up 22.5% to KES 217.1M while the net surplus grew 40.6% to KES 112.6M. Their total assets were up 16.8% to KES 3B. The interest on member deposits was 9.5% [2021: 9%] while the dividend rate on members’ share capital was 18% [2021: 15%].

🧐 A Default By Another Name? | Bank of Uganda is asking holders of a domestic bond maturing in April 2023 to convert their holdings into longer-dated bonds. Commenting on this, S&P Global sees this as only suggesting “heightened medium-term fiscal and monetary risks associated with rising debt servicing costs.”

“On Wednesday 8th February 2023, BoU will offer a bond switch/conversion auction for current holders of Treasury bond number UG0000001244 11.000% 13-APRIL-2023 to switch into the existing on-the-run bonds. The offer will only be for willing holders of the source bond UG0000001244 11.000% 13-APRIL-2023 to voluntarily exchange part or their entire stock of the existing bond for another preferred bond (destination bond) by the same issuer.”

Bank of Uganda