👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover FY 2022 bank earnings, the government-to-government oil deal, and the capital markets this week.First off, enjoy a dose of our weekly business news in memes:

Review of Bank Earnings

Interest Income Mapping: In FY 2022, KCB Group reported KES 86.7B in Net Interest Income (NII), up 11.5% year-on-year, with Co-operative Bank of Kenya registering KES 45.5B in NII, a growth of 10.9%. Absa Bank Kenya saw its NII edge upwards by 31.8% to KES 32B, while StanChart’s NII hit a milestone by breaching the KES 20B mark to reach KES 22.2B, a growth of 18.1%. Stanbic registered the highest growth in NII [+31.8%] across the banks that have reported so far, to KES 18.9B.

Forex Trading Income: With the current challenges around the sourcing of dollars in the economy, banks are making huge profits from their FX trading operations. In the current operating period, KCB Group had the highest growth in FX trading income at 69.2% to reach KES 11.1B. Stanbic had the second-largest absolute number at KES 8.6B, a 36.8% growth. StanChart recorded KES 5.9B, up 58.4%, while Absa Bank Kenya and Stanbic Bank Kenya were up 59.7% and 36.8% to reach KES 6.6B and KES 8.6B, respectively.

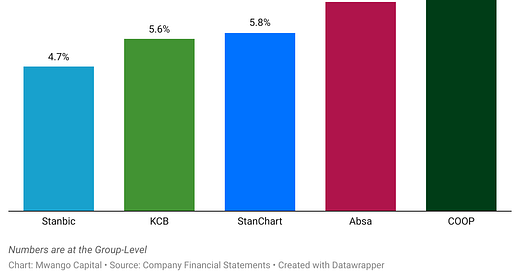

Investment in Securities: Cooperative Bank had the highest share of total assets invested in investment securities at 28.8%. In absolute numbers, KCB had the largest pile of investment securities on its balance sheet at KES 266.7B, down 1.5% from FY 2021. Co-operative Bank had the highest share of its balance sheet deployed in securities at 28.8%, followed by StanChart at 27.5%, Stanbic at 20.9%, Absa at 19%, and KCB at 17.2%. Stanbic recorded the highest year-on-year increase in holdings of securities at 40.3% while Co-operative Bank recorded the lowest growth at -5.7%.

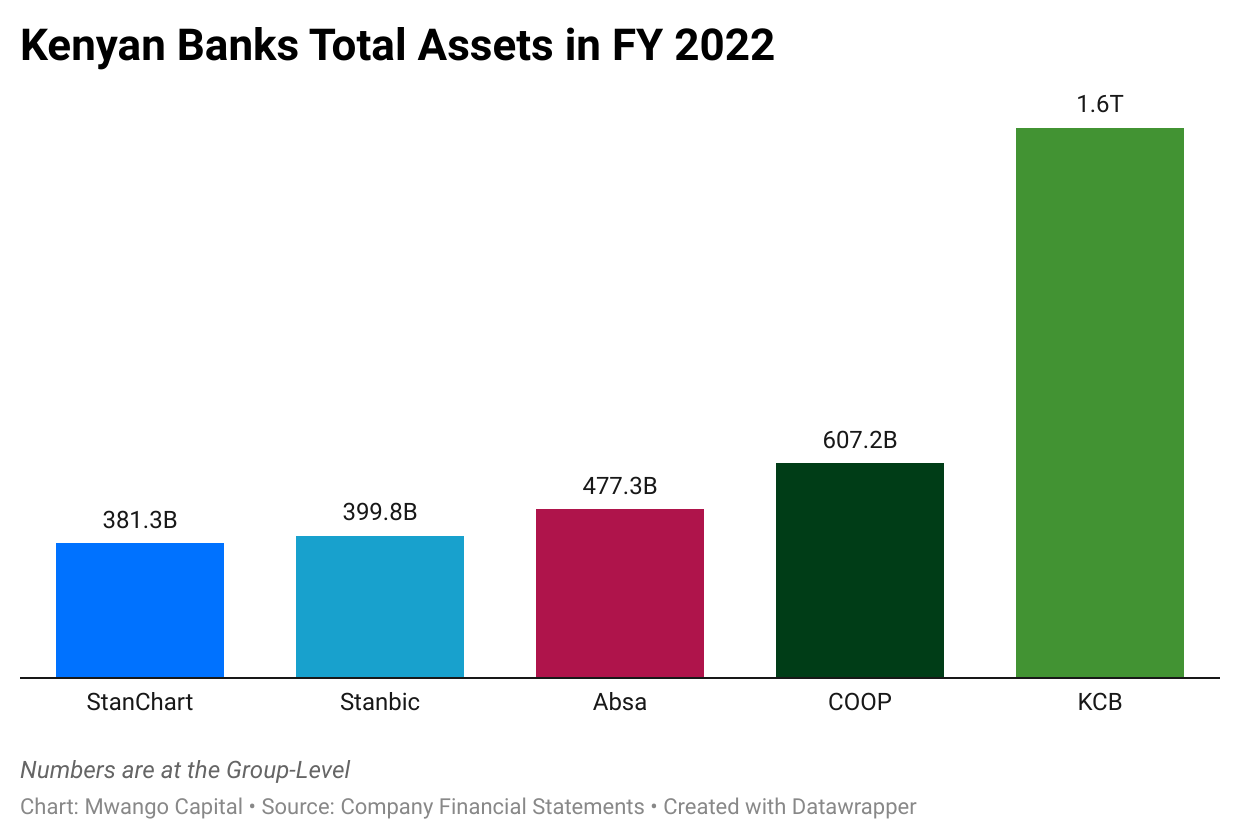

Asset Base: KCB’s asset size crossed the KES 1.5T mark to reach KES 1.55T, a 36.4% rise, recording the largest asset base in the banking industry in Kenya as well as the highest change as compared to last year across the banks that have reported so far. Cooperative Bank recorded marginal growth in its gross assets, up by 4.7%, to stand at KES 607.2B while Absa’s asset size inched higher by 11.3% to KES 477.3B. Stanbic bank’s asset base was up by 21.6% to reach KES 400B, the highest year-on-year change the bank has recorded since 2013 when its total assets grew by 26%. StanChart’s base of assets reached KES 381.3B, a growth of 13.9%.

Loan Loss Provisions: In absolute terms, KCB had the highest Loan Loss Provisions in the operating period at KES 13.2B, up 1.68%. StanChart had the least aggregate provisions at KES 1.3B, a 36.2% drop from 2021. Absa Bank Kenya’s provisions were KES 6.5B, up 37.6%, while those from Stanbic edged higher by 95.9% to reach KES 4.9B - equivalent to those recorded in 2020 at the height of the COVID-19 Pandemic.

Profitability: KCB Group posted the largest Net Profit in the operating period at KES 40.8B, a growth of 19.5%. At 34.2%, Absa posted the highest year-on-year increase in its Net Profit position to reach KES 14.6B. StanChart posted KES 12B in Net Income, up 33.3%, marking the first time the bank’s bottom line has crossed the KES 10B mark. Stanbic’s net result for the year was KES 9.1B, a growth of 25.7%. Across the 5 banks that have reported their FY 2022 results so far, the consolidated Net Profit stood at KES 98.6B.

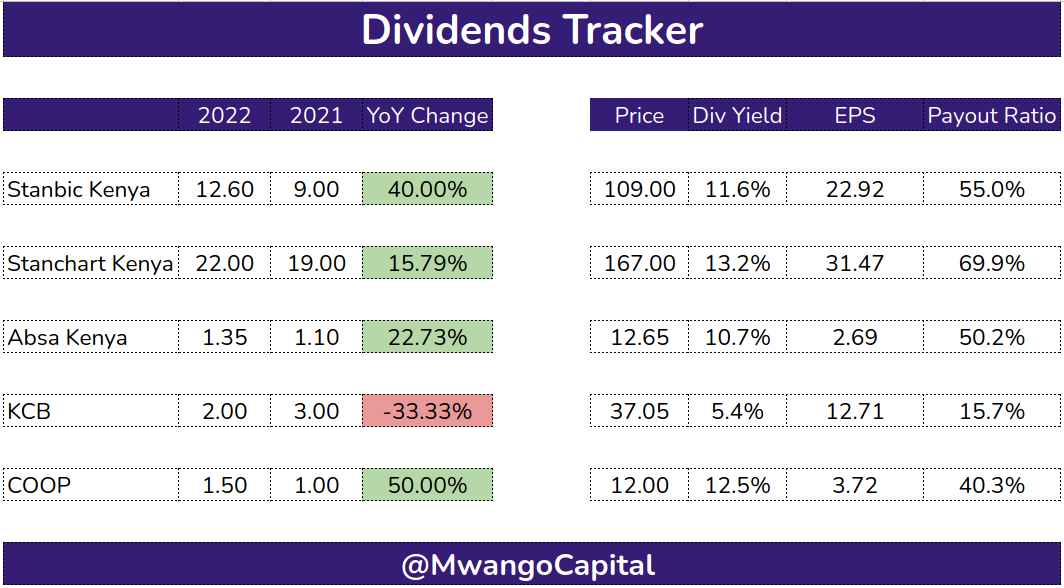

Dividends: KCB Group is the only bank that cut its dividend to return KES 2 per share to shareholders, [2021: KES 3]. Here is what the CFO had to say about the dividend decision:

“We are paying a dividend. It is lower than in 2022 but we are paying a dividend. So at least that’s a good sign. In making this decision, we have to look at the holistic picture and have a long-term view in mind. We invested heavily in acquiring TMB towards the end of last year. We believe commercialization of that acquisition is something we should be able to do in a year, max 15 months. There is some investment that needs to go there. In a very short period of time, the shareholders will actually be seeing an improved dividend payout.”

KCB Group CFO, Lawrence Kimathi

While StanChart’s DPS increased by 15.8% year-on-year, at 69.8%, the payout ratio was the lowest since the 51.2% recorded in FY 2014. Here is what the CFO had to say about the decision around the dividend.

"So what we’ve done is, we got Tier 2 Capital which is $60M in three trenches, which were priced off Libor. We took this to have capital covers. So really we've retained a bit more because we are going to pull out the tier two capital by recalling it and then obviously we must replace it by retaining the tier one. So we recalled the first tranche in December - $20M, and we will recall the rest early this year. We’ve already approved it at the board."

StanChart Kenya CFO, Chemutai Murgor

Stock Market Reaction: Last week, KCB’s share price went from a high of KES 37.05 as of market close on Wednesday, to KES 31 as of market close on Friday, a depreciation of 16%. Below is the share price performance of banking counters that released have released their FY 2022 results so far:

More Results: Other than BK Group Plc which will report on 31st May 2022, other listed Tier I banks are yet to give dates on which they intend to release their results.

Here is a link to a consolidated document containing the financial results of banks that have reported so far.

Gov’t-to-Gov’t Oil Deal

Highlights: Starting next month, the government has changed how it procures fuel to a regime where International Oil Companies (IoCs) will supply petroleum products for 6 months before payment is effected. In the previous regime, an Oil Marketing Company (OMC) that won the tender to import petroleum products would import the products and distribute them to other OMCs for local distribution and supply. The new system aims to reduce the pressure on the US Dollar supply in the country.

“The OMCs will not be looking for the dollars and this will mean that there will be adequate dollars for other sectors and Kenyans as well, The exchange rate will come down from the KES 140 currently, The US dollar requirements by OMCs currently account for about 30% of Kenya’s total US dollar requirements, putting foreign exchange reserves under pressure, causing serious deficiency in the availability of US dollars and the rate at which the US dollar is made available. This has resulted in the depreciation of the Kenya Shilling.”

Energy and Petroleum CS, Davis Chirchir

How the New Mechanism Works: The government will issue Letters of Credit with tenors of 180 days and the identified supplier IoC will get paid in US Dollars. The IoC identified to procure the petroleum products will then nominate OMCs to import the petroleum products on its behalf, and these nominees will work with banks to issue an Irrevocable Letter of Credit to the IoC. Participating OMCs in the Open Tender System will pay the nominated OMC in Kenya Shillings for Super Petrol and Diesel destined for the local market while Kerosene and other cargo in transit will continue to be paid for in US Dollars. The nominated OMC will source US Dollars before the end of the 180 days to meet the requirements of the Letter of Credit.

Here is a link to the entire document with the details of the new arrangement.

Mar/Apr Pump Prices: EPRA has raised the price of Super Petrol by KES 2 to KES 179.3 per litre, while the prices of Diesel and Kerosene have been left unchanged at KES 162 and KES 145.94 per litre, respectively. The price of diesel has been cross-subsidized with that of Super Petrol and the subsidy on Kerosene for the pump cycle has been maintained at KES 23.49 per litre. Notably, the price of Murban Crude Oil per barrel dropped by 11.87% to $80119 in February 2023 [January 2023: $90.9]. According to the regulator, the mean monthly USDKES exchange rate was $133.98, a depreciation of 2.56% [January 2023: $130.64].

Weekly Capital Markets Wrap

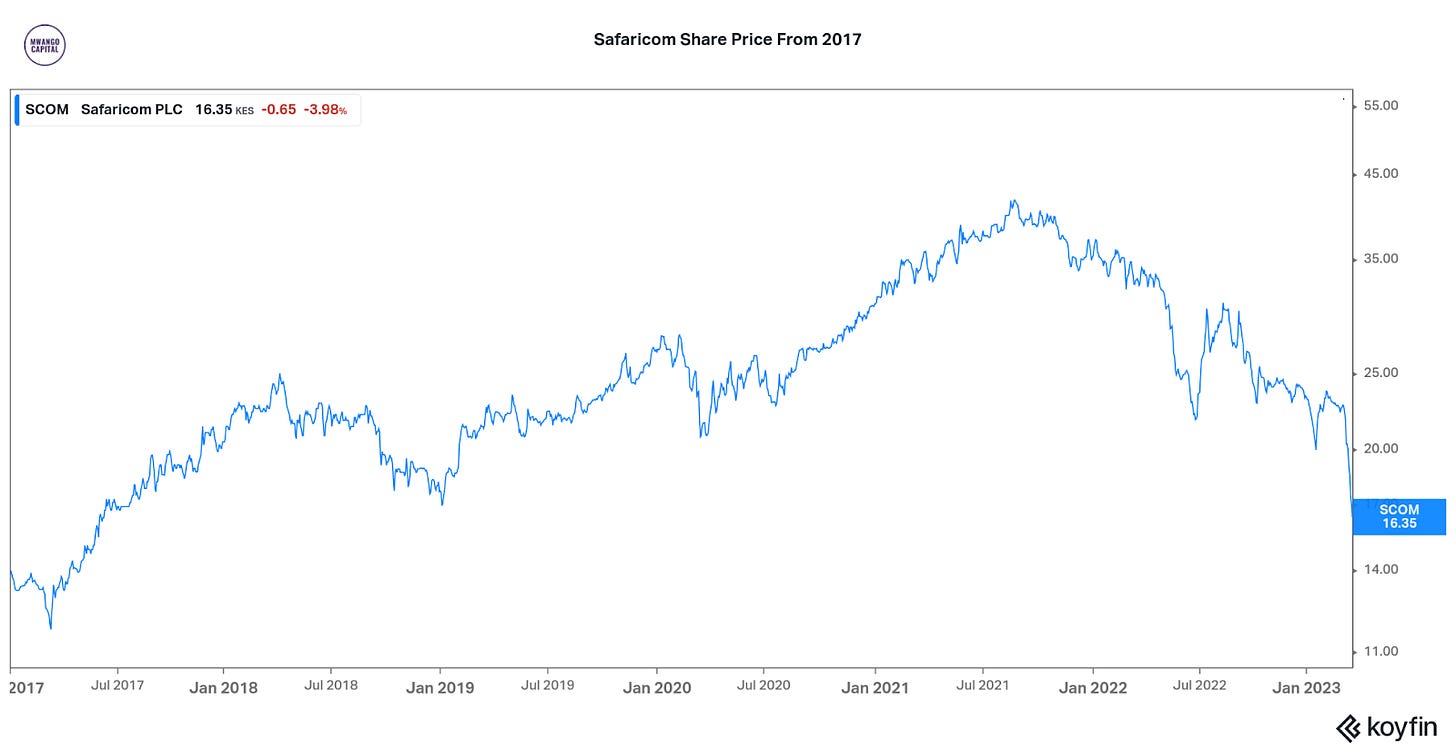

The NSE: In Week 11 of 2023, Olympia was the top gainer, up 8.5% week-on-week to KES 2.68, while Safaricom was the top loser, down 20.6% to KES 16.35, a 69-month low. The NSE 20 and NSE 25 indices fell by 4.9% and 9.7% to 1,520.2 and 2,706.3 points, respectively while the NSE All Share Index fell 6.6% to 103.5 points. Equity turnover was up 93.7% to KES 2.9B while bonds turnover was down 119.5% to KES 18.6B.

T-Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.78%, 10.285%, and 10.777% respectively. The total amount on offer was KES 24B with the CBK accepting KES 28.8B of the received bids. The acceptance rate was 119.94%.

T-Bonds: The CBK has issued a prospectus for Re-opened FXD2/2018/10, FXD1/2022/03 and FXD1/2019/15 with a total amount of KES 20B on offer. The tenors for the instruments are 5.8, 2.1 and 10.9 years, while the coupon rates are 12.502%, 11.766% and 12.857%. The period of sale for FXD2/2018/10 is between 16th March 2023 to 4th April 2023, while that for FXD1/2022/03 and FXD1/2019/15 is between 16th March 2023 and 18th April 2023. Separately, Across the tap sale on IFB1/2023/17 infrastructure bond, total bids received at face value were KES 12.719B. The CBK accepted bids totalling KES 12.7B bringing the weighted average rate of accepted bids to 14.399%. On aggregate, the performance was 63.6%.

Eurobonds: Last week, the yields were up on a week-on-week basis across all 6 outstanding papers.

KENINT 2024 recorded the largest rise, up by 232 basis points (bps) week-on-week to 13.866%, while KENINT 2048 recorded the lowest gain at 96.7 bps. The average increase was 147 bps.

All instruments were up on a year-to-date basis. KENINT 2028 was up the highest at 247bps to 12.782% while KENINT 2024 was up the least, rising by 126.3 bps.

KENINT 2048 led price losses year-to-date, declining 11.9% to 66.271 while KENINT 2024 recorded the least price depreciation, by 0.4% to 92.144. On a week-on-week basis, KENINT 2048 was down the most, by 7.8%, while KENINT 2024 was down by 2.6%, the least across all instruments.

The spike in yields last week saw the paper maturing 2024 reach levels last witnessed in July 2022.

Other Market Gleanings

✂️ | Haircut | Given that Ghana has been restructuring its debt, some banks are taking a hit. Four of South Africa’s top Banks (Standard Bank, FirstRand, Absa, and Nedbank will set provisions of $267M for losses incurred in the impairment of their holdings of Ghanaian bonds. Standard Chartered UK will set aside $160M. Their share prices are all down month-to-date perhaps because of this.

“It is unfortunate where they find themselves. The debt sustainability just wasn’t there and when you are over-geared, you eventually run out of cash and you have to call a default.”

FirstRand CEO Alan Pullinger

🧾 | More Gov’t Appointments | Last week, President William Ruto nominated 50 people to the position of Chief Administrative Secretary (CAS), in what is an expansion from 23 CASs in the previous administration. The compensation structure for the appointees - who are set to undergo vetting in parliament, includes a monthly salary of KES 765K, a KES 10M car grant, a KES 35M mortgage, and KES 10M in in-patient insurance.

🏦 | KMRC Doubles Asset Base | For the year ended 31st December 2022, Kenya Mortgage Refinance Company (KMRC) reported KES 666.5M in Net Interest Income, up 43.6% year-on-year. The asset base more than doubled over the operating period, crossing the KES 20B mark to reach KES 21.4B. The net result for the year inched higher by 63.5% to KES 321.4M.

💰 | Diaspora Remittances | In February 2023, diaspora remittances fell by 3.8% year-on-year to $309.2M, while on a month-on-month basis, the inflows were down 11.5%. The cumulative remittances for the 12 months to February 2023 totalled $4.026B, up 4.8% year-on-year.