ADQ to Invest USD 0.5B in Kenya

The Abu Dhabi investment firm has set up a framework to explore investments in Kenya's economy

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover ADQ’s USD 500M planned investment in Kenya, Sanlam Kenya PLC and TPS Eastern Africa PLC FY 2023 results, and NCBA’s raise of base lending rates.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Pay to any Paybill & Till with MCo-opCash and stand a chance to be among the 100 daily winners of Ksh 1,000.

ADQ’s Planned USD 500M Investment

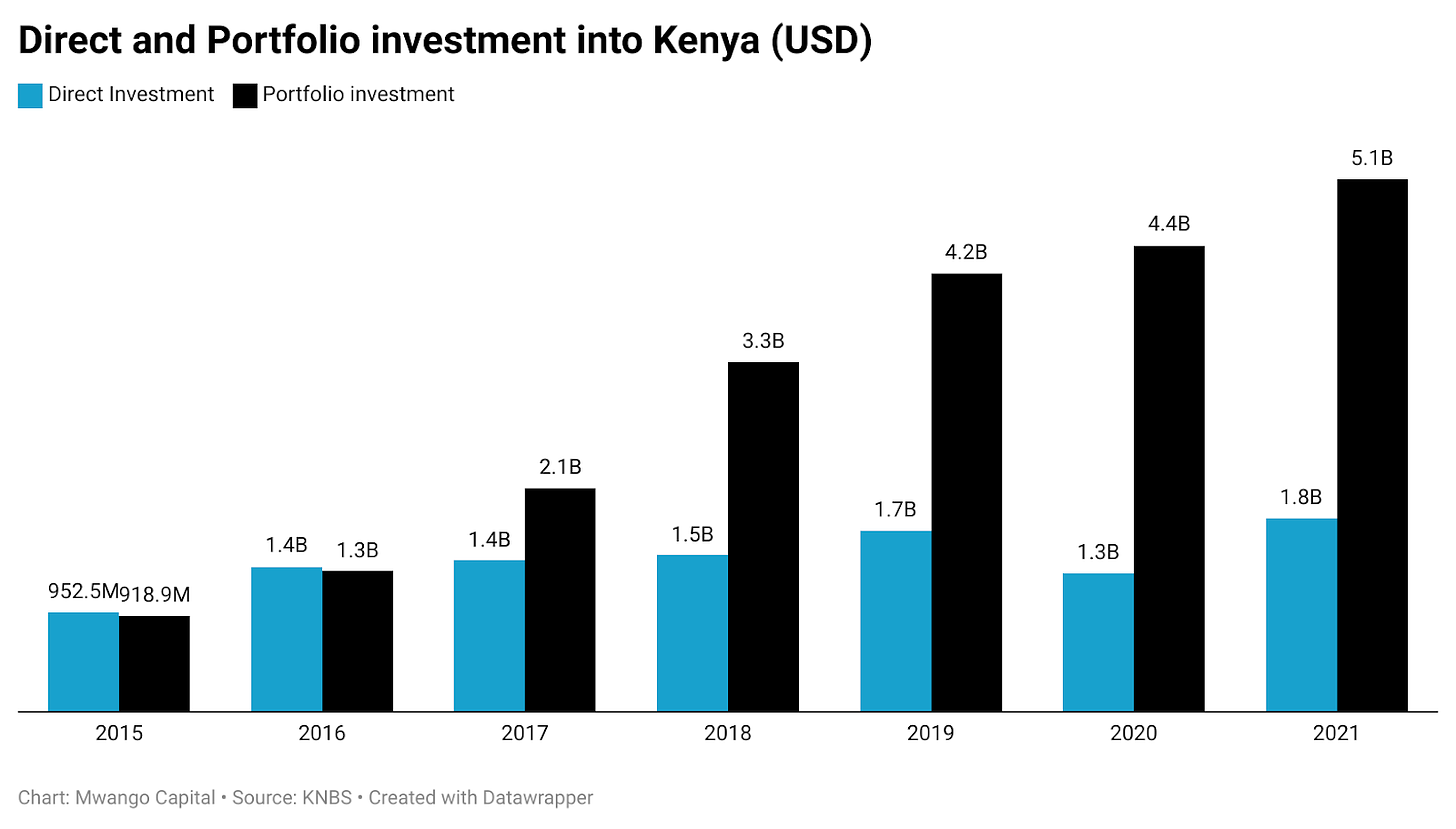

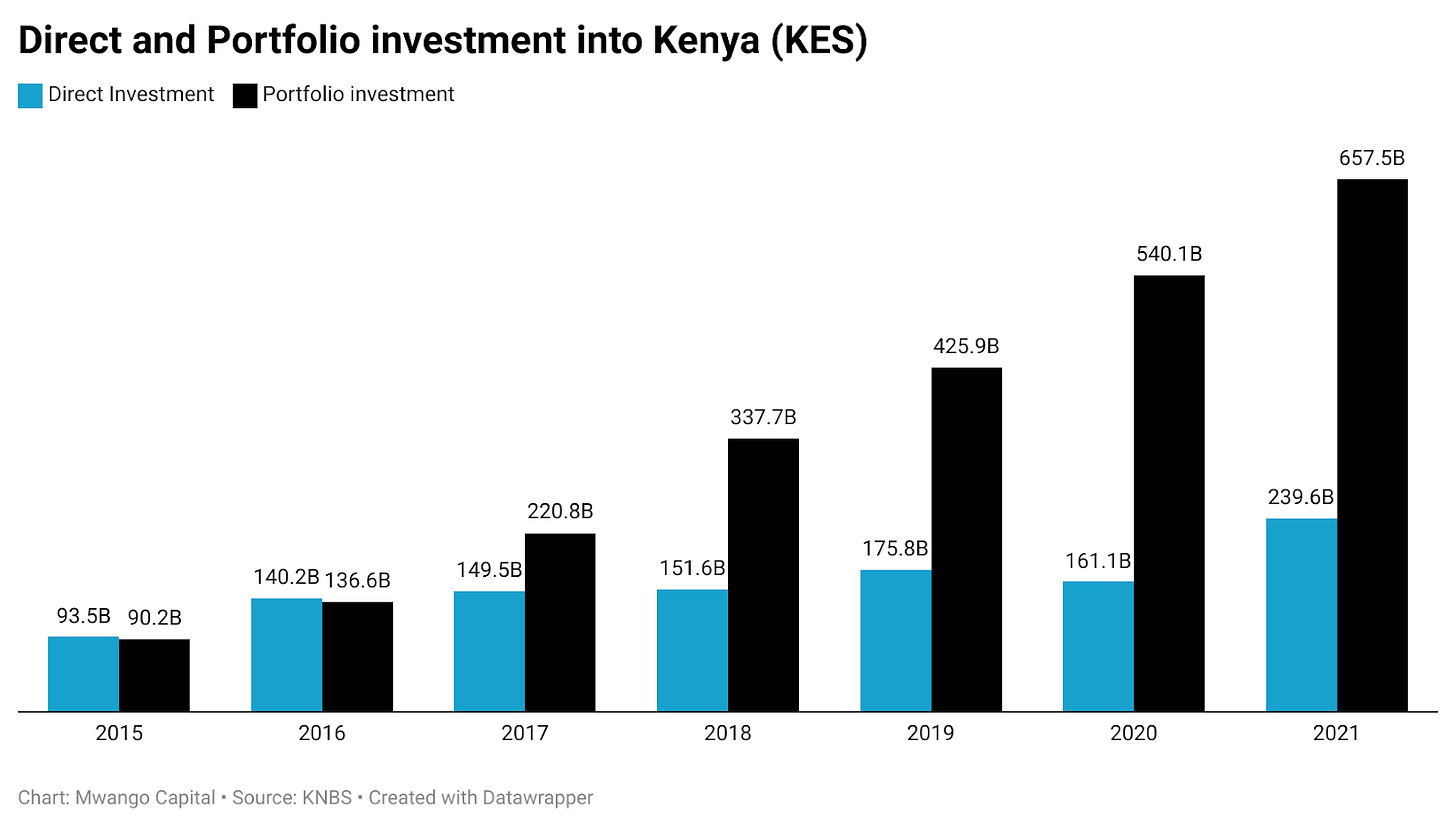

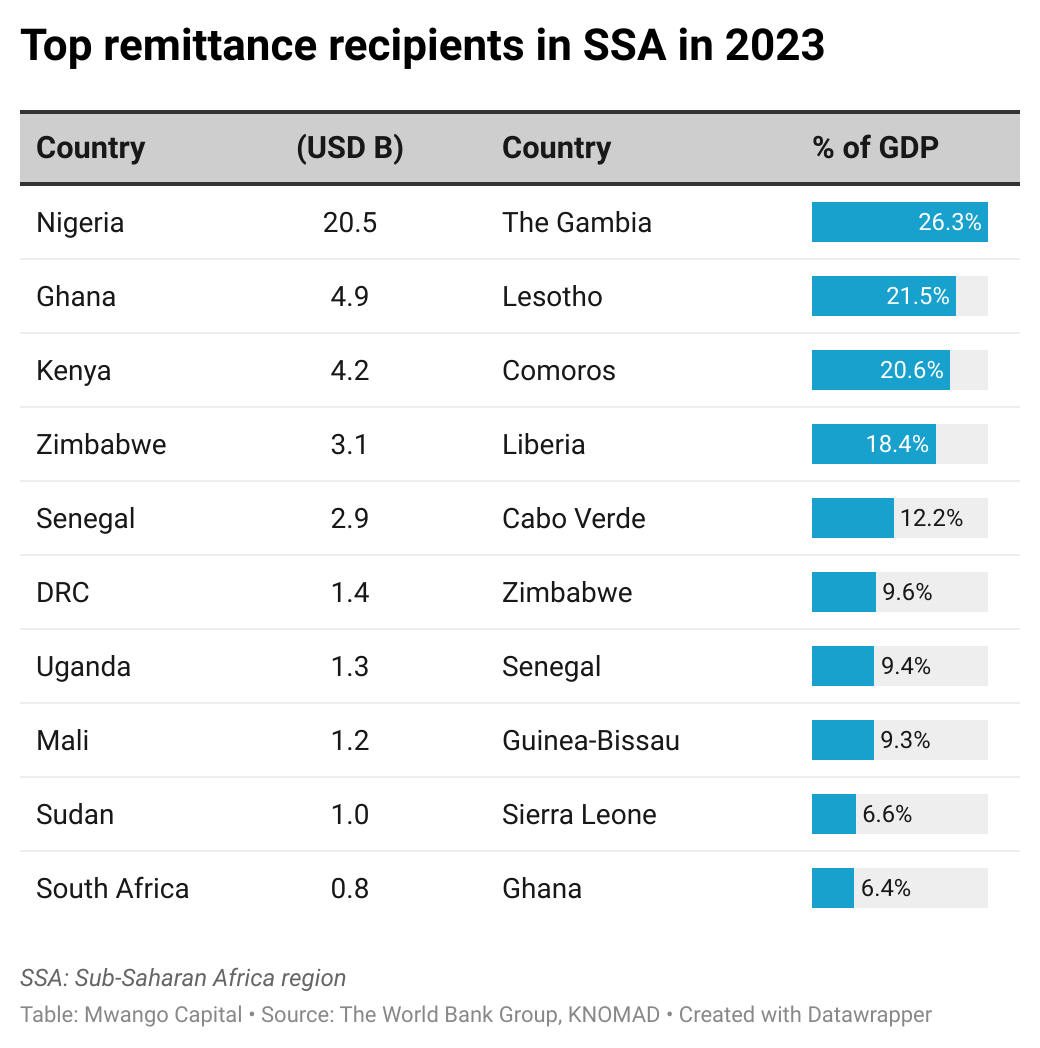

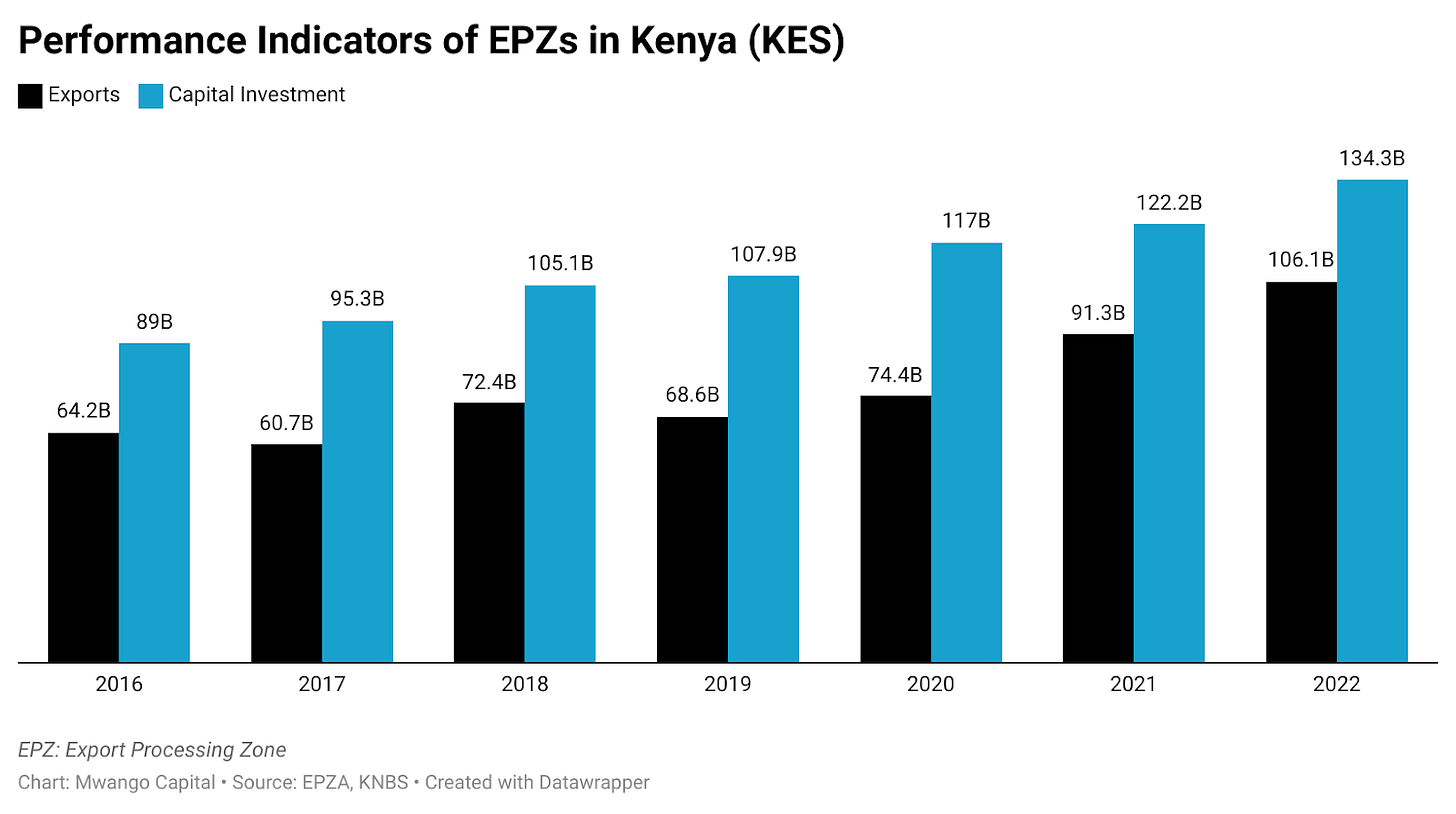

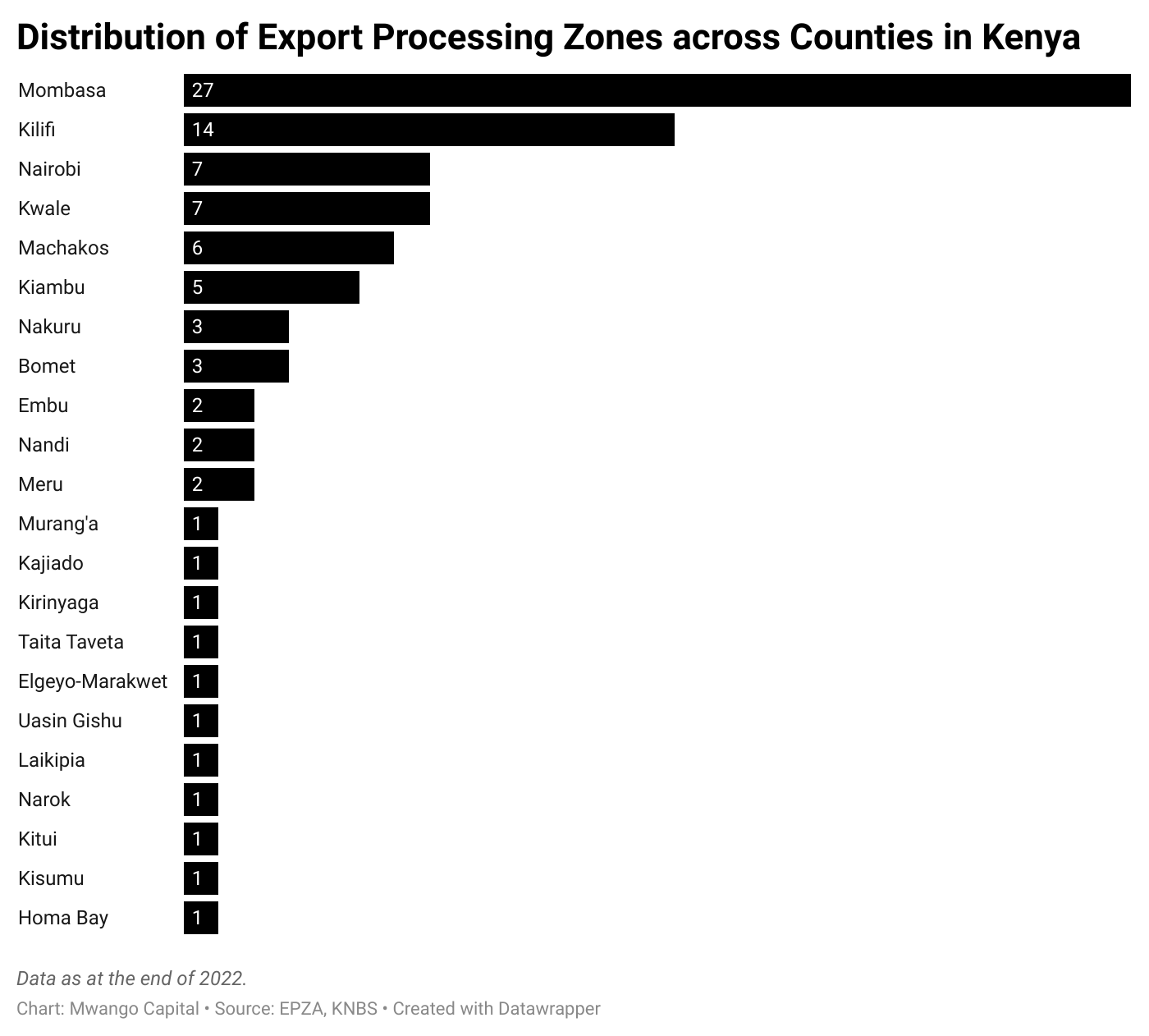

0.5% of GDP: ADQ, an Abu Dhabi investment firm with USD 199B (KES 26.8T) in assets under management (AUM), has set up a finance and investment framework with Kenya's National Treasury to explore investments of up to USD 500M (KES 67.4B) in Kenya's economy. The planned investment sum is equivalent to about 0.5% of Kenya’s GDP. The key sectors that have been prioritized in the framework include food production, mining, technology, and logistics.

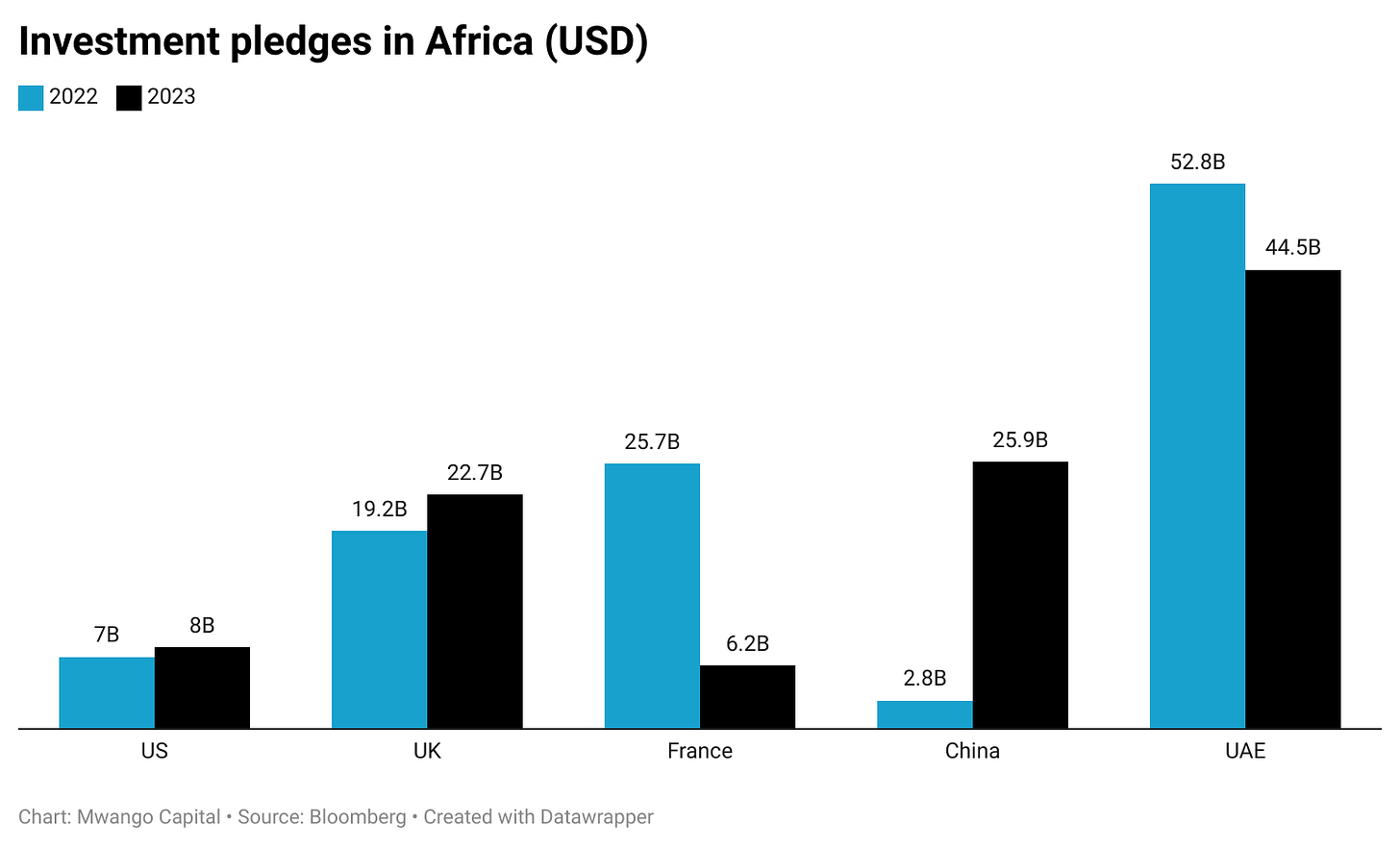

Across the Region: According to media reports, South Sudan agreed to a USD 12.9B loan from a UAE firm, offering oil as repayment in an arrangement that makes it the largest oil-for-cash deal in Africa. The deal is nearly 2X South Sudan’s GDP and almost 5X the country’s external debt. Under the arrangement, the lender is set to access oil discounted at USD 10 per barrel for a total period of 2 decades. In 2023, the UAE’s investment pledges in Africa totaled USD 44.8B, nearly twice the sum of China’s.

FY 2023 Results Wrap

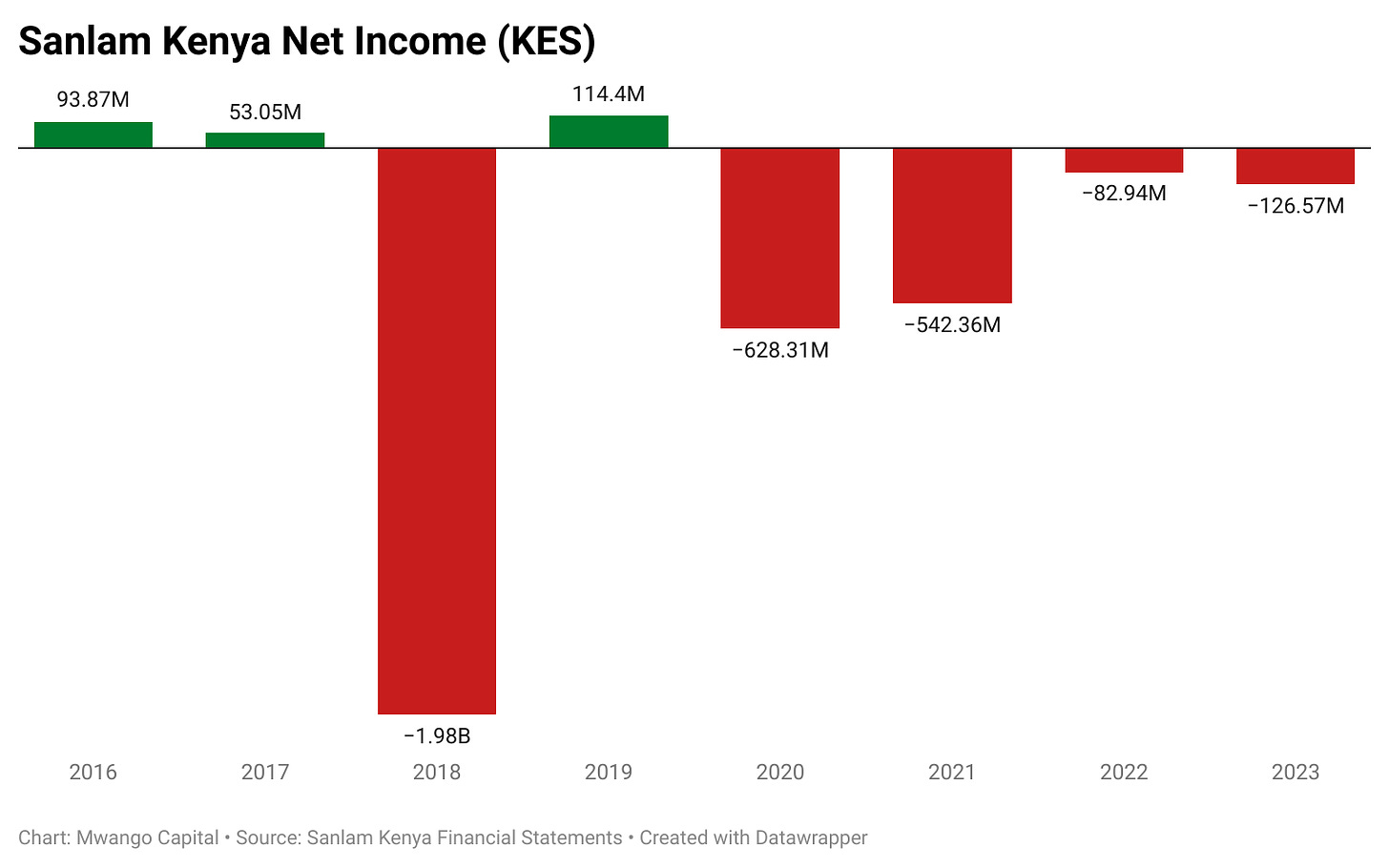

Sanlam Widens Net Loss: In FY 2023, Sanlam Kenya PLC’s insurance revenue edged lower by 16.5% year-on-year to reach KES 6.9B. A 38.2% cut in insurance service expenses resulted in KES 686M in net insurance revenue as compared to a KES 97.5M loss in FY 2022. In line with the profit warning issued in December 2023 projecting FY 2023 earnings to be 25% lower than those in FY 2022, the insurer’s net result for the year was a KES 126.6M loss, KES 43.6M greater than that incurred in FY 2022.

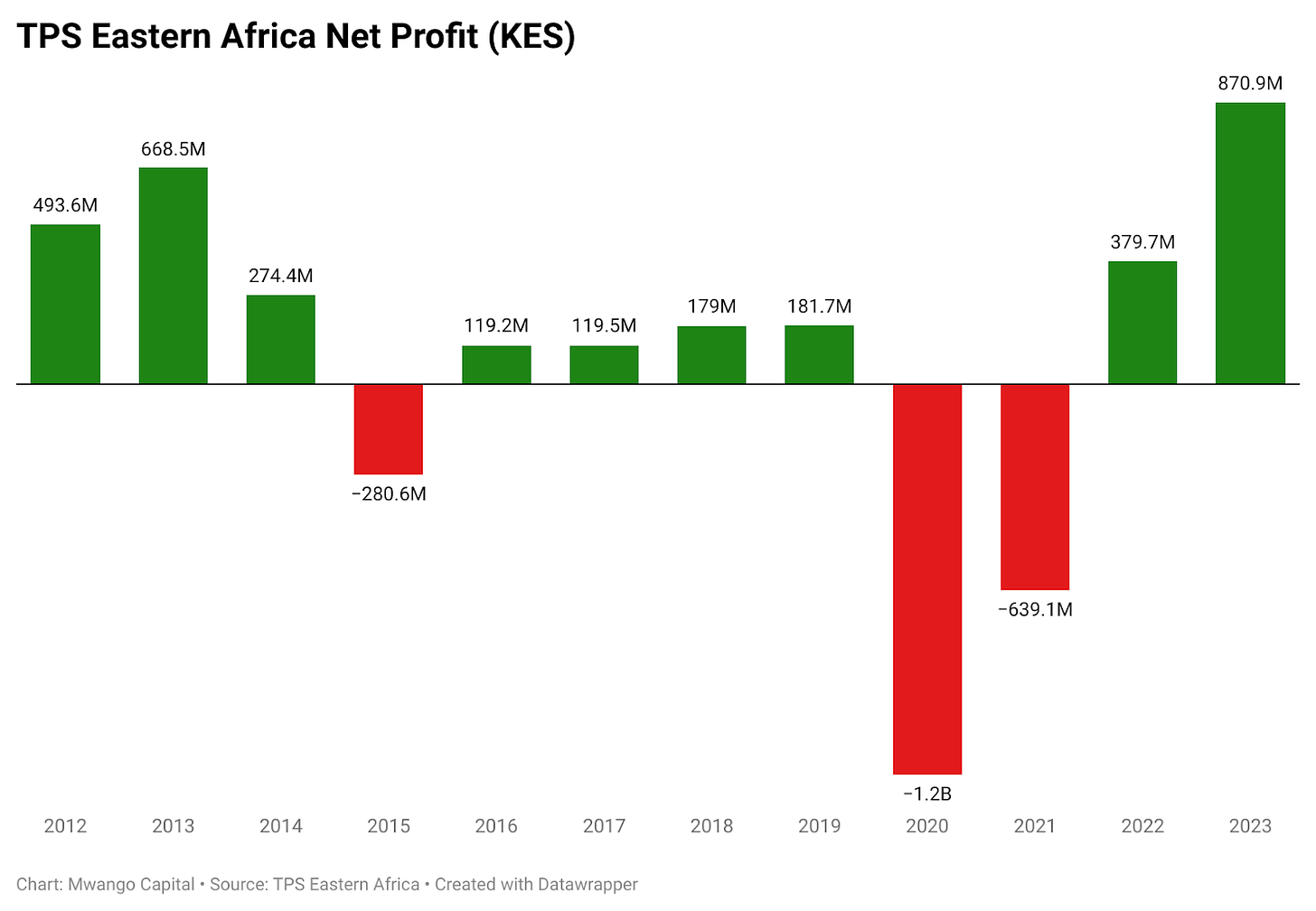

TPSEA on Recovery Path: In FY 2023, TPS Eastern Africa PLC recorded KES 9.7B in revenue, up 39.5% year-on-year. Earnings before interest, taxes, depreciation, and amortization (EBITDA) totaled KES 2.7B, up 48%. The firm recorded its second consecutive net profit, netting in KES 870.9M, up a whopping 129.4% from FY 2022 and an improvement from the KES 639.1M loss incurred in FY 2021. The Board of Directors, however, did not declare a dividend, opting to invest in the business and undertake upgrades previously impeded by the COVID-19 pandemic.

Find Real People Kenya FY 2023 results here and a thread on insurance firms’ FY 2023 results here.

Mergers, Deals and Acquisitions

Naivasha 1GW Data Center: Kenya is set to begin construction of a 1 GW Data Centre in Naivasha that will serve Africa. The project is a collaboration between Microsoft, Eco-cloud, and the G42 investment group. The data centre, powered by green energy, is expected to create jobs while enhancing efficiency in service delivery.

M-KOPA in e-motorcycle Deal: To increase the uptake of electric motorcycles among boda boda riders, Bolt is set to subsidize 20% of the acquisition cost equivalent to KES 50K. The deal involves riders paying between KES 10K and 15K for e-motorcycles valued over 200K with the remaining cost being covered by M-Kopa. The initiative targets 1,000 bodaboda riders across the country by year-end.

Rubis Injects KES 5B in NOCK: In line with earlier announced plans, Rubis Kenya has injected KES 5B into the National Oil Corporation of Kenya in what is a move to revitalize the business of the state-owned Oil Marketing Company (OMC). In the deal, KES 2B has been earmarked to renovate all the 100 NOC pump stations countrywide, while KES 3B for fuel stocks.

Kenya Ports - Kenya Pipeline SLA: The Kenya Ports Authority and the Kenya Pipeline Company (KPC) last week signed a Service Level Agreement (SLA) for the operations and maintenance of the new Kipevu Oil terminal. The SLA outlines the roles of the two corporations, with KPC’s being to provide a secure supply of petroleum products across the region. KPC is set to bring in close to 9B litres of petroleum products this year, with 60% consumed locally and 40% for transit markets in East Africa.

TBL-IFC-COPRA Partnership: Farmers in Dodoma and those involved in the supply chain are set to benefit from a new collaboration between Tanzania Breweries Limited (TBL), the International Finance Corporation (IFC), and the Cereals and Other Produce Regulatory Authority (COPRA). The partnership aims to enhance farmer contracts, facilitating financing and investments to address capacity challenges and boost the production of barley, wheat, sunflower, and soya. By improving access to finance and capital, the partnership seeks to address capacity challenges within the supply chain.

Markets Wrap

NSE: In Week 17 of 2024, Sanlam was the top-performing stock, up 10% to close at KES 6.60. StanChart was the worst-performing stock, down 11.9% to close at KES 172.0. The NSE 20 was down 0.1% to close at 1688.3 points, the NSE 25 increased by 1.3% to close at 2858.2 points, and the NASI index decreased by 0.9%, to close at 107.60 points. Equity turnover was down 9.0% to KES 1.45B from KES 1.6B in the prior week while bond turnover closed the week at KES 31.4B compared to the prior week’s KES 23.45B.

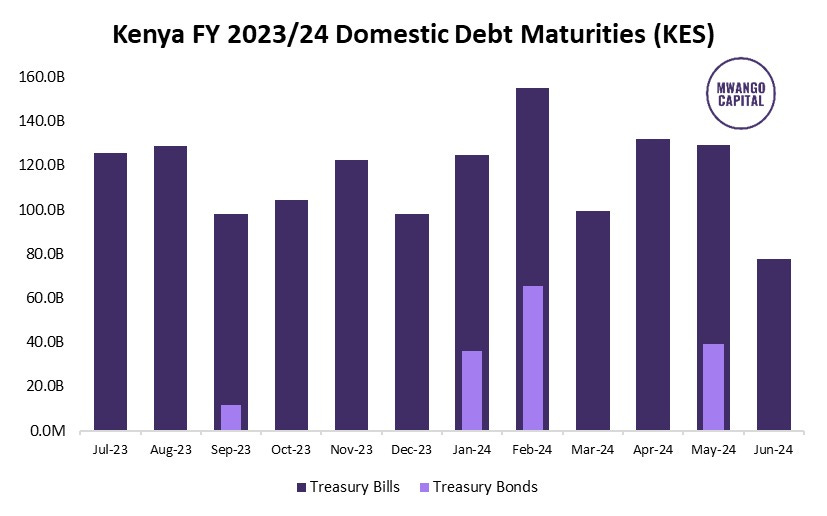

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.8232%, 16.4600%, and 16.4924% respectively. The total amount on offer was KES 24B with the CBK accepting KES 23.3B of the KES 23.5B bids received, to bring the aggregate performance rate to 98.18%. The 91-day and 364-day instruments recorded 149.6% and 106.4% performance rates, respectively.

Treasury Bonds: In its prospectus for the re-opened 10-year FXD1/2024/10 treasury bond, the Central Bank of Kenya is seeking KES 25B from the instrument. The period of sale is from 25th April to 2nd May 2024, and the coupon rate is 16.0%.

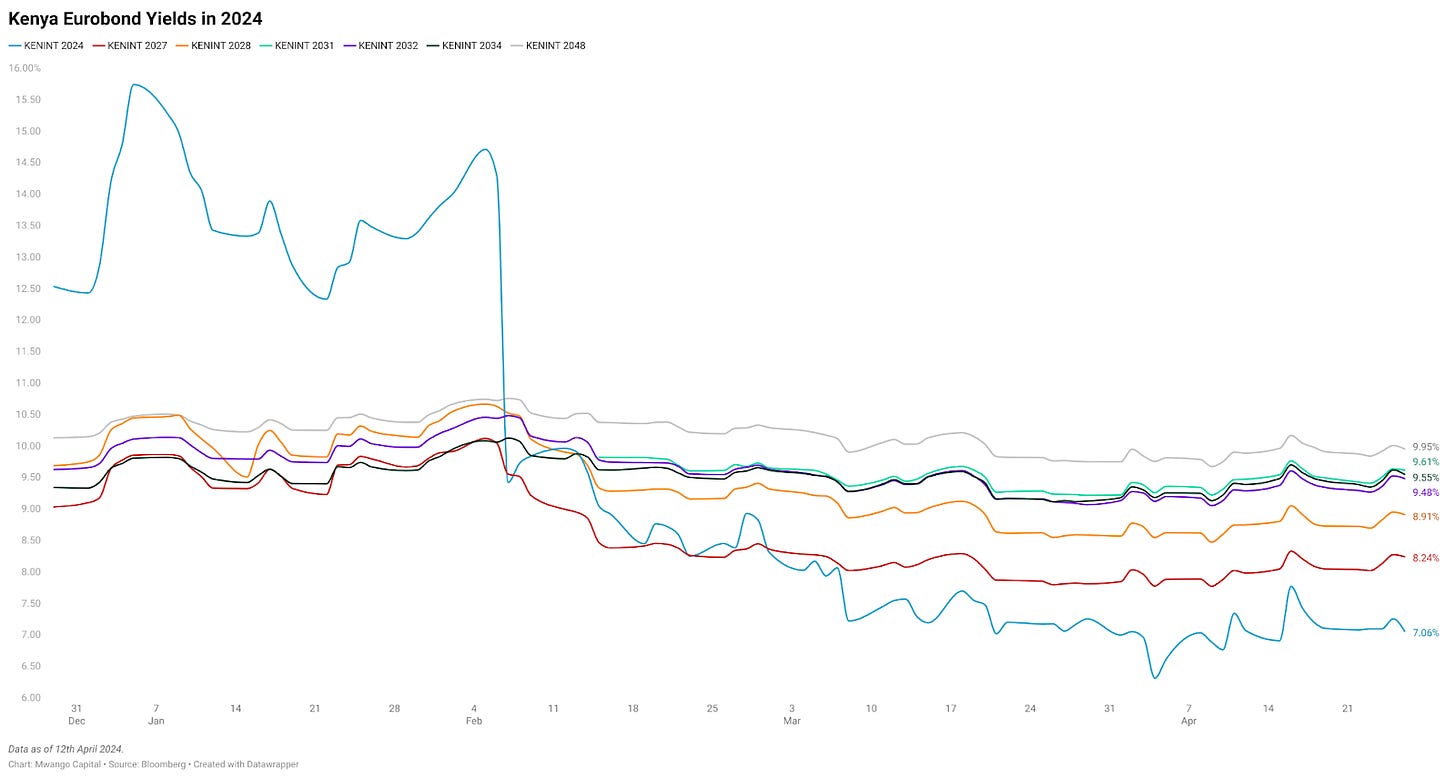

Eurobonds: In the week, the yields were mixed across the 7 outstanding papers.

KENINT 2024 was the only paper that fell week-on-week, down by 4.60 basis points (bps) to 7.056%. KENINT 2027 rose the most, up by 19.50 bps to 8.240%. The average week-on-week change stood at 10.66 bps.

All papers except for KENINT 2034 had their yields fall on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 547.40 bps while KENINT 2034 rose by 21.00 bps.

Prices were mixed week-on-week, with KENINT 2024 remaining flat at 99.948 while other papers recorded declines led by KENINT 2032 at 0.8% to 91.779. YTD, KENINT 2028 rose the most at 3.1% to 94.703, while KENINT 2034 fell the most at 1.0% to 79.697.

Market Gleanings

📈| NCBA Raises Lending Rates | NCBA Bank Kenya has announced changes to its base lending rates affecting variable rate loans effective from May 21, 2024. The Kenya Shilling base lending rate will see an increase from 16.50% p.a. to 17.50% p.a., while the USD base lending rate will rise from 11.0% p.a. to 11.75% p.a. For new loan facilities, the revised base lending rates will be applied immediately.

📜| Tax Amnesty Update | KRA this week announced that over 500K Kenyans had regularised their tax compliance status. The amnesty initiative has led to the payment of KES 20.8B in overdue principal taxes, with an additional KES 25.7B self-declared as unpaid taxes. Taxpayers who had defaulted on filing and paying their taxes have benefited from a waiver of KES 24.7B in penalties and interests.

⚡| Kenya Power to Invest in EV Charging Stations | Kenya Power has announced a significant investment of KES 258M towards the promotion of e-mobility in the country. An EV charging station has been established at Stima Plaza at KES 4.5M and two heavy-duty electric vehicles for routine operations have been acquired for KES 18M. An annual budget of KES 20M has been set aside to establish EV charging stations at various company offices across the country.

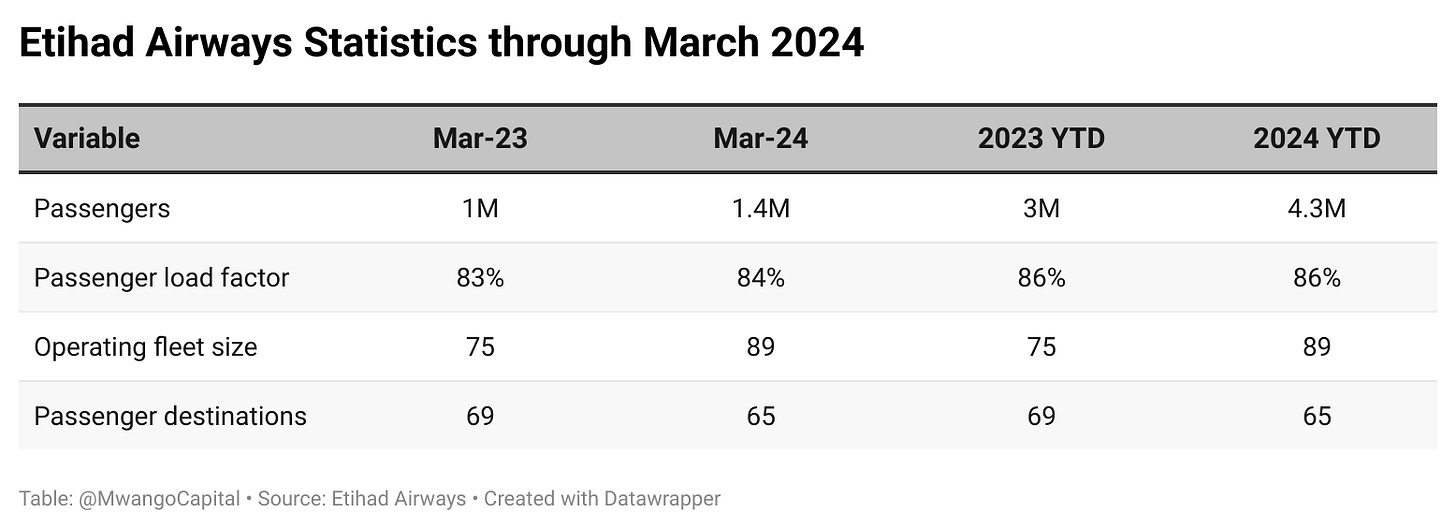

✈️| Etihad to Resume Nairobi Flights | Etihad Airways, the UAE's national carrier, is set to resume flights to Nairobi, commencing on May 1, 2024. The airline will operate a modern Airbus A320, equipped with both business and economy cabins. Flights from Abu Dhabi to Nairobi are scheduled to depart at 9:05 AM and arrive at 1:15 PM. The return flights from Nairobi to Abu Dhabi are set to depart at 6:10 PM.

📡| Safaricom Ethiopia Reaches 9M Users | Last week, Safaricom, announced that it had reached 9M customers in Ethiopia, with a third of this customer base actively using M-Pesa. By the end of 2023, the company had established 2,242 base stations, covering 33 towns, and launched the fastest data network in Ethiopia. Separately, Safaricom PLC is set to release its set of FY 2023/2024 results on 9th May 2024.

🇪🇬| Egypt’s USD 400M Budget Support | Egypt is set to receive a financial boost as the UK pledges USD 400M in budget support over the next two years. This funding will be supplemented by budget financing from the World Bank, forming part of a previously announced USD 6B, three-year package.

💸| Nigeria Plans USD 10B Diaspora Fund | Nigeria is planning to set up a USD$10B diaspora fund to attract investment from its more than 20M citizens living abroad to support critical sectors including infrastructure, health care, and education to grow the economy. The country is seeking bids from asset managers to set up the fund which ballparks 2.1% of GDP.