Safaricom’s Upcoming Restructuring

The telco will convert into a holding company that will own all its businesses

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Safaricom’s upcoming restructuring, the new gov’t taking shape, and BOC's takeover dragging on.First off, enjoy our weekly business news in memes brought to you by Mwango Capital:

Safaricom’s Upcoming Restructuring

Safaricom's Group Structure: According to Safaricom’s Chief Executive Officer, Peter Ndegwa, Safaricom will convert into a holding company that will own all its businesses including Mobile Money business M-PESA. The telecommunications firm will also set up a tower company so that it can share towers with Airtel Kenya and Telkom Kenya, and is expected to give timelines on the M-PESA launch in Ethiopia.

At the moment, there isn’t any need to create a separate business. What we intend to do is create a group structure. So Safaricom Plc becomes a group, and then you have different businesses.”

Safaricom Plc CEO, Peter Ndegwa

SIM Registration Exercise: According to the Communications Authority of Kenya (CA), Safaricom and Airtel Networks have in the last 12 months increased their compliance levels from 52% to 93% and 42% to 81.2%, respectively. The CA is yet to issue an update on Telkom Kenya and has given the operators 60 days to ensure 100% compliance by effecting various measures including Denial of Service. The CA has placed a penalty of up to 0.5% of Gross Annual Turnover for non-compliant operators. With total revenue of KES 298B in FY 2022, the penalty would translate to about KES 1.49B for Safaricom.

“We have been given by the CA another 60 days not necessarily as an extension of the registration process but as a way of avoiding everyone being deregistered today but ensuring that everyone including those in the rural areas. Because there’s a lot of people in remote parts of Kenya that we need to take into account. There’s only about 7% remaining, so we believe during the next 60 days we should enable everyone to register, including those living abroad. There’s a portal that everyone can use to make sure they are registered.”

Safaricom Plc CEO, Peter Ndegwa

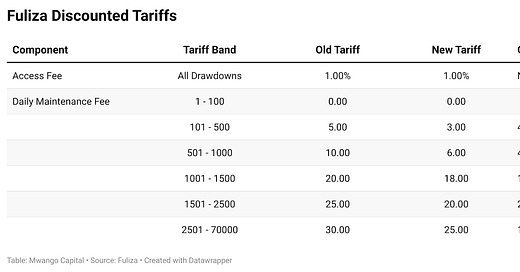

Fuliza Costs Down 50%: According to Peter Ndegwa, the cost of borrowing on Fuliza has been slashed by 50% on average.

“We are delighted to be restructuring the cost of Fuliza to individuals. As you know Fuliza is a very popular product. Fuliza is used by 7 out of 10 if not more of our customer base across the country. We were conscious that there were complaints we had got about the level of cost of Fuliza but also how Fuliza is used. Sometimes people extend the credit. Fuliza is supposed to be used as an emergency credit for a few days. If you use Fuliza for a few days, Fuliza is fairly affordable. So what we did is to restructure the cost.”

Safaricom Plc CEO, Peter Ndegwa

Longer-Term Credit Products: Based on feedback from Fuliza usage, Safaricom will in the future offer credit solutions that are longer-term compared to the current term structuring around Fuliza.

“If a customer needs something else, they can come for a term loan or they can go to a bank and going forward, we’ll be announcing new products that we can give customers options instead of Fuliza. We realized that Fuliza was being used for up to 10 days or 14 days or 20 days which becomes too expensive for customers.”

Safaricom Plc CEO, Peter Ndegwa

CRB Listing: Safaricom will be coordinating with its banking partners to strike off 4M people from the Credit Reference Bureau (CRB) starting November, which is expected to open a path for them to access loans. This move augurs with President William Samoei Ruto’s agenda to revamp the credit scoring system and eliminate blacklisting.

“We are also working with NCBA and KCB as our banking partners are going to be repairing 4 million that were previously listed on the CRB so that they are able to access new loans. 4 Million additional customers will be able to access Fuliza and other products out there. The repairing will happen from November.”

Safaricom Plc CEO, Peter Ndegwa

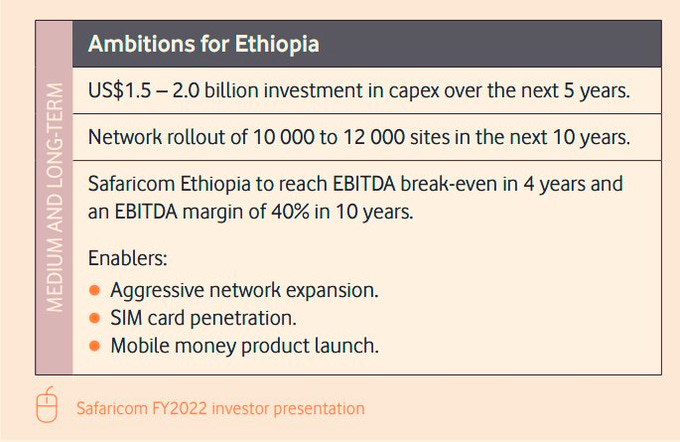

Investment in the Ethiopia Business: Safaricom has spent a total of $1.2B in Ethiopia, including $300M in Capital Expenditure. Over 5 years, Safaricom intends to spend approximately $2B in Ethiopia, and the composition of equity and debt financing will depend on currency and tax considerations.

“The split of debt and equity will be dependent on not just the ratios we need to retain locally, but also the need to mix between dollar and locally denominated debt so that we can also be able to ensure that it's efficient from a currency perspective. The level of debt that we take is also dependent on the tax consideration. The local tax laws will indicate the balance between equity and debt.”

Safaricom Plc CEO, Peter Ndegwa

Safaricom Ethiopia Profitability: Safaricom projects that its Ethiopia business will reach EBITDA break-even in 4 years and hit an EBITDA margin of 40% in 10 years. Through the 2018 - 2020 fiscal years, Ethio Telecom had an average of $734M (ETB 38.88B, KES 89B) in gross revenue. This is equivalent to 35.8% of Safaricom’s average gross revenue in the same period, or 51% of Safaricom’s average revenue in the period excluding M-PESArevenue.

“So far we have put in Capex of approximately $300 million. Including the licence, we have spent roughly $1.2 billion in total. We gave a forecast for the year that we'd spend in the first year, approximately Sh 60 billion, which is about $500 million. So we are in line with that. That does not include any amounts that we pay for mobile financial services, but that will be announced at an appropriate time.”

Safaricom Plc CEO, Peter Ndegwa

New Gov’t Takes Shape

CS Nominees' Vetting: Last week, some nominees to the Cabinet faced Members of the National Assembly for vetting, and below are some key takes related to the economy from the process that was chaired by the Speaker to the National Assembly, Hon. Moses Wetangula.

On Handling Kenya's Public Debt:

"The best would be to look for concessional financing that would retire most of the debt, especially the domestic debt, which is very expensive. It's taking quite a large proportion of recurrent expenditure, to the tune of about 33%."

CS Nominee to the National Treasury, Prof. Njuguna Nd'ungu

On the Dollar Shortage:

"When the crisis started biting, especially the whole world, it was only the US Fed that actually started tightening their monetary policy. And you can see, even Europe started being affected because they were not following suit. When everybody followed suit, there was a whole tightening even in Kenya here and so the signalling is that there will be scarcity of dollars. So the dollars that you mentioned in terms of deposits, they are owned by individuals and everybody moves into a different direction because they are anticipating that there will be tightening.”

CS Nominee to the National Treasury, Prof. Njuguna Nd'ungu

On Kenya Airways:

“What we need to do with the KQ is to ensure that perhaps create subsidiaries maybe a budget airline like the one we have Jambo Jet to continue doing what it used to do, a cargo airline to be separated Mr. Speaker, and maybe a charter airline that can be able to fly to bring tourists from Europe. We might need Kenya Airways to have other services by the side, drone services, surveying services and other services that other private companies are giving.”

CS Nominee to Roads, Transport and Public Works Ministry, Kipchumba Murkomen

Declared Wealth: The cumulative declared net worth of the nominees to the Cabinet stood at just over KES 16B ($132M). This is more than the total net worth of the Cabinet of the United States Government - which stands at KES 14B ($118M). In 2021, Kenya’s GDP Per Capita stood at $2,006.8 (KES 243K), which is 2.9% that of the US which was $69,287.5 (KES 8.4M).

Mashujaa Day Celebrations: Last week, on October 20, Kenyans celebrated the country’s heroes who fought for freedom from colonial rule in a fete presided over by President William Ruto at Uhuru Gardens. The President, in his speech, highlighted key areas of focus for his government. Below are key takeaways from his speech:

Agriculture: The government plans to double the land under irrigation to 1.4M acres, which is equivalent to 9.77% of Kenya’s arable land. Out of the 1.4M acres, 200K acres will be put under rice irrigation while 500K acres will be put under other food crops.

Housing: The government is targeting to increase the supply of housing units 4X from 50K to 200K per year. The government has so far completed 2,592 units, with 40,452 units under construction, and over 500K in the pipeline requiring financial backstopping. The government is set to collaborate with counties to target 5K units in every county.

Hustlers Fund: The government is set to launch the KES 50B Hustler Fund credit and savings product on December 1. According to the President, every saving made by borrowers on the Hustlers Fund platform will be merged by the government on a 2:1 ratio to a level to be determined by the program.

Credit Access: The president pointed out that Fuliza interest rates have been reduced by 50%, and 4M borrowers have been removed from the Credit Reference Bureau as part of that agreement. The government has secured an agreement with CRB to abandon blacklisting and instead adopt a credit scoring system.

You can access a copy of the speech here.

BOC Takeover Drags On

Petition Stopped: The High Court has dismissed a petition by a former director of BOC Kenya seeking to stop the takeover of the company by Carbacid Investments Plc. The director had cited undervaluation in Carbacid’s offer to acquire BOC at KES 63.5 per share. The dismissal of the petition does not clear the path to acquisition by virtue of Mr Ngugi Kiuna’s ongoing legal challenge to the process at the Capital Markets Tribunal.

Mapping BOC, Carbacid Numbers: In November 2020, Carbacid Investments made a bid to acquire 100% of BOC Kenya for KES 1.2B. At the time, BOC traded at between KES 50 - KES 58 per share, but has since appreciated by 44.8% to reach KES 84 as at market last week, with a total market cap of KES 1.64B. In the 2021 fiscal year, BOC’s asset base fell by 4.4% year-over-year to reach KES 1.997B, bringing the company’s Price to Book to 0.82. On the other hand, Carbacid has appreciated from KES 6 - KES 10 per share from November 2020 and closed at KES 12.15 last week with a market cap of KES 3.1B and an asset base of KES 3.7B in the 2021 fiscal year - a year-over-year increase of 6.5%, to bring the Price to Book ratio to 0.84.

Debt Markets

T-bills: In the Treasury Bills market, the market-weighted average interest rate for the 91-Days, 182-Days and 364-Days papers stood at 9.1%, 9.664% and 9928%, respectively. The 91-Days paper registered the highest acceptance rate at 346%, while the 182-Days and 364-Days papers had acceptance rates of 46.73% and 39.66%, respectively. On aggregate, the acceptance rate was 93.69% compared to 112.56% in the previous auction.

Treasury Bond Market: The Central Bank of Kenya accepted KES 13.665B in bids out of KES 14.894B in received bids in its auction of Twenty-Five Year Treasury Bond Issue No. FXD1/2022/025. The total advertised amount was KES 20B, translating to an acceptance rate of 68% against a performance rate of 74.47%. The auction registered a weighted-average interest rate of 14.188%, the first time it has surpassed 14% in 2022.

Corporate Bond Market: Acorn Holdings last week issued a notice to all noteholders under its KES 5.7B Medium Term Note Programme it will be redeeming KES 800.2M, or 14% of the bond’s issue amount on or before October 31 this year. As of market close last week, the total outstanding value of corporate bonds trading at the Nairobi Securities Exchange (NSE) stood at KES 22.53B.

KES 890B Proposed Bonds: The incoming government plans to issue securities to meet various financial commitments as it embarks on its agenda. The national government plans to securitize KES 600B in pending bills and KES 140B in infrastructure pending bills. Nairobi County Government plans to float a KES 150B green bond to revamp the city's outlook. The total securitization efforts at all levels of government now stand at KES 890B.

Eurobond Market: In last week’s trading action, yields on Kenya’s Eurobond maturing in 2024 - KENINT 2024, rose by 91.2 basis points week-on-week to 17.6%; while on the farthest end - KENINT 2048, yields were up 29.9 basis points to 12.023%. Yields on outstanding Kenya Eurobonds are up by an average of 62.78 basis points in H2 2022.

What Else Happened This Week

🛑 Court Freezes Equity-Spire Deal: The Employment and Labour Relations Court has frozen Equity Bank’s acquisition of Spire Bank after Spire employees sued to block the acquisition through the Bank Insurance and Finance Union. The employees argued Spire kept them in the dark over the acquisition process.

💰 Inflation Tax Adjustment Impact: The Kenya Revenue Authority projects additional excise tax collections arising from inflation adjustment at KES 3B - which is equivalent to 1% of excise revenue collected in the 2021/22 fiscal year. KRA earlier adjusted excise tax to reflect the average inflation rate of 6.3% recorded in FY 2021/22.

💸 Co-op Bank Eyes Hustler Fund Rollout: Kenya’s fourth largest bank by assets Co-operative Bank of Kenya (KES 603.9B) says it will leverage its relationships in the co-operative movement to support the rollout of the government’s KES 50B Hustler Fund, which will offer soft loans to small enterprises.

💱 Growth in Foreign Direct Investments: Kenya’s FDI inflows are on the rebound after a 3 year lull on slow economic growth triggered by the Covid-19 pandemic. KenInvest registered and facilitated 167 foreign investment projects worth KES 47.44B in FY 2021. Energy, Construction, finance and Manufacturing sectors have drawn more FDI interest.

❌ Judge Blocks ARM Employees’ Bid: Last week, a judge rejected a bid by 30 former employees of Athi River Mining Cement (ARM) to join National Cement Company (NCC). The former ARM employees wanted to join NCC on grounds of plans by NCC to acquire ARM.

Interest Rate Watch

🇿🇦 South Africa: The South Africa Reserve Bank (SARB) is expected to hike its benchmark interest rate despite cooling inflation according to projections by market participants. Speculation on borrowing costs through forward-rate agreements are fully pricing in a 75 basis-point hike at the next meeting of SARB’s Monetary Policy Committee (MPC) which is slated for November 24. In September 2022, South Africa's inflation eased to 7.5% from 7.6% recorded in August and an over 13-year high of 7.8% in July.