Ethiopia Gov't, TPLF Reach Agreement

Representatives conclude the peace agreement bringing to an end a two-year conflict

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the Ethiopia-TPLF agreement, pressures due to the dollar crisis, and the KQ-KALPA stalement.First off, enjoy our weekly business news in memes brought to you by the Mwango Capital:

Ethiopia-TPLF Agreement

Peace Agreement: Last week, after 10 days of intensive negotiations, Representatives of the Government of the Federal Democratic Republic of Ethiopia and the Tigray Peoples’ Liberation Front (TPLF) concluded a peace agreement in South Africa, bringing to an end a two-year conflict in Northern Ethiopia that has cost thousands of lives. Among the leaders spearheading the efforts were the African Union’s High Representative for the Horn of Africa former President Olusegun Obasanjo and Kenya’s immediate former President Uhuru Kenyatta.

The Conflict in Numbers: According to the World Health Organization, about 5.2M people in Tigray need humanitarian assistance, and 3.8M people require health care. Over the 2 years, as many as 500K people have died as a result of war-related violence and famine and at least 5.1M people have been internally displaced.

Eurobond Rally: Following the announcement of the peace agreement, the yield on Ethiopia’s $1B of Eurobonds due in 2024 fell more than 400 basis points (bps) to close at 44.07% on Wednesday compared to 45.8% a day earlier.

Impact on Business Environment: The end of the war reduces the operational risks for companies operating in Ethiopia. Investors will watch the agreement's aftermath and how it impacts Ethiopia's liberalization agenda. Ethiopia opened up its telecommunications sector to foreign investment as attested by the Safaricom Ethiopia launch last month. Africa's second most populous country also plans to open up part of its banking sector to foreign banks.

Dollar Crisis Pressures

Higher Financing Costs: The depreciation of the local unit is set to expose State-Owned Enterprises (SOEs) with non-guaranteed foreign currency debt to higher financing costs. Cumulatively, the SoEs are sitting on total foreign currency debt worth KES 74.9B, equivalent to $616.2M at an exchange rate of 121.51 units to the dollar.

Dollar Rate Up: Last week, banks were exchanging a dollar for KES 130 per unit and buying the US currency within a range of KES 117 and KES 119. When compared to the equivalent official buying rate as quoted by the Central Bank of Kenya (CBK), the KES 8.67 margin highlights the situation around dollar availability in the country.

Insurance Industry Q2 2022 Report

The Insurance Regulatory Authority released its report for Q2 2022, and below are key highlights:

Long-Term Insurance Business

Gross Premium Income in the long-term insurance business rose 20.5% year-over-year to KES 70.7B. Class-wise, group life had the highest change in premium income, at 48.5% to KES 9.1B, while premiums from the investments class dropped 31.5% to KES 1.8B.

As of June 2022, Britam had the largest market share by gross premium income among long-term insurers at 20.7%, followed by ICEA Lion Life Assurance, at 13.5%, and Jubilee Insurance Company, at 13.1%. Over the last three years, GA Life Assurance has tripled its market share from 1.9% in Q2 2019 to 6.1% in Q2 2022.

Long-Term Insurers placed 79.3% of their business investments in government securities compared to 74.7% in Q2 2021. Investments in equities fell 25.1% to KES 19.7B to account for 3.6% of total long-term insurers’ business investments compared to 5.3% in Q2 2021.

General Insurance Business

Gross Premium Income grew 8.2% to KES 92.4B. Fire Industrial Premiums rose 28.9%, the highest across all classes, while those from the Workmen’s Compensations class reduced by 10.4%.

In terms of market share by Gross Premium Income, APA Insurance Company led with 9.4%, Old Mutual General Insurance at 9.3%, while GA Insurance and CIC General Insurance Company were third at 8.7%. GA Insurance had a market share of 5.3% in Q2 2019 compared to CIC’s 8.3%.

Claims incurred grew 14.5% to KES 37.1B with the medical class-leading in claims at KES 15.5B, or 41.7% of total claims incurred, an increase of 23.4%. Total claims amounting to KES 34.5B were paid in the review period, an increase of 12.7%. The medical class accounted for 44.4% of paid claims, up 27.4%.

The net results of general insurers were a KES 1.49B loss compared to a KES 1.46B in Q2 2021. The motor private class accumulated the most significant losses at KES 2.4B, albeit a decrease from the KES 2.9B losses posted in Q2 201.

58.1% of general insurers’ business investments were in government securities compared to 52.5% in Q2 2021. Investments in equities rose 21.6% to KES 4.5B to account for 3% of general insurance business investments.

Reinsurance Business

Total Net Premium Income in the long-term reinsurance business fell 27.7% to KES 1.1B, while investment income was down 3.3% to KES 556.9M. In terms of asset allocation, 55.8% of investments were in government securities, an increase of 34.9%. Equities accounted for 1.2% of the investments, a decrease of 48.5% to KES 178.2M.

In the general reinsurance business, Net Premium Income rose 29.9% to KES 15.8B with KES 2.1B booked in operating profit. 42.2% of general reinsurance business investments were held in government securities, a 7.2% increase. Holdings of equities fell by 14.3% to account for 1.7% of total business investments.

Overall Industry

Total Shareholders’ Funds for the insurance industry rose by 3% to KES 177.51B compared to KES 172.39B in Q2 2021. Total investments in income-generating assets were up 9.8% to KES 766.4B from KES 698.1B in Q1 2021, with 72.2% deployed in government securities, 10.8% in investment property, and 3.3% in equities.

You can access the full report here.

Kenya Airways Grounded

Pilots' Strike: On November 4, the Kenya Airline Pilots Association (KALPA), the representative body of pilots in the country including Kenya Airways, announced the withdrawal of labour effective November 5 at 06:00 hrs EAT. The pilots cited failed attempts to seek better working conditions for its members for the industrial action pursued.

The Fallout: The national carrier noted that the action by the 400 pilots affected travel plans and was estimated to cost KES 300M a day, aggregating to KES 2.1B in a week. On Saturday, 15 planes were grounded affecting 10K passengers and 6K tonnes of cargo.

KALPA Doubles Down: On Saturday, the pilots reiterated their position and placed the weight of the matter on the airline’s management.

“To this end, as the Association had stated yesterday, 4th November 2022, no KQ aircraft has departed Jomo Kenyatta International Airport (JKIA) flown by a KALPA member from 6:00 am this morning. The strike is fully in force: KALPA members are exercising their right to withdraw their labour forthwith. The onus is on the Kenya Airways management to bridge this impasse.”

KALPA General Secretary & CEO, Capt. Murithi Nyagah

Headway: Kenya’s Cabinet Secretary for Roads and Transport Kipchumba Murkomen said in a statement that the government had established a committee to be chaired by the Principal Secretary for Labour Eng. Peter Tum with a view of engaging KALPA and Kenya Airways on the issues occasioning the strike.

“I urge KALPA to obey the court order that suspended the strike and give the established Committee a chance to work on resolving their grievances. The Government of Kenya is keen to see these issues resolved. For progress to be made on this front, therefore, it is imperative that KALPA calls off the strike and returns to the negotiation table.”

Cabinet Secretary for Roads and Transport, Kipchumba Murkomen

Pilots Maintain Position: Pilots are maintaining their stance, grounding flights for the third day even as the management says it is open to discussions with the pilots but pointed out the window for negotiations was closing.

Ormat Technologies Q3 2022 Results

KPLC’s Contribution: In the three months ended September 30, total revenue edged 10.7% higher year-on-year to $175.9M (KES 21.4B), with the Kenya Power and Lighting Company (KPLC) constituting 15.2% of the revenues compared to 16.1% in 2021. In the 9 months to September 30, Kenya Power’s contribution was 14.9% compared to 16.3% in 2021.

Overdue Amounts in Kenya: As of September 30, the amount outstanding from KPLC was $20.6M (KES 2.5B) of which $2.7M (KES 328M), equivalent to 13.1%, was paid in October. Ormat believes it will collect all past due amounts in Kenya through a support letter from the Government of Kenya that underwrites certain cases of KPLC non-payment.

Debt Markets

10% Yield: In the short-term debt markets, yields for the 91-Days, 182-Days, and 364-Days papers were 9.1%, 9.7%, and 10.1%, respectively. The yield on the 364-Days paper breached 10% to stay 40 bps above the current inflation rate of 9.6%.

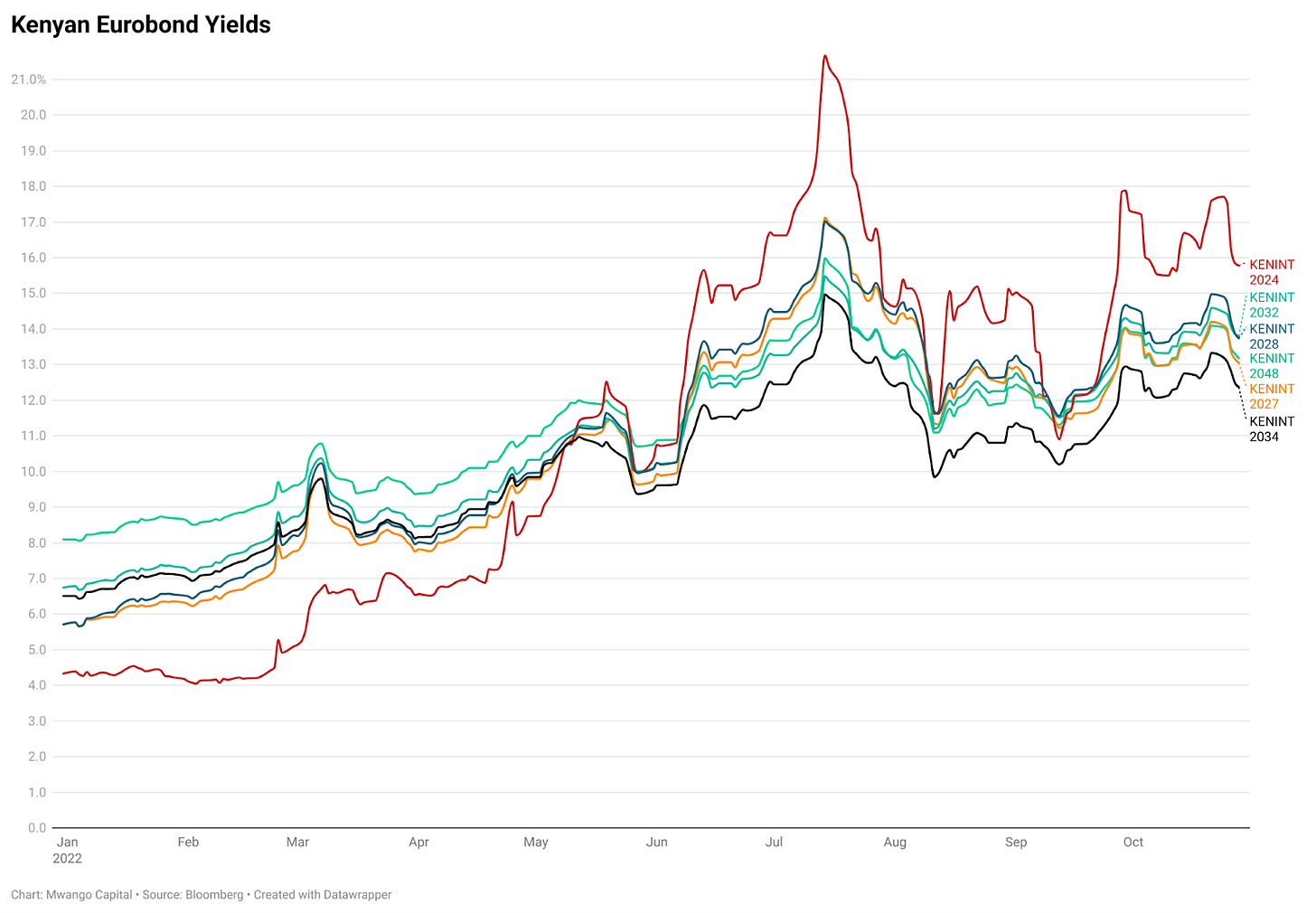

Eurobond Market: In the Eurobond market, yields on all papers extended their decline last week, with three papers falling by over 100 bps. KENINT 2024, KENINT 2027 and KENINT 2028 all fell by 182.5 bps, 114.6 bps and 123.9 bps, respectively, while KENINT 2032, KENINT 2034 and KENINT 2048 fell by 79.3 bps, 95.6bps, and 91.1 bps, respectively; bringing the average week-on-week change to -114.5 bps.

What Else Happened This Week

🪖 Kenya Deploys Contingent to DRC: The Kenya Defence Forces is set to deploy a contingent of troops to the Eastern region of the Democratic Republic of Congo to help with efforts to quell violence in the region. The deployment is part of the East Africa Community Regional Force initiated under the EAC Heads of State Conclave on Peace and Security in Eastern DRC.

💸 Public Universities in Cash Crisis: Through the Universities Fund, Public universities are seeking a KES 2.4B bailout from the World Bank to alleviate an acute crisis that is threatening to ground their operations. As of June 2022, the institutions of higher learning had KES 56.1B in pending bills with at least KES 13.6B owed to suppliers, part-time lecturers and SACCO contributions.

🧾 Ruto Names PSs: President Ruto last week unveiled 51 Permanent Secretaries to his Cabinet, an increase of 21% from the 42 that served under immediate former President Uhuru Kenyatta. The distribution according to gender shows that 22% of the accounting officers are women.

🏦 Lap Trust Imara I-REIT: Last week, the Capital Markets Authority (CMA) announced the approval of a listing by introduction of the Local Authorities Pension Trust (Laptrust) Imara Income Real Estate Investment Trust (I-REIT) on the NSE’s Main Investment market. The I-REIT will be a close-ended fund at KES 20/unit based on the Net Asset Value of the scheme as of listing, with a total of 346.2M units.

📉 Sugar Import Quota to Fall: Kenya will fall short of meeting its sugar import quota from the Common Market for Eastern and Southern Africa (COMESA) due to shortages in the global markets. In the current year, Kenya’s allocated quota was 180,000 tonnes, of which 48% (86,400 tonnes) has been imported with two months left to year-end.

📈 Rising Inflation: In October, Kenya’s inflation rate stood at 9.6%, an increase of 40 basis points (bps) from the 9.2% registered in September. Food and Non-Alcoholic Beverages Index rose 15.8% year-on-year, the highest across the tracked indices, while the Insurance and Financial Services Index rose the least at 0.5%. Commodity-wise, diesel rose the most at 47% while tomatoes registered the most significant price drop by 11.3%.

🗠 Stanbic October PMI: Stanbic Bank Kenya’s Purchasing Managers’ Index for October was 50.2 compared to 51.7 in September on ongoing concerns about the rising cost of living and a renewed drop in output. Inflationary pressures led to a record increase in purchasing costs which occasioned a softer expansion in new orders and an increase in output charges.

🧾 SGR Contract Published: According to disclosures released by Cabinet Secretary for Roads and Transport Kipchumba Murkomen regarding the Standard Gauge Railway (SGR), the interest rate, management fee and commitment fee on the $1.6B tranche of the financing was locked in at 2% per annum, 0.25% and 0.25% per annum, respectively. The maturity period for the facility is 10 years with a 7-year grace period and a 13-year repayment period. The contract also provides Beijing as the venue for arbitration of arising disputes, giving Chinese lenders an upper hand in the arrangement. You can access the documents here.

Interest Rate Watch

🇰🇪Kenya: Banks have adjusted their borrowing costs upwards by up to 110 basis points after the rate hikes by the CBK this year, which total 125 basis points to bring the key interest rate to 8.25%. While some banks effected these measures last month, others have set this month as the effective date for the adjustments.