👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, Equity Group’s FY 2024 results, Kenya Airways’ first full-year profit in a decade, and the Supreme Court’s decision on banks raising interest rates.Equity Group PLC FY 2024 Results

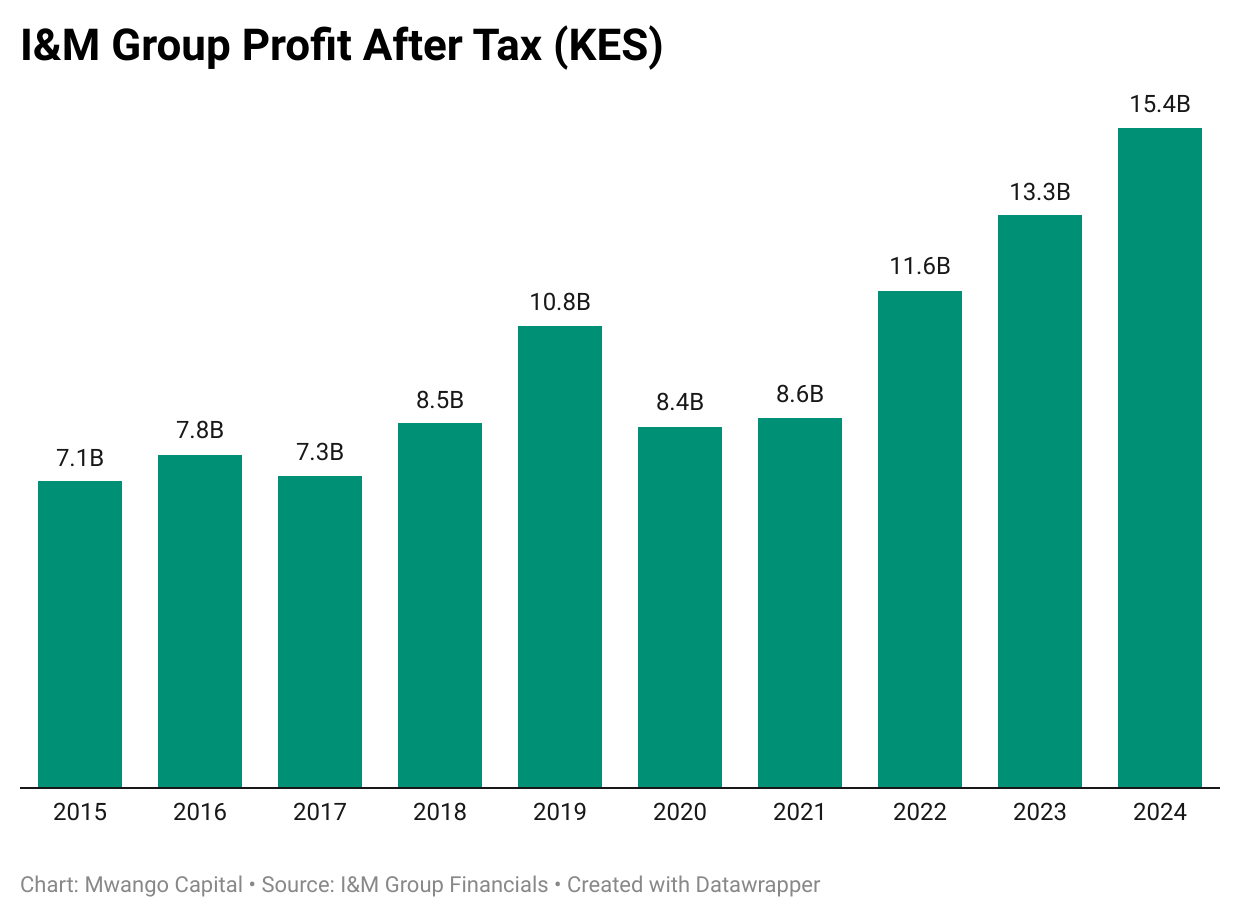

Profit Up 11.6%: Equity Group Plc reported an 11.6% YoY rise in net profit to KES 48.8B, driven by a 43.3% YoY decline in loan loss provisions to KES 20.2B. The non-performing loans ratio stood at 12.2%, below the industry average of 16.4%, though gross non-performing loans rose 6.5% YoY to KES 122B.

Earnings per share increased to KES 12.33, allowing for a final dividend of KES 4.25 per share, up 6.3% YoY, translating to a 9.1% yield. The payout ratio declined to 34.5% as the bank prioritized capital preservation.

Non-interest income grew 10.7% YoY to KES 85.1B, supported by trade finance, forex income, and digital transaction fees.

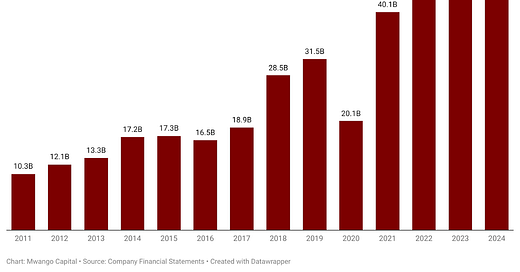

Loan Book Shrinks 7.7%: Equity’s loan book declined 7.7% YoY to KES 819.2B, reflecting weaker credit demand. However, Equity Bank Rwanda saw a 30% YoY increase in loan growth in constant currency, partially offsetting the slowdown. Non-performing loans coverage improved to 71% from 67.3% in FY 2023, signaling a cautious risk approach.

Net interest income rose 3.7% YoY to KES 108.7B, driven by a 5.3% YoY increase in loan income and a 9.9% YoY rise in government securities income. Interest expenses surged 20.3% YoY to KES 61.6B, with deposit costs up 45.0% YoY to KES 48.5B, squeezing margins despite restructuring efforts.

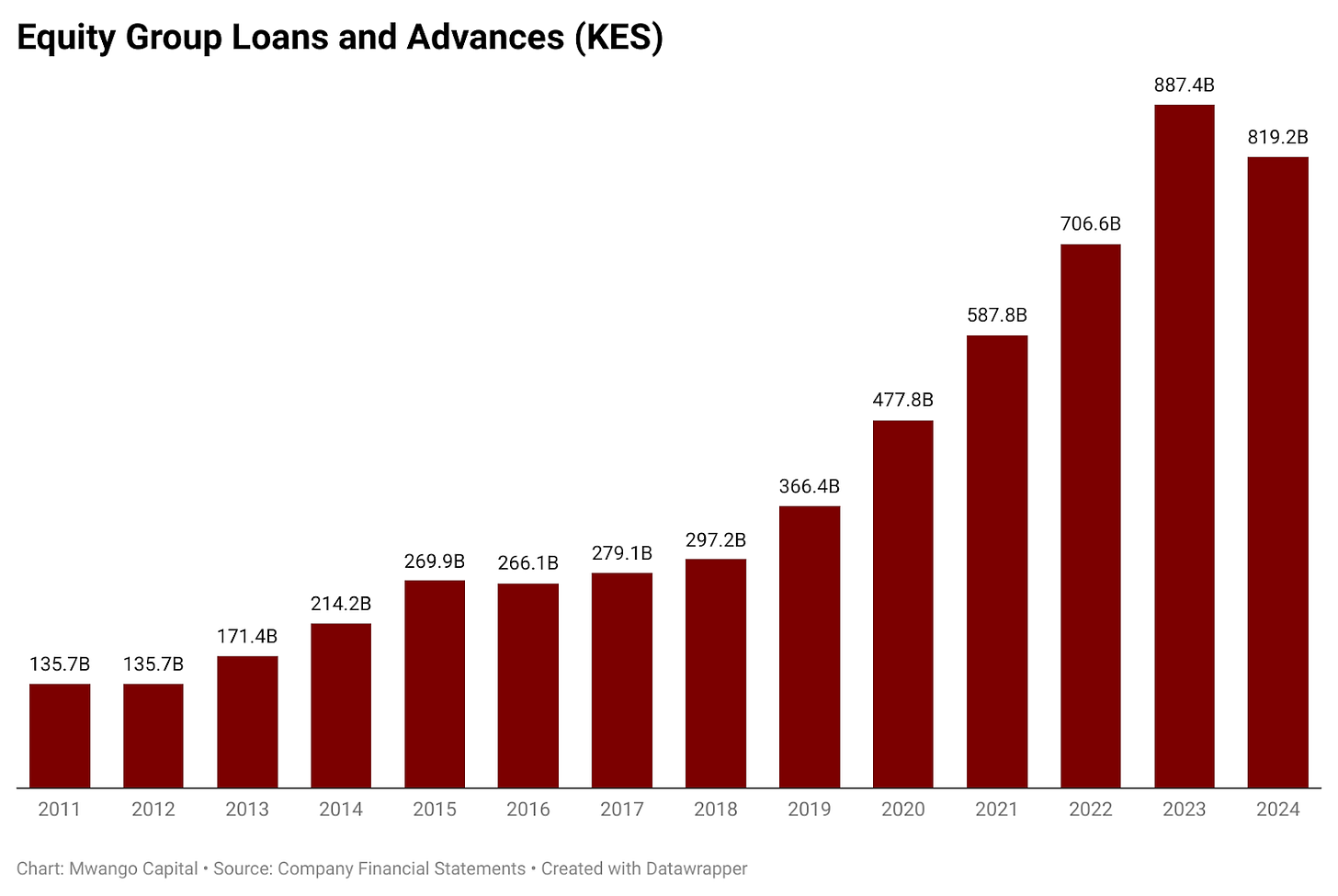

I&M Profit Rises 22%: I&M Group Plc reported a 21.9% YoY increase in profit after tax to KES 15.4B, primarily driven by a 35.0% YoY rise in total interest income to KES 68.1B. However, margin pressures persisted as interest expenses surged 40% YoY to KES 30.5B, reflecting higher deposit costs, which rose 44% YoY to KES 25.4B.

The loan book contracted 7.8% YoY to KES 287.1B, impacted by subdued corporate credit demand, while asset quality deteriorated, with the NPL ratio increasing to 12.4% from 11.4%. Gross non-performing loans rose 0.4% YoY to KES 35.5B, leading to a 14% YoY increase in loan loss provisions to KES 7.8B, signaling a more cautious credit stance.

Non-interest income declined 2.8% YoY to KES 13.7B, weighed down by a 34.6% drop in forex income, although other fees and commissions provided some support, rising 29.4% YoY. The bank increased its total dividend by 17.6% YoY to KES 3.00 per share, maintaining a 32.3% payout ratio.

NCBA Profit Rises 2.0% as Provisions Drop: NCBA Group’s profit after tax rose 2.0% YoY to KES 21.9B, driven by a 40.0% drop in loan loss provisions to KES 5.5B. However, operating income declined 1.5% to KES 62.7B, weighed down by weaker non-interest income, while operating expenses increased 10.6% to KES 32.2B due to rising costs.

The loan book contracted 10.4% YoY to KES 302B, while customer deposits fell 13.4% to KES 502B, contributing to a 9.3% decline in total assets to KES 666B. Despite these, the bank raised its total dividend by 15.8% to KES 5.50 per share, up from KES 4.75 in 2023.

This week’s newsletter is brought to you by:

Invest in the Global Markets with Arvocap Multi-Asset Strategy Fund

Unlock the potential of global markets, from groundbreaking space technology to advanced AI. The Arvocap Multi-Asset Strategy Fund offers a diversified portfolio that includes international markets, emerging tech, and stable commodities like gold and oil.

Join us and invest in a future where you grow with the world's most innovative advancements.

Seize the opportunity to be part of something bigger.

www.arvocap.com

FY 2024 Results Wrap

Kenya Airways’ First Profit in a Decade: Kenya Airways (KQ) posted a KES 5.5B pretax profit in FY2024, its first in over ten years, driven by forex gains and revenue growth. Revenue rose 6% YoY to KES 188.5B, with passenger numbers up 4% to 5.23M and cargo volumes up 25% to 70,776 tonnes. Operating costs rose just 2% to KES 171.9B, lifting operating profit by 58% to KES 16.6B.

A key driver was KES 10.55B in forex gains, reversing a KES 15.04B loss in 2023, as the KES strengthened over 20% against the dollar. Net finance costs fell 67% to KES 11.1B, helping KQ recover from a KES 22.7B net loss to a KES 5.4B net profit.

Britam Posts Record Profit but No Dividend: Britam Holdings reported a 53.5% surge in net profit to KES 5.03B in 2024, its highest ever, marking four consecutive years of profitability. The growth was fueled by a 163.4% rise in net investment income to KES 30.59B, alongside a 3.1% increase in insurance revenue to KES 37.56B. The net insurance service result rose 35.1% to KES 5.07B, driven by higher premiums and lower reinsurance costs.

Pre-tax profit stood at KES 7.33B, with Kenyan operations contributing KES 6.1B and regional subsidiaries adding KES 1.2B. However, Britam General Insurance saw a 14.4% decline in net profit to KES 1.25B, impacted by higher claims from floods and anti-government protests. Despite the record-breaking performance, no dividend was declared.

Kenya Re Profit Declines, Dividend Unchanged: Kenya Re reported a 10.8% drop in net profit to KES 4.44B for 2024, weighed down by a KES 1.68B foreign exchange loss as the shilling appreciated. Despite this, the reinsurer maintained its total dividend payout at KES 839.94M, equivalent to KES 0.15 per share after adjusting for last year’s bonus issue.

Insurance service results improved significantly, surging 336% to KES 2.95B, supported by lower claims. Investment income also grew 23.2% to KES 5.61B, but a 15.7% decline in net insurance and investment income to KES 6.89B weighed on overall profitability.

NSE Profit Surges on Higher Trading Volumes: The Nairobi Securities Exchange (NSE) posted a 532% jump in net profit to KES 116.3M in 2024, driven by increased trading activity. Equity transaction levies rose 20.2% to KES 253.7M, while bond transaction levies surged 163.7% to KES 169.9M, boosting total income by 25.1% to KES 828.4M. Interest income grew 21.5% to KES 147M, further supporting earnings.

Despite a 13.1% decline in data vending income to KES 101.3M, NSE more than doubled its dividend to KES 0.32 per share from KES 0.16 in 2023.

Markets Wrap

NSE Weekly Recap: Week 13 (21 - 28 Mar 2025):

Liberty Kenya (+25.9%) surged to KES 10.30, while Kenya Re-Insurance (-15.7%) dropped to KES 1.61, leading the gainers and losers.

Markets showed slight positive movement—NASI (+0.45%) at 130.8, NSE 20 (-0.81%) at 2,226.9, NSE 10 (+0.48%) at 1,342.4, and NSE 25 (-0.07%) at 3,532.4.

Equity turnover decreased by 43.3% to KES 1.3B, and bond turnover fell by 6.8% to KES 70.9B.

Foreign investors made up 41.96% of total turnover, with KES 545.44M in trades.

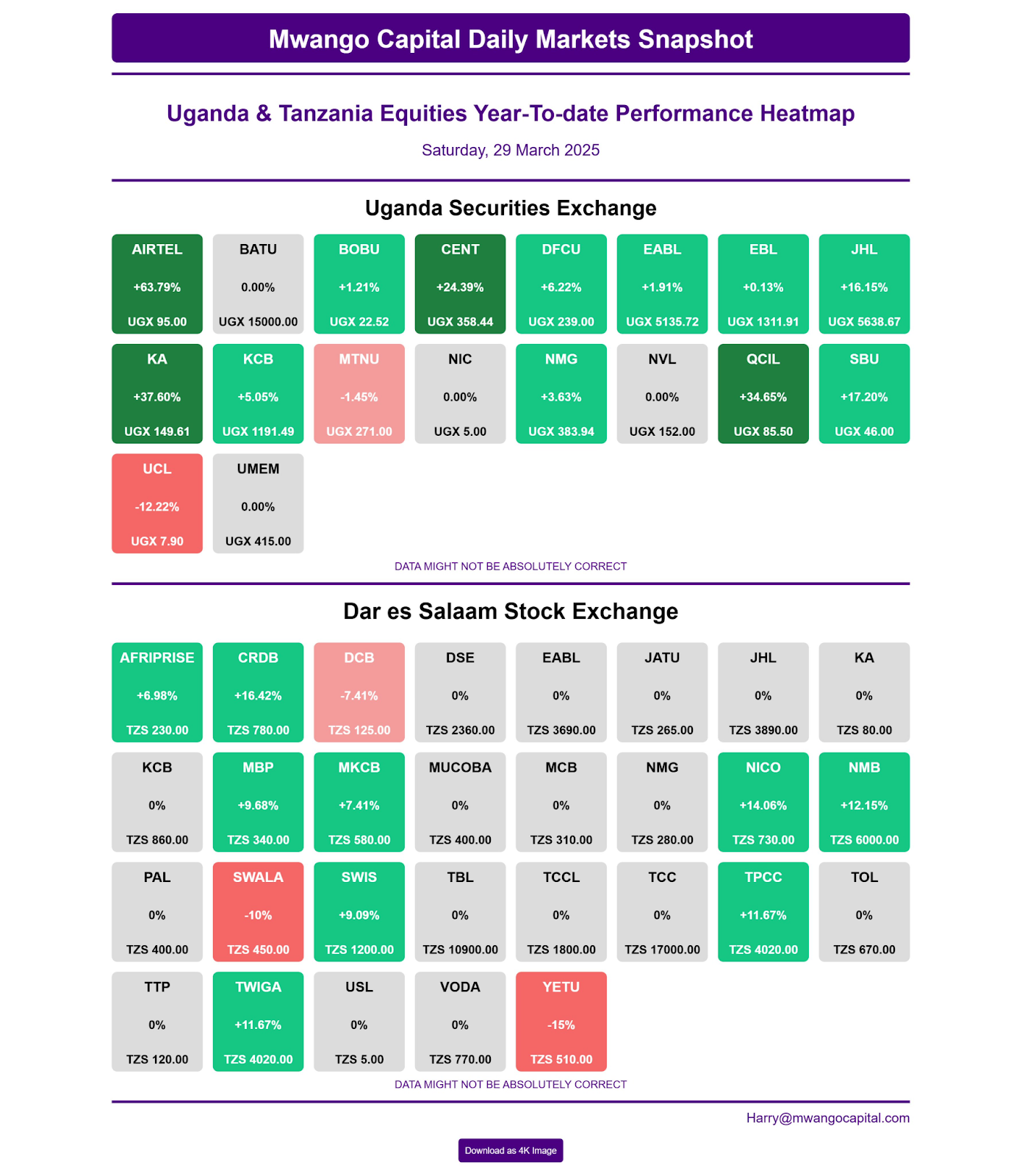

Uganda and Dar es Salaam Securities Exchange:

Treasury Bills: Treasury bills were undersubscribed last week, recording a subscription rate of 61.44%, down from 128.99% the previous week. Investors placed bids totaling KES 14.7B, with the Central Bank of Kenya (CBK) accepting KES 14.5B out of the KES 24B on offer. Yields on the 91-day, 182-day, and 364-day T-bills declined by 4.95, 2.77, and 4.96 basis points to 8.7907%, 9.0583%, and 10.4117%, respectively.

Eurobonds: Last week, yields on six of Kenya’s seven outstanding Eurobonds rose, led by the KENINT 2036 bond, which gained 22.80 basis points to 10.581%. The KENINT 2028 bond followed, climbing 17.0 basis points to 8.522%, while the KENINT 2027 bond was the only decliner, dropping 5.90 basis points to 6.902%. On average, Eurobond yields increased by 10.17 basis points week-on-week.

Market Gleanings

💰| Kenya Secures KES 60B for Road Contractor Debt | Kenya has secured USD 464M in bridge financing from a consortium of banks, arranged by Trade and Development Bank, to settle unpaid road contractor bills. The loan will be repaid through proceeds from a road levy securitized by the Kenya Roads Board (KRB) via a Special Purpose Vehicle (SPV). With KES 175B owed to contractors and landowners, the government plans to issue a medium-term bond by June to refinance the loan. Talks are ongoing with contractors to waive up to 50% of accrued interest, aiming to restart stalled road projects while addressing funding gaps caused by the country's high debt risk.

⚖️| Supreme Court Rules on Loan Rates | The Supreme Court has ruled that banks must get Treasury approval before raising loan interest rates, affirming that Section 44 of the Banking Act applies to both banking charges and interest rates. The decision, issued in a case between Stanbic Bank and Santowels Ltd, settles legal uncertainty on whether banks can unilaterally adjust rates. The court emphasized that regulation prevents exploitative lending while allowing contractual negotiations within set limits.

✔️| KCB to Acquire 75% Stake in Fintech Firm | KCB Group has signed a deal to acquire a 75% stake in fintech firm Riverbank Solutions Ltd, pending regulatory approvals. The acquisition aims to consolidate KCB’s banking services, integrate Riverbank’s payment solutions such as Zedi 360 and Swipe, and expand its distribution network across Kenya, Uganda, and Rwanda. Riverbank has provided KCB with agency banking solutions since 2013. Upon completion, the firm will become a KCB subsidiary.

🔺| BOC Takeover Bid Collapses | BOC Kenya has announced that the planned takeover by Carbacid Investments and Aksaya Investments will no longer proceed after the offer lapsed. Initially proposed in January 2021, the deal faced a prolonged legal challenge that was only resolved in August 2024. However, despite the dismissal of the appeal, the buyers determined that the necessary conditions had not been met within the required timelines.

🚩| Lipa Later Placed Under Administration | Kenyan credit startup Lipa Later has gone into administration despite raising nearly KES 2B in equity and debt financing for expansion. Joy Vipin Chandra Bhatt of Moore JVB Consulting has been appointed as the administrator, taking control of the company’s assets and management. Creditors have until April 23, 2025, to submit claims.

🛢️| EACOP Secures USD 1B in Funding | The USD 5B East African Crude Oil Pipeline (EACOP), planned to export crude oil from Uganda via a port in Tanzania, has secured its first tranche of external financing. EACOP Ltd., the company overseeing the project, confirmed the closure of this initial USD 1B funding, provided by a syndicate of financial institutions, including Afreximbank, Standard Bank, Stanbic Bank Uganda, KCB Bank Uganda, and the Islamic Corporation for the Development of the Private Sector (ICD).

✅| CAK Approves NOCK-Rubis Partnership | The Competition Authority of Kenya (CAK) has approved a five-year non-equity strategic partnership between the National Oil Corporation of Kenya (Nock) and French oil marketer Rubis Energy Kenya. Initially, the firms sought an eight-year exemption, but CAK shortened the duration to mitigate long-term risks. The approval allows Nock and Rubis to collaborate while maintaining independent ownership.

🇪🇹| Ethiopia Holds Interest Rate at 15% | Ethiopia’s central bank has kept the interest rate at 15% to control inflation, which fell to 15% in February from 28.2% a year ago. Headline inflation dropped to 15% in February from 15.5% in January, while food inflation fell to 14.6%, down from 31% a year ago.

🇺🇬| Uganda Cuts Loan Request for Umeme Buyout | Uganda’s government has revised its loan request for acquiring electricity distributor Umeme, lowering it from over USD 190M to USD 118M. The adjustment follows a Special Audit Report presented in Parliament on March 27, 2025, confirming Umeme’s actual investment value. Starting April 1, 2025, Uganda Electricity Distribution Company Limited (UEDCL) will assume electricity distribution responsibilities from Umeme across Uganda.