👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover rising Eurobond yields, the depreciating shilling, the latest company earnings, and bottom-up budget proposals.First off, enjoy a dose of our weekly business news in memes:

https://twitter.com/MwangoCapital/status/1652649971248660482?s=20

Rising EuroBond Yields

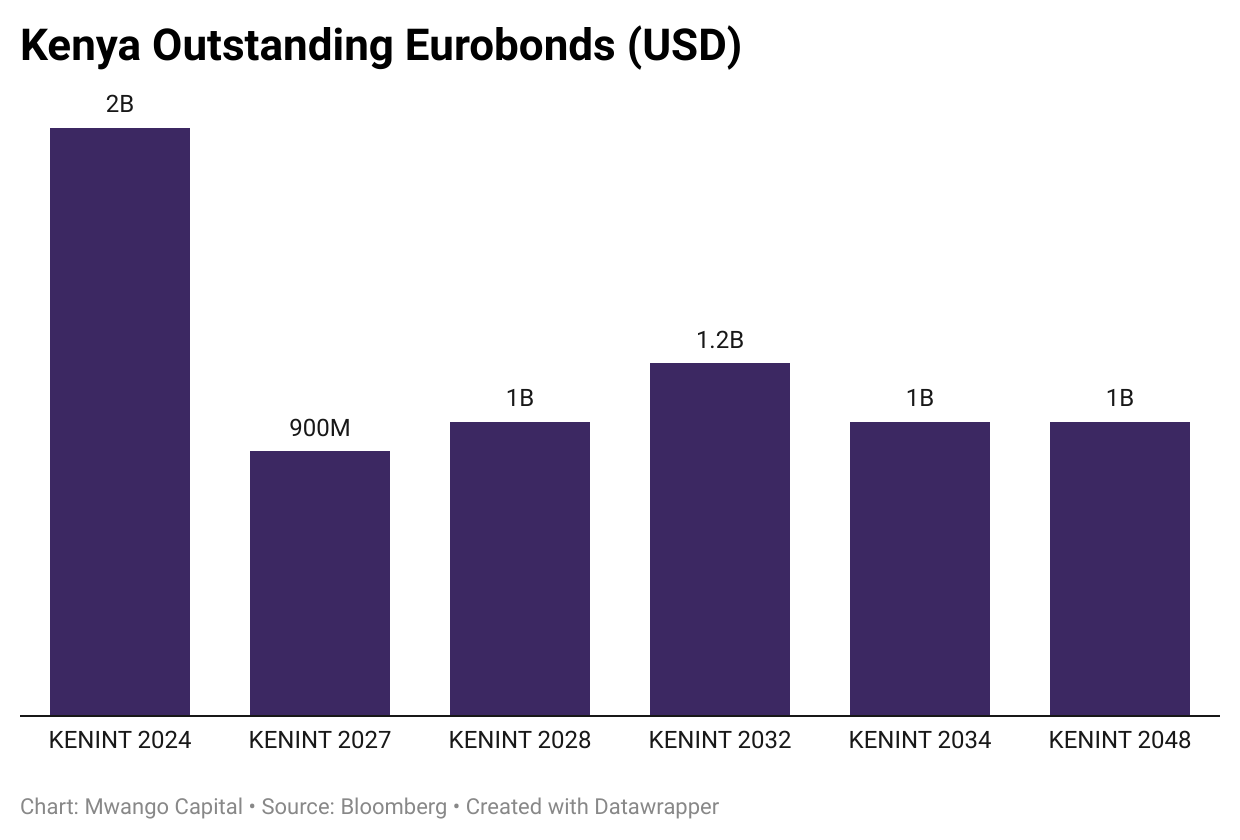

20.5%: Kenyan Eurobonds yields rose significantly in April with the yields for KENINT 2024 that is maturing in June 2024 more than doubling. Notably, the KENINT 2024 yield shot to reach an all-time high of 21.67% in mid-July 2022 on debt restructuring concerns. The Eurobond, whose yield was at 8.74% in April 2022, closed at 20.5% last week amid concerns about the ability to repay the debt.

“What you have seen over the past year or a bit more is a general increase in all Eurobond yields and this is primarily tied to people expecting the US Federal Reserve to hike rates which has led to spread concerns in the market about how these countries borrowed a lot and were running quite substantially fiscal deficits, how they would be able to refinance.”

REDD Intelligence Senior Analyst, Mark Bohlund

“KENINT 2024 continued its poor run, its yields trending higher by 170 bps in the week to end at 20.5% levels. The rest of Kenyan Eurobonds posted lower yields compared to the previous week's levels. Although the refinancing for KENINT 2024 has come into sharp focus, Kenya will largely muddle through with the wide array of options that GoK can pursue to implement its liability management operations. Broad-based weakness for single B-rated countries seems to be the overarching theme.”

IC Asset Managers Economist, Churchill Ogutu

Restructure or Default? Kenya’s Cabinet Secretary to the National Treasury has ruled out debt restructuring pointing out that such a move would mean the country is unable to meet its obligations as and when they fall due.

“We can't restructure because when you restructure, you are like telling people that you are unable to service the debt. We are able to service the debt but we want to reduce the liability. That is, we want to make sure that whenever we are dealing with debt, first, let's consider that it is better to have concessional long-term debt. But in the process, because there is always a cash management issue, there will be short-term debt that is coming up. But then, you can actually use a liability management strategy so that you pay off short-term maturities so that you retire short-term debt in favour of concessional debt.”

National Treasury CS, Prof. Njuguna Ndungu

Maturing Debt: As KENINT 2024 approaches maturity, Kenya’s National Treasury is exploring ways to refinance the dollar debt amounting to $2B. In April, the Treasury advertised that it was looking for arrangers as it sought to tap the international capital markets to raise finances to settle the upcoming Eurobond debt. Here is what Mark Bohlund had to say about the rising yields on #MwangoSpaces last week.

“There will be financing being made available for Kenya in the next few months from the World Bank, from the IMF, and potentially also bilateral sources like China. So, that should ease the financing situation and refinance the 2024 Eurobond. The countervailing force will be how the market reacts to potential credit events in Egypt and Pakistan. My view is that there’ll be more multilateral financing being made available for Kenya, so my personal view is that default on the 2024 Eurobond is considerably lower than what is currently priced in the market. But I don’t think that the multilateral financing expected to come in the few months will crowd in private financing.”

REDD Intelligence Senior Analyst, Mark Bohlund

The Cabinet Secretary to the National Treasury also highlighted the liability management steps around the Eurobond maturing in 2024.

“What we have done is actually to advertise for a show of interest for leading banks in Eurobond to help us in advisory as we manage our liability, that is, liability management and the payment of 2024. So, essentially, that is what happens in the cycles of the Eurobond. We coordinate everyone. The whole issue is that we already know our target for 2024, and what normally happens is that you get an advisor to move you towards the liability management of that bond. As we start in June, it'll be one year to that. So, we have one year in terms of that liability. That's why we had advertised for a show of interest.”

National Treasury CS, Njuguna Ndungu

Tanzania to Float Eurobond: Tanzania is set to issue a Eurobond next year and is looking for arrangers to facilitate the raise in the international capital markets.

“The credit ratings I expect to be announced in the next couple of months. Perhaps to guess, I think Moody’s has their own solicited rating as a B with a positive outlook. I think they could get a B+ rating from Fitch. These Eurobond investors do not have any Tanzania exposure at the moment so I think if they go ahead with issuing a Eurobond, it will be snapped up by investors. I don’t think there will be too much competition between the two. The Eurobond market is small. It could be a positive if Tanzania potentially came first into the market rather than Kenya, but it's hard to say what difference that actually would make.”

REDD Intelligence Senior Analyst, Mark Bohlund

The Depreciating Shilling

Weakening Shilling: The Kenyan shilling was down 9.1% vs the dollar in 2022 and the impact of this can be seen in the commentary from the FY 22 results of manufacturing companies:

Crown Paints: “The weakening of the Kenyan Shilling against the US Dollar and other major world currencies made it more expensive to import raw materials, and this, in turn, impacted the cost of production.”

Sameer Africa: “The Group's earnings reduced by 54% from KShs 217 million in 2021 to KShs 100 million in 2022 mainly due to performance in the tyre trading segment of the business which has been adversely impacted by global supply chain disruptions and further weakening of the Kenya shilling.”

TotalEnergies Kenya: “The increase in operating expenses is majorly attributable to increased business activities post COVID-19 coupled with inflation and foreign exchange on the cost of goods and services…The foreign exchange gains and losses of KShs 147 million (2021: KShs 56 million) are attributable to the valuation of foreign-denominated currency assets and liabilities at year-end.”

WPP ScanGroup: “The effect of fluctuations in exchange rates on the firm’s Cash and cash equivalents position stood at KES 68.6M in FY 22, which was significant in absolute terms compared to the KES 13.1M impact recorded in FY 21.”

Standard Group: “The Kenya Shilling depreciated against the dollar by 9%, which led to an increase in the cost of imports, hence an increase in the cost of direct materials.”

Flame Tree Group: “When you look at our 2022 results specifically, there’s no question that the operating environment was challenging, prices of coal, diesel and gas rose to sky-high levels, manufacturing companies battled with high operating costs, mainly driven by the haulage and freight cost on the back of the global supply disruptions and this coupled with foreign exchange fluctuation exerted pressure on operating cost affected volume growth and margins.”

Dollar Shortage Easing? There are some signs that the dollar shortage issues are subsiding as the interbank currency market reopens. The rate of change of the KES vs the dollar has slowed down and the gap between the official rate and the market rate is also narrowing.

On the G2G Deal: Last week, the Energy CS said that any currency depreciation occurring between the delivery of the oil products and payment will be borne by the consumer. The government took the first delivery of petroleum products exceeding 170K MT under the new government-to-government oil deal, which is likely to hit the pump in the next week or so.

“As a government, we are willing, through EPRA, to manage and recover the depreciation at the pump. That is what the LOS (Letter of Support) just does, which is what we do in the energy sector and power we take the dollar valuation forex loss to the customer. If we release the products today in Kenyan shillings, and the conversion rate varies between today and the time of payment, we will take that variation through EPRA, which is allowed by these regulations, to recover that amount from the pump and that requires some government commitment through that LOS.”

Energy CS, Davis ChirChir

Bottom-Up Budget Proposals

The government has produced a budget brief for FY 2023/24. Here are some highlights:

Revenue and Expenditures:

Total revenues are projected to be up 14.5% from KES 2.5T in FY 22/23 (18.3% of GDP) to KES 2.9T (17.8% of GDP). The revenues are expected to rise 44.8% to KES 4.2T in FY 26/27 (18.3% of GDP).

The total expenditure for FY 23/24 is projected at KES 3.6T (22.1% of GDP). Of this, recurrent expenditure will be KES 2.5T while the development expenditure will be KES 689.1B.

The deficit is projected at KES 663.5B in FY 23/24 (4.1% of GDP), down from the current project deficit projected for FY 22/23 of KES 1.12T (6.2% of GDP).

County Governments: Shareable revenues and conditional grants to the devolved units have been projected to be KES 429.7B (25.7% of GDP) Vs KES 370B in FY 22/23. This includes KES 385.4B in shareable revenues and KES 44.2B in conditional grants from the national government. Notably, the Council of Governors has, this week, pointed out that the counties are on the verge of a shutdown owing to arrears totalling KES 94.35B for the months of February, March, and April.

Some Finance Bill Highlights: Among the highlights for the Finance Bill FY 2023/24 are proposals to:

Exempt liquefied petroleum gas from VAT, railway development levy, and import declaration fee.

Introduce a 1-year amnesty on penalties and interest for accrued tax debts which currently stand at KES 1.5T in a bid to encourage debtors to clear the payments.

Remove the provision that allows the Commissioner General to adjust specific excise duty to annually on account of inflation.

Here is a link to the budget brief.

Latest Company Earnings

Below is a round-up of company earnings this week.

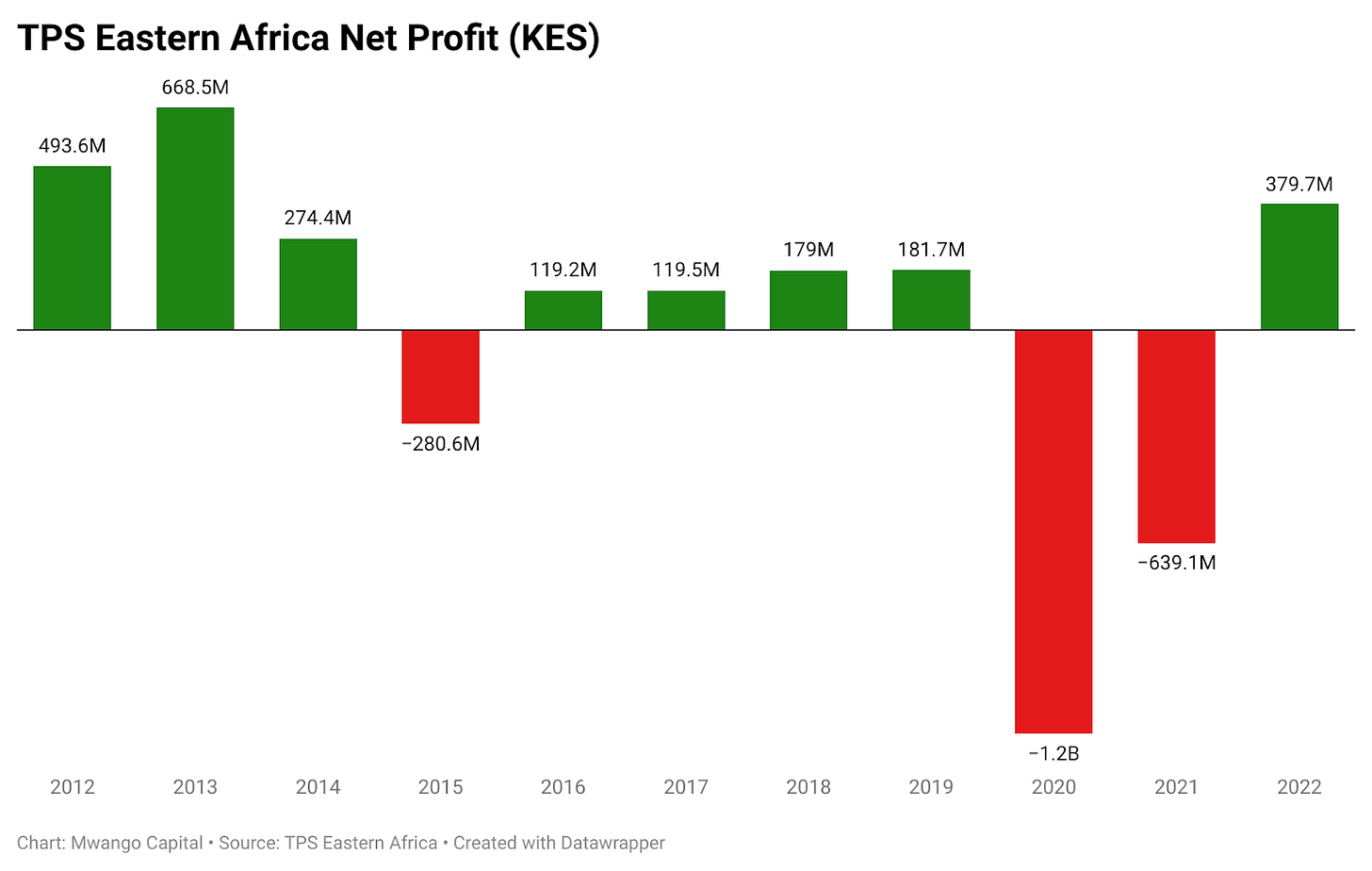

TPS EA Rebounds to Profit: In its results for the fiscal year ended 31st Dec 2022, revenues were up 111.2% to reach KES 6.9B. The firm rebounded to a KES 379M profit from a loss of KES 639.1M recorded in FY 21. Earnings Per Share amounted to KES 1.45 [FY 21: KES -3.43].

“Given the evolving nature of the challenges, the Board of Directors does not recommend the payment of a dividend for the year ended 31 December 2022, and notably whilst the Company concentrates on its strategy to enhance investments in product improvements and business recovery.”

Crown Paints Dividends Unchanged: Gross Revenue rose 6.1% to reach KES 11.4B. The net profit stood at KES 824M, up 12.7% to bring the net margin to 7.2% [FY 21: 6.8%]. They declared a dividend of KES 4 (unchanged from FY 21) for a dividend yield of 20.1%.

Eveready PLC Widens Yearly Loss: Net Sales fell by 7.8% to reach KES 83M with Operating Expenses contracted by 13.3% to reach KES 60.9M. The Loss for the Year increased by 46.6% to KES 50.9M bringing the Loss Per Share to KES 0.24 [FY 21: KES -0.17]. The company will once again not pay dividends this year just as it did not in 2021. Separately, InvestAfrica has entered into a sale of shares agreement with EABL that will see InvestAfrica buy 73M shares of Eveready from EABL. At the close of the proposed transaction, InvestAfrica shall hold 35% of the issued share capital of Eveready.

WPP ScanGroup Back to Profit: The firm rebounded to a profit position of KES 75.2M from a KES 37.9M loss posted in FY 21. No dividend here. An interesting side fact, there were bids of 1 cent and 11 cents for 630k and 50k shares respectively of ScanGroup on Friday. Notably, we are hosting the CEO on #MwangoSpaces next week.

Changes at Bamburi: For the year ended 31 SDec 2022, sales were down 5.8% to KES 39B with net profit down a whopping 86.9% to KES 181M, bringing the net margin to 0.5% [FY 21: 3.3%]. The Board announced a DPS of KES 0.75, down 79.1%. Bamburi PLC’s CFO has resigned effective 31st May 2023 following reassignment within the Holcim Group. Eugene Antera has been appointed the new CFO effective 1st June 2023. Waeni Ngea has also resigned as Company Secretary effective 30th June 2023. In March, the CEO resigned and was replaced in April.

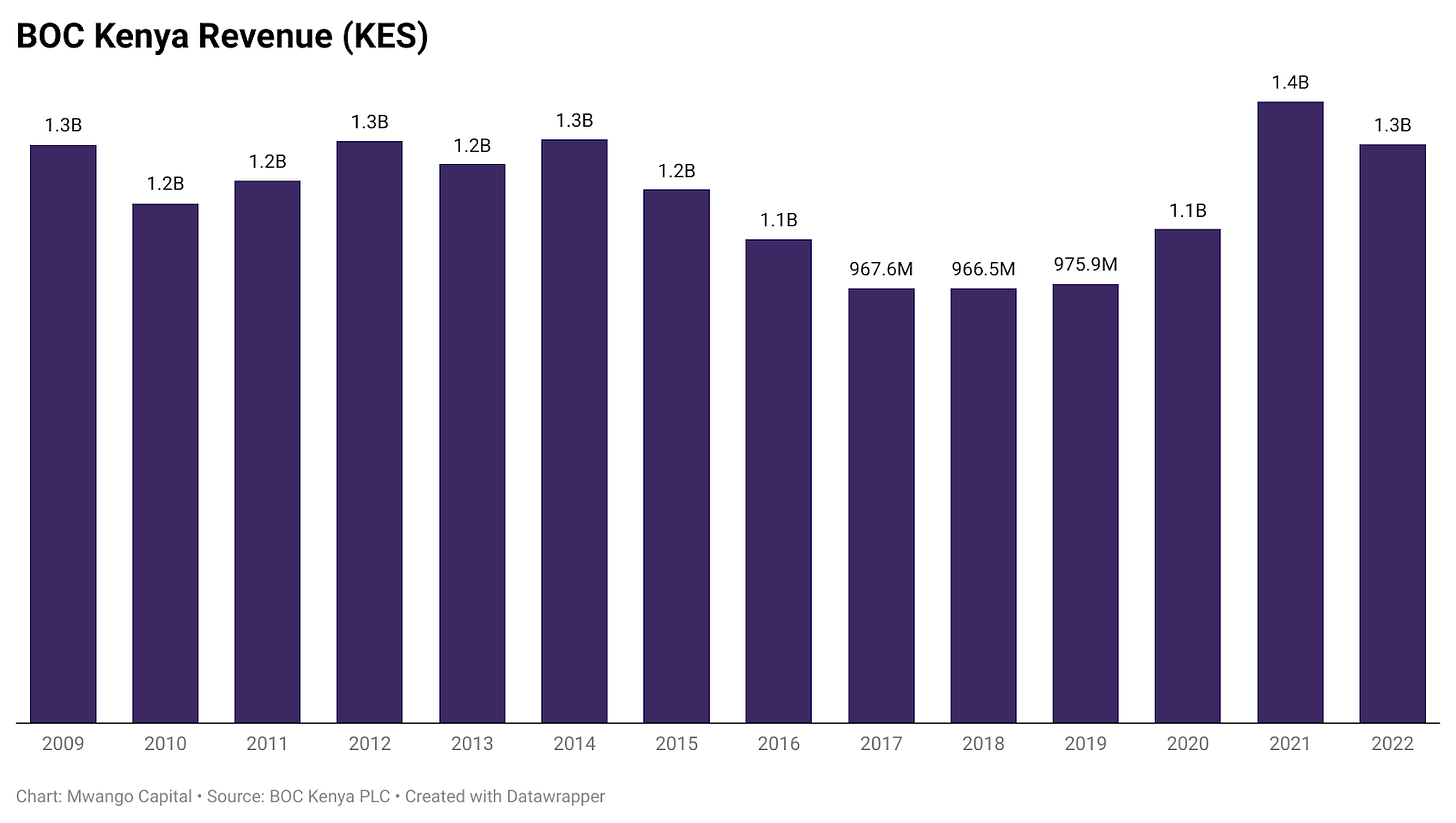

COVID-induced Demand Wanes for BOC: Revenue declined by 6.8% to KES 1.3B in FY 22 as COVID-19-induced demand for medical oxygen waned. The pandemic was the catalyst for the revenue renaissance in between FY 2019 - FY 2022 with the gas company recording an all-time high sales of KES 1.4B in FY 21. Net income increased by 36% to KES 147M with the dividend for the period being KES 6.05, bringing the payout ratio to 79.8% [FY 21: 79.3%].

Pending Bills Impact Standard Group: Total sales fell by 13% to KES 2.7B, while total operating costs expanded by 17% to KES 3.6B, outpacing revenue growth in the operating period to bring the loss before tax to KES 1B [FY 21: KES 22M]. An income tax credit to the tune of KES 158.3M helped to soften the net earnings in the year to a loss of KES 865.2M, 11.8X the loss recorded in FY 21. Investors will not get a dividend in FY 22 just like in FY 21.

“Further, there was an increase in the provision for expected credit losses, due to pending government bills.”

EA Cables Widens -ve Working Capital: In FY 22, gross revenue edged higher by 41% to reach KES 2.6B. The gross profit increased by 21.5% to KES 686.8M, bringing the gross margin to 26.4% [FY 21: 30.6%]. The net loss was reduced by 22% to KES 319.9M, and there will be no dividends for investors, just like in FY 21. Notably, negative working capital stood at KES 1.2B, up 1.7X that recorded in FY 21.

“A material Uncertainty Related to Going Concern section that draws attention to Note 2(f) of the audited consolidated financial statements indicates that East African Cables Plc incurred a loss of Kshs 345.27 million during the year ended 31 December 2022 and as of that date, the current liabilities exceeded current assets by Kshs 1,244.63 million. These events or conditions, along with other matters as set forth in Note 2(f) of the audited consolidated financial statements, indicate a material uncertainty exists that may cast significant doubt on East African Cables Plc’s ability to continue as a going concern.”

Flame Tree Group Sinks to Loss: Revenue increased by 19% to reach KES 4B. Total operating expenses were up 80% to KES 1.02B to eclipse the KES 976.2M gross profit. The operating loss amounted to KES 39.4M [FY 21: KES 262.8M] while the full-year loss was KES 215M from a profit of KES 102.5M in FY 21. Effects of foreign currency translations also had a significant impact on the overall results.

Exchange differences in translation of foreign currency in the P & L resulted in a KES 57.6M loss [FY 21: KES 2.6M gain]. This loss alone was 1.5X the operating loss incurred in FY 22.

On the Cash Flow Statement, the effects of foreign currency translations occasioned a KES 11.5M loss compared to KES 26B gain in FY 21.

Weekly Capital Markets Wrap

The NSE: In Week 17 of 2023, Kakuzi was the top gainer, up 46.3% week-on-week to KES 424.5 while I&, Holdings was the top loser, down 14.6% to KES 17.30. The NSE 20 and NSE 25 indices fell by 1% and 0.5% to 1,578.9 and 2,855.0 points, respectively while the NSE All Share Index was down by 0.2% to 107.6 points. Equity turnover was down 63.1% to KES 1.03B while bonds turnover inched higher by 14.4% to KES 12.4B.

T-Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day treasury bills were 10.275%, 10.511%, and 11.124% respectively. The total amount on offer was KES 24B with the CBK accepting KES 8.9B of the KES 9B bids received, to bring the aggregate performance rate to 37.52%. The 91-day and 364-day instruments recorded a 167.18% and a 14.44% performance rate respectively.

T-Bonds: The CBK has issued a prospectus for three-year new FXD1/2022/003 with a total amount of KES 20B on offer. The tenor for the instrument is 3 years. The period of sale is between 26th April 2023 to 9th May 2023.

Market Gleanings

💰 | Expected $2B Financial Flows | Kenya is expecting $400M in syndicated funds in May 2023 to be priced at 685-785 basis points above the US 2-Year treasury notes. This is in addition to the $200M in syndicated funds that have already been received for the month of April. Additionally, $1.2B is expected in late May, while $400M is expected from the IMF in June 2023. These flows are expected to bolster Kenya’s forex reserves and improve the standing of the import cover.

📱 | Safaricom Ethiopia | In October 2022, Safaricom PLC CEO Peter Ndegwa pointed out that Safaricom Ethiopia was targeting to get to 25 cities and cover 25% of the population by the end of March 2023. Recent data shows that as of April 2023, Safaricom Ethiopia had grown its subscriber base to over 2.8M customers, up from 1M in November 2022.

👨💼 | Appointments |

Abdi Mohamed has been appointed as Managing Director and CEO of Absa Bank Kenya PLC following regulatory approval.

WPP ScanGroup appointed MS Miriam Kagwa as CFO effective 1st February 2023.

Trade CS Moses Kuria has appointed Dr. Kenneth Chelule Langat as the CEO of the Special Economic Zones Authority for a period of 3 years effective 21st April 2023.

Dr. Eng. John Mativo has been appointed by the Board of Directors of KETRACO as the new CEO of the electricity transmission company for the next 3 years.

The Acting Managing Director (MD) at Kenya Pipeline Joe Sang has been confirmed as MD for a term of 4 years.

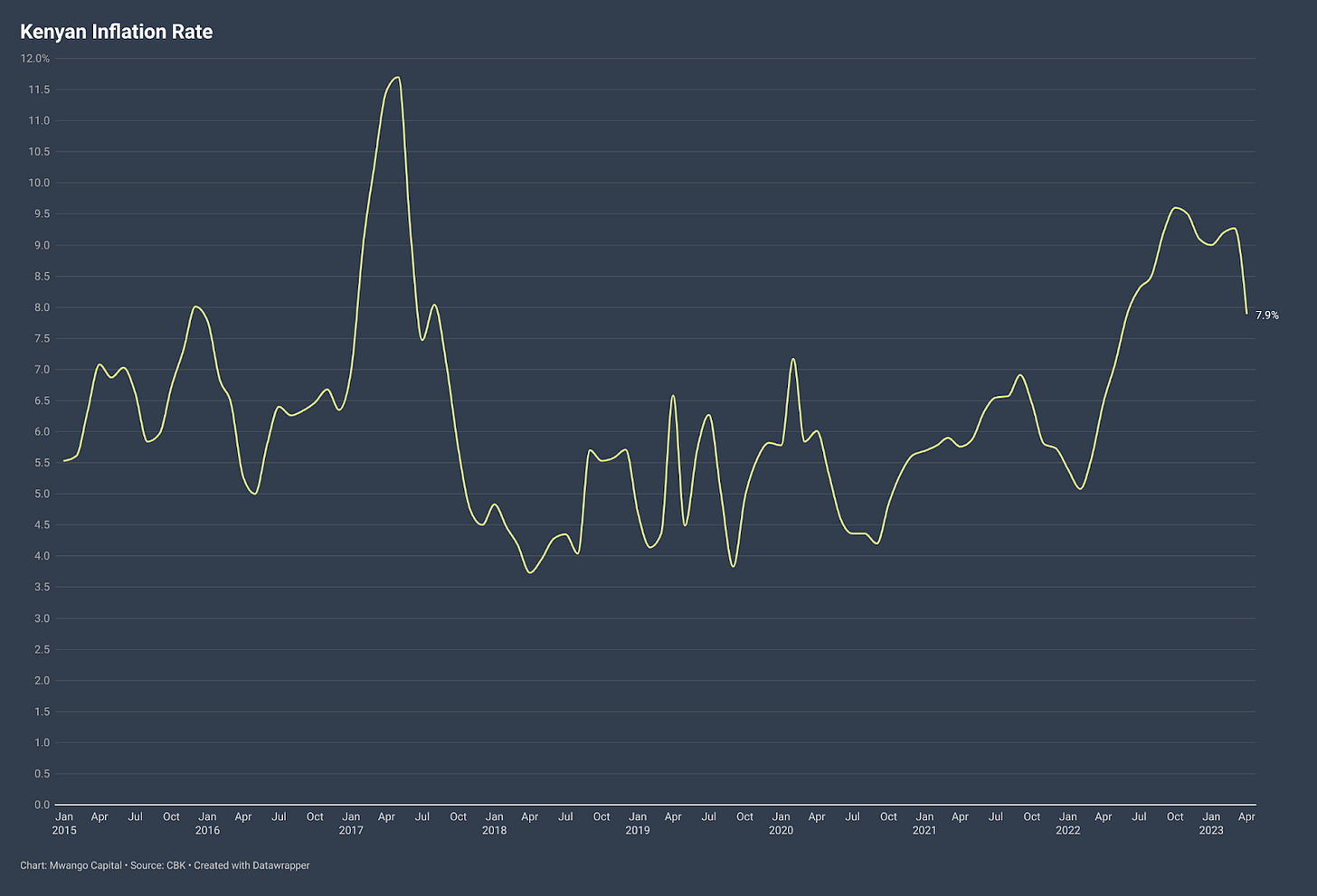

📉 | Inflation Falls 130 bps to 7.9% | Overall inflation for April 2023 fell to 7.9% from 9.2% recorded in March 2023. The Food & Alcoholic Beverages Index rose the most year-on-year at 10.1%, while the Insurance and Financial Services Index recorded the lowest growth at 1.4%. Commodity-wise, 200 Kilowatts of Electricity jumped the most at 63.8% while Onion Leeks and Bulbs Rent rose the least at -11.2%.

🧾 | Tanzania Banks Q1 2023 Results |

NMB Bank reported TSHS 215.4B/$91.6M in Net Interest Income, up 14.9% year-on-year. The Loan Book expanded by 36.8% to reach TSHS 6.6T/$2.8B, while the asset base grew by 21% to TSHS 10.8T/$4.6B. The net result for the year was TSHS 123B/$ 52M.

CRDB’s Loan Book grew by 30% to reach TSHS 7.2T/$ 3.1B. Total assets expanded by 27.5% to TSHS 11.9T/$ 5.1B. Net Interest Income rose by 9.9% to $192.4B/$81.9M. The net profit for the operating period fell by 0.2% to TSHS 90.2B/$ 38.4M.

Here are links to NMB Q1 2023 and CRDB Q1 2023 financial results.

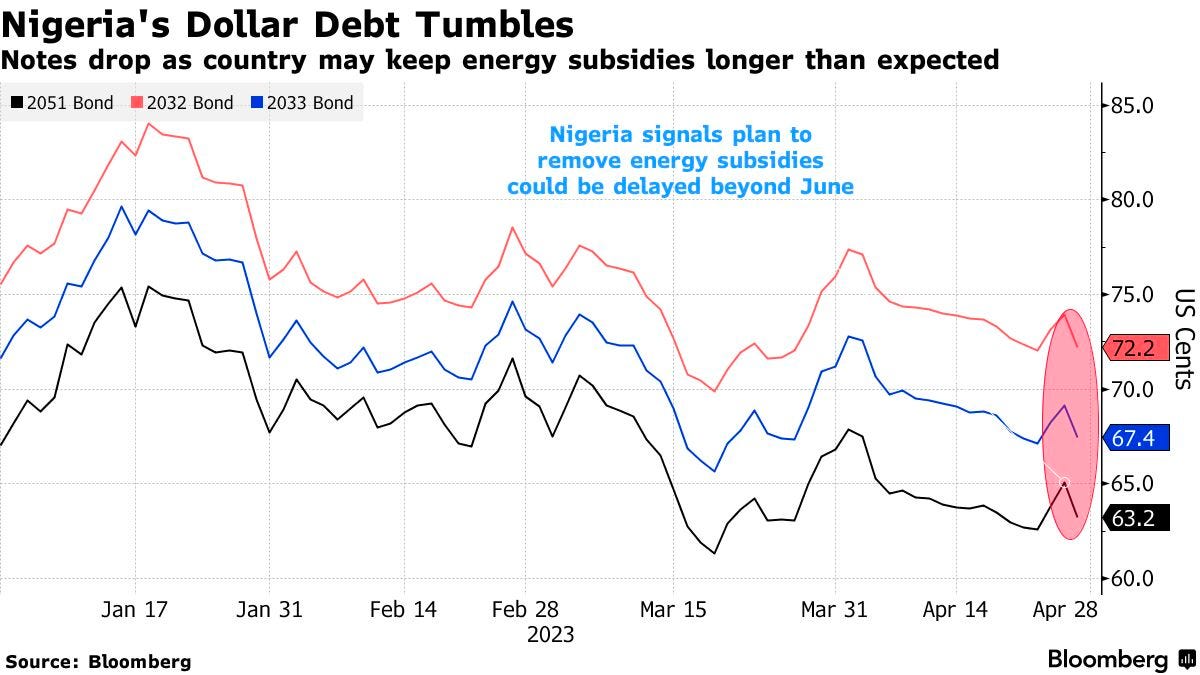

🧾 | No more subsidies | Nigeria's dollar debt yields are rising and prices are falling. Its dollar bonds posted the biggest losses in emerging markets on Thursday after the government said it would delay the planned removal of energy subsidies by 1st June 2023.