👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the rejection of the Finance Bill, 2024, shareholders’ resolutions at Equity Group’s 20th AGM, and Kenya’s inflation for June 2024.This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Kenya’s Finance Bill Protests

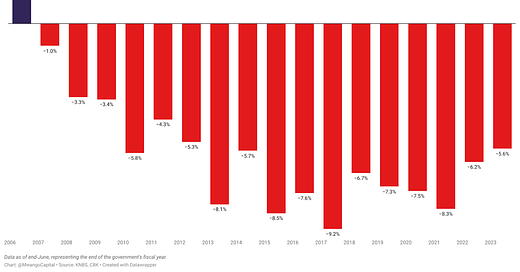

Rejected: The rejection of Kenya's Finance Bill, 2024, on 26th June 2024, was in the backdrop of significant public backlash and nationwide protests against clauses contained in the Bill. In response, President William Ruto directed the National Treasury to implement budget cuts to align with the current fiscal realities. On 28th June 2024, the President assented to the Appropriations Bill 2024 and mandated the National Treasury to prepare a supplementary budget to address the KES 346B deficit in the FY 24/25 budget caused by the Finance Bill's rejection. The Speaker of the National Assembly referred the President's Memorandum, issued on 26th June 2024, to Parliament’s Finance and National Planning Committee for review. The memorandum recommends deleting all 69 clauses of the Bill, effectively rejecting it in its entirety. This development has significant implications for Kenya's fiscal policy and debt management strategies moving forward.

"NOW THEREFORE, in exercise of the powers conferred to me by Article 115(1)(b) of the Constitution and having reservations on the contents of the Bill in its entirety, I decline to assent to the Finance Bill, 2024, and refer the Bill for reconsideration by the National Assembly with the recommendation for the deletion of all the clauses thereof."

President of Kenya, William Samoei Ruto

Lean Times Ahead: The rejection of the Bill also reflects a pivotal moment for Kenya's fiscal policy under President Ruto, highlighting the delicate balance between revenue generation and public sentiment. Kenya's FY 24/25 Budget faces a KES 346B shortfall following President Ruto's rejection of the Finance Bill, 2024. To address the gap, the National Treasury will implement across-the-board budget cuts, focusing spending on critical and essential services only. Accounting officers are mandated to comply strictly with the Public Finance Management Act and related regulations, ensuring disciplined fiscal management. President Ruto has also directed the KES 346B expenditure gap to be evenly split between National and County Governments. Consequently, the County Allocation and Revenue Bill has been returned to Parliament for adjustment, and amendments to the Division of Revenue Act 2024 will be submitted to reflect the status quo. In the interim, essential services will receive up to 15% of the budget until the supplementary budget is approved, ensuring the continued operation of critical government functions.

Analysts Perspectives: Given the rejection of the Finance Bill, analysts have raised concerns about Kenya's financial outlook. Moody's predicts significant revenue shortfalls and higher borrowing costs, highlighting that the government's ability to implement future tax measures will be severely compromised, exacerbating an already weak debt affordability situation. The rating agency also points out that increased interest payments will consume a larger share of government revenue, further pressuring the nation's fiscal health. Morgan Stanley warns that Kenya is likely to miss its fiscal targets for this year and the next, citing the bill's rejection as a critical factor. The expected shortfall could hinder Kenya's access to IMF funding and limit its market access, as bond yields have soared above 10%. Here's what other analysts think:

“The Kenyan authorities have so far followed a standard-style IMF-supported fiscal consolidation program evenly balanced between revenue increases and expenditure cuts. It appears to be the shift in the tax burden from direct taxes, such as personal income, to secondary taxes, such as VAT, which are to a higher degree paid by the poor, have contributed to the conditions which have sparked the latest protests. The President appears committed to continuing to reduce the fiscal deficit, a wise strategy given Kenya’s elevated debt-servicing costs, by matching the cost of the withdrawn tax measures with expenditure cuts evenly spread by the national and county-level governments.”

“While the President has stated that the expenditure cuts are to be focused on cutting out the costs of the higher administration, it remains to be seen if this is actually the case. I see it as more likely that cuts will come in development expenditure, which may well fall below 3% of GDP. However, the elephant in the room remains the sharp increase in the government’s interest costs which will likely have to be addressed in the coming years, although it is unclear exactly how this will be done.”

REDD Intelligence Senior Analyst, Mark Bohlund

"Kenya's fiscal targets are unlikely to be achieved against a backdrop of mounting societal pressure to repeal the Finance Bill. In line with our existing base case, we anticipate the administration will now become more cautious about taxing the economy, given the high cost of living and the population's concerns around it…We project that ongoing revenue shortfalls and higher-than-budgeted domestic debt-servicing costs will keep fiscal deficits wide at 5% of GDP in fiscal 2025, compared with 5.6% in fiscal 2024"

“What a week we have had! President Ruto declining to assent into law the Finance Bill, followed by the austerity cuts suggests that the authorities may want to see fiscal consolidation. We should get to the weeds of the actual cuts in the coming days, but for it to be significant, it has to go beyond mere operational expenditure cuts. Focus needs to be on wasteful spending which means a broad-based relook at the FY25 budget to trim it back to a more realistic level. Absence a credible spending cut, the fiscal deficit will widen to c. 5.0% from the initial 3.3% presented.”

IC Asset Managers Economist, Churchill Ogutu

Equity Group’s ESOP

Plan Endorsed: Last week, Equity Group held its 20th Annual General Meeting (AGM) where shareholders approved several key proposals put forward to them by the Board of Directors. Shareholders endorsed the Equity Group's new Employee Share Ownership Plan (EGH ESOP), allocating 5% of the Group’s issued share capital (equivalent to KES 5.0) to the plan. This share-based long-term incentive scheme aims to attract and retain talent across all subsidiaries of Equity Group Holdings Plc by allowing qualifying employees to purchase shares at a significantly discounted price, with grants made annually and options vesting three years after the grant date. The ESOP includes provisions for forfeiture of options under certain conditions and limits the maximum units issued to 10% of the Group's share capital. Employees can redeem their units for cash or shares two years after issuance without needing to go to public markets.

New Subsidiaries: Apart from approving a KES 15.1B payout for the second year in a row (36% payout ratio), the AGM also approved the formation of a banking holding company to house the activities of banking within the Group. This restructuring will see Equity Group operate under four distinct groups: Banking, Insurance, Technology, and Foundation. Further, shareholders also ratified the acquisition of Cogebanque in Rwanda, bringing the Group’s market share in the country’s banking sector to 18%.

Mary Wamae Exits: Equity Group celebrates the career of Mrs. Mary Wangari Wamae, who steps down from the Board after two decades, during which she advanced from Head of Legal to Group Executive Director, oversaw key subsidiaries, and was recognized as a leader in banking and finance. She had been touted as a potential successor to the current CEO James Mwangi.

Markets Wrap

NSE This Week and Month: In Week 26 of 2024, Car General led the market, rising 12.8% to KES 22.55, while Kenya-Re was the worst performer, dropping 49.8% to KES 1.42. The NSE 20, NSE 25, and NASI indices all declined by 4.3%, 2.2%, and 2.9% closing at 1,656.5, 2,861.0, and 109.5 points, respectively. Equity turnover fell by 24.8% to KES 900.8M, while bond turnover rose to KES 25.45B from KES 23.29B the previous week. Month-on-month, Express Kenya was the top gainer, up 13.78% to KES 3.22, followed by BK Group and Williamson Tea Kenya, up 13.56% and 8.18% to KES 36 and KES 271, respectively. Kenya RE was the worst performer, down 40.59% to KES 1.42, followed by EA Portland Cement and Transcentury, which fell 29.72% and 21.15% to KES 4.99 and KES 0.41, respectively.

NSE Mid-Year Analysis: Kenya Re emerged as the top performer, surging by 51.06% to KES 1.42. This was followed closely by Liberty Kenya which rose by 43.63% to KES 5.30, and KCB Group, which rose by 42.69% to KES 31.25. On the downside, EA Portland Cement was the worst performer, plunging by 37.63% to KES 4.99. Unga Group and TransCentury saw significant declines, falling by 25.52% to KES 12.55 and 21.15% to KES 0.41, respectively.

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.9771%, 16.7636%, and 16.7911% respectively. The total amount on offer was KES 24B with the CBK accepting KES 6B of the KES 7.6B bids received, to bring the aggregate performance rate to 32%. The 91-day and 364-day instruments recorded 109.03% and 14.94% performance rates, respectively. The Central Bank of Kenya has announced a tap sale of Treasury Bond, Issue No. FXD1/2023/002, dated July 8, 2024. A gross amount of KES 20B is on offer, with the bond having a coupon rate of 16.9723%. The adjusted average price for this bond is KES 106.3186 per KES 100, The CBK also issued a Prospectus for Re-Opened Ten and Twenty Years Fixed Coupon Treasury Bonds FXD1/2024/10 and FXD1/2008/20 with a coupon rate of 16.00% and 13.750% respectively dated 22/07/2024. The period of sale is from 26/06/2024 to 17/07/2024.

Eurobonds: In the week, yields were up week-on-week across the other 5 outstanding papers.

KENINT 2028 rose the most, up 20.30 bps to 10.170%, followed by KENINT 2027 at 18.0 bps to 8.796%. KENINT 2031 rose the least, up 5.00 bps to 10.607%. The average week-on-week change stood at 12.87bps

Except for KENINT 2027 which shed 23.3bps, yields on the remaining papers rose on a year-to-date (YTD) basis, with KENINT 2031 rising the most by 10.607 percentage points followed by KENINT 2034 at 118.40 bps to 10.521%.

All prices fell week-on-week, led by KENINT 2034 fell the most at 1.1% to 74.927, followed by KENINT 2048 at 0.7% to 77.739. KENINT 2031 fell the least at 0.2% to 95.972. YTD, KENINT 2027 was the only paper that rose, up 1.4% to 95.492. KENINT 2034 fell the most at 6.9% followed by KENINT 2048 at 6.5%.

Market Gleanings

💸| Inflation Declining | Kenya's inflation rate for June 2024 has slowed to 4.6%, marking the lowest level since September 2020 and falling below the midpoint of the Central Bank of Kenya's (CBK) target range for the first time since October 2020. This is a significant decrease from 5.1% in May 2024 and 7.9% in June 2023.

💸| Eurobond Repayment | Kenya's forex reserves fell by $521M last week, settling at $7.8B (4.1 months of import cover), down from $8.321B (4.3 months of import cover) the previous week. The decline resulted from a $500M Eurobond repayment on June 21, 2024. Earlier this year, Kenya successfully issued a $1.5 billion Eurobond at a 10.375% yield to partially buy back the June 2024 $2B Eurobond.

☕| Tea Earnings Wrap |

Kapchorua Tea Kenya PLC: Kapchorua Tea Kenya Plc reported results for the year ended 31st March 2024 last week, with revenue rising by 23.7% to KES 2.2B. The company saw a 27% increase in profit after tax, reaching KES 399M, and earnings per share also grew by 27% to KES 51.04. Dividends per share remained constant at KES 25.0 while the total assets surged by 22.9% to KES 2.9B.

Williamson Tea Kenya: The company’s revenue increased by 4.3% to KES 4.2B, while profit after tax declined by 6.6% to KES 526.9M. Earnings per share dropped by 3.4% to 28.41. Total assets grew by 7% to KES 9B, but cash from operations decreased significantly by 68.2% to KES 310M, resulting in a 51.4% reduction in cash balance to KES 716.3M

🫴 | Standard Group’s Rights Issue | Standard Group has announced a KES 1.5B (equivalent to 3X its current market capitalization) Rights Issue aimed at strengthening and restructuring its balance sheet. As of market close last week, the company’s share price was KES 6.80, down 12.1.% YTD and 24.8% over the last one year.

🇬🇭| Ghana Debt Restructuring | Ghana has reached an Agreement in Principle (AIP) with private creditors to restructure approximately USD 13B of debt representing around 17% of Ghana’s GDP. The AIP outlines two main options for bondholders: a PAR option that maintains the principal amount but extends maturities and reduces interest rates (capped at USD 1.6B), and a DISCO option involving a 37% reduction in principal but offering higher interest rates on the restructured bonds. These measures are expected to give Ghana approximately USD 4.7B in debt relief.

💰| IMF Reaches Agreements with Tanzania, Zambia |

Tanzania: Last week, the International Monetary Fund (IMF) completed the third review of Tanzania’s Extended Credit Facility (ECF) arrangement, allowing for an immediate disbursement of approximately USD 149.4M to support the country’s budget. Additionally, the IMF approved a 23-month arrangement under the Resilience and Sustainability Facility (RSF) amounting to about USD 786.2M.

Zambia: The International Monetary Fund (IMF) completed the third review of Zambia’s 38-month Extended Credit Facility (ECF) Arrangement, approving an augmentation of approximately USD 385.7M. As a result, Zambia now has immediate access to a disbursement of about USD 569.6M, bringing the total disbursement under the ECF-supported program to approximately USD 1.1B.