Safaricom's New Board Chair

John Ngumi elected to chair the Safaricom's Board of Directors effective 1st August

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Safaricom’s new Board chair, CMAs Q2 statistical bulletin, and EABL FY '22 results.

First off, enjoy our weekly business news in memes brought to you by The Shack Nairobi:

End of an Era at Safaricom

MJ Out: Michael Joseph, the founding CEO of Kenya’s largest listed firm, Safaricom, is leaving his current position at the firm as the Chairperson of its Board of Directors. The long-time Safaricom executive has pointed out that he is stepping down to focus on Safaricom’s Ethiopia expansion and restructuring at Kenya Airways, where he chairs the Board.

Ngumi in: John Ngumi was appointed to the Board of Directors and elected to chair the Board in a meeting held on July 28, 2022. He will be taking effect on August 1, 2022. John Ngumi chairs the Board of Directors of the Industrial and Commercial Development Cooperation, sits on the board of Kenya Airways, and chaired the Presidential Taskforce on Review of Power Purchase Agreements. In other board changes, Mr. Sitholizwe Mdlalose resigned from the Board effective August 1, 2022.

Roundup of Telco News:

CBK Blocks Faraja Launch: The regulator this week blocked the launch of Safaricom-backed zero-interest credit service Faraja. The planned launch of the Buy Now Pay Later product intended to disrupt the mobile loans market was suspended pending ongoing regulatory reviews.

“Faraja was to be offered by EDOMx in partnership with Safaricom and Equity Bank. As communicated by EDOMx, Farajas’s launch was postponed and a new date will be communicated in due course.”

Safaricom statement

No Separation Yet: Following the move by Airtel Networks Kenya Limited to spin its mobile money business into an independent unit, Airtel Money Kenya Limited, Safaricom’s outgoing Board Chair Michael Joseph has said the firm does not intend to split its telecommunication business from its mobile money service M-Pesa.

Safaricom Pays IFC: Safaricom and its partners in the Ethiopia business Joint Venture paid the International Finance Corporation (IFC) a KES 474M transaction fee for services rendered in the entry into the new market. Safaricom has a 55.71% indirect shareholding in Safaricom Telecommunication Ethiopia. According to the latest disclosures, Safaricom closed FY 22 with KES 30.8B in Net Cash and Cash Equivalents.

CMA Q2 2022 Statistical Bulletin

The Capital Markets Authority released its Statistical Bulletin for Q2 2022. Below are a few highlights:

Bond Market

Treasury Bond Market: 7 Treasury bonds were issued including 1 reopening, 2 tap sales, and 4 new issues. The government sought to raise KES 240B in total and received KES 222.71B bids. Out of this, it accepted KES 202.86B bringing the performance and acceptance rates to 92.79% and 84.52%, respectively.

Corporate Bond Market: Outstanding corporate bonds grew by 2.43% to KES 29.51B as of March 2022 compared to KES 28.81B reported at the end of FY 2021. EABL’s Fixed Medium Term Note (First Tranche) had the largest amount outstanding as of March 2022 at KES 11B or 37.27%.

Market Turnover: Turnover fell by 27.86% year-on-year to KES 195.67B in Q2 2022 compared to KES 271.24B of bonds traded in Q2 2021.

Equity Market

Market Cap: The total value of the listed firms fell by 28.24% to KES 1.939T in Q2 2022 compared to KES 2.702T in Q2 2021.

Turnover: Turnover decreased by 30.94% year-on-year to KES 26.24B in Q2 2022 compared to KES 37.99B in Q2 2021.

Shares Traded: The volume of shares traded fell by 20.87% to 870.20M in Q2 2022 compared to 1.099B shares traded in Q2 2021.

Investor Participation: Foreign investors' participation in Q2 2022 was 61.54% compared to 54.88% in Q2 2021. The net foreign portfolio outflow in Q2 2022 came in at KES 10.895B compared to KES 1.687B in Q1 2022.

Collective Investment Schemes

Assets Under Management: Total assets under management grew by 4.45% to KES 140.67B compared to KES 134.67B managed in Q4 2021. CIC Unit Trust Scheme had the highest AUM at KES 56.92B - accounting for 40.46% of gross AUM.

You can find the full document here.

EABL Net Profit Up

In its results for the year ended June 30, 2022, EABL reported growth in net sales of 27.3% to KES 109.4B, well above the growth in the cost of sales which came in 16.5% higher compared to the previous financial year.

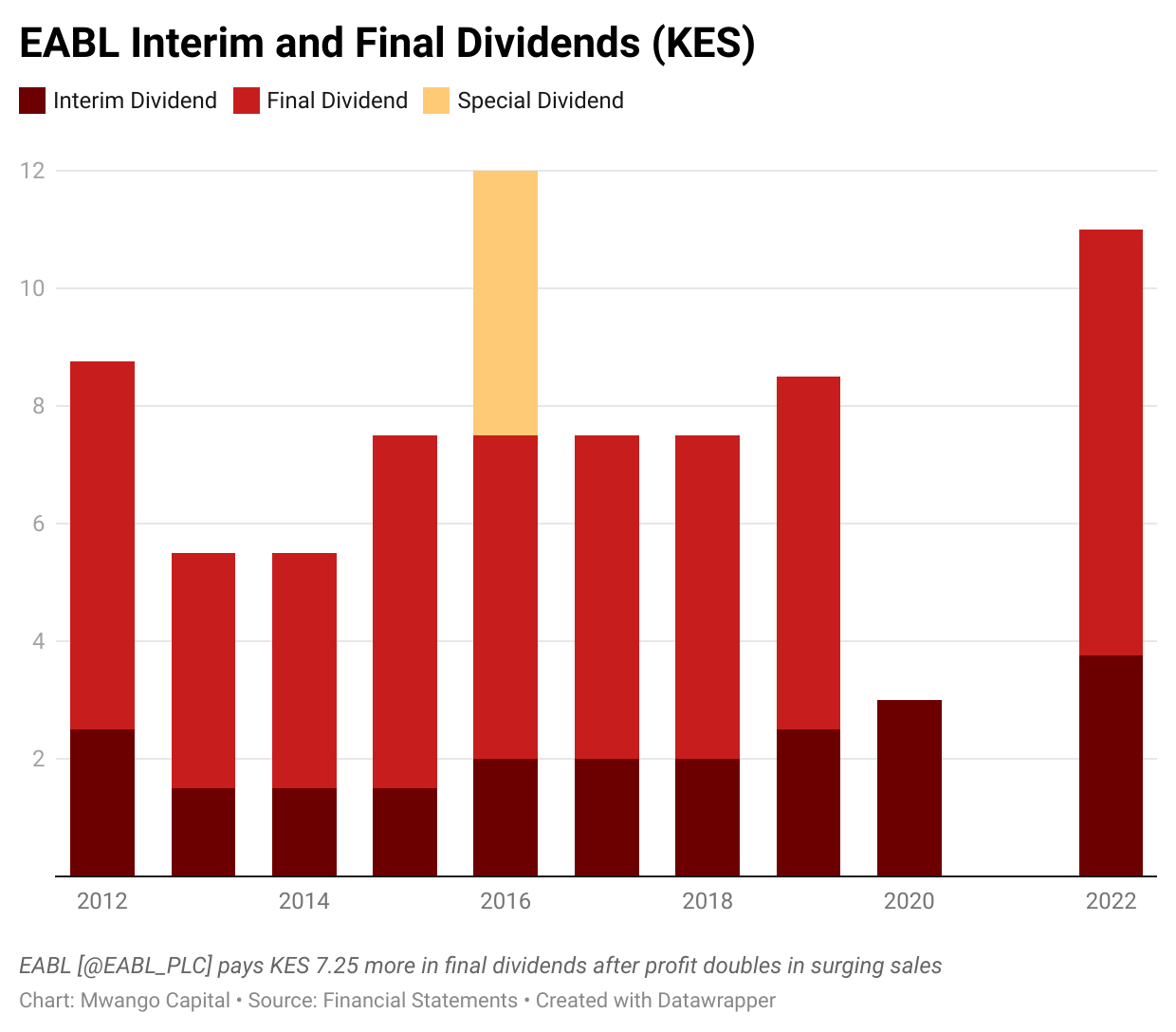

Net Income grew by 124% over the year to reach KES 15.6B. The Board of Directors has recommended the payment of a KES 7.25 per share final dividend bringing the total dividend for the year to KES 11 per share [2021: Nil].

In light of the challenges firms have had in sourcing dollars from banks this year, EABL has taken a dollar-denominated overdraft to plug gaps created by limited foreign exchange supply. According to the firm, the bank is only able to access $5K from banks daily which is insufficient to meet the brewer’s demand.

“We have taken a bank overdraft to manage the current liquidity in foreign currency primarily. This has meant that we have had to apply foreign currency overdraft to meet the demand for payments. We don’t borrow in FX as a matter of principle. However, with the limited liquidity of dollars, we have managed this by getting an overdraft in dollars and we pay it down as liquidity becomes available.”

EABL CFO, Risper Ohaga

Centum FY 2022 Results

Centum reduced its loss from investment operations to KES 547M in FY 2022 from a KES 1.15B loss in FY 2021. Two Rivers weighed heavily on the Group’s P&L as the loss from its operations increased by KES 126.551M to stand at KES 1.985B in FY 22. On aggregate, the full-year loss came in at KES 1.34B compared to KES 1.37B in 2021.

The firm has announced a dividend per share of KES 0.587 [2021: KES 0.33]. Centum continues to trade at an 85% discount compared to its Net Asset Value which stood at KES 62.1 in FY 22 compared to KES 62.85 in FY 21.

The drop in the NAV is a result of the impact of unrealized fair value loss movements of KES 227M in the year. In the 2021 financial year, revaluation losses stood at KES 4.2B. Centum is down 4.7% and 33.9% on a week-on-week and Year-to-Date basis at the NSE.

Find the results here.

Earnings RoundUp

Stanchart Africa & Middle East: Operating income for H1 2022 year edged higher by 3.28% to reach $1.291B, accounting for 15.74% of $8.2B in global revenue. Africa & Middle East banking operations were the most inefficient, with the cost-to-income ratio coming in at 62.6%. Comparatively, Asia and Europe & Americas had the ratio at 61.9% and 53.4% respectively. Profit before tax was up 22.32% in the period under review to $574M, translating to 20.7% of the Groups profit before tax.

Tanzania’s Top 2 Banks

CRDB Net Income Up 83%: Interest income grew by 22% to reach TZS 229B, while non-interest income was up 47% to TZS 91B. CRDB’s total assets rose by 9% from the previous quarter to TZS 10,254B, maintaining its lead as the country’s largest lender by asset size.

NMB PAT Crosses TZS 100B: Operating income was up 52.64% to TZS 153.028B. NMB’s net income officially crossed the TZS 100B mark in the period under review, posting a growth of 52% to TZS 106.623B.

Mergers, Deals, and Acquisitions

Hospitality Sector:

Crowne Plaza Hotel Sale: Kasada Hospitality Fund, backed by Qatar's Sovereign Wealth Fund - the Qatar Investment Authority - has bought Crowne Plaza Hotel for a total consideration of KES 4.6B. The transaction has received regulatory approval but payments have not been made in full.

680 Hotel Sale: The property is being disposed of to Maanzoni lodges for an estimated KES 1.2B (5.6X 2018 Revenues) in a transaction that is subject to regulatory approval. The sale is part of a group of hotels including Boulevard Hotel, Castle Royal Hotel (Mombasa), Elementaita Lodge, Samburu Lodge, Sentrim Tsavo, Sentrim Amboseli, and Sentrim Mara that are in the pipeline for disposal by Knight Frank on behalf of billionaire investor Jagdesh Patel.

Banking Sector:

Daraja Microfinance Bank Sale: UMBA Inc., a fintech company incorporated in the State of Delaware, USA, has acquired 66.06% of Daraja Microfinance Bank Limited. UMBA is licensed to carry out non-deposit-taking credit business in Kenya. Daraja’s customer deposits grew 3.8% year-on-year in 2021 and has a market share of less than 1%.

What Else Happened This Week

Kenyan bond yields improve: In the domestic debt market, investors continued to concentrate on shorter-term securities. For the 91-day paper, the CBK accepted bids worth KES 14.1B out of an offer of KES 4B at an average market-weighted average interest rate of 8.399%, 8 basis points higher compared to last week’s auction. Total accepted bids as a percentage of advertised amounts stood at 18.56% and 23.37% for the 182-day and 364-day paper at 9.392% and 9.946%.

Inflation hits 8.3%: Annual inflation for July 2022 came in at 8.3%, 40 basis points higher than in June. The Food and Non-Alcoholic Beverages index was up the highest year-on-year at 15.3%, followed by the Household Equipment and Transport index which rose 9.8% and 7.0% Year, respectively. Inflation continues to be in breach of CBK’s set target of 2.5 - 7.5%.

KRA Reopens Keroche: The taxman last week opened Keroche Breweries in Naivasha following a court directive.

CBK vs Chipper, Flutterwave: In an unusually direct response to a question during the CBK press briefing, the Central Bank Governor, Patrick Njoroge, pointed out that Flutterwave and Chipper Cash were not licensed to operate as remittance or payments service providers in Kenya. The CBK later wrote to financial institutions to cease and desist from dealing with the two organizations. Bloomberg reported that Flutterwave had responded to the allegation by saying that they are waiting for a response from the CBK for a Payment Service Provider license it had applied for in 2019.

Kenya Airways Bailout: The Transport Ministry has hinted that a State loan earmarked for Kenya Airways to the tune of KES 36B in FY 2022/23 is conditional and its release will be scheduled and performance-based. The total stock of loans to the airline from the government grew by 134.12% year-on-year to KES 25.78B. KQ’s total guaranteed and unguaranteed debt stood at KES 104B as of March 2022.

Interest Rates Watch

🇰🇪 Kenya: The Monetary Policy Committee of Kenya’s Central Bank left rates unchanged in its meeting last week, citing the ongoing transmission of the 50 bps hike in May. The apex bank also pointed out that the recently rolled out Stimulus Package coupled with moderating global commodity prices are set to ease domestic inflationary pressures in the near term.