👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the full-year earnings from EABL and Centum, updates from the Safaricom investor briefing and AGM, and Moody’s conclusion of Kenya’s credit rating.First off, enjoy a dose of our weekly business news in memes.

This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Ready to take control of your financial future? Start your journey to financial success with a YEA Account. Save, invest, and grow your wealth with access to mobile loans and a range of financial benefits.

EABL Profits Decline

Costs Rising Fast: A combination of taxes and inflation hit EABL’s FY 2023 earnings hard. The cost of sales rose 10.1% year-over-year, faster than the marginal rise in revenues of 0.2% as the operating environment got worse and inflation picked up in H2 2023 as compared to H1 2023. Moreover, indirect taxes grew by 4.2% to KES 87.9B and accounted for 44.5% of gross sales [2022: 43.6%]. This is the worst year-on-year decline in gross profits in the last decade, bringing the gross margin to 43.2%, down from 48.3%.

“Inflation really picked up across all the markets and when you look at our inputs, ethanol was scarce throughout H2 and that started late in H1 and picked in H2. We are having to now source ethanol at 60% above what we were buying before, so it is like a 61% inflation on ethanol, grain is almost 31% following the drought, glass following the excise increments we are buying that at 20% above and that follows transport and logistics, electricity 40% so you can see just from an inflation perspective, we’ve seen immense pressures come through and I think all the consumers are feeling this across our countries.”

EABL Plc CFO, Risper Genga

Profitability: EABL’s net profits for the year were down 21% to KES 12.3B, lowering the net margin by 300 basis points to 11.2% [2022: 14.2%]. This is still the third-highest absolute net profit in the last decade.

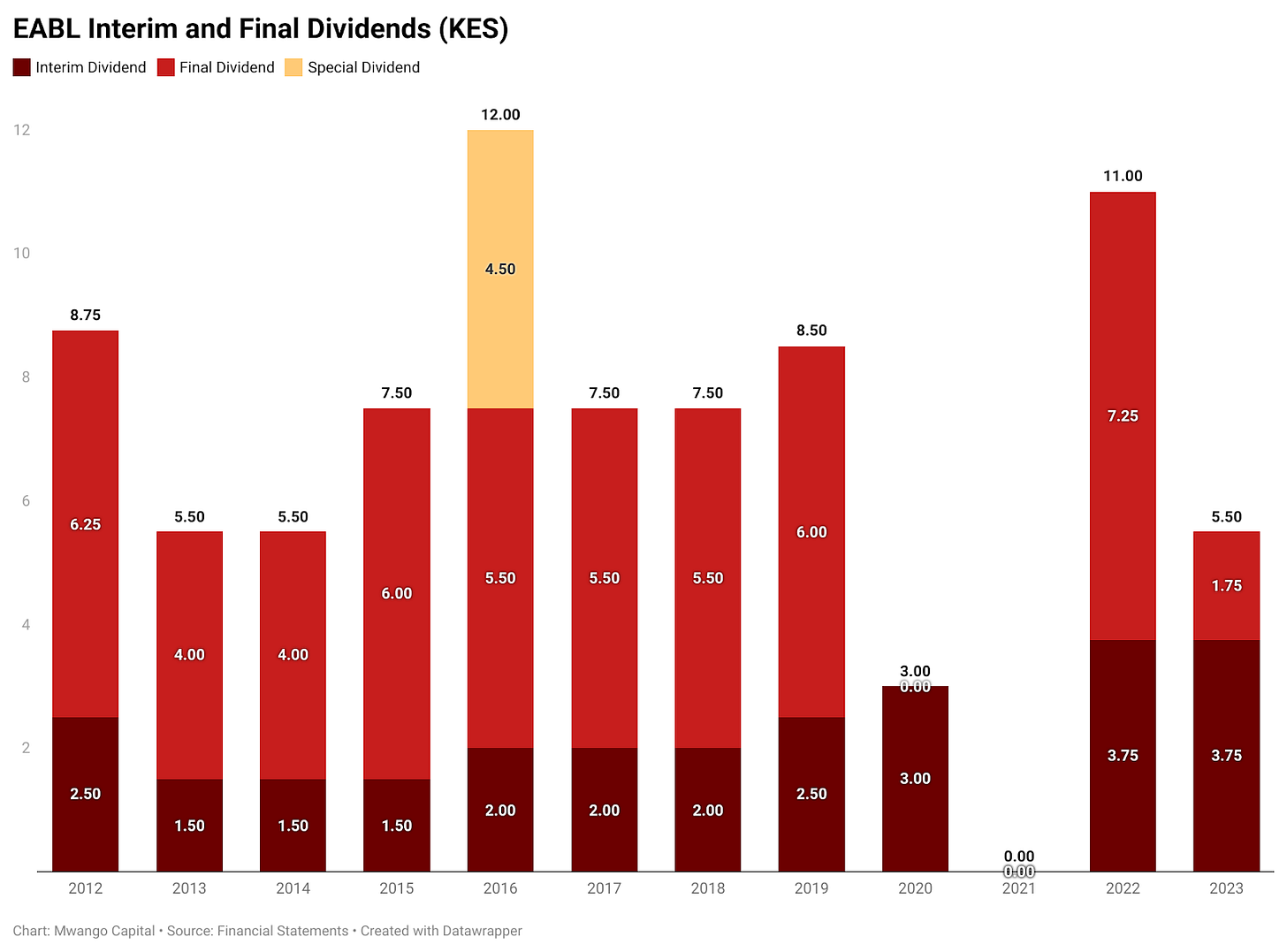

Depressed Dividends: The final dividend proposed of KES 1.75 per share is far below the final one of KES 7.25 proposed last financial year. This brings the company’s total dividend for FY 2023 to KES 5.5 per share [2022: KES 11]. The market was unhappy with the results, pushing the share price down by 6.7% on Friday to KES 153.5.

Extra: Here are links to the results, presentation, and analysis. One interesting slide from the EABL presentation is how Kenyans are allocating their spend pre and post-Covid:

Centum’s Losses Widen, Declares Dividends Still

Widening Losses: On a consolidated basis, FY 2023's net loss was up 3.5X to KES 7.3B. Excluding fair value gains on investment property, the total comprehensive loss would have exceeded KES 11.2B - equal to 30.2% of equity. At the company level, investment income was KES 2.1B, up 28.3%, and the loss for the year was KES 4.9B [FY 2022: KES 247.9M].

Fair Value Gains: Gains on investment property were KES 2.1B, up 4.1X from 2022. Gross profit from residential unit sales rose by 23.6% to KES 413.9M while other income fell by 10.3% to KES 88.9M. From the disposal of investment properties, a loss of KES 52.6M was incurred compared to a KES 111.1M profit in 2022. Operating costs rose by 52.5% to KES 685.3M bringing operating profit to KES 1.9B, 3X up from 2022. Centum Real Estate’s FY 2023 results can be found here.

Pivot at Two Rivers: Sales and investment income fell by 33.4% to KES 251.1M. The share of loss from the joint venture was KES 1.1B, up 10.7%. The net loss from Two Rivers Development Group was KES 7.1B [2022: KES 2.3B], which also resulted from a one-off loss from the impairment of Two Rivers Development Limited assets.

“KES 3.9B of the unrealized losses relate to the full write-down of the carrying value of Two Rivers in Centum’s books. KES 1.6B of the OCI movement relates to deferred tax recognized on cumulative realization reserves following the review of CGT rate from 5% to 15%.”

Centum PLC Group Finance Director, Risper Alaro

Dividends: The Board of Directors has proposed a KES 0.60 DPS [FY 22: KES 0.59]. The KES 400M aggregate dividend payout is in line with the firm’s policy to pay out at least 30% of its annuity income as dividends. FY 2023 annuity income totalled KES 1.3B.

“The recommended dividend is courtesy of strong performance in annuity income generated from our marketable securities portfolio (MSP) as well as private equity dividend income. MSP yielded an annualized return of 15.5%, an improvement from a yield of 13.7% in the prior year.”

Centum PLC CEO, Dr. James Mworia

Updates on the Share BuyBack Programme: Since the start of the programme on 6th February 2023, 4.8M shares have been purchased, constituting 7.2% of the maximum possible 66.5M shares that may be purchased over the 18-month period. The aggregate shares traded totalled 10.5M, and therefore the SBB purchases accounted for 45% of gross trading activity. The company has also been actively trying to reduce debt levels:

“We have made good progress at Centum company level. We do not have dollar-denominated facilities At Centum Real Estate, those are also converted. We are in the process of fully unwinding dollar-denominated liabilities.”

Centum PLC CEO, Dr. James Mworia

We also hosted Dr. James Mworia on #MwangoSpaces on Friday to discuss the results. Here is a link to the results, presentation, and analysis.

Large Foreign Seller at Safaricom

At the NSE: In a week when Safaricom’s M-PESA platform was under cyber attack, there was also a large foreign seller on the counter at the NSE on Friday. The investor’s sales were executed in two batches, the first at around 1210 HRS of around 130M shares. At 208M, the total shares traded on Friday accounted for 98.7% of daily NSE trading activity, with local investors accounting for 94.8% of buys. This was the highest trading volume recorded since June 2008 when the firm listed at the NSE. The share price closed the week at KES 16.60, down 31% year-to-date and down 44.7% over the last 1 year.

On Safaricom Ethiopia: Safaricom PLC held an investor briefing with updates on Safaricom Ethiopia. Here are some 2 key quotes on the operating landscape there from Safaricom PLC CFO Dilip Pal:

On the exchange rate: “It continues to be a challenge. And the gray market - - the gray rate and the official rates, that difference continues, although I think if you look back from the last 3 to 4 years, the ETB has depreciated but the gray market rates have also gone up. So necessarily, they have not been able to bridge that gap, and that continues to be. And obviously, until such time that currency stabilizes and there is enough flow, we will be going through a challenging time. And for us, I think the focus is to ensure that we service our local payments as much as possible to the fullest through the ETB, the local currency borrowing and then pay to our importer, major payments to importers through the funding and also the funding that you will get from the IFC, which is expected to be concluded this quarter. So it is not necessarily a problem right now, but it is something that we need to watch out very closely as government progresses on its liberalization agenda.”

On M-PESA in Ethiopia: “On M-PESA, commercial readiness preparation.We have incorporated the subsidiary in Ethiopia, the operations will be done through a subsidiary, which is called Safaricom and M-PESA Mobile Financial Services. We have briefed you previously that we have started configuring the systems. So we have kicked off testing of the system and all the functionalities as the team is doing all end-to-end and reissuance tests and also for the customer experience. We have onboarded our agents and also pursued recruiting. So in kind of completing the recruitment process of agents in preparation for the launch in this quarter. So from a commercial side and the technical side, I think we are fairly ready. We are just finishing the last leg of testing.”

Buy Now, Pay Later: Safaricom and EDOMx have partnered to allow customers to access the Faraja Buy Now Pay Later service across businesses on Lipa na M-PESA, allowing customers to make purchases of between KES 20 - KES 100K at a zero interest fee and a 30-day payment window. The partnership will see Safaricom enable EDOMx to offer Faraja services to more than 606K businesses on Lipa Na Mpesa at a negotiated facility fee payable by the business.

Earnings Wrap

I-LAM Fahari I-REIT: For the 6 months ended 30th June 2023, rental and related income grew at 6% year-on-year to KES 179.5B, while net revenue was KES 177.8M, up 5.6%. Interest income rose by 14% on higher interest rates, while operating expenses stood at KES 109.9M, up 9.8%, equal to 61.8% of revenue [2022: 59.5%]. Net profit fell by 0.2% to KES 86M.

Nairobi Business Ventures: For the year ended 31st March 2023, revenue was KES 308.3M, up 62.2% year-on-year on the back of the shift from trading in building materials to chemicals. Net profit fell by a whopping 83% to KES 8.6M and the Board of Directors did not recommend a dividend despite the revenue growth on account of macro challenges.

Kenya Power’s Loss Projection: For the fiscal year ending 30th June 2023, Kenya Power is projecting a KES 5.6B pre-tax loss on account of the depreciation of the Kenyan Shilling against major currencies.

Tanzanian Banks H1 2023 Results: Tanzania’s two largest banks by asset size - CRDB Bank PLC and NMB Bank PLC, have released their H1 2023 results:

CRDB: The loan book grew by 29.2% year-on-year to TZS 7.7T (USD 3.2B), while government securities were up 32.4% to TZS 2.2T (USD 934.5M). Total assets rose by 33.3% to TZS 12.5T (USD 5.2B). Net interest income edged higher by 11.2% to TZS 201.6B (USD 84.4M), while non-interest income grew by 10.7% to total TZS 101B (USD 42.3M). Net profit was TZS 89.8B (USD 37.6M), up 7.3%, while Earnings Per Share (EPS) were TZS 34.37 (USD 0.01).

NMB: Loans rose by 31.7% to TZS 6.6T (USD 2.8B), while government securities stood at TZS 2.4T (USD USD 987.7M), down 42.9%, to account for 9.5% of the total assets [2022: 21.1%]. Total assets grew by 26.5% to TZS 11.5T (USD 4.8B). Net interest income and non-interest income rose by 24.5% and 16.3% to TZS 236.8B (USD 99.1M) and TZS 113.5B (USD 47.5M), respectively. Net income for the period was TZS 139.3B (USD 58.3M), up 30.9% while the EPS was TZS 1.1K (USD 0.5).

Here are links to CRDB Bank PLC and NMB Bank PLC H1 2023 results.

Markets Wrap

NSE: In Week 30 of 2023, Umeme was the top-performing stock on the Nairobi Securities Exchange, appreciating by 10.8% to KES 13.3. Longhorn was the worst-performing stock, falling 18.8% to KES 2.11. All indices were in the red, with NSE 20, NSE 25, and the NSE All Share Index (NASI) falling by 89%, 4.4% and 4.8%, respectively, to close at 177.8, 2,739.2 and 105.3 points, respectively. Equity turnover increased by 439.6% to KES 4.3B - partly on account of the Safaricom block trade, while bonds turnover rose by 30.1% to KES 18.3B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day closed at 12.352%, 12.392% and 12.728%, respectively. The total amount on offer was KES 24B with the Central Bank of Kenya (CBK) accepting KES 8.9B of the KES 9.1B bids received, to bring the aggregate performance rate to 38.1%. The 91-day and 364-day instruments recorded 176.84% and 7.08% performance rates, respectively.

Eurobonds: In the week to 27th July 2023, the yields fell across the 6 outstanding papers on a week-on-week basis.

KENINT 2027 fell the most, down by 43.8 basis points to 10.168%, while KENINT 2024 fell the least, down by 21.3bps to 12.016%. The average week-on-week change stood at -33.77 bps.

The yields were mixed on a year-to-date (YTD) basis, with KENINT 2023 falling by 58.7 bps, while for the remaining instruments, they appreciated, with KENINT 2034 rising the most, up by 54.9 bps, while KENINT 2048 rose the least, up by 12.6 bps to 8.250%. The average increase was 18.17 bps.

KENINT 2048 led price gains week-on-week rising by 2.7% to 77.123 - while year-to-date, KENINT 2024 rose the most at 3.5%. The average price change on a week-on-week and YTD basis was -0.2% and 1.8%, respectively.

Market Gleanings

⚖️ | Finance Act 2023 to Supreme Court | After the Court of Appeal, on 28th July 2023, overturned a High Court Order delivered on 30th June 2023 suspending the implementation of the Finance Act 2023; Busia Senator and activist Okiya Omtatah and Others, announced, via a Notice of Appeal, their intention to appeal the decision at the Supreme Court.

“Take Notice that Okiya Omtatah Okoiti, Eliud Karanja Matindi, Benson Odiwuor Otieno, and Blair Angima Oigoro, respectively, the 1st, 2nd, 4th and 5th respondents, being dissatisfied with the entire Ruling of the Court of Appeal (Warsame, M’Noti & Omondi, JJ.A) given at Nairobi on the 28th day of July 2023, intend to appeal to the Supreme Court against the whole decision.”

🤝 | Deals, Mergers, and Acquisitions | The Competition Authority of Kenya (CAK) approved some acquisitions in the week:

Nairobi Women’s Hospital: The CAK approved the proposed acquisition of a controlling stake in Nairobi Women’s Hospital by the founder, Dr. Sam Thenya, allowing him to regain control from US-based PE Fund, Evercare Health Fund. Prior to the transaction, Dr. Thenya held a 25% stake in Heathlink which trades as Nairobi Women’s Hospital.

Car & General Acquisition of Cummins C&G: The CAK approved Car & General's proposed acquisition of sole control in Cummins C&G Holdings Limited from Cummins BV. Prior to the transaction, Cummins C&G was equally owned by Car & General & CMI Africa Holdings BV.

📉 | Moody’s Outlook Changed to Negative | Slightly over a week after Fitch Ratings downgraded Kenya’s long-term foreign-currency Issuer Default Rating from B Stable to B Negative, Moody’s Investors Service announced the completion of its review for downgrade initiated on 12th May 2023; confirming long-term foreign currency and local-currency issuer ratings and senior unsecured debt ratings at B3, with the outlook changed to Negative.

💱 | Naira FX Losses Dent Earnings: As a result of FX changes by Nigeria’s central bank on 14th June 2023, MTN Nigeria’s calculations show there was an approximate 60% movement in the exchange rate, bringing the USDNGN to 756.24 as at the end of H1 2023. Here is a summary of the impact on earnings:

Guinness Nigeria: For the year ended 30th June 2023, unrealized foreign exchange losses totalled N45.9B (USD 60.8M) compared to N221.9M (USD 530.9K) in 2022.

Dangote Cement: Exchange rate losses totalled N103.8B (USD 137.3M), bringing H1 2023 pre-tax profits to N239.9B (USD 317.2M), a 10.4% decrease.

Nestle Nigeria: H1 2023 financial data on Nairametrics shows Nestle Nigeria’s FX loss was N123.7B (USD 163.6M), pushing pre-tax losses to N86.5B (USD 114.4M).

Airtel Africa: For the quarter ended 30th June 2023, Airtel Africa reported an N128.6B (USD 170M) net loss due to an N356.2B (USD 471M) loss from derivatives and FX.

MTN Nigeria: Unrealized FX losses rose 9.7X year-on-year to N131.5B (USD 173.9M), exceeding net profit which fell by 29.1% to N128.B (USD 170.2M).

“The immediate impact on our results for H1 was the unrealized forex losses included in our net finance charges. Net finance costs increased by 164.3% due to increased borrowings and an unrealised forex loss of N131.5 billion (H1 2022: N13.6 billion) on our net foreign currency liabilities following the significant devaluation of the Naira. Trade line facilities were required to establish letters of credit to fund our capex program given the paucity of forex.”

🗠 | Interest Rate Watch Across Africa | Over the week, a few Central Banks hiked their interest rates on account of the inflation trajectory and outlook. Here is a summary of the key actions:

Ghana: The Bank of Ghana hiked its key rate by 50 bps to 30% on elevated inflation risks driven by the second-round effects of food prices. Inflation has persistently hovered around 42% throughout Q2 2023, with headline inflation rising to 42.5% in June 2023.

Nigeria: The Central Bank of Nigeria raised its benchmark interest rate by 25 bps to 18.75% - the fourth consecutive rate hike in 2023. Nigeria’s headline inflation rate also climbed to 22.79% in June 2023, the highest since September 2005.