Savannah Clinker's Bid for Bamburi

The company offers to acquire up to 100% of the ordinary shares at KES 70 each

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Savannah Clinker Limited's counter offer to acquire Bamburi Cement, Kenyan banks earnings in H1 2024, and Tax Procedures (Amendment) Bill 2024.Savannah Clinker Enters the Fray

Savannah’s Sweet Counter Offer: Savannah Clinker Limited has officially made a competing offer to acquire up to 100% of the ordinary shares of Bamburi Cement PLC at KES 70 per ordinary share. This proposal follows the initial offer made by Amsons Industries (K) Ltd aiming to buy out the existing shareholders at KES 65 per share. Savannah has offered to buy out the existing shareholders at KES 5 more than Amsons which represents a premium of 7.7%. Savannah’s offer price also represents a premium of 4.5% over Bamburi’s recent trading price, setting a new benchmark for the valuation of Bamburi Cement. Savannah Clinker is betting on its status as a Kenyan company compared to Amsons Tanzania, arguing that the synergies likely to result from the combination of Savannah Clinker and Bamburi operations are likely to have more benefits compared to Amsons’ bid.

Bamburi shares gained 21% in the week and are up 116% this year on the back of the bids for acquisition.

Rationale for Savannah’s Offer: Savannah Clinker's offer outlines several strategic motivations behind the bid, including leveraging Bamburi's established market position and vast resources in the Kenyan and East African cement industry. The company, which is wholly owned by Benson Sande Ndeta, sees this acquisition as an opportunity to integrate Bamburi's operations with its own clinker processing and mining activities, thus creating a more robust and vertically integrated business model. Given the scale of the offer and the stakes involved, Savannah Clinker has emphasized its commitment to maintaining the listing of Bamburi on the Nairobi Securities Exchange (NSE), provided it can secure 90% or more of the shares, a move designed to reassure minority shareholders of its long-term intentions.

Funding the Bid: Savannah Clinker has outlined that the offer price will be paid in cleared funds within 30 days after the completion of the offer, provided all conditions are met. Savannah Clinker has also indicated that this timeline may be extended subject to approval by the Capital Markets Authority (CMA) if certain conditions, such as regulatory approvals and the acquisition of at least 60% of the shares, are not met by the initial long stop date of February 2025. This level of detail underscores the company's determination to see the deal through, potentially outmaneuvering Amsons Industries, whose offer price is KES 65 per share, KES 5 lower than Savannah Clinker's bid.

Savannah’s Continuity Plans: One of the standout elements of Savannah Clinker’s offer is the explicit guarantee of continuity for Bamburi’s employees. The company has publicly committed to retaining all existing contractual and statutory employment rights post-acquisition. This assurance, coupled with promises of opportunities for growth and advancement, is likely aimed at mitigating any workforce anxiety that could arise from such a significant corporate shake-up. Moreover, Savannah Clinker plans to continue with Bamburi’s existing business operations, including its cement production plants in Mombasa and Athi River, while also potentially benefiting from the synergies that will emerge from combining its mining assets in Kitui County with Bamburi’s established manufacturing base.

What Next? This competing offer is likely to trigger a critical response from both Bamburi’s board and its shareholders. With Savannah Clinker’s premium offer on the table, alongside its commitments to employee retention and business continuity, the dynamics of the acquisition battle have undoubtedly shifted. Investors and industry analysts will be watching closely as the competing bids progress, particularly how the involved parties navigate the regulatory landscape and whether additional counteroffers might emerge in response to Savannah Clinker’s aggressive move. The outcome of this acquisition could significantly reshape the competitive landscape of the Kenyan cement industry.

H1 2024 Results: In the six months ended June 2024, Bamburi Cement's turnover was up a modest 4% year-on-year to reach KES 10.9B, with operating costs remaining flat at 0.2% to KES 10.1B. The operating profit was up a whopping 76.1% to KES 544M to bring the operating margin to 5% up from 3% in H1 2023. Profit before tax grew by 114%, notably buoyed by net finance income which was up 10X to reach KES 151M. The company recorded a growth of 131% in profit from continuing operations to KES 525M, and when this is adjusted for the loss from discontinued operations as a result of the disposal of sale of Hima Cement, the loss for the year was KES 877M compared to KES 88M profit in H1 2023. The Board of Directors did not recommend the payment of an interim dividend for the period under review, though shareholders are set to receive a special dividend of KES 18.25 per share following the divestment of Bamburi’s shareholding in Hima Cement.

Find Savannah Clinker’s counteroffer here, the press release here, Bamburi’s acknowledgment of the Notice of Intention by Savannah Clinker here, and Bamburi’s H1 2024 results here.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Kenyan Banks H1 2024 Results

Muted Growth in Lending: There was generally modest growth in lending across the listed banks, with 3 banks - Absa Bank Kenya, Equity Group, and DTB Group reporting year-on-year contractions in their loan books at 0.5%, 3.2%, and 4.7%, respectively. Stanbic Holdings was the only bank that recorded double-digit and the highest growth at 28.4%. When the loan books are juxtaposed with the balance sheets, Stanbic Holdings recorded the largest share at 72.6%, albeit a contraction from 73.2% in H1 2023. Conversely, StanChart Kenya had the lowest loans as a share of assets at 39.6%. Absa Bank Kenya recorded the highest growth from 63.1% in H1 2023 to 65.7% in H1 2024, while Equity Group recorded the lowest at 45.3% in H1 2024 from 49.7% in H1 2023.

Across holdings of investment securities, most banks reduced their stock relative to H1 2023, extending a theme that had been registered across Q1 2024 results. Absa Bank Kenya led the cut, reducing its stock of securities by 18.1% to KES 94.9B. DTB Group reduced its stock by 10.6% to KES 189B, while NCBA Group’s stock closed the half year at KES 218.9B, down 5.5% from H1 2023. I&M Group grew its pile by 29.4% to KES 143B, registering the highest growth across the major listed lenders on account of growth in Kenya government securities held at amortised cost and those held at fair value through other comprehensive income.

DTB Group had the highest share of investment securities to total assets at 32.3% [H1 2023: 36.5%], while Stanbic Holdings closed H1 2024 at 13.1% which was a marginal decline from the 14.2% recorded in H1 2023. Except for I&M Group whose stock of securities as a share of assets moved from 21.9% to 25.4%, all the other banks recorded declines in H1 2024 relative to H1 2023.

Mapping Interest Income: I&M Group recorded the highest growth in interest income from loans at 48.4% to KES 22.6B, closely followed by Stanbic Holdings at 44.3% to KES 18.3B, and StanChart Kenya at 43.4% to KES 11.5B. The least growth was 19.6% by Equity Group to KES 53.5B. KCB Group recorded the largest absolute amount of income at KES 69.2B, and StanChart Kenya the least at KES 11.5B.

Equity Group recorded the largest interest income from government securities at KES 28.3B, up 24.8%, followed by KCB Group at KES 25B, up 40.6% and the highest growth in interest income from securities in the period under review. StanChart Kenya closed H1 2024 with the smallest income at KES 4.3B, a contraction of 11.44%, followed by Absa Bank Kenya at 8.6% to KES 4.3B, and NCBA Group at 1.9% to KES 13B.

Surging Interest Expenses: As a result of the higher interest rate environment, funding of the balance sheet was at a higher cost relative to the previous half year periods as evidenced in the interest expenses recorded in the latest results. Stanbic Holdings recorded a 154.3% growth in total interest expenses to KES 12.3B, becoming the bank that recorded the highest growth relative to H1 2023. This was followed by StanChart Kenya at 78.4% and NCBA Group at 64.5%. The lowest growth was recorded by DTB Group at 28.7%.

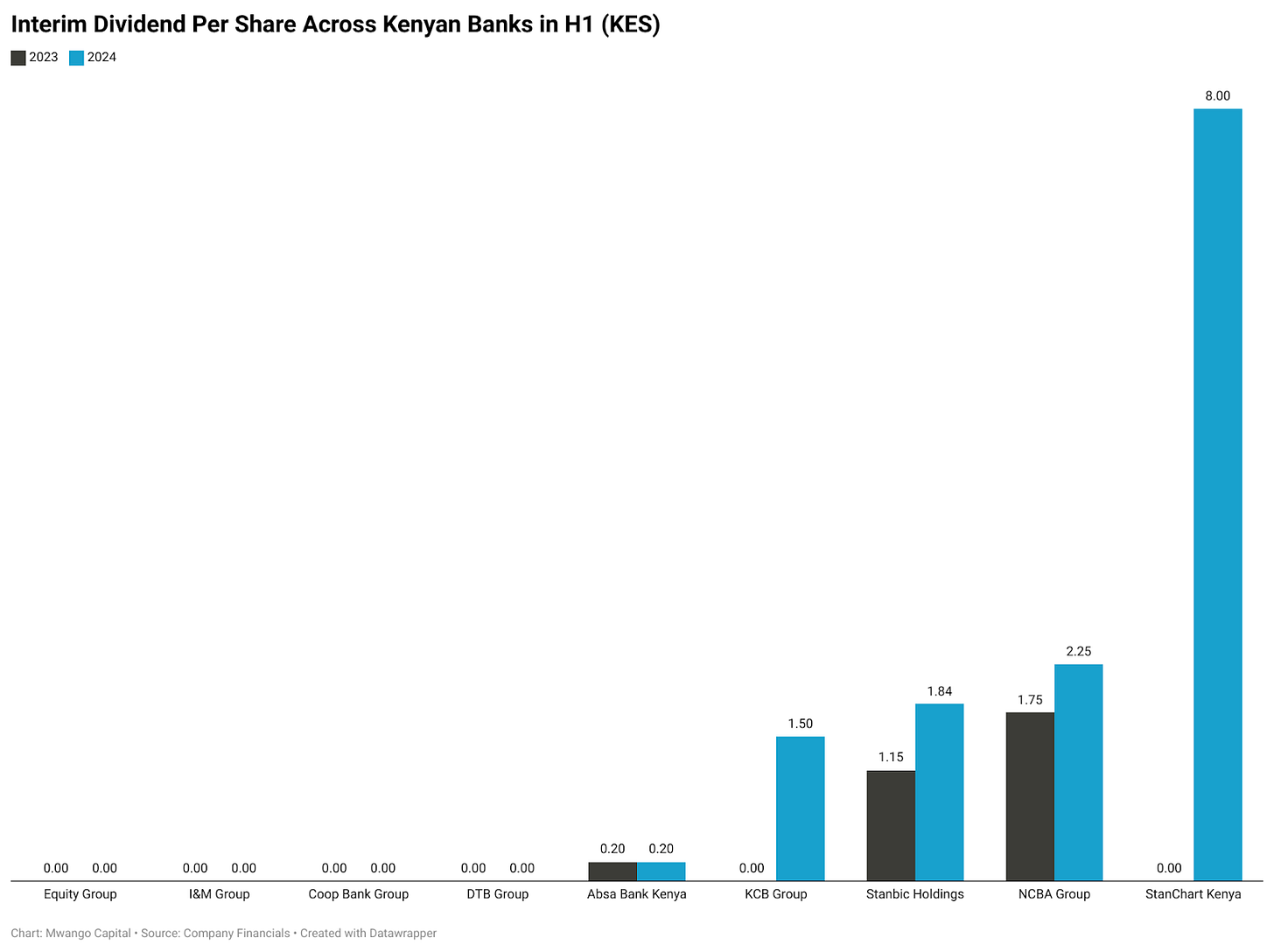

Profitability and Shareholder Returns: Across the listed banks that reported, only 4 banks declared an interim dividend with KCB Group resuming dividend payments after the hiatus in FY 2023 on account of recapitalization requirements at KCB Bank Kenya. Stanbic Holdings bumped up its interim dividend by 60%, while Standard Chartered Bank Kenya declared an interim dividend of KES 8.00 per share in contrast with 2023 when the interim dividend was declared in Q3 2023 amounting to KES 6.00 per share.

Find a consolidated document with the results for all the major listed banks here.

Markets Wrap

NSE: In Week 35 of 2024, Bamburi led the market, rising 21.1% to KES 77.50, while I&M Holdings was the worst performer, dropping 20.7% to KES 22.05. The NSE 20 dropped by 1.2% to 1,678.2 points, the NSE 25 went down by 0.4% to 2,812.8 points, and the NASI index declined by 1.2% to 103.7. points, while the NSE 10 edged up by 1.1% to 1,088.2 points. Equity turnover rose by 92.1% to KES 2.3B, while bond turnover went down to KES 19.4B from KES 44.5B the previous week.

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.78%, 16.63%, and 16.84% respectively. The total amount on offer was KES 24B with the Central Bank of Kenya (CBK) accepting KES 23.6B of the KES 24.2B bids received, to bring the aggregate performance rate to 100.84%. The 91-day and 364-day instruments recorded 437.4% and 22.5% performance rates, respectively.

Eurobonds: In the week, yields fell week-on-week across the 5 outstanding papers with KENINT 2027 falling the most, down 22.2 bps to 9.95%, followed by KENINT 2034 at 20.3 bps to 10.37%. KENINT 2048 recorded the least week-on-week decline at 12.7 bps to 10.77%, and the average week-on-week change stood at -18.5 bps.

Tap Sale Results: The Central Bank of Kenya has announced the results of the Treasury bonds tap sale for issue number IFB1/2023/017, which aimed to raise KES 15B. The sale garnered interest, receiving bids totaling KES 35.2 billion, more than double the targeted amount. The CBK accepted bids worth KES 32B. The average rate for accepted bids was 17.73%, with an adjusted average price of KES 91.01 per KES 100.00. The bond carries a coupon rate of 14.3990%.

Market Gleanings

📄| Tax Procedures (Amendment) Bill 2024 | The Kenyan government has proposed amendments to its Tax Procedures Act through the Tax Procedures (Amendment) Bill, 2024, aiming to extend tax amnesty, introduce relief measures, and streamline tax processes. Key changes include:

Extension of Tax Amnesty (Section 2): The amnesty period is extended to 30th June 2025, offering more taxpayers the opportunity to settle their dues without penalties.

Relief for Difficult Tax Recovery (Section 3): A new provision allows the Commissioner to seek approval from the Cabinet Secretary for relief on taxes deemed difficult or impossible to recover.

Time Computation for Objections (Section 4): The bill proposes excluding weekends and public holidays from the timeframe for lodging tax objections and appeals.

Delegation of Legislative Powers (Section 3): The Cabinet Secretary is granted authority to approve tax reliefs, subject to gazettement and parliamentary oversight.

💰| National Government Guarantees for FY2023/24 | The National Treasury and Economic Planning has said that there were no new loan guarantees issued by the National Government during the fiscal year 2023/24. As of the end of June 2023, the government had outstanding guaranteed debt totaling KES 170.2 billion (~$1.2 billion). This debt is associated with entities such as the Kenya Power and Lighting Company (KPLC), Kenya Ports Authority (KPA), Kenya Electricity Generation Company (KenGen), and Kenya Airways (KQ). Out of this, KES 82.0 billion ($600 million) was related to uncalled guarantees, while KES 88.2 billion ($600 million) was a called-up guarantee specifically related to Kenya Airways.

📑| H1 Earnings Wrap |

TotalEnergies: TotalEnergies Marketing Kenya PLC reported its 2024 H1 results, with revenue rising by 6.1% to KES 79.2B. However, gross profit decreased by 5.1% to KES 4.7B, while profit before tax slightly declined by 0.8% to KES 1.25B. Despite these, the company achieved a 14.1% increase in profit for the year, reaching KES 938.5M.

Crown Paints Kenya: Crown Paints Kenya reported its H1 2024 results, with revenue increasing by 10% to KES 6.2B and net profit soaring by 103% to KES 75M. Higher sales volumes and a stronger Kenyan shilling against major world currencies bolstered profitability, which lowered the cost of imported raw materials. The company did not declare an interim dividend.

Flame Tree Group: Flame Tree Group's H1 2024 results show a 1.3% decline in revenue to KES 2.1B, while gross profit increased by 6.4% to KES 765M. The company reported a net loss of KES 90.7M, a significant drop from the KES 6.8M profit in H1 2023. Loss per share stood at 0.15, compared to an earnings per share of 0.45 in the previous year.

Britam Holdings: Britam's H1 2024 results show a 7.4% increase in insurance revenue to KES 17.8B and a remarkable 150.0% rise in net investment income to KES 13.3B. Interest and dividend income grew by 34.1% to KES 9.1B, contributing to a 22.6% increase in profit for the year, which reached KES 2.0B. The company did not declare an interim dividend.

Standard Group: Standard Group's H1 2024 results show a 16.8% decline in revenue to KES 1.05B, while total operating costs decreased by 11.4% to KES 1.19B. The company reported an 8.4% increase in its loss, reaching KES 111.6M, with Loss per share falling to 1.39 from 1.29 in 2023. Total assets grew by 5% to KES 4.3B

Find the results for Old Mutual Group, NSE PLC, and Real People Kenya Limited here.

🔴| Base Titanium Exits Kwale | Base Titanium is set to lay off 1,746 employees and individual contractors before closing its operations in Kwale County by December 2024. The Australian mining company will spend USD 7.7M on severance pay and other related costs. Despite the closure, Base remains hopeful about continuing exploration activities in Kenya, with eight licenses pending approval.

🔴| Bond Deals Gone Awry | The Central Bank of Kenya (CBK) has flagged potential irregularities in bond transactions conducted between May and July 2024 involving the National Social Security Fund (NSSF) Kenya, Humphrey Wachira Gichuru, and Pergamon Investment Bank.

Analysis of the trades between these parties indicates that the NSSF Kenya was buying bonds at significantly higher prices than the market average while in some cases, NSSF Kenya sold some bonds at lower prices and bought the same bonds at higher prices in a few days. The purpose of this letter is to request the CMA to review the conduct of the above-mentioned parties and share the actions taken with the Central Bank of Kenya.

📈| Inflation in August 2024 | Kenya's annual inflation rose slightly to 4.4% in August, up from 4.3% in July, driven by increased food prices which rose 5.3% year-on-year. This uptick reverses July's 46-month low inflation rate of 4.3%. The Central Bank's Monetary Policy Committee recently cut the policy lending rate to 12.75%, citing easing inflation and a stable shilling. Kenya targets a medium-term inflation rate between 2.5% and 7.5%.

🤝| Mergers, Deals and Acquisitions |

Acquisition of 51% stake in Monarch: The Competition Authority of Kenya has unconditionally approved the acquisition of a 51% shareholding in Monarch Insurance Company Limited by a consortium comprising Ondoba Limited, Kenyoro Limited, and Equico Thirteen Limited. Monarch offers a range of composite insurance products, including general and life insurance.

Wasoko-MaxAB Merger: Kenyan-founded B2B e-commerce platform Wasoko has merged with Egyptian online retailer MaxAB in Africa’s largest all-stock transaction. The combined company will be co-led by Daniel Yu of Wasoko and Belal El-Megharbel of MaxAB, with key shareholders including Silver Lake, Tiger Global, and British International Investment.

💼| FY 2025/26 Budget Process | The National Treasury will launch the budget preparation process for the FY 2025/26 and the medium-term on September 9th, 2024, at the KICC, starting at 8:30 a.m. Presentations will cover key highlights on MTP IV, the macroeconomic outlook for the medium term, and details on the FY 2025/26 and medium-term budget process.

📶| Bayobab’s Fibre Network Project | Bayobab Kenya has completed a multi-million-shilling long-distance fibre network connecting Mombasa to Malaba and Busia. This new route, running along Kenya Railway’s metre gauge railway line, spans over 1,000 kilometres and interconnects with Uganda for further connectivity to Rwanda, South Sudan, and the DRC.

🚘| Bolt Hikes Fares | Ride-hailing platform Bolt has increased driver earnings by 10% across all ride categories to address rising operational costs, effective August 26, 2024. This follows a similar move by Little App, which increased driver earnings by 15 percent to ensure fair wages.

☀️| iColo’s Solar Power Efforts | Digital Realty’s iColo has successfully installed over 650kW of solar panels at its data center campuses, with 450kW at the NBO1 campus in Nairobi and 200kW at the MBA1 campus in Mombasa. This move aligns with iColo’s sustainability goals and supports its customers’ renewable energy targets. iColo plans to open a second facility in Nairobi by Q3 2025 with an IT load of 6.5MW.