👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenyan banks' Q3 2024 earnings, Kakuzi’s profit warning, and the Kenya Bankers Association’s (KBA) push for a reduction in the Central Bank Rate.Review of Kenyan Banks Q3 2024 Earnings

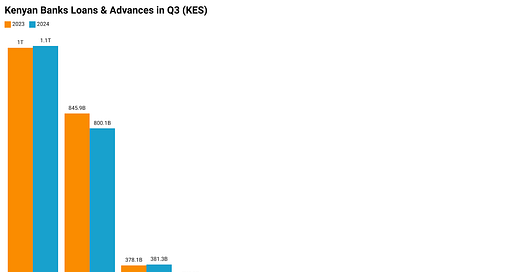

Stalled Loan Book Expansion: A review of Q3 2024 financial results reveals that most banks experienced a contraction in their loan books compared to the same period in 2023, where all listed banks recorded year-on-year increases, with seven of the nine tier-one banks achieving double-digit growth.

Standard Chartered Kenya was a notable exception in 2024, posting the highest loan growth at 5.4% to KES 151.3B, while KCB Group and Co-op Bank managed only marginal increases of 0.5% and 0.9%, reaching KES 1.1T and KES 381.3B respectively. In contrast, Stanbic Kenya saw the largest decline, with its loan book contracting 12.8% to KES 218.8B.

Shift to Govt Paper: Banks demonstrated a growing appetite for government securities during Q3 2024, with six of the nine listed lenders increasing their holdings. Stanbic Bank Kenya emerged as a standout, with its holdings in government paper soaring by 82.6% to KES 74.2B. On the other hand, NCBA, KCB Group, and Absa Bank Kenya reduced their positions, with declines of 11.1%, 2.1%, and 8.5% to KES 178.4B, KES 318.6B, and KES 97.5B, respectively.

Expensive Deposits: Interest on customer deposits remained a key driver of interest expense growth in Q3 2024, as all banks recorded double-digit year-on-year increases. Stanbic Bank saw a significant increase in interest expense by 147.4% to KES 19.8B, driven by a rise in customer deposits to KES 327.8B amid a high-interest rate environment. KCB Group had the highest interest expense in absolute terms at KES 56.2B, marking a 44% increase, with KES 40.7B attributed to the cost of deposits (+46.8%). Equity Group recorded the slowest growth in interest expenses, rising by 17.7% to KES 45.3B.

KCB Beats Equity on Profit: KCB Group's profit after tax (PAT) for the first nine months ended September 2024 grew by 49% to KES 45.8B, surpassing Equity Group, whose PAT increased by 13.1% to KES 40.9B. This marks KCB's first lead over Equity since Q3 2019 when KCB posted KES 19.2B against Equity's KES 17.5B. Standard Chartered led in quarterly growth with a 62.7% rise to KES 15.8B, while NCBA recorded the slowest growth, up 3.1% to KES 15.1B.

NPL Trends: Absa Kenya experienced the steepest rise in gross non-performing loans (NPLs), up 42.7% to KES 42.7B, indicating deteriorating asset quality. KCB Group held the largest stock of NPLs in the industry, increasing by 15.1% to KES 215.3B, driven by deteriorations in the manufacturing, real estate, trade, and construction sectors. KCB Kenya and NBK contributed to this increase with NPLs rising by 12.8% to KES 166.7B and 36.2% to KES 30.2B respectively. Equity Group saw a modest increase of 0.7% in NPLs to KES 125.3B.

In contrast, StanChart posted a significant reduction in its NPL book, down 48.4% to KES 12.1B. NCBA and I&M Group also improved their asset quality, with gross NPLs down 4.3% and 1.3% respectively.

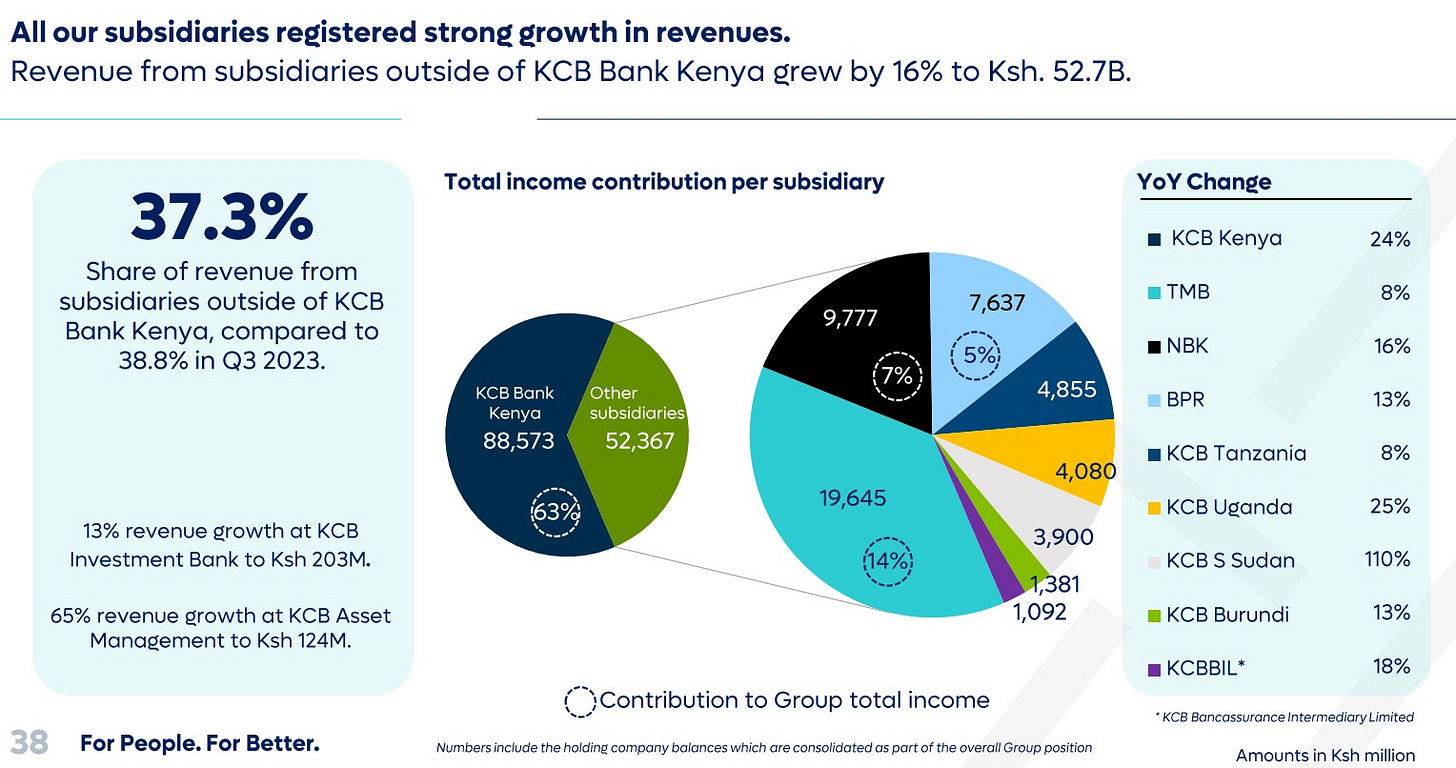

Subsidiaries Performance: Equity Group led in profitability, with 53% of its profit before taxes (PBT) generated outside Kenyan banks in Q3 2024. The life insurance business also performed well, with PBT rising 181% to KES 1.1T. KCB Group reported a revenue contribution by subsidiaries at 37.3%, down slightly from 38.8% in Q3 2023, but saw a notable 65% growth in revenue at KCB Asset Management to KES 124M. The strengthening shilling resulted in currency losses from the translation of financial statements, impacting overall performance.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Earnings Wrap

Centum H1 2025: Centum Group reported a reduced H1 2025 net loss of KES 346M (H1 2024: KES 426M), supported by improved performance in trading, Two Rivers Development, and investment operations. EPS was -0.22 (H1 2024: 0.09). Profit after tax fell to KES 431M (H1 2024: KES 1.4B) due to lower investment income, while operating and finance costs decreased by 13% YoY from cost containment and debt repayment. Other comprehensive income dropped to KES 13M (H1 2024: KES 4.8B) with no private equity revaluation. NAV per share rose to KES 63.0 from KES 62.4 in March 2024, driven by liability reductions.

Eaagads H1 2024: Eaagads Ltd posted a significant revenue growth of 9,360% YoY to KES 103.9M for the six months ended September 2024, driven by increased production despite a 421% rise in production costs to KES 101.9M. Gross profit improved to KES 2.5M from a loss of KES 17.0M in 2023, while PAT narrowed by 54.2% to a loss of KES 15.1M (2023: -33.1M). EPS improved to -0.47 from -1.03.

NCBA Group Q3 2024: NCBA Group reported Q3 2024 results with total assets steady at KES 679B. Operating income rose 0.6% to KES 46.9B, while operating expenses increased 1.6% to KES 28.6B. Credit loss provisions surged 32.8% to KES 4.1B, but profit before tax grew 1.0% to KES 18.4B, and profit after tax increased 3.0% to KES 15.1B. Digital loan disbursements rose 8% to KES 751B.

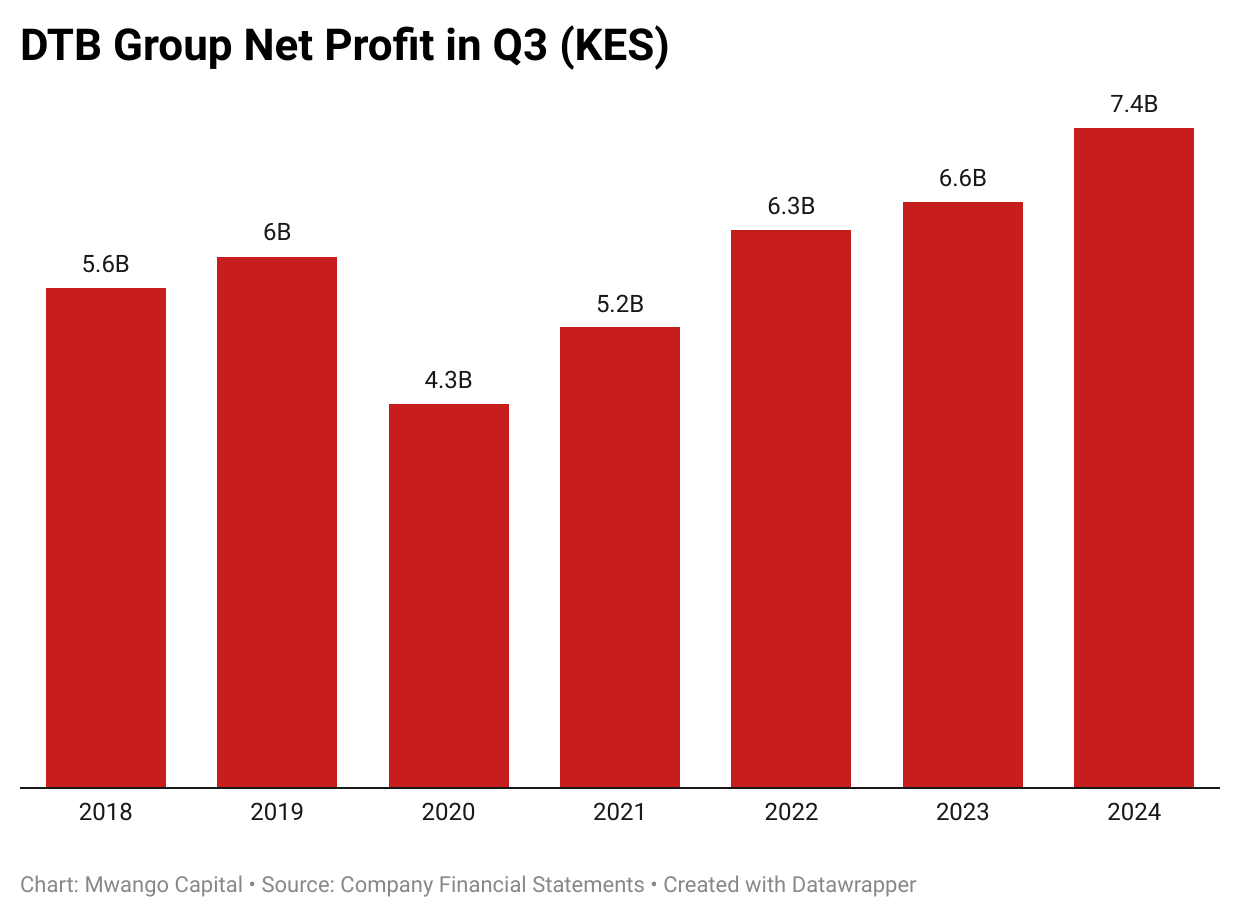

DTB Group Q3 2024: In Q3 2024, DTB Group recorded a 1.2% decline in total assets to KES 590.6B and a 4.9% reduction in the loan book to KES 275B. Gross NPLs increased slightly by 1.1% to KES 39.1B, while net NPLs rose 19.9% to KES 23.8B. Net interest income grew 6.1% to KES 21.3B, with provisions falling 12.3% to KES 5.3B. Profit before tax rose 12.3% to KES 9.8B, and profit after tax increased 12.6% to KES 7.4B, driving an 8.4% rise in EPS to KES 23.27.

East African Portland Cement FY 2024: East African Portland Cement reported FY 2024 revenue growth of 11.0% to KES 3.3B, with the gross loss narrowing by 18.7% to KES 777.5M. A 4.7x surge in fair value gains on investment property to KES 3.0B drove a profit before tax of KES 1.07B, reversing a loss of KES 1.4B in FY 2023. Total assets grew 7.3% to KES 35.2B, while total equity rose 6.2% to KES 20.4B. EPS improved to KES 11.86 from a loss of KES 15.07, and the company declared a DPS of KES 1.00.

Deals, Mergers, and Acquisitions

ADvTECH Acquires Flipper School: ADvTECH, owner of Makini School, has finalized a USD 7.5M deal to acquire 100% of Ethiopia’s Flipper International School, which operates five campuses in Addis Ababa. Founded in 1998, Flipper adds approximately 3,000 students to ADvTECH’s international portfolio. This acquisition marks ADvTECH's second major East African expansion, following the acquisition of Makini Group in 2018.

Airtel Money Partners with Naivas: Airtel Money has partnered with Naivas to allow customers to deposit and withdraw cash at all 109 Naivas branches across Kenya. With 90,000 agents nationwide, Airtel aims to strengthen its presence and increase its market share, which grew to 6.6% in June 2024, up from 2.8% in June 2023.

Mawingu Acquires Habari: Kenya-based Internet Service Provider (ISP) Mawingu has acquired Arusha-based Habari after securing USD 15M for its regional expansion. The financing, a mix of debt and equity, includes USD 11M in long-term senior debt from the Africa Go Green Fund (AGG), along with a USD 4M investment from Infraco Africa and Dutch development fund FMO.

Solarise and RUBiS Launch RUBiSOL: Solarise Africa and RUBiS Energy Kenya have launched RUBiSOL, a joint venture focused on delivering renewable energy solutions to Commercial and Industrial (C&I) clients across East Africa. RUBiSOL aims to provide solar and other renewable energy solutions, offering reliable and affordable decentralized energy for businesses.

Trapin Holdings Acquisition Approved: The Competition Authority of Kenya (CAK) has approved the acquisition of Trapin Holdings Limited by Botswana-based Pamstad Proprietary Limited, a firm under CA Sales Holdings Limited. Pamstad will acquire minority stakes in Trapin, including veto powers and board representation rights, giving it effective control of the Kenyan firm. CAK determined that the acquisition will not impact market competition, as Pamstad has no operations in Kenya's FMCG market.

Markets Wrap

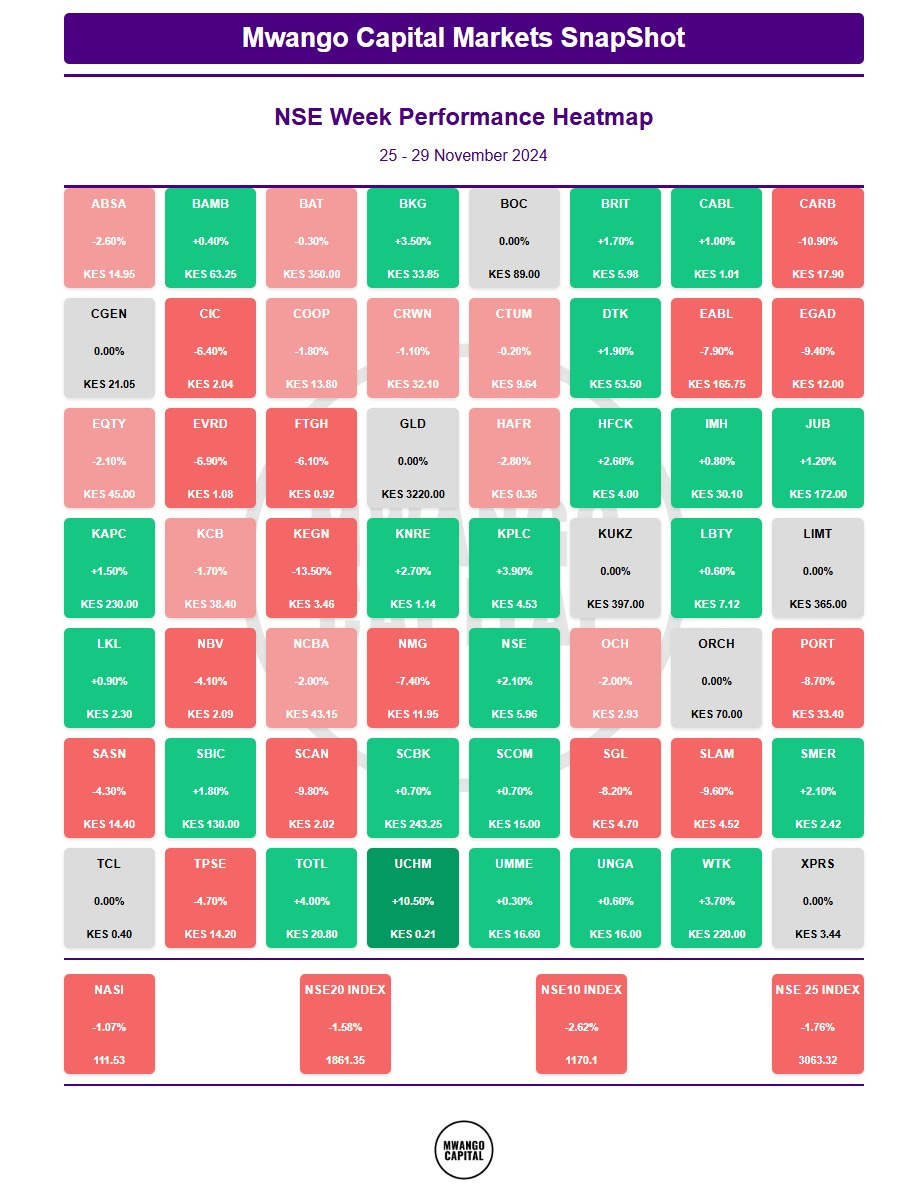

NSE This Week: In Week 48 of 2024, Uchumi led the top gainers, rising by 10.5% to close at KES 0.21, while Kengen was the worst performer, dropping 13.5% to close at KES 3.46. All indices were red, with the NSE 20, NSE 25, NSE 10, and NASI falling by 1.6%, 1.8%, 2.6%, and 1.1% to close at 1,861.4, 3,063.3, 1,170.1, and 111.5 points respectively. Equity turnover rose by 94.1% totaling KES 2.5B, while bond turnover fell to KES 27.9B from KES 31.9B the previous week.

Treasury Bills and Bonds: Treasury bills were oversubscribed in the week with an overall subscription rate of 211.1%, down from 321.8% the previous week. Investors placed bids worth KES 50.7B, out of which KES 34.7B was accepted, resulting in an acceptance rate of 68.4%. Yields on the three treasury bill tenors continued to decline, dropping by 154.1 basis points, 171.9 basis points, and 140.9 basis points, closing at 11.25%,11.34%, and 12.49% for the 91-day, 182-day, 364-day bills.

The Central Bank of Kenya (CBK) has issued a prospectus for re-opened fixed-coupon Treasury bonds: FXD1/2023/10 with a 14.151% coupon and FXD1/2018/20 with a 13.2% coupon, targeting a combined KES 25B, alongside FXD1/2024/10 with a 13% coupon targeting KES 20B.

Eurobonds: Last week, yields on Kenya's six outstanding Eurobonds declined across the board, with the KENINT 2028 recording the sharpest drop of 28.5 basis points to 8.498%, followed by the KENINT 2031, which fell 19.1 basis points to 9.70%. The average week-on-week yield decrease was 16.6 basis points.

Market Gleanings

🔺| Kakuzi Profit Warning | Kakuzi has issued a profit warning for the financial year ending December 31, 2024, citing an expected decline in net earnings of over 25% compared to 2023. The drop is attributed to lower turnover from avocado exports due to reduced crop and supply chain disruptions caused by Middle East geopolitical tensions. The closure of the Red Sea route to key European markets has forced longer shipping routes around the Cape, leading to significant fruit spoilage and reduced market returns. On a positive note, the macadamia business has performed strongly, with full order books and prices nearly double compared to last year, though this recovery cannot fully offset the losses from avocado shipping delays.

💵| Kenya Introduces Conservation Levy | Kenya has proposed a new 1% levy on entry fees to national parks, reserves, and conservancies as part of efforts to bolster wildlife conservation. The funds will be directed to the Wildlife Conservation Trust Fund, established under the Wildlife Conservation and Management Act, to support the restoration and management of protected areas and conserve endangered species. This move underscores the critical role of tourism, which remains a key foreign exchange earner for the country, with park visits increasing by 43% to 3.64 million in 2023. The government has invited public feedback on the proposed levy, with submissions open until December 6, 2024, in line with its consultative approach to policy-making.

🇪🇹| Ethiopia Gains IMF Funding Boost | The IMF and Ethiopian authorities have reached a staff-level agreement on the second review of Ethiopia’s USD 3.4B Extended Credit Facility program. Once approved by the IMF Executive Board, Ethiopia will gain access to $251 million in funding. The agreement highlights significant progress in Ethiopia’s economic reform agenda, including the transition to a market-determined exchange rate. Foreign exchange shortages have eased, with the gap between official and parallel markets falling below 10%. The IMF commended Ethiopia’s strong commitment to economic stability and growth, emphasizing the importance of sustained reforms to achieve long-term fiscal and monetary stability.

📊| Nigeria Ends Rate Hike Cycle | The Central Bank of Nigeria (CBN) has implemented a cautious 0.25% interest rate hike, bringing the benchmark rate to 27.5%, marking a possible end to its two-year tightening cycle. Governor Olayemi Cardoso emphasized the Monetary Policy Committee’s commitment to combating inflation, which surged to 33.9% in October due to rising food and fuel costs and a weaker currency.

💵| EAPCC Declares Dividend | East African Portland Cement Company (EAPCC) has declared its first dividend since 2011, proposing KES 1 per share (KES 90M total) after posting a KES 1B net profit for FY2024, driven by Sh3B fair value gains on investment properties. Revenue grew 11% to KES 3.2B despite elevated costs of KES 4B. The dividend, pending approval, will be paid by February 28, 2025. EAPCC shares, up 350% YTD, closed at Sh36 on Wednesday, fueled by expectations of cash flow from non-core land sales. Total assets increased to KES 35.1B from KES 32.7B last year, marking a significant turnaround.

🏦| Kenya Bankers Push for CBR Cut | Kenya's inflation rate increased slightly to 2.80% in November 2024, up from 2.70% in October 2024. Meanwhile, the Kenya Bankers Association has called for a significant cut in the Central Bank Rate (CBR) ahead of the Monetary Policy Committee meeting scheduled for 5th December 2024. The recommendation is anchored on four key factors: inflation remains low and well-anchored below 5%; economic growth is slowing, with GDP growth down to 4.6% in Q2 2024 compared to 5.6% in Q2 2023; private sector credit growth has stagnated at 0%, hindered by high non-performing loan ratios of 16.5%; and a stable external sector supported by strong remittance inflows, a rebound in tourism, declining oil prices, and steady KES/USD exchange rates. The association argues that a CBR cut would stimulate lending, lower borrowing costs, and support economic recovery.

✔️| CMA Approves Ziidi MMF | The Capital Markets Authority (CMA) has approved Safaricom PLC to launch the Ziidi Money Market Fund (MMF) as a Collective Investment Scheme (CIS). Accessible through the M-PESA platform, the fund is the result of a partnership between Safaricom and three fund managers: Standard Investment Bank, ALA Capital Limited, and Sanlam Investments East Africa Limited.

❗| StanChart Plans Divestment in Africa | Standard Chartered PLC is considering divesting its wealth and retail banking operations in Botswana, Uganda, and Zambia as part of a broader restructuring aimed at reducing costs and refocusing on higher-margin businesses. The lender is shifting its strategy to prioritize affluent individuals and international companies, which offer higher fee income. This potential divestment marks the first step in a series of exits, aligned with the bank’s goal of doubling its investment in wealth management while scaling back retail banking.

💼| Key Appointments |

Farmers’ Choice: Farmers’ Choice Limited (FCL), has appointed Felisters Gitau as its new CEO, succeeding James Taylor, who served over 40 years at the company’s helm. Gitau will lead the company's expansion across Africa, while Taylor will remain with the firm in an advisory role, offering strategic counsel and overseeing key special projects vital to the company's growth.

LTWP: The Lake Turkana Wind Power (LTWP) Board has appointed George Njenga as Executive Chairman, effective 1st November 2024. Njenga previously co-developed and chaired the 100MW Kipeto wind project.

Family Bank: Family Bank has appointed three new directors: Prof. Winnie Iminza Nyamuite, an accounting expert with over 30 years of experience; Hannah Njeri Mbugua, a seasoned banker with over 20 years in finance and strategy; and Peninah Wanjiru Kariuki, a development economics expert with 35 years in the banking sector.

NCBA: The Board of Directors of NCBA Bank Kenya PLC has announced the appointment of Ms. Rebecca M. Mbithi, former CEO of Family Bank, as an Independent Non-Executive Director, effective 1st December 2024.