👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya Power H1 2024/25 Results, EABL H1 2024/25 results and The FY 2024 results of Tanzania’s top banks.Kenya Power H1 2024/25 Results

Kenya Power posted impressive results for the first half of the 2024/25 financial year, with net profit surging 31 times to KES 9.97B. Despite a 5.4% decline in revenue to KES 107.4B due to a reduction in electricity tariffs, the company managed to cut costs and improve efficiency.

The cost of sales dropped by 14% to KES 71.3B, boosting the gross margin by 18% to KES 36B. Operating profit grew 8.5% to KES 15.7B while finance costs plummeted by 86.9% to KES 1.9B.

Stronger Shilling Cuts Costs: The appreciation of the Kenya shilling against the dollar played a crucial role in Kenya Power’s improved financial position, cutting debt repayment expenses by KES 13B. With about 90% of its loans denominated in foreign currency, the company benefited from lower finance costs, contributing to its bottom line. Additionally, electricity sales increased by 5% to 5,506 GWh, offsetting the impact of lower tariffs. This was supported by improved network reliability, faster outage resolution, and the availability of critical materials like meters and transformers, enabling new customer connections.

“Finance costs reduced by KES.13,052 million, from KES.15,023 million in December 2023 to KES. 1,971 million in December 2024. This reduction is attributed to the strengthening of the Kenyan Shilling against major foreign currencies, which account for 90% of the loan portfolio, as well as a reduction in loan balances due to continued repayment.”

Kenya Power

Dividend Resumption: With its strengthened financial position, Kenya Power declared an interim dividend of KES 0.20 per share—the first in nine years. The last interim dividend was paid in 2015 before the company halted distributions due to financial struggles. The strong earnings performance and dividend announcement drove Kenya Power to close the week as one of the top gainers, up 18.87% to KES 7.56 per share.

Happy New Month!

This week’s newsletter is brought to you by Arvocap Asset Managers.

At Arvocap Asset Managers, we take pride in being your trusted financial partner, dedicated to helping you, the investor, turn your dreams into reality. Whether you're looking to grow your wealth, secure your future, or build financial resilience, we offer expertly managed investment solutions tailored to your goals.

Start investing today and let your money work for you!

Download the Arvocap Investment App or visit www.arvocap.com to begin your journey.

Inflation Edges Higher

Up 30 bps: In January 2025, Kenya's inflation rate rose to 3.3%, up from 3.0% in December, according to the Kenya National Bureau of Statistics (KNBS). This increase follows a 17-year low of 2.7% recorded in October 2024.

For the first time, KNBS separated core inflation excluding food, fuel, and transport from non-core inflation, which includes these volatile items. Core inflation stood at 2.0%, slightly lower than 2.2% in December, while non-core inflation jumped to 7.1%, up from 5.2%, mainly driven by rising food prices. Food inflation rose 6.1%, while fuel prices saw a modest 0.7% increase.

KBA Recommends Further CBR Cut: The Kenya Bankers Association (KBA) is calling for a further reduction in the Central Bank Rate (CBR) to enhance credit growth and support economic recovery. According to KBA, inflation remains stable, but economic growth slowed to 4.0% in Q3 2024, with high non-performing loan ratios limiting access to credit. The research highlights that exchange rate stability, strong foreign reserves, and steady remittance inflows provide a conducive environment for monetary easing. The Monetary Policy Committee (MPC) is set to meet on February 5, 2025.

“In view of these developments, and the growing need to reverse the deceleration in private sector credit, we call for a further cut in the Central Bank Rate (CBR) to provide additional impetus to the ongoing downward adjustments in the commercial banks’ lending rates.”

Kenya Bankers Association

Tanzania's Banks’ FY 2024 Results

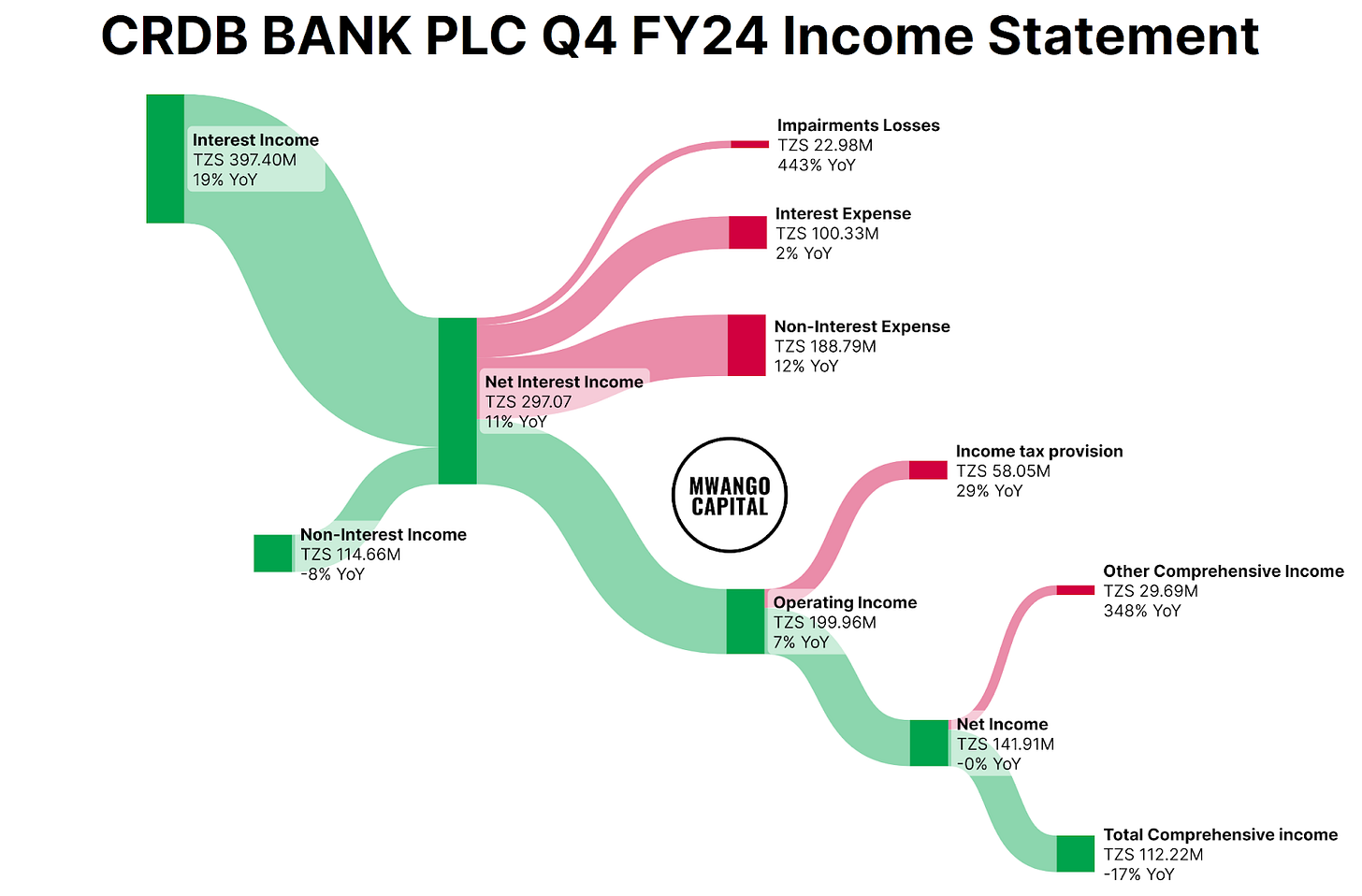

CRDB Bank: CRDB Bank posted strong growth in its balance sheet metrics for FY 2024. Loans increased by 2.8% quarter-on-quarter (q/q) to TZS 10.4T, while government securities declined by 1.7% to TZS 2.1T. Customer deposits grew significantly, up 6.8% to TZS 10.8T, driving total assets to increase by 3.4% to TZS 16.6T. On a year-on-year (y/y) basis, CRDB reported impressive performance in its profit and loss statement. Net interest income surged 30.4% to TZS 1.1T, while non-interest income rose 14% to TZS 511B. The bank’s profit after tax (PAT) recorded a 30% jump to TZS 550.8B.

NMB Bank: NMB Bank demonstrated consistent growth across key metrics in FY 2024. On a quarterly basis, total assets expanded by 2.5% to TZS 13.7T, loans and advances rose by 1.6% to TZS 8.5T, and customer deposits increased by 2.9% to TZS 9.3T.

Year-on-year, the bank delivered solid profitability, with net interest income climbing by 13.1% to TZS 1T and non-interest income jumping by 23.2% to TZS 577.1B. Profit after tax (PAT) grew by 18% to TZS 644B.

Deals, Mergers and Acquisitions

Actis to Sell Java House to Private Equity Firms: Actis has agreed to sell Java House to two Africa-focused private equity funds, Alterra Capital and Phatisa. The deal, for an undisclosed amount, will see Alterra Capital take a majority stake, while Phatisa, despite holding a minority stake, will have controlling rights.

KCB and Mastercard Launch Multi-Currency Card: KCB Bank Kenya, in collaboration with Mastercard, has launched a multi-currency prepaid card that supports 11 hard currencies. The card is designed to simplify international transactions, allowing users to easily make payments across different countries. It supports currencies including the Kenyan Shilling, US Dollar, British Pound, Euro, Swiss Franc, Australian Dollar, and others.

Mi Vida Homes Partners with HFC: Mi Vida Homes has signed a partnership with Housing Finance Company (HFC), the banking arm of HF Group Kenya. The agreement will allow home buyers to access up to 95% financing at a fixed rate. The partnership aims to expand beyond development and financing, incorporating investment opportunities and property value enhancement.

TikTok Partners with Aleph and Wowzi: TikTok has partnered with Aleph Holdings and Wowzi to enhance its presence in Kenya. Aleph will offer Kenyan businesses direct access to TikTok and hands-on support, while Wowzi will assist local creators in building stronger relationships with brands and agencies.

Diageo Sells Ghana Stake to Castel Group: Diageo plc has announced the sale of its 80.4% stake in Guinness Ghana Breweries to Castel Group. While Castel will take control of the brewery, Diageo will retain the Guinness brand and other products made by Guinness Ghana, which will now be licensed under a new long-term agreement. Diageo will continue to oversee the brand and marketing strategy for Guinness, collaborating with Castel to foster growth.

Markets Wrap

NSE This Week:

EA Cables (+55.3%) soared to KES 2.47, while Africa Mega Agricorp (-18.9%) tumbled to KES 56.75, leading gains and losses respectively.

Markets took a hit—NASI (-3.17%) at 128.3, NSE 20 (-1.07%) at 2,162.6,

Equity turnover held at KES 2.00B, but bond turnover crashed 42.9% to KES 28.00B.

Foreign investors dumped KES 395.8M, driving 72.71% of total turnover.

Kengen’s first and final dividend payment of KES 0.65 per share is expected on 13 Feb 2025.

NSE January 2025 Recap:

TransCentury Ltd (+246.15%) led the market, surging to KES 1.35, with EA Cables (+128.70%) and Home Afrika (+86.49%) following.

On the losing side, EA Portland Cement (-11.76%) and Africa Mega Agricorp (-10.00%) took the biggest hits.

Markets held firm—NASI climbed 3.89% to 128.28, NSE 20 surged 7.56% to 2,162.58, while NSE 10 (+0.79%) and NSE 25 (+0.98%) saw modest gains.

Other standout gainers included Flame Tree (+77.00%), Uchumi (+64.71%), and Kenya Power (+57.17%), while Nation Media (-3.47%) and BAT Kenya (-3.59%) struggled.

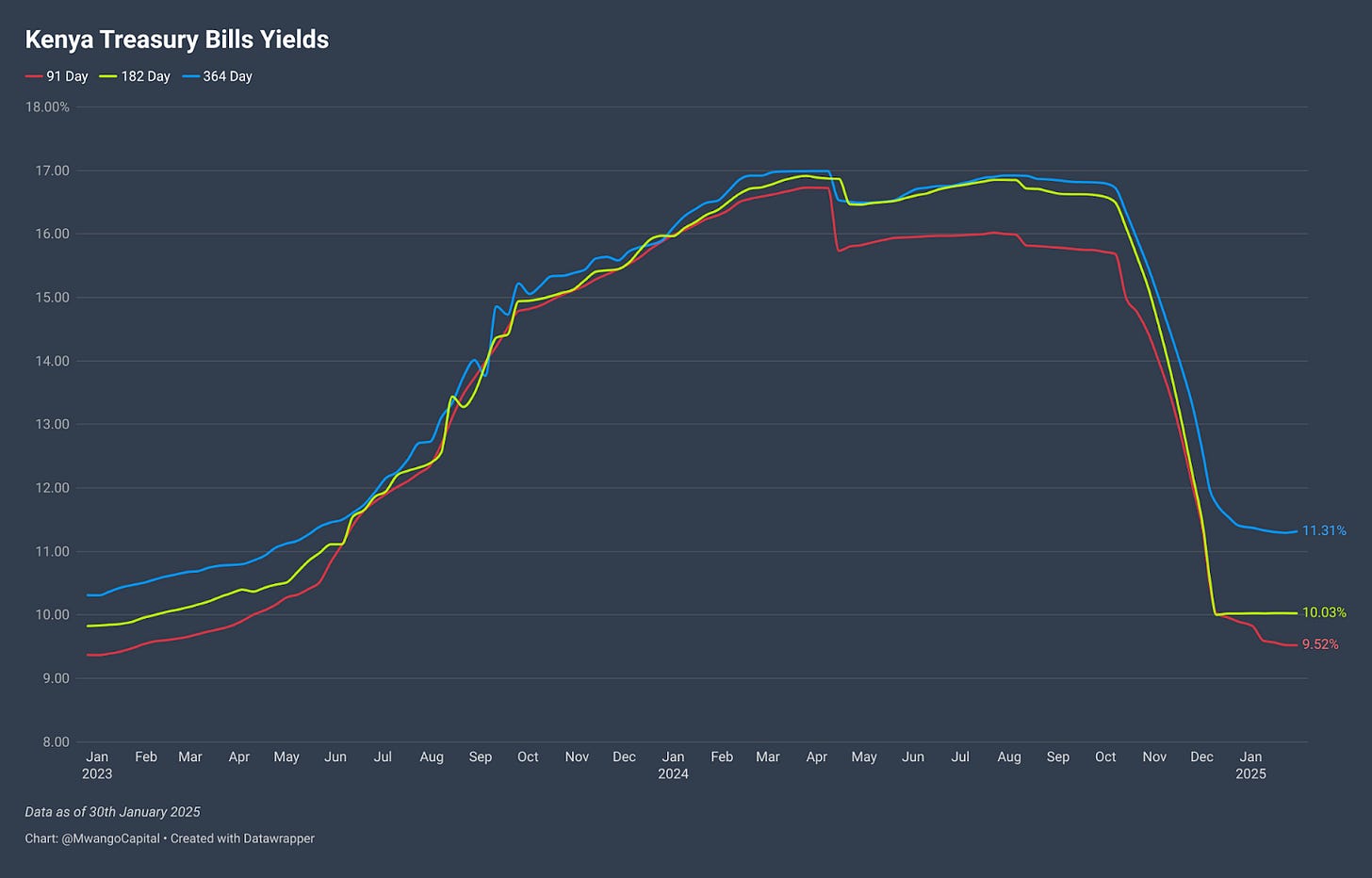

Treasury Bills: Treasury bills were undersubscribed last week, with a subscription rate of 56.09%, down from 136.73% the previous week. Investors placed bids totaling KES 13.46B, of which KES 13.09B was accepted, reflecting a 99% acceptance rate. Yields on the 91-day and 182-day T-bills declined by 33 and 3 basis points to 9.5219% and 10.0275%, respectively, while the 364-day yield surged by 187 basis points to 11.3132%.

Eurobonds: Last week, yields on Kenya’s five outstanding Eurobonds increased, with the KENINT 2048 bond recording the sharpest rise of 7.90 basis points to 10.22%. The only exception was the KENINT 2028 bond, which saw a slight decline of 0.70 basis points to 8.793%. On average, Eurobond yields rose by 4.20 basis points week-on-week.

Market Gleanings

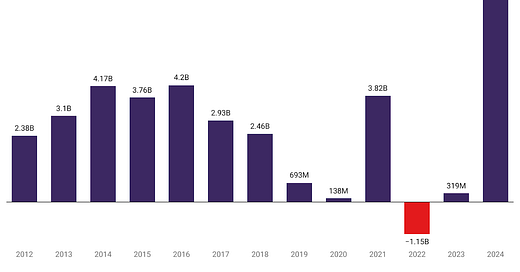

🍺| EABL H1 24/25 Results | EABL posted strong H1 24/25 results, with net sales increasing by 2% to KES 67.9B and profit after tax rising 20% to KES 8.1B. The company reported a positive FX gain of KES 1.1B, a significant improvement from last year’s loss of KES 2.3B.

Net finance costs dropped 14.3% to KES 3.4B, driven by a KES 4.6B reduction in borrowings. Liquidity strengthened, with cash and cash equivalents up 32% to KES 14.1B, and trade receivables grew 66% to KES 20.9B.

💰| KRA Reports 4.5% Revenue Growth | KRA's H1 FY 24/25 revenue grew 4.5% to KES 1.243T, falling short of the KES 1.283T target. Exchequer revenue totaled KES 1.120T, and agency revenue reached KES 122.8B, exceeding the KES 101.3B target by 21.3%. Customs revenue rose 4.8% to KES 429.1B, missing the KES 448.0B target. Domestic taxes increased 4.4% to KES 811.8B, below the KES 835.3B target (97.2%). The FY 2024/25 revenue target is KES 2.684T.

📉| Banks Cut Lending Rates | Following the Central Bank of Kenya’s (CBK) rate cut, 23 of the 38 commercial banks lowered their lending rates between November and December to support economic activity amid low inflation and a stable shilling. However, 14 banks slightly raised their rates, while Equity Bank Kenya left its rates unchanged. Overall, lending rates dropped to 16.89% from 17.22% a month earlier, while deposit rates saw a slight uptick to 10.45%.

✔️| Kenya Orchards Rebrands to Africa Mega Agricorp | Kenya Orchards Limited (KOL) has officially changed its name to Africa Mega Agricorp Plc following the sale of an 84% stake to Africa Mega Agriculture Centre (AMAC). The buyout, announced in June 2024, was finalized after shareholder approval at an extraordinary general meeting in August. The name change was confirmed with a certificate issued by the Registrar of Companies on December 16, 2024.

💼| Leadership Changes |

NSE: The Nairobi Securities Exchange (NSE) has appointed Ms. Millicent Ngetich as its new Company Secretary, effective January 24, 2025. This follows the departure of Kuria Waithaka, who held the role for the last five years.

CIB: Commercial International Bank (CIB) Kenya has appointed Abhinav Nehra as its new Chief Executive Officer (CEO) and Managing Director. Nehra brings over 30 years of experience in the banking and payments sector, having worked across Africa, Asia, and other emerging markets.

🚂| Chinese Firms to Build USD 2B Tanzanian Rail Link | Tanzania has signed a USD 2.15B deal with two Chinese firms, China Railway Engineering Group Ltd. and China Railway Engineering Design and Consulting Group Co., to construct a railway linking Dar es Salaam port to a nickel mine in Burundi. The 282-kilometer rail line, funded by a loan from the African Development Bank, aims to facilitate mineral exports and boost cross-border trade between Tanzania and Burundi.

⚡| Uganda Plans USD 260M Power Line to South Sudan | Uganda plans to construct a 300-kilometer transmission line to export power from its Karuma plant to South Sudan, where only 5% of the population has access to electricity. The African Development Bank (AfDB) will finance the USD 260M project, contributing USD 189M, including a USD 122M loan for Uganda and a USD 33M grant for South Sudan. Uganda will contribute USD 18M, with the European Union providing an additional USD 53M.