👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya's USD 1.5B debt buyback, HY 2024/25 results wrap, and rising inflation.New Bond to Manage Debt Load

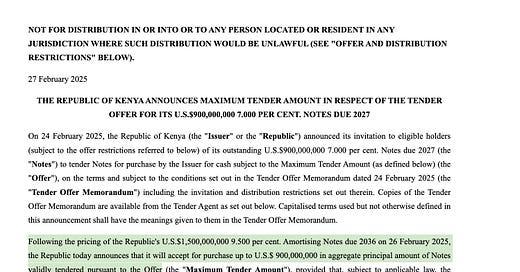

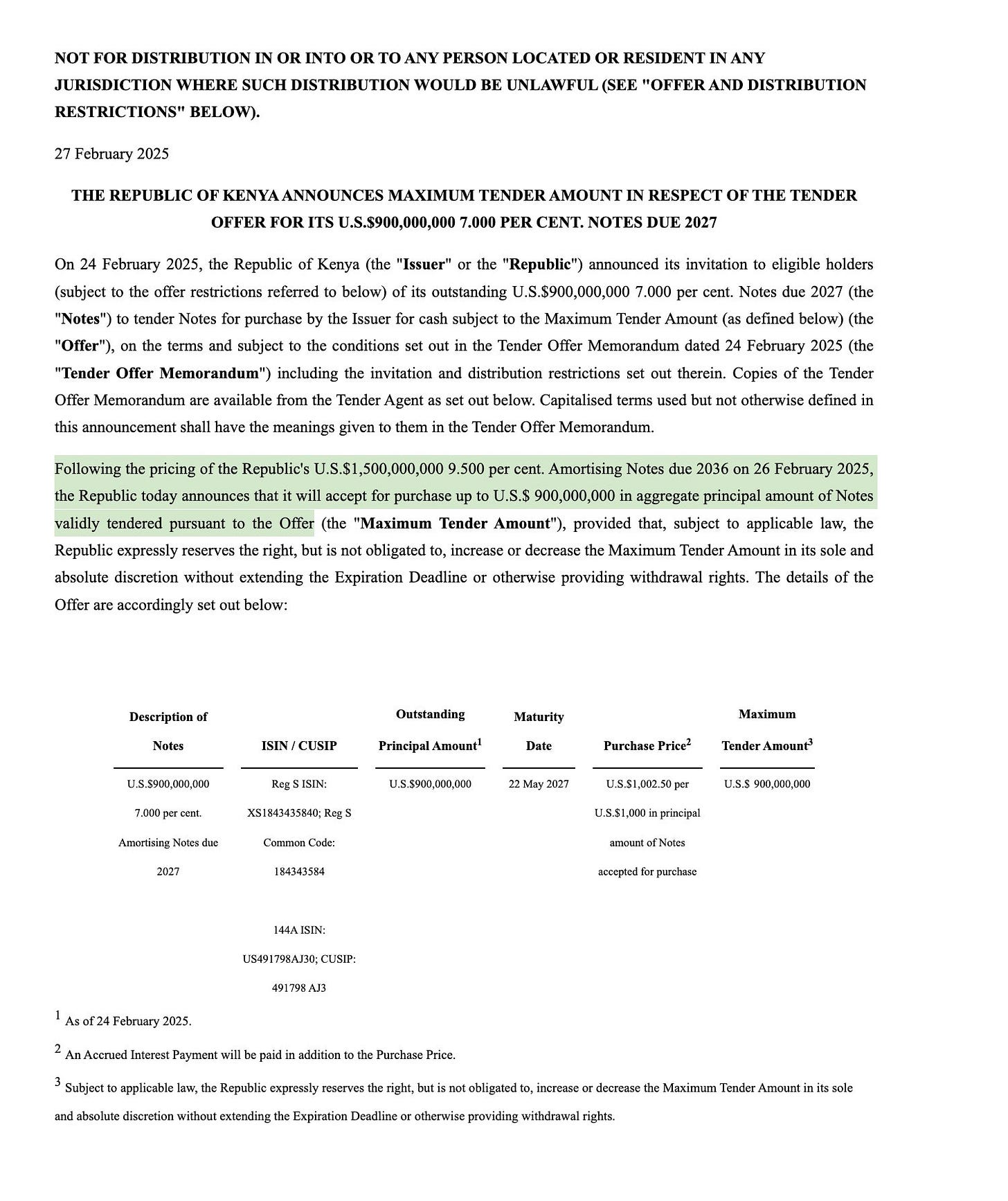

Kenya has successfully raised USD 1.5B through an 11-year bond priced at 9.5%, yielding 9.95%. The issuance, managed by Citigroup Inc. and Standard Bank Group Ltd., is aimed at refinancing existing debt, particularly the USD 900M 7% notes due in 2027. The proceeds will largely fund a tender offer allowing holders of the 2027 notes to sell them back to the government at USD 1,002.50 per USD 1,000 in principal.

This move is part of a broader strategy to extend Kenya’s debt maturity profile and reduce near-term repayment pressure. Demand for the bond was strong, reaching USD 5B according to the National Treasury.

“The buyback is a strategic debt management move that strengthens investor confidence in our ability to meet short-term obligations. The real concern, however, lies in the cost of refinancing this bond. It raises the question—would a delay have secured a lower rate? In hindsight, debt servicing, particularly interest payments, has significantly devoured our revenue collections. Issuing a 9.5% bond to refinance a 7% amortized note—one that was relatively manageable—suggests either a desperate need for funds or a complete disregard for prudent use of taxpayer money. Refinancing the 2028 maturity would have been the more logical move, given its bullet payment structure. However, opting for an amortized bond raises concerns. While the IMF has flagged costly borrowing, its concerns weren’t specifically directed at the 2024 issuance, which addressed that year’s buy back. My suspicion is that uncertainty around the final review of the IMF-Kenya program has prompted the government’s proactive stance. Looking ahead, debt servicing costs are likely to remain elevated, though easing domestic interest rates could help offset external pressures. Still, the debt management outlook appears increasingly constrained, particularly post-2028. That said, the government will likely refinance the 2028 bond as well—if not, it would raise serious questions about the rationale behind their selection strategy.”

SIB Senior Research Associate, Stellar Swakei

Debt Buyback and IMF Considerations: The timing of the buyback has drawn attention, as the 2027 notes were amortizing over three years and were not seen as an immediate risk. The decision to issue a new bond now suggests Kenya is positioning itself for greater financial flexibility, possibly reducing reliance on an IMF-funded program that expires on April 1. An IMF mission is expected in Nairobi soon to review the USD 3.6B program, with discussions on a successor agreement already underway.

“Kenya sold USD 1.5B Eurobond—amortizing with final maturity of 2036—this week with a coupon rate of 9.50%, proceeds that will partly buyback KENINT 7.00% 2027 with an outstanding amount of USD 900.0mn. The authorities have also mentioned that the balance of the USD 1.5B KENINT 9.50% 2036 will be used to offset some expensive syndicated loans. With anecdotal evidence capping the interest on the syndicated financing at low double digits, the 9.50% on KENINT 2036 looks attractive. The surprise buyback and new issue cements the possible lack of IMF disbursement in the upcoming ninth review, as has been telegraphed in the 2025 Budget Policy Statement. Furthermore, the authorities are also eyeing a USD 1.5B private placement from UAE, which will ideally go towards budget support. With the pace and timing of the external financing this week, the authorities are undoubtedly keeping the IMF at bay.”

IC Asset Managers Economist, Churchill Ogutu

Managing Eurobond Obligations: Kenya has been actively restructuring its external debt after experiencing significant fiscal pressure due to its Eurobond maturities. Last year, the country refinanced USD 2B worth of bonds, extending their maturity to 2031 but at a relatively high interest rate. The next major repayment hurdle is a USD 1B Eurobond due in 2028. The move comes just a week after Kenya concluded its first domestic bond buyback, in which the Central Bank of Kenya (CBK) met its KES 50B target, reducing upcoming maturities from KES 185.05B to KES 135B in the auction that closed on February 17, 2025.

KSH 1 BILLION IN ASSETS UNDER MANAGEMENT!

This week’s newsletter is brought to you by Arvocap Asset Managers.

From a vision to a movement—this journey has always been about you.

We started with a simple yet powerful goal: to make investing smart, accessible, and rewarding for all. And today, because of your trust and commitment, we’ve hit a major milestone:

KSH 1,000,000,000 in Assets Under Management!

Every shilling invested carries a story of determination, progress, and the pursuit of greater possibilities.

And we’re just getting started. The next billion will be bigger, better, and even more impactful. Will you be part of it?

HY 2024/2025 Results Wrap

Unga Group Returns to Profit: Unga Group Plc reported a strong turnaround in its HY 2025 results, posting a net profit of KES 82.2M, a 124.1% increase year-on-year. This marks its first profit since FY 2022 when it recorded KES 311.3M. Revenue grew by 4% to KES 12.94B, while operating profit surged 1,192.5% to KES 351.9M. Pre-tax profit rose 126.4% to KES 127.0M, with EPS up 125.3% to KES 0.63. However, cash and cash equivalents stood at a deficit of KES 772.7M, while total assets declined 14.7% to KES 9.30B. Despite the improved performance, the company cites challenges including reduced disposable incomes, raw material cost uncertainties, and exposure to interest and currency risks. No interim dividend was declared.

East African Portland Cement: East African Portland Cement recorded a solid performance year-on-year in HY ended December 31, 2024, with revenue surging 79% to KES 3.30B and gross profit jumping 266.7% to KES 532.1M. Operating profit rose 94.5% to KES 39.96M, while net profit grew 95.1% to KES 35.05M, translating to an EPS of KES 0.39 (+104.9%). The company’s cash position improved significantly, with cash and cash equivalents up 545.6% to KES 172.26M. Despite a slight 0.7% dip in total assets to KES 34.95B, the strong results fueled investor confidence, making EAPC one of the top performers at the NSE for the week, gaining 10.5% to close at KES 23.7.

Carbacid Profits Drop as Sales Decline: Carbacid Investments reported a decline in performance for the six months ended January 31, 2025, with turnover falling by 13% to KES 940.6M, mainly due to a stronger shilling impacting export sales and weaker demand for carbon dioxide in various markets. Operating profit dropped 20.6% to KES 387.7M, while profit after tax declined 10.4% to KES 434.9M. The company cited increased administration and financing costs, alongside regional dollar shortages, as additional challenges. Despite this, total net assets grew by 14.3% to KES 5.6B.

Markets Wrap

NSE This Week:

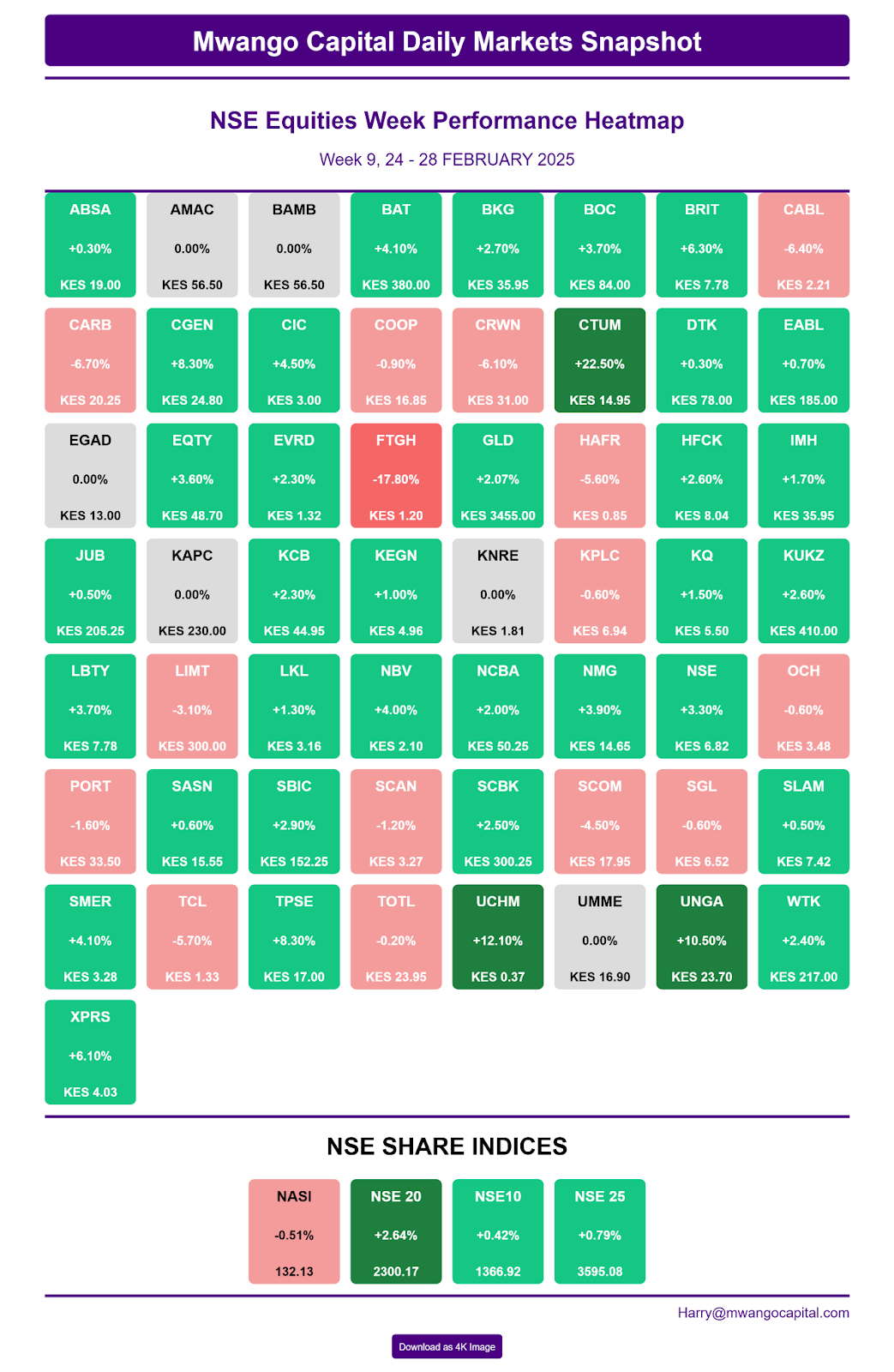

Centum (+22.5%) rose to KES 14.95, leading the week’s gainers, while Flame Tree Group (-17.8%) dropped to KES 1.20, posting the biggest loss.

Markets were mixed—NASI slipped 0.51% to 132.1, NSE 20 climbed 2.64% to 2,300.2, NSE 10 gained 0.79% to 1,366.9, and NSE 25 rose 0.79% to 3,595.1.

Equity turnover edged up 5.3% to KES 1.90B, while bond turnover surged 67.9% to KES 52.50B.

Foreign investors remained net sellers, offloading KES 264.8M, accounting for 19.38% of total turnover.

Focus now shifts to Stanbic’s FY results (5 March) and KCB’s FY results (12 March).

NSE Monthly Recap: February 2025

Centum (+39.72%) led the market, climbing to KES 14.95, with Uchumi (+32.14%) and Standard Group (+30.40%) following closely. Other notable gainers included EA Portland Cement (+24.07%), Home Afrika (+23.19%), HF Group (+20.00%), and Unga Group (+19.40%).

On the losing side, Flame Tree Group (-32.20%) was the worst performer, closing at KES 1.20. Bamburi Cement (-20.34%), EA Cables (-10.53%), and Africa Mega Agricorp (-10.32%) also struggled.

Markets posted solid gains—NASI rose 3% to 132.13, NSE 20 jumped 6.36% to 2,300.17, NSE 10 added 4.14% to 1,366.92, and NSE 25 climbed 4.63% to 3,595.08.

Uganda and Dar es Salaam Securities Exchange:

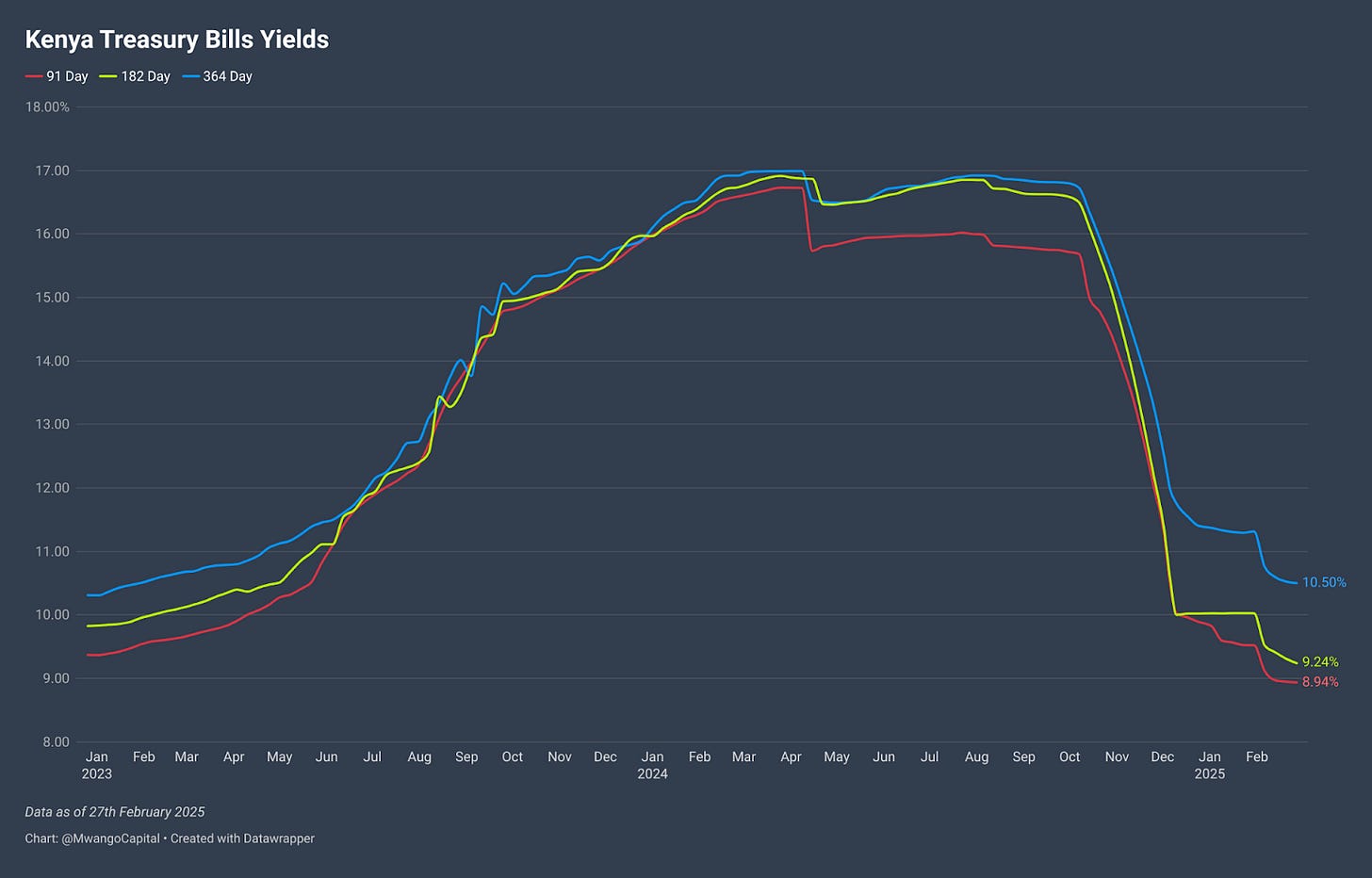

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 152.3%, down from 137.3% the previous week. Investors placed bids totaling KES 36.55B, out of which KES 36.51B was accepted, reflecting a 99.9% acceptance rate. Yields on the 91-day, 182-day, and 364-day T-bills declined by 1.1, 7.2, and 2.6 basis points to 8.937%, 9.239%, and 10.5%, respectively.

Treasury Bonds: The Central Bank of Kenya (CBK) is inviting bids for the re-opened FXD1/2018/25 Treasury bond with a 13.400% coupon. The bond auction aims to raise KES 25B, with the deadline for bids set for 5th March 2025 at 10:00 AM.

Eurobonds: Last week, yields on Kenya’s six outstanding Eurobonds declined, with the KENINT 2028 bond leading the drop, falling by 54.80 basis points to 7.911%. The KENINT 2027 bond followed, decreasing by 50.0 basis points to 6.96%. On average, Eurobond yields fell by 30.07 basis points week-on-week.

Market Gleanings

⚖️| ODPC Fines BD East Africa and Safaricom | The Office of the Data Protection Commissioner (ODPC) has fined Becton Dickinson and Company (BD East Africa) and Safaricom PLC a total of KES 500K for unlawfully processing personal data without consent. The case involved an ex-employee’s national ID being shared with Safaricom to facilitate the transfer of a work-issued SIM card after termination. ODPC ruled that BD East Africa violated data protection laws by sharing the data without consent, while Safaricom failed to verify authorization before processing it.

📈| Rising Inflation | Kenya's inflation rate rose to 3.5% in February 2025, up from 3.3% in January, marking the fourth consecutive monthly increase since June 2022. The Consumer Price Index reached a new all-time high of 143.12 points. The rise was primarily driven by non-core inflation, which surged to 8.3% from 5.2% in January due to higher food and fuel prices, while core inflation, which excludes food and energy, remained stable at 2.0%, down slightly from 2.2% in the previous month.

📄| SACCOs FY 24 Results | Last week, more SACCOs reported their FY 2024 results:

Stima SACCO: The Sacco’s total assets increased by 12.4% to KES 66.5B, while net interest income rose 15.4% to KES 5.2B. The net surplus grew by 50% to KES 2.2B, with loans to members up 11.3% to KES 50.2B. Interest on member deposits remained at 11%, while dividends on share capital increased to 16% from 15% in 2023. The Sacco made a KES 108M impairment related to KUSCCO.

Mhasibu SACCO: Mhasibu Sacco’s net interest income surged 42% to KES 599M in 2024, while total assets grew 16% to KES 12.3B. Loans and advances to members increased by 21.4% to KES 9.2B. Interest on member deposits declined to 8% from 8.6% in 2023, while dividend rates dropped slightly to 15% from 15.5% the previous year. The Sacco took a KES 480.6M loss due to KUSCCO's inability to honor a matured fixed deposit withdrawal request.

Harambee SACCO: Harambee Sacco’s net interest income grew by 13.8% to KES 3.2B in 2024, while total assets increased by 5.3% to KES 38.7B. Loans and advances rose 9.8% to KES 32B. Interest on member deposits stood at 9%, up from 8.5% in 2023, while dividends on members' share capital rose to 15% from 12%.

💰| KRA to Collect KES 3.5B from Mumias | The Tax Appeals Tribunal has ruled in favor of the Kenya Revenue Authority (KRA), allowing it to collect KES 3.5B in unpaid taxes from Mumias Sugar. The case arose after the miller’s receiver manager challenged an assessment by KRA, which raised tax demands due to the failure of the caretaker manager to file annual returns and pay various tax heads between 2013 and 2023. The tribunal upheld KRA’s position, stating that the appellant failed to prove that the tax assessments were unjustified.

🤝| CFAO to Acquire Goodlife Pharmacy | CFAO Group, a subsidiary of Toyota, is set to take full ownership of Goodlife Pharmacy by acquiring a 69.9% stake from LeapFrog Investments and management shareholders. This move builds on its initial 30.1% acquisition in 2022 and aligns with its strategy to expand in East Africa’s healthcare sector. The deal, awaiting regulatory approval from the Comesa Competition Commission, reflects CFAO’s broader push to strengthen pharmaceutical distribution across Africa.

✔️| Amsons Group Moves to Fully Acquire Bamburi | Tanzania’s Amsons Group has launched a final push to acquire the remaining 3.46% stake in Bamburi Cement after securing a 96.5% majority ownership. The firm, which had offered KES 65 per share, has given non-assenting shareholders six weeks to accept the deal or seek a court order to block the acquisition or renegotiate terms. Bamburi has also received regulatory approval to suspend trading of its shares on the Nairobi Securities Exchange (NSE) to facilitate the transition, paving the way for Amsons to become the sole shareholder.

⚖️| Court Orders PCF to Refund KES 36M | The High Court has ruled that the Policyholders Compensation Fund (PCF) must refund KES 36M it unlawfully withdrew from the accounts of the collapsed Resolution Insurance and paid to Millimo Muthomi & Co Advocates. Justice Alfred Mabeya found that PCF acted illegally by making payments after the insurer was placed under liquidation, violating the Insolvency Act. The court criticized PCF for attempting to favor some unsecured creditors over others and ruled that all transactions post-liquidation were void.

🏦| Invesco Assurance Statutory Management Extended | The Commissioner of Insurance has extended Invesco Assurance’s statutory management for another six months, effective February 14, 2025.Invesco was placed under statutory management in August 2024 due to financial struggles, with PCF appointed as the Statutory Manager. In December 2023, the firm was also placed under liquidation to facilitate the settlement of shareholder and creditor claims.

☑️| Olkaria Declared a Special Economic Zone | The Government has designated the Olkaria area in Naivasha as a Special Economic Zone (SEZ). The zone spans 8,292 acres and aims to promote industrial investment, clean energy manufacturing, and export-oriented production by offering incentives such as tax exemptions and affordable geothermal power.KenGen's Green Energy Park within the SEZ will facilitate green manufacturing, agro-processing, electric mobility, and data centers

💼| Leadership Changes |

Absa Bank: The Board of Directors of Absa Bank Kenya has appointed Anne Nyongesa as the new Company Secretary effective Friday, February 28. Prior to joining Absa Kenya, Nyongesa held various legal, governance and company secretary positions in the financial services sector.

BOC Kenya: The Board of Directors of BOC Kenya PLC has appointed Lawrence Githinji as Managing Director, effective March 3, 2025. He succeeds Joseph Ramashala, who had been serving in an acting capacity.

🇪🇹| Ethiopia’s USD 60M FX Auction | The National Bank of Ethiopia (NBE) conducted a USD 60M foreign exchange auction on February 25, 2025, with 27 banks participating. The weighted average rate of successful bids was 135.6185 birr per US dollar. This marks the second auction since Ethiopia's economic reform program began in July 2024. The NBE noted that additional forex sales may be considered to support market liquidity and monetary stability.