👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s banking sector Q1 2024 results, the World Bank’s USD 1.2B DPO, and Kenya’s inflation in May 2024.This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Kenyan Banks Q1 2024 Results

All 9 major listed banks have released their set of Q1 2024 results, with Equity Group reporting the highest operating income at KES 50.1B, up 25.0% year-on-year. Most of the banks posted significant growth in interest expenses on the back of high interest rates in the macroeconomic environment. The stock of Non-Performing Loans (NPLs) was also up across 7 of the banks, and regarding loan loss provisions, 5 banks ramped up provisioning relative to Q1 2023.

Asset Base: KCB Group closed the quarter with the largest asset base at KES 1.99T, representing a growth of 22.4% year-on-year. However, this was not the largest change relative to Q1 2023, as Stanbic Holdings posted a 22.5% jump in assets to KES 491.5B. Absa Bank Kenya’s asset base contracted by 3.3% to go below sub-KES 500B, closing at KES 497B, while Standard Chartered Bank Kenya recorded the lowest balance sheet at KES 391.3B. Of note was the Co-operative Bank of Kenya’s balance sheet breaching the KES 700B mark to reach KES 714.7B.

Customer Deposits: KCB posted a robust 25.4% growth in the deposit base to KES 1.5T, recording the highest change in deposits across the major listed lenders in the quarter. The deposits as a proportion of the assets was 75.19%, up from 73.38% in Q1 2023. StanChart posted the lowest growth in deposits at 1.0% to KES 306B, which represented 78.19% of assets [Q1 2023: 77.95%]. Notably, Absa’s deposits as a share of assets were up significantly, closing at 71.32% in Q1 2024 from 60.4% in Q1 2023.

Loans and Advances: I&M Group recorded the highest growth in the loan book at 13.1% to reach KES 291.5B, equivalent to 54.69% of the asset base. Only two other banks posted double-digit changes in loans, that is Stanbic Holdings and NCBA Group at 11.1% and 11.6% to KES 255.8B and KES 320.5B accounting for 52.04% and 46.12% of assets, respectively [Q1 2023: 58.80% and 45.67%]. DTB Group was the only bank that posted a decline in loans, down a marginal 0.5% to KES 268.9B, representing 47.03% of the balance sheet [Q1 2023: 48.86%].

Government Securities: Equity closed the quarter with the largest stock of government securities at KES 473.2B, which represented a growth of 20.58%, while Stanbic had the least stock at KES 42.1B, a whopping 36.67% reduction from Q1 2023 as well as the largest drop across the reporting banks. Apart from Equity, only Co-op and KCB witnessed growth in the securities at 11.53% and 32.02% to KES 201.9B and KES 393B, respectively. I&M recorded the least drop at 2.11% to KES 108.4B.

DTB had the largest proportion of securities to the balance sheet at 32.01% [Q1 2023: 35.66%], followed by Co-op at 28.25% [Q1 2023: 28.69%]. Stanbic’s holdings of the securities were equal to 8.56% of assets in Q1 2024 [Q1 2023: 16.97%].

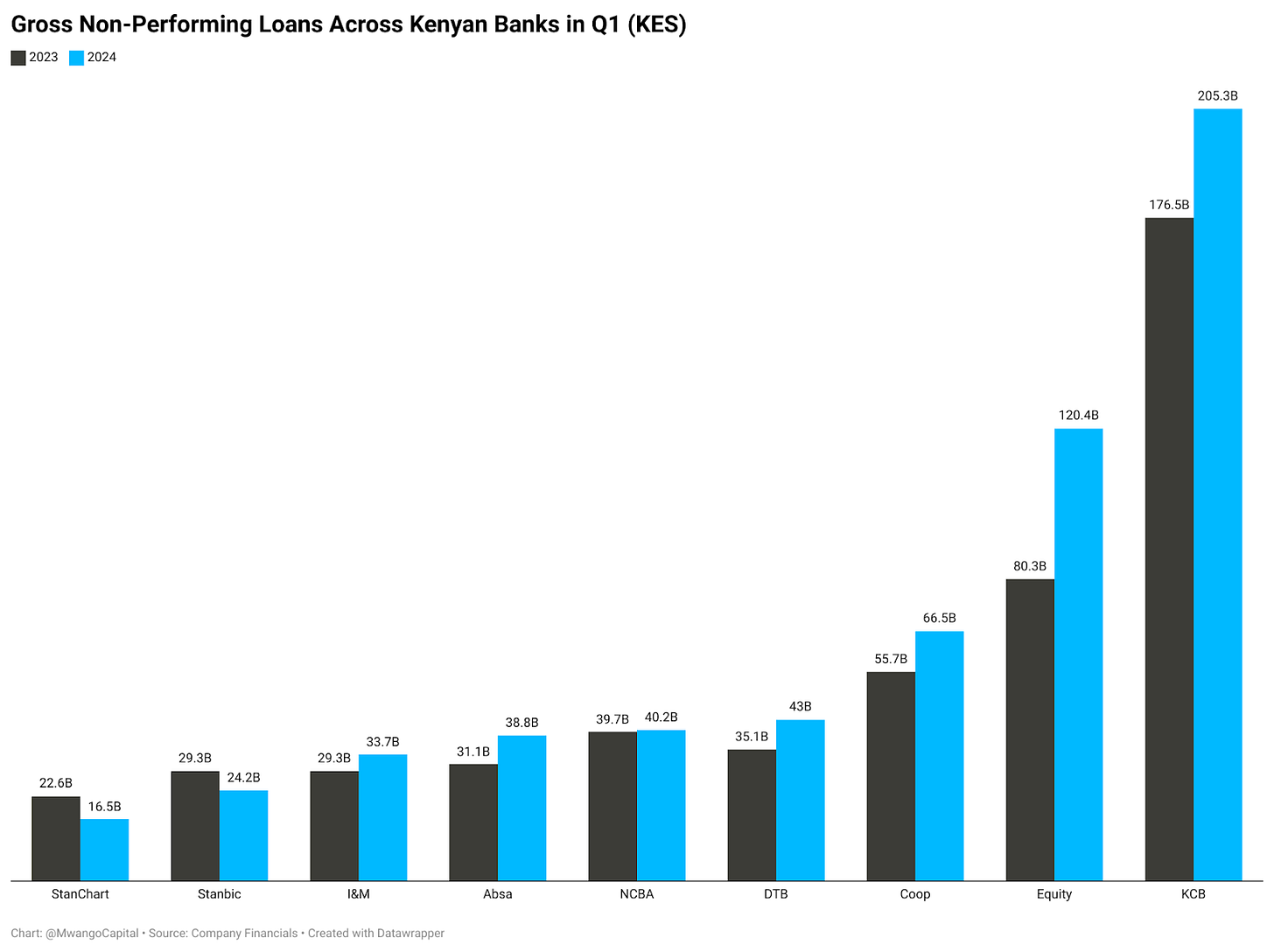

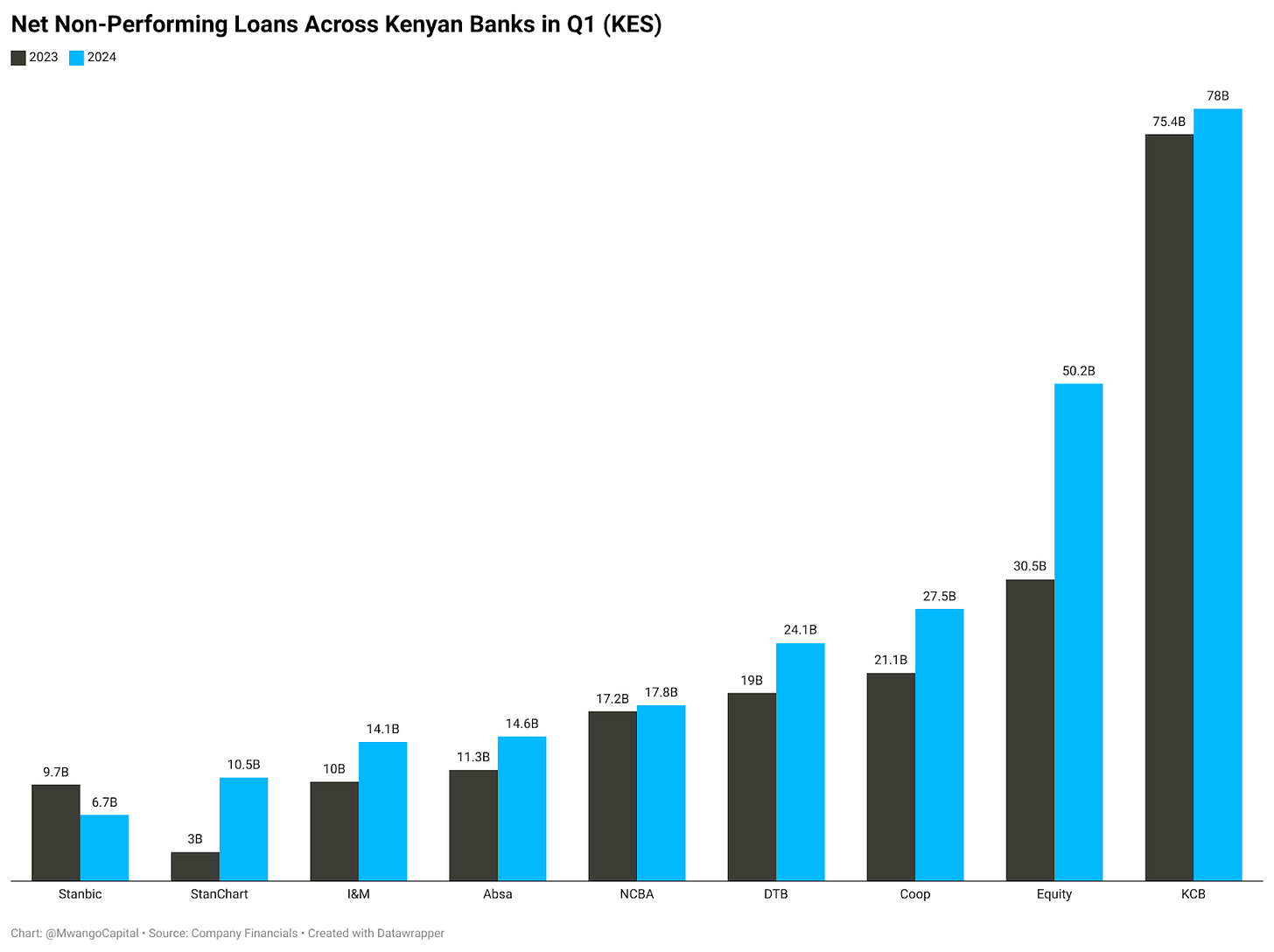

Asset Quality: KCB had the largest stock of gross NPLs at KES 205.3B, up 16.3%, equivalent to 20.2% of the loan book [Q1 2023: 19.0%], the highest across the reporting banks. Equity Group recorded the highest growth in the NPL stock, up 50.0% to reach KES 120.4B, which accounted for 15.5% of gross loans, up from 10.6% in Q1 2023. Stanbic and StanChart are the only banks that recorded a reduction in NPLs at 17.3% and 26.9% to KES 24.2B and KES 16.5B to account for 9.5% and 10.8% of their loan books [Q1 2023: 12.7% and 16.5%], respectively.

Regarding the net NPLs, StanChart recorded the highest growth at 250.4% to KES 10.5B, followed by Co-op at 164.5% to KES 27.5B. Stanbic was the only bank that recorded a drop in the net NPLs at 31.3% to KES 6.7B.

Across loan loss provisions, Equity recorded the highest growth at 74.5% to KES 6.1B - equivalent to 0.8% of loans, followed by KCB at 53.4% to KES 6.3B - equivalent to 0.6% of the loan book. NCBA cut its provisions the most across the reporting banks, reducing them by 30.9% to KES 1.4B accounting for 0.4% of gross loans.

Interest Income: I&M posted the highest growth in interest income from loans and advances at 57.6% to KES 11.4B, while DTB recorded the lowest growth at 23.4% to KES 7.9B. KCB led the banks in posting the largest amount of interest income from loans at KES 33.6B, followed by Equity at 27.4B and Co-op at 12.4B, representing growth of 36.2%, 311.9% and 24.2%, respectively. From government securities, Equity posted the largest interest income at KES 14.6B, up 36.5%. KCB recorded the highest growth at 51.7% to KES 13.3B, while Stanbic, Absa, and StanChart posted declines of 1.2%, 9.0%, and 19.9% to KES 1.3B, KES 2.2B, and KES 2B, respectively.

Surging Interest Expenses: As a result of higher interest rates in the macroeconomic environment, interest rates have surged across the board and this is evident in the banking sector results. All the major lenders reported growth in their interest expenses, with the average growth rate at 89.58%. StanChart recorded the highest growth at 259.87% to KES 2.5B, followed by Stanbic, I&M, and Absa at 130.18%, 76.04%, and 74.42% to KES 5.6B, KES 7.2B, and KES 4.9B, respectively. Equity and DTB Group recorded the least growth at 41.38% and 36.80% to KES 15.2B and KES 7.5B, respectively.

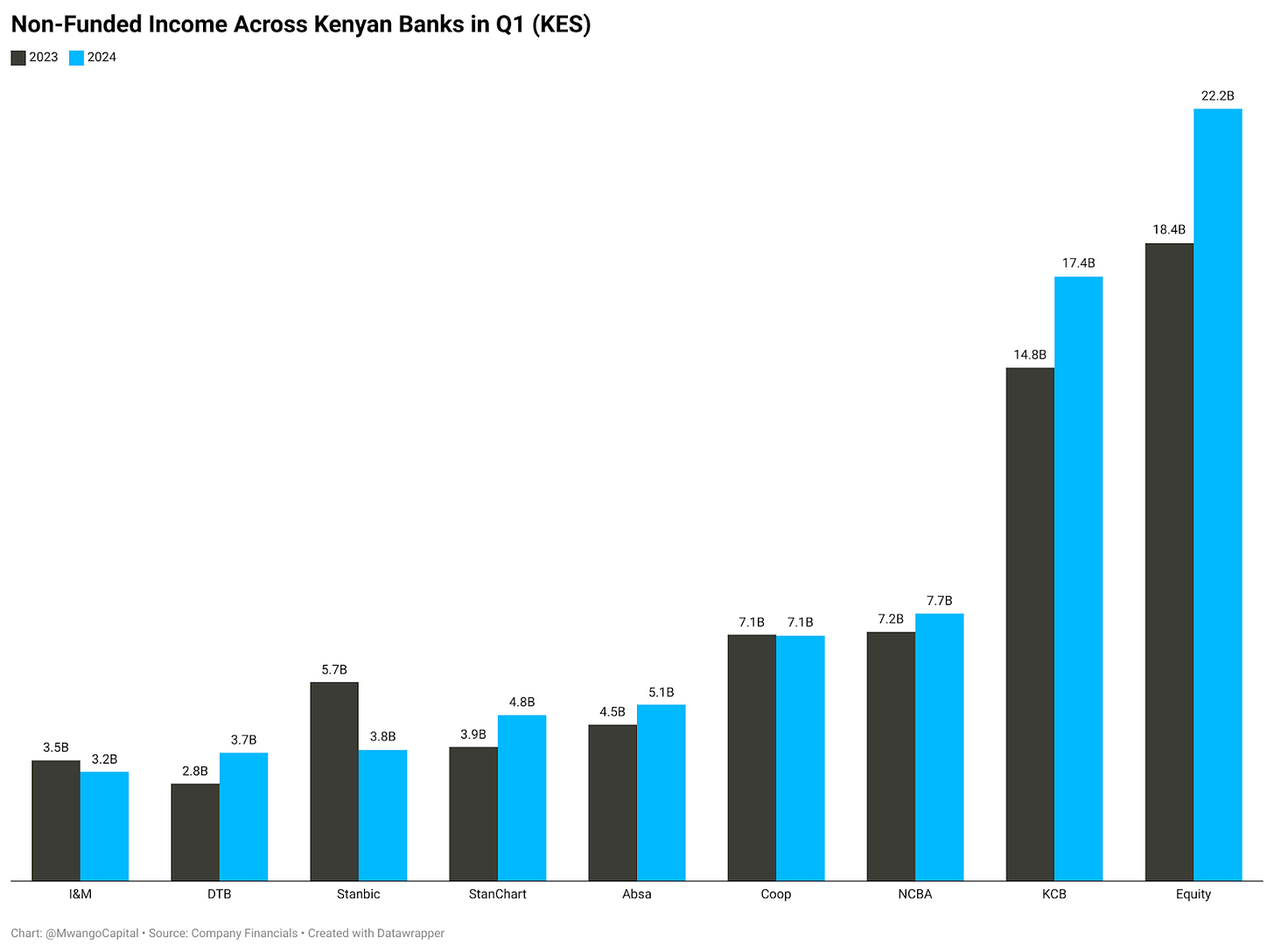

Waning FX Trading Income: Through FY 2023, a significant majority of the major listed lenders reported robust profits in foreign exchange trading Income on account of the prevailing conditions in the foreign exchange market in the country, prominently the US Dollar shortages. With the policy actions that were taken to streamline the market and the unwinding of the situation, Q1 2024 banking results featured declines in the income line, with all banks reporting year-on-year drops in FX trading income except for KCB, Co-op, and DTB which posted 81.22%, 30.84%, and 14.35% year-on-year growth to KES 4.8B, KES 1.4B, and KES 1.7B, respectively.

DTB Group posted the highest change in Non-Funded Income (NFI) at 31.84% to KES 3.7B. Co-op, I&M, and Stanbic recorded declines of 0.33%, 9.36%, and 33.98% to KES 7.1B, 3.2B, and 3.8B, respectively. Equity had the largest NFI at KES 22.2B, representing a 21% growth, while KCB Group recorded KES 17.4B, up 17.8%.

Profitability: KCB’s Profit Before Tax (PBT) surged 52.7% to reach KES 21.6B, followed by I&M, StanChart, and Absa whose PBT edged higher by 38.5%, 35.4%, and 32.0% to KES 4.9B, KES 7.6B, and KES 8.5B, respectively. Noteworthy, despite the KES 35B gap between I&M and Absa’s asset bases, Absa posted KES 3.6B more in PBT compared to Absa.

KCB recorded the highest growth in Profit After Tax (PAT) at 69.0% to KES 16.5B, which was also the largest amount of net profit posted in the quarter under review. In terms of PAT size, KCB was followed by Equity at KES 16.0B, up 25.2%. Stanbic recorded the lowest growth at 2.8% to KES 3.9B, and DTB recorded the smallest PAT size at KES 2.94B, up 11.0%.

Find a consolidated document with the results here. Separately, find a thread on remuneration for Kenyan Banks' CEOs & directors and shareholder returns in FY 2023 here.

World Bank’s USD 1.2B DPO

First of Three: The World Bank has approved a USD 1.2B financial package for Kenya, targeting both immediate fiscal challenges and long-term sustainable growth through the Development Policy Operation (DPO) framework. This package comprises a USD 850 million loan from the International Bank for Reconstruction and Development (IBRD), a USD 300M credit from the International Development Association (IDA), and a USD 50M IDA grant specifically designated for host communities and refugees.

Central to this financial package are several key reform commitments, including the creation of a Treasury Single Account (TSA) to streamline government finances, the consolidation of the national wage bill, and the enhancement of the social protection system. Furthermore, the reforms aim to eliminate licensing inefficiencies at the county level, liberalize the Information Communication Technology (ICT) sector for foreign investment, and bolster access to essential services.

This DPO marks the first installment in a planned series of three operations which are aimed at alleviating liquidity constraints, rejuvenating investor confidence, and attracting capital inflows. Concurrently, the program emphasizes robust climate action plans - just like the current IMF program via the Resilience and Sustainability Fund (RSF) that Kenya has tapped, such as promoting green public transportation, expanding forest coverage, and harnessing climate finance through carbon credits and green bonds.

The long-term objectives are ambitious, focusing on bolstering resilience through improved social protection, public service delivery, and job creation, particularly benefiting the 550K refugees within Kenya. According to the Bank, these efforts are poised to foster a more inclusive and sustainable economic environment, ensuring that both immediate and future development needs are adeptly addressed.

Shareholding Boost: Kenya will increase its shareholding in three key African financial institutions, including the African Development Bank (AfDB), by USD 100M [KES 13.1B], equivalent to 0.1% of Kenya’s KES 15.1T GDP. President William Ruto announced at the AfDB annual meetings in Nairobi last week that additional capital will also go to the African Export-Import Bank (Afreximbank) and the Trade and Development Bank (TDB). Kenya is also committing an extra USD 20M [KES 2.6B] to AfDB’s concessional window, supporting lending to fragile countries.

“Because we must believe in ourselves, for others to believe in us, we must invest in these institutions for others to invest in them. Kenya has made the decision that over the next 3 years, we are going to invest USD 100M in enhancing our shareholding in Africa Development Bank, Afrexim bank and Trade Development Bank. We have already made an investment in Afrexim Bank. I will be discussing with Adesina [AfDB Group President] on our investment in the African Development Bank because as nations in this continent, we must begin to understand that if others have to believe in our institutions, we must believe in them first as their owners.”

President of Kenya, William Samoei Ruto

Find a summary of the key targets of the DPO here and the document detailing the USD 1.2B DPO here.

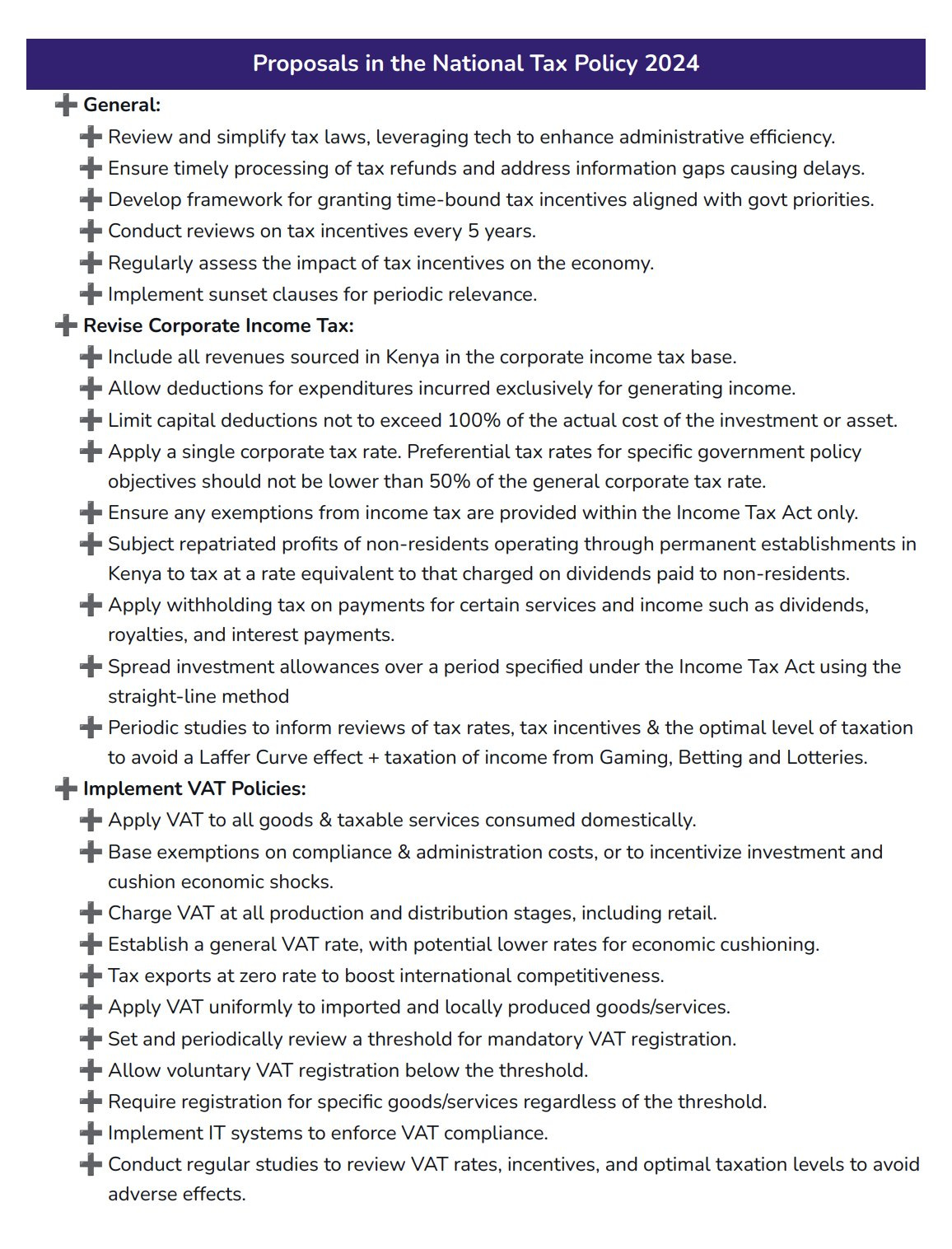

National Tax Policy Published

After publishing the draft National Tax Policy in July 2022, the National Treasury last week published the National Tax Policy vide Sessional Paper No. 02 of 2023 as part of the government’s efforts to harmonize Kenya’s tax policies and provide a coherent and predictable taxation environment. On the broad outlines, the policy aims to provide guidelines for Kenya’s taxation framework, build structures for managing refunds, incentives, amendments, and public participation regarding tax legislation. Below are some of the key takeaways from the policy document:

Find the entire document here.

Insurance Sector Results Wrap

Jubilee Holdings FY 23 Highlights: In the financial year 2023, Jubilee Holdings demonstrated growth in Total Assets by 13.7%, reaching KES 191.7B [2022: KES 168.6B], and an 8% increase in Insurance Revenue to KES 22.8B [2022: KES 21.1B]. However, the Insurance Services Result saw a significant decrease of 52.2% to KES 676.4M [2022: KES 1.4B]. The Profit After Tax also declined by 19.8% to KES 4.4B [2022: KES 5.5B], and Earnings Per Share dropped by 21.3% to KES 59 [2022: KES 75].

Dividend: The Board of Directors recommended for approval an ordinary dividend of KES 12.0 per share, bringing the total dividend for the year to KES 12 [2022: KES 12.0]. In addition, the board has recommended a special dividend of KES 2.30 [2022: KES 30] per share. Separately, Jubilee Holdings announced the appointment of two new directors, Rosemin Bhanji as an Independent Non-Executive Director and Amyn Lali as a Non-Executive Director.

Kenya RE FY 2023 Results: Kenya Reinsurance Corporation (Kenya Re) announced its financial results for the fiscal year 2023 in the week with insurance revenue at KES 19.6B, down 15.4%. Net investment income surged 42.8% to KES 6.6 billion, with the profit before tax going up by 53.2% to KES 7B. The profit for the year rose by 41.6% to KES 4.97B, with total assets growing by 14.8% to KES 65.98B. Earnings per share (EPS) increased to KES 1.78 from KES 1.25 in FY 2022, and the dividend per share was raised to KES 0.3 from KES 0.2.

At its upcoming Annual General Meeting (AGM), the special business that has been outlined includes the increment of the insurer’s authorized share capital to KES 16B, listing of an additional 3.2B ordinary shares, and the approval of a bonus issue with 2.799B ordinary shares to be distributed.

Find our analysis of Jubilee Holdings here and Kenya RE here.

Markets Wrap

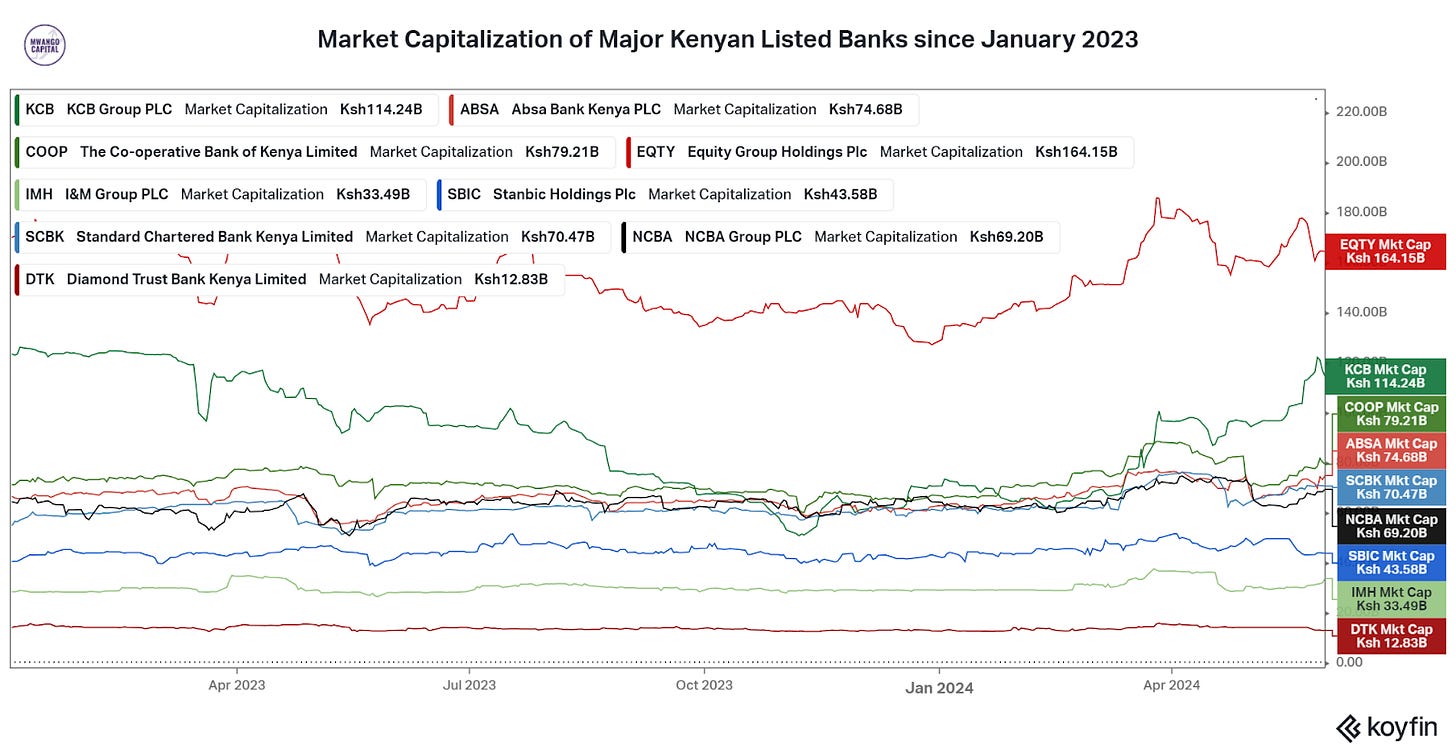

NSE: In Week 22 of 2024, Kenya RE was the top-performing stock, up 19.5% to close at KES 2.39. Bamburi was the worst-performing stock, down 14.3% to close at KES 41.15. The NSE 20 was up 0.3% to close at 1,722.5 points, the NSE 25 edged lower by 0.4% to close at 2,961.5 points, while the NASI index fell by 0.1%, to close at 113.0 points. Equity turnover was up 422.0% to KES 11.7B from KES 2.2B in the prior week while bond turnover closed the week at KES 28.72B compared to the prior week’s KES 22.90B.

Month-on-Month, Kenya RE was the top-performing stock, surging by 23.83%, followed by BOC Kenya and KCB Group at 23.47% and 18.70% to KES 90.75 and KES 35.55, respectively. The worst-performing stock was TPS Eastern Africa, which shed 21.62% of its value to KES 14.5, followed by TransCentury and Express Kenya which lost 20.00% and 18.91% to KES 0.52 and KES 2.83, respectively.

Year-to-Date, KCB Group was the top performer, edging higher by 62.33%, followed by Liberty Kenya and East African Breweries PLC (EABL) at 57.18% and 38.60% to KES 5.80 and KES 158.0, respectively. Express Kenya was the worst performer, having fallen by 23.51%, followed by Nairobi Business Ventures (NBV) and Unga Group at 18.15% and 16.32% to KES 2.21 and KES 14.10, respectively.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.9545%, 16.6076%, and 16.7061% respectively. The total amount on offer was KES 24B with the CBK accepting KES 32.79B of the KES 33.51B bids received, to bring the aggregate performance rate to 139.63%. The 91-day and 364-day instruments recorded 446.60% and 64.75% performance rates, respectively.

Treasury Bonds: The Central Bank of Kenya (CBK) invites bids for re-opened fixed coupon Treasury Bonds including FXD1/2023/02, FXD1/2024/03, FXD1/2023/05, and FXD1/2023/10. The tenors for the instruments are 2.2 years, 3.6 years, 4.1 years, and 8.7 years, respectively, and the total consolidated value of the offer is KES 60B. The period of sale for FXD1/2023/02 and FXD1/2024/03 is from 30th May to 5th June, while for FXD1/2023/05 and FXD1/2023/10 between 30th May to 12th June. The minimum bidding amount has been set at KES 50K.

Separately, the CBK is set to introduce revamped M-Akiba retail bonds via DhowCSD that will allow low-income investors to buy government securities for as little as KES 634 (USD 5).

Eurobonds: In the week, the yields were mixed across the 7 outstanding papers.

KENINT 2027 was the only paper whose yield fell week-on-week, down 0.80 bps to 8.231% while KENINT 2024 rose the most, up by 12.40 bps to 9.222%. KENINT 2048 rose the least, up by 0.10 bps to 10.066% The average week-on-week change stood at 3.04bps.

Except for KENINT 2034 which gained 31.20 bps to 9.649%, yields on the remaining papers declined on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 330.80 bps while KENINT 2048 fell the least at 6.10 bps.

All prices were flat week-on-week, except KENINT 2028 and KENINT 2031, which fell by 0.2% and 0.1% to 94.127 and 100.062, respectively. YTD, KENINT 2027 rose the most at 2.8% to 96.813, while KENINT 2031 rose the least, at 0.4%. Only the KENINT 2034 price fell YTD, down 1.5% to 79.275.

Market Gleanings

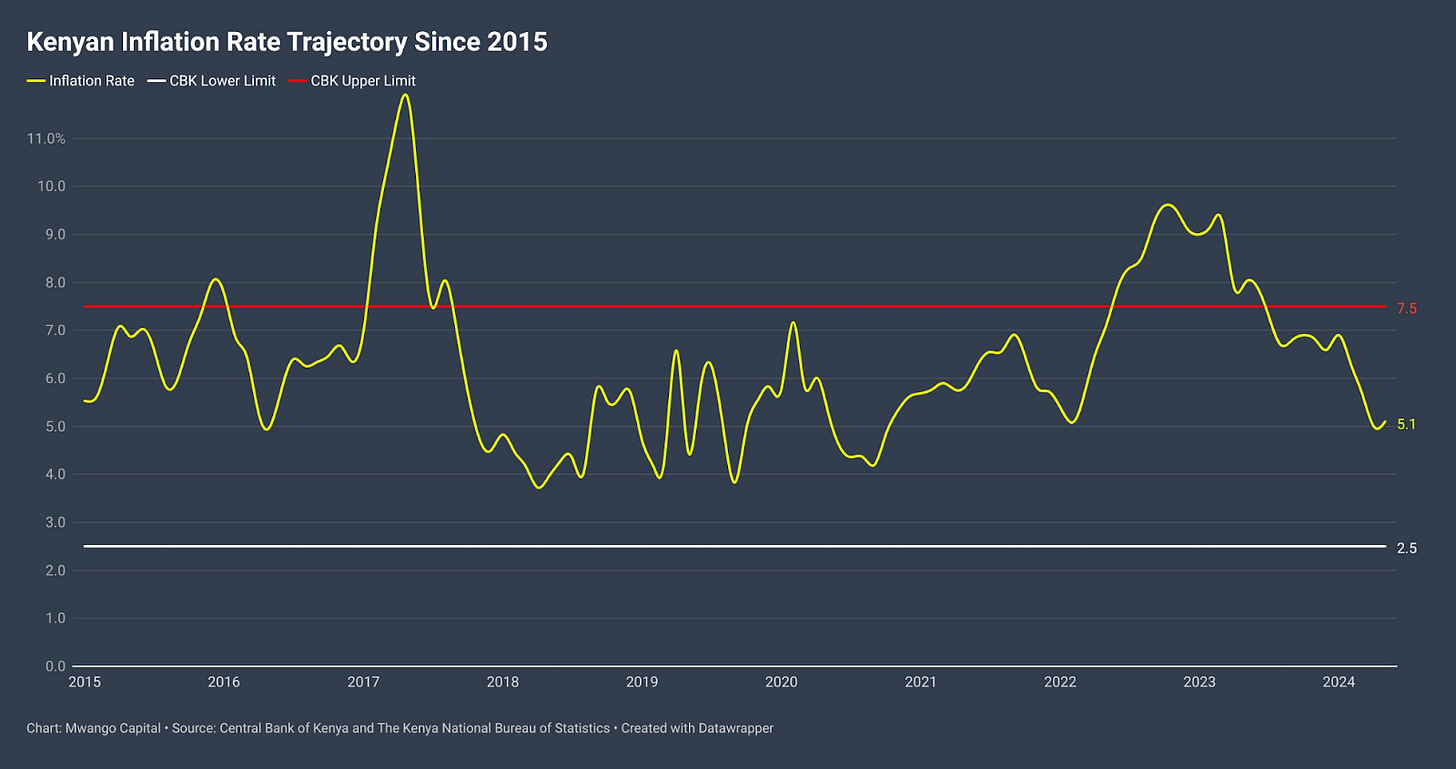

📈 | Kenya’s inflation in May 2024 | Kenya's inflation for May 2024 stayed steady at 5.1%, a decline from 5.0% in April 2024 and 8.0% in May 2023. Across indices, the Transport index rose the most year-on-year at 8.1%, followed by the Alcoholic Beverages, Tobacco, and Narcotics index at 8.0% while the Insurance and Financial Services index rose the least at 1.0%. Across commodities, 1 kilogram of onion rose the most year-on-year at 67.7%, followed by 1 kilogram of spinach at 30.9% and 1 kilogram of tomatoes at 29.7%. 2 kilograms of sifted maize flour posted the largest year-on-year decline at 28.1%, followed by 2 kilograms of fortified maize flour at 27.5% and 1 kilogram of loose maize grain at 24.1%.

Ahead of the CBK's Monetary Policy Committee (MPC) slated for 5th June, the Kenya Bankers Association expects the MPC to maintain rates at 13.0% on account of inflation within the CBK’s target range of 5% 2.5%, robust economic growth momentum from 2023 (5.6% growth), strong credit growth despite concerns about asset quality and interest rates and stability in the external sector with a stronger Kenya Shilling against US Dollar.

⚠️ | KNCCI Concern on Export Levy | The Kenya National Chamber of Commerce and Industry (KNCCI) and the Cereal Growers Association (CGA) have expressed concern over the Agriculture and Food Authority’s (AFA) recent imposition of a 0.3% export levy on cereals, legumes, roots, and tubers. They argue that this levy, which comes at a time when the agriculture sector accounts for 21.8% of Kenya’s GDP and is the second highest wage employer in the private sector, could reverse the gains made in promoting agricultural exports and make Kenyan produce less competitive internationally.

🏬 | Car and General’s Mall Project | Car & General is set to invest KES 800M in a new mall project in Shanzu, Mombasa. This move is part of the company’s ongoing strategy to diversify its revenue streams and expand its footprint in the property business. The planned mall, which will be built on a 4-acre plot, is expected to open in 2026, coinciding with the completion of the upgraded Mombasa-Mtwapa-Kilifi highway.

🧾 | Standard Group Delayed Results | The Standard Group PLC last week announced the delay in publishing the audited financial statements for the fiscal year ended 31st December 2023 due to unexpected delays in the external audit process. The audited results will now be published on or before 30th June 2024. In FY 2022, the Group reported a net loss of KES 865.2M which was almost 12X the loss recorded in FY 2021.

🤝 | India - Tanzania Trade | Tanzania has become India's second-largest trading partner in Africa, with bilateral trade rising by 22% to USD 7.9B in the current financial year, up from USD 6.48B in 2022/23. This growth has moved Tanzania ahead of Nigeria as Tanzanian exports to India, including legumes, avocados, gold, and coal, surged by 29.5% to USD 3.29B, improving the trade balance by USD 435.5M.

📊 | Ghana Keeps Rates Unchanged | The Bank of Ghana has kept its benchmark interest rate unchanged at 29%, citing modest upside risks to inflation. This decision follows a 100 bps cut in January that ended a tightening cycle that began in 2021. Despite a significant drop in the inflation rate from 54.1% in December 2022 to 23.2% in February, Governor Ernest Addison indicated that inflation risks remain and warrant close monitoring.