👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover TransCentury’s return to profitability, Equity Group’s Q1 2025 results, and Access Bank’s completion of the National Bank of Kenya acquisition.TransCentury Posts First Profit Since 2013

TransCentury PLC reported a profit after tax of KES 580M for FY2024, its first full-year profit since 2013, when the company reported a KES 626M profit. The turnaround was supported by a 27% increase in gross profit to KES 2.3B and an operating profit of KES 715M, compared to a loss of KES 371M in 2023.

Foreign exchange gains amounted to KES 1.2B, reversing a KES 1.5B loss in the prior year. Revenue grew slightly by 2% to KES 6.7B, while total assets declined by 20% to KES 10.8B. The Group did not declare a dividend.

Subsidiary Performance: East African Cables reported improved revenue and an EBITDA of KES 179M, reversing a KES 20M loss in 2023. Tanelec saw a 13% rise in EBITDA and continued geographic expansion into Ethiopia, Mozambique, and the DRC. AEA Limited grew revenue by 37% and improved EBITDA by 54%, supported by project completions in agriculture, energy, and industrial sectors.

Find our analysis of the results here.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Equity Group Q1 2025 Results

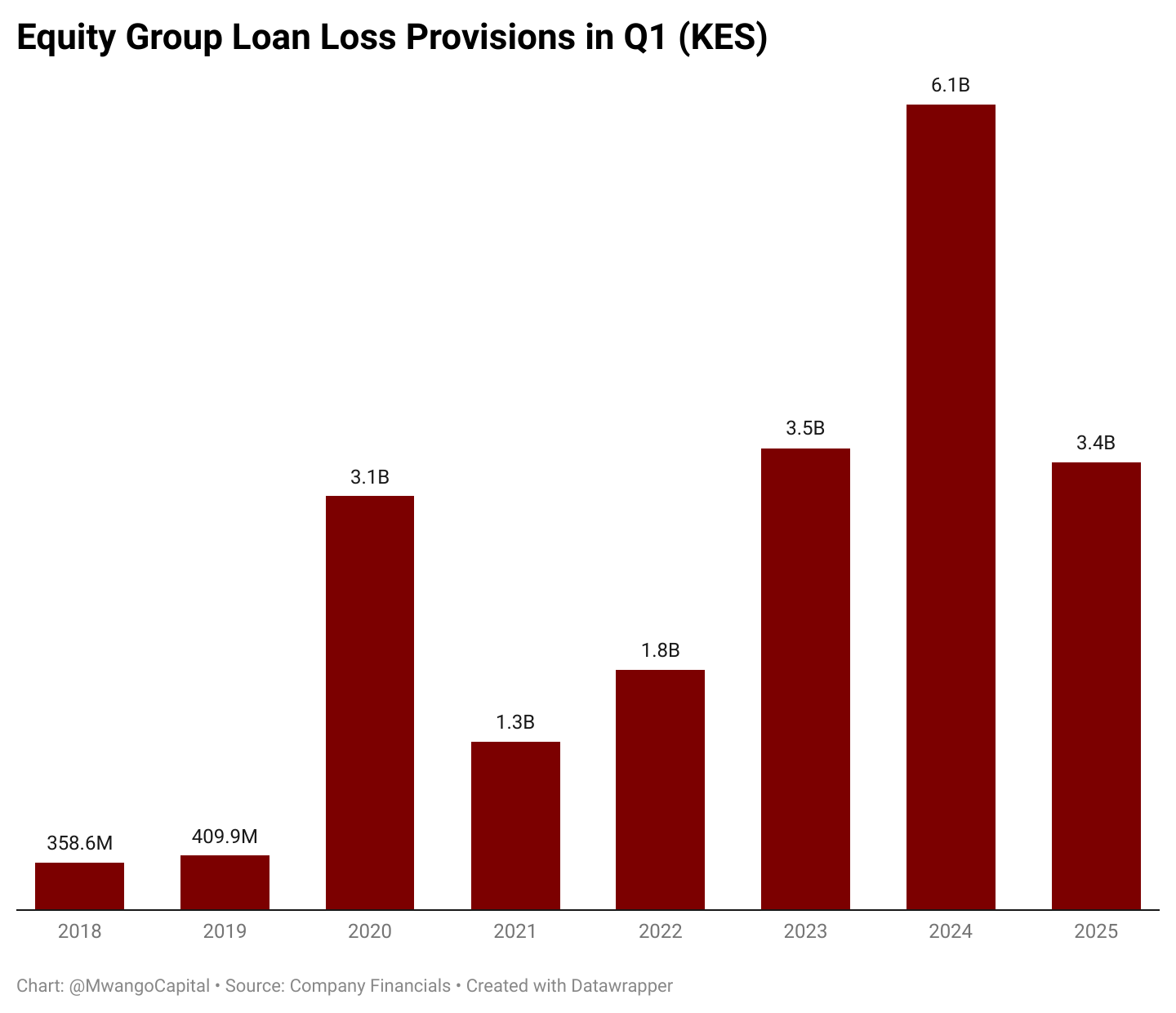

Profitability Impacted by Lower Non-Interest Income: Non-funded income declined 11.8% YoY to KES 19.6B, largely due to a 29.9% drop in FX trading income to KES 2.7B and a 27.0% fall in other income. This dragged non-interest revenue to 40.7% of total income from 44.4% in Q1 2024. Despite a 44.4% YoY reduction in loan loss provisions to KES 3.4B, pre-tax profit declined 8% YoY to KES 18.7B, while net income dipped 4% YoY to KES 15.4B.

Profitability was also weighed by the currency impact on regional subsidiaries and a KES 3.1B non-operating gain recorded in South Sudan in Q1 2024 versus a KES 100M loss in Q1 2025.

"South Sudan is a country that has really had challenges. Customer loans are less than a billion, just 900 million, while deposits stand at 12 billion, but we’re not able to lend because of the challenges. Last year, after the stoppage of oil exports, inflation went off the roof. We had to register a profit of 3.1 billion against revenue of 3.3 billion, but costs remained.”

Equity Group CEO, James Mwangi

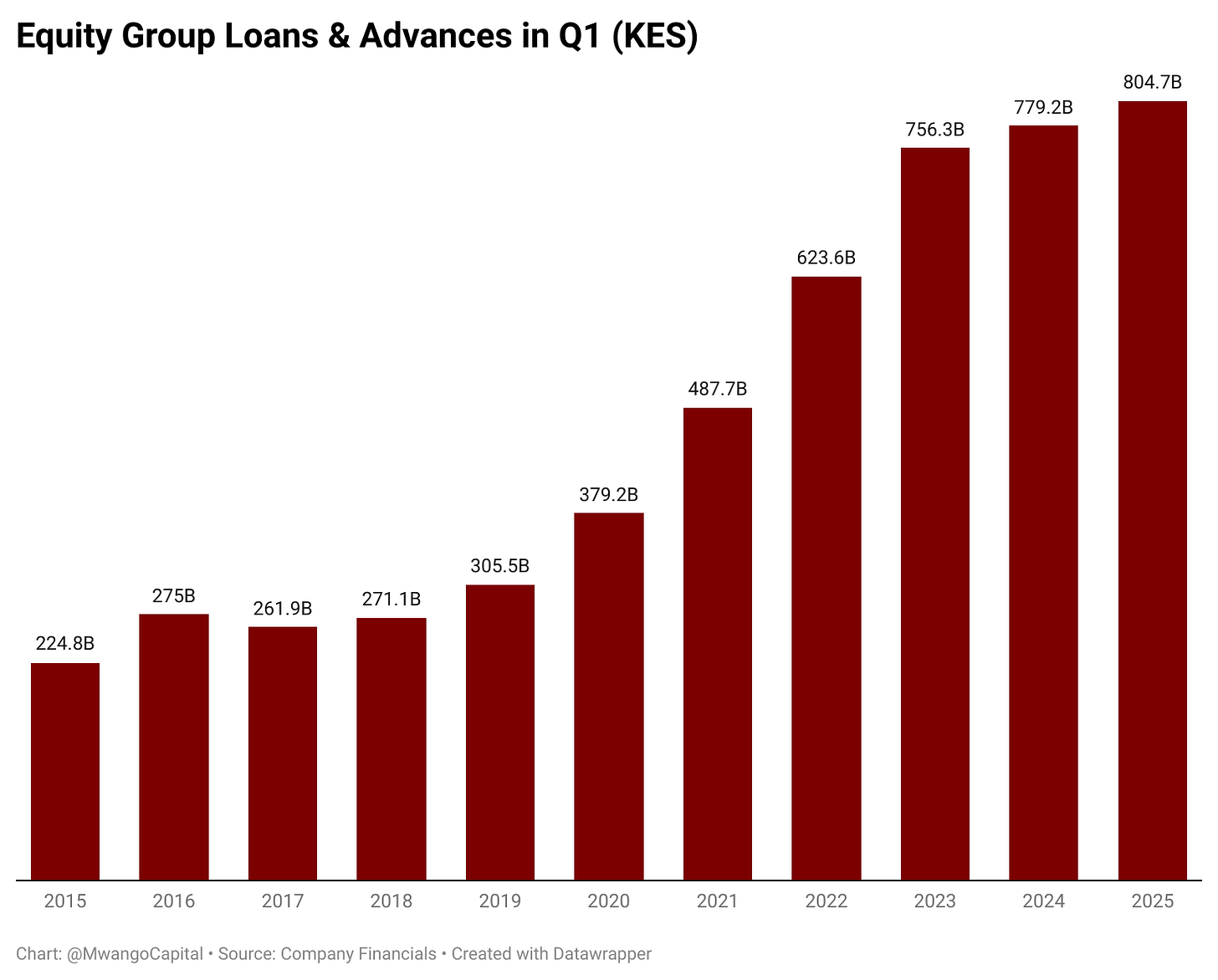

Slow Growth in Core Metrics: Equity Group posted modest growth in Q1 2025, with deposits rising 7% YoY to KES 1.32T and net loans increasing 3% YoY to KES 804.7B. Total assets stood at KES 1.75T (+4% YoY). Net interest income grew 2.6% YoY to KES 28.6B, supported by a sharper drop in interest expenses (-12.4% YoY) than the decline in interest income (-2.7% YoY).

While income from government securities rose 4.4% YoY, interest from loans and advances fell 7.9% YoY due to weaker loan yields and muted private sector demand. Group lending rose 7.0% YoY on a constant currency basis, with growth driven by regional subsidiaries in Rwanda (+36%), Tanzania (+20%), and the DRC (+11%).

Subsidiaries’ Performance: Equity Bank Kenya’s profit after tax rose 55% YoY to KES 8.5B, supported by a 24% drop in loan loss provisions and a 17% increase in net interest income to KES 16.3B. Regional subsidiaries contributed 42% of the group's profit after tax, down from 62% in Q1 2024, due to weaker performance in DRC and currency depreciation. The insurance unit posted a 27% rise in PBT to KES 414M, with total assets and liabilities both up 13% YoY to KES 28.5B and KES 22.5B, respectively.

Find our analysis of the results here.

DTB Q1 2024 Results

Earnings Up 10%: DTB Group posted a 10% YoY rise in profit after tax to KES 3.2B in Q1 2025, supported by an 8% increase in net interest income to KES 7.7B and a 43% drop in loan loss provisions to KES 886.3M. Total assets rose 4% to KES 595.1B, driven by 9% growth in deposits to KES 463.6B and a 5.7% increase in loans to KES 284.3B.

The Group’s gross non-performing loans declined 8% to KES 39.7B, indicating improving asset quality. DTB Kenya contributed net income of KES 2.1B, up 7% YoY, as provisions fell 39% to KES 579M and net interest income rose 17%. EPS stood at KES 10.21, up 8.7% YoY.

Group interest income remained flat at KES 14.7B, while interest expenses declined 7.8% to KES 6.9B. Income from loans rose 4% to KES 8.3B, supported by a 6% expansion in the loan book. Interest income from deposits and placements with banking institutions jumped 52% to KES 410M, while income from government securities fell 7% to KES 6.0B.

Interest expense on customer deposits rose 11% to KES 6.5B, reflecting a higher cost of deposits compared to Q1 2024. Non-interest revenue fell 19% to KES 3.0B, weighed down by a 56% drop in FX trading income to KES 746M. Fees and commissions rose 3% to KES 1.5B, while other income increased 36% to KES 753M.

Find our analysis of the results here.

Markets Wrap

Treasury Bills: Treasury bills were oversubscribed last week, with a subscription rate of 229.6%, up from 142.44% the previous week. Investors submitted bids totaling KES 55.1B, and the Central Bank of Kenya (CBK) accepted KES 43.7B out of the KES 24B on offer. Yields on the 91-day, 182-day, and 364-day T-bills declined by 3.04, 1.08, and 0.26 basis points to 8.2927%, 8.5642%, and 10.00%, respectively.

Treasury Bonds: The CBK’s re-opened 20-year bond FXD1/2012/020 received KES 54.39B in bids against KES 30B offered, with KES 43.52B accepted at an average yield of 13.65%. Proceeds will cover KES 14.23B in redemptions and raise KES 29.29B in new borrowing.

Eurobonds: Last week, yields on Kenya’s seven outstanding Eurobonds fell, led by the KENINT 2028 bond, which dropped by 52.30 basis points to 8.548%. The KENINT 2027 bond followed, down 38.70 basis points to 6.913%. On average, Eurobond yields declined by 34.40 basis points week-on-week.

Market Gleanings

🤝| Access Bank Completes NBK Acquisition | KCB Group Plc and Access Bank Plc have finalized the sale of National Bank of Kenya (NBK), transferring full ownership of NBK to Access Bank. The transaction, initiated in March 2024, concluded following the receipt of all necessary regulatory approvals. While NBK and Access Bank Kenya will continue to operate independently during the integration phase, the acquisition marks a key step in Access Bank’s East Africa expansion strategy, positioning it to offer enhanced banking services across Kenya.

💸| Sanlam Completes Rights Issue | Sanlam Kenya Plc last week announced the results of its 2025 Rights Issue, raising KES 2.5B through the issuance of 500 million new shares at KES 5.00 each. The offer achieved an 81% subscription rate under shareholder entitlements and an overall 82% subscription before underwriting. The remaining 92.3 million untaken shares were successfully subscribed by Sanlam Allianz Africa Proprietary Limited under an underwriting agreement, bringing the total subscription performance to 100%. The new shares will be listed on the Nairobi Securities Exchange on 4 June 2025.

📉| Inflation Eases to 3.8% in May | Kenya’s inflation slowed to 3.8% year-on-year in May from 4.1% in April, remaining well within the Central Bank’s 2.5%–7.5% target range. Core inflation stood at 2.8%, while non-core inflation reached 6.0%. Month-on-month inflation rose slightly to 0.5%. The Kenya National Bureau of Statistics reported a 6.3% annual increase in food and non-alcoholic beverage prices, while transport costs rose 2.3%. The Central Bank is expected to announce its next lending rate decision on June 10.

📜| NSE Announces Changes to Share Indices | The Nairobi Securities Exchange Plc has completed its annual review of the NSE 10, NSE 20, and NSE 25 Share Indices to better reflect market dynamics. HF Group Plc joins all three indices, while Diamond Trust Bank Kenya Ltd returns to the NSE 20 Index. I&M Group Plc is added to the NSE 10 Index, and BK Group Plc, Trans-Century Plc, and Carbacid Investments Plc join the NSE 25 Index. The review is based on market capitalization and liquidity metrics.

📈| HF Group Q1 Profit Doubles to KES 327.9M | HF Group reported a 118% year-on-year surge in Q1 2025 profit after tax to KES 327.9M, driven by strong growth in net interest income, which rose 46.1% to KES 989.7M. Total assets grew 17.9% to KES 73.4B, while provisions declined 8% to KES 100.4M. Loans expanded slightly by 2% to KES 38.9B, with gross non-performing loans rising 6.8% to KES 11.9B. However, FX trading income dropped 28.3% to KES 34.5M. Despite the profit jump, EPS fell sharply by 89% to KES 0.14.

✔️| CAK Clears Kimo Kali’s Acquisition of Three FMCG Distributors | The Competition Authority of Kenya has approved Kimo Kali Holdings Limited’s acquisition of Jumra Limited, Sojpar Limited, and Raisons Distributors Limited. Kimo Kali, backed by Twiga Holdings Limited, will acquire shares in the three companies operating across Nairobi, western Kenya, and coastal regions to consolidate FMCG supply chains and logistics.

💰| KOKO Networks Secures USD 179.6M Guarantee | The Multilateral Investment Guarantee Agency (MIGA), part of the World Bank Group, has issued a USD 179.6M guarantee for KOKO Networks Limited’s investment from Mauritius into its Kenyan operations. The guarantee covers risks such as expropriation, war, transfer restrictions, and breach of contract for up to 15 years. KOKO Networks supplies bioethanol-based cookstoves and fuel to low-income Kenyan households to reduce reliance on charcoal and wood.

📉| AfDB Cuts Africa’s 2025 Growth Forecast | Africa’s economic growth is projected at 3.9% in 2025, down from an earlier forecast of 4.1%, according to the African Development Bank’s latest African Economic Outlook. The revision reflects the impact of newly imposed U.S. tariffs and global retaliatory measures, which have disrupted trade flows and weakened commodity prices. Despite the downgrade, 21 African economies are still expected to grow above 5%, with Ethiopia, Niger, Rwanda, and Senegal forecast to expand by at least 7%.