👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the surprise 100 bps rate hike by the Central Bank of Kenya and Kenya’s telecommunication sector statistics in Q3 FY 2022/2023.First off, enjoy a dose of our weekly business news in memes.

This week’s newsletter is brought to you by:

Co-operative Bank of Kenya. With a Co-op Prepaid Card, you can instantly send pocket money to your child from anywhere, and receive transaction alerts for every purchase they make.

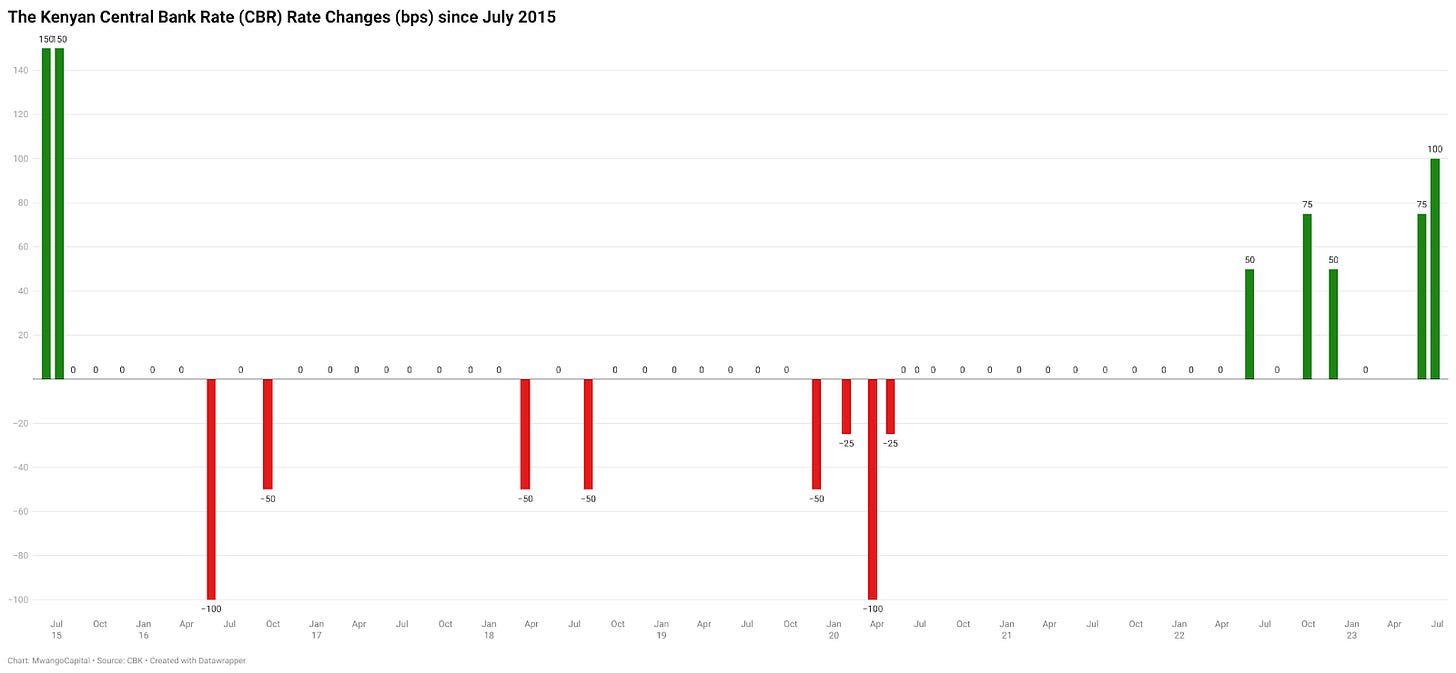

Surprise 100 bps Rate Hike

Thugge’s First: The Central Bank of Kenya’s Monetary Policy Committee (MPC) last week held an unscheduled emergency meeting, in what was Dr. Kamau Thugge’s first MPC meeting as Governor since his assumption to office on 19th June 2023. The MPC delivered a hike of 100 basis points to bring the Central Bank Rate to 10.5%. Here is the CBK Governor laying out the reason for the hike, the highest since the beginning of the current tightening cycle:

“The Monetary Policy Committee did meet on May 29th. There have been some questions raised as to why we are again meeting on June 26th when the Monetary Policy Committee met on May 29th. They had the information that they had before they made the decision to maintain the CBR unchanged at 9.5 was a situation where the inflation rate seems to be improving and the prospects for lower inflation looked quite imminent….at that point the CBK had anticipated that inflation for May may even be within the upper range of the CBK target of 7.5% and had anticipated that it’ll actually go to 7.1%. So on the basis of that, the Monetary Policy Committee, therefore, decided to leave the rate unchanged at 9.5%. So I think that was the right decision at that point, given the information that was available then. Since that time we then received information on inflation for May and that information indeed indicated that inflation had accelerated and instead of it going to 7.1%, it had actually gone to 8%. And again, most of the items went up, food prices went up. Fuel prices also went up and core inflation as non-food non-fuel inflation also went up.”

Central Bank of Kenya Governor, Dr Kamau Thugge

Inflation Trajectory: The Governor pointed out that recent data points to elevated inflation compared to the sentiment in the last MPC meeting held on May 29th. Inflation for June 2023 stood at 7.9%, slightly lower than May’s rate of 8.0%, while inflation for April was 7.9%. Among the goods that stood out was sugar, whose inflation stood at 58.1% year-on-year, up from 49.2% in Ma. Inflation for 200 kilowatts of electricity stood at 53.4% compared to 66.5% in May.

“We have looked at all these factors in terms of where we expect inflation to be and we do think, for example, on the issue of the VAT, obviously there are also offsetting factors. As you are aware, the import declaration fee has been reduced from 3.5% to 2.5%. And similarly, the Railway Development Levy has also been reduced from I believe 2% to 1.5%. So these will mitigate any impact that may arise from the VAT on fuel but we do expect some increase in July. But overall, given the actions that we are now taking, by August earliest and latest by September, we expect the overall rate of inflation to come to below the upper range of 7.5% and to be firmly within our target range of between 2.5% and 7.5%.”

Central Bank of Kenya Governor, Dr Kamau Thugge

Salient Macro Data: The Governor highlighted that the government managed to borrow KES 436B domestically compared to a target of KES 475B in the 2022/2023 fiscal year - a 92% uptake. In terms of composition, the share of longer-dated treasury bonds stood at 87% [June 2017: 63%] with an average time to maturity of about 9 years [June 2017: 6.2 years]. The latest data by the CBK show that at the end of April 2023, Kenya’s stock of external debt crossed the KES 5T mark to close at KES 5.1T, accounting for 52.9% of gross public debt which stood at KES 9.63T. Across banking, the non-performing loans ratio stood at 14.9% in May, up 30 bps from April 2023. Private sector credit growth stood at 13.2% in May, unchanged from April. While exports rose 5.5% in the 12 months to May, imports fell 2.3%.

Across the Region: In an update, Tanzania’s Central Bank announced that it would change the calculus of its monetary policy framework, shifting from targeting money supply to a regime that is interest-rate-based starting from January 2024. The apex bank has cited the provenance of the efficiency and transparency of interest-rate-based monetary policy in some 45 countries where it is in use globally.

"The Bank of Tanzania wishes to inform the general public that, in order to improve the effectiveness of the monetary policy, it will shift from conducting monetary policy based on the current monetary targeting framework, which targets money supply, to an interest rate-based monetary policy framework that focuses on interest rate, effective from January 2024."

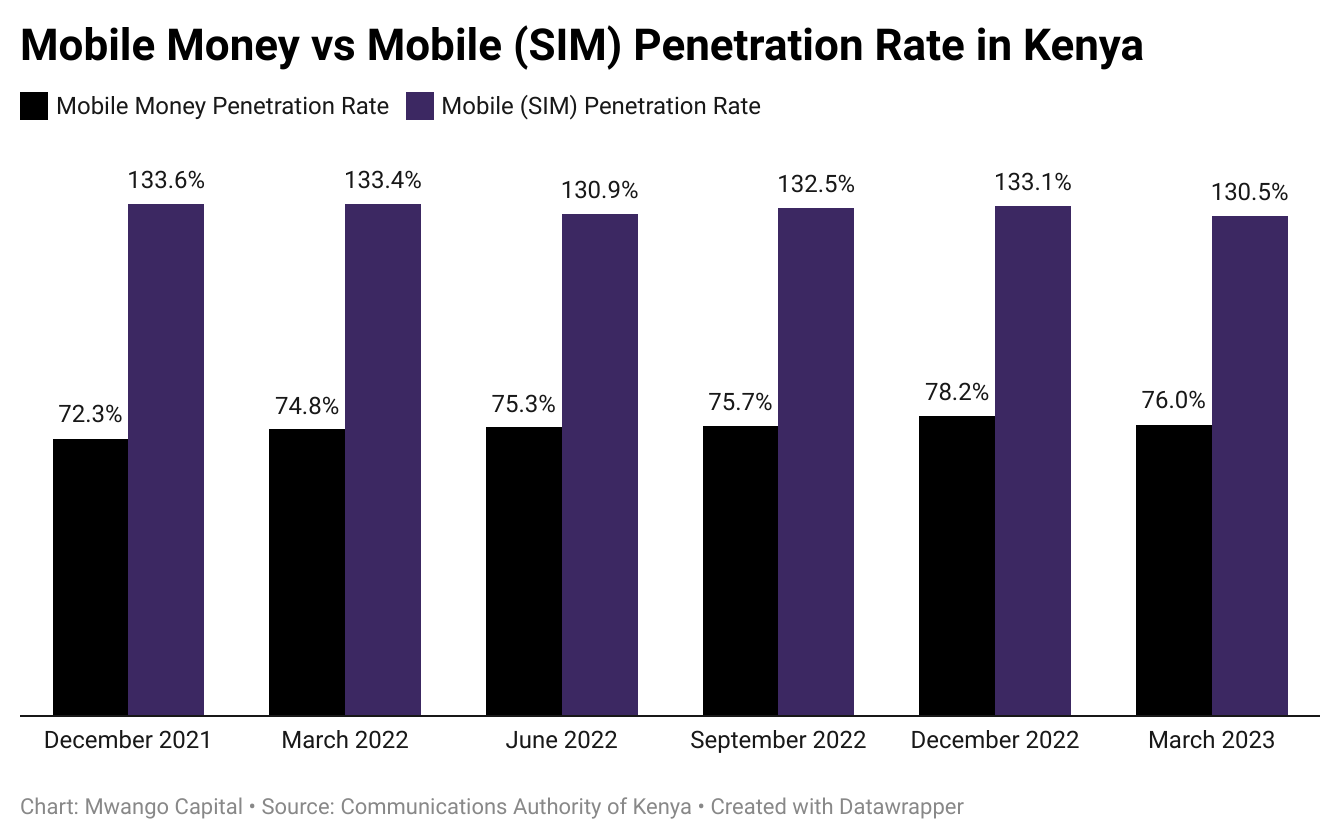

Kenya’s Telecom Sector in Q3 2022/2023

Mobile Services: Total mobile (SIM) subscriptions rose by 1.7% year-on-year to reach 66.1, translating to a mobile (SIM) penetration of 130.5%. Out of these, 98% (64.7M) were prepaid and 2% (1.3M) were postpaid. Mobile money subscriptions declined by 5.5% to 38.4M. In terms of market share, Safaricom accounted for 96.5% of total mobile money subscriptions, while Airtel Money and T-Kash accounted for 3.4% and 0.1%, respectively.

Data Market Share: Safaricom had 399.3K fixed data subscriptions, up 7.1%, to represent a market share of 35.9% compared to 46.1% in December 2022. On the other hand, Wananchi Group saw its subscriptions rise 10.0% to 252.1K, representing 22.7% of the market share as compared to 28.7% in December 2022.

Cyber Threats Abound: The total number of cyber threats detected rose 137.1% to 187.8M as of March 2023. Cyber threat advisories rose by 23.2% to 3.6M, advisories issued on malware were up 26.6% to 69.2K, and those on system vulnerabilities edged lower by 84.3% to 3.5M.

Find the link to the entire report here.

Energy Wrap

July Pump Prices: In the week, EPRA announced new pump prices effective 1st July to 14th July to reflect the increase in the VAT on petroleum products from 8% to 16% following the enactment of the Finance Act 2023, despite court orders in the week suspending the implementation of the Act. While the prices have been adjusted for VAT, they do not take into account the reduction of the Import Declaration Fee (IDF) and Railway Development Levy (RDL) as outlined in the Act. The price of Super Petrol, Diesel, and Kerosene rose by KES 13.5, KES 12.4 and KES 11.96 per litre, respectively.

Renegotiation of IPP Contracts: Kenyan MPs want the government to renegotiate contracts with Independent Power Producers (IPPs) to reduce prices per unit by at least KES 10 and pay them in local currency as opposed to USD. This is not the first time legislators are delving into the IPPs' subject with regard to expensive electricity. Earlier in March this year, the Senate Committee on Energy resolved to look into all the IPPs and the Power Purchase Agreements signed with a view of reducing the cost of energy in the country.

“The contract with the IPPs must be in Kenyan shillings. They must be willing to take the risk for the benefit of the end user, the consumer, The IPPs must be prepared to reduce the price they sell power by at least KES 10. This is a conversation we need to have and we are ready to go all the way. I am ready to propose a law that any contractor coming to Kenya must sign in Kenyan shillings because they are operating within Kenya's borders.”

Member of Parliament for Gem Constituency, Elisha Odhiambo

Kenya Seeks Investors for High Voltage Cables: According to the Public-Private Partnerships (PPPs) Directorate, Kenya is inviting private investors to fund the construction of high-voltage power lines to reduce its reliance on public funding for infrastructure. KETRACO has identified 5 projects to be constructed through PPPs and is seeking a transaction advisor to help structure the deal.

Globeleq’s Geothermal Plant Project: The Kenyan government has given a letter of support to Globeleq, a UK-based energy company, for its 35 MW geothermal power plant project in Menengai, Nakuru. The letter of support will enable the company to secure funding and is a significant boost to the project, which had experienced delays for more than 7 years.

“The letter of support which is supposed to be provided for Globeleq has already been signed by the National Treasury.”

Geothermal Development Company Managing Director, Paul Ngugi

Across the Region: Taifa Gas announced an investment in the region of $100M in power generation in Zambia through a joint venture with Delta Marimba. The project is expected to start production in 24 months after securing relevant environmental impact approvals and will see the establishment of an LPG plant in Northern Zambia - the first of its kind in the country. The plant is expected to inject at least 100 MW into the Zambian national grid once operational. Separately, the involvement of TotalEnergies SE in the 1,443 KM EACOP project faced a new obstacle after the energy major faced a new lawsuit in Paris by an alliance of NGOs and civilians. This is the second round of litigation after a similar challenge by activists lodged in 2018 was thrown out by a French court earlier in February this year.

Earnings Wrap

Kapchorua Tea FY 2023 Results: For the year ended 31st March 2023, total revenues edged higher by 25.3% year-on-year to close at KES 1.8B. Profit Before Tax increased by 50.1% to KES 454.7M while the net profit for the year was up 47% to KES 314.5M. The Board of Directors recommended a first and final dividend of KES 25 per share, set to be paid on 4th September 2023.

“Inflationary pressures continue, market intelligence shows very large stocks of Kenyan tea being held by some producers thus further dampening demand from buyers. We will be working extra hard to combat these threats.”

Williamson Tea Kenya FY 2023 Results: Revenue was up 14.6% to KES 4.01B for the fiscal year ending 31st March 2023. Net profit totalled KES 564.3M, equivalent to 14% of gross revenues [2022: 15.1%]. Earnings Per Share were down 1% to KES 29.42, with the Board of Directors recommending a dividend per share of KES 30, payable on 23rd August 2023.

“The disruption to global supply chains and current inflationary pressures on all inputs means our costs will rise. The demand and price side is impossible to control but we are confident of remaining competitive.”

Olympia Capital Holdings Financials: For the year ending 28th February 2023, revenue grossed KES 494.5M, up 14.8% year-on-year. Gross profit was up 20% to KES 153.5M bringing the gross margin to 31% [2022: 29.7%]. Operating profit edged higher by 90.1% to KES 57.7M while the net profit for the operating period stood at KES 35M, double the KES 17.5M reported in the previous year. The asset base expanded by 3.9% to reach KES 1.5B.

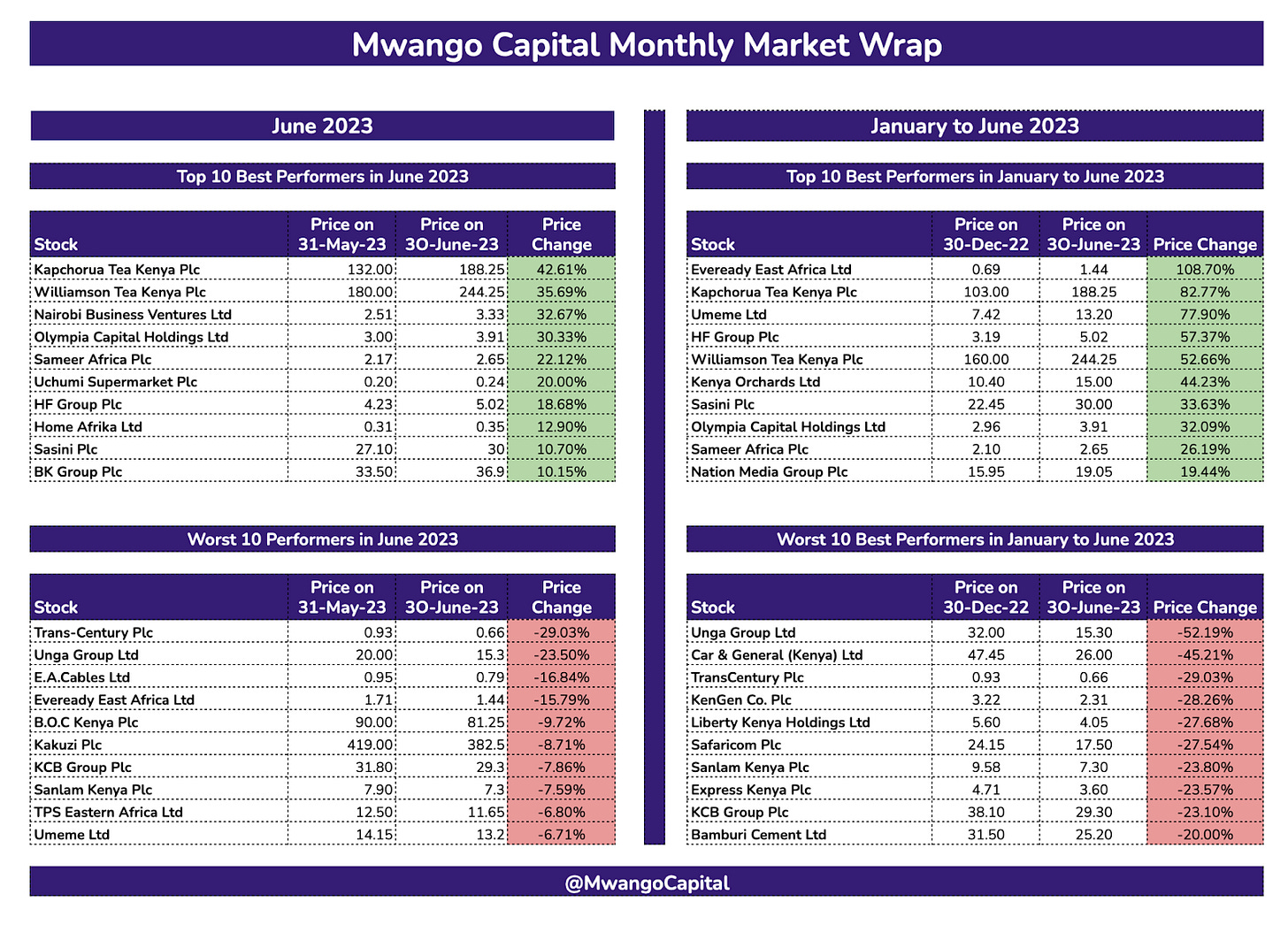

At the NSE, Kapchorua Tea, Williamson Tea, and Olympia Capital Holdings are up 82.77%, 52.66% and 32.09% year-to-date. Over the last 1 year, the stocks have appreciated by 93.9%, 126.8% and 70%, respectively.

Find the link to the results here.

Markets Wrap

NSE Wrap:

In Week 26 of 2023, Kapchorua Tea was the top-performing stock on the Nairobi Securities Exchange, unchanged from last week, appreciating by 23% to KES 188.25. Umeme was the worst-performing stock, falling 25% to KES 13.20. The NSE 20 index rose by 3% to 1,574.9 points while the NSE 25 index appreciated by 0.4% to 2,728.9 points. The NSE All Share Index (NASI) however edged lower by 0.2% to close at 107 points. Equity turnover was down 41.2% to KES 585.5M while bonds turnover fell by 2.7% to KES 16.5B.

Month-on-Month, Kapchorua Tea was the top gainer, up 42.61% to KES 188.25, while TransCentury PLC was the top loser, depreciating by 29.03% to KES 0.66. Sector-wise, the Agricultural sector was the top performer, appreciating by 14.81%, while Investment Services was the worst-performing sector, down 3.08%. Across indices, the NSE 20 and NASI gained 1.82% and 3.19% to 1,574.92 and 107.00 points, respectively, while NSE 25 edged lower by 4.42% to 2,728.89 points. Market Cap increased by 3.2% to 1,666.29 points.

In H1 2023, Eveready PLC was the top gainer, up 108.7% to KES 1.44, while Unga Group PLC was the worst performer, down 52.19% to KES 15.3. The Agricultural sector was up the highest, up 30.85% - with Kapchorua Tea being the best performer, up 82.77%. Insurance was the worst performer, down 11.43%. All indices were in the red, with NASI leading losses at 16.06%, followed by NSE 25 at 12.92%, and NSE 20 at 6.04%.

Treasury Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day treasury bills were 11.904%, 11.947%, and 12.157% respectively. The total amount on offer was KES 24B with the CBK accepting KES 5.5B of the KES 9.4B bids received, to bring the aggregate performance rate to 39.54%. The 91-day and 364-day instruments recorded 144.5% and 15.14% performance rates, respectively.

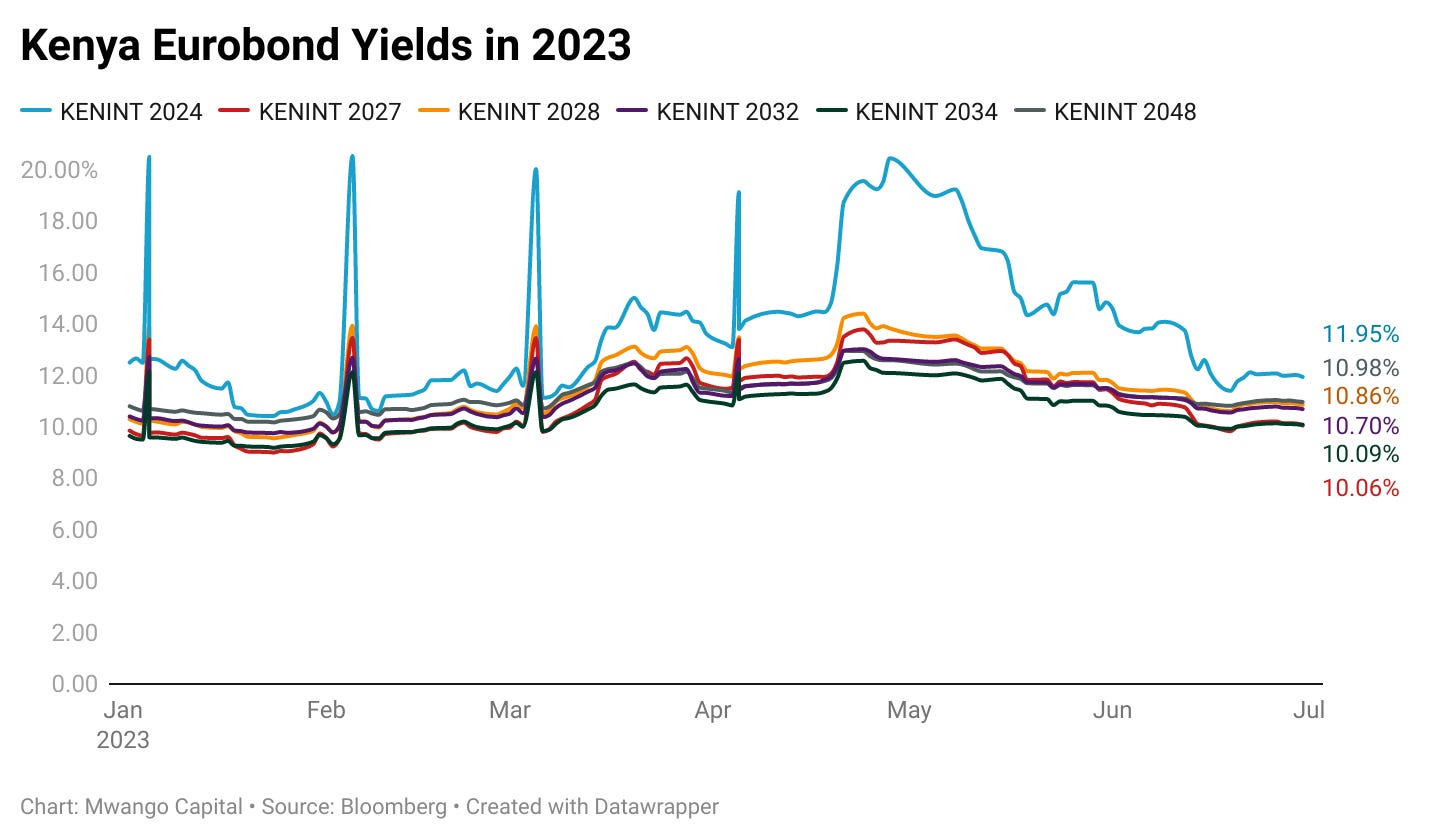

Eurobonds: In the week, the yields fell across the 6 outstanding papers on a week-on-week basis.

KENINT 2027 fell the most, down by 12 basis points to 12.060%, while KENINT 2034 fell the least, down 1.6bps to 10.094%. The average week-on-week change stood at -6.7 bps.

All yields were up on a Year-To-Date (YTD) basis, with the exception of KENINT 2024, which fell by 65.1 bps to 11.952%. KENINT 2028 led gains, appreciating by 55.2 bps, while at the lower end, KENINT 2048 appreciated by 15.3 bps. The average increase was 15.78 bps.

KENINT 2027 and KENINT 2028 led price gains week-on-week, rising by 0.4% to 90.350 and 87.061, respectively. On a YTD basis, KENINT 2024 price was up the most at 3.2%, followed by KENINT 2027 at 0.4%. All other instruments recorded price depreciation, with KENINT 2034 leading at -2.3%. The average price change on a week-on-week and YTD basis was 0.3% and -0.3%, respectively.

Market Gleanings

🚗 | Car Sales Up Marginally in May 2023 | According to data by the Kenya Motor Industry Association, car sales rose by 0.5% Month-on-Month to 1,025 units in May 2023 on the back of rising prices. Year-to-date, the sales are up 29.4%, while the average of units sold per month stands at 956. The depreciation of the Kenya Shilling to the US Dollar - currently at 13.9% so far this year - has also been cited among the contributors to price increases.

"There are two sides to the dollar exchange rate impacting our business. The dollar strength against the shilling and dollar scarcity in the market. For strength, we are responding through price adjustments. The changes have been upwards of 10%.”

Isuzu EA General Manager, Commercial Finance, Gabriel Kanyingi

💸| NMG Share Repurchase Program | Nation Media Group (NMG) shareholders have approved the proposed share repurchase program which is set to allow NMG to buy back 10% of its issued and paid-up share capital. The program will be conducted through open market purchases at the NSE and is expected to start on 3rd July 2023 and close on 2nd July 2024. The buyback price is KES 20 per ordinary share, while the maximum number of ordinary shares that may be acquired through the program is 19,029,516 shares. The shares acquired through the buyback will be held as Treasury shares.

👨💼 | Corporate Changes |

Orlando Lyomu in the week exited as Chief Executive Officer of Standard Group PLC after a 5-year stint at the helm of the media firm. He has been appointed as a board member of the Kenya Private Sector Alliance (KEPSA) effective 30th June 2023.

Mr. Dayalan Nayager resigned from the position of Director at the Board of Directors of East African Breweries Plc, while Mr. John Musunga has been appointed as a Non-Executive Director.

The Kenya Tea Board and the Kenya Revenue Authority have both re-advertised for the positions of Chief Executive Officer and Commissioner General, with deadlines for applications set at 18th July 2023 and 21st July 2023, respectively.

🛠️ | Zambia’s Debt Restructuring | After a deal with creditors led by China and France to restructure bilateral debt totalling $6.3B through the Group of 20 Common Framework, Zambia - Africa’s first pandemic-era sovereign defaulter, now sees a path to reaching an agreement with creditors over the restructuring of some $3B in Eurobonds in default for 3 years now.

“I think there are no obstacles anymore. I don’t see anything standing in the way of getting a deal. Private creditors have been ready for a long time to provide the necessary debt relief.”

Emerging Markets Debt Portfolio Manager, Carlos de Sousa