👋 Welcome to the Baobab Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Kenyan banks’ 2021 earnings and the Kenyan insurance industry.First off, our weekly business news in memes brought to you by Safaricom PLC:

Equity Group Earnings

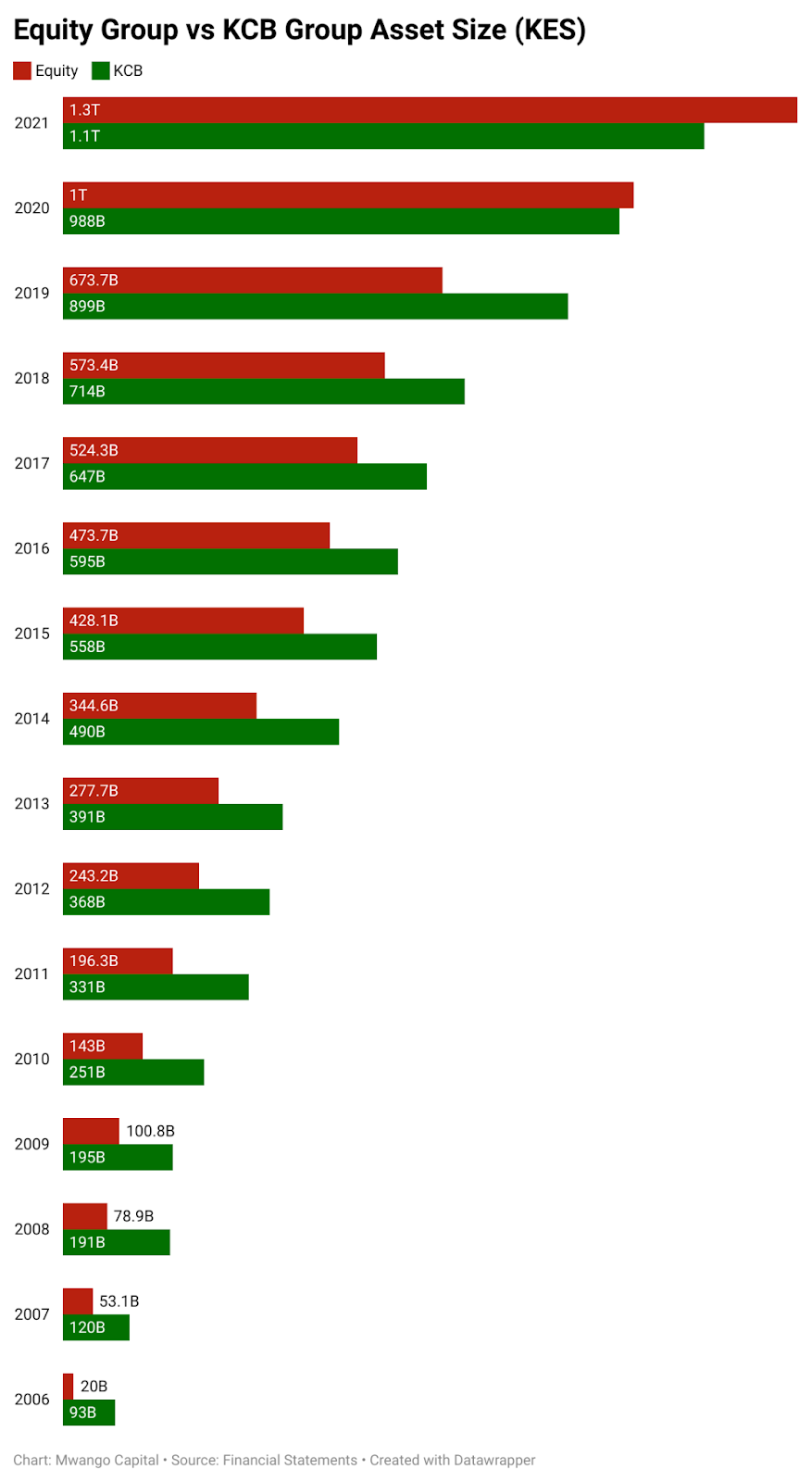

Highlights: Equity released its FY 2021 results and like other banks, has reported huge profit growth. Like its counterpart KCB, revenue crossed the KES 100B mark to reach KES 113.3B, a 21% growth from the previous year.

Deprovisioning: Equity registered a 78% reduction in loan loss provisions, the highest among listed banks so far. This led to a 134% growth in profit before tax to KES 51.8B. Gross non-performing loans fell 9.3% to KES 53.8B.

Revenue Mix: Net interest income grew 25% to KES 68.8B, contributing 60.7% to total revenue. Non-interest income grew 16% to KES 44.6B, contributing 39.3% to total revenue.

Dividends: Net income grew 99% to KES 40.1B, out of which, KES 11.5B will be paid in dividends - a 28.9% dividend payout ratio. The KES 11.5B remains the highest quantum in the industry.

Subsidiaries: Among its banking subsidiaries, the DRC operation outperformed the others with profit before tax growing 204% and net income rising 211%. It contributed 10% to the Group's net income.

NCBA’s Asset Growth

Milestone: NCBA assets grew 12% to reach KES 591.1B, surpassing Co-operative Bank’s KES 579.7B. This effectively makes it Kenya’s third-largest lender by assets.

PAT up 124%: Profit before tax grew 145% to KES 16B pushing net income to KES 10B. Of this, KES 4.1B will be paid as dividends - a 36% payout ratio. The full-year dividend is KES 2.25 [2020:1.5].

Asset Allocation: The loan book shrank 2% to KES 244B while investment in government securities grew 32.1%. NPLs fell 25% and loan loss provisions reduced 37.8%. This reflects the CEO’s comments on asset allocation in March 2021.

“There is still not strong uptake from a loans perspective and the other option where we put our money is government paper.”

NCBA CEO John Gachora

East to West: NCBA is exploring entry to the Ghanaian market and is in partnership discussions with a local lender. The lender has operations in West Africa in Ivory Coast in addition to operations in Tanzania, Uganda, and Rwanda [Bloomberg].

Kenya’s Insurance Industry

Liberty Holdings: Insurance premiums grew 2.1% in FY 2021, pushing net insurance premiums up 0.6%. PAT reduced by 87% to reach KES 81.8M. There was no dividend announcement, as in the previous year.

CIC’s Land Disposal: CIC this week changed the variables of the disposal of its 200-acre parcel in Kiambu. The listed insurer is looking to decompose the single sale transaction into different transactions. This was informed by a depressed real estate sector in the wake of deteriorating economic conditions.

Dividend Drought: CIC did not make any dividend announcement for the year. The company reported improved results in the last trading year making a profit of KES 668.4M compared to a KES 296.8M loss in 2020.

Outlook: Investors will be looking to see the impact of this year’s election on the insurance business and implications for profit trajectories and stock performance. It is worth noting that some insurers are yet to retrace the highs they recorded during the 2017 election year.

Interest Rate Watch

South Africa: The South Africa Reserve Bank hiked its repurchase rate by 25 basis points to 4.25%.

Tanzania: The Monetary Policy Committee of the Bank of Tanzania kept rates unchanged in its March 24 meeting.

Kenya: The interest rate decision is slated for Tuesday, March 29 when the Monetary Policy Committee meets.

Charts of the Week

Inflation Rates vs Central Bank Rates

Checkmate

What Else Happened This Week?

📱 CBDC’s Tech Challenges: Hardware limitations are in the way of implementing CBDCs in Kenya. According to the CBK Governor, CBDCs require at a minimum, a 4G environment for operation, which is currently a challenge in Kenya given the low [41%] penetration of smartphones [Business Daily].

🦏 SA’s Rhino Bond: In an effort to boost conservation efforts, the World Bank has issued a wildlife conservation bond raising $150M. The funds will go towards the protection of the endangered black rhino populace in South Africa [Reuters].

🇪🇹 Ethiopian Airlines CEO Exits: Tewolde GebreMariam took an early retirement from the continent’s leading airline citing health reasons. Under his stewardship - a role he had for 11 years - the airline tripled its fleet, more than doubled its turnover, and became the largest African Airline [TheAfricaReport].

💰 Bigger Issuances: Kenya will offer a minimum quantum of KES 50B of local currency bonds that are set to mature in less than five years. Longer-dated bonds will have a floor of KES 75B in a World Bank-backed program oriented towards strengthening Kenya's debt market [Bloomberg].

🤝 DRC to Join EAC: DRC is at the tail-end of its admission process to the East African Community - adding to the community a 90M market. Key beneficiaries from this development at the NSE will be banking counters which already have operations there [The EastAfrican].