👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the rising inflation, the Finance Act 2022, and the Q1 2022 economic update.First off, enjoy our weekly business news in memes brought to you by Mtalii Solutions:

Inflation Edges Higher

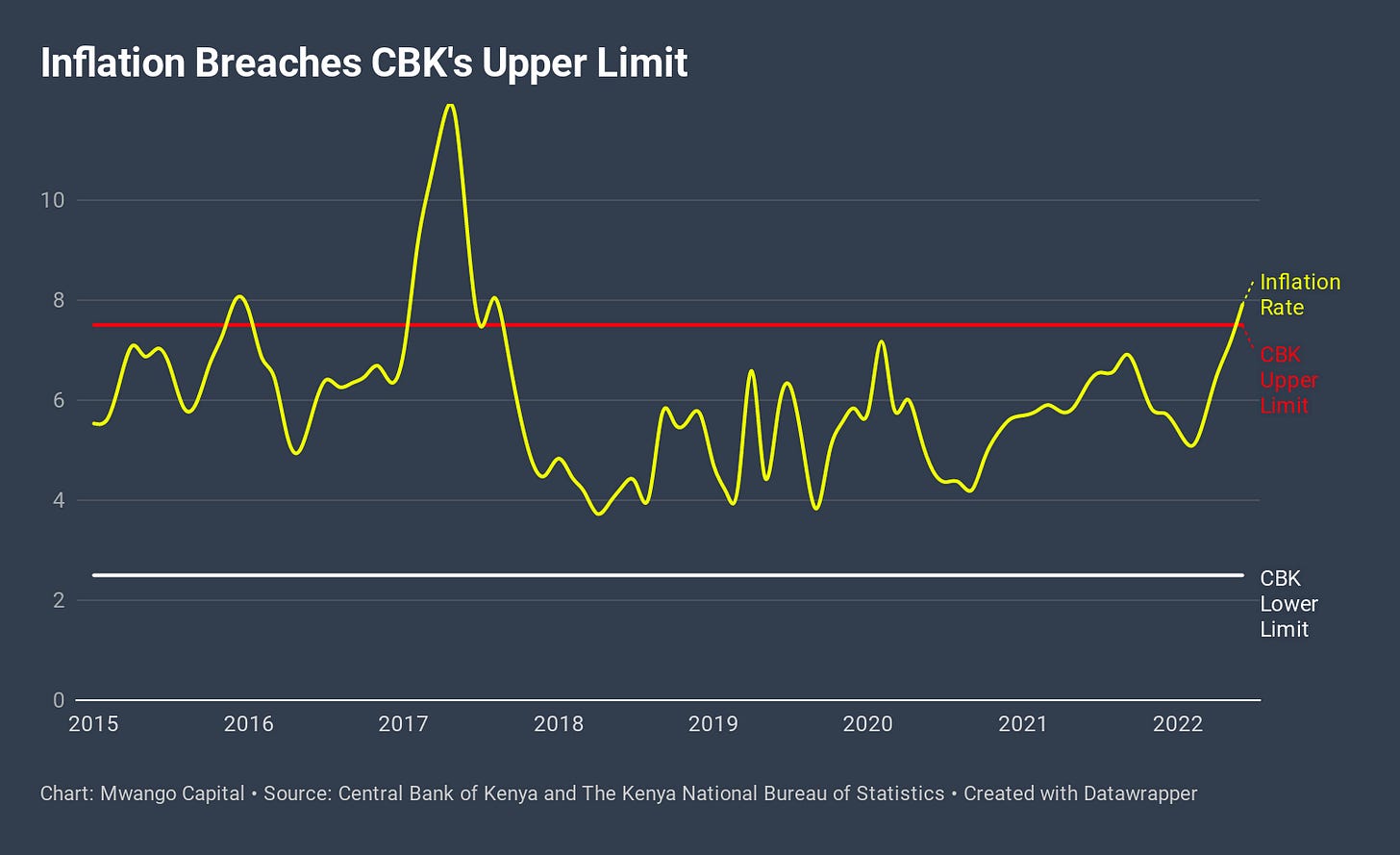

CBK’s Target Breached: Inflation numbers for June 2022 came in at 7.9% from 7.1% in May, a 58-month high, effectively breaching CBK’s upper inflation target of 7.5%. Cooking oil, wheat flour, and kerosene were the products that registered the highest price changes year-over-year. The Food and Non-Alcoholic Beverages Index rose the most over the last 1 year by 13.8%.

Treasury’s U-turn: In light of rising inflation, the National Treasury will not cap the price of basic items in line with the Price Control (Essential Goods) Act 2011. Instituted during the late President Mwai Kibaki’s regime, the Act gives the Finance Minister powers to set maximum prices of gazetted essential commodities upon consultation with the relevant industry.

“Restricting prices is in the old times, we have gone to a competitive economy where we want freedom, we want suppliers to be able to compete so price controls is not something that is encouraged nowadays in the current way of doing business anywhere in the world,” - National Treasury Principal Secretary Julius Muia

Harbinger to Higher CBR?: In the MPC’s last meeting, the key benchmark interest rate was raised by 50 basis points to 7.5% on rising inflation. With inflation currently 40 basis points above the key rate, it is highly likely that the CBK will consider a rate rise in the next MPC meeting.

Across Borders: In Uganda, inflation for June 2022 increased by 50 basis points to 6.8%, the highest it has been since 2017. With the key benchmark rate at 7.5%, there is less pressure on the Bank of Uganda's MPC to hike rates when compared to Kenya's situation.

Q1 2022 Economic Update

Economic Expansion: In the first quarter of the year, the economy grew by 6.8% compared to 2.7% growth in Q1 2021. This is the highest growth in GDP in the first quarter in the last 5 years. Particularly, the Accommodation and Food Serving Activities sector recorded the largest recovery at 56.2% on the back of a receding pandemic.

Macro Snapshot: As of the end of Q1 2022, inflation eased by 34 basis points to stand at 5.56% in March 2022 compared to 5.9% registered in March 2021. However, inflation has picked up to stand at 7.9% as of the end of Q2 2022. Bearing key hallmarks of cost-push inflation, the price gains have been occasioned by rising commodity prices globally resulting from supply chain bottlenecks brought by the Covid-19 pandemic and geopolitical instability.

Finance Act 2022

Here are a few highlights from the finance Act 2022:

Mobile Phone Prices Up: The cost of mobile phones is set to increase following the provision for a 10% excise duty on the importation of cellular phones and a KES 50 excise duty on every imported ready-to-use SIM Card.

Passenger Motor Vehicles: The tax legislation exempted locally manufactured passenger vehicles from VAT and Excise Duty.

Tax Appeals: The proposal in the Finance Bill to have the taxpayer pay at least a 50% deposit of the amount in contention in a special account at the CBK in order to appeal a ruling by the Tax Appeals Tribunal was rejected by Parliament.

Human Vaccines: The manufacture of vaccine shots has been exempted from Income Tax, Withholding Tax, VAT, Import Declaration Fee, and the Railway Development Levy.

Overpaid Tax: The Act has provided for a 2-year window for the refund of overpaid tax to the taxpayer, failure to which there will be a 1% interest each month on the outstanding amount.

Tax Recovery: The Act has empowered the Commissioner-General to dispose of taxpayer assets in a bid to recover the defaulted tax.

Investments: The piece of legislation re-introduces a 150% Investment Deduction in counties outside Nairobi and Mombasa on investments of at least KES 2B.

Capital Gains Tax: The Act has increased the rate from the 5% to 15% with effect Jan 1, 2023.

Digital Lenders: Fees charged by the lenders will be subject to an excise duty of 20%.

LPG: VAT on Liquid Petroleum Gas was slashed from 16% to 8%.

You can find a copy of the Finance Act here.

Debt Markets

CBK Seeks KES 60B: The apex bank is in the markets to raise a cumulative KES 60B through the reopened 15-year fixed-coupon treasury bonds and a tap sale on an infrastructure bond. The CBK is targeting KES 40B through the reopened instruments and KES 20B from the tap sale.

KES 147B Financing Miss: With the closure of the 2021/22 fiscal year, the National Treasury has missed out on KES 147B funding that was slated for the just-closed financial year. The Treasury was to raise the funds from a KES 117B syndicated loan and a KES 28B IMF credit line.

T-Bills: In the auction held on the last day of the 2021/22 fiscal year, yields for 91-day, 182-day, and 364-day instruments came in at 8.097%, 9.196%, and 9.985%. These yields are higher compared to the previous auction.

Ghana Cuts Loans: Due to rising borrowing costs, the West African nation of 31M people has slashed its borrowing from international lenders by $500M to $250M at an average interest rate of 8.4%. Ghana will also tap the IMF for financing.

Finance Roundup

Equity Mulls Share Splits: In its AGM held earlier this week, Equity Group said that it was eyeing the issuance of bonus shares and stock splits in place of foregone dividends and retained earnings. Investors are in doubt whether bonus shares and stock splits are essential at the moment as opposed to dividend payments. The stock closed at KES 43.00 last week, up 10.3% on a week-on-week basis.

“Whenever we retain significant amounts, that is capitalized and given to shareholders in the form of shares and that’s why a share in 2000 is now equal to 600 shares. That increase is a result of splits and bonuses which is the capitalization of retained earnings and foregone dividends. With the market providing the right price, the board would consider a bonus issue like it has in the past.” - Equity Group Managing Director James Mwangi

Weakening Shilling Raises Finance Costs: Listed firms that carry heavy exposure to currency rate risk occasioned by their significant dollar borrowings from external lenders and Development Finance Institutions are facing higher finance costs as a result of the weakening shilling against the greenback.

CMA Launches Investigations: The capital markets regulator is investigating Kakuzi over alleged profit shifting and corporate governance issues perpetrated by its majority shareholder Camellia plc. Elsewhere, the regulator is also looking into Limuru Tea regarding the undervaluation of its 696.8-acre plantation and manipulation of books of account.

Financial Results:

Kapchorua Tea: FY 2022 turnover was up 2.1% to KES 1.4B, bringing profit before tax to KES 303M compared to KES 34M in FY 2021. Net income was up 30-fold to KES 214M. At the Nairobi bourse, the stock is up 24.8% over the last 1 year and up 13.4% YTD. Find the results here.

Williamson Tea: While revenue came in 6.1% lower to KES 3.5B, the firm made a KES 540M net income for FY 2022 compared to a KES 132.4M loss in 2021. The firm will pay a dividend of KES 20 per share - a payout ratio of 67.2%. Find the results here.

NSSF FY 2020: Find our analysis of NSSF's 2020 financials here.

What Else Happened This Week

MTRs Ruling: The Communications and Multimedia Appeals Tribunal is expected to deliver a ruling on Mobile Termination Rates on August 5 following the move by the Communications Authority to reduce MTRs from KES 0.99 to KES 0.12 earlier this year.

Kune Food: In an update on the closure of the startup, Kune Founder Robin Reecht has cited deteriorating unit economics and lack of funding as reasons for shutting down. Rising inflation and a funding round that achieved 16% of the target amount heavily impacted cash flows rendering operations unsustainable.

New Reigns at MTN Uganda: The Ugandan telco has appointed Safaricom’s Chief Consumer Business Officer Sylvia Mulinge to head its operations effective October 2022. Elsewhere, Airtel Networks Kenya Limited has appointed Mr. Louis Otieno and Mr. Ashish Malhotra as the new Chairman and CEO respectively.

TRA Collections Rise: In the 2021/22 financial year that ended June 30, the Tanzania Revenue Authority collected TZS 22.28T (KES 1.3T) in taxes. The amount is 99.22% of targeted collections and an increase of 22.8% year-over-year.

Angola’s Oil Gains: A surge in crude oil prices occasioned by the Ukraine invasion is helping Angola, the second-largest oil producer in Sub-Saharan Africa, pay off debts to Chinese lenders. Angola's total external debt stood at $50.1B as of December 2021 with $13.5B owed to the Chinese Development Bank. Brent Crude is up 48% YTD and Angola’s oil earnings were up 50% in May 2022 to $2.1B.

Interest Rates Watch

🇿🇼 Zimbabwe: The Monetary Policy Committee of the Reserve Bank of Zimbabwe this week more than doubled its key benchmark rate from 80% to 200% as inflation jumped 30.7% Month-on-Month to 191.6% on the depreciation of the Zimbabwe dollar.

🇰🇪 Kenya: Inflation in East Africa’s largest economy breached the Central Bank’s upper target of 7.5% to reach 7.9% in June 2022. In its next meeting, the MPC is highly likely to consider a rate hike in a bid to tame inflation.

Charts of the Week

In our NSE H1 2022 performance analysis, Sameer Africa recorded the highest price increase while Nairobi Business Ventures had the largest decline.