👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya's energy sector FY 2023/24 earnings, Tanzanian banks Q3 2024 results and IMF’s 7th & 8th review of Kenya’s USD 3.6B programme.Kenya Power’s Record Profit and KenGen’s Doubled Dividends

Record Profit: Kenya Power reported a record profit of KES 30.08B for the year ending June 2024, a major turnaround from the KES 3.19B loss in the prior year. The company’s profit was largely boosted by a 21% appreciation of the Kenyan shilling, which reduced its foreign-denominated debt obligations, resulting in KES 7.88B in unrealized foreign exchange gains from KES 5.32B in forex losses last year. Revenue also surged 21% to KES 231.12B driven by increased consumption from commercial and industrial customers and boosted by tariff increases in April 2023. Kenya Power added 427,251 new connections in the financial year and expanded its customer base to 9.7 million.

First Dividend in Six Years. Kenya Power has proposed to pay a dividend of KES 0.70 per share payable in January 2025, totaling KES 1.3B — its first payout since 2017. Meanwhile, the return to profitability has enabled the company to end a moratorium on KES 25B in loans, clearing KES 3.3B between July and September 2024. Kenya Power plans to settle approximately KES 12B by the end of the 2025 financial year. A stronger shilling has played a key role in reducing its debt burden, with the exchange rate strengthening from 140.45 to 128.4 units per dollar over the past year, resulting in significant foreign exchange gains given that 90% of the utility’s debt is in foreign currency.

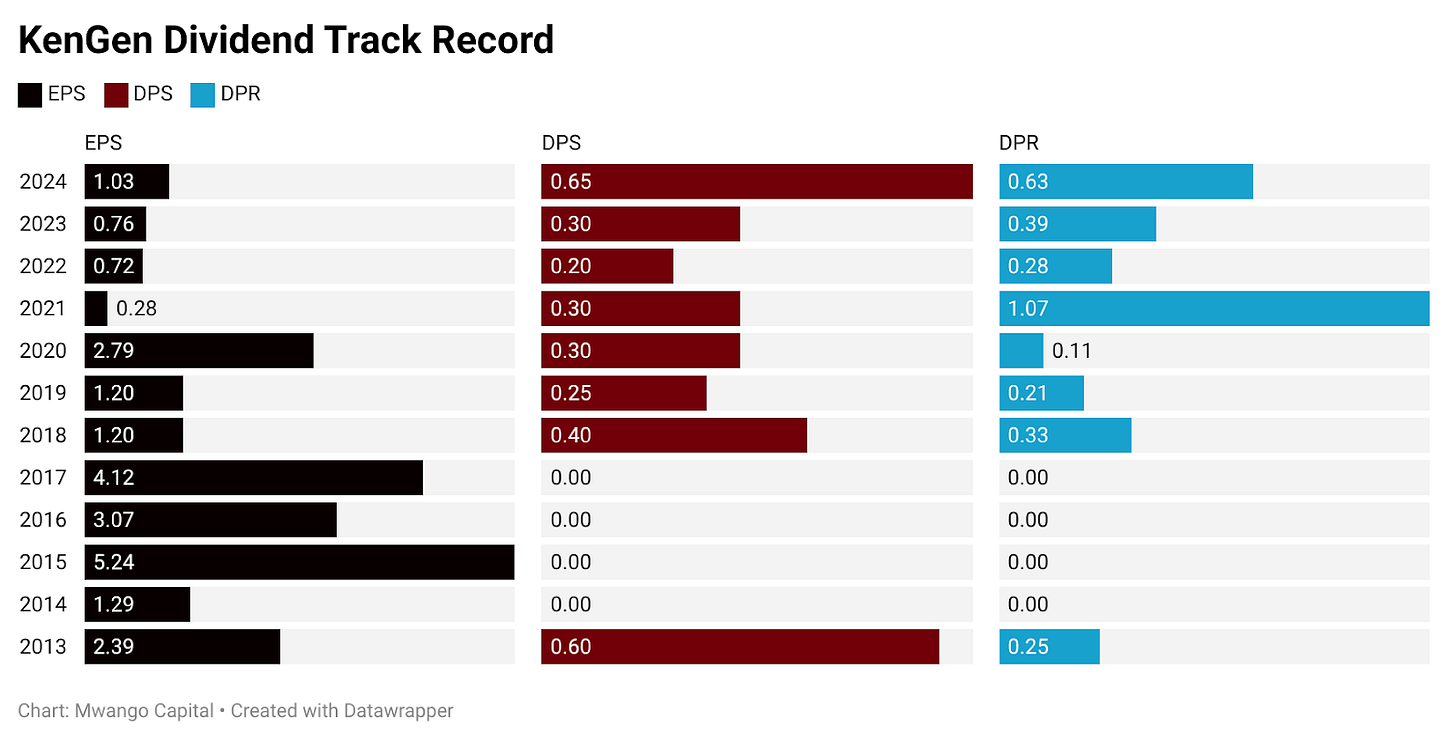

KenGen Doubles Dividend: KenGen reported a 35.5% increase in net profit to KES 6.8B for the year ending June 2024 supported by higher electricity demand and increased generation from its geothermal and hydro plants. Revenue rose by 4% to KES 56.3B driven by a 4% increase in electricity dispatched to 8,384 GWh. Despite adverse weather and the decommissioning of 133.5 MW from thermal plants, KenGen doubled its dividend payout to KES 0.65 [2023: KES 0.30] per share with a total shareholder payout of KES 4.3B [2023: KES 1.98B].

Share Price Reaction: Both energy counters saw rallies during the week with KPLC hitting KES 5.24 while KenGen hit 4.13 but closing lower at KES 4.56 and KES 3.82 respectively.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence.

Learn more: KMRC website.

IMF Disbursement to Kenya

Approved: Last week, the IMF approved a $606M disbursement to Kenya, split between $485.8M under the EFF/ECF for fiscal reforms and $120.3M from the RSF, to boost climate resilience. The funding, arriving after a challenging year of fiscal pressures and a 15% revenue shortfall in FY 2023/24, signals IMF support for Kenya’s stabilization efforts. The IMF also granted waivers for Kenya’s missed tax and budget targets, backed by corrective actions in the Supplementary FY2024/25 Budget. The IMF also appreciated Kenya's recent improvements in foreign reserves and a stable shilling, reflecting strengthened economic resilience.

On a side note, the National Treasury will hold public hearings on the proposed FY 2025/26 and Medium-Term Budget from November 20th to 22nd, 2024, at the KICC.

“Today, the IMF has released KES 78 billion, but if the Kenya Revenue Authority (KRA) puts systems in place, we can collect not less than KES 400 billion. That means we can do without some of these loans”

National Treasury CS, John Mbadi

“Firstly, we anticipate that the disbursement will further strengthen forex reserves, which will help stabilize the shilling within current resistance levels for an extended period. Additionally, this inflow is expected to elevate the actual external borrowing, which has notably lagged behind prorated targets since the fiscal year began, shifting much of the financing burden to the domestic market. Consequently, this support should ease pressure on the fiscal agent and potentially drive domestic interest rates lower, as domestic debt costs have remained persistently high. Meanwhile, the rebalancing of pending disbursements and including disbursements in this review into the zero-interest ECF will help marginally reduce future debt repayment obligations. Looking ahead, with around KES 102bn in pending disbursements—a comparatively modest amount relative to financing needs—the government may pivot toward commercial debt, a move likely to increase the debt servicing burden”

SIB Analyst, Stellar Swakei

IMF Staff Report: In conjunction with the approval, the IMF issued a detailed staff report. Here are a few things you need to note from the report:

Compensation to Gulf Oil Companies: Kenya may need to compensate Gulf oil companies for not meeting minimum fuel import volumes as per the government-to-government (G2G) agreement. This shortfall is due to decreased domestic fuel demand and Uganda’s decision to directly import fuel, bypassing Kenyan routes.

PPP Initiatives: The Kenyan government has planned 37 Public-Private Partnership projects, valued at KES 1.6 trillion, across transportation, water & sanitation, and healthcare sectors. These are set for execution over the coming years in FY 2024/25.

Pending Bills Resolution: Outstanding bills totaling KES 572 billion are projected to be cleared over five years starting in FY 2025/26.

Tax Amendments for Revenue Generation: Following the withdrawal of the Finance Bill 2024, the proposed Tax Laws (Amendment) Bill 2024 and Tax Procedures (Amendment) Bill 2024 aim to increase revenues by 0.9% of GDP. Below are some of the key highlights of the proposed Tax Laws (Amendment) Bill 2024:

Allowable deductions: Contributions made to the Social Health Insurance Fund (SHIF) and Affordable Housing Levy are proposed to be deductible. Deductible contributions to registered pension funds are also proposed to be increased to KES 360,000 per annum from KES 240,000 per annum.

Insurance relief: The Bill proposes harmonization of Section 31 of the Income Tax Act with the Social Health Insurance Act in respect of insurance relief.

Digital marketplace: The Bill proposes expansion of the definition of digital marketplace to include ride-hailing services, food delivery services, freelance services, and professional services.

Railway Development Levy: The Bill proposes an increase of Railway Development Levy to 2.5% from 1.5%.

Supplementary Budget II & Finance Bill 2025: Supplementary Budget II is coming by the end of January 2025. The Finance Bill 2025 will focus on adopting a comprehensive reform plan on VAT, Personal income tax (PIT), and corporate income taxes (CIT)

Extension of Tax Amnesty Program: The FY 2023/24 tax amnesty program, which raised KES 50.5 billion, is proposed to be extended until the end of June 2025, potentially contributing an additional 0.2% of GDP.

State-Owned Enterprises (SOE) Review: The government conducted financial evaluations of 70 SOEs based on their FY 2022/23 accounts, recommending specific actions. The Treasury has submitted a policy paper to the Cabinet suggesting the consolidation, dissolution/privatization, or reintegration of certain SOEs into line ministries.

Tanzanian Banks Q3 2024 Results

The Top Two Banks:

CRDB: Total assets increased by 7.2% to TZS 16.0T, with loans, advances, and overdrafts rising 6.3% to TZS 10.1T. Customer deposits grew by 2.6% to TZS 10.1T, showing a steady expansion in the institution’s asset base and loan portfolio. Net interest income rose 32.1% to TZS 805.4B, while non-performing loans (NPLs) dropped by 12.3% to TZS 270.4B. Profit after tax (PAT) increased by 45.8% to TZS 408.9B, driven by higher income and improved credit quality.

NMB: Total assets grew by 3.3% to TZS 13.4T, while loans, advances, and overdrafts rose 3% to TZS 8.3T. Customer deposits increased by 1.4% to TZS 9T, and borrowings climbed 6.3% to TZS 1.5T, reflecting moderate growth across key asset and liability categories. Net interest income rose 10.7% to TZS 265B. However, non-performing loans (NPLs) increased by 11.2% to TZS 260.5B. Profit after tax (PAT) saw a significant boost of 51%, reaching TZS 476B, driven by higher income despite rising NPLs.

Other Banks with Kenyan Parents:

I&M Bank Tanzania: Total assets rose 3% to TZS 782.2B, customer deposits increased 4.8% to TZS 621.1B, and net interest income surged 48.8% to TZS 44.8B. Profit after tax jumped 175.8% to TZS 9.0B.

NCBA Bank Tanzania: Total assets increased by 5% to TZS 617.8B, while customer deposits rose by 2.6% to TZS 285.4B. Net interest income grew by 8% to TZS 30.8B, but profit after tax fell 42.8% to TZS 9.4B. Loans, advances, and overdrafts decreased by 2.2% to TZS 321.0B.

DTB Bank Tanzania: Total assets grew by 1% to TZS 1.9T, while loans, advances, and overdrafts increased by 1.5% to TZS 1.0T. Customer deposits dropped by 2.4% to TZS 1.5T. Net interest income rose sharply by 26.7% to TZS 86.0B, and non-performing loans (NPLs) declined by 10% to TZS 76.3B. Profit after tax surged by 331.7% to TZS 40.7B.

Equity Bank Tanzania: Total assets decreased by 3.7% to TZS 1T, with loans, advances, and overdrafts down 3.8% to TZS 516.0B. Customer deposits fell by 3.6% to TZS 733.8B. Net interest income increased by 21.4% to TZS 42.2B, while non-performing loans (NPLs) rose by 2% to TZS 63.5B. Profit after tax grew by 15.8% to TZS 15.1B.

KCB Bank Tanzania: The loan book increased by 2.3% to TZS 995B, while government securities rose 7.4% to TZS 202B. Customer deposits grew 3.8% to TZS 1T. Net interest income climbed 15% to TZS 23B, and non-interest income increased 2% to TZS 9B. PAT surged 50% to TZS 39B.

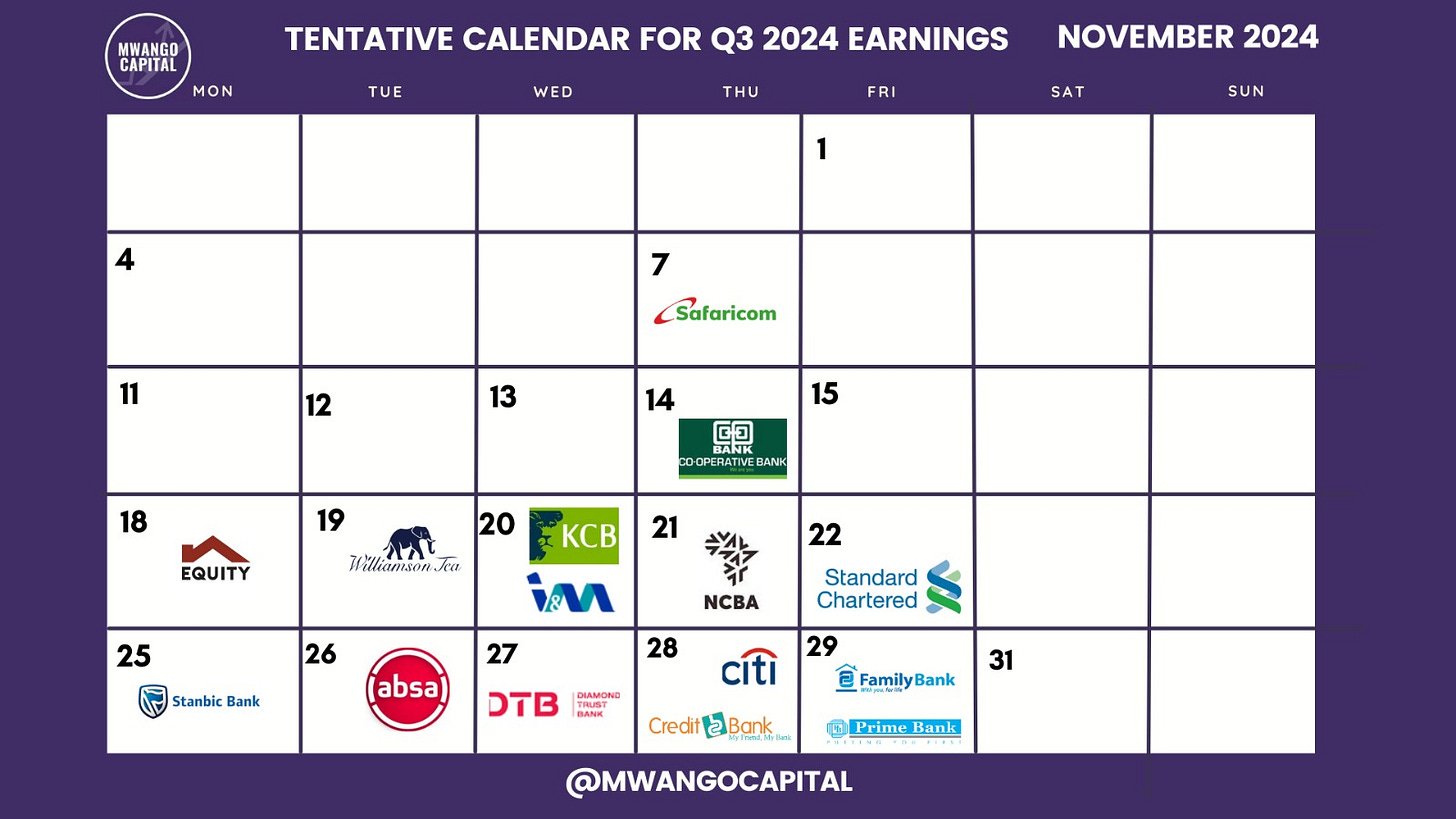

Q3 2024 Results: November 2024 will see Kenyan banks report their Q3 2024 results.

Markets Wrap

NSE This Week: In Week 43 of 2024, Bamburi led the week’s top gainers rising 17.4% to close at KES 69.00, while EA Portland was the worst performer, dropping 18.5% closing at KES 22.00. The NSE 20 went down by 0.4% to 1,853.8 points, the NSE 25 declined by 0.3% to 3,131.7 points, and the NASI index advanced by 0.8% to 115.5 points, while the NSE 10 dropped by 0.8% to 1,215.0 points. Equity turnover increased by 45.9% to KES 1.17B, while bond turnover went down to KES 19.24B from KES 34.44B the previous week.

In October 2024, Kenya Orchards was the top-performing stock, appreciating by 205.01% to KES 70.00, followed by Liberty Kenya, which gained 39.93% to KES 7.50. Sameer Africa lost 15.83% of its value in the month to close at KES 2.18, becoming the top losing stock in the month.

Year To Date, E.A. Portland Cement appreciated by 298.75%, becoming the top performer, followed by Kenya Orchards at 258.97%. Nation Media Group was the worst performer in the period under review, declining by 29.68% to KES 14.10.

Treasury Bills and Bonds: Treasury Bills were oversubscribed for the fifth consecutive week, with an overall subscription rate of 259.03%, down from 357.33% the previous week. Investors placed bids worth KES 62.2B, out of which KES 28.1B was accepted, resulting in an acceptance rate of 45.17%, slightly lower than the previous week’s 48.7%. Yields on the three Treasury Bill tenors saw a decline, dropping by 46.6 basis points, 62.3 basis points, and 50.1 basis points, closing at 13.966% for the 91-day, 14.523% for the 182-day, and 14.968% for the 364-day bills.

Reopenings: The Central Bank of Kenya is seeking to raise KES 45B through the issuance of reopened 10 and 15-year Treasury bonds, FXD1/2023/10 (8.3 years), FXD1/2022/15 (12.5 years), and FXD1/2024/10 (9.4 years). The period of sale for the FXD1/2023/10 and FXD1/2022/15 bonds is from October 25, 2024, to November 6, 2024, while the sale period for the FXD1/2024/10 bond runs from October 25th, 2024, to November 13th, 2024.

Eurobonds: During the week, yields rose across five outstanding bonds, with KENINT 2028 experiencing the largest increase, up 8.40 basis points to 8.94%. KENINT 2048 followed, rising 4.10 basis points to 10.202%. KENINT 2023 was the only bond to decline, falling by 4.70 basis points to 9.67%. Overall, the average week-on-week change in yields was 2.65 basis points.

Market Gleanings

📉| October Inflation | Kenya’s inflation rate dropped to a record low, driven by easing costs in fuel, food, and utilities, with the consumer price index rising just 2.7% in October compared to 3.6% in September. This marks the slowest pace since March 2010, as key categories — food and non-alcoholic beverages, transport, and housing — registered softer price increases, together comprising 57% of the inflation basket.

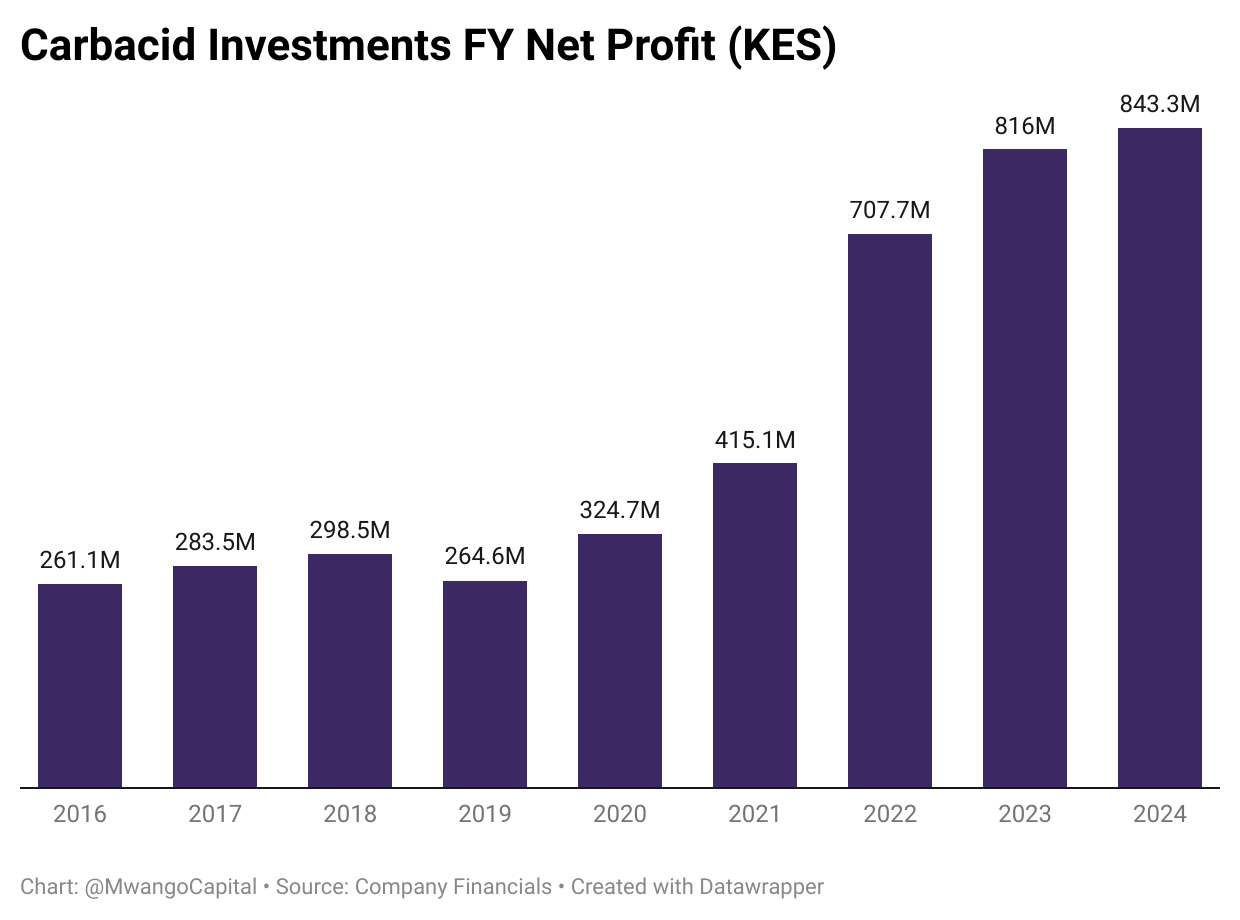

📄| Carbacid FY 23/24 Results | Carbacid Investments reported a 20% increase in turnover to KES 2.07B for the year ended 31st July 2024 driven by strong regional demand for CO₂ and entry into new markets. Operating profit rose by 20.5% to KES 1.22 billion, supported by effective cost management despite supply chain challenges. Net profit after tax increased by a more modest 3.3% to KES 843 million, with earnings per share improving by 3.4% to KES 3.31. The smaller growth in net profit compared to operating profit is attributed to a 162.3% rise in finance costs, which increased to KES 43.1 million from KES 16.4 million due to new borrowings for growth initiatives. The board recommended a final dividend of KES 1.70 per share, totaling KES 433.2 million, consistent with the previous year’s payout.

✅| CAK Approves NBK Acquisition | The Competition Authority of Kenya has conditionally approved Access Bank Plc's acquisition of the National Bank of Kenya (NBK), with requirements to retain at least 80% of NBK’s 1,384 employees and all 316 staff members of Access Bank Kenya for one year following the merger. The transaction includes NBK’s subsidiary, NBK Bancassurance Intermediary Limited, and will elevate Access Bank Kenya from Tier 3 to Tier 2 in market classification, bringing their combined market share to 1.9%. The merged entity's total assets remain significantly smaller than Tier 1 banks.

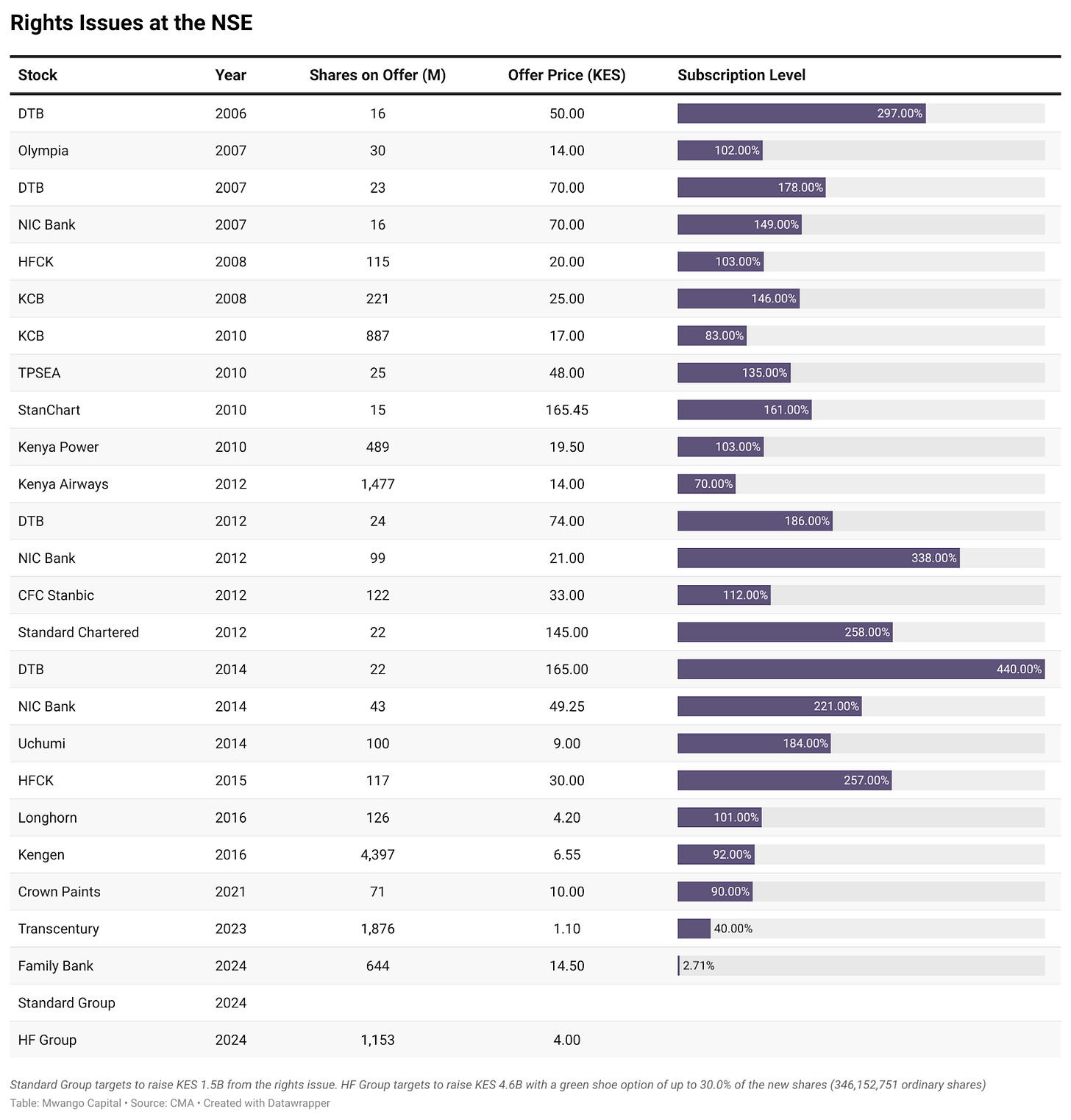

💸| HF Group Rights Issue | The book closure date for the rights issue has been revised to 3 pm on 4th November 2024 from 3 pm on 1st November 2024. Subsequently, the offer will now open at 9 am on 13th November 2024 and close at 5 pm on 9th December 2024. HF is in the market for a 2:1 rights issue seeking to raise KES 4.6B at an offer price of KES 4.00 per share, to be utilized towards implementing the Group’s growth strategy and strengthening HFC’s capital base.

⚖️| Supreme Court Upholds Finance Act 2023 | The Kenyan government scored a major win last week as the Supreme Court overruled the Court of Appeal’s finding that declared the entire Finance Act, 2023 unconstitutional. Instead, it upheld the Act with specific modifications. The Supreme Court found that the issue surrounding the Affordable Housing Levy (Section 84) was moot due to the enactment of the Affordable Housing Act, 2024. The Court affirmed that certain sections of the Act, which included amendments to the Kenya Roads Act and Unclaimed Financial Assets Act, were unconstitutional due to the lack of public participation and for being unrelated to a money bill.

🇪🇹| Ethiopia’s Ambitious Revenue Target | Ethiopia has increased its revenue target to USD 12.5B for the 2024-25 fiscal year, seeking to collect 1.5T birr as part of its International Monetary Fund (IMF) USD 3.4B bailout program. To achieve this goal, the government is introducing new taxes, including value-added tax on banking services, property taxes, and an excise tax on telecommunications. While authorities reported a 65% increase in revenue during the first quarter, overall collection remains low compared to the ambitious target.

💸| Absa Secures USD 150M Facility | Absa Group Ltd. has secured a USD 150M trade financing facility from the UK's British International Investment Plc to support small and medium-sized businesses across Africa. This funding aims to address the estimated USD 100B to USD 120B trade financing gap in the region, particularly benefiting sectors such as agriculture and healthcare. Absa's head of fixed-income trade sales emphasized that this partnership will enhance liquidity and support trade volumes in countries like Nigeria and Kenya.

💼| Key Appointments |

Diamond Trust Bank Kenya has appointed Murali Natarajan as its new Managing Director and CEO. He brings over 15 years of experience from his previous role as MD at DCB Bank, where he served until April this year. Both DCB Bank and DTB Group are affiliated with the Aga Khan Fund for Economic Development (AKFED), with AKFED holding a 15% stake in DCB and a direct 16.5% stake in DTB.

Effective November 1, 2024, Nation Media Group has announced the appointment of Joe Muganda as an Independent Non-Executive Director. Mr. Muganda previously served as CEO of VIVO Energy Kenya, Kenya Breweries Limited, and British American Tobacco. He also held the position of Group CEO at Nation Media Group between 2015 and 2018.