👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the conclusion of Kenya’s banking sector Q3 2023 results, Kenya’s privatisation drive, and half-year results from Centum and Eaagads.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Ready for your Coastal escape? Swipe your Co-op Visa card at Sun and Sand and enjoy a 10% discount on your stay.

Kenya’s Banking Sector Q3 2023 Results

Diamond Trust Bank Kenya, HF Group, and BK Group reported during the week, concluding Kenya’s banking sector Q3 2023 reporting season.

DTB Group was the last major Kenyan listed bank to report earnings, and here is a rundown of the results.

Asset Allocation: The group’s KES 457.7B (+27.3% y/y) worth of customer deposits were utilised in growing the lender’s loan book by 18.7% y/y to KES 289.1B. In contrast, the group’s holdings of government securities were cut by 4.2% y/y to close the period at KES 129.4B.

Revenue Mix: Non-interest income propelled by 32.3% y/y and 39.1% y/y growth respectively of other fees and FX trading incomes grew faster by 33.9% compared to net interest income which grew by 19.6%, as interest income growth of 33.0% y/y was weighed down by 51.5% y/y growth of interest expenses. The group’s operating income closed the period at KES 29.3B (+23.7% y/y).

Profitability: The group’s profit before tax slowed down to KES 8.7B compared to KES 8.9B the prior year, owing to increased operating expenses in the period, as the lender doubled its loan loss provisions to KES 6.0B compared to KES 4.0B the prior year. Profit after tax closed the period at KES 6.6B up by 5.0% compared to KES 6.3B the prior year.

Across banking sector news:

India Exim Bank Enters East Africa: Last week, Kenya’s Cabinet approved the request by the Export and Import Bank of India (Exim) to locate its East Africa Representative Office in the capital, Nairobi. Legal procedures are set to follow given the approval on course to the commencement of operations.

Equity Acquires Cogebanque: Equity Group announced the completion of the acquisition of 91.93% of the issued shares in the capital of Cogebanque PLC in Rwanda. The Group plans to integrate the acquisition with Equity Bank Rwanda Limited (EBRL), and the resulting entity is set to be bigger than KCB Group’s BPR, but less than half in size of market leader Bank of Kigali in terms of asset size. In Q3 2023, EBRL returned KES 2.8B in net profit, up 46% year-on-year.

We prepared a summary thread of the key highlights of Kenya’s banking sector Q3 2023 results. Find it here.

Kenya’s Privatization Drive

11 Earmarked for Sale: Following the assent of the Privatization Bill 2023, Kenya’s National Treasury this week listed 11 state-owned enterprises (SOEs) set for divestiture. The SOEs include Kenya Pipeline Company, Kenya Literature Bureau, and Kenya International Convention Centre (KICC). The public has up to 11th December 2023 to submit comments on the proposed privatisation programme.

Speaking at the NSE Market Place launch last year, President William Ruto promised six to ten listings at Kenya’s exchange via privatisation.

“As we prepare between six and ten companies for listing in the stock exchange in the next twelve months, I promise you we will deliver on that commitment. I also want to encourage the private sector as we bring ten companies please bring five.”

Half-Year Results Wrap

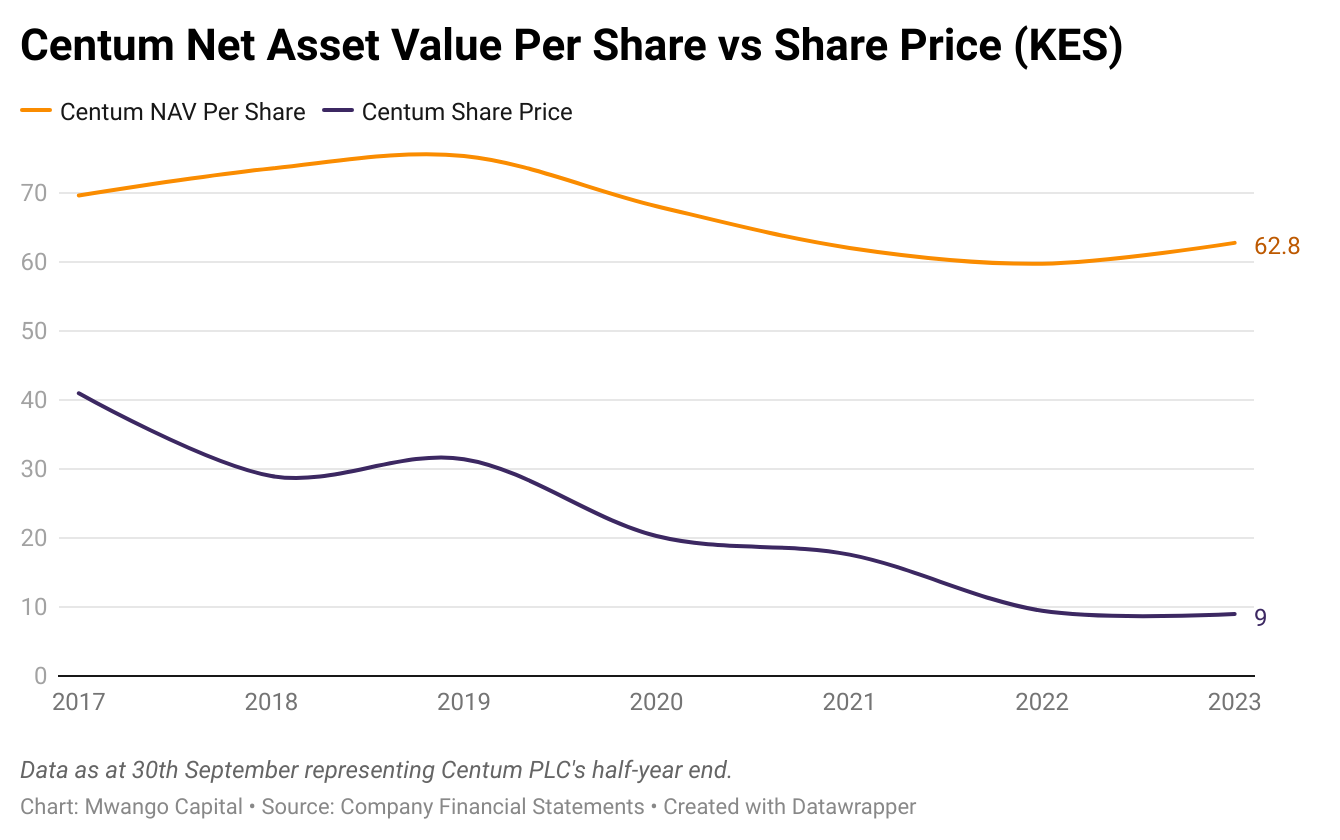

Centum Narrows Half-Year Loss: The investment firm’s group net loss closed the period ended 30th September 2023 at KES 426.4M compared to KES 1,3B the prior year, as Two Rivers Development and the Real Estate business units recorded improved performances. The company’s 18-month share buyback program garnered a total of 6M share purchases as at November 2023 against 66.5M targeted translating to an 8.98% performance rate.

Eaagad’s Revenue Drops by 99%: The agricultural firm cited ongoing government-initiated coffee reforms as having negatively impacted the firm’s ability to do direct coffee sales resulting in a 99% drop in the firm's top line.

Markets Wrap

NSE: In Week 48 of 2023, Olympia was the top-performing stock, up 17.0% to close at KES 3.10. Flame Tree was the worst-performing stock, down 14.5% to close at KES 1.00. The NSE 20 index fell by 1.0% to close at 1,494.5 points, the NSE 25 edged lower by 0.8% to close at 2,397.1 points, and the NASI index was flat at 92.3 points. Equity turnover jumped by 90.0% to KES 987.17M from KES 519.52M in the prior week while bond turnover closed the week at KES 9.7T compared to the prior week’s KES 13.9T.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.53%, 15.50%, and 15.73% respectively. The total amount on offer was KES 24B with the CBK accepting KES 22.8B of the KES 24.1B bids received, to bring the aggregate performance rate to 100.26%. The 91-day and 364-day instruments recorded 484.97% and 19.66% performance rates, respectively.

Eurobonds: In the week, yields were mixed across the 6 outstanding papers.

KENINT 2024 rose the most week-on-week, up by 47.80 bps to 13.281% while KENINT 2028 fell the most, depreciating by 52.80 basis points to 11.053%. The average week-on-week change stood at -32.05 bps.

KENINT 2028 rose the most on a year-to-date (YTD) basis, appreciating by 74.10 bps while KENINT 2048 rose the least at 24.60 bps.

Prices were mixed week-on-week, with KENINT 2048 rising the most at 2.1% to 76.368. KENINT 2024 was the only depreciating eurobond at 0.1% to 96.880. Year-to-date, KENINT 2024 rose the most, appreciating by 4.5%. The largest price losses YTD were 2.8% for KENINT 2034 to 73.352. The average price change week-on-week and YTD was -0.15% and 1.47%, respectively.

Market Gleanings

📉 | Inflation Down Slightly | In November 2023, Kenya’s inflation rate was 6.8%, down by 10 basis points from October 2022 - the fifth consecutive month inflation has stayed within CBK’s target range of 5 +/-2.5pp. Across indices, the transport index recorded the highest change year-on-year at 13.6%, followed by Housing, Water, Electricity, Gas and Other Fuels at 8.5%. Commodity-wise, 1 kg of onion leeks and bulbs grew the highest year-on-year at 53.8%, followed by 50KWh of electricity at 45.9%, and 1 kg of tomatoes at 40.4%.

🤝 | Bamburi’s Disposal of Hima Shares | Bamburi Cement issued a shareholder circular giving notice of a virtual Extraordinary General Meeting (EGM) on 14th December 2023 at 10:00 AM to deliberate on the proposed sale of Bamburi’s 70% shareholding of shares in Hima Cement Limited in Uganda to Rwimi Holdings Limited, a subsidiary of Sarrai Group. You can access the circular here.

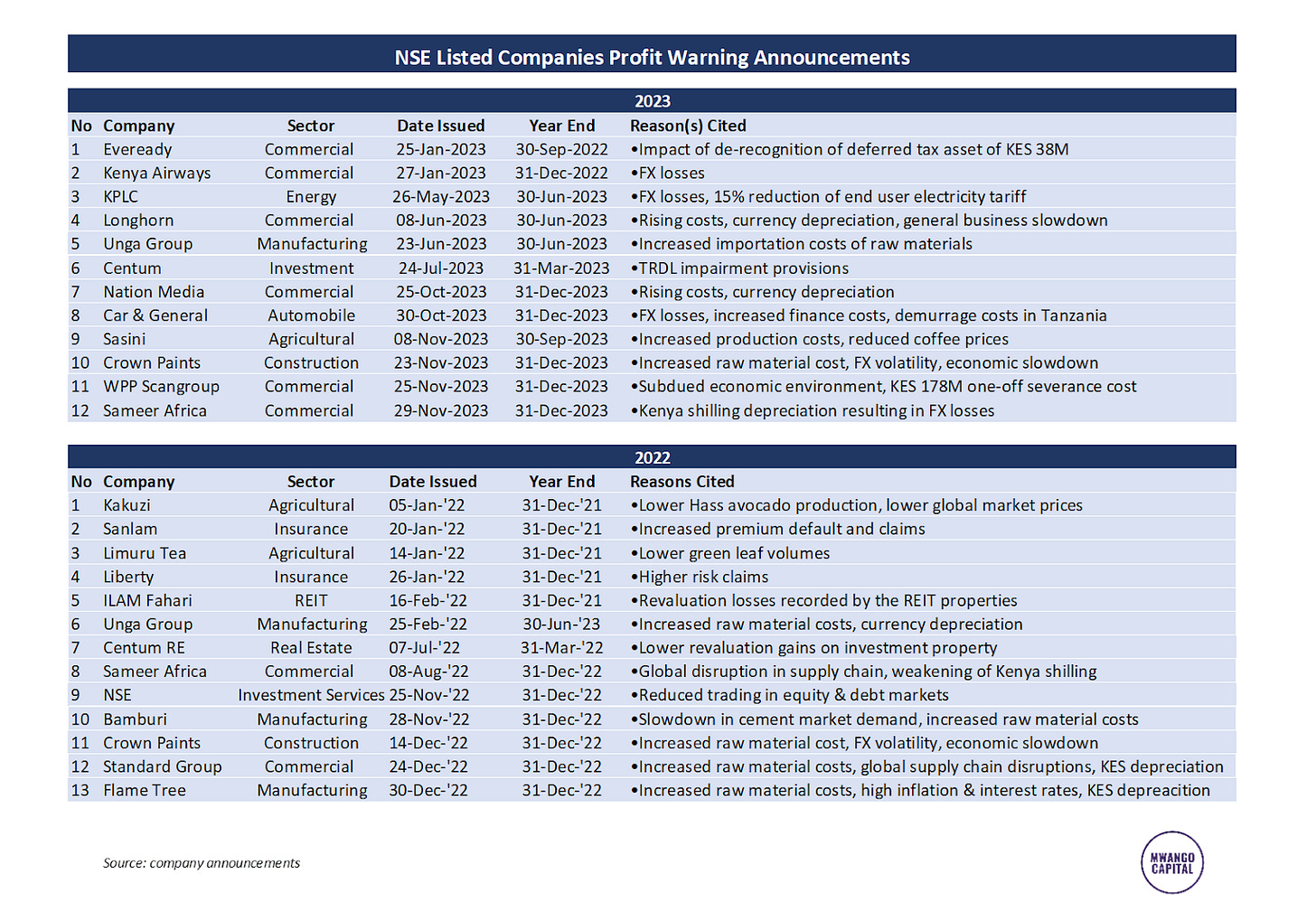

⚠️ | Sameer Issues Profit Warning | Sameer Africa last week issued a profit warning on the expectation that projected net earnings for the period to 31st December 2023 will be 25% lower than those recorded in 2022. The firm has cited FX losses in its warning and it becomes the 12th firm to issue a profit warning in 2023.

“The decline in forecasted earnings is attributable to the continued depreciation of the Kenya shilling against major currencies. This has seen the company incur substantial foreign exchange losses for the period arising from the translation of foreign-currency-denominated liabilities.”

🧾 | ILAM Fahari I-REIT Delisting | ILAM Fahari I-REIT unitholders, during its EGM held on 24th November 2024, approved all resolutions put forward by the board, including the proposed operational restructuring and delisting of the REIT from the main investment market segment of the Nairobi Securities Exchange (NSE).

⚖️ | Finance Act 2023 Update | The 3-judge bench constituted by Chief Justice Martha Koome delivered its verdict on the Finance Act 2023 in the week. The bench ruled the housing levy unconstitutional but issued a stay on its orders up to 10th January 2024.

🛫 | KQ to Resume Mogadishu Flights | Kenya Airways is set to resume direct flights from Nairobi to Mogadishu, Somalia’s capital, effective 14th February 2024. The resumption of service will see the carrier operate 3 weekly flights in February 2024 as part of a phased resumption process.

🛑 | Constrained Global Markets Access | According to the cabinet secretary for the National Treasury Prof. Njuguna Ndung’u, Kenya will not raise capital in the international markets in the 2023/2024 financial year on account of the high cost of dollar debt.

“The soaring yields make the floating of a sovereign bond expensive, and, therefore, unfeasible. Kenya will access commercial funding when global market conditions improve.”

Cabinet Secretary for the National Treasury, Prof. Njuguna Ndung’u

💼 | Browns Acquires Finlay Kenya | After reaching an agreement in May 2023, Browns Investments announced the completion of the acquisition of Kenyan tea estates business James Finlay Kenya from Finlays. The transaction includes all parts of James Finlay Kenya Limited except for Saosa tea extraction plant which will remain under Finlays and be known as ‘Finlays Extracts, Kenya.’