👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the National Treasury looking to issue a sovereign bond, Jubilee Insurance’s FY 2022 results, and the capital markets this week.First off, enjoy a dose of our weekly business news in memes:

https://twitter.com/MwangoCapital/status/1650113144709062656?s=20

EuroBond Loading

Kenya Needs Money: Kenya is set to issue a new Eurobond before the end of the fiscal year 2023/24 (1st July 2023 to 30th June 2024) to refinance the $2B Eurobond maturing next year that was issued in 2014. As a result, the country has issued a Request for Expression of Interest from financial institutions to provide "comprehensive Lead Manager services to successfully accompany Kenya’s return to international capital markets".

At the same time, the National Treasury is holding public consultations on the amendment of the public debt limit from a fixed limit to a percentage of GDP. The key roles of the lead manager include:

Yields Spike: Last week, the 2024 Eurobond yields were sharply up around 400+ basis points to 18% from 13% the previous week perhaps spooked by the fact that Kenya is raising a Eurobond soon. The country’s Eurobonds were down 4% in April.

No Appetite for Local Bonds: The CBK re-opened 2 bonds last week (FXD1/2022/3 and FXD1/2019/15). Due to a market preference for shorter-dated instruments and aggressive bidding on long-dated instruments, CBK was, in a rare move, forced to cancel the auction for the longer-dated 15-year treasury bond. Of the KES 30B on offer for the 3-year bond, KES 7.3B bids were received, translating to a 24.4% performance rate. Of the received bids of KES 7.3B, only KES 1.8B was taken up. Sunil Sanger, MD at Orion Advisory Services, comments on the recent trends in local bonds:

“With the upward movement in the yields of bonds in the last year, banks are carrying significant mark-to-market losses on their bond portfolios. This has made banks and other investors reluctant to increase their exposure to longer-term government securities, and are opting to invest in shorter maturity instruments, particularly the 91-day treasury bills. The only exception to this trend has been on tax-free Infrastructure bonds, though there is declining interest in these bonds as well.”

Tanzania eyeing the Eurobonds market too: This week, Moody's gave Tanzania a B2 rating with a positive outlook. That’s one step made towards the issuance of a Eurobond for Tanzania. It seems like Kenya and Tanzania will be going to the market at around the same time. For comparison, Kenya has a B2 rating with a negative outlook:

“The positive outlook reflects our view that political risks have lessened under the government's new approach of more active engagement with the international community & its structural reform agenda…The current presidential administration under President Hassan has taken steps at dismantling regulatory impediments to investment, removing restrictions on media and opposition parties, and mending international relationships”

Moody’s

Here is some commentary from Credit Research analyst Mark Bohlund on the raise by Tanzania:

"There should be a sufficient appetite in the market to absorb both Eurobond issues, with the Kenyan sale clearly the more challenging given that investors are likely to be very keen to gain exposure to Tanzania given its absence from the Eurobond market so far and strong growth prospects. The announcement of further multilateral financing for Kenya in the form of lending through the IMF’s new Resilience and Sustainability Trust (RST) and a continued fiscal consolidation should reduce the spreads on Kenya’s Eurobond over the remainder of the year. Nonetheless, the government may still need credit enhancements from the World Bank or the African Development Bank to access the Eurobond market next year.”

Contagion from Egypt?: In a note this week, Goldman Sachs said that the situation in Egypt was weighing down on the performance of credit in some emerging markets like Nigeria, Kenya, Angola, and Senegal. A resolution to the Egyptian predicament would help make it easier for Kenya to access credit markets:

“Egypt’s spreads are now well above 900bp, the point at which market access tends to become impaired, and the others are hovering around this level, suggesting the market is pricing a high degree of repayment risk for this group as a whole..he current market pricing suggests that parts of EM credit are pricing a higher probability of a very negative state of the world as a whole, such as a deep global recession that could leave these sovereigns without market access for a prolonged period of time (i.e., years), a risk that is not reflected in other assets”

Jubilee Insurance 2022 Results

The Impact of Exits: Most of the metrics were down due to the company's divestitures as it sold parts of some of its subsidiaries to Allianz. The decline in gross premiums was due to the removal of the onerous accounts which the company chose to pre-empt and the ceding of General Insurance in Kenya, Uganda, TZ, and Mauritius to Allianz:

"We shed off loss-making/ onerous accounts in preparation for IFRS 17."

Jubilee Holdings CEO Dr. Julius Kipngetich

Operating Highlights: In the period ended 31 December 2022, gross written premiums by the insurer were down 15% to KES 26.0B [2021: KES 30.6B] with net insurance premium revenue in the period down 5.9% to 20.6B [2021: KES 21.9B]. Investment income was 5.8% to KES 13.1B bringing the total income for the period to KES 36.8B [2021: KES 39.5B]. Profit after tax was down 3.8% to KES 6.6B [2021: KES 6.8B].

“Having completed in part the strategic partnership with Allianz in the General insurance businesses in Kenya and Uganda last year, the Group gained KES 3.3 billion in 2021. During the year, the company completed the remaining partnership with Allianz in the General insurance businesses in Burundi, Mauritius and Tanzania recording a gain of KES 2.2 billion, which gave a combined profit of KES 7.5 billion Profit Before Tax for 2022

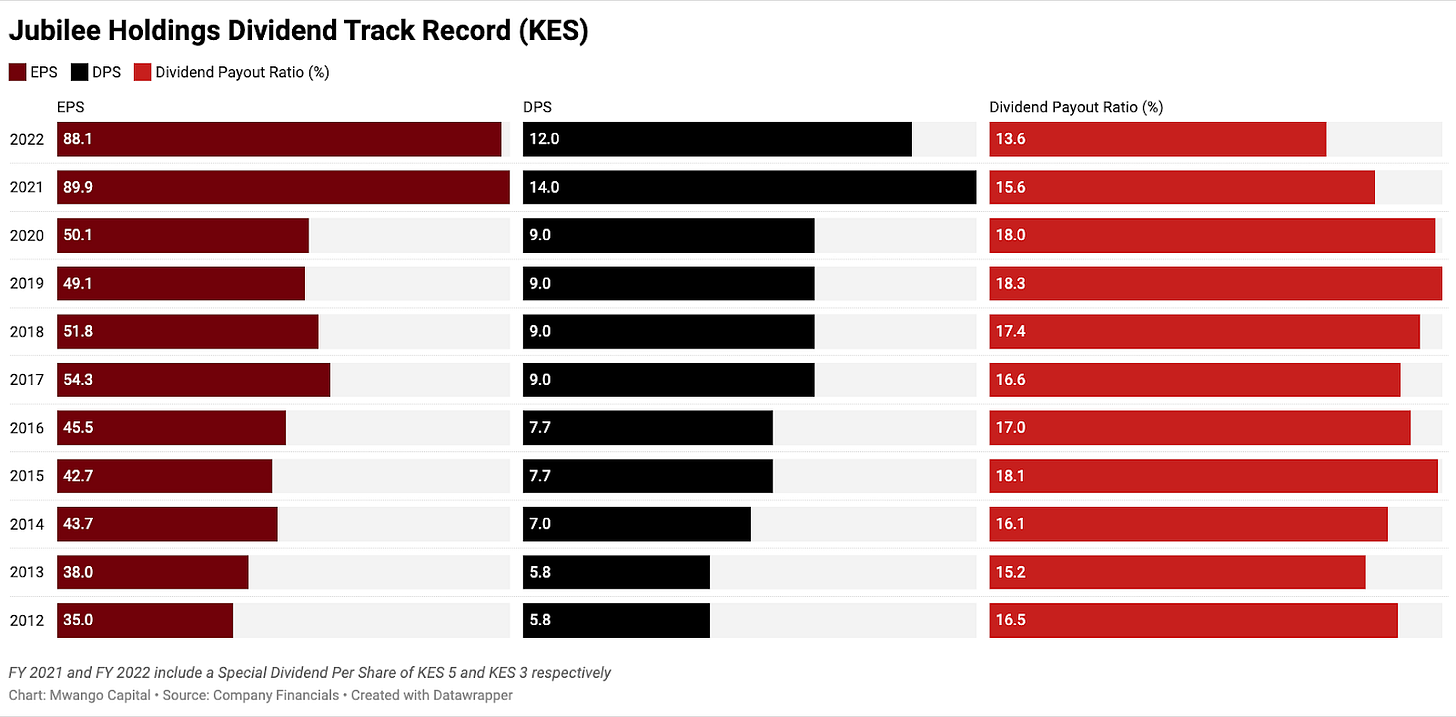

Dividend: The directors recommended for approval a final dividend of KES 8 per share, bringing the total dividend for the year to KES 9 [2021: KES 9]. The board of directors has also recommended a special dividend of KES 3 [2021: KES 5] per share to reflect the completion of the Jubilee-Allianz transaction in which Allianz acquired a majority stake in Jubilee Holdings Limited’s general insurance business in Kenya, Uganda, Tanzania, Burundi, and Mauritius.

This is dictated by prudence. We have been consistent in paying out even in tough times during Covid. We are preserving cash and capital for the tough times. The market should reward us for consistency and for being faithful to our shareholders. Our business is self-funding and so we have never done a capital raise.

Jubilee Holdings CEO Dr. Julius Kipngetich

Other Companies That Reported Last Week

Sameer Africa’s 2022 revenues were down 5.9% to 613.1M while its profit after tax was down a whopping 54% YoY to 100.3M. For comparison, revenues were also down 14% in 2021. The company did not issue dividends just as it did not in 2020 and 2021. The reason for the poor performance was “mainly due to performance in the tyre trading segment of the business which has been adversely impacted by global supply chain disruptions and further weakening of the Kenya shilling.”

TotalEnergies Marketing Kenya has seen its accounts receivables more than double to KES 26.1B: Gross and net sales were up +28.3% and 37.6% YoY respectively to KES 141.3B and 102.8B. Profit after tax was down 10.8% to 2.4B. The company maintained EPS at 1.31 just as in 2022. A major driver of the decline in profits was the increase in OpEx and finance costs:

“The increase in operating expenses is majorly attributable to increased business activities post-COVID-19 coupled with inflation and foreign exchange on the cost of goods and services. The increase in net finance costs to KShs 353 million (2021: net finance cost of KShs 67 million) is a result of high working capital requirements.”

Weekly Capital Markets Wrap

The NSE: In Week 16 of 2023, Jubilee was the top gainer, up 19.2% week-on-week to KES 189.25 while BOC Kenya was the top loser, down 8.8% to KES 70.25. The NSE 20 and NSE 25 indices fell by 1.2% and 1.8% to 1,594.1 and 2,868.0 points, respectively while the NSE All Share Index edged lower by 3.3% to 107.8 points. Equity turnover was down 38.6% to KES 632M while bonds turnover inched higher by 32% to KES 10.8B. Notably, the NSE 20 Index fell below the 1,600 points mark in the week's trading action.

T-Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day treasury bills were 10.159%, 10.477%, and 11.059% respectively. The total amount on offer was KES 24B with the CBK accepting KES 33.3B of the KES 35.2B bids received - an aggregate performance rate of 146.47%. The 91-day and 364-day instruments recorded an 800% and a 10.2% performance rate respectively. Notably, the 364-day T-bill’s interest rate was up 12.7 basis points to cross the 11% mark.

T-Bonds: Bids totalling KES 7.3B were received out of the KES 30B offered for the re-opened three-year Treasury bond FXD1/2022/03, translating to a 24.43% performance rate. The CBK accepted bids totalling KES 1.8B at a weighted average interest rate of 13.471%. The auction for FXD1/2019/15 was cancelled.

Market Gleanings

💰 | Takeaways from Annual Reports | NCBA and Equity Bank have released their 2022 annual reports which showed:

NCBA Group CEO John Gachora's total compensation rose 87.7% to KES 147.7M with the directors' total compensation up 62.7% to KES 364.5M. Shareholders’ price and total returns were around +55% and +80.3% in 2022 respectively.

Equity Group CEO James Mwangi's total compensation was up 49.4% to KES 213.6M with the total directors' compensation up 41% to KES 321.7M. The bank’s share price was down 15.6% in 2022 while the total return was down 9.6% in 2022.

NCBA Group now owns 100% of its Tanzanian subsidiary up from 93.4% in 2022:

Equity Bank injected KES 1.1B into its Tanzanian subsidiary while also raising its stake in its Congolese subsidiary from 77.5% in 2021 to 84.2% in 2022:

⚔️ | Taking on NSSF | CPF Financial Services has received regulatory approval from the Retirement Benefits Authority to manage tier II contributions from employers who opt out of NSSF. CPF will use its Taifa (Umbrella) Pension Fund to manage these. CPF is the largest pension administrator in Kenya with an estimated 500,000 members. Since the end of February this year, the 2013 NSSF Act came into being and it allows employers to channel Tier II contributions to private pension schemes.

“By joining Taifa, an employer enjoys the benefit of opting out of NSSF Tier II statutory contributions to instead provide pension through a scheme with superior benefits.”

🤝| KCB + NBK + Sanlam Partnership | Sanlam Life Insurance has partnered with KCB Bank and its subsidiary National Bank of Kenya (NBK) to distribute life cover products underwritten by Sanlam. The partnership is expected to increase the uptake of Sanlam’s products throughout Kenya by utilizing the combined 300 branches of KCB and NBK. The partnership is also projected to expand KCB’s and NBK’s play in the insurance market, effectively boosting Kenya’s life insurance penetration rate. Under the partnership, the players have rolled out an endowment policy dubbed Nawiri which is a savings and investment product that offers a guaranteed return after a set period, and a last expense cover which is a funeral insurance product that helps offset costs associated with bereavement.

🤑| Funding Secured | Savannah Cement has secured $500M in funding to develop the largest single-site cement clinker manufacturing plant in East Africa. The company intends to invest in the latest cement manufacturing technologies that include carbon capture and the generation of clean power. The investment raised through a privately placed debt arrangement will eventually be listed on a regulated international exchange.

🇺🇬| Another listing In Uganda | Airtel Uganda is prepping for listing and has selected Crested Capital and Absa Bank Uganda to help them with this. The listing is planned to take place before December this year.