👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the Finance Bill 2025, Kenya’s pension industry’s Q4 2024 update, and Car & General’s return to profit in FY 2024.The Finance Bill 2025

A. Income Tax Changes – Employee Related

Per Diem Threshold Increase

Change: Per diem - The tax-free threshold is increased from KES 2,000 to 10,000

Implications: Aligns with current economic conditions; reduces administrative burden

Effective Date: 1st July 2025

Pension and NSSF Withdrawals

Change: Tax exemption on withdrawals from pension schemes and NSSF

Implications: Currently, the law only exempts the first KES 600k from tax on withdrawal

Effective Date: 1st July 2025

B. Income Tax Changes – Company Related

Expanded Definition of Royalty

Change: Now includes the distribution of software where regular payments are made for the use of the software through a distributor

Implications: Allocation of licence fees from related entities within the group will be treated as a royalty and subject to withholding tax

Effective Date: 1st July 2025

Wear & Tear Deduction

Change: 100% deduction allowed on tools and utensils (excluding machinery/plant)

Current Rate: 10%.

Effective Date: 1st July 2025

Limiting Tax Loss Deductions

Change: Limitation of tax loss deduction to 5 years with possible extension beyond 10 years upon application to the Commissioner and approval by the CS National Treasury

Current Law: Currently, the law provides for perpetual tax deduction of the tax losses

Effective Date: 1st July 2025

Introduction of Advance Pricing Agreements (APA)

Change: APA framework introduced for related-party transactions, valid for 5 years

Currently, the law does not provide for APA’s. An Advance Pricing Agreement (APA) is an agreement between the taxpayer and the Tax Authority in relation to the determination of the appropriate transfer pricing method for related party transactions

Effective Date: 1st January 2026

Capital Gains Tax on Listed Shares

Change: CGT to apply on the sale of shares on all CMA-licensed exchanges (currently exempt on NSE)

Effective Date: 1st July 2025

C. VAT Changes

General VAT Adjustments:

Deletion of Provision to Claim Withholding VAT Refund

Implications: Taxpayers cannot claim WHVAT refunds

Effective Date: 1st July 2025

Shorter VAT Refund Timeline

Change: Application timeline reduced from 24 to 12 months

Implications: This reduces the window to apply for refunds

Effective Date: 1st July 2025

VAT Refund on Bad Debts

Change: Refund claim period reduced from 3 to 2 years after the debt remains unpaid

Implication: This will help businesses to apply for a refund of Input VAT on bad debts within a shorter period

Effective Date: 1st July 2025

New VAT Rates:

VAT Exempt items to be VATable at 16% Effective 1st July 2025

Aircraft, spacecraft, and parts

Specially designed, locally assembled motor vehicles for the transportation of tourists

Taxable goods, excluding motor vehicles, imported or purchased for direct and exclusive use in geothermal, oil, or mining prospecting

Specialized equipment for the development and generation of solar and wind energy, including photovoltaic modules, direct current charge controllers, direct current inverters, and deep cycle batteries that use or store solar power

12. VAT Zero-rated Items moved to VAT exempt – Means that affected businesses will not claim input VAT, effective 1st July 2025

Inputs or raw materials (either produced locally or imported) supplied to pharmaceutical manufacturers in Kenya

Transportation of sugarcane from farms to milling factories

The supply of locally assembled and manufactured mobile phones

The supply of motorcycles

The supply of electric bicycles.

The supply of solar and lithium-ion batteries.

The supply of electric buses

Inputs or raw materials, locally purchased or imported, for the manufacture of animal feeds

Bioethanol vapour (BEV) Stoves

D. Tax Procedures Act Changes

Withholding VAT Payment Timeline Adjusted

Change: Payment of Withholding VAT deducted within 5 working days deleted

Implication: Withholding VAT will now be due by the 20th day of the following month

Effective Date: 1st July 2025

10% Penalty on Withholding VAT Removal

Implications: 10% penalty for not deducting withholding VAT deleted

Effective Date: 1st July 2025

Extended Refund Processing Period

Change: The period to review and determine tax refund applications increased from 90 to 120 days

Implications: This will likely lengthen the refund processing period

Effective Date: 1st July 2025

The CS National Treasury may waive penalties & interest upon recommendations from the Commissioner arising from:

Electronic system errors

Delays in updating systems

Duplicate penalties/interest

Incorrect taxpayer registration

Effective Date: 1st January 2026

Implication: This provides a window to seek for waiver of interest & penalty related to eTIMs

Find the full report here.

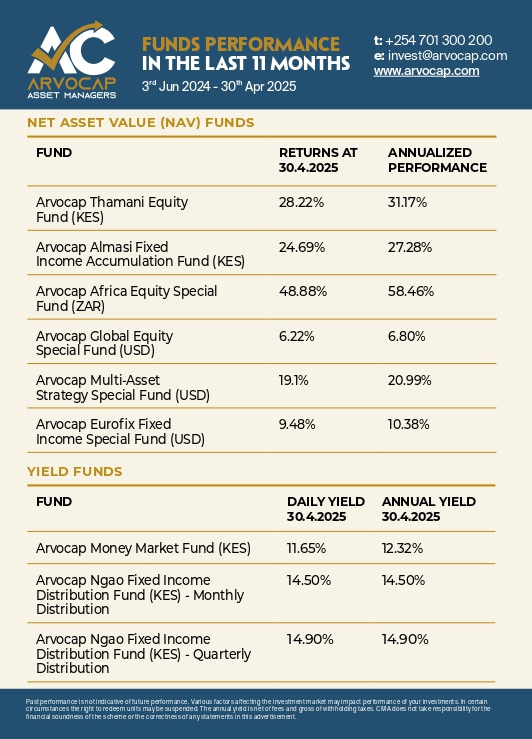

This week’s newsletter is brought to you by Arvocap Asset Managers.

Q4 2024 Pension Industry Update

The Retirement Benefits Authority (RBA) released its December 2024 industry brief. Below are some highlights:

AUM Hit KES 2.26T: As at 31st December 2024, Kenya’s pension industry reported total Assets Under Management (AUM) of KES 2.26T. This marked an increase of KES 276.5B, or 14%, from KES 1.97T in June 2024. The growth was primarily driven by investment income and higher contributions under the second year of the NSSF Act implementation, which raised the lower contribution limit from KES 6,000 to KES 7,000 and the upper limit from KES 18,000 to KES 36,000.

Asset allocation remained concentrated: 51.1% in government securities, 19.4% in guaranteed funds, 11.0% in immovable property, and 9.0% in quoted equities, together accounting for over 92% of the total.

Shift Toward Alternatives: Pension schemes maintained their core in traditional investments but made notable shifts into alternative assets. Government securities grew from KES 1.01T in June 2024 to KES 1.18T in December 2024, a 17.0% rise. Quoted equities increased 15.6% to KES 202.3B. Guaranteed funds rose by 8.0% to KES 437.5B, while immovable property grew modestly by 5.5% to KES 249.2B.

In alternatives, private equity surged by 85.1% to KES 16.2B, offshore investments rose 65.3% to KES 64.5B, and unquoted equities rose slightly to KES 4B. Commercial paper and other non-listed bonds hit KES 3.2B, while “other assets” more than doubled to Kshs. 0.2 billion. However, REITs declined 7% to KES 11.7B.

Assets Held by Fund Managers: Fund managers’ AUM increased by 16% from KES 1.48B in June 2024 to KES 1.7B in December. GenAfrica led with KES 651.4B (+40%), followed by Co-optrust at KES 303.4B (+31%). African Alliance doubled its AUM to KES 201B (+102%). The top five fund managers held 91.9% of the market.

Among the 18 approved issuers, total AUM grew by 8% to KES 437.5B. ICEA Lion led with KES 108.2B, followed by Jubilee Insurance at KES 102.7B. Britam, Kenindia, and GA Life rounded out the top five, which collectively held 85.1% of all guaranteed funds.

Assets Held by NSSF: The National Social Security Fund’s total assets rose to KES 476.8B as at December 2024, up from KES 402.0B in June an increase of KES 74.8B. Externally managed assets grew from KES 348.7B to KES 424.6B, while internally managed funds stood at KES 52.2B, including KES 38.6B in immovable property. NSSF asset allocation was conservative: 67.4% in government securities, 14.3% in listed shares, 7.4% in property, 5.2% in other assets, 3.1% in fixed deposits, and small holdings in unlisted shares, corporate bonds, and cash. Annual contributions increased to KES 59.3B in 2024, from KES 25.4B in 2023.

Find the full briefing here.

Earnings Wrap

Car & General Reports KES 526M Profit in FY24: Car & General reported a net profit of KES 526M for the 12 months ending December 2024, a recovery from a KES 273M loss in the previous 15-month period. Revenue decreased to KES 20.9B, down from KES 27B in the prior period, with EBITDA falling to KES 1.1B. The Kenyan boda boda market, which had peaked at 20,000 units per month in 2022, declined to an average of 4,600 units per month, negatively affecting the company’s performance. However, sales growth in Uganda and Tanzania, now accounting for 58% of group sales, helped mitigate the impact. Cash from operations amounted to KES 1.4B.

Express Kenya Posts KES 108M Net Loss in 2024: Express Kenya recorded a KES 107.9M net loss in FY 2024, widening slightly from KES 103.4M in 2023, as revenue fell 4.1% to KES 26.4M due to reduced warehouse clientele and storage space. Shareholders’ funds dropped 20.7% to KES 412M, while cash and equivalents halved to KES 608K. Loss before tax stood at KES 136.4M, with EPS at -2.26. The company did not declare a dividend and says its delayed redevelopment project is still in progress.

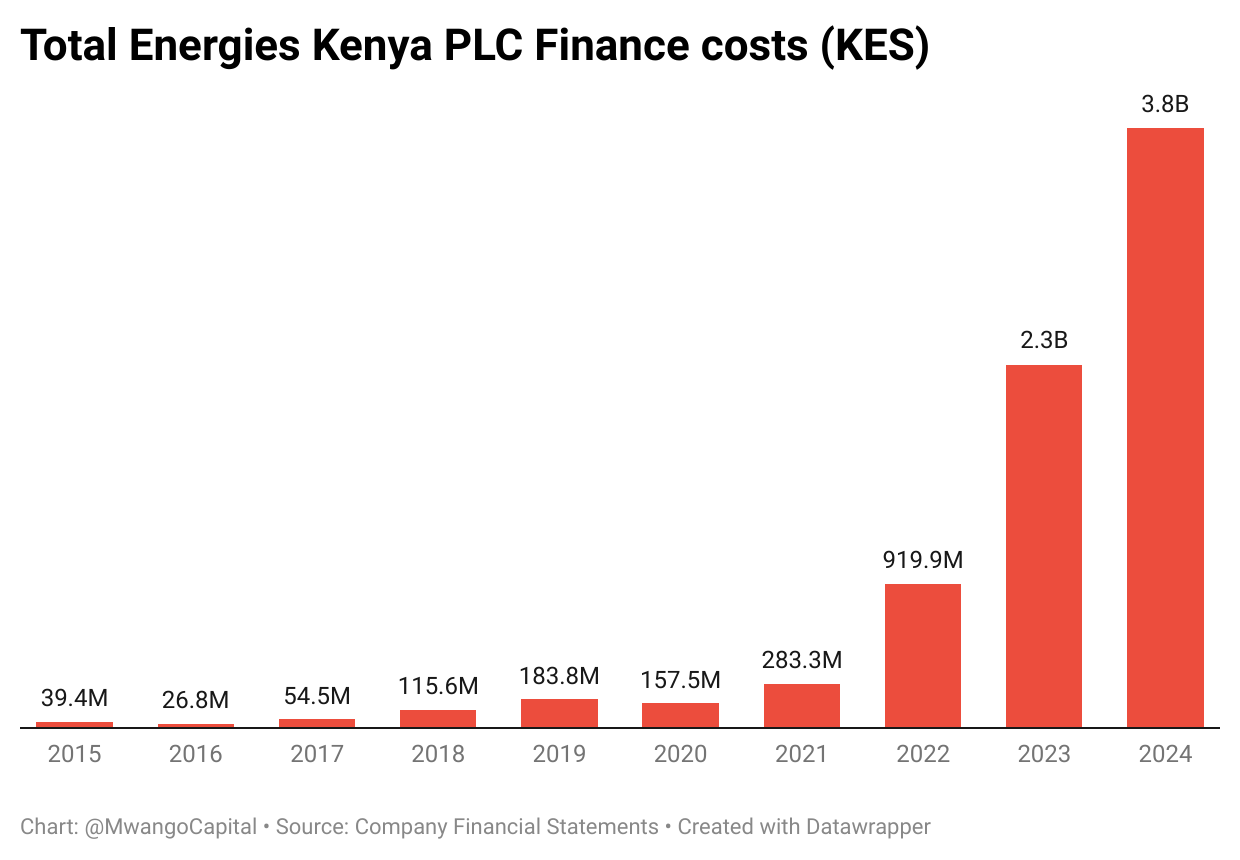

Total Energies Kenya Profit Halves to KES 1.5B in 2024: Total Energies Marketing Kenya posted a 50.8% drop in net profit to KES 1.49B in FY 2024, hit by a 30% decline in gross margins to KES 8.99B and a 65% rise in finance costs to KES 3.83B. Net revenue slipped 5.4% to KES 114.2B, while EPS fell to 2.36 from 4.80; total assets dropped 9.8% to KES 67.9B despite increased capex and a rebound in FX gains to KES 2.07B.

Crown Paints Posts KES 544M Profit: Crown Paints rebounded to a KES 544M net profit in FY 2024 from a KES 29M loss in 2023, driven by a 7.6% revenue rise to KES 13.45B and improved margins. Profit before tax jumped to KES 787M while EPS rose to 3.82. The board proposed a KES 3.00 dividend. Cash from operations fell 70% to KES 510M, while cash and equivalents more than doubled to KES 344M.

Markets Wrap

NSE Weekly Recap: Week 18 (25 Apr –2 May 2025)

Top gainer: Olympia Capital +18.6% to KES 3.70

Top loser: Sanlam –17.6% to KES 7.38

NASI flat at 125.6 (–0.16%)

Market cap: KES 1.97T

Equity turnover fell 42.7% to KES 1.3B

Bond turnover down 27.8% to KES 39B

Foreign activity 72.4%, net outflow KES 10.8M

Upcoming Earnings: Safaricom is set to release its results on Friday, 9th May. Stay tuned as we break down key expectations throughout the week and provide a full analysis in next week’s newsletter.

Treasury Bills: Treasury bills were undersubscribed last week, with a subscription rate of 76.56%, down from 178.53% the previous week. Investors submitted bids totaling KES 18.37B, and the Central Bank of Kenya (CBK) accepted the full amount out of the KES 24B on offer. Yields on the 91-day and 364-day T-bills declined by 3.76 and 1.50 basis points to 8.4058% and 10.058%, respectively, while the yield on the 182-day T-bill remained unchanged at 8.169%.

Bonds: The Central Bank of Kenya announced the results of its treasury bond auction for reopened fifteen and twenty-five-year bonds. Investors submitted bids totaling KES 57.1B, resulting in a performance rate of 114.2%. The Bank accepted KES 50.4B, with a bid-to-cover ratio of 1.13. The coupon rates were set at 13.94% for the fifteen-year bond and 14.19% for the twenty-five-year bond.

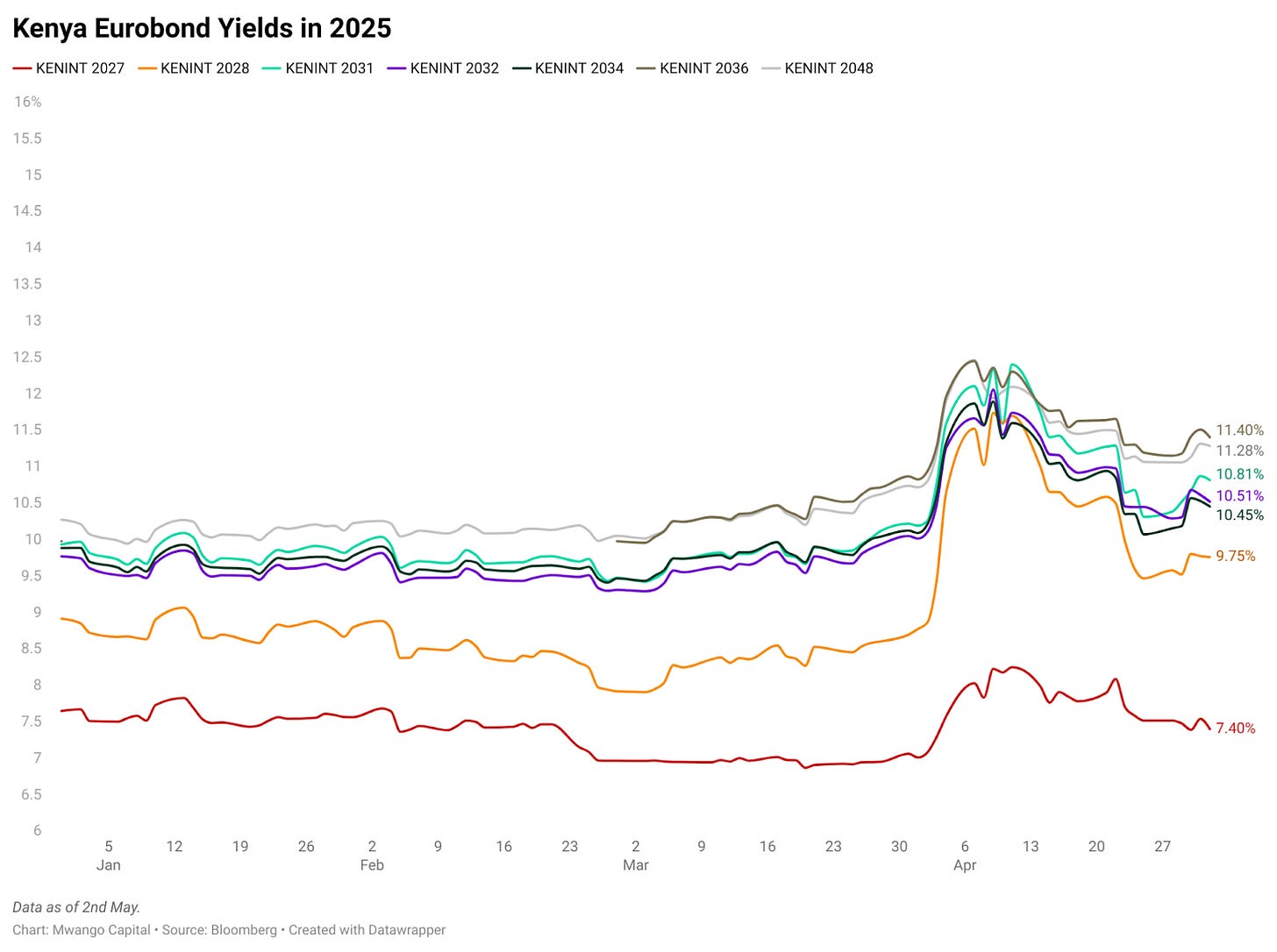

Eurobonds: Last week, yields on six out of the seven outstanding Eurobonds rose, led by the KENINT 2031 bond, which climbed 50.60 basis points to 10.810%. The KENINT 2034 bond followed, increasing by 38.30 basis points to 10.448%. The only decline was recorded on the KENINT 2027 bond, which fell by 11.60 basis points to 10.514%. Overall, Eurobond yields rose by an average of 22.43 basis points week-on-week.

Market Gleanings

🔺| KBA Rejects CBK Proposal on Credit Pricing | The Kenya Bankers Association (KBA) has opposed the Central Bank of Kenya’s proposal to use the Central Bank Rate (CBR) as the base rate for loan pricing with a regulated premium “K,” calling it a return to interest rate capping. KBA warns this would limit credit to MSMEs, weaken monetary policy transmission, and violate the legal framework for market-driven interest rates. Instead, KBA proposes the interbank rate as a more effective and market-based reference rate and calls for full flexibility in setting the premium “K” based on actual lending costs and risk profiles.

📊| Kenya Inflation Hits 4.1% in April | Kenya’s inflation rose to 4.1% in April 2025 from 3.6% in March, the sixth consecutive monthly increase. Core inflation edged up to 2.5% while non-core inflation jumped to 8.4%, though the headline rate remains within the Central Bank’s 2.5%–7.5% target range.

💰| Kenya Raises USD 500M via 2032 Bond | Kenya has successfully priced a USD 500M 8.25% amortising bond due in 2032 through a private placement, meaning the bond was sold directly to a select group of investors rather than through a public offering. The bond, issued at par, will support budgetary needs and manage existing debt. Settlement is set for April 30, 2025.

🇹🇿| New Currency Regulations in Tanzania | The Bank of Tanzania has officially prohibited the use of foreign currencies in local transactions, effective from March 28, 2025, under the newly gazetted Regulations on the Use of Foreign Currency. All prices and payments for goods and services must now be quoted and settled in Tanzanian Shillings (TZS). It is now an offence to price, advertise, or accept payment in foreign currencies within the country. While select transactions may still be permitted in foreign currencies, contracts requiring such payments cannot be entered into or renewed. Tourists must exchange money via licensed banks or Bureaus de Change, though card and digital payments remain valid.

🗞️| Standard Group Delays 2024 Results | Standard Group PLC has announced a delay in publishing its audited financial results for the year ended 31st December 2024, citing an unforeseen holdup in finalizing the external audit. The board assures shareholders and stakeholders that efforts are underway to complete the process, with a firm commitment to release the results by 9th May 2025.

⚡| Umeme Granted Extension for FY2024 Results | Umeme Limited has received approval from the Uganda Securities Exchange to extend the publication of its audited financial statements for the year ended 31st December 2024 to 31st May 2025. This follows a formal Notice of Dispute issued to the Government of Uganda and ongoing good faith negotiations regarding the Buy-Out Amount, critical to finalizing the accounts. As a result, the Company’s Annual General Meeting, originally set for 22nd May 2025, has been rescheduled to a date no later than 15th August 2025.

✔️| CAK Approves Tamini’s 65% Acquisition of Takaful Insurance | The Competition Authority of Kenya (CAK) has approved the acquisition of 65% of Takaful Insurance of Africa Limited’s issued share capital by Tamini Insurance S.A., a private company incorporated in Djibouti. CAK stated that the approval is unlikely to negatively impact competition in the general insurance sector. With 61 registered insurance and reinsurance companies in Kenya, including major players like AAR Insurance, AMACO, and Britam, the deal is expected to align with the current competitive landscape.

⚖️| StanChart Takes KES 30B Pension Battle to Supreme Court | Standard Chartered Bank Kenya has moved to the Supreme Court to challenge a KES 30B pension ruling awarded to 629 former employees, after losses at both the High Court and Court of Appeal. The pensioners had accused the bank’s scheme of underpaying their lump sum dues and demanded KES 9B in arrears, interest, and a KES 1.1B surplus refund. In its 2024 annual report, the bank revealed it had filed for stay orders to halt execution of a Retirement Benefits Authority Tribunal directive, which had ordered recalculation of benefits to factor in cost of living adjustments and allowances.