👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the recently launched Hustler Fund, Absa's Q3 2022 results, and Centum’s proposed share buyback.First off, enjoy our weekly business news in memes brought to you by the Mwango Capital:

Ruto Launches Hustler Fund

All Systems Go!: Last week, Kenya’s President William Samoei Ruto launched the Financial Inclusion Fund, or the Hustler Fund, a key campaign promise of his administration. He launched the Personal Finance product, with the Micro, MSME, and Start-Up products slated for 2023.

“I am very grateful to the many leaders, CEOs of companies, our banks, our Mobile Service Operators, and all other people who have come together so that we can fashion this Hustler Fund in the manner in which we have arrived at today. If there has been a demonstration of patriotism, I have seen it in the formulation of the Hustler Fund. It is not common that competitors sit together to agree on a product that is not necessarily their own product. They have products but have sat down out of patriotism out of minding for the ordinary people of Kenya.”

President of Kenya, William Samoei Ruto

Product Terms: For the Personal Finance product, individuals can borrow amounts ranging from KES 500 - KES 50K at 8% interest per annum on a pro-rated basis repayable in 14 days. The daily interest rate is 0.002%. The process is mobile-based. Find the Frequently Asked Questions here.

Start-up Funding: This product is in the works and the Cabinet is expected to agree on the framework of the Start-up bill next week. Other products including the Micro and SME loans are slated for launch in 2023. The SME product will offer loans ranging between KES 100K - KES 5M.

“Start-ups will have a chance to be funded because today we have many ideas, we have many interventions, we have many apps that don’t go very far because there is no start-up capital. We’re going to make sure that we have start-up capital. Next week when we pass the Start-up bill in Cabinet, it will go to Parliament so that we can be able to take our investments and our opportunities to the next level.”

President of Kenya, William Samoei Ruto

Savings Component: Every loan disbursed through the Fund will see the client get 95% while 5% will be channelled towards a savings scheme in which 70% will be put in a long-term vehicle and 30% in a short-term one.

“I made a commitment that we are going to match, for those who are employed, their employers match their savings. For those who are not employed, borrowing on the Hustlers Fund, the Government of Kenya is going to match your savings the same way employers match for their employees. We will consider the Government of Kenya as your employer and that is why we are going to match your savings 1 shilling for every 2 shillings to the maximum of 6,000 shillings per year. If you save 6,000 shillings per year, we will give you 3,000 shillings.”

President of Kenya, William Samoei Ruto

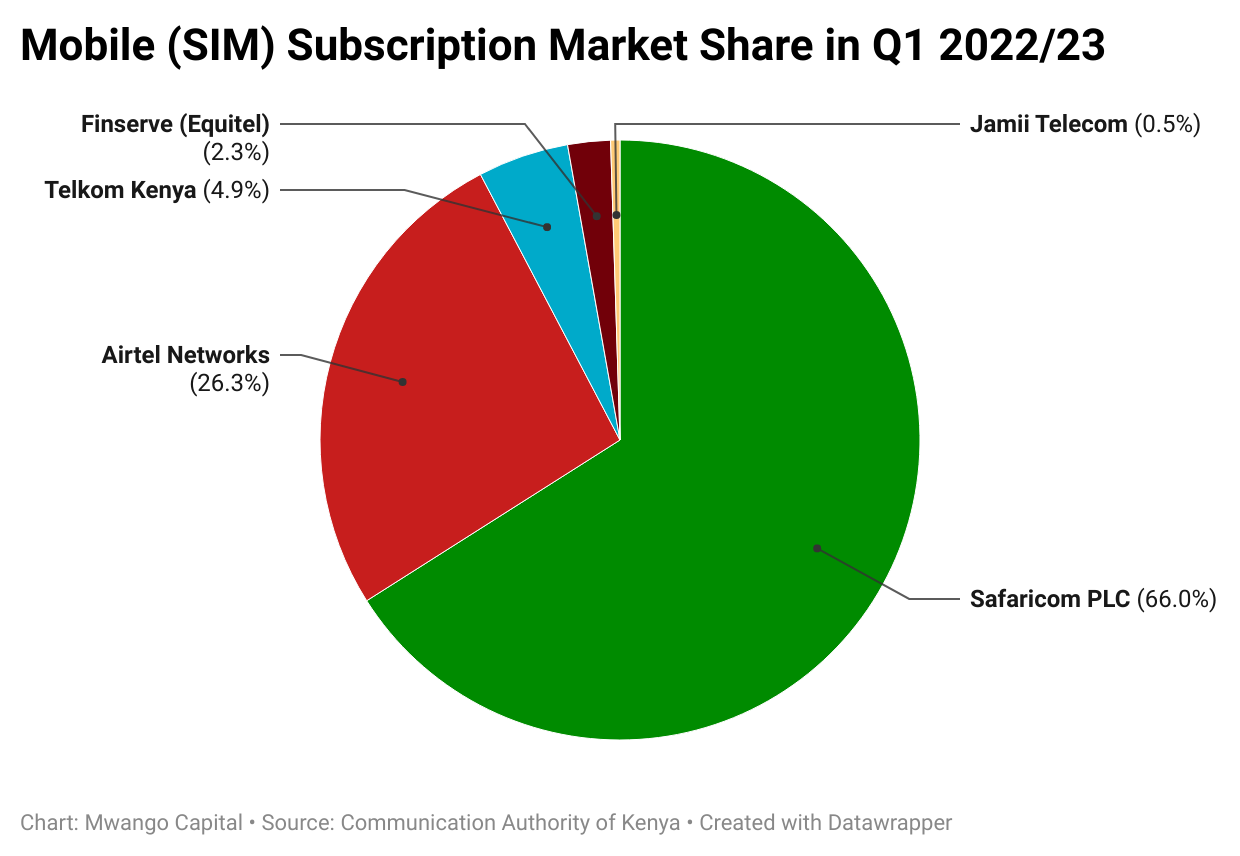

Uptake: As of 0700H this morning, 10.6M customers had opted in. The total amount disbursed was KES 3.7B, out of which KES 190.6M had been repaid with KES 184.5M realised in savings. In H1 23, Fuliza, Safaricom’s overdraft service, had 7.4M distinct customers [2021: 6.4M] with an average ticket size of KES 320.9 [H1 22: KES 375.8].

Absa Q3 2022 Results

Balance Sheet Up 17%: Total Assets rose by 16.9% year-on-year to reach KES 481.3B [2021: KES 411.4B]. The loan book grew 26.4% to KES 289.4B [2021: 229.1B], accounting for 60.1% of the balance sheet. Holdings of investment securities increased 12.9% to KES 92.2B [2021: KES 81.7B], representing 19.1% of the balance sheet.

Accelerated Lending: The 26.4% change in the size of the loan book is the highest the bank has recorded over the last few years. In particular, the loan-to-deposit breached 100% to reach 102.9% in 2022 [2021: 85.2%] - the highest across all the listed banks at the Nairobi Securities Exchange (NSE).

Asset Quality: Gross Non-Performing Loans (NPLs) rose 2% to KES 20B [2021: 19.6B], equivalent to 6.9% [2021: 8.6%] of the loan book. Net NPLs were down 20% to reach KES 4B, equivalent to 1.4% of gross loans. Loan loss provisions through the income statement edged 47.9% higher to reach KES 5B [2021: KES 3.4B] or 15% [2021: 12.5%] of gross operating income.

Interest Income: Interest income from loans and advances rose 27.8% higher to reach KES 21.7B [2021: KES 17B], while that from government securities rose 13.7% to KES 6.9B [2021: 6.1B]. Total Interest Income edged up 24.7% to reach KES 29.3B [2021: 23.5B].

Revenue Mix: Net Interest Income rose 25.3% to KES 23.3B [2021: KES 18.6B], while Non-Interest Income rose 16.4% to reach KES 10.2B [2021: KES 8.7B], bringing the contribution to operating income to 70:30 [2021: 68:32]. Total operating income for the period was up 22.5% to KES 33B [2021: KES 27.3B].

Net Profit Up 30%: Profit Before Tax was up 27.6% to KES 15.1B [2021: 11.9B] increasing the Net Income for the period by 30.1% to KES 10.7B [2021: 8.2B].

KenGen FY 2021/22 Results

Revenue Up 7.5%: Total sales in the year rose 7.5% year-on-year to KES 49.2B [2021: KES 45.8B]. Operating profit declined 72.3% to reach KES 4.5B, bringing the operating margin to 9.3% [2021: 35.9%].

Net Income Jumps 158%: Profit Before Tax fell 48.1% to KES 7.9B [2021: 15.3B]. Net Income increased 157.9% to KES 4.7B. The aggregate tax obligation was KES 3.2B [2021: KES 13.5B], having a comparatively lesser effect on earnings than in 2021. The income tax expense was equivalent to 40.6% of Pre-Tax Profit in 2022 [2021: 88.4%].

Centum HY 23 Results

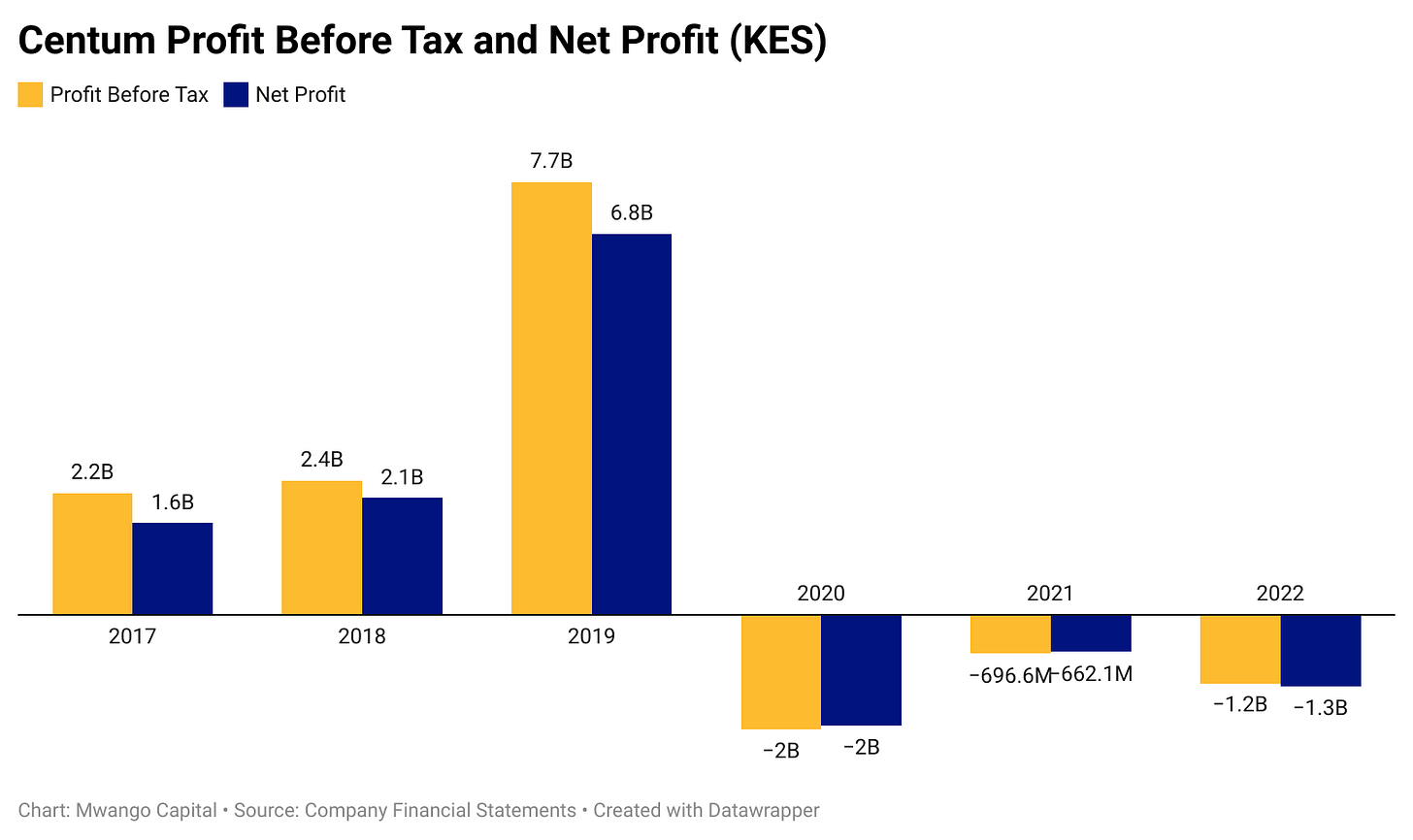

Income Statement Snapshot: Losses from Real Estate Operations and Two Rivers Investment Operations widened by 88.9% and 187.5% to reach KES 267.9M [2021: KES 141.8M] and KES 984.5M [2021: KES 342.4M], respectively. The loss before tax was KES 1.2B [2021: KES 696M], while the net loss increased by 94.9% to KES 1.3B [2021: KES 662.1M].

Portfolio Allocation: As of September 2022, Centum’s investment portfolio grossed KES 46B in assets. The allocation across the Growth Portfolio and the Marketable Securities Portfolio (MSP) was 84.6% and 15.4%, and the NAV Per Share was KES 49.1 and KES 10.7, respectively. MSP assets grossed KES 7B [2021: KES 7.9B], and Centum reallocated USD 11.5M/KES 1.4B in its MSP to Eurobonds, to bring the share of Eurobonds in the MSP to 20%. The MSP generated an average annualized gross return of 14% p.a in HY 23 [HY 22: 15%].

“There are many Eurobonds issued. We have more in Egypt than Kenya. Around July, there was a panic, so yields shot up to like 19%. The aggregate thing was bought at 72 relative to par. So as it matures, you have two things that we didn’t have before. Before we were just focusing on interest income. Now you have a capital gain perspective.”

Centum Plc CEO, James Mworia

NAV Per Share v Share Price: As of September 30 2022, Centum’s NAV Per Share stood at KES 59.8 [2021: KES 62.09], a 3.7% decline. As of March 31 2022, the NAV Per Share stood at KES 62.1, and Centum has attributed the decline to KES 59.8 to the impact of unrealised foreign exchange translation movements in some subsidiaries and the reclassification of proposed dividends.

USD Debt Reduction: Centum expects to book KES 1.5B in realized gains on the completion of the sale of its equity stake in Sidian Bank to Access Bank Kenya. The amount will be applied towards repayment of the company’s US Dollar (USD) liabilities to mitigate forex risk exposure. The planned USD debt repayment is $10M.

“We have around $15M [in dollar debt] left in Centum. Why did we take dollar-denominated debt originally? It was a lot cheaper. When there was Quantitative Easing, there were a lot of dollars. Rates were very low. So we were borrowing at 5%, whereas Kenya Shilling debt was 13%. So we had a differential of about 8% and you could borrow internationally cheaply, so it made sense to borrow in dollars. But in 2018/2019, our view was that this is not going to last, which is why we made decisions to make exits early and first retiring the dollar-denominated debt.”

Centum Plc CEO, James Mworia

Share Buyback: Centum’s Board of Directors has resolved to propose to shareholders the purchase of up to 10% [66.5M shares] of the issued and paid-up share capital in a buyback arrangement. The buyback period is 18 months at a KES 0.5 - KES 9.03 share price range. The KES 9.03 upper limit is an 11.8% premium to last week's KES 8.1 closing price which is down 44.8% year-to-date. Centum’s total outstanding issued shares stand at 665.4M.

NMG Buyback Outcome: In 2021, shareholders of Nation Media Group (NMG), East Africa's largest media house, approved a share buyback programme to purchase 10% [20.7M shares] of its issued share capital. The share repurchase scheme ran from June and closed on September 24, 2021, realising an 82.5% uptake [17.1M shares]. NMG share price closed at KES 16.1 last week, down 64.2% since the buyback programme closed and down 12.3% year-to-date. Separately, the firm last week announced layoffs as part of the workforce reorganization.

More Earnings

NBV Net Income Down 89%: For the six months ended September 30 2022, Nairobi Business Ventures' (NBV) revenue fell 28.2% year-on-year to KES 348.4M [2021: KES 485.3M]. Direct costs declined by 34.8% to KES 220.1M [2021: 337.7M], bringing the gross profit to KES 128.3M, a 13.1% decrease. Net income fell 88.8% to KES 3.9M and the Board of Directors did not declare an interim dividend. In November, NBV had the second highest net inflows at the NSE at $21.8K/KES 2.7M, equivalent to 0.1% of its market cap in the month.

Eaagads Ltd. Rebounds to Profit: Revenue for the 6 months ending September 2022 edged 177.8% higher year-on-year to KES 158.9M [2021:KES 57.2M]. The firm attributed this growth to a 179.5% increase in clean coffee production to 232 Tons [2021: 83 Tons] albeit a 13.8% decline in the average price realized to $5.7/Kilogram of clean coffee [2021: $6.62]. Gross profit rose 283.8% to KES 51.5M [2021: 13.4M], and the net income was KES 37.2M [2021: KES -376K]. The company's Board did not recommend an interim dividend.

Debt Markets

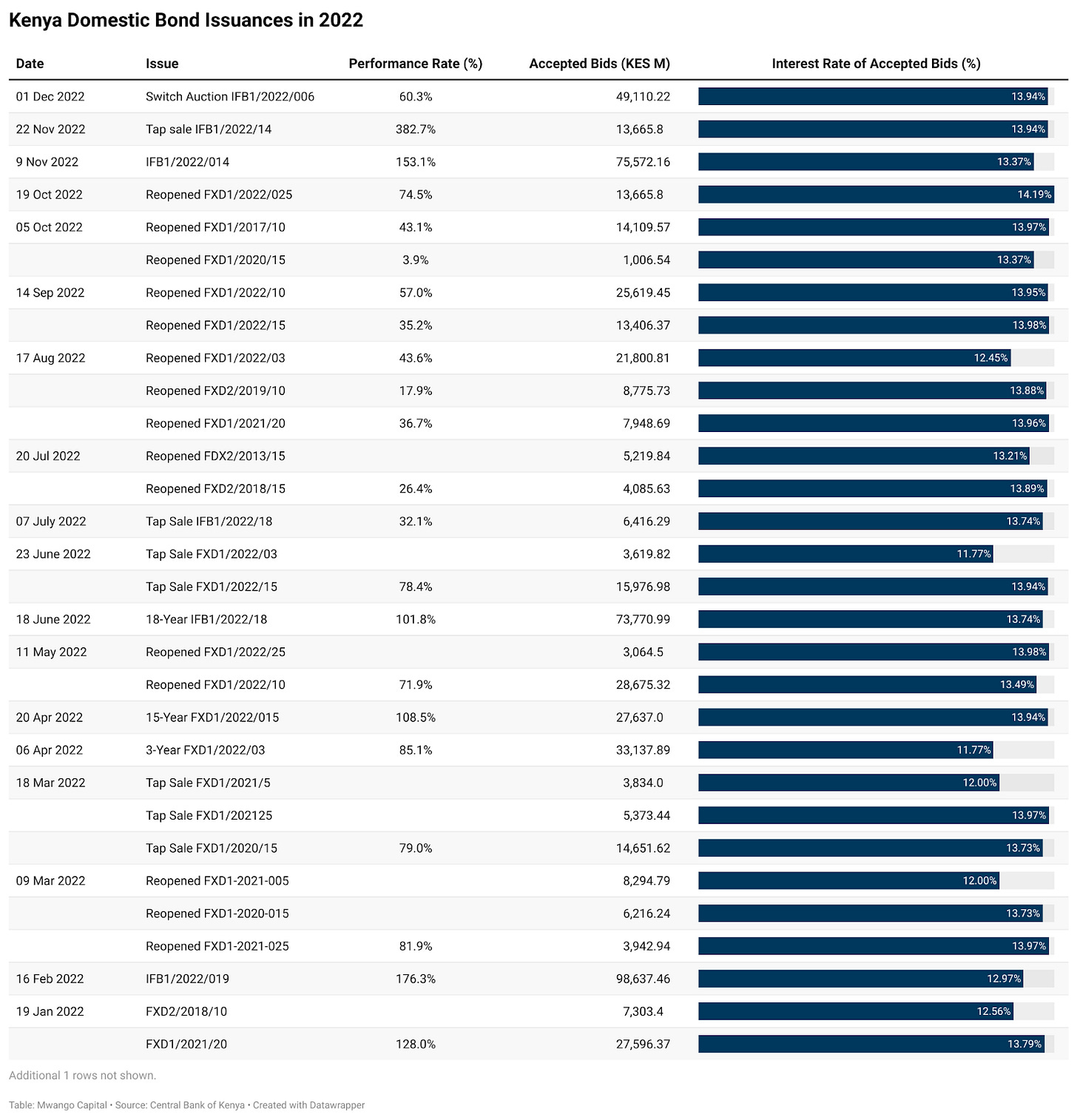

T-bills: In the short-term debt markets, yields for the 91-Days, 182-Days, and 364-Days instruments were 9.275%, 9.752%, and 10.225%, compared to 9.237%, 9.733%, and 10.219%, respectively, in last week’s auction. On a gross basis, investor bids were KES 19.8B against KES 24B on offer with the Central Bank of Kenya (CBK) accepting KES 19.7B. The performance and acceptance rates stood at 82.4% and 81.9%, respectively.

Switch Auction Results: In last week’s switch auction that had a KES 87.8B target amount, investors offered to roll over KES 52.9B in liquidity from various maturing securities to 6-year IFB1/2022/6, bringing the performance rate to 60.3%. Out of the KES 52.9B, the CBK accepted KES 49.1B, bringing the acceptance rate to 55.9%. The market-weighted average rate of accepted bids stood at 13.2%.

Corporate Bond Market: As of market close last week, the value of outstanding corporate bonds at the NSE was KES 22.5B. EABL’s domestic Medium Term Note (MTN) had the highest outstanding value at KES 11B, while Kenya Mortgage Refinance Company’s MTN had the least outstanding value at KES 1.4B. Centum RE’s Senior Secured MTNs had the least days to maturity at 376 days with KES 2.9B outstanding.

Eurobond Market: Yields on Kenya’s outstanding Eurobonds fell by a cumulative 237 basis points (bps) week-on-week, with KENINT 2048 extending the fall at 47 bps. KENINT 2034 fell by the least margin at 33.5 bps. At 3.3%, price gains were highest on the farthest end - KENINT 2048 to 80.349. The price traded above 80 in April this year. KENINT 2024 witnessed the least price appreciation at 0.8% to 93.6.

What Else Happened This Week

📉 Inflation Cools in November: Annual inflation fell by 10 bps to 9.5% [October: 9.5%]. The Food & Alcoholic Beverages Index rose the most year-on-year at 15.4%, followed by the Transport and Household Equipment indices at 11.7% and 10.6%, respectively.

⚠️ NSE issues Profit Warning: Last week, the NSE issued a profit warning, expecting its Net Profit to decline more than 25% year-on-year in the fiscal year ending December 31, 2022. The NSE becomes the second firm to issue a profit warning for fiscal 2022 results after Bamburi Cement.

✅ CDF Funding Greenlight: The National Treasury is set to begin KES 2B weekly disbursements to Constituency Development Funds (CDFs) across the country effective December 9.

🧾 ETR Transition: As of November 30, the compliance rate for fitting ETRs linked to its Tax Invoice Management System (TIMS) across small, medium and large taxpayers registered for Value Added Tax stood at 43%, 82%, and 94%, respectively.

🛠️ Debt Restructuring: According to the governor of the Bank of Zambia, the extent of the haircuts Zambia is asking creditors to accept is proving an obstacle in debt restructuring talks. Yesterday, as part of its debt restructuring, Ghana announced a planned exchange of domestic bonds for new bonds.

Interest Rate Watch

🇬🇭 Ghana: The Monetary Policy Committee of the Bank of Ghana hiked the key policy rate by 250 bps to 27%, bringing the total hike in 2022 to 1,250 bps. Annual inflation in Ghana stood at 40.4% in October 2022[September: 37.2%], a fresh 21-year high, and the cedi is down 126.3% year-to-date.

🇳🇦 Namibia: Last week, the MPC of the Bank of Namibia unanimously decided to increase the benchmark rate by 50 bps to 6.75% in a bid to strike a balance between inflation and economic recovery. Overall inflation in Sub- Saharan Africa’s least densely-populated country stood at 7.1% in October 2022, and the projections for overall inflation for 2022 stand at 6.1% and 4.9% in 2023.