👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Equity's acquisition of Spire Bank, January's drop in inflation, and January stock performance at the NSE.First off, enjoy a dose of our weekly business news in memes brought to you by the Mwango Capital:

Equity Completes Spire Acquisition

Highlights: On February 1, Equity Group officially announced the completion of the acquisition of certain assets and liabilities of Spire Bank Limited after the transaction received the relevant regulatory approvals. The Equity Group CEO shared what inspired the deal:

“The decision to acquire Spire Bank’s certain assets and liabilities was not hard and was inspired largely by our history with teachers who have continued to support the Bank over the years. This long-standing partnership extends to other collaborative initiatives including the Wings to Fly scholarship program that has benefited over 60,000 scholars. We have also partnered with our schools to support them transition to clean energy for lighting and cooking. Today, we celebrate the completion of the transaction and are happy to report we have started serving former Spire Bank customers.”

Equity Group CEO, James Mwangi

What it Means: Equity Bank Kenya has acquired approximately 20K deposit customers holding KES 1.3B in deposits and 3.7K loan customers with outstanding loan balances at a net carrying value after statutory loan loss provisions of KES 945M. Mwalimu Sacco will pay an amount of just over KES 500M to Equity Group to make the assets and liabilities net off.

“Equity is not being paid to acquire Spire Bank. We were getting equivalent amounts of loans and deposits.”

Equity Group CEO, James Mwangi

“With the completion of the transaction, customers holding deposits in Spire Bank, other than the remaining deposits from Spire Bank’s controlling shareholder, and specified loan customers will now transition to become EBKL customers. This means that these customers will have new Equity Bank accounts and besides their domicile branch, they become part of a big network offering more capabilities to self-serve and enjoy banking on their mobile devices.”

Reprieve for Mwalimu Sacco: The completion of the transaction helps Mwalimu Sacco offload the struggling bank.

“This is a unique transaction structured as an asset and liabilities purchase agreement. Equity will be acquiring part of our subsidiary’s assets and liabilities in the form of customer loans and deposits. [...]. We don’t take it for granted. We have come to the end of this journey.“

Mwalimu Sacco CEO, Joel Gachari

Inflation is Cooling

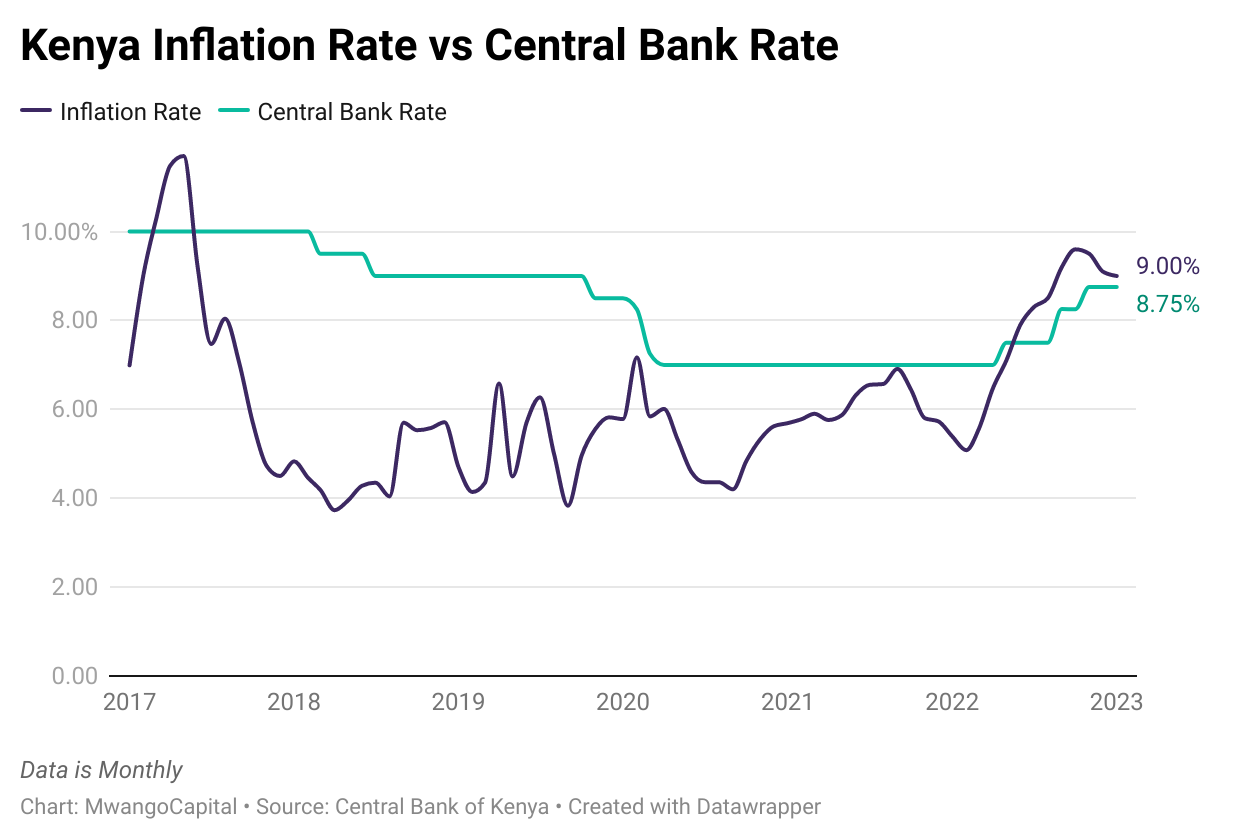

Transport Index Up Highest: Inflation in Jan 2023 dropped by 10 bps to 9.0% [Dec 2022: 9.1%]. The Transport index rose 13.1% year-on-year - the highest across all divisions - while the Information and Communication index rose the least at 1.1%. Across commodities, diesel recorded the largest change at 46.1% while onion leeks and bulbs had the least change at -7.1%.

CBR - Inflation Spread: The difference between Kenya’s Central Bank Rate (CBR) and the Inflation Rate was -24bps in January 2023 compared to 161 bps in January 2022. While the CBR has increased by 175 basis points over the period, inflation has surged by 361 bps - double the change in the CBR.

January NSE Performance

With January coming to an end last week, we reviewed the month-on-month performance at the Nairobi Securities Exchange in January 2023. Below are some highlights:

Top Gainers: Trans-Century, which is currently undertaking a rights issue, recorded the largest rise in price of 38.7% to close the month at KES 1.29. It was followed by Kenya Orchards and Umeme which recorded 31.7% and 30.5% gains to close the month at KES 13.70 and KES 9.68 respectively.

Top Losers: Last year’s best performer, Car & General, fell 24.1% to close the month at KES 36, down from a price of KES 47.45 at the end of Dec 2022. The second worst performer this January was Liberty Kenya Holdings which lost 18.9% of its value while Nairobi Business Ventures was down 14.9%.

Indices: The NSE 20 Share Index was down 1.1% during the month to close at 1657.32. The NSE All-Share Index (NASI) fell 1.1% to close the month at 125.91. The NSE 25 Share Index was down 0.7% during the month to close at 3115.27.

Looking ahead: A busy earnings season lies ahead as banks report their Q4 and 2022 full-year earnings next month. BAT reports its full-year 2022 earnings on the 16th of this month.

Debt Markets

T-bills: In the short-term public debt markets last week, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.581%, 9.997%, and 10.550% respectively. The total amount on offer was KES 24B with the CBK accepting KES 32.4B of the received bids. The performance rate was 208.9%.

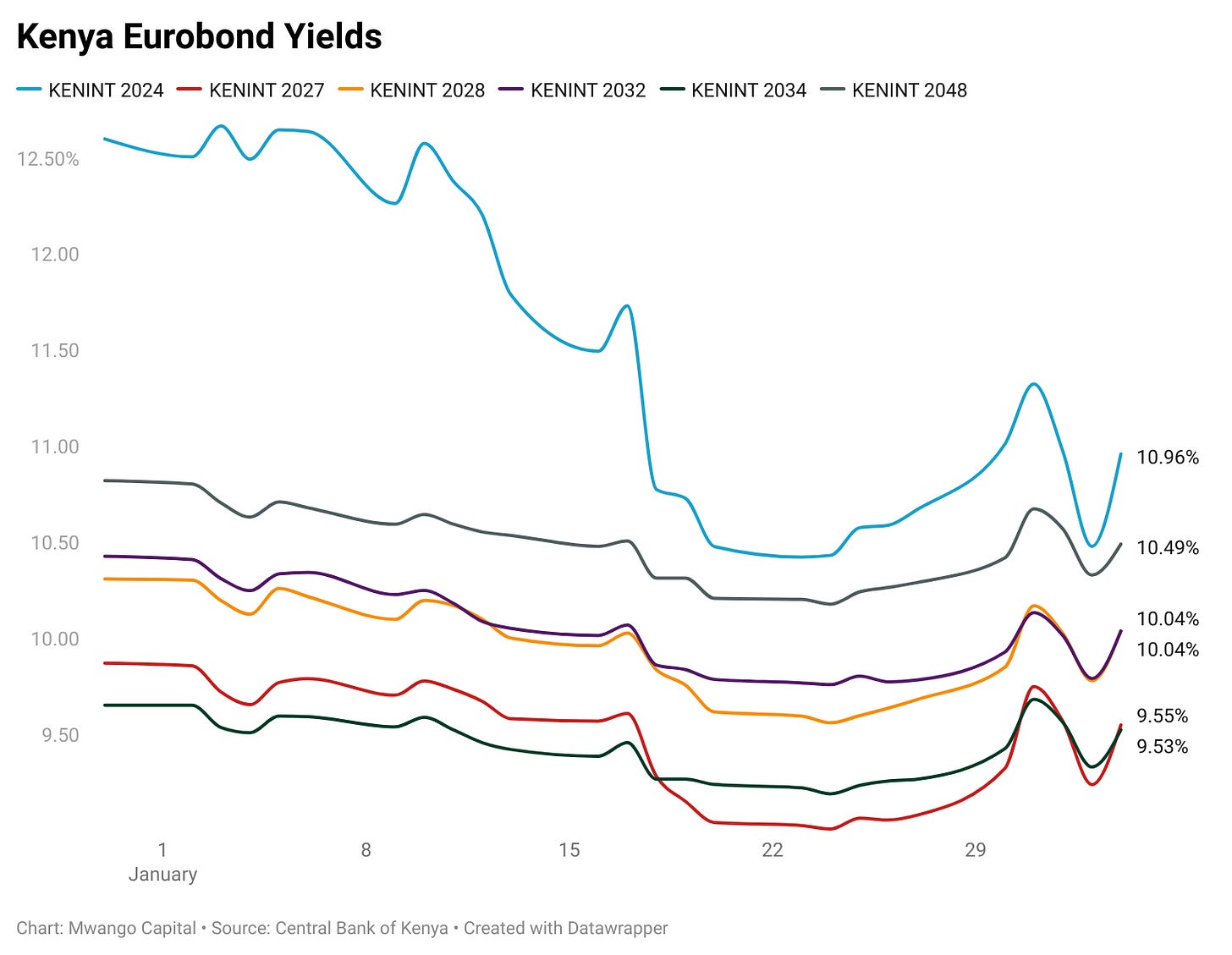

Eurobonds: Last week, the yields edged higher week-on-week across all 6 outstanding papers.

KENINT 2027 recorded the largest gain, increasing by 46.9 basis points (bps) week-on-week to 9.552%.

All yields were down on a Year-To-Date basis. KENINT 2024 fell the most, by 164 bps to 10.963% while KENINT 2034 fell the least; by 12.9 bps to 9.525%.

KENINT 2024 led price gains year-to-date, rising 2.6% to 94.874. On a week-on-week basis, prices fell across the board led by KENINT 203R and KENINT 2048 at -1.8% in both cases.

What Else Happened This Week

🧾 Focus on Taxes: The Kenya Kwanza regime is focused on ensuring that all due tax payments are made. NCBA's tax exemption in 2018 during NIC's merger with CBA and an exemption from Estate Duty for former presidents, Jomo Kenyatta and Daniel Moi, have been major discussion points this week. Over the weekend, Kenya's President and his team were clear that everyone who owed taxes must pay:

"...irrespective of your status, there will be no waiver of taxes for anybody"

Kenyan President Dr. William Ruto

"Everyone has to come on board when it comes to paying taxes because even the President is paying his taxes…There are people in this country who have not been paying taxes since independence"

KRA Chairman, Anthony Ng’ang’a Mwaura

“There is a law governing exemptions. That is the one we are following strictly."

Treasury CS, Njuguna Ndung’u

The NCBA CEO has, however, assured Kenyans that the bank would pay the contentious KES 350M tax waiver if the court determined that it was not entitled to it.

“What I assure every Kenyan is that should the court find that NCBA was not entitled to that waiver… the day the court makes that determination, the following day we will send a cheque of Sh350 million. That I can assure you."

NCBA CEO, John Gachora

💵 Hustler Fund Updates: The President provided some updates on the Hustler Fund on Friday last week. So far, 16.8B has been disbursed to 15M Kenyans with 800K of them having challenges with repayment. Of the remaining 14.2M, 6M with a good repayment record will have increased credit limits from last Saturday. Furthermore, the Hustler Fund Microcredit product will be launched at the end of this month.

💡 Kenya Power CEO: Kenya Power placed an ad for a new MD/CEO in the local newspapers. Late last month, the company proposed a raise in electricity prices, an issue the new CEO will have to deal with.

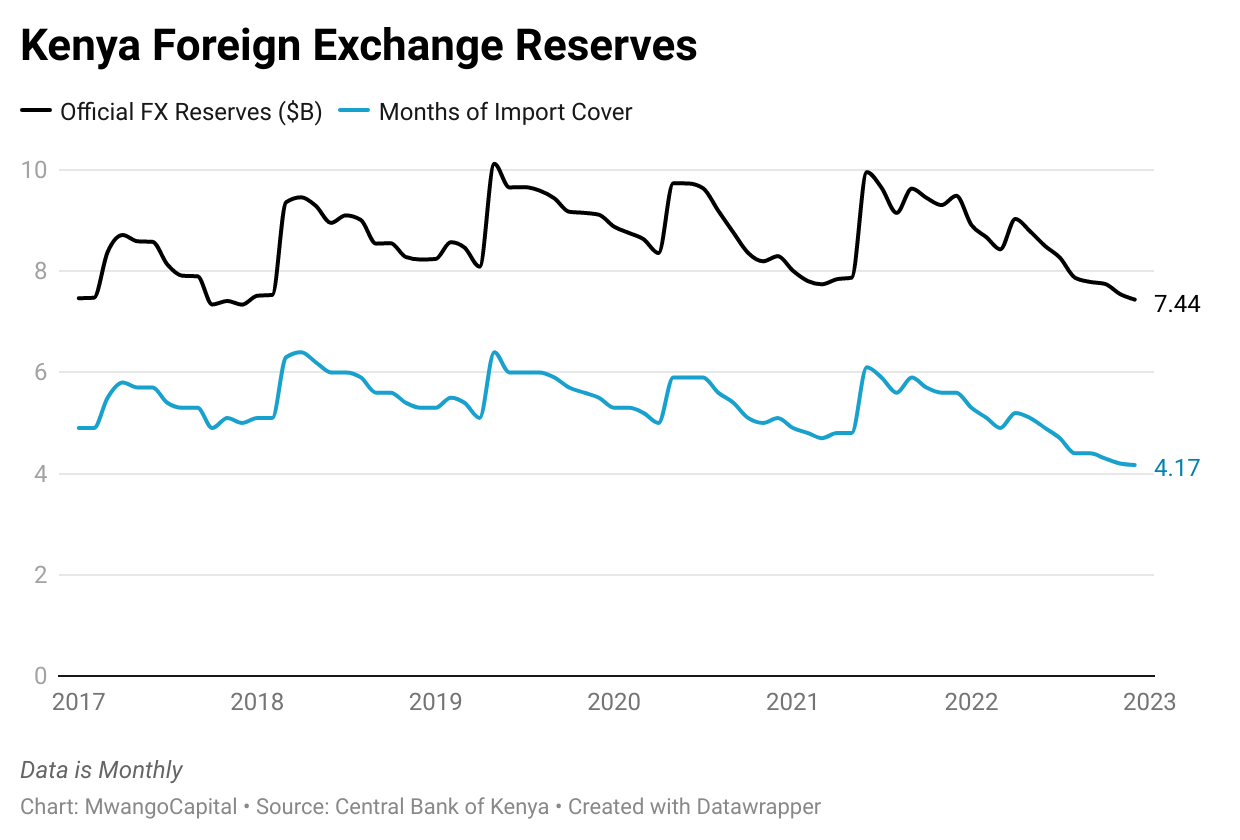

💰 $700M Multilateral Funding: Kenya is set to receive a gross amount of $700M from the World Bank and the IMF in months, according to CBK Governor Patrick Njoroge. The disbursements will definitely ease pressure on foreign currency reserves which reached $7B as of January 27 2023, equivalent to 3.9 months of import cover.

🪓 Safaricom Split: The Kenyan Central Bank Governor hinted at delays in the Safaricom split:

"On the separation, I would only say that this is ongoing and… I don't have an update at this moment. There are delays. So just be patient."

CBK Governor Patrick Njoroge

🦄 Another One! Egypt’s biotech ecosystem, MNT-Halan, this week said it had raised ~$400M in equity [$260M] and debt [$140M] financing giving it a post-money valuation of ~ $1B. Among the investors is Abu Dhabi–based Chimera Investments who gave ~$200M.

“As one of the region’s premier and most progressive investors, Chimera Abu Dhabi brings a unique and dedicated understanding of our business. Having the backing of Chimera Abu Dhabi is of significant support to the execution of our strategy.”

MNT-Halan Founder & CEO, Mounir Nakhla