👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the dollar shortage in the country, Kenya Power's half-year losses, and KenGen's half-year growth in revenues.First off, enjoy a dose of our weekly business news in memes:

King Dollar

There are some signs that all is not well in the forex market as companies and individuals battle to lay their hands on scarce dollars.

Dollar-Based Electricity Bills? This week as Kenya Power reported its half-year results and the significant pressure the depreciating Kenyan shilling has put on its results was clear. As a result, the company wants to bill some customers in dollars. This is in addition to the fact that, currently, electricity bills include a charge for their exchange rate losses.

“To mitigate against the impact of the fluctuation in foreign exchange rates that have continued to adversely affect the financial performance, we are pursuing several initiatives including allowing a section of our customers whose income is in foreign currency (USD and EURO) to settle their electricity bills in these currencies”

Grace Period for Oil Imports: According to the Energy CS Davis Chirchir, Kenya is asking for a grace period of 6 to 12 months to pay for imported oil as compared to the current pay-on-delivery mechanism in a bid to relieve the pressure on the foreign exchange rate. Over the last 1 year, the stock of Kenya’s official forex reserves has fallen by 15.6% to $6.86B, while the import cover has reduced from 5.07 to 3.84 months.

“When products arrive in Mombasa port (today), we pay about $500M within three days. That causes significant pressure. There are guys working around the clock to make sure that the products for April/May are supplied under that framework.”

Energy Cabinet Secretary, Davis Chirchir

NSSF Wants More Eurobonds: The aim here is to reduce the beating their returns get when the shilling moves rapidly against them.

“It’s very important to note that the Kenya shilling has taken a beating against the US dollar and some of these bonds we are holding are shilling-denominated. I am encouraging management to speak to the fund managers and see whether we can increase our threshold of dollar-denominated bonds like Eurobonds for example. That way we hedge against the shilling and its devaluation.”

NSSF chairman, Anthony Munyiri

Parallel Market? The official exchange rate stands at KES 126.8529 to the dollar while the Bloomberg rate stands at 126.93. There have been increased reports of even higher quotes from banks and forex bureaus. Here is what the CBK Deputy Governor Nominee Dr Susan Koech said on the exchange rate during the vetting process:

“What can be done, still on the exchange rate, because right now there is a huge difference between what is being quoted at the Central Bank, according to the Honorable Senator, and what clients are getting possibly in the commercial banks. If we have an interbank forex market that’s working, we would not see this scenario, because the scenario we are in right now is not even allowable because IMF wouldn’t actually allow a deviation of over 5% between what is being quoted by the Central Bank and what is happening in the commercial banks.”

CBK Deputy Governor Nominee, Susan Koech

Her take on how to improve the situation around the exchange rate:

“...short-term is we need to have a vibrant and functioning inter-bank market so that they retrieve flow of forex and number 2 is the aspect of exports diversification so that we can have more exports, and number 3 is to create buffers on our foreign exchange. Most of the imports we’ve been doing are actually food-related items. So if we can have the relevant interventions as a country so that we do not import a lot of food items, then we can be able to manage the depreciation of the Kenya Shilling.”

CBK Deputy Governor Nominee, Susan Koech

Shortage Impacting Ops: In its results for the 6 months to 31st January 2023, Carbacid Investments highlighted the impact the dollar shortage is set to have on its business in the current financial year.

“Global disruptions, inflationary pressures, a weakening currency, and increasing cost of operations will be major challenges for the rest of the financial year. The US dollar shortages in most regional markets are also impacting demand and that is a new challenge the business is adjusting to.”

Forward Guidance? In more late-night musings, Trade CS Kuria issues a guidance/target that the KES will be at 85 vs the dollar, a >30% change from the present rate of KES 127 vs the dollar. The last time the rate was at around KES 85 was in early 2014.

Kenya Power Swings To Losses

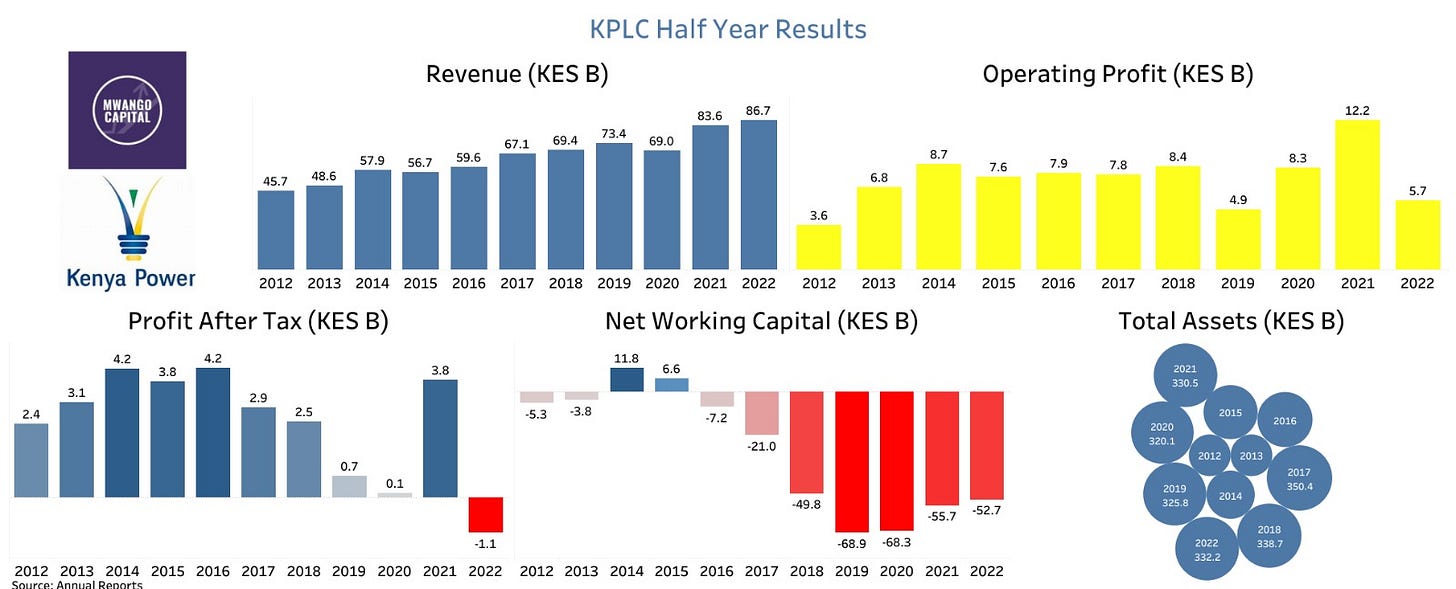

Swinging into Loss: For the six-month period ended 31st December 2022, electricity sales rose by 4.4% to 4,746 GWh on account of increased energy demand. The total revenue for the period was up 3.7% to KES 86.7B but a higher growth in the cost of sales saw the gross margin contract by 27.2% to KES 20.6B. For the first time in 10 years, Kenya Power recorded a net loss amounting to KES 1.1B.

In the News: Electricity costs have been a topic of significant concern recently, with particular attention paid to the cost of power:

Kenya Power, in its most recent financial statements for the fiscal year ended June 2022, sourced 62% of its power units from KenGen and the remaining amount from independent power producers (IPPs). In terms of power purchase costs, the IPPs were paid KES 56.3B (59.3%) for power purchases compared to KES 38.7B paid to KenGen.

As of June 30 2022, Ndindi Nyoro was the largest individual shareholder in Kenya Power, tripling his shareholding in the company to 27.3M shares from 9.1M shares in June 2021.

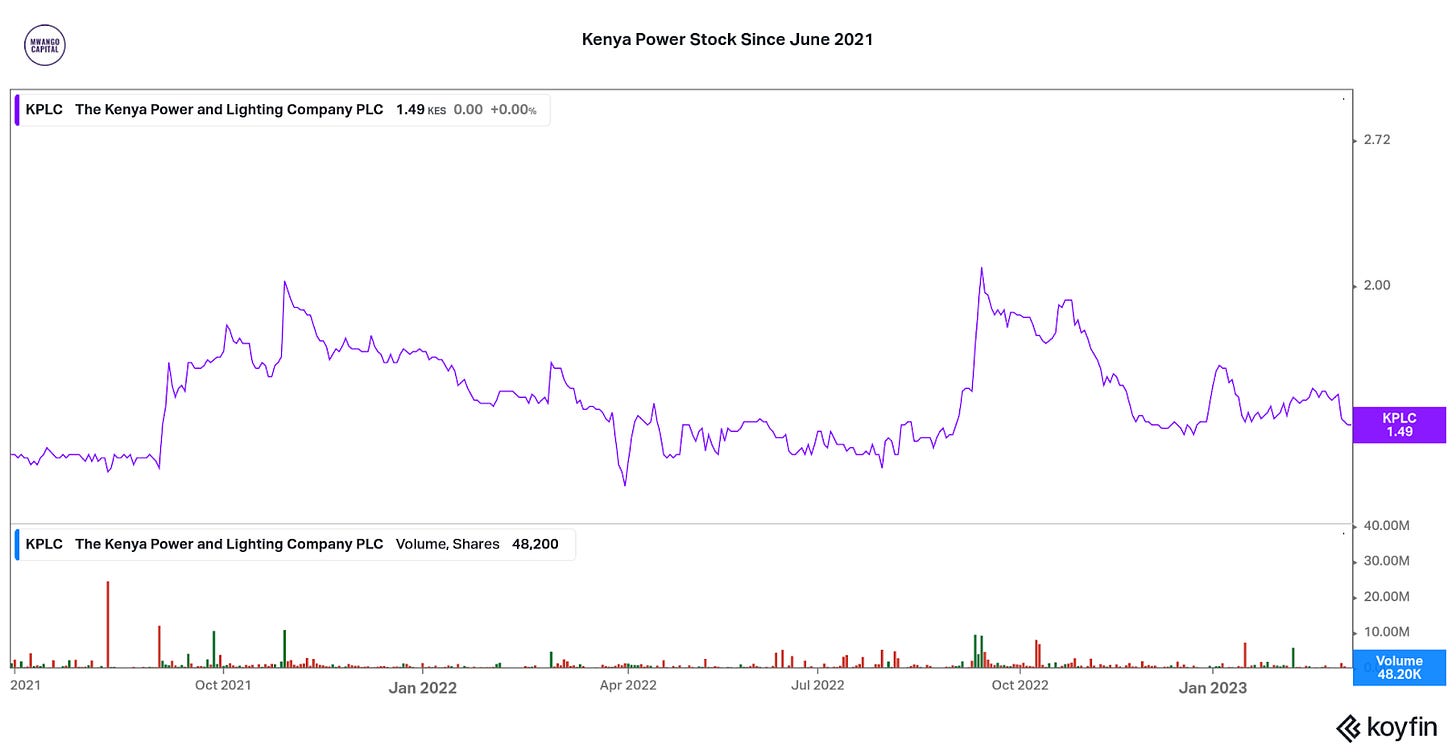

Share Price Trend: Kenya Power stock is up 6.4% from June 2021 to date and down 11.3% over the last 1 year. Its market capitalization is currently at KES 3.1B, equivalent to 0.9% of its total assets.

KenGen Growing Revenues

Highlights: Gross revenue for the six-month period ended 31st December 2022 jumped by 11% year-on-year to reach KES 27.5B. This is attributable to the successful addition of 86MW from Olkaria I Unit 6 geothermal plant resulting in a 4.8% growth in unit sales to reach a total of 4,200GWh. The additional power generation capacity further occasioned a 5.6% increase in the national peak demand to 2,149MW.

Cost Structure: Operating Margins have dropped by half over the last five years falling from 33.4% in 2017 to 17.8% in 2022. This is on the back of rising operating costs which have grown from KES 11.6B in 2017 (52% of gross revenues) to KES 18.1B in 2022 (65.8% of revenues).

Increasing Capacity: KenGen is on schedule to start the development of the 45MW Olkaria I geothermal plant to boost its capacity to 63MW. In the pipeline also are scheduled upgrades of Olkaria I Additional Units 4 & 5 and Olkaria IV to a combined capacity of 340MW from the current 300MW as well as implementation of Olkaria IV Unit 1 & 2 uprating power project. The Cabinet last week approved the lifting of the moratorium on power purchasing agreements as a way of opening the country’s energy sector for continued investments.

Share Price Performance: Over the last year, KenGen stock is down 34.1% to KES 2.38 while in a 10-year period, the stock is down 80.2%.

Bank Earnings Season

A Flood of Earnings: The earnings season for banks starts next week.

Expectations: AIB Analyst Solomon Kariuki has this to say on the 3 things they are paying attention to.

“First, the effect of dollar shortage has had in terms of providing arbitrage opportunities for banks as seen in the jump in forex trading income in Q1-Q3. Secondly, we are also looking out at dividends issued. In FY'21, we felt like the PAT was largely driven by reduced provisioning and banks did not feel comfortable issuing a DPS increase. Now that we expect more "tangible" profits can they offer in terms of DPS? Third, we are also looking out for the effect of the rising yield curve on the mark-to-market valuation of government securities holdings.”

Other Banking News:

Phase 2 of Hustler Fund: President William Ruto launched the second phase of the Hustler Fund, the micro-loan product. The product will target small businesses, offering loans ranging from KES 10K - KES 200K at an interest rate of 6% and accessible over 1, 3, 9 and 12 months.

FCB Bank Acquisition: Premier Bank, a Somalia-based sharia-compliant lender, has received approval from the Competition Authority of Kenya to acquire a 62.5% stake in First Community Bank (FCB). As of 30th June 2022, FCB’s market share in the banking sector stood at 0.38% and had KES 22.2B in deposits.

Absa Bank Kenya: Absa Bank Kenya has picked a new CEO and MD, Abdi Mohamed, who is currently the Managing Director of Absa Bank Tanzania. Yusuf Omari has been the bank’s Acting Chief Executive Officer since the exit of Jeremy Awori who was appointed as the Group CEO of Ecobank Group.

Weekly Capital Markets Wrap

The NSE: In Week 9 of 2023, TPS EA was the top gainer, up 10% week-on-week to KES 13.75, while Stannbic was the top loser, down 8.3% to KES 100. The NSE 20 and NSE 25 indices fell by 1.3% and 0.5% to 1,634.1 and 3,133.3 points, respectively while the NSE All Share Index fell 0.2% to 126.2 points. Equity turnover was up 23.9% to KES 1B while bonds turnover was down 22.6% to KES 9.5B.

T-Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.698%, 10.165%, and 10.69% respectively. The total amount on offer was KES 24B with the CBK accepting KES 23.8B of the received bids. The acceptance rate was 99.1%.

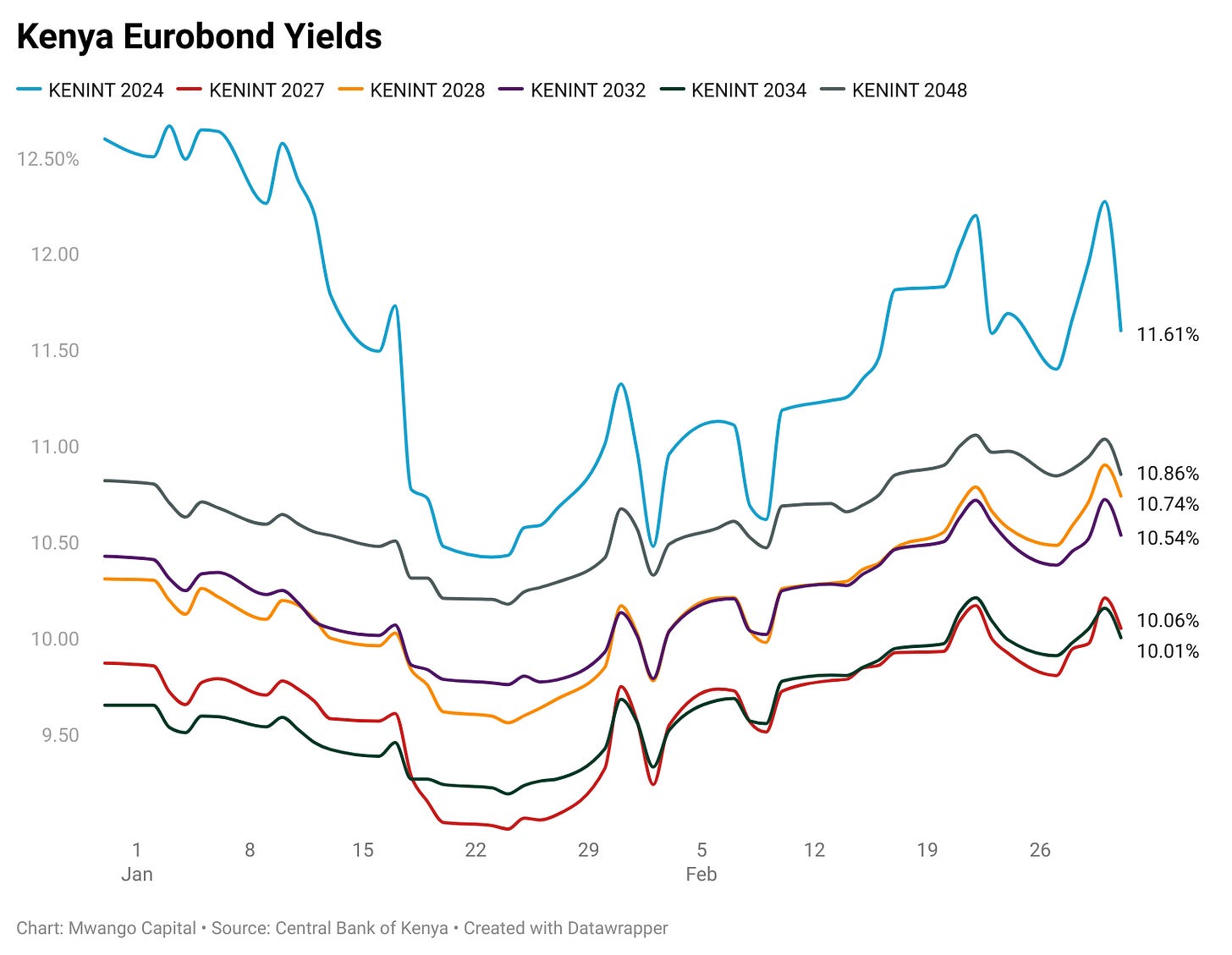

Eurobonds: Last week, the yields were mixed on a week-on-week basis across all 6 outstanding papers.

KENINT 2048 recorded the largest fall, declining by 12 basis points (bps) week-on-week to 10.857%.

All instruments except KENINT 2024 were up on a Year-To-Date basis. KENINT 2024 was down by 99.8bps while KENINT 2028 was up the most, rising by 43.2 bps to 10.744%.

KENINT 2024 led price gains year-to-date, rising 2.1% to 94.428. On a week-on-week basis, prices were mixed, with the KENINT 2048 leading price gains at 1.1% to 77.696, while KENINT 2028 had the most price depreciation at -0.6% to 86.796.

Other Market Gleanings

🔦 | Jumia on the Spot | The COMESA Competition Watchdog has ruled that Jumia will now be liable for the safety and quality of products sold on its platform by third-party merchants.

“In this regard, the Commission… required them to make necessary amendments as follows: Jumia includes a specific provision in its terms and conditions that highlights the entity to be served for legal purposes with its full details, Jumia guarantees the authenticity of such information, to the extent that where the seller cannot be traced in the case of a dispute, Jumia shall be liable as there is a legitimate expectation by consumers that Jumia should have adequate terms and conditions for engaging the sellers.”

📈 | Inflation Rises in February | Kenyan inflation for February 2023 rose to 9.2% from 9.0% recorded in January. The Food & Alcoholic Beverages Index rose the most year-on-year at 13.3%, while the Information and Communication Index recorded the lowest growth at 1.2%. Commodity-wise, diesel jumped the most at 46.1% while House Rent for a single room rose the least at 3.1%.

📉 | Unga Group Sinks into Loss | Revenue expanded by 35% year-on-year to KES 12B on the back of increased prices of finished products that helped to recover price inflation of raw materials. However, the firm incurred an Operating Loss of KES 107.5M as compared to an Operating Profit of KES 79.3M in 2021. The net result for the year was a KES 131.3M loss from a Net Profit position of KES 8.5M in 2021. Unga has attributed the loss to increasing raw material prices and foreign exchange losses.

🧾 | Carbacid Investments Results | For the six months to 31st January 2022, turnover grew by 21.9% to reach KES 855.5M on account of regional economic recovery and new markets for liquid carbon dioxide. Operating Profit in the period was up 15.2% to KES 367M, and the net result for the period was KES 411.7M, up 14.1% and the Board of Directors did not announce a dividend.

“As has been the practice in recent years a final dividend will be considered based on full-year results.”

🗠 | Stanbic February PMI | Kenya’s headline Purchasing Managers’ Index for February fell to 46.6 from 52 in January - an 11-month high. Inflation upended sales, while output and new orders fell, impacting employment numbers.

“At the same time, currency weakness and reports of increased tax burdens fed through to a sharper rise in input costs, and one that was among the fastest seen since the series began in 2014. For the first time in six months, the headline PMI registered below the 50.0 no-change mark in February.”

🗳️ | Nigeria Elects New President | The Independent National Electoral Commission in Nigeria (INEC) announced the results of its General Elections with Bola Tinubu from the ruling All Progressives Congress party emerging as the winner of the Presidential Election. He garnered 35% of the total votes cast, followed by Atiku Abubakar in second place with 28%, and Peter Obi third at 24%. If the elections go unchallenged, Tinubu will be inaugurated on 29th May 2029. In the markets, Nigerian bonds rebounded from a three-day slump occasioned by the chaos around the results. Dollar-denominated papers maturing in 2046 and 2051 rose more than 1% on the dollar on Friday to bring their yields down to 11.91% and 12.31%, respectively; with the sovereign-risk premium falling by 12 bps to 779.