👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the reported dollar shortage, CBK’s 2021 Annual Supervision Report, and Sanlam's FY21 results.First off, enjoy our weekly business news in memes brought to you by DTB Kenya:

Dollar Shortage

Is There a $hortage? Earlier in the week, the Kenya Association of Manufacturers (KAM) said its members were having problems sourcing dollars in the market for importing raw materials, intermediate inputs, and capital goods. According to KAM, the dollar shortage runs the risk of creating a parallel shadow market.

“Although the formally quoted exchange rate for the US dollar in the market is hovering around KES 115-116, none of our members can access currency at that price in the market. The real market price is now above KES 120. Neither are banks able to trade dollars between themselves, further exacerbating the supply constraints. The risk here is that we are creating a parallel shadow market with unwanted consequences.”

Parallel Market Risk: In a post-MPC briefing this week, the Governor of the Central Bank of Kenya responded to questions regarding concerns by KAM on the dollar shortage. The Governor noted that there was no shortage and that there is sufficient liquidity in the forex market.

“The [forex] market generates and distributes something like $2B every month. So if you have somebody or a sector which is importing $90 million or $100 million, I think that’s nowhere near the $2 billion that we are putting out there. [...] What’s clear is that… they should understand that they are small in that sense and sort of go to the market like everyone else. There are no favourites in the market.”

CBK Governor, Dr. Patrick Njoroge

Implications: It seems like the prevailing dollar shortage is hurting production with Pwani Oil halting production temporarily partly because of this. The current weight of evidence favors the Kenya Association of Manufacturers’ stand.

CBK’s 2021 Annual Supervision Report

Below are some highlights from the report:

Banking Environment: In 2021, the banking environment had 22 local players and 17 foreign players. In terms of market size, the 9 large banks took up the largest market share at 74.8% while medium and small banks jointly accounted for 24.2%. The total net assets in the banking sector were up 11.4% to stand at KES 6T as of December 2021.

Mergers and Acquisitions: In the year under review, there were two acquisitions in the banking sector. Sanlam African Bank of Djibouti acquired 100% of Uwezo Microfinance Bank LImited, and Wakanda Network Limited of UK acquired 85% of Choice Microfinance Bank.

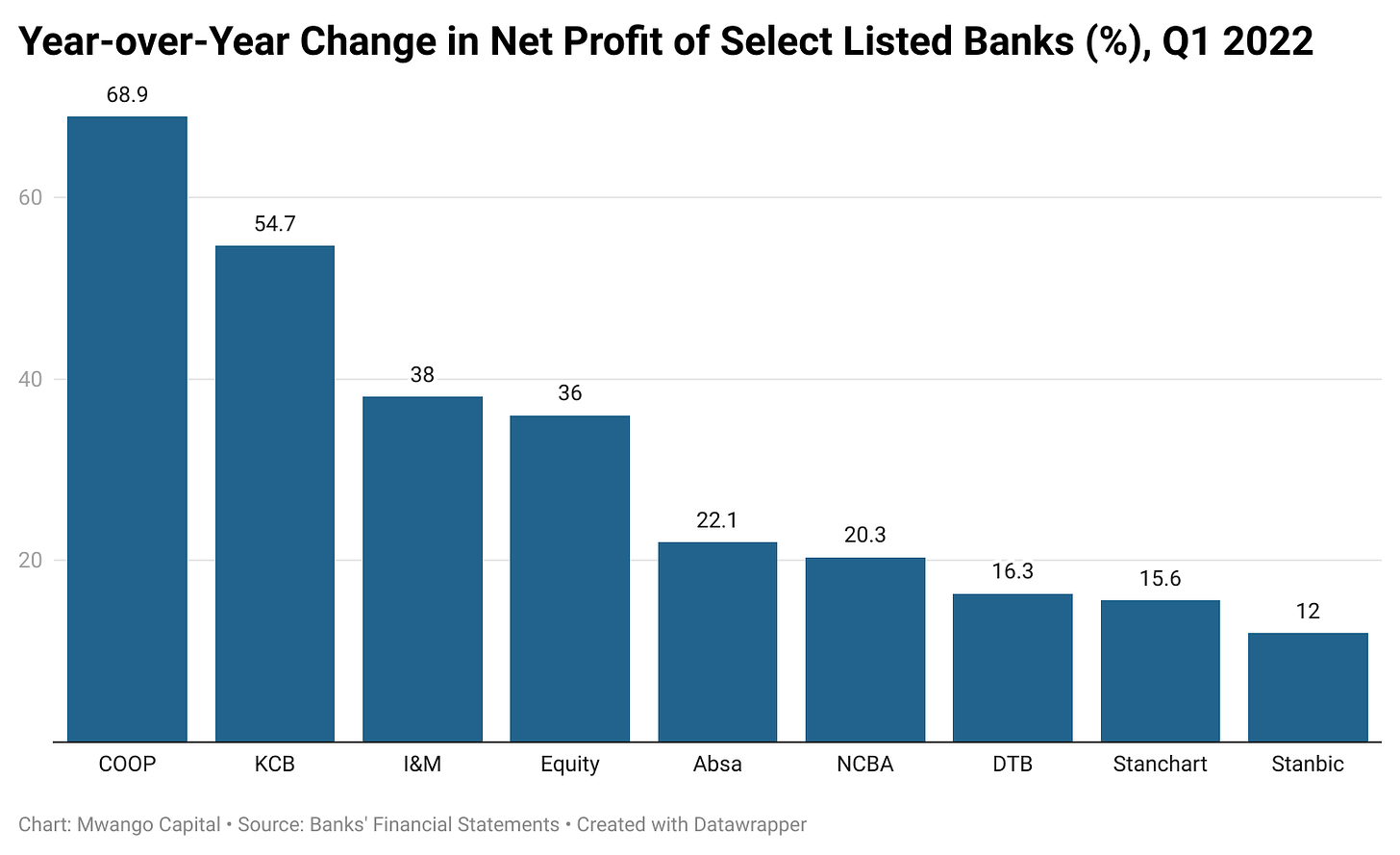

Banking Sector Performance: The combined revenue of the banking sector increased by 9.3% to KES 630.2B in Dec 2021, while expenses fell by 6.7% to KES 433.1B. Microfinance banks posted a combined loss of KES 877M for the year compared to a KES 2.2B loss in 2020. Only 4 microfinance banks reported a profit.

Regional Plays: DRC accounts for the most of regional assets of Kenyan banks subsidiaries across the region at 34.5% - a figure that has grown from 12.1% in 2019. KCB’s acquisition of BPR Rwanda saw the Kenyan lender increase its regional branches to 196 in 2021 from 58 in 2020. The second-order effect of the acquisition is that Rwanda effectively became the country with the most number of branches of Kenyan banks at 197 from 58 in 2020.

You can access more on this here.

Sanlam FY 2021 Results

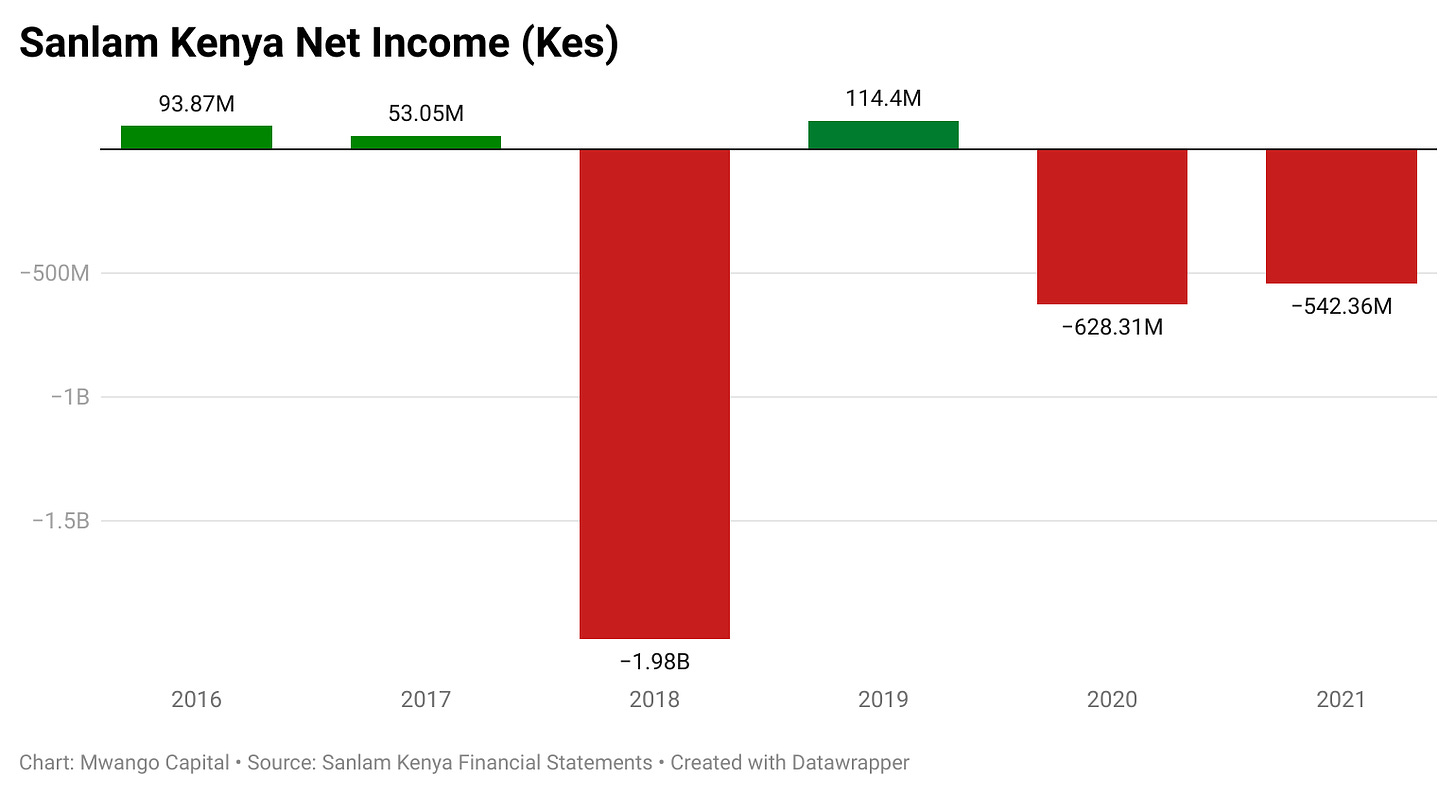

Reduces Loss: Sanlam’s 30% Revenue growth to KES 12.4B in FY 2021 was not sufficient to outpace expenses growth which rose 28% to KES 12.8B. This resulted in a full-year loss of KES 542.2M [2020: KES 628.3M]

Banking on Life: All its units reported a loss except Sanlam Life Insurance which recorded a 28.7% jump in profit to KES 641.9M. The Life unit also helped to buoy 2020 full-year results by posting KES 498.5M in net income at a time when other units ran losses. Regionally, the recent joint venture between Sanlam Africa and Allianz will have insurance solutions as a key area of focus across its markets.

“At Sanlam Kenya and through our Sanlam Life Insurance Limited and Sanlam General Insurance Limited, we are resilient and remain well positioned to continue meeting the unique client needs in the General and Life Insurance space as we embark on an accelerated business recovery journey.”

Sanlam Group CEO, Dr. Patrick Tumbo

Good to Know: NSSF’s realignment of its fund managers saw Sanlam get a KES 46B reallocation in assets under management from Britam. This pushed its portfolio to KES 288.8B from KES 226.9B, effectively becoming Kenya’s largest pension fund manager.

More information on Sanlam’s FY 2021 results here.

Sasini H1 2022

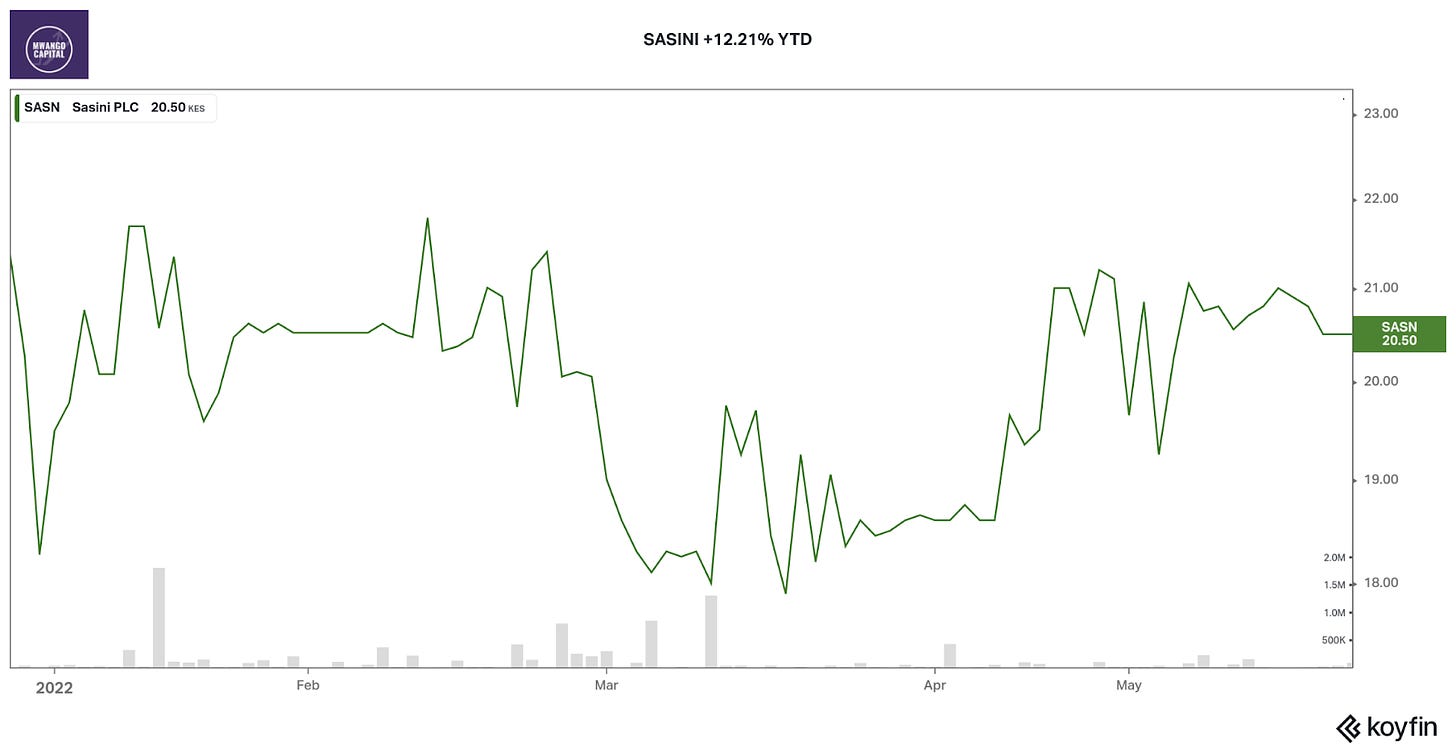

100% Interim Dividend: Turnover increased by 65.3% over the past year to KES 3.3B while the bottom line came in 244.8% higher to KES 421.3M, translating to a 12.6% net margin. The Board of Directors has recommended the payment of an interim dividend of 100% (KES 1.0) on account of good performance for the trading period. At the bourse, Sasini is up 12.21% YTD.

You can access the full results here.

Finance Bill 2022

These are the highlights of the outcome of Parliament’s deliberations last week on the Finance Bill.

Capital Gains Tax: MPs endorsed the proposal to set capital gains tax at 15% from the current 5%.

“The Committee is proposing to retain the Capital Gains Tax as provided for in the original bill at 15%. [...] Our neighbours have it at 30% in Tanzania, 20% in Uganda. The only proviso is on the issue of indexation so that the property does not carry the inflation value, because [if so ...], then you can be paying taxes on inflation instead of the actual value of the property.”

Finance & Planning Committee Chairperson, Gladys Wanga

Excise Tax: The National Assembly dropped the amendment to levy excise duty fees charged on advertisement revenue by media houses. Kikuyu MP Kimani I’chingwa proposed the introduction of an excise tax at KES 50 per unit of ready-to-use imported SIM Cards.

Liquid Petroleum Gas: MPs endorsed the proposed amendment to the finance bill to reduce VAT on LPG to 8% from 16%. As an aside, Kenya is planning to challenge Tanzania’s domination in the LPG market through the construction of the biggest import and storage gas facility in Mombasa.

Inflation Adjustment: The proposal to have inflation adjustment on excise tax done once every year was thrown out in favor of annual adjustment.

Derivatives Trading: Parliament has exempted the trading of derivatives from income tax.

Fertilizer: MPs zero-rated the supply of fertilizer.

Banking Roundup

KCB Statutory Actions: Kenya’s second-largest lender by assets this week seized English Point Marina and placed its holding firm Pearl Beach Hotels under statutory management over a KES 5.2B debt. KCB has also sued Nairobi County over a KES 4B loan default stretching back to 2011. The lender is seeking KES 4.2B and KES 900M in accrued costs.

Stanbic Shareholding Restructuring: Stanbic Africa Holdings Limited (SAHL) completed the acquisition of 31,669,091 shares in Stanbic Holdings plc from a target of 59,000,000 shares. The outcome of the tender offer pushes the shareholding of SAHL in Stanbic to 74.92%.

I&M Completes Stake Purchase: The lender has purchased the remaining 35% stake in I&M Burbidge Capital. This makes the advisory unit a wholly-owned subsidiary of the bank.

What Else Happened This Week

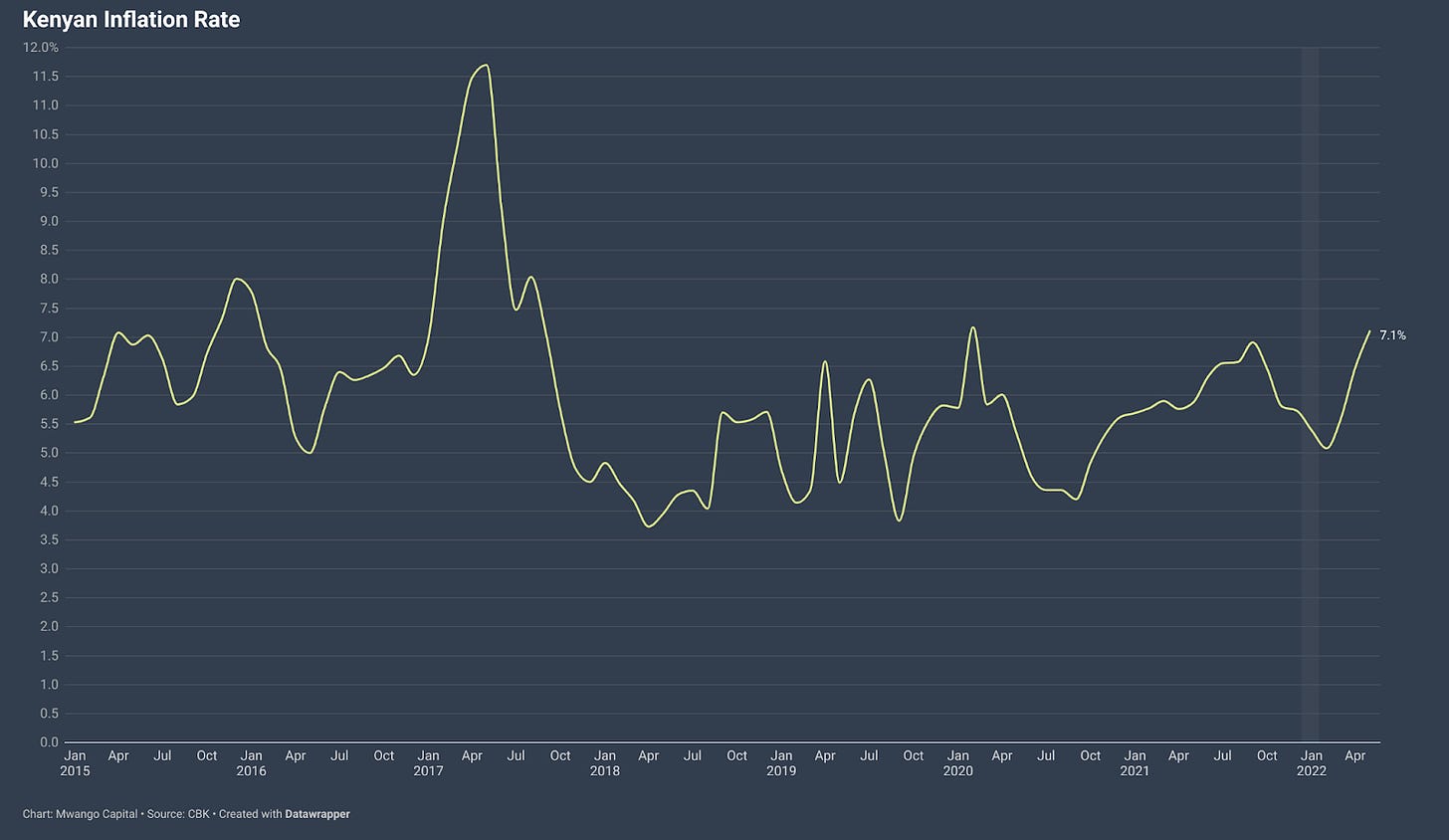

💸 Inflation Watch: Kenya’s inflation rose by 63 basis points to 7.1% in May. The Food and Non-Alcoholic Beverages Index rose the most yearly by 12.4%. Commodity-wise, cooking oil has appreciated the most over the year by a whopping 47.1%. Over in Uganda, May inflation came in at 6.3%. [Mwango Capital]

🔺 Debt Ceiling Raised: In a gazette notice, the National Treasury has raised Kenya’s debt ceiling to KES 10T from KES 9T. The latest data from the Central Bank of Kenya shows that Kenya’s total public debt stands at KES 8.4T. [Mwango Capital]

💳 M-Pesa Virtual Visa Card: Safaricom and Visa introduced the M-Pesa GlobalPay Visa Virtual Card aimed at facilitating payments in over 200 countries through Visa’s network. The card will be exclusively for international and online payments outside the country, including e-commerce platforms and global apps. [Mwango Capital]

“M-PESA has over the past fifteen years evolved from a simple money transfer service to become a robust payment platform and driver of financial inclusion for Kenyans. This has paved the way for numerous innovative services and by partnering with Visa to provide the M-PESA GlobalPay Visa Virtual Card, we are looking to bridge the gap for our customers who would like to use M-PESA anywhere across the world.”

Safaricom CEO, Peter Ndegwa

⚡ Another Kenya Power Capital Injection: The National Treasury has extended a subsidy of KES 7.05B to KPLC. The injection is aimed at delivering the second cut of electricity bills by 15% without impacting its cash flows. The funding is in addition to a KES 7.5B bailout received in the current financial year. [Mwango Capital]

🥊 DRC - Rwanda row: The two countries are at loggerheads with DRC accusing Rwanda of backing the M23 rebel group in Congo. There has been renewed fighting near the border of the two countries. The escalation has seen RwandAir cease operations in DRC. [Bloomberg]

Interest Rates Watch

Kenya: The Central Bank of Kenya moved to hike rates for the first time since 2015 by increasing the Central Bank Rate by 50 basis points to 7.5%.

Uganda: In light of rising inflationary pressures, the Bank of Uganda hiked its benchmark interest rate by 100 basis points to 7.5%.

The Gambia: Monetary authorities increased the key interest rate by 1 percentage point to 11%.

Mauritius: The Bank of Mauritius raised its key Repo Rate by 25 basis points to 2.25% on the heightened risk of inflation.

Angola: The Monetary Policy Committee of the National Bank of Angola maintained its basic interest rate at 20%.