👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover FY2024 Results from Kenyan Banks, Proposed Roads Bond, and Extension of the G-to-G DealReview of Kenyan Banks' Performance in FY 2024

Banks Shift to Government Paper: Kenyan banks continued to increase their exposure to government securities, reducing lending to the private sector despite declining returns from domestic debt.

Stanbic Bank recorded the highest year-on-year growth in government paper holdings, rising by 70.6% to KES 77.4B, while Absa Bank followed with a 37.6% increase to KES 130.6B. KCB Bank maintained the largest absolute position at KES 302.8B, despite a 13.2% decline from the previous year. Equity Group held KES 300.9B, while NCBA reduced its holdings by 11% to KES 180.8B.

Loan Book Contraction: Kenyan banks experienced a decline in loan book growth in FY 2024, with all lenders reporting negative growth compared to FY 2023. Banks attributed this trend to the strengthening of the Kenyan shilling, which impacted the valuation of loans issued by regional subsidiaries, alongside reduced demand for credit.

KCB Bank retained the largest loan book at KES 990.4B, though this marked a decline from KES 1.1T in FY 2023. Stanbic Bank recorded the steepest drop, with loans to customers falling by 11.3% to KES 230.3B, followed by NCBA, which saw a 10.4% reduction to KES 302.1B.

Despite the overall contraction, digital lending remained strong, with KCB disbursing KES 1.1B daily via mobile loans, while Absa’s Timiza disbursed KES 25B, up 21% year-on-year.

Interest Income Growth Defies Loan Book Contraction: Kenyan banks recorded strong growth in interest income from loans and advances in FY 2024, despite a decline in lending to customers.

I&M Bank led in growth, posting a 32.3% year-on-year increase to KES 48.3B, followed by NCBA Group, which grew 27.8% to KES 46.5B. KCB Group held the largest interest income in absolute terms at KES 153.6B, while Equity Group recorded the slowest growth at 5.3%, reaching KES 107.7B.

Interest income from government securities also saw strong gains, with Stanbic Bank leading at 97.4% growth to KES 10B, followed by I&M Bank, up 38.6% to KES 16.6B. NCBA was the only bank to report a decline, with interest income from government securities falling 5.6% year-on-year to KES 25.6B.

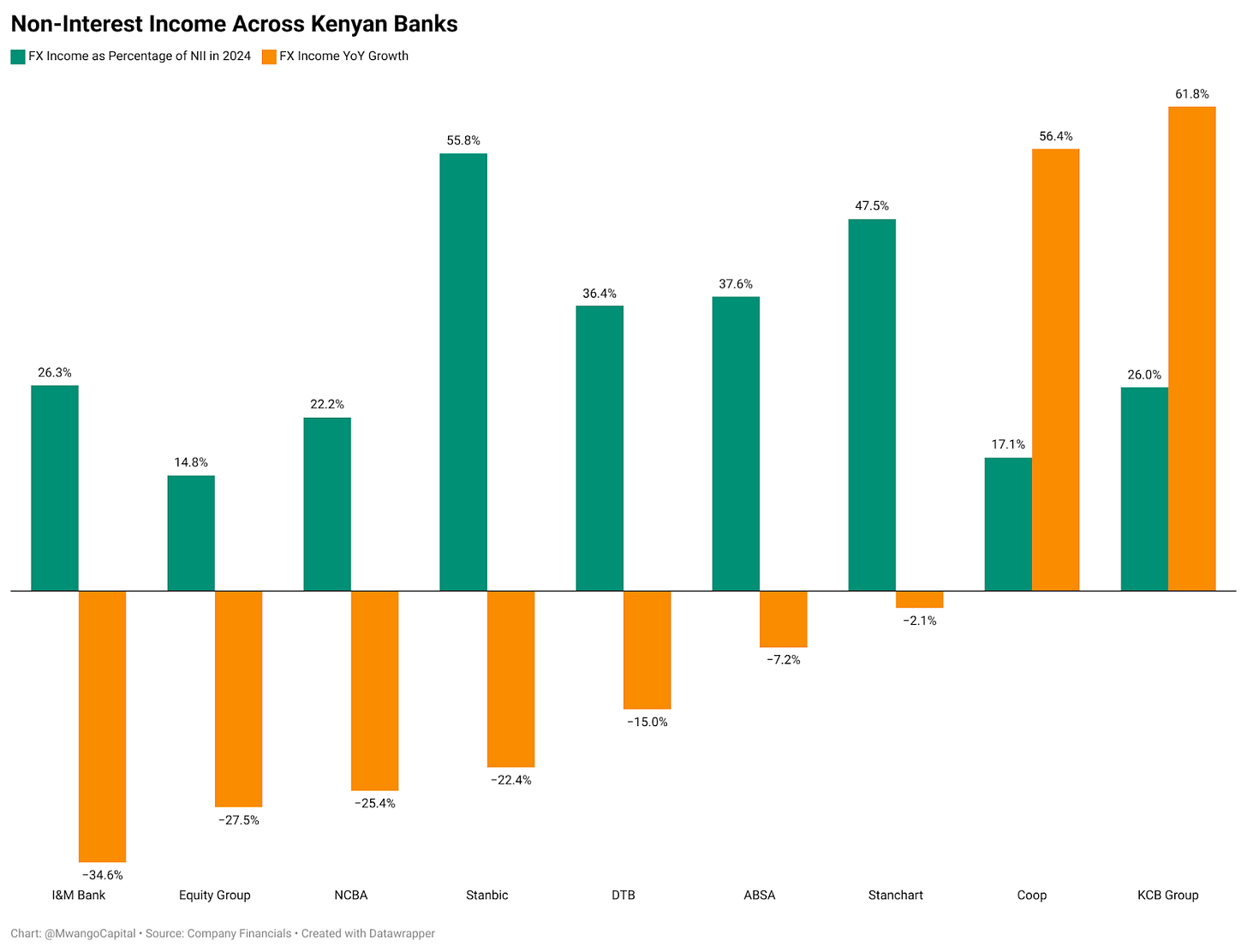

Slow Growth in Non-Interest Income as Forex Earnings Decline: Non-interest income growth remained sluggish across banks in FY 2024, except for Standard Chartered Bank, which posted a 40.4% increase to KES 17.4B, driven by a rebound in other income to KES 2.5B from a KES 1.9B loss in FY 2023. Stanbic Bank recorded the steepest decline, with non-funding income falling 22% to KES 12.5B.

Forex trading income also took a hit due to reduced dollar demand following the appreciation of the Kenyan shilling. However, KCB Bank and Co-op Bank defied the trend, posting 61.75% and 56.4% growth in forex income to KES 17.4B and KES 4.9B, respectively.

Rising Interest Expenses: Interest expenses surged across all banks in FY 2024, driven by the high-interest rate environment that made government securities more attractive to depositors. With significant returns on T-bills and bonds, many depositors opted to shift funds away from regular accounts in search of higher yields, increasing banks' cost of funds.

Stanbic Bank recorded the sharpest increase in interest expenses, rising 105.75% to KES 25.4B, followed by Standard Chartered, which saw an 83.4% jump to KES 5.5B. Equity Group had the slowest growth in interest expenses, up 20.3% year-on-year to KES 61.6B.

Loan Loss Provisions: In FY 2024, most Kenyan banks reduced their loan loss provisions, signaling improved asset quality or more cautious lending strategies. Stanbic Bank made the steepest cut, reducing provisions by 51.8% to KES 3.5B, followed by Equity Group, which trimmed its provisions by 43.3% to KES 20.3B. Despite a reduction, KCB Group maintained the highest stock of provisions at KES 29.9B.

On the other hand, Co-op Bank and I&M Bank bucked the trend, increasing their provisions by 44.2% and 13.2% to KES 8.6B and KES 7.8B, respectively.

Non-Performing Loans: Kenyan banks reported mixed movements in gross non-performing loans (NPLs) in FY 2024, reflecting varying credit quality. Absa Bank recorded the highest growth, up 20.5% to KES 42.5B, while KCB Group rose 8.4% to KES 225.7B and held the largest stock of NPLs in the sector.

On the flip side, Stanbic Bank saw the steepest decline, down 51.8% to KES 3.5B, followed by Standard Chartered, which dropped 30.2% to KES 12.0B.

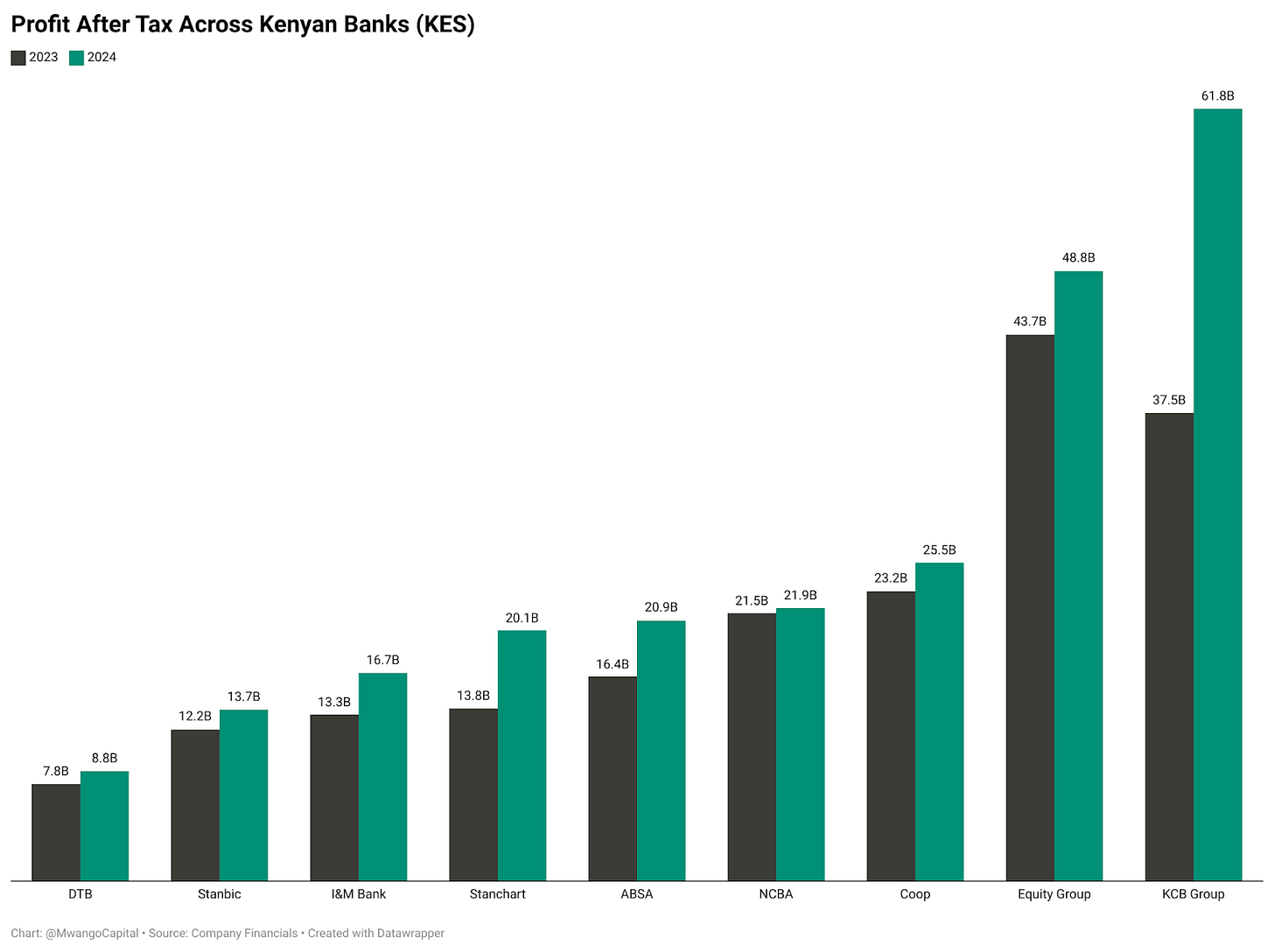

Profit After Tax: Kenyan banks posted solid profit growth in FY 2024 as they passed on the elevated interest rates to borrowers, driving strong earnings from both loans and government securities.

KCB Group led the sector with a 64.9% rise in net profit to KES 61.8B, followed by Standard Chartered with a 45.0% increase to KES 20.1B. Absa and I&M Bank also recorded notable growth at 27.5% and 24.8% respectively. NCBA’s profit remained flat with a marginal increase of 1.9% to KES 21.9B.

Dividends: Kenya’s top banks announced record dividend payouts for FY 2024, driven by strong earnings. KCB declared KES 3.00 per share on the back of a 64.9% profit surge, while Equity paid out KES 4.25 per share. Standard Chartered led with KES 45 per share, marking a 55% jump.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Markets Wrap

NSE Weekly Recap: Week 14 (28 - 4 April 2025):

Transcentury (+11.1%) surged to KES 1.40, while ScanGroup Limited (-9.5%) dropped to KES 2.95, leading the gainers and losers.

Markets showed slight positive movement—NASI (+0.54%) at 131.5, NSE 20 (-0.08%) at 2,225.1, NSE 10 (+0.13%) at 1,344.1, and NSE 25 (+0.11%) at 3,536.2.

Equity turnover increased by 56.6% to KES 2.1B, and bond turnover fell by 49.5% to KES 35.8B.

Foreign investors made up 49.8% of total turnover, with KES 1.04B in trades.

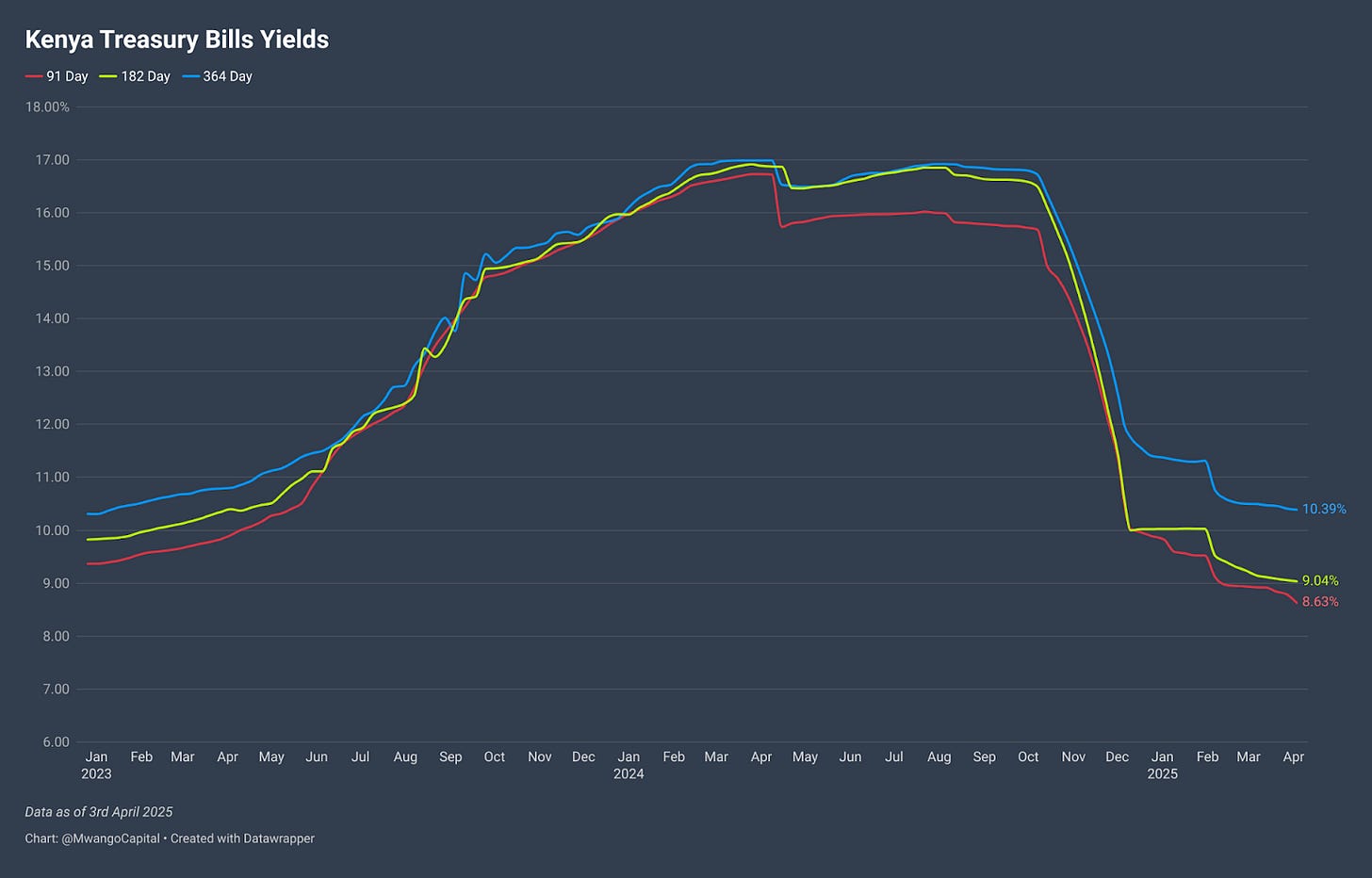

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 169.5%, up from 61.44% the previous week. Investors placed bids totaling KES 40.7B, with the Central Bank of Kenya (CBK) accepting KES 40.5B out of the KES 24B on offer. Yields on the 91-day, 182-day, and 364-day T-bills declined by 16.13, 2.33, and 2.52 basis points to 8.6294%, 9.035%, and 10.3865%, respectively.

Eurobonds: Last week, yields on the seven outstanding Eurobonds rose, led by the KENINT 2038 bond, which gained 204.4 basis points to 10.64%. The KENINT 2032 bond followed, climbing 132.2 basis points to 11.251%. On average, Eurobond yields increased by 132.51 basis points week-on-week.

Market Gleanings

📄| Govt to Float KES 175B Bond | The government plans to float a KES 175B bond within the next 90 days to clear pending contractor payments and restart stalled road projects. About 80% of the funds are expected from external markets. A KES 74B bridge loan from Trade Development Bank and Afreximbank is already being used to pay contractors 40% of their outstanding dues, enabling work to resume. The short-term loan, issued at 7.8% interest over two years, will be repaid using proceeds from the upcoming bond.

⛽| Govt Renews G-to-G Deal | The government has renewed its fuel import agreement with three Gulf state-owned firms—Saudi Aramco, Emirates National Oil Co., and Abu Dhabi National Oil Co.—for another 24 months under a 180-day credit plan. The extension, set to begin later this year after current shipments are completed, comes with reduced freight and premium charges: diesel down 11% to USD 78/ton, gasoline by 7% to USD 84, and jet fuel by 13% to USD 97.

🔉| Sanlam Kenya Announces Rights Issue | Sanlam Kenya Plc is set to raise up to KES 2.5B through a Rights Issue opening on 25 April and closing on 12 May 2025, following approvals from the CMA, NSE, IRA, and South Africa’s Reserve Bank. The funds will be used to recapitalize the company’s balance sheet by settling a loan facility from Stanbic Bank and reducing long-term debt. The Rights Issue is fully underwritten by Sanlam Kenya’s parent company, Sanlam Allianz Africa.

🏦| KBA Pushes For Rate Cut Ahead of MPC Meeting | Ahead of the Monetary Policy Committee (MPC) meeting on 8th April, the Kenya Bankers Association (KBA) is advocating for a further reduction in the Central Bank Rate (CBR). The KBA argues that, while inflation remains stable, economic activity is fragile due to weak credit growth and global uncertainties. They emphasize that previous rate cuts have had limited impact on private-sector lending and that a further reduction could stimulate credit growth.

🟥| Trump Announces New Tariffs | On Wednesday, President Donald Trump unveiled a new set of tariffs, arguing they are essential to address trade imbalances and protect American jobs. The key elements of the plan include a 10% baseline tariff on all imports, effective 5 April, which will be levied on companies bringing foreign goods into the US. Additionally, specific tariffs will be imposed on 60 countries deemed "worst offenders," with rates ranging from 20% to 54%, affecting key trading partners like the EU, China, and Vietnam. Kenya will face a 10% tariff, similar to the rate it charges the US. Canada and Mexico are excluded from these new tariffs.

📄| Jubilee Holdings FY 24 Results | Jubilee Holdings reported solid performance for FY24, with total assets rising by 12% to KES 213.6B. Insurance revenue increased by 13.5%, reaching KES 25.7B, while the insurance services result grew by 20% to KES 699.9M. Profit after tax saw a significant increase of 82.5%, totaling KES 4.7B, and earnings per share rose by 80.6% to KES 65. The company also declared a dividend per share (DPS) of KES 13.5 (2023: KES 14.3).

📊| Stanbic PMI March 2025 | Kenya's private sector activity saw its fastest expansion in 10 months in March. The Stanbic Bank Kenya Purchasing Managers' Index (PMI) rose to 51.7 in March, up from 50.6 in February, marking the highest reading since May 2024. The growth was driven by improved performance across most sectors, although manufacturing experienced a contraction.