👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover NSE’s first listing in four years with SKOL’s debut, Zenith Bank’s push into Kenya’s banking sector, and a groundbreaking KES 44.8B infrastructure ABS reshaping public finance.An End to NSE Listing Drought in Sight

NSE Ends Listing Drought with SKL: Packaging firm, Shri Krishana Overseas Limited (SKOL), a packaging materials manufacturer, has secured regulatory approval to list 50.5 million shares on the Nairobi Securities Exchange (NSE). The listing will be by introduction at a price of KES 5.90, valuing the transaction at KES 298 million. This is the NSE’s first new equity listing since 2020 and the 15th listing by introduction since 2006.

SKOL will list on the SME Market Segment, (formerly GEMS), a route designed for companies seeking a lighter regulatory burden than IPOs. Listings by introduction are used when firms already meet minimum shareholder thresholds or have conducted private placements, bypassing public capital raising. SKOL’s listing does not involve raising new capital, and the company has appointed Synesis Capital as the lead transaction advisor and MWC Legal as the legal advisor. The listing was approved by both the Capital Markets Authority (CMA) and NSE under the 2023 Capital Markets Regulations.

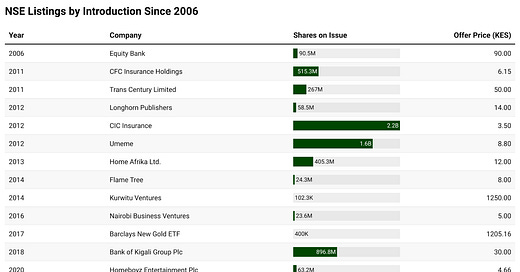

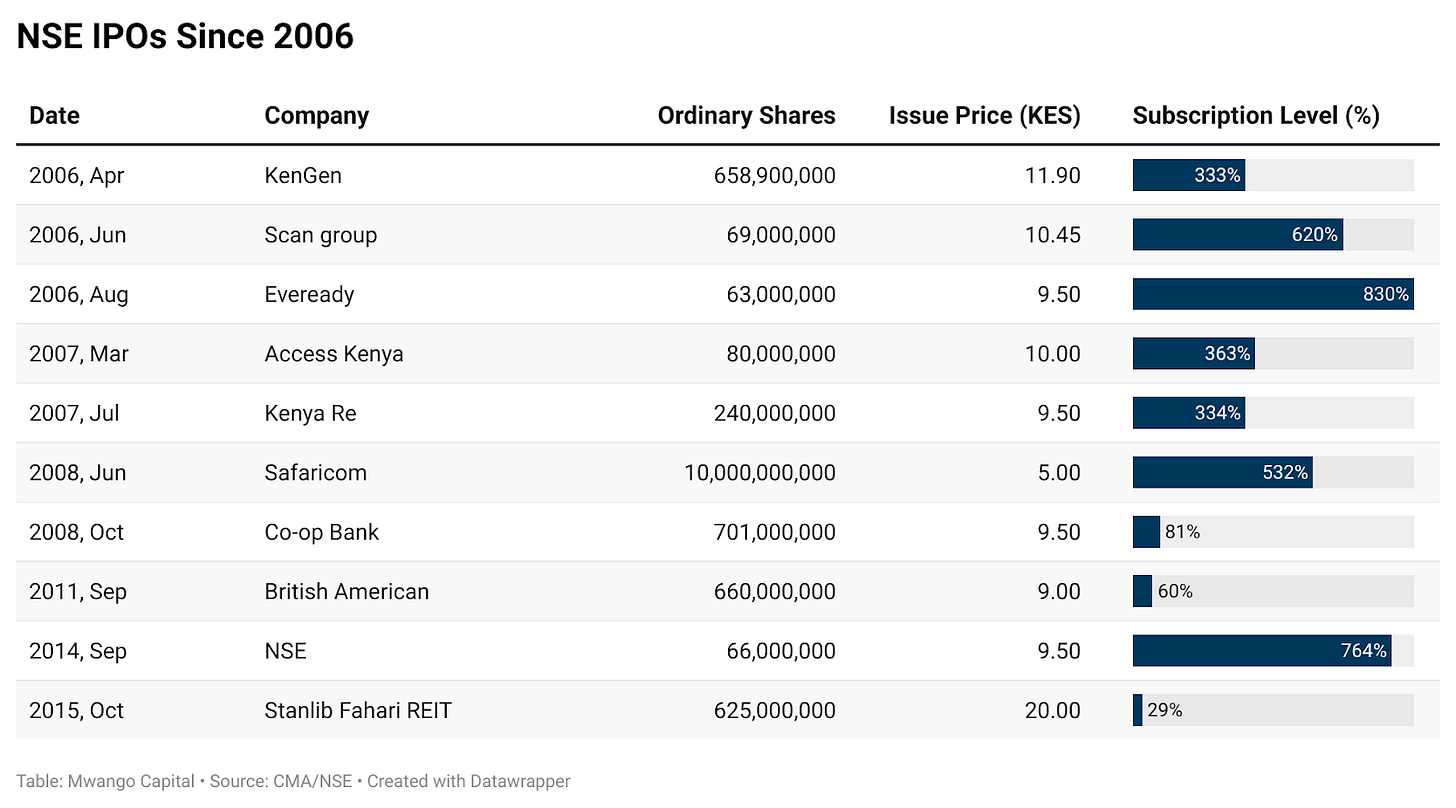

NSE’s Go-To Route for Listings: SKOL joins 14 other companies that have been listed by introduction since 2006, pushing total issued shares under this route to over 6.1 billion. Historical examples include Equity Bank (2006, 90.5M shares at KES 90), CIC Insurance (2012, 2.18B shares at KES 3.50), and Bank of Kigali (2018, 897M shares at KES 30). Offer prices have ranged from as high as KES 1,250 (Kurwitu Ventures, 2014) to as low as KES 3.50 (CIC), reflecting wide variance in company profiles.

SKOL’s KES 5.90 offer aligns with mid-tier SMEs, signaling continued use of this mechanism for strategic market entry without dilution. With only two IPOs on the NSE since 2011, listings by introduction have become the default entry route for firms navigating bearish markets, foreign investor dominance, and tighter capital market regulations. The NSE’s 2025–2029 strategy targets 40 new listings and nine million additional retail investors, with SKOL’s listing serving as a critical early benchmark.

Kenya Pipeline Teased: While in London this week, President William Ruto reaffirmed Kenya’s intention to deepen domestic capital markets by announcing plans to list Kenya Pipeline Company (KPC) at the NSE through an IPO before year-end. This comes despite a lack of follow-through on earlier commitments made in 2022 to bring 6–10 public sector firms to the NSE, alongside private companies such as Credit Bank and Bio Foods. Although the Cabinet approved plans in June 2024 to divest minority stakes in select parastatals, implementation remains pending. If executed, the KPC IPO would be the first major listing in over a decade. The key question now is whether this marks a credible inflection point or yet another rhetorical high watermark.

“Cabinet approval for the privatisation of Kenya Pipeline has yet to be granted, and indeed, tendering for the transaction advisors by way of an RFP has yet to be initiated. In an ideal world, should the above approvals come through, the earliest one would expect in respect of any SoE coming to the market by way of an IPO would be between 6-9 months from the date of the issuance of the RFP. Therefore, it is highly unlikely that we will see Kenya Pipeline come to the market in 2025. At the earliest, we could possibly expect it in Q1/Q2 2026”

KASIB Director, Ewart Salins

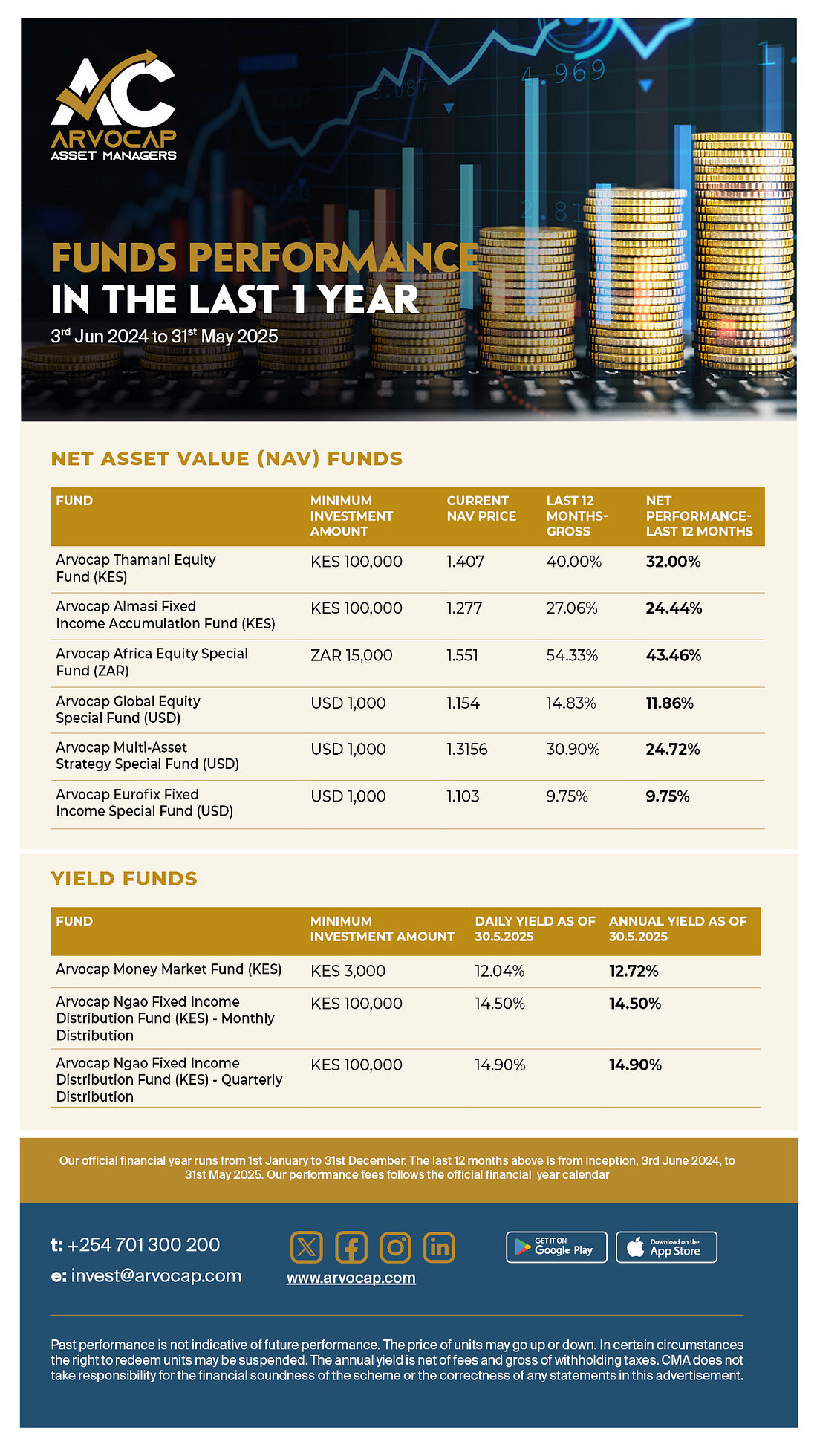

This week's newsletter is brought to you by Arvocap Asset Managers, a licensed and trusted investment partner committed to your financial growth. The Almasi Fixed Income Accumulation Fund has recorded a 27.06% cumulative return since inception, driven by strategic investments in government and corporate fixed-income securities. Learn more at www.arvocap.com.

Zenith Eyes Kenya in Regional Expansion

Nigerian Banks Accelerate Cross-Border Growth: The Business Daily reported this week that Zenith Bank, Nigeria’s second-largest lender by assets, is in advanced discussions to acquire a tier-two Kenyan bank, marking a strategic move into East Africa’s financial services market.

The deal would extend a broader trend of Nigerian banks pursuing regional diversification and scale amid tighter margins and rising capital requirements at home. It follows Access Bank’s acquisition of National Bank of Kenya (NBK) from KCB Group and signals sustained momentum from Nigerian lenders—Access Bank, UBA, GTBank, and now Zenith—seeking to expand into Kenya as mid-sized local banks face regulatory pressure and accelerating consolidation. Under proposed reforms, Kenyan banks must raise their core capital to KES 10 billion by 2029, narrowing the field for undercapitalized players and creating acquisition opportunities.

Potential Targets: As of December 2023, Kenya has eight tier-two banks but with NBK now fully acquired, only seven viable targets remain. Leading candidates include Prime Bank (core capital: KES 29.02B) and Family Bank (KES 15.96B), both locally owned, well above regulatory thresholds, and open to strategic partnerships.

While Prime is already well-capitalized, its private ownership structure could make it appealing to a regional suitor. SBM Bank Kenya (KES 8.02B) and Ecobank Kenya (KES 8.5B) fall below the KES 10B mark and may require recapitalization. SBM appears a more likely seller given past exit signals, while Ecobank is less so as its parent injected KES 3.5B earlier this year.

Meanwhile, Bank of Baroda (KES 31.8B) is highly capitalized but state-owned, and both Citibank N.A. Kenya (KES 25.02B) and Bank of India (KES 28.4B) are constrained by global or public sector ownership, making them unlikely acquisition targets for Zenith.

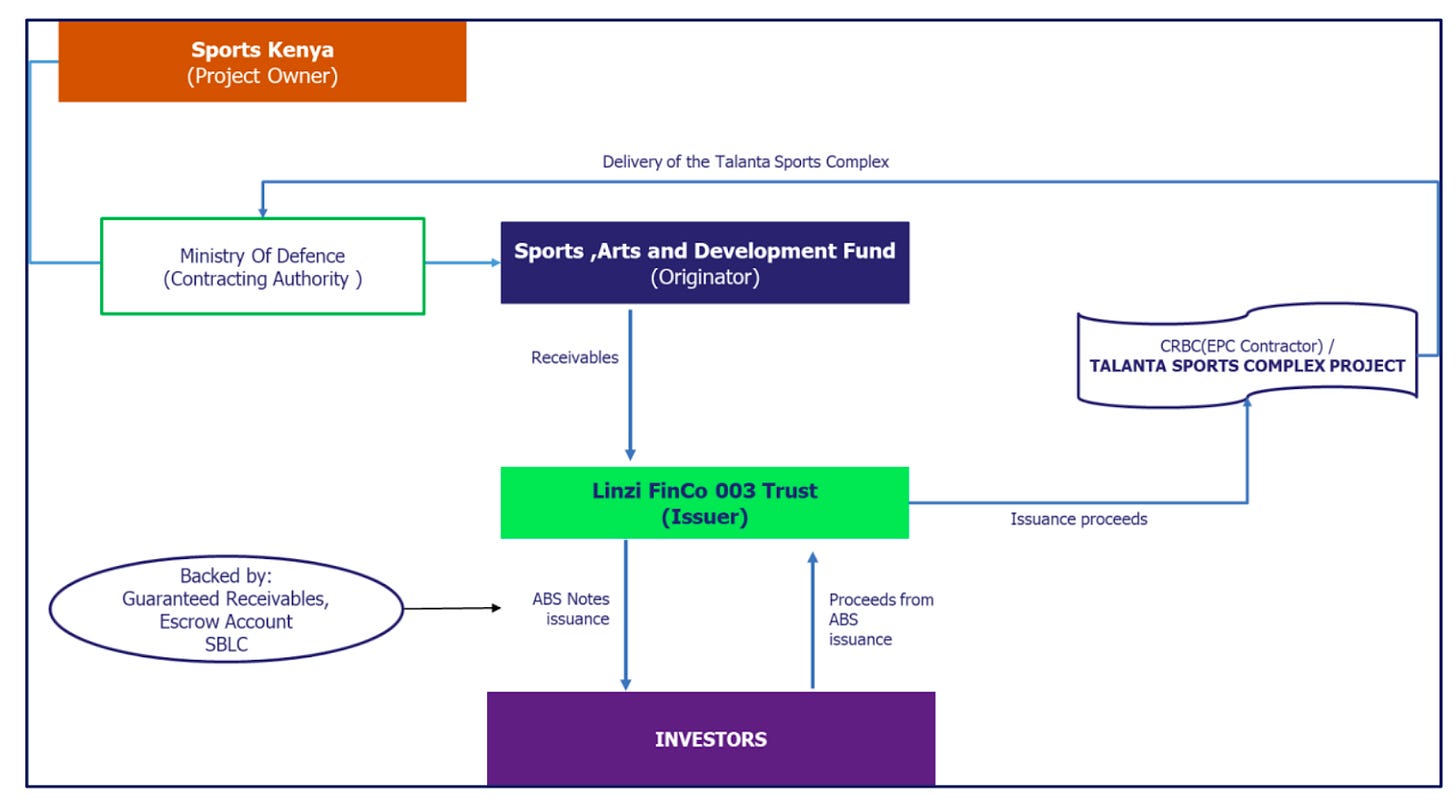

Landmark KES 44.8B Infrastructure ABS

Landmark infrastructure ABS executed: Linzi FinCo 003 Trust has closed its landmark KES 44.791 billion Infrastructure Asset-Backed Securities (IABS) issuance at 100.19% subscription, drawing KES 44.876 billion in bids against a KES 44.791 billion target. Structured as a restricted public offer targeting qualified institutional investors, the transaction securitized receivables from the Sports, Arts, and Development Fund (SASDF). The robust demand—achieved in a market characterized by cautious liquidity deployment—signals institutional investor confidence in securitized public infrastructure projects, especially those backed by ring-fenced government revenue streams.

Early-bird investors who subscribed within the first five days received guaranteed allocations of at least 50%, with the remainder allotted on a pro-rata basis. The 15-year notes offer a fixed annual return of 15.04% and mature in 2040. Rated AA(KE)(IR) by GCR Moody’s, the securities are backed by securitized receivables and credit-enhanced through a fully funded Debt Service Reserve Account (DSRA) covering three months of debt service. This structure offers both yield and downside protection in a market that is increasingly sensitive to sovereign and quasi-sovereign credit risk.

The notes will be listed on the Nairobi Securities Exchange’s Restricted Fixed Income Market Sub-Segment (RFISMS) as of 8 July 2025 and will trade in minimum lots of KES 100,000, thereby enhancing both marketability and secondary liquidity among institutional investors. Here is the Project Structure:

Talanta Stadium Anchors Use-of-Proceeds: Proceeds from the issuance will finance the construction of the Talanta Sports Complex, a high-profile, government-prioritized infrastructure project led by the Ministry of Defence. The Engineering, Procurement, and Construction (EPC) contract, worth KES 28 billion, has been awarded to China Road and Bridge Corporation (CRBC), with payments to the contractor structured around periodic Interim Payment Certificates (IPCs) funded from note proceeds.

By anchoring the transaction on a defined, shovel-ready project with government step-in guarantees and SASDF-linked receivables, the structure minimizes construction and revenue risks, making it a precedent-setting model for future securitized public infrastructure in Kenya. Here is the Transaction Structure:

Markets Wrap

Below are some NSE highlights from week 27:

Market Performance: The Nairobi Securities Exchange posted strong gains in Week 27, with the All Share Index rising 5.72% to close at 161.2. Market capitalization increased to KES 2.54T, up 5.77% from the previous week. Equity turnover rose 124.6% to KES 3.73B, while bond turnover declined 28.8% to KES 47.28B. Foreign investors traded KES 1.67B (44.8% of turnover), while locals accounted for KES 2.06B (55.2%).

Top Movers: Sameer Africa led the week’s gainers with a 48.8% jump to KES 6.16. Kakuzi was the top loser, falling 8.7% to close at KES 365.25. Other notable gainers included Kapchorua Tea (27.1%) and Nation Media Group (15.6%), while Olympia Capital and NBV posted weekly losses of 6.9% and 5.6%, respectively.

Corporate Actions & Announcements:

Final dividend payments were made by Equity Group (KES 4.25 per share) and Crown Paints (KES 3.00 per share).

Sasini replaced TransCentury in the NSE 25 Share Index following the suspension of TransCentury shares.

Trading of Single Stock Futures was approved by the NSE and begins on 7 July 2025 for KPLC, KenGen, Kenya Re, Liberty Kenya, and Britam, with initial margin requirements ranging from KES 1,000 to 4,300.

BAT Kenya’s books closed on 28 June for its FY24 final dividend of KES 45.00 per share, with payment scheduled for 25 July 2025.

Treasury Bills: Treasury bills were undersubscribed last week, with a subscription rate of 90.9%, up from 60.37% the previous week. Investors submitted bids totaling KES 21.8B, and the Central Bank of Kenya (CBK) accepted KES 21.7B out of the KES 24B on offer. Yields on the 91-day increased by 0.67 basis points to 8.1454% while the 182-day and 364-day T-bills declined by 1.13 and 0.87 basis points to 8.45% and 9.7134%, respectively.

FY 2025/26 First Bond: Kenya’s National Treasury is seeking KES 50B in its first bond sale for the 2025/2026 fiscal year, aiming to raise KES 635.5B from the domestic market. The government is reopening two bonds first issued in 2018: 20-year and 25-year papers. The 20-year bond now has 12.8 years to maturity with a 13.2% coupon rate. The 25-year bond has 18 years remaining and a 13.4% coupon

Eurobonds: Yields on six of Kenya’s seven outstanding Eurobonds declined last week, with the KENINT 2048 leading the drop, falling by 26.90 basis points to 10.451%. The KENINT 2028 followed, with its yield down 24.70 basis points to 8.044%, while the KENINT 2027 held steady at 6.979%. On average, Kenya’s Eurobond yields fell by 21.97 basis points week-on-week.

Market Gleanings

💵| New U.S. Tax Threatens Kenya Remittances | U.S. President Trump has signed off on a 1% tax on remittances, part of his “Big, Beautiful Bill” recently passed by the U.S. Senate. The levy, which applies to all remittance senders, including U.S. citizens, is expected to significantly impact inflows to countries like Kenya. In 2024, Kenyans abroad sent home a record $4.9 billion (KES 633 billion), with over 100,000 Kenyans in the U.S. contributing 53% of that ($2.63 billion or KES 340 billion). The tax will hit formal channels such as banks, Western Union, MoneyGram, and M-Pesa.

Remittances are a vital source of income and stability for low- and middle-income countries, but the new tax risks reducing inflows by both shrinking amounts sent and discouraging transfers altogether. The levy, therefore, poses a risk to one of Kenya’s most reliable sources of foreign exchange. Research by Ahmed et al. (2021) found that a 1% increase in remittance costs leads to a 1.6% decline in amounts sent. If this relationship holds, Kenya could see a drop of nearly $80 million in annual inflows.

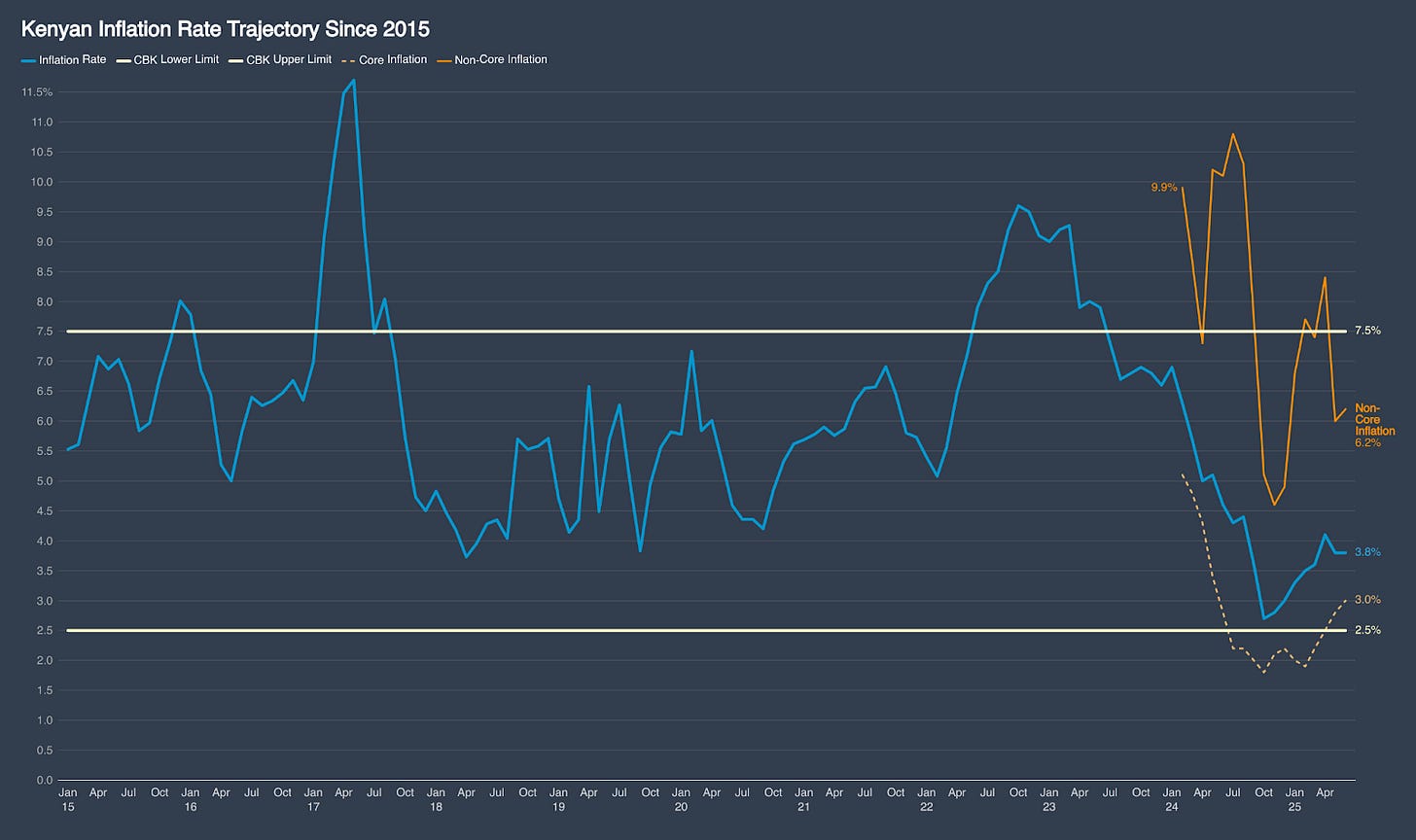

📊| Inflation Steady in Kenya | Headline inflation remained unchanged at 3.8% in June 2025, reflecting stable overall price levels compared to the same period last year. Food and non-alcoholic beverages rose 6.6% year-on-year, contributing 2.0 percentage points to the headline rate. Transport increased 3.2%, while housing, water, electricity, gas, and other fuels rose 0.2%. Together, these three categories make up 57.0% of the CPI basket. On a month-to-month basis, consumer prices rose by 0.5%, with the index moving from 144.88 in May to 145.58 in June.

Core inflation, which excludes volatile items such as fuel and unprocessed foods, was recorded at 3.0%, while non-core inflation stood at 6.2%. Prices for key food items continued to rise, with cabbages and carrots increasing by 10.8% and 11.1% respectively. Petrol prices rose by 1.6% to KES 178.19 per liter, while diesel dropped slightly by 1.1% to KES 163.89. Core inflation contributed 2.7 percentage points to the headline rate, with food alone accounting for 2.0 points.

📉| Kenya PMI Falls as Orders Shrink | Kenya’s private sector activity weakened further in June as the Stanbic Bank PMI dropped to 48.6 from 49.6 in May, its weakest reading in 11 months. The decline was driven by reduced output and new orders amid weak consumer spending and disruptions from protests. Despite the slowdown, business confidence improved to a 13-month high, with firms expecting better sales ahead. Employment and inventory levels rose slightly, while delivery times improved and inflation pressures remained moderate.

🏦| IMF Completes Governance Mission in Kenya | The IMF staff have completed a Governance Diagnostic mission to Kenya, identifying critical governance weaknesses and corruption vulnerabilities. The mission, led by Rebecca A. Sparkman, engaged with Kenyan authorities, civil society, and international partners to inform reform priorities.

“This was kind of the first step of a process that we expect to take until the end of the year. So, collaboration on government diagnostics. It will continue over the next several months. A draft diagnostic assessment report is expected to be shared with the Kenyan authorities before the end of the year. So that first report will go to the authorities, and then the report will be published once consent is received from the authorities. So that is the process that we'll have. But it will take quite some time to get that report prepared and ready.”

IMF Director of the Communications Department, Ms. Julie Kozack

📄| Olympia Capital Reports Weaker Earnings | Olympia Capital Holdings reported a 49.9% decline in net profit to KES 17.6M for the year ended 2025, as revenue dropped 16.3% to KES 457.2M. Gross profit fell 9.0% to KES 156.5M, while operating profit declined 27.5% to KES 45.9M. Finance costs decreased significantly by 46.7% to KES 4.5M. Earnings per share dropped 49% to KES 0.25. Despite the weaker earnings, the company’s total assets grew 33.1% year-on-year to KES 1.92B.

✈️| KQ Signs Partnership with Qatar Airways | Kenya Airways has secured three weekly landing slots at London Gatwick, launching direct flights from Nairobi and establishing its second UK gateway after Heathrow. The new service raises KQ’s total London frequencies to 10 per week, adds 700 weekly seats, and strengthens earnings from the UK market, which contributes over 10% of the airline’s turnover. It aligns with a strategic MoU with Qatar Airways to expand codeshares, including a third daily Nairobi to Doha flight and new KQ-operated Mombasa to Doha service starting this winter. Meanwhile, Business Daily reported that the airline’s capacity remains strained after two Boeing 787-8 Dreamliners, 20% of the fleet, were grounded for delayed engine overhauls, now taking up to 120 days. The resulting capacity crunch is expected to weigh on 2025 revenues as the airline scales back frequencies, a reminder that KQ posted a 5.6% revenue jump to a record KES 188.5 billion in 2024 and reported its first net profit since 2012 of KES 5.4 billion.

🟥| Moody’s Downgrades Afreximbank | Moody’s has downgraded African Export-Import Bank’s (Afreximbank) long-term issuer and senior unsecured ratings to Baa2 from Baa1, with the outlook revised to stable from negative. The downgrade reflects weaker-than-expected asset performance and increased capital risk from the bank’s growing exposure to distressed sovereign borrowers like Ghana and Zambia. The shift from trade finance to unsecured sovereign lending has heightened Afreximbank’s sensitivity to its challenging operating environment. In addition, diversification in funding sources has eroded, with limited recent market-based issuances.

📄| Old Mutual to Wind Down South Sudan Operations | Old Mutual Holdings has announced that its subsidiary, UAP Insurance South Sudan Limited (UAPISS), will stop issuing new insurance policies and renewing existing ones effective 3 July 2025. The decision follows a strategic review of the business and its operating environment. Despite the move, UAPISS will continue servicing existing policies and fulfilling all obligations to policyholders. The company remains solvent and will meet all valid claims and liabilities throughout the run-off period, in line with applicable laws and regulatory requirements

🛢️| G2G Oil Supply Partners Slow Down Acquisition Plans | Two of Kenya’s key partners in the G2G fuel deal, Saudi Aramco and Adnoc, are now scaling back their multibillion-dollar acquisition sprees amid falling oil prices and revenue pressures. Benchmark crude has dropped from over $80 in January to $67, with some Gulf producers now below break-even levels. The two energy giants, who have announced over $60 billion in acquisitions in recent years, are reassessing their spending and M&A activity as oversupply and geopolitical uncertainty weigh on the market.

💼| Key Leadership Changes |

Standard Chartered Bank Kenya has announced the departure of Richard Etemesi as Non-Executive Director, effective June 30, 2025, after 33 years of service.

Unga Group Plc has appointed Mr. James Nyutu as Group Managing Director, effective July 1, 2025.

Standard Group has appointed Chaacha Mwita as Acting Group CEO and Executive Director, effective July 1, 2025, following the resignation of Marion Gathoga Mwangi.

East African Breweries (EABL) announced a leadership reshuffle across its East African operations, with Andrew Itambo Kilonzo moving from Uganda Breweries to become Managing Director of Kenya Breweries Limited to replace Mark Ocitti Ongom, who departs after 11 years with Diageo. Felicite Nson, formerly with Guinness Ghana and with prior experience at Coca-Cola and MTN, takes over as MD of Uganda Breweries.