👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s annual inflation in September 2024, Kenya’s Q2 2024 GDP report, and Stanbic Bank Kenya PMI for September 2024.Inflation Falls Ahead of Key MPC Meeting

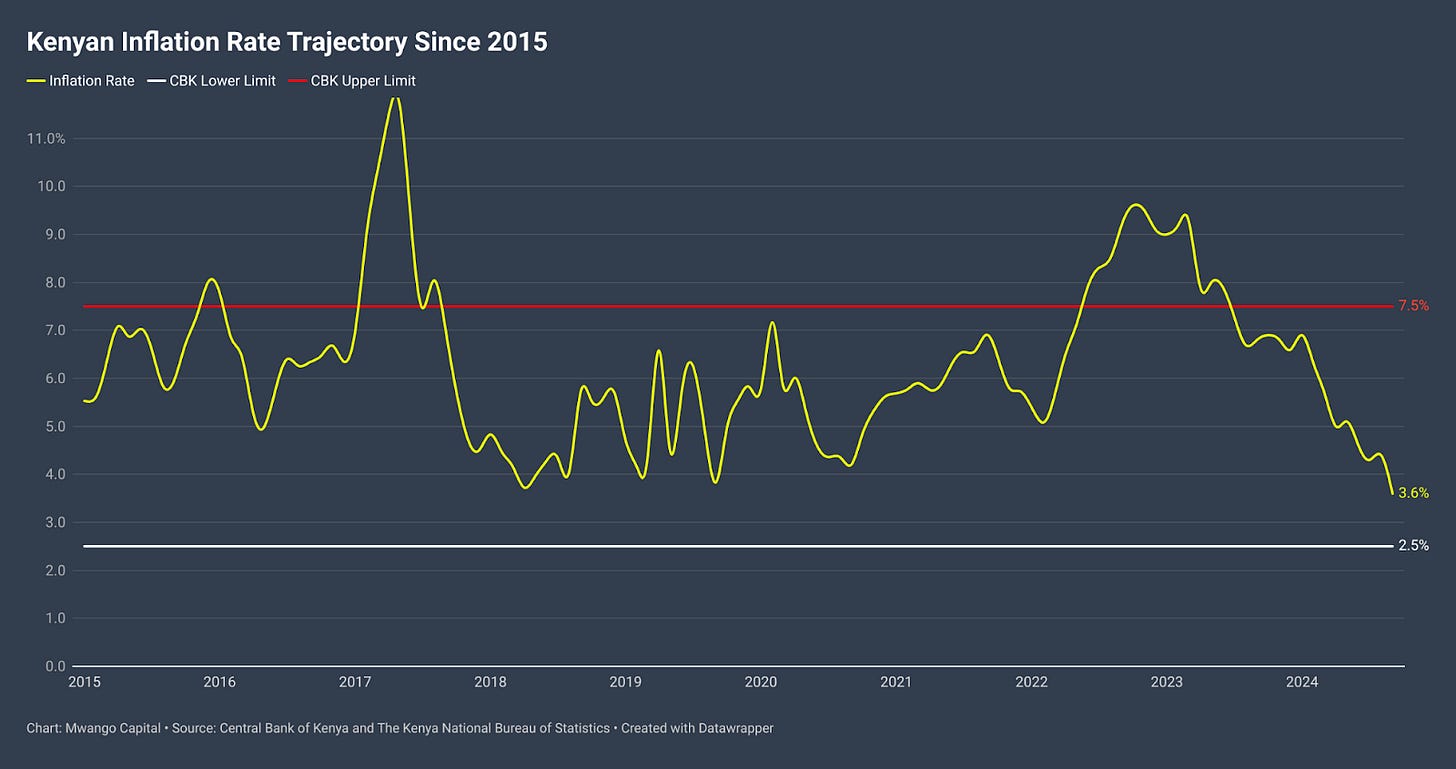

Inflation Down to 3.6%: In September 2024, Kenya's inflation rate fell by 80 bps to 3.6%, the lowest since September 2019. The alcoholic beverages, tobacco, and narcotics index rose 7.7% year-on-year, while food and non-alcoholic beverages increased by 5.1%. Transport saw the slowest growth at 0.5%, followed by insurance and financial services at 0.7%. Cabbage prices surged 39.5%, and Irish potatoes rose 31.2%. Meanwhile, sugar prices dropped 29.7%, from KES 218.78 in September 2023 to KES 153.80 in 2024. This inflation moderation reflects easing price pressures in key sectors. Noteworthy, sugar prices have fallen by the largest margin across the selected commodities from KES 218.78 per kilogram in September 2023 to KES 153.80 in September 2024.

Subdued Fuel Inflation: Fuel inflation cooled by more than 300 bps to close at 1.1% in September 2024 relative to 4.7% recorded in August 2024. This was due to declines in pump prices, electricity prices, and liquified petroleum gas (LPG) prices. As a result, the transport index recorded 0.5% year-on-year growth in September 2024, which is one of the two indices with sub-zero price growth in September 2024. On the other hand, food inflation fell to 5.1% in September 2024 compared to 5.3% in August 2024 on the back of declining vegetable inflation. Non-food non-fuel (NFNF) inflation for the month stood at 3.4% (August 2024: 3.5%).

KBA Calls for Rate Cut: Ahead of the Central Bank of Kenya (CBK) Monetary Policy Committee (MPC) meeting slated for 8th October 2024, the Treasury CS John Mbadi and the Kenya Bankers Association (KBA), in a research note, called for a decisive rate cut on account of the current state of the macroeconomic fundamentals. According to the bankers, underpinning their thesis is the declining trend in inflation, declining food and fuel prices, global economic recovery, lackluster private sector growth, and the stability in the currency and policy easing in Advanced Economies (AEs). Kenya’s inflation trajectory has been on the downtrend throughout the year, while the currency, since its unwinding in Q1 2024 on the back of a confluence of macroeconomic developments, has been oscillating between the 128 - 135 range. With the prevailing high interest rate environment, private sector credit growth has taken a hit, which has also resulted in non-performing loans in the banking sector surging to multi-year highs. A rate cut at this juncture would boost lending to the private sector.

Across the Pond: In its last policy rate action, the Federal Reserve reduced the target range for the Fed Funds Rate by 50 bps to the 4.75% - 5.00% target range, and the move was outsized given most economists polled predicted a 25 bps rate cut. In a speech at the National Association for Business Economics Annual Meeting held on 30th September 2024, the Federal Reserve Board Chairman Jay Powell acknowledged inflation was getting to the Fed’s 2% objective, signalling more scope for rate cuts. As the US eases, the general expectation is that other central banks and monetary authorities in AEs will follow through, followed by Emerging Markets (EMs).

“For much of the past three years, inflation ran well above our goal, and the labor market was extremely tight. Appropriately, our focus was on bringing down inflation. By keeping monetary policy restrictive, we helped restore the balance between overall supply and demand in the economy. That patient approach has paid dividends: Inflation is now much closer to our 2% objective. Today, we see the risks to achieving our employment and inflation goals as roughly in balance. Our decision to reduce our policy rate by 50 basis points reflects our growing confidence that, with an appropriate recalibration of our policy stance, strength in the labor market can be maintained in a context of moderate economic growth and inflation moving sustainably down to 2%.”

Federal Reserve Board Chairman, Jerome Powell

In Kenya, the real interest rate - which is the difference between the central bank rate and the inflation rate - is 9.15%, which is at a multi-year high, adequately pointing to a rate cut by the MPC in its upcoming sitting.

“With the synchronized easing across major economies, and prospects of further cuts in the near to medium term, there is ample scope to effect a policy rate cut and other support to economic growth without any adverse risks on exchange rate movements.”

Find the entire September 2024 inflation media release here, the research note by the Kenya Bankers Association here, and a transcript of Powell’s speech here.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence.

Learn more: KMRC website.

Q2 2024 GDP and BOP Highlights

In the week, the Kenya National Bureau of Statistics released statistics about Kenya’s economy in the second quarter of the year. Here are a few key highlights:

Economic Growth: In the quarter, Kenya’s economy grew by 4.6% year-on-year, a decline of 10 bps from the growth rate recorded in Q2 2023. The growth was underpinned by the accommodation and food services sector which grew at 26.6%, followed by the ICT sector which grew at 7.2%, and the professional, administrative and support services sector which expanded by 6.8%. Notably, the real estate sector grew at 6.0% while the agriculture, forestry and fishing sector registered a 4.8% growth rate.

Currency Performance: Piggybacking on the appreciation in Q1 2024 that was driven by macroeconomic developments in the country, the Kenya Shilling appreciated against all significant currencies in Q2 2024 relative to Q2 2023. Quantitatively, the shilling gained 3.7%, 4.6%, and 5.6% against the Sterling Pound, US Dollar, and Euro, respectively, and regionally, the Kenyan shilling recorded gains against Tanzania’s and Uganda's currencies.

Capital Markets: At the Nairobi Securities Exchange (NSE), the total number of shares traded was 279M, up 32.2%, while the aggregate value closed at KES 5.0B, up 22%.The NSE 20 Share Index surged by 5.2% to 1,657 points (Q2 2023: 1,575 points, Q2 2022: 1,613 points).

Foreign Debt: External debt held by the government closed the quarter at KES 5.1B, representing a decline of 4.3% or KES 230B in absolute terms. Multilateral loans accounted for the largest source of debt at KES 2.8T, followed by bilateral loans at KES 1.1T.

Trade: The volume of total trade closed the quarter at KES 935.2B, up 3.9% from Q2 2023, or by KES 35B. EAC trade was at KES 100.5B [Q2 2023: KES 11B), COMESA at KES 105B [Q2 2023: KES 109.9B], while trade with the EU grew marginally year on year to KES 95.1B from KES 94.9B in Q2 2023. Domestic exports contracted 1.1% to KES 223.3B, while imports closed at KES 659.5B, up 1.2%.

Current Account Deficit: The trade deficit closed the quarter at KES 383.8B, a significant improvement from the KES 403.0B recorded in Q2 2023, and the unwinding of the trade balance was attributed to faster growth in exports relative to imports. In absolute terms, the current account deficit was KES 104B compared to KES 131.2B in Q1 2024 and KES 158.9B in Q2 2023.

Diaspora Remittances: Total remittances from the diaspora were KES 157.4B, up 12% from KES 140.5B in Q2 2023.

Find the GDP report here and the balance of payments report here.

Markets Wrap

NSE: In Week 40 of 2024, EA Portland led the market, rising 56.9% to KES 28.80, while Bamburi was the worst performer, dropping 27.30% to KES 58.50. The NSE 20 declined by 0.7% to 1,777.7 points, the NSE 25 gained 1.3% to 2,903.4 points, and the NASI index advanced by 0.7% to 107.2 points, while the NSE 10 edged up by 1.6% to 1,124.6 points. Equity turnover decreased by 25.8% to KES 1.05B, while bond turnover declined to KES 28.92B from KES 35.20B the previous week.

In September 2024, E.A. Portland Cement was the top-performing stock, appreciating by 304.73% to KES 31.65, followed by Kenya Power, which gained 72.41% to KES 3.50. Bamburi Cement lost 24.19% of its value in the month to close at KES 58.75, becoming the top losing stock in the month.

Year To Date, E.A. Portland Cement appreciated by 295.63%, becoming the top performer, followed by Kenya Power at 146.48%. Standard Group was the worst performer in the period under review, declining by 27.65% to KES 5.60.

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.69%, 16.50%, and 16.73% respectively. The total amount on offer was KES 24B with the Central Bank of Kenya (CBK) accepting KES 29.2B of the KES 53.96B bids received - a performance rate of 224.83%. The 91-day and 364-day instruments recorded 433.83% and 202.11% performance rates, respectively.

Eurobonds: In the week, yields rose week-on-week across the 6 outstanding papers with KENINT 2028 rising the most, up by 51.10 bps to 8.935%, followed by KENINT 2032, down 37.90 bps to 9.628%. KENINT 2048 recorded the least week-on-week decline at 27.4 bps to 10.137%, and the average week-on-week change stood at 37.7 bps.

Market Gleanings

📄| Stanbic Kenya PMI | The Stanbic Bank Kenya Purchasing Managers Index (PMI) for September 2024 fell to 49.7 points from 50.6 points in August 2024 (September 2023: 47.8 points). This was on the back of economic challenges at both the business and household levels which occasioned a dip in sales, resulting in an overall economic slowdown.

🔋 | Kenya’s Maiden BESS | Kenya is set to install its first 100 MW Battery Energy Storage System (BESS) this year, with plans for an additional 250 MW by 2026 under the World Bank-funded GREEN program. The installation of the BESS is part of efforts by the Energy Petroleum Regulatory Authority (EPRA) to fast-track the adoption of clean energy across the country.

📶| Standing Orders on M-PESA | Safaricom has rolled out M-PESA Ratiba, a new feature that allows users to set up standing orders for automatic payments directly from their M-PESA wallets. This move simplifies recurring payments such as bills, subscriptions, and money transfers, giving users the flexibility to schedule them on a daily, weekly, monthly, or yearly basis.

🇹🇿| Adani in Tanzania | Indian conglomerate, Adani Group, is in talks with the Tanzanian government for a USD 900M public-private partnership to construct high-voltage power lines, according to David Kafulila, Executive Director of Tanzania’s Public-Private Partnership Centre. Tanzania is also in discussions with UK-based Gridworks Development Partners LLP for a separate USD 300M power-lines project.

🇹🇿| BoT’s Gold Purchase Program | The Bank of Tanzania’s (BoT) Domestic Gold Purchasing Program, which allows gold sellers to sell their gold directly to the BOT at competitive world market prices, has set the price per gram before fees at TZS 232,876.89, with a royalty fee of 4% and no inspection fee. The program promises reduced fees and faster payment processing, while the BoT will cover all refining costs.

📄| NBE Grants Licences to FX Bureaus | The National Bank of Ethiopia has granted operational licenses to five non-bank foreign exchange bureaus to facilitate the buying and selling of cash notes in major convertible currencies. The NBE has also allocated USD 175M to the foreign exchange market to support fuel-related imports and stabilize the economy.

Earlier last month, Ethiopia and China reached a currency swap agreement, allowing trade in Ethiopian Birr and Chinese Yuan. The agreement aims to enhance trade flexibility, increase foreign direct investment (FDI), ease foreign exchange shortages, and strengthen Ethiopia’s economic partnerships.

Separately, Ethiopia has proposed an 18% loss for bondholders in a USD 1B debt restructuring, but investors have rejected the offer, citing the IMF’s debt analysis. On its part, Ethiopia has cited economic hardship risks, while creditors have their eyes on liquidity issues.

💸 | Zambia’s Sovereign Wealth Fund | Zambia is set to establish a sovereign wealth fund in 2025 to create a financial buffer to protect the country from economic shocks while supporting crucial sectors like health and education. Cornwell Muleya, CEO of the Industrial Development Corp., highlighted that the fund will enable investment of surplus revenues from natural resources, ensuring financial stability.