👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the MPC's decision to retain the Central Bank Rate, full-year 2023 results from the Nairobi Securities Exchange, Sameer Africa, and Branch Microfinance Bank, and the Stanbic Kenya Purchasing Managers Index for March 2024.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Whether it's restocking shelves with pharmaceuticals for your chemist, replenishing agricultural supplies for your agrochemical shop, or acquiring tools and equipment for your hardware store, their tailored financing solutions can help you get the cash you need.

CBK’s MPC Retains CBR

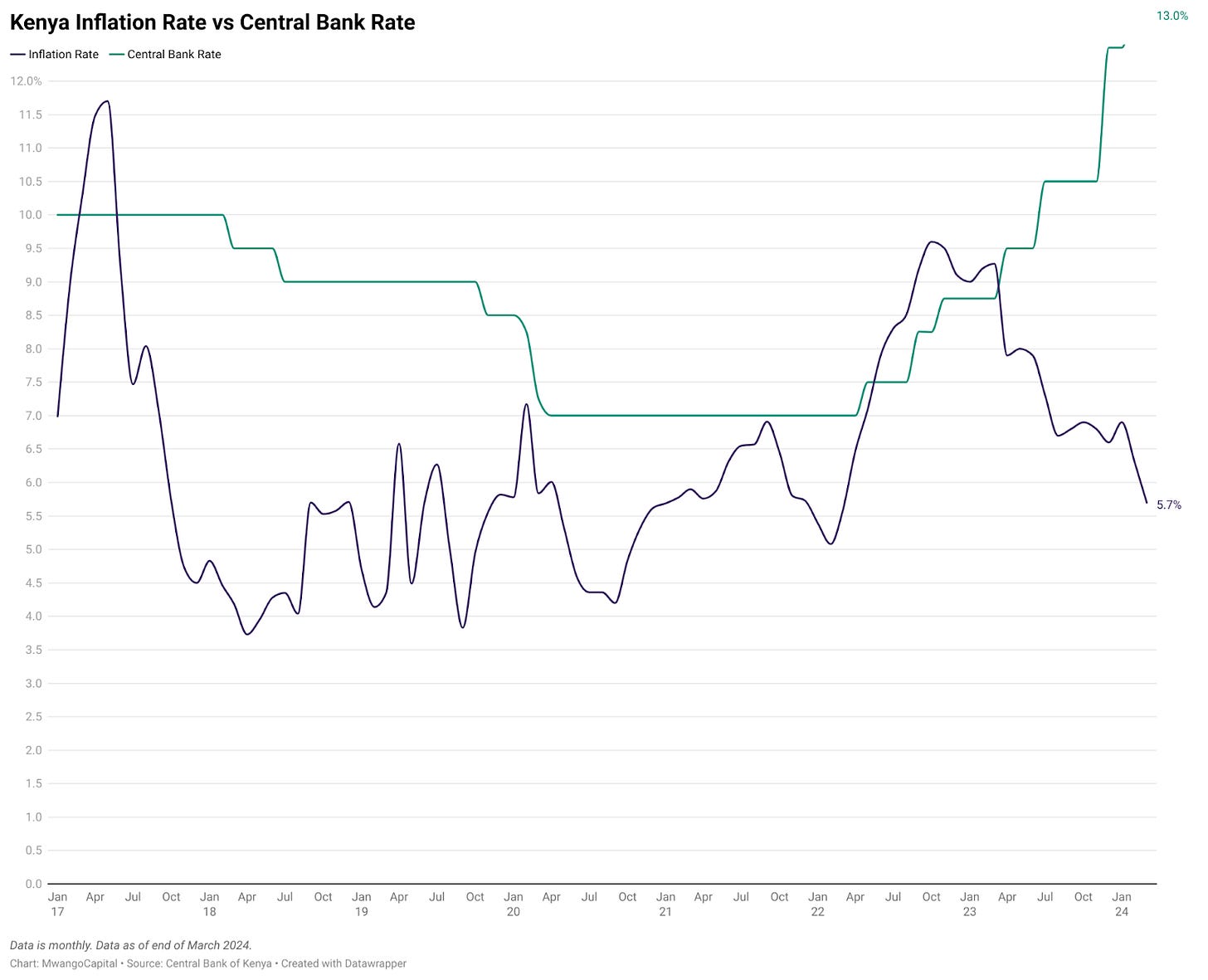

Key Rate Held at 13.0%: In the week, the Monetary Policy Committee of the Central Bank of Kenya (CBK) held the Central Bank Rate (CBR) constant at 13.0%, citing previous measures that have lowered inflation and reduced pressure on the exchange rate. The MPC expects inflation, which closed March 2024 at 5.70%, to fall to the 5.00% mid-point of the 5.0% +/- 2.5% target range in the near term on account of lower food and fuel inflation coupled with the strengthening of the Kenya Shilling.

Sticky Banking Sector NPLs: One of the notable data points arising from the MPC was the surge in the NPL ratio in the banking sector, indicating strain across borrowers in the economy. As of February 2024, the NPL ratio, which measures the proportion of gross Non-Performing Loans (NPLs) to total loans in the banking sector, was at a multi-year high of 15.5% from 14.8% in December 2023. From the FY 2023 banking sector results, executives pointed out strain in the manufacturing and trade sectors, government pending bills, and the impact of the depreciation of the Shilling as some of the factors behind the growth in NPLs.

“On the NPLs, of course the NPLs, we are always concerned about the NPLs and indeed they have increased from 14.8% at the end of December to 15.5%. We are very cautious about it. We have enhanced just our consultations with the banks to make sure that they are provisioning adequately, that they have enough capital and from that perspective, for the banking sector as a whole, the capital is quite significant in terms of the capital adequacy ratio we’ve seen the latest information we have is that almost 19% and this is compared to the legal requirement of 14.5%. So there is significant scope there in terms of the availability of capital.”

“But we’ve also seen banks are taking the initiative to restructure some of those loans so as to avoid them becoming non-performing. But so far, even with the provisioning, the banks have continued to make significant profits so yes we are concerned about it and we are making sure that the banks follow closely what’s going on and we hope that this trend will reverse.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Shilling Rally Cuts Debt Stock: The appreciation of the Kenya Shilling against the US Dollar has reduced the shilling equivalent quantum of dollar-denominated debt, which has essentially saved the government debt service costs related to the depreciation of the shilling. In sum, the recent appreciation has cut the shilling equivalent of the debt by about KES 1T. The latest data indicates that the stock of external debt stood at USD 38.51B at the end of January 2024, equivalent to KES 6.19T, as compared to USD 38.92B, or an equivalent of KES 6.809T as at the end of December 2023.

“We estimate that we have reduced the shilling-denominated dollar debt by at least KES 1T. If you consider our external debt is about USD 38B, and we have reduced the exchange rate from 160 to roughly 130 let’s say, that’s KES 30. And every shilling will save the government KES 40B. So you can see this transaction we did in February with the Eurobond which removed the kind of the risk that people felt was there and which I believe was exaggerated has actually saved the country a huge amount of debt and you should now see when you look at the overall debt in terms of shillings, there should be a reduction in the total stock of debt in terms of shillings.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

The governor pointed out that the appreciation of the exchange rate was having a positive passthrough impact on the inflation rate as a result of lower electricity and fuel prices.

“When the shilling appreciates, then electricity prices, which take into account the depreciation or appreciation of the shilling, we should expect to see electricity prices come down. Similarly for the pump prices, (petrol, diesel and paraffin), that too will now see the full impact of the appreciated exchange rate and so there we also expect pump prices to, if not decline, because we’ve also seen there is a trend since January, the Murban oil prices have actually been trending up but we should see that that upward trend mitigated by the appreciation of the exchange rate and of course now that with imports, imported inflation will decline. So we do expect the appreciation of the exchange rate to have a positive impact on the overall inflation going forward.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Update on Government Borrowing: The government expects external funding ballparking USD 1.2B from the World Bank’s Development Policy Operation in April, and the size of the package is lower than the earlier anticipated USD 1.5B on account of the KENINT 2031 Eurobond in February 2024 which helped to cement the government’s efforts of offsetting the KENINT 2024 Eurobond maturing in June 2024. Along the same lines, the International Monetary Fund (IMF) mission was in the country last week for the 7th review of the current Extended Fund Facility (EFF) and Extended Credit Facility (ECF) program.

Kenya is expected to receive USD 1B as at the completion of the 7th reviews in July, with USD 937M coming from the EFF and ECF and USD 59M from the Resilience and Sustainability Fund (RSF). This will bring the total amount received under the current program to USD 4.43B. The expected external flows from the World Bank and the IMF, when taken together, are expected to see the country’s stock of Foreign Exchange reserves grow past the USD 8B mark to reach USD 8.1B, or an equivalent to 4.1 months of import cover at year-end. As at the end of last week, the reserves were USD 7.148B, equivalent to 3.8 months of import cover.

“On the DPO, I know the World Bank and the Treasury are discussing the amounts. Of course as government, we had wanted USD 1.5B but you may recall that the normal World Bank DPO, is roughly, at least in the past was about USD 750M and the World Bank was very kind to us to increase that, to even consider increasing that to USD 1.5B in part to address the maturities of the eurobond in June 2024, but since now we were able to address the eurobond through the issuance of another bond, then it may be the case that the World Bank may not provide the full USD 1.5B and may provide a bit less than that but that is being discussed between the World Bank and the National Treasury.”

“The IMF mission is in the country to conduct the 7th reviews of the ECF and EFF as well as the Resilience Sustainability Facility, the RSF. They will be here for another week and a half at the end of which we expect to reach agreement with them. They will have the Board meeting in early June I believe and we expect a disbursement of at least USD 1B from the IMF.”

“In terms of the usable foreign exchange reserves, we have seen a fairly steady increase from the end of 2023 where we had reserves worth USD 6.5B. As of 2nd April [2024], that had risen to USD 7.1B and as I’ve indicated from the balance of payments, we expect this figure to rise by another USD 1B so that by the end of December of 2024, we should have USD 8.1B of usable foreign exchange reserves and that will be equivalent to about 4.1 months of import cover.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Peaking Rates?: According to the governor, another consequence of the expected external funding is the reduction in the reliance on domestic debt for funding the budget deficit, which will have the net result of driving down yields in the domestic debt market.

“So essentially we expect rates to have peaked. One of the reasons why rates have gone up to where they have was the reliance on domestic financing. Now I think going forward now we have the money coming in from the DPO, that will reduce domestic requirements for funding the budget. We also expect the Treasury to submit a supplementary budget with a reduced deficit. The Treasury continues to ensure that the revenue mobilization and the revenue targets are met although there are a few shortfalls here and there. So yes we expect now that the rates to start coming down just because we will have alternative sources of funding the deficit rather than issuing treasury bills. So I think going forward we should expect Treasury bill rates and bond rates to start coming down.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Banks’ Capital Requirements to be Revised: The governor also highlighted that there will be upcoming changes in the capital requirements for the banks that will raise the current thresholds to ensure banks are adequately capitalized in light of risks in the operating environment. This is in line with the actions by the Central Bank of Nigeria (CBN) late last month, where it increased the capital base requirement for banks to N500B [~$0.4B] for international banks and N200B [~$0.15B] for national banks. All banks have 24 months to comply, starting 1st April 2024 and ending 31st March 2026. Banks can meet the capital requirements by issuing new shares (public offer & private placements), mergers and acquisitions, and license adjustments (upgrade or downgrade of license category). The aim is to strengthen banks against shocks, enhance financial stability, and support a US$1T economy by 2030, and the CBN requires all banks to submit an implementation plan on how they will meet the new requirements by 30th April 2024.

“On the issue of the increase in the capital requirements for the banks, I think I’ve indicated in the past that this is one area that we would like to address this year. We are in the process of deciding what kind of capital requirements we would require from the banks. I believe very strongly that the capital requirements for banks need to be increased. We’ve seen increased risks whether it is from climate change or cybersecurity. So we need very strong banks. We need strong banks that can not only operate in Kenya but also operate in the region and outside the East African region and we hope that or rather we expect that we will be making a proposal and even for public participation hopefully in the coming 1 month as to where we think the capital requirements for the banks should be.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Separation of M-PESA from Safaricom: The governor also commented on the ongoing efforts to split off mobile money platform M-PESA and spin off into a stand-alone subsidiary that will fall under the jurisdiction of the CBK. In the financial year ended 31st March 2022, M-PESA pulled in KES 117.2B in revenue, which amounted to 38% of Safaricom PLC’s gross revenue, as compared to 36% in the previous fiscal year.

“On the issue of the separation of M-PESA and Safaricom to operate as a separate company, these are discussions that we are continuing to have. We have arranged to meet with the Board [of Directors] of Safaricom in the near future. The Treasury needs to also be involved in this particular case but really one of the factors that has been delaying this - the delinkage of M-PESA mobile money from the rest of Safaricom, is the tax liability which is fairly significant, in the order of roughly KES 75B and what to do with it. We believe that there needs to be a separation. We believe that the Central Bank should oversee M-PESA and therefore we will continue to engage Safaricom and the Treasury to see how quickly this separation can be done.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Other Salient Data: Goods exports and imports fell by 1.7%and 8.5% in the 12 months to February 2024 as compared to a growth of 9.6% and 3.5% in the same period in 2023, respectively. The current account deficit is estimated at 4.3% of GDP in the 12 months to Feb 2024, down from 4.7% of GDP in a similar period of 2023 and is projected at 4% of GDP in 2024. The decline in exports in 2023 was across several categories, except food, petroleum products & manufactured goods exports which increased by 3.0%, 20.3% & 1.4% respectively. On the imports side, the decline is attributable to reduced imports in all categories, except for food and crude materials. Noteworthy, the cumulative diaspora remittances for January and February 2024 grew by 21% year-on-year to cross the USD 700M mark to reach USD 798.3M.

Across the Region: The Bank of Tanzania has raised the central bank rate from 5.5% in Q1 24 to 6.0% in Q2 2024, contrasting to that of 10% in Uganda and 13% in Kenya. The prevailing inflation rates across Kenya, Tanzania and Uganda are 5.7%, 3.0%, and 3.4%, respectively, bringing the real interest rates to 7.3%, 3.0% and 6.6%, respectively. The Bank of Uganda is set to announce its interest rate decision on 8th April 2024 at 1300H.

Find the MPC press release here, the MPC media briefing here, and a thread with key takeaways from the MPC here.

Results Wrap

NSE Slashes Dividend by 20%: Interest income grew by 15.9% year-on-year to reach KES 120.9M, and when aggregated with other income lines, the total income for the year amounted to KES 662.3M, up 3.0%. The net profit for the year was KES 18.4M, up 34.1% and Per Share Earnings were KES 0.07, representing a growth of 40%. The Board of Directors recommended the payment of a first and final dividend of KES 0.16 per share, down 20% as compared to that recommended in FY 2022.

Sameer Africa Revenue Dips 36%: In the year ended 31st December 2023, Sameer Africa's revenue fell by 36.3% year-on-year to KES 390.5M, while the cost of sales fell by a whopping 85.8% to KES 34.5M, bringing the gross profit to KES 356M, down 3.8%. Operating expenses were up marginally by 2.4% to KES 141M, and the firm recorded an operating profit of KES 230.9M, down 6.5%. Net finance costs were up 98.4% to KES 140.8M, and the net result for the year was KES 46.3M, down 54% from KES 100M in FY 2022. The Board of Directors did not recommend a dividend.

Branch MFB PAT Up 27.65%: For the year ended 31st December 2023, Branch Microfinance Bank (MFB) recorded KES 885.6M in total income, up 27.6% year-on-year. Loan loss provisions fell by 25.5% to KES 323.8M, equivalent to 90.4% of the loan book [FY 2022: 134.8%]. The MFB returned to operating profitability, reporting KES 97.5M in profit as compared to a KES 86.9M operating loss in FY 2022. The stock of gross NPLs grew by 22.2% to reach KES 73.8M, accounting for 20.6% of the loan book [FY 2022: 18.7%]. The net profit for the year amounted to KES 65.3M, up 41.3%.

Markets Wrap

NSE: In Week 14 of 2024, TransCentury was the top-performing stock, up 18.4% to close at KES 0.58. BOC Kenya was the worst-performing stock, down 9.0% to close at KES 76.00. The NSE 20 was down 2.0% to close at 1,748.1 points, the NSE 25 rose by 0.5% to close at 3,000.5 points, and the NASI index edged higher by 0.2%, to close at 113.4 points. Equity turnover was down 54.9% to KES 2.4B from KES 5.3B in the prior week while bond turnover closed the week at KES 10.5B compared to the prior week’s KES 23.6B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.7243%, 16.8738%, and 16.9898% respectively. The total amount on offer was KES 24B with the CBK accepting KES 26.2B of the KES 28.5B bids received, to bring the aggregate performance rate to 118.65%. The 91-day and 364-day instruments recorded 217.29% and 139.14% performance rates, respectively.

Treasury Bonds: Across the tap sale of FXD1/2023/005 and FXD1/2024/010 treasury bonds, total bids received at face value were KES 35.5B and KES 12.B respectively. The CBK accepted bids totalling KES 33.9B and KES 11.8B respectively bringing the weighted average rate of accepted bids to 18.4% and 16.5%, respectively. On aggregate, the performance and acceptance rates were 191.2% and 96%, respectively.

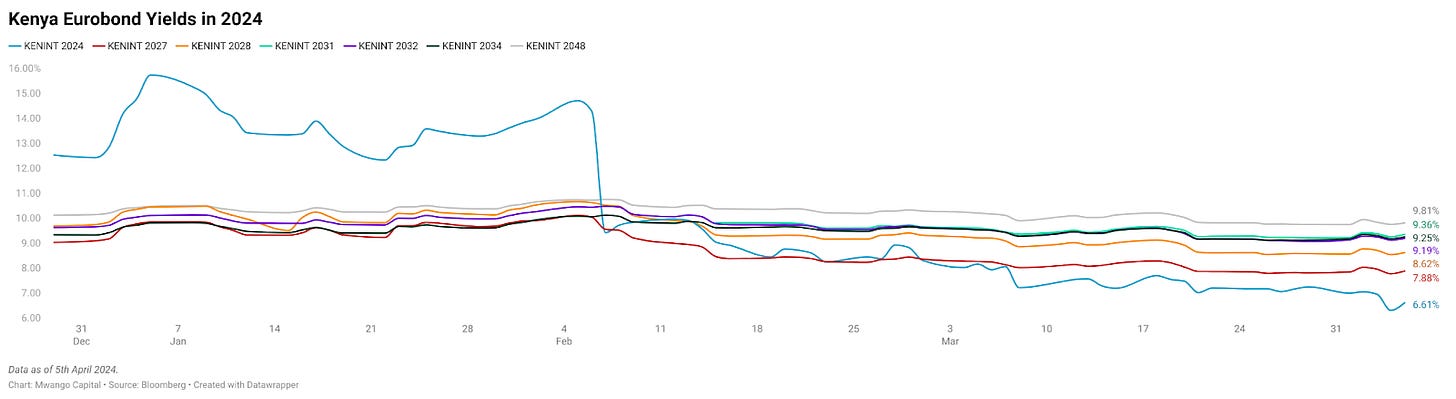

Eurobonds: In the week, yields were mixed across the 7 outstanding papers.

KENINT 2024 was the only paper whose yield fell, down by 64.10 bps to 6.611% while KENINT 2031 rose the most, appreciating by 14.00 basis points to 9.356%. The average week-on-week change stood at -1.07 bps.

All papers had their yields fall on a year-to-date (YTD) basis, with KENINT 2024 falling the most by 591.90 bps while KENINT 2034 fell the least at 8.50 bps.

Prices were mixed across the board week-on-week, with KENINT 2024 the only paper recording an appreciation, rising by 0.1% to 100.027. YTD, KENINT 2028 rose the most at 4.1% to 95.541, while KENINT 2034 rose the least at 1.0% to 81.238.

Market Gleanings

📊| Stanbic Kenya PMI | Kenya's private sector activity softened slightly in March after a six-month expansion, with the Purchasing Managers Index (PMI) falling to 49.7 from 51.3 in February, indicating a slight decline in operating conditions. Despite this, there were notable positives: staffing and inventories continued to grow, input cost inflation reached its lowest level over three years, and output prices rose slowly. Additionally, despite a fractional decline in new orders, firms remained optimistic, with expectations for future output hitting a four-month high. Employment numbers rose marginally for the third consecutive month, while reduced purchasing activities led to shorter supplier delivery times.

📈| FTSE Russell Upgrades Kenya | The Nairobi Securities Exchange (NSE) equity market has been upgraded from ‘restricted’ to ‘pass’ by the FTSE Russell Index Governance Board, following an interim review of Kenya’s equity market. This upgrade, effective September 2023, signifies that Kenya’s equity market has resolved previous delays in the repatriation of capital by institutional investors. Separately, Emily Fletcher, the Co-Manager of BlackRock’s Frontiers Trust Investment recently highlighted the potential of the NSE. She pointed out that the NSE, with its stable political backdrop and improving macroeconomic indicators, is currently trading at a price-to-earnings ratio of 5X. Given these favorable conditions, she suggested that it might be an opportune time for investors to reconsider the market potential of the NSE.

🏦| BK’s Rep Office Closed | The Central Bank of Kenya last week announced the closure of the Bank of Kigali’s Representative office in Kenya, effective from April 2nd, 2024. The decision follows a strategic shift by the Bank of Kigali to focus more on digital service delivery channels. The government of Rwanda is the majority shareholder in the bank, with the remaining portion held between institutional and retail shareholders. The bank is also cross-listed on the Nairobi Securities Exchange.

🏥| Final SHI Regulations | The Social Health Insurance (General) Regulations have introduced several key changes to Kenya's healthcare system. These include mandatory registration for all residents with the Authority by June 30, 2024, the commencement of contributions and access to healthcare services from July 1, 2024, and the requirement for beneficiaries to provide their biometric data at a designated registration point.

💸| Ethiopia Capital Markets Fundraising | Ethiopia’s financial sector is set for a major transformation with the launch of its first stock exchange since the 1970s. The exchange’s capital raise of USD 12M was oversubscribed, reflecting strong interest from local and international investors. This initiative, offering 75% ownership to private investors has garnered support from domestic financial institutions such as Zemen Bank. Separately, Ethiopia's creditors gave the country extra time, until end of June, to finalize a loan agreement with the IMF. Talks in March ended without a deal, raising concerns about Ethiopia's debt relief. This extension offers some relief after the nation defaulted on a debt payment in December.

⛽| Tanzania Fuel Prices | As of April 3rd, 2024, Dar es Salaam's retail fuel prices for petrol, diesel, and kerosene have been adjusted. Petrol and diesel prices have increased by 17.12% and 12.75% year-on-year, respectively, reaching TZS 3,257 and TZS 3,210 per litre. Kerosene, however, shows a decrease of 3.04% year-on-year, costing TZS 2,840 per litre.