👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover leadership changes at CBK and highlights from the Finance Bill 2023 and the Economic Survey 2023.First off, enjoy a dose of our weekly business news in memes:

Who Comes Next?

And Then There Were 6: Out of 24 applicants, The Public Service Commission (PSC) has shortlisted 6 candidates to replace Dr. Patrick Njoroge as the Governor of the Central Bank of Kenya (CBK). The interviews will all take place on Tuesday, 9th May 2023. The shortlisted candidates are:

Adan Mohamed and Kamau Thugge, who are advisors to the current President.

Haron Sirima, the Director-General of the Public Debt Management Office at the National Treasury, and Edward Sambili, a former Planning PS, have both served as CBK Deputy Governors and were on the shortlist for CBK Governor in 2015.

Nancy Onyango, the Director of the Office of Internal Audit and Inspection at the IMF, and

Dorcas Muthoni Mutonyi, the founder of OpenBusiness Africa.

End of An Era: The current CBK Governor’s term ends next month after serving 2 full terms. Dr. Njoroge’s successor will play a significant role in the country’s economic recovery and the overall implementation of the Kenya Kwanza Economic Agenda. Their intray includes stabilizing a rapidly depreciating shilling which lost 9.1% of its value in 2022 and has fallen 10.5%YTD, dealing with dollar shortages and dwindling forex reserves, and helping the country meet the huge external debt redemptions due in 2024.

In addition, the PSC has also advertised for the position of the Chairperson of the CBK whose term is 4 years, renewable once.

IMF has Kenya’s Back: Meanwhile, the IMF Managing Director, Kristalina Georgieva, was in Nairobi last week to hold talks with President William Ruto. She was pleased with Kenya's progress in economic management and was confident Kenya would repay Eurobonds due next year. She advised the government to offer bondholders higher returns to entice them to lend to the government and also said that the country had applied for access to a new long-term funding facility called the Resilience and Sustainability Trust meant to assist low-income and vulnerable middle-income countries to build resilience to external shocks.

“Countries that are at the point of needing debt restructuring are still a relatively small group. Kenya is definitely not among them. We think Kenya is a case of an innocent bystander. It has been hit by external shocks. We do not see Kenya facing difficulties to serve the $2B next year…Kenya made a request (for access to RST) and we will have a mission in May (to consider the request)."

IMF Managing Director, Kristalina Georgieva

The Finance Bill, 2023

The Kenya Kwanza government tabled its maiden Finance Bill. Here are some key takeaways:

The Departmental Committee on Finance and National Planning has invited the public and stakeholders to submit written memoranda/comments on the Finance Bill, 2023 on or before 20th May 2023.

You can access the Finance Bill here.

The 2023 Economic Survey

The Kenya National Bureau of Statistics released the Economic Survey 2023 and here are a few key highlights:

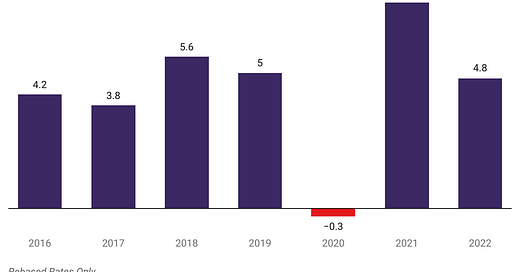

GDP: Real GDP grew at 4.8% in 2022 from a revised growth of 7.6% in 2021. Nominal GDP increased by 11.1% to KES 13.4T. Agriculture contributed the most to GDP at 21.2% or KES 2.8T in absolute terms, up 9.5% year-on-year.

Revenue and Expenditure: FY 2022/23 Tax Revenue is projected to increase by 14.4% to KES 2.3T, while Ordinary Revenue is expected to rise by 15% to KES 2.5T. Expenditure projection is at KES 3.4T, up 12.5%.

Trade: Total Imports and Exports edged higher by 17.5% and 17.4% to KES 2.5T and KES 873.1B, respectively. Total Trade with the EAC was up 13.8% to KES 324.2B, while that with COMESA grew by 9.5% to KES 390.6B. The Trade Balance was up by 17.6% to KES 1.6T [2012: KES 856.74B], while the current account deficit widened by 7.9% or KES 49.8B to KES 679.6B, equal to 5.1% of GDP [2021: 5.2%].

Manufacturing: The total value of the sector was up by 17.6% to KES 2.7T. Its contribution increased by 40 basis points to 7.8% [2012: 11%], and the total credit that was extended to the sector expanded by 14.3% to KES 532B.

Banking: Banking system assets grew by 2.3% to KES 5T, and the total domestic credit jumped by 12.2% to KES 6.2T. Credit to the Public Sector grew faster, at 12.2% to KES 2.1T, compared to Private Sector Credit which was up by 11.9% to reach KES 2.5T. The Trade sector accounted for the largest credit extended at KES 605B, up 10.4%; Mining and Quarrying the least at KES 22.9B, up 32.2%.

Tourism: Total international holiday arrivals expanded by 86.2% to reach 559.1M, while aggregate arrivals grew by 76.9% to 1.54M. International arrivals at MIA and JKIA expanded by 73% to 1.2M, while other border points recorded 342K arrivals, up 92%.

Transport: Total freight traffic on the SGR expanded by 12.6% to 6.1K tonnes. Revenue-per-tonne-KM edged higher by 1.8% to KES 4.48, while revenue per Passenger-KM was 2.38, down 0.4% to KES 2.39. At the Mombasa Port, Container traffic in TEUs increased by 1% to 1.4M, while ships docking at the port fell by 4.5% to 1.56K. Total Transit traffic through the Mombasa Port was down 7.3% to 10.2K.

You can access our analysis of the report here and the full document here.

Company Earnings

Homeboyz Turns a Profit: For FY 22, revenues increased by 144% to reach KES 366M, while the Gross Profit rose by 178.7% to KES 116.4M to bring the Gross Margin to 31.7% [FY 21: 27.8%]. Profit after Tax stood at KES 10.7M from a loss of KES 17.4M in FY 21. There will be no dividend payments, unchanged from FY 21.

“The stellar growth witnessed in the company’s financial performance in 2022 was largely driven by the recovery of the social scene in the post-pandemic era. The growth is also attributable to the heightened campaign activities leading up to the 2022 general election.”

Branch MFB Assets Down 11% in Last 2 Years: For the year ending 31st December 2022, the Total income for Branch Microfinance Bank increased 8.4X to reach KES 694.1M, while gross expenses were up 8.7X to KES 781M. The operating loss expanded 12X to KES 86.9M, and a Tax credit amounting to KES 133M resulted in a net profit position of KES 46.2M [FY 2021: KES -7.7M]. The asset base was up 147% to KES 990.8M, with a liquidity ratio of 93.4%.

Weekly Capital Markets Wrap

The NSE: In Week 18 of 2023, Kakuzi was the top-performing stock on the Nairobi Securities Exchange in April 2023, appreciating by 60.8% to KES 424.5, while Liberty Holdings was the worst-performing stock, falling 17.3% to KES 3.98. The NSE 20 and NSE 25 indices fell by 2.8% and 4.7% to 1,534.5 and 2,721.4 points, respectively while the NSE All Share Index was down by 4.3% to 103 points. Equity turnover was down 13.3% to KES 893.8M while bonds turnover inched higher by 12% to KES 13.9B.

T-Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day treasury bills were 10.318%, 10.678%, and 11.170% respectively. The total amount on offer was KES 24B with the CBK accepting KES 25.5B of the KES 26.6B bids received, to bring the aggregate performance rate to 110.72%. The 91-day and 364-day instruments recorded 508.1% and 53.36% performance rates, respectively.

Eurobonds: Last week, all yields fell on a week-on-week basis across the 6 outstanding papers.

After touching a high of 20.5% earlier in the week’s trading action, KENINT 2024 retreated the most, by 173 bps to 18.9%, while KENINT 2027 fell the least, by 6.3 bps.

All yields were up on a Year-To-Date (YTD) basis. KENINT 2024 led the gains at 638.8 bps, compared to an increase of 4.99 bps in a comparative period in 2022. The significant increase this year reflects the market’s orientation around the management of the $2B KENINT 2024 maturity. KENINT 2048 appreciated the least YTD, by 161bps.

KENINT 2024 led price gains week-on-week, rising by 1.7% to 88.192. On a YTD basis, prices on all yields fell, with KENINT 2048 leading price losses at 14.8% to 66.054. KENINT 2024 recorded the least price depreciation at 4.7%.

Market Gleanings

💼 | Funding Secured | The African Development Bank Group has extended a €63M/KES 9.5B loan to Kenya for the Kenya Emergency Food Production Facility (AEFPF-K). Regional lender African Export-Import Bank inked a 3-year $3B/KES 407B facility, and the World Bank has extended a $300M/KES 41B facility to Kenya Power Lighting Company to improve operations. Notably, the new World Bank’s President Ajay Banga was in the country during the week.

💰 | StanChart to Stay Out of EACOP | Standard Chartered Group will not participate in the financing of the 1,443KM/900 Mile East Africa Crude Oil Pipeline (EACOP). Barclays PLC ballparks the pipeline’s budget at $5B and its emissions have been estimated at 7X the CO2 emissions than the entire country of Uganda. TotalEnergies, the lead investor in the project, has signed a deal with China Petroleum Engineering (CPP) where a significant amount of lending is expected. The National Offshore Oil Corporation owns 8% of EACOP, and this, coupled with the CPP funding, points to more Chinese execution and involvement in the project.

💣 | Another US Bank Folds | First Republic Bank became the fourth bank to fail globally, and the third in the US to fail this year, after the collapse of Silicon Valley Bank and Signature Bank. The collapse was the 2nd largest by Total Assets after Washington Mutual in 2008 during the Global Financial Crisis. JP Morgan Chase entered into an agreement with the FDIC for the purchase of deposits and assets of First Republic. Meanwhile, the US Fed hiked the Federal Funds Rate to the 5.00 - 5.25% range, a 16-year high.

💵 | From Loans To Debt | The Nigerian Government’s loans from the Central Bank total $22.7T Naira/$49B and this week, the Nigerian Parliament approved outgoing President Muhammadu Buhari's request to convert the loans into a 40-year bond that pays a 9% interest rate. This will raise the country's debt by ~50% to a record of ~69T Naira/$ 149B.

👨💼 | Key Appointments |

Dr. Eng. Joseph Siror has been appointed as the Managing Director and CEO of Kenya Power and Lighting Company PLC.

Mrs Hellen Chepchumba Chepkwony has been appointed as the CEO of Kenya Deposit Insurance Corporation for a term of 3 years.

Mr Lawrence Kibet has been appointed as the Director General of Public Investments and Portfolio Management.

🧾 | The Week Ahead | Safaricom is reporting its FY 2022/23 results on Thursday, 11th May 2023. We will host a Twitter Space on Thursday at 8 pm to cover the results.