👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s austerity measures due to the withdrawal of the Finance Bill, 2024, Kenya’s Q1 2024 GDP report, and Standard Group’s FY 2023 earnings.This week's newsletter is brought to you by The Kenya Mortgage Refinance Company.

First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Kenya’s Austerity Measures

The Aftermath: The country is currently dealing with the repercussions of the persistent protests that have led to the scrapping of the government’s intended tax plans through the Finance Bill 2024. The protests have led to a surge in Kenya's credit-default swaps, which represent the cost to insure the country's debt. The surge is a sign of shaken investor confidence.

Budget Cuts: As a result of the rejection of the Finance Bill, 2024, Kenya is exploring alternative ways to fund the KES 346B deficit that was to be funded by the Bill. The government now plans to cut its spending plans for the 2024/2025 financial year and implement austerity measures. In his address to the nation on 5th July 2024, President William Ruto pointed out that the executive will be proposing a KES 177B (USD 1.38B) budget cut and borrowing the remaining KES 169B (USD 1.32B). According to the Budget Statement read in Parliament by the Cabinet Secretary to the National Treasury, the fiscal deficit for FY 2024/2025 was KES 597B (3.3% of GDP), and the additional KES 169B borrowing is set to bring the deficit to KES 766B (4.6% of GDP). The estimated fiscal deficit for FY 2023/2024 is 5.6% of GDP.

Tightening the Belt: Among the measures the government plans to introduce to cope with the withdrawal of the Finance Bill are the scrapping of 47 State Owned Enterprises (SOEs) with overlapping functions, suspension of the decision to fill the positions of the Chief Administrative Secretaries, reducing the number of government advisors by 50%, suspension of motor vehicle purchase by government, suspension of non-essential travel, among others. These measures are set to help the government realize the new budget with the available resources. The National Treasury on 5th July 2024 also asked Ministries, Departments, and Agencies (MDAs), Judiciary, Parliament, Constitutional Commissions, and independent offices to submit new budget estimates for FY 2024/2025 by COB on Monday, 8th July 2024.

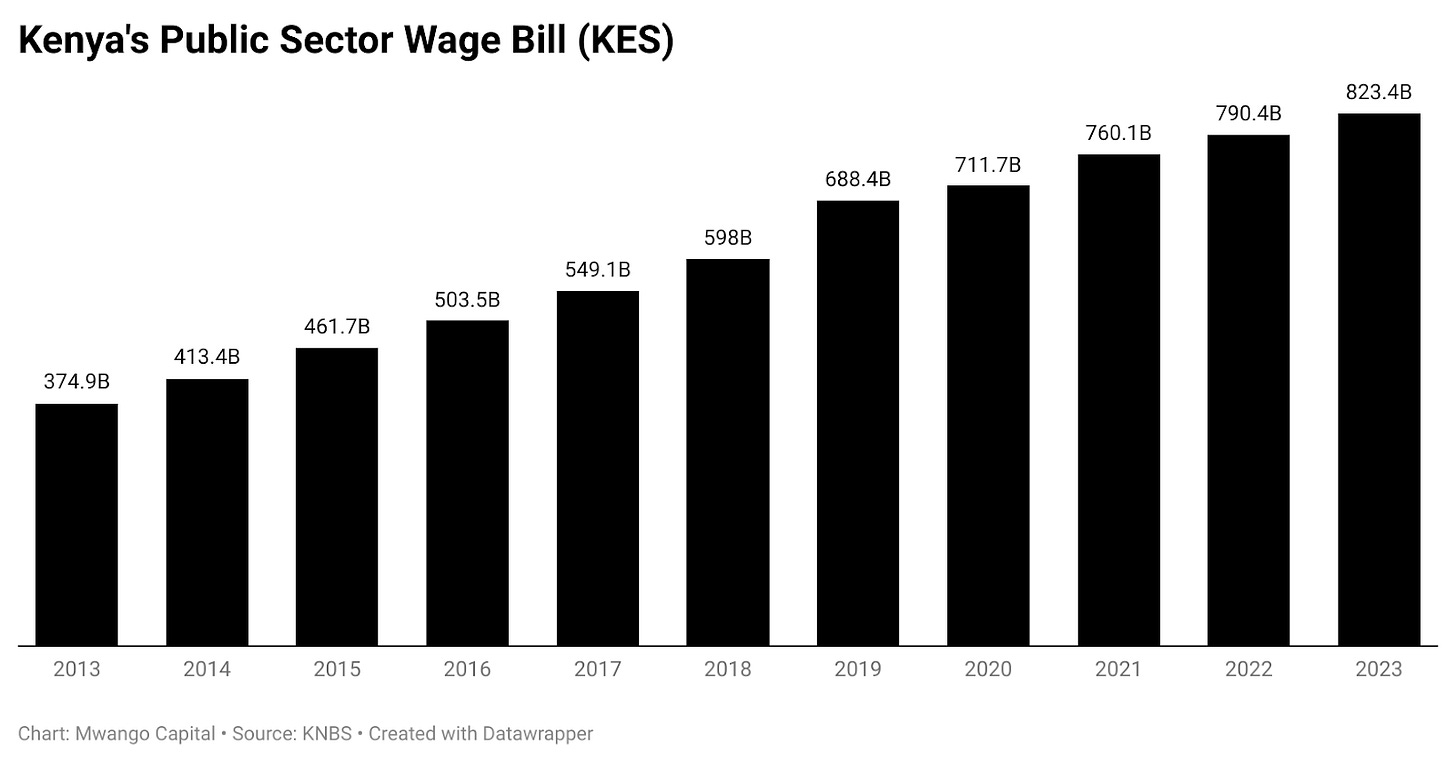

Hiring Freeze: Further, the Kenyan government has announced an immediate suspension of all new and ongoing public service recruitment for one year, citing the need to align with austerity measures and reduce the public wage bill. This directive, issued by the Ministry of Public Service, Performance, and Delivery Management, aims to control runaway expenditures on salaries and allowances, which currently strain national finances. A tripartite committee comprising representatives from the Ministry of Public Service, the National Treasury and Economic Planning, and the Public Service Commission (PSC) will evaluate recruitment initiatives to ensure compliance with the new fiscal directive. The move follows resolutions from the Third National Wage Bill Conference and the recent Budget presentation to Parliament, emphasizing the urgency of fiscal prudence and resource allocation to essential national priorities.

Public Debt Audit: The President also announced the creation of a Presidential Taskforce on Forensic Audit of Public Debt. Vide Gazette Notice No. 8261 of 2024, the President appointed Nancy Onyango as Chairperson and Luis G. Franceschi (Prof.) as Vice Chairperson. Others appointed include CPA Philip Kaikai (ICPAK Chair), Faith Odhiambo (Law Society of Kenya President), Shammah Kiteme (Eng.) (IEK President), and Vincent Kimosop. The joint secretaries are Abraham Rugo (Dr.) and Aaron Thegeya (Dr.).

However, the Law Society of Kenya issued a statement stating that it was not going to participate in the process, emphasizing that the entire process is a precinct of the Auditor General.

Kenya’s Q1 2024 GDP Report

The Kenya National Bureau of Statistics released its report for Q1 2024. Here are key highlights from the report:

GDP Growth: Real Gross Domestic Product (GDP) expanded by 5.0% year-over-year in Q1 2024 [Q1 2023: 5.5%]

Sectoral Growth: The growth was primarily driven by expansions in Agriculture, Forestry, and Fishing activities (6.1%), Real Estate (6.6%), Financial and Insurance sectors (7.0%), Information and Communication (7.8%), and Accommodation & Food Services (28.0%).

Balance of Trade: Imports in Q1 2024 increased by 16.0% to KES 683.9B. Total exports rose 28.0% to KES 297.8B, bringing the trade account deficit to KES 386.1B [Q1 2023: KES 357B].

Current Account Deficit: The deficit increased by 18.8% to reach KES 131.2B [Q1 2024: KES 110.5B], accounting for 0.86% of GDP.

Remittances: Diaspora remittances increased by 40.4% to reach KES 181B [Q1 2023: KES 128.9B].

Find the entire report here.

Standard Group’s FY 2023 Results

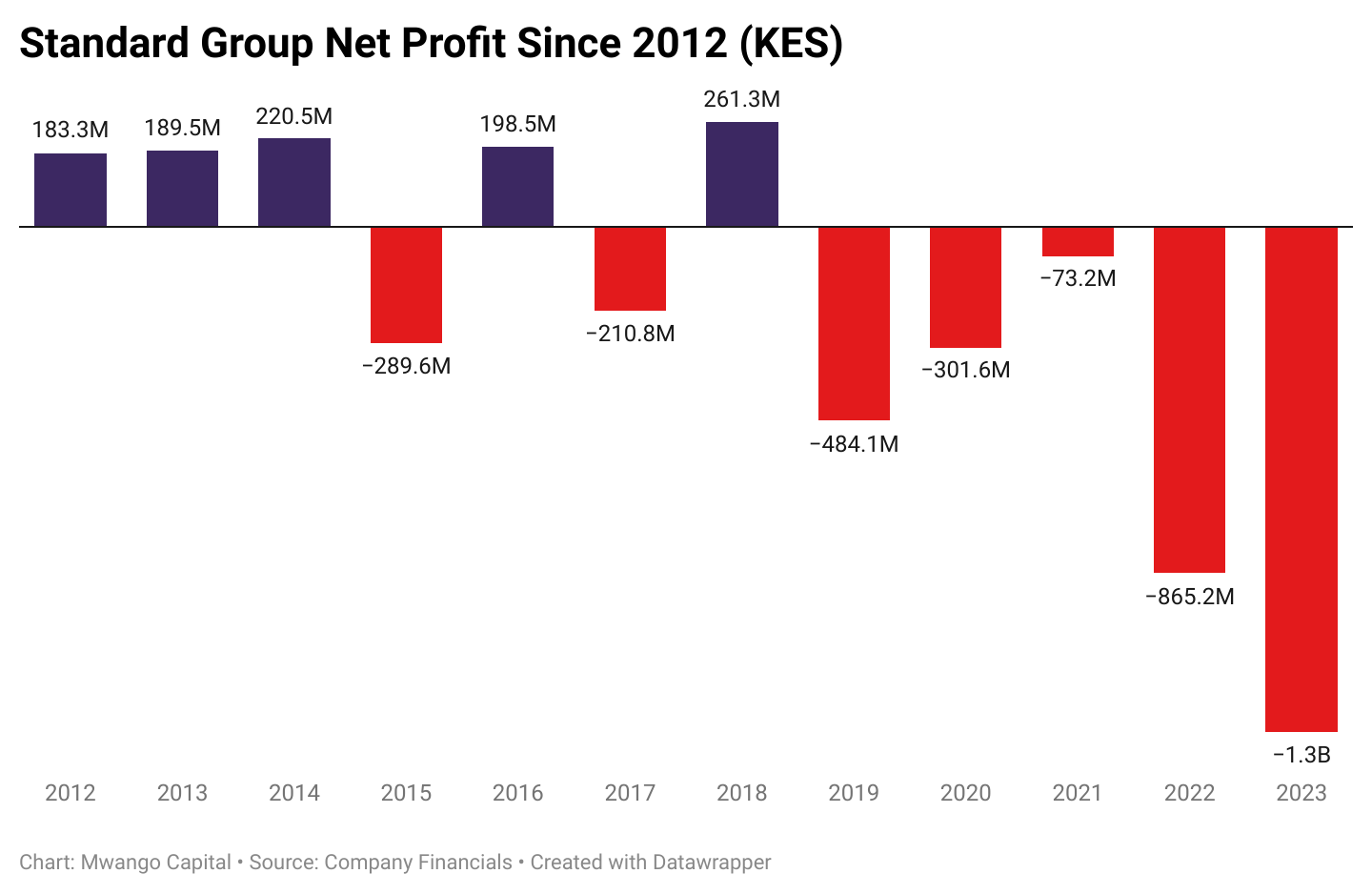

13% Revenue Dip: For the financial year ended 31st December 2023, Standard Group PLC revenues were KES 2.4B, a decline of 13% year-on-year. The revenue fall was attributed to reduced business from advertising clients as firms cut marketing spending due to the challenging business environment. This was exacerbated by the reduction in advertising by the government.

Loss Widens: Total operating costs were down by 15% to reach KES 3B, surpassing revenue earned by KES 625.3M as compared to KES 807.8M in FY 2022. When adjusted for other losses and net finance costs, the loss before tax amounted to KES 722.5M [FY 2022: KES 1.2B]. The net loss for the year widened by KES 231.9M to KES 1.3B. The loss per share was KES 14.27 [FY 2022: KES 10.05].

Find the results and analysis here.

Markets Wrap

NSE: In Week 27 of 2024, Longhorn led the market, rising 12.0% to KES 2.34, while BK Group was the worst performer, dropping 13.9% to KES 31.00. The NSE 20 rose by 0.2% 1659.7 points while both the NSE 25 and NASI indices declined by 0.2%, closing at 2,854.8 and 109.0 points, respectively. Equity turnover rose by 8.4% to KES 976.79M, while bond turnover went down to KES 35.0B from KES 35.45B the previous week.

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.9868%, 16.7951%, and 16.8299% respectively. The total amount on offer was KES 24B with the CBK accepting KES 27.9B of the KES 29.8B bids received, to bring the aggregate performance rate to 124.4%. The 91-day and 364-day instruments recorded 370.1% and 56.32% performance rates, respectively. The Central Bank of Kenya has announced the results of the tap sale of the FXD1/2023/002 treasury bond, investors submitted KES 487.5M out of the KES 20B on offer, resulting in a performance rate of 2.44%. The Central Bank of Kenya accepted KES 485.48M.

Eurobonds: In the week, yields were down week-on-week across the 5 outstanding papers.

KENINT 2028 fell the most, down 19.80 bps to 9.972%, followed by KENINT 2048 at 13.70 bps to 10.748%. KENINT 2034 fell the least, down 7.20 bps to 10.449%. The average week-on-week change stood at 15.40bps.

Except for KENINT 2027 which shed 31.30bps, yields on the remaining papers rose on a year-to-date (YTD) basis, with KENINT 2034 rising the most by 1.11 percentage points followed by KENINT 2032 at 73.70 bps to 10.361%.

All prices rose week-on-week, led by KENINT 2048 which rose by 1.2% to 78.694, followed by KENINT 2028 at 0.7% to 91.848. KENINT 2027 rose the least at 0.2% to 95.711. YTD, KENINT 2027 was the only paper that rose, up 1.6% to 95.711. KENINT 2034 fell the most at 6.4% to 75.316 followed by KENINT 2048 at 5.4%.

Market Gleanings

📄| SRC Freezes Salary Reviews | In response to recent media reports about salary increases for MPs and other State officers, the Salaries and Remuneration Commission (SRC) has clarified that these increases were part of a previously published Gazette Notice on 9 August 2023. Given current fiscal challenges and proposed budget cuts, the SRC, in consultation with the National Treasury, has decided to freeze the upward review of salaries for State officers for the 2024/2025 period.

🤝| KCB and CAK Settle | The Competition Authority of Kenya and KCB Bank Kenya Limited have reached a settlement agreement following investigations initiated under the Competition Act. The complaint centered around an advertisement on the Company’s website, falsely claiming that Platinum Credit Card holders were entitled to a 45-day interest-free period.

📃| NCBA Acquires AIG Insurance | NCBA Group PLC has successfully finalized its 100% acquisition of AIG Kenya Insurance Company Limited, reinforcing its position in the financial services industry. Having held a minority shareholding in AIG Kenya for over 18 years, this move brings a venerable 50-year-old insurance business into the NCBA fold.

🏦| Update on Bank Al-Habib | Bank Al-Habib Limited of Pakistan (BAHLP) has closed its Kenyan representative office, four years after its establishment. The bank announced that October 27th, 2023, was the official date when it received CBK's guidance on winding up operations, with June 30th, 2024, marking the last day of its business activities in Kenya.

💸| Dahabshiil and M-Pesa Safaricom Partner | Money transfer company Dahabshiil and M-PESA Safaricom-Ethiopia have signed a strategic partnership, enabling the Ethiopian diaspora to send money directly to M-PESA mobile wallets. The agreement, signed in Addis Ababa aims to streamline the remittance process, ensuring faster transfers and increased security.

🏛️| Tanzania’s CBR at 6.0% | Tanzania's central bank has maintained the interest rate at 6.0% for the coming quarter. This decision aims to balance economic growth and stable inflation. The bank expects the economy to keep growing at a good pace, with low inflation and a stable exchange rate thanks to factors like increased tourism and exports. This decision comes after the bank raised the rate from 5.5% in April to fight inflation.

The Bank is also buying six tonnes of gold this year, the most ever, to diversify the country's foreign exchange reserves and reduce reliance on a single currency. This is part of the government's National Gold Reserve program, which aims to increase foreign exchange reserves from USD 5B to cover more than four months of imports to a higher level.

🇹🇿 | Tanzania Sugar Industry Reforms | Tanzania aims to achieve sugar self-sufficiency by 2025/26 by expanding sugar factories, attracting investment, and efficient sugar production and distribution. The plan also involves the National Food Reserve Agency (NFRA) managing sugar imports, if needed, and revising the 2001 sugar law to establish fair pricing and improve transparency.