👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover KCB's acquisition of an 85% stake in DRC’s Trust Merchant Bank, insurance companies’ half-year results, and SASRA's 2021 annual report.First off, enjoy our weekly business news in memes brought to you by Abojani Investment:

KCB Acquires Stake in TMB

Scoop: KCB Group, Kenya’s second-largest bank by asset size, has announced the acquisition of an 85% stake in DRC’s Trust Merchant Bank (TMB). The transaction is at a consideration based on TMB’s Net Asset Value as of the completion of the transaction and at a Price-to-Book multiple of 1.5. KCB intends to complete the acquisition by the end of Q3 2022 and will gradually acquire the remaining 15% minority shareholding over the next 2 years.

“This is part of our ongoing strategy to tap into opportunities for new growth while investing in and maximizing returns from the Group’s existing businesses. It gives us strong headroom to accelerate our growth ambitions to deliver better value for our shareholders and to bolster the push for deeper financial inclusion and social and economic transformation in Africa and beyond. We are excited that we can now play a role in catalyzing DRC’s and indeed East Africa’s economic expansion agenda.”

KCB Group Chairman, Andrew Kairu

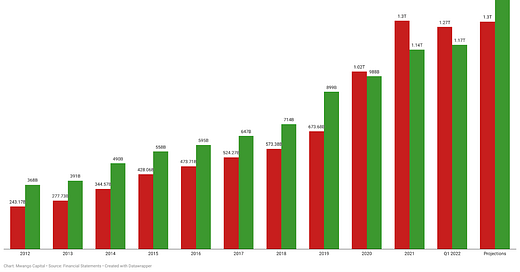

Impact: KCB is set to become East Africa’s largest bank by assets post-acquisition, with a gross base of KES 1.5T, ahead of current market leader Equity, whose total assets stood at KES 1.3T as of March 31, 2022. TMB has an asset base of $1.5B with over 110 branches countrywide. Equity entered the DRC market through the acquisition of 79% of ProCredit Bank Congo, which later merged with another acquisition of BCDC to form EquityBCDC. EquityBCDC is DRC’s largest lender by asset size at KES 361.3B and currently has 74 branches. It was the best-performing subsidiary, returning KES 1.4B in net profit in Q1 2022.

In other banking news:

Stanbic’s Headwinds in S. Sudan: Stanbic’s unit in South Sudan is operating as a branch of the Nairobi HQ rather than a subsidiary, something that the Bank of South Sudan does not like. The regulator this week threatened to revoke its license lest the unit transformed to a subsidiary on claims that its status as a branch was effectively making it a parallel central bank.

SBM to Pay Deposits: A court this week ordered SBM Bank (Kenya) to pay Afrasia Bank over $7.5M (KES 892M) which the latter placed in deposits in bust Chase Bank in April 2016. Due to the acquisition of the collapsed bank, the court argued SBM Bank was equally liable for its liabilities, including the Afrasia deposits.

Egypt Bank Opens Office: This week, the Central Bank granted Banque Misr-S.A.E. of Egypt authority to establish a representative office in Kenya. Wholly owned by Egypt's government, the lender is currently the second largest commercial bank in Egypt by asset size and market share, and its office in Kenya will operate by the name Banque Misr-S.A.E-Kenya Representative Office.

Insurance Companies’ Half-Year Results

Kenya RE H1 Results: The underwriter grossed KES 1B in profit before taxes to a record KES 1.19B. Net earned premium grew by 12.4% year-on-year to KES 9.77B while on a net basis, claims and benefits were up 3.8% to KES 6.14B. Among the insurers that have reported for the period ended June 30, 2022, Kenya RE has recorded the highest increases in PBT and PAT by 55.9% in both cases to KES 1.19B and KES 832.1M, respectively.

CIC Net Income Up: The insurer’s gross written premium for the period under review grew 22.9% to KES 13.2B. Operating expenses were up 8.46% to KES 9.9B while profit before tax increased by 37.7% to reach KES 463.6M. The bottom line grew by 45% to KES 376.4M on a year-on-year basis, with the underwriter closing the trading period with KES 4.26B in cash and equivalents, which are up 16.9% year-on-year.

Sanlam Reduces FY Loss: In the period ended June 30, 2022, the underwriter reported a 9.1% year-on-year decrease in gross written premiums to KES 5.38B. Investment income fell by 50.2% to KES 1.02B, occasioning a fall of 4.55% in total income for the operating period to KES 5.66B. At 5.53%, net earned premiums grew almost double the pace of net claims growth on year-on-year terms, to reach KES 4.6B while claims were up 3.96% to KES 4.2B. While the firm was able to hold back on operating expenses which fell 3.38% year on year, it narrowly reduced its Full Year loss by KES 4.11M to KES 287.75M.

Insurance Sector Report Q1 2022

The Insurance Regulatory Authority released its report for the first quarter of 2022. Below are some highlights:

Long-Term Insurance: In the period under review, gross premium income was up 12.1% year-on-year to KES 34.51B. At 34.4% and 25.1%, Deposit Administration and Life Assurance accounted for the largest year-on-year changes in gross premium income. Personal pensions fell 11.1% year on year to KES 1.54B. Over the last four years, the ratio of shareholders' funds to total assets has been on a steady decline, topping at 10.62 in Q1 2019 to 9.51 in Q1 2022. However, the pace of asset growth has been terrific, reaching 9% in CAGR compared to that of shareholders funds of 6.04% in the same period.

General Insurance: Gross premiums for the general insurance business grew 11.2% year-on-year to KES 53.92B in Q1 2022. Underwriting results were a gross loss of KES 510.21M, a reduction from the KES 1.74B posted in Q1 2021. The subsector's combined ratio reduced to 101.9 in Q1 2022 from 110.4 in Q1 2020, when it posted a KES 2.36B loss.

Reinsurance: The subsector posted KES 925.47M in net income in Q1 2022 compared to a KES 505.59M loss position in Q1 2021. The results were buoyed by a 54.5% year-on-year rise in commissions to KES 2.7B in Q1 2022 and a 43.1% decrease in management costs to KES 551.38M. The net effect of these two measures was KES 538.83M or 58.22% of Gross Subsector Net Income. Given that the objective of reinsurers is to underwrite insurers, the record 37.2% year-on-year growth in the net premium earned points to the level of risk sentiment and caution taken thereof in the period under review.

Overall: Confirming the trend in the just-released results by insurance firms for the six months to June 2022, the industry's cash pile grew by 43.1% year-on-year to KES 12.39B in Q1 2022. Investments in income-generating assets grew by 11.15% year-on-year to KES 753.7B. Government securities accounted for the largest share of the investments at 69.7% or KES 525.33B.

You can find the report here.

SACCOs 2021 Report

The SACCO Societies Regulatory Authority (SASRA) released its annual report for 2021 and below are some key highlights:

Asset Base: Among the top 5 large-tiered SACCOs by asset size, at 13.14% and 12.79%, only Stima and Kenya Police SACCO registered double-digit growth in assets on year-on-year terms in 2021. With a nationwide footprint of 18 branches, market leader Mwalimu Sacco topped SACCOs by asset size, posting KES 60.6B in assets in 2021, which is 5.03% year-on-year growth, and returned KES 7.58B in Total Income.

Membership: The distribution of total assets of the SACCO subsector by membership and common bond cluster shows that 117 Government-based SACCOs controlled the highest share of assets at 65.66% in the period ended December 2021.

Loans and Provisions: In 2020, the number edged up to KES 25.05 across Deposit Taking (DT) and Non-Withdrawable Deposit Taking (NWDT) Saccos, a year-on-year growth of 29.3%. In 2021, the provisions came in at KES 36.07B, a 43.98% year-on-year growth to KES 36.07B or 6% of gross loans in the SACCO subsector. What is striking is the provisioning in the NWDT Saccos which rose 133.8% year-on-year to KES 2.02B in 2021 from KES 0.86B in 2020.

Non-Remitted Deductions: Employers paid KES 1.7B in non-remitted deductions in 2021 to bring the outstanding amount to KES 3.4B from KES 5.05B in 2020. Deposit-Taking Saccos had the largest amount of arrears at KES 3.01B, while NWDT SACCOs accounted for KES 388.2M, or 11.41%.

Active Member Accounts: More than 1.18M out of 6M SACCO members, or 19.7%, stopped making monthly contributions. The ratio stood at 19.8%, 16.8% and 16.1% in 2020, 2019, and 2018, respectively.

You can find the report here.

Debt Markets

Eurobond Yields Ease: The yield curves for Kenya’s Eurobonds have been falling since they last touched all-time highs in Mid-July. The bond due 2024 closed last week at 15.136% compared to an all-time high of 21.670% on July 14, 2022. The bond due in 2048 closed at 12.648% compared to an all-time high of 15.984% on July 14, 2022. Yields are looking for direction from the outcome of elections on Tuesday this week which will have implications for the debt management of Kenya’s KES 828.841B Eurobond pile.

Treasury Seeks KES 50B: The Central Bank of Kenya has released a prospectus for re-opened three-year FXD1/2022/03, ten-year FXD2/2019/10, and twenty-year FXD1/2021/20 fixed coupon Treasury bonds, seeking to raise KES 50B across the instruments. There has been lackluster activity in the bond markets recently, and it remains to be seen how these re-opened instruments will perform.

T-Bills: In the Treasury bills market, investors continued to pile in the front end. Across the 91-day, 182-day, and 364-day instruments, the CBK accepted KES 7.47B, KES 2.02B, and KES 1.93B at 8.473%, 9.4%, and 9.92%, respectively. Cumulatively, the CBK accepted KES 11.4B out of the KES 24B offer, an aggregate performance rate of 47.6%.

What Else Happened This Week

🏭 Kenya’s July PMI Falls: Stanbic’s Purchasing Managers’ Index for Kenya for July 2022 fell to 46.3 from 46.8 in June, the fourth consecutive month of decline for the country’s private sector. Inflationary pressures have dampened demand and new orders fell, effectively muting business confidence.

⚖️ CMA v Chase bank: The Capital Markets Authority has issued sanctions and fines against Chase Bank Directors, Management, and its reporting accountant, Deloitte, for their role in the KES 4.8B botched bond in 2015. Out of a KES 10B approved bond amount, the now-bust bank issued the first tranche amounting to KES 3B at 13.1% with a 7-year tenor. The MTN proceeds were meant to be directed towards expanding the branch network, strengthening the capital base, and investing in IT and product development.

🔦 Kakuzi in the Spotlight: Kakuzi Plc is now facing scrutiny from Kenya Revenue Authority on transfer pricing practices that might have had tax implications. Previously, CMA has questioned the firm’s CEO and CFO on allegations of shifting profits abroad and conflict of interest by its majority shareholder Camellia Plc.

📅 KRA’s Extended Deadline: The taxman has extended the deadline for the requirement by taxpayers to comply with the Tax Invoice Management System to September 30 to allow for more time for ETR upgrades. There were ETR scarcity complaints as the deadline neared.

🇨🇳 Kenyan Avocados in China: The first containers of fresh Kenyan avocados arrived in China last week. This follows a directive by the General Administration of Customs of China on June 1st allowing Kenyan avocados into the country. Kenya recently overtook South Africa to become Africa’s largest avocado exporter.

⚠️ Sameer Profit warning: Sameer Africa became the latest company to issue a profit warning for the FY 2022 citing issues to do with the disruption of the supply chain which has made it difficult to get raw materials indeed in tyre production. They also cite the weakening Kenyan Shilling, whose impact they can’t pass on to consumers, as one other issue impacting profits.

🇲🇬 Madagascar’s Rate Hike: In what is a rate hike for a second consecutive quarter, the Monetary Policy Committee of Madagascar’s Central Bank last week increased the key benchmark rate by 90 basis points to 8.9%. Inflation in the country of 27M people is currently at 6.4%.

🇹🇿 BoT to Reduce Liquidity: The Tanzanian Central Bank aims to reduce “the speed of expanding liquidity” over the rest of 2022 to contain a surge in inflation which stood at 4.4% in June. Not much more detail was provided on how this will be done.