👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover performance at the NSA in 2022, KNBS's Q3 2022 report, and tax changes coming into effect in 2023.First off, enjoy our weekly business news in memes brought to you by the Mwango Capital:

The NSE in 2022

Highlights: Car & General was the best-performing stock on the Nairobi Securities Exchange in 2022 as its share price appreciated by 179.5% to KES 47.45 as of 30 December 2022 from KES 16.98 on 31 December 2022. Centum Investment Company Plc was the worst-performing stock, registering a price return of -40.7%.

Across sectors: The Automobile & Accessories sector maintained its 2021 trend to emerge as the stock with the highest average share price change in the year. The Telecommunications sector - comprising Safaricom only out of 4 telecommunication firms in Kenya, plunged the most in 2022. Safaricom officially launched operations in Ethiopia last year, and the latest numbers put its customer base at 1.3M in Africa’s second most-populous nation.

Total Returns: Car and General Posted the highest total returns in the year at 186.27%, followed by NCBA Group at 63.77% and Olympia Capital Holdings at 48%. The three trailing stocks were Safaricom Plc, Centum Investments Plc and Nairobi Business Ventures at -30.6%, -33.65% and -37.8%, respectively.

Indices: The Nairobi All Share Index (NASI) fell 23.4% year-over-year to close at 127.47 points [2021: 166.5]. The NSE 20 Index was down 11.9% to close at 1,676.1 points [2021: 1,902.6], while the NSE 25 Index dropped 16.3% to close at 3,133.6 points [2021: 3,743.9].

Market Cap: Total Market Capitalization at the Nairobi bourse fell 23.4% to KES 1.9T [2021: 2.6T]. Total shares traded were up 88.6% to 19.2M [2021: 10.2M], while equity turnover edged higher by 44.1% to KES 496.6B [2021: 344.6B].

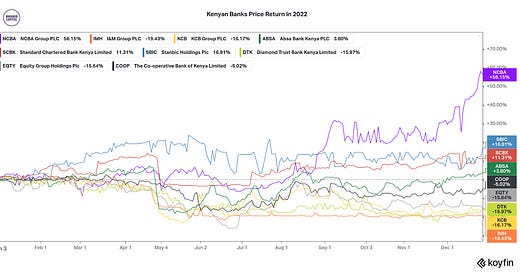

Banking sector: NCBA Group - which recorded the highest year-over-year change in Net Profit in Q3 2022 [+96.2% to KES 12.8B]; was the best-performing banking stock in 2022 in price returns. The counter appreciated by 56.2% to reach KES 39.35 [2021: KES 25.2]. Overall, the sector registered an average share price change of 0.6% [2021: 9.8%].

Profit Warnings: In the 2022 calendar year, 13 listed firms issued profit warnings [2021: 10]. Nearly half of the firms cited increased raw material costs and global supply chain disruptions. In terms of sectoral distribution, 30% of firms were in Construction and Manufacturing sectors, a contrast from 2021 where at least 50% of warnings were from the Banking, Insurance and Investment sectors.

Leadership Changes: There were 11 executive changes in 2022 across listed firms. The bulk of these changes (4) were in the banking sector, 2 in the Energy and Petroleum Sector, and the rest across Energy, Insurance, Telecommunications, and Commercial and Services sectors. Across the general corporate scene, there were a total of 22 executive changes in the year.

Q3 2022 GDP

The Kenya National Bureau of Statistics released its report for economic activities for Q3 2022. Below are key highlights from the report:

GDP Growth: Real Gross Domestic Product (GDP) expanded by 4.7% year-over-year in Q3 2022 [Q3 2021: 9.3%].

Sectoral Growth: After a rebound in Q3 2021 due to the waning pandemic, growth decelerated across most sectors in Q3 2022. The Accommodation and Food Service sector grew the most by 22.9%, followed by the Wholesale and Retail Trade and the Professional and Administrative sectors at 9.1% and 8.7%, respectively.

Balance of Trade: Imports in Q3 2022 stood at KES 661.8B, an increase of 22.2%. Total exports rose 29.7% to reach KES 227.8B; bringing the trade account deficit to KES 434B [Q3 2021: KES 366.1B].

Current Account Deficit: The deficit widened by 5.5% to reach KES 193.425B [Q3 2021: KES 183.4B], to account for 6% of GDP in the quarter [Q3 2021: 6.2%].

Remittances: Diaspora remittances totalled KES 114.3B, or 50% of total exports [Q3 2021: KES 106.1B or 61.3% of exports] in the quarter, an increase of 7.7%. In his first live interview since assuming office, 56-year-old President William Ruto said his government is targeting KES 1T/USD 8.1B in remittances in 2023.

You can access the reports here and here.

Tax Changes in 2023

A raft of new measures come into effect in 2023 affecting various sectors and transactions. Below is a run-down of the changes:

Capital Gains Tax: Capital Gains Tax (CGT) on the transfer of property, unquoted securities and rights has been tripled to 15%. However, worth noting is CGT on transfer by a company certified by the Financial Center Authority with an investment of KES 5B is set to remain flat at 5%.

Corporate Income Tax: Companies operating shipping businesses and those in the carbon market in Kenya will pay 15% tax from 30%.

Excise Duty: 20% excise duty on Bank to Mobile Wallet transactions and vice versa has been reintroduced. The Kenya Revenue Authority (KRA) Commissioner General is also now empowered to exempt specified goods from the Excise Duty Inflationary Adjustment after considering prevailing economic conditions.

Value Added Tax: VAT on services supplied online including E-books, Video conferencing, Movies, and Music has been set at 16%. Multinationals Google and Quickbooks have already issued notices to that effect.

Withholding Tax: Withholding Tax on derivatives earnings by foreigners has been set at 15%, while that on interest earnings on bearer bonds issued to non-residents is 7.5%.

KRA’s Minimum Tax Push: The KRA is moving to the Supreme Court to challenge the decision by the Court of Appeal that upheld the High Court’s decision to quash the introduction of the Minimum Tax which would see all firms - even loss-making ones, pay a 1% tax on gross annual sales.

What Else Happened This Week

💳 Bank-to-M-PESA Charges: Following an announcement by the CBK in 2022 lifting the suspension of charges on money transfer between Banks and Mobile Wallets, banks have reintroduced charges and the matrix below gives a representation of how the fees are stacked across various institutions. Just over KES 16T has been transacted through banks and M-PESA over the life of suspension of the charges.

💰 Kenyan T-bills: In the short-term public debt markets last week, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.392%, 9.369%, and 10.369% respectively. The total amount on offer was KES 24B with the CBK accepting KES 31.4B of the KES 31.6B bids received. The performance and acceptance rates were 131.65% and 130.8%, respectively.

🕳️ FX Losses Hit Embassies: Kenyan embassies abroad funded in local currency in their respective stations are asking the government for a special fund to cushion them from mounting foreign exchange losses threatening their operations. The embassies are funded in KES while their spending is in Foreign Currency.

🛑 KQ Trading Suspension: The NSE issued a notice extending the suspension from trading of Kenya Airways Plc Shares for 12 more months. The suspension was approved by the CMA effective January 5, 2023. Previously, the flagship carrier had its shares suspended from trading for 12 months in April 2021.

👨💼 Ngumi Exits Safaricom: John Ngumi resigns as Chairperson from Safaricom’s Board of Directors effective December 22 2022, and Adil Arshed Khawaja will replace him following his approval by the Board on January 5 2023. Ngumi was appointed to Safaricom’s Board in July 2022.

📈 PMI Reaches 3-Month High: The Stanbic Bank Kenya Purchasing Managers Index (PMI) reached a 3-month high of 51.6 in December 2022 from 50.9 in November. Output expanded for the second month running amid higher demand, favourable weather conditions and softer price pressures. Employment growth was highest since March, while orders continued to rise, boosted by a rise in demand despite export growth falling to a 9-month low.

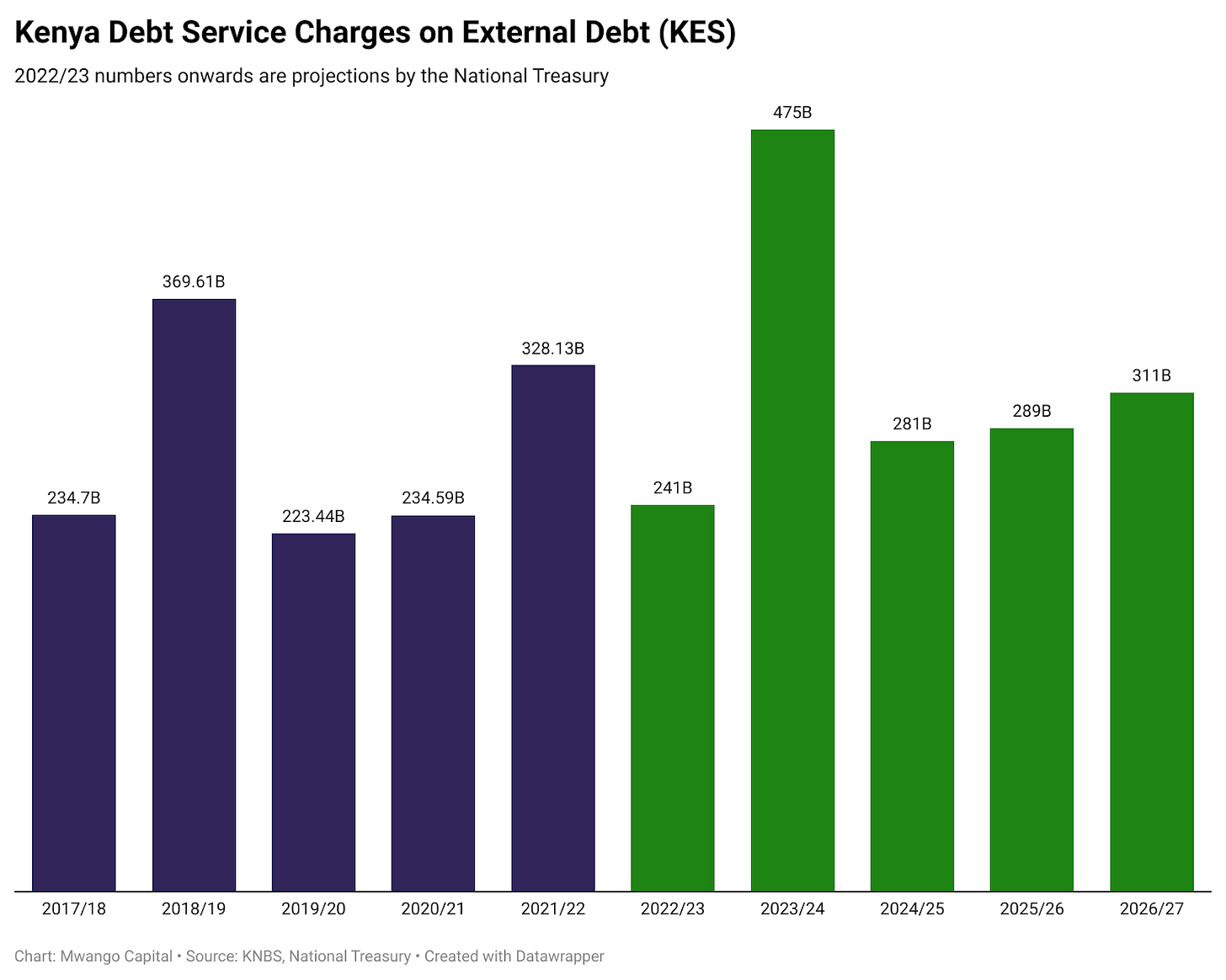

💵 KES 1.6T External Debt Service: Projections by the National Treasury show that over the 5 years — Jul 2022 to Jun 2027 — the govt will spend KES 1.6T [Last 5 years: KES 1.4T] servicing external loans which hit KES 4.36T in Oct 2022. The 2023/24 fiscal year has the largest outlay at KES 475B as Kenya’s $2B worth of Eurobonds fall due.

African Startup Funding: In 2022, African startups raised a record $5.3B, exceeding the investment in 2021 by $100K. The number of deals jumped 20% to 964 - bringing the average deal size to $5.5M. Investment was concentrated in 4 countries including Egypt, Nigeria, Kenya and South Africa, which jointly account for more than 50% of Africa’s GDP.

Interest Rate Watch

🇸🇱 Sierra Leone: The country is the first African country to hike its interest rate in Africa in 2023. The Central Bank of Sierra Leone hiked its key benchmark rate by 125 basis points to 18.25%. Inflation in the country stood at 32.98% as of October 2022 compared to 16.65% in January 2022.

🇮🇱 Israel: The Monetary Policy Committee of the Bank of Israel on January 2, 2023, increased the interest rate by 50 bps to 3.75%. Inflation stood at 5.3% over the last 12 months and the apex Bank has pointed out that the pace of rate hikes will be in accordance with inflation developments.