Sanlam-Allianz Join Forces

This will be the largest Non-Banking Financial Institution in the Africa

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the 2021 Economic Survey, the Sanlam-Allianz JV and give a roundup of some interesting banking sector developments.First off, enjoy our weekly business news in memes brought to you by The Shack Nairobi:

The Sanlam-Allianz Africa Combination

Scoop: Sanlam and Allianz last week reached an agreement to combine their current and future operations in Africa, save for South Africa, in what will be the largest Non-Banking Financial Institution [NBFI] in the continent. The Sanlam-Allianz shareholding structure will be 60:40 and will span 29 countries. The chairmanship of the entity is set for a two-year rotation period.

“The combined operations of Sanlam and Allianz will create a premier Pan-African non-banking financial services entity, operating in 29 countries across the continent. The joint venture will be the largest Pan-African insurance player and is expected to be ranked in the top three, in the majority of the markets where the entity will operate. The entity is expected to have a combined total group equity value (GEV) in excess of 33 billion South African rand (€2B).”

Previously: Allianz has steadily increased its Africa footprint, notably in the East Africa region. It has made some key acquisitions in Jubilee General Insurance Kenya with a 66% stake at KES 10.8B and a 51% stake in Jubilee’s Burundi unit. For the Sanlam Kenya deal, the existing shareholding structure will not be altered.

Good to know: In Kenya, Sanlam grew its Assets Under Management by 27.2% [KES 61.8B] to KES 288.8B in 2021, becoming Kenya's largest fund manager.

2021 Economic Survey Highlights

The 2021 Economic survey was released last week by the Kenya National Bureau of Statistics (KNBS). Below are some notable highlights:

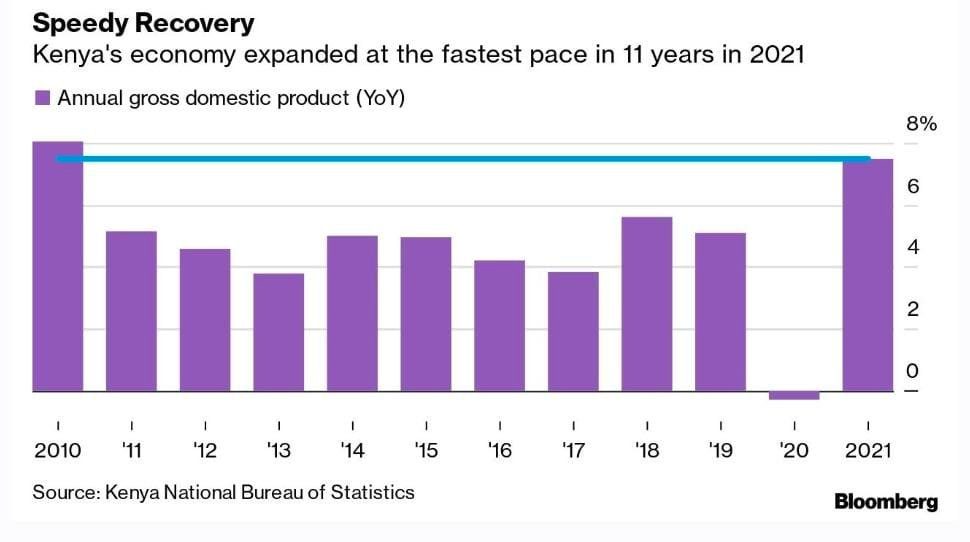

Economic growth: Kenya’s economy expanded by 7.5% in 2021 compared to -0.3% in 2020. Inflation was up 6.1% in 2021 compared to 5.4% in 2020.

Trade Deficits: The trade deficit widened by 40.7% to KES 1.4T. Imports increased by 30.8% and exports by 15.5% with the local demand for overseas commodities increasing as the pandemic effects gradually receded. Petroleum products became the highest import commodity surpassing industrial machinery.

Commercial Bank Credit: Total credit extended grew by 12.7% to KES 4.9T. Loans and advances to the public sector grew 20.7% to KES 1.7T while private sector credit expanded 8.7% to KES 2.4T. The Building, Construction, and Real Estate sector was the largest recipient at 21.3% [KES 531.3B]. The Mining and Quarrying sector trailed at 0.7% [KES 17.2B].

Agriculture: The agricultural sector contracted by 0.2% due to drought. Production of horticultural products was up the most by 29.3%; while Wheat production fell the most by 39.4%. Wheat importation expanded by 0.3% or 6.4K Tonnes and tea production contracted the least at 5.6%.

Government Revenue: Ordinary revenue is expected to grow 14.3% to KES 2.039T for the fiscal year ending June 2022. Tax revenue is expected to comprise 89.9% of this estimate.

Employment: Public sector jobs rose 4.3% to 923,000 while those in the private sector increased 6.7% to 1,984,000. The informal sector was the largest employer at 83.2% of total employment while formal and self-employment accounted for 15.9% and 0.9% respectively.

Tourism: Visitors to national parks and game reserves increased by 50% to reach 1.5M in 2021. International visitor arrivals were up 50.3%.

Read more of our highlights here.

Banking Roundup

NCBA Q1 Results: NCBA Group was the first bank to report Q1 2022 results in Kenya. The bank’s balance sheet was up 8.3% to KES 587B YoY, loans and advances grew 0.3% to KES 244B, and customer deposits grew 7.2% to KES 465B. Asset allocation remains skewed to government securities as evidenced by a 30% YoY increase in investment in Kenya debt securities. Check out our analysis here.

Tanzanian Banks Q1 2022 Results: Here is a quick summary of the top two banks in Tanzania. Notably, CRBB has expressed ambitions to move into the DRC where it will face off with Kenyan counterparts like KCB and Equity Bank.

StanChart Selling Mombasa Building: Standard Chartered Kenya is expecting to dispose of its iconic Treasury Square building in Mombasa in this financial year. The building was designated for sale in 2020 but this was suspended due to the Covid-19 pandemic. The property’s 2021 value stood at KES 222M.

“The property was designated as held for sale in June 2020. Due to the impact of COVID-19 management has not been able to sell the asset within one year from the date of the initial sale decision. As the circumstances were beyond the Group’s control, in line with the Group’s accounting policy the asset has been retained as held for sale at 31 December 2021. Management remains committed to sell the property.”

KCB opens Rwanda Subsidiary: KCB last week opened its Rwandan subsidiary, BPR Bank Rwanda, an entity resulting from the merger of KCB Bank Rwanda and Banque Populaire du Rwanda (BPR). BPR will be the second-largest bank by assets in Rwanda after Bank of Kigali. Other Kenyan banks with a presence there include I&M, Equity, and NCBA Group.

What Else Happened Last Week?

⚡ Ormat to Increase Generation: IPP Ormat Technologies is set to complete an enhancement of the Olkaria power plant by the end of Q2 2022. The plant currently generates 123 MW.

“...we are on track to complete the enhancement of the OEC by the end of the second quarter and expect to gradually increase capacity by 10 to 12 megawatt and even more. In addition, we are on track to start our drilling campaign in the third quarter of this year, which should enable us to restore capacity further and potentially reach full capacity during 2023.”

Ormat Technologies CEO Doron Blachar, Q1 2022 Earnings Call

The latest results from Ormat’s Q1 2022 Form 10-Q filing also show that as of Mar 31, 2022, Kenya Power owed them $19.8M, of which $9.4M was paid in Apr 2022. Kenya Power was the third-largest source of Ormat’s Revenues, contributing 14.1% [$27.3M] of total revenues.

🇰🇪 Kenya May Issue a Eurobond: The Kenyan government is planning to raise $1B through a Eurobond before the end of June 2022. This is despite the fact that yields on Kenya’s Eurobonds have spiked sharply, usually an indication of the high finance costs the country faces if it issues bonds.

“We’re issuing because it’s part of financing.”

Treasury Secretary, Ukur Yatani

🏃 Capital Flight: The NSE witnessed an additional KES 1.7B drawdown in April as foreign investors fled. this brought the Net Selling Position of foreign investors to KES 3.4B as Kenyan elections draw closer. The NSE All-Share Index is down 11.34% year-to-date.

📈 Africa’s Fastest Growing Companies 2022: The Financial Times released its inaugural list of 75 of the fastest growing companies in Africa as measured by Compound Annual Growth Rate (CAGR) between 2017 & 2020. The minimum CAGR for the cut-off was 7.99% and Kenya had 10 companies on the list.

⚖️ Draft CMA Regulations: The Capital Markets Authority has released draft regulations aimed at spurring activity in the financial markets. Some of the suggestions in the draft include barring firms from raising private capital using channels including advertising and marketing, and scrapping of rules that protected firms that raised more than KES 100,000 per investor from scrutiny. Find the draft regulations here.

Interest Rates Watch

Rwanda: The Monetary Policy Committee of the National Bank of Rwanda is expected to meet on May 11 where it will decide the trajectory of the Central Bank Rate. In its last meeting, the MPC unexpectedly hiked the benchmark rate after almost a decade by 0.5% to 5%.