👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s October 2023 MPC meeting and highlights from the KNBS Q2 2023 GDP and BOP reports.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Are you in the process of purchasing or constructing a home? Cooperative Bank has a range of loan options starting from KES 500,000 to KES 8M.

Benefit from up to 90% financing when building and a full 100% financing for pre-constructed homes.

CBK Holds Rates Steady

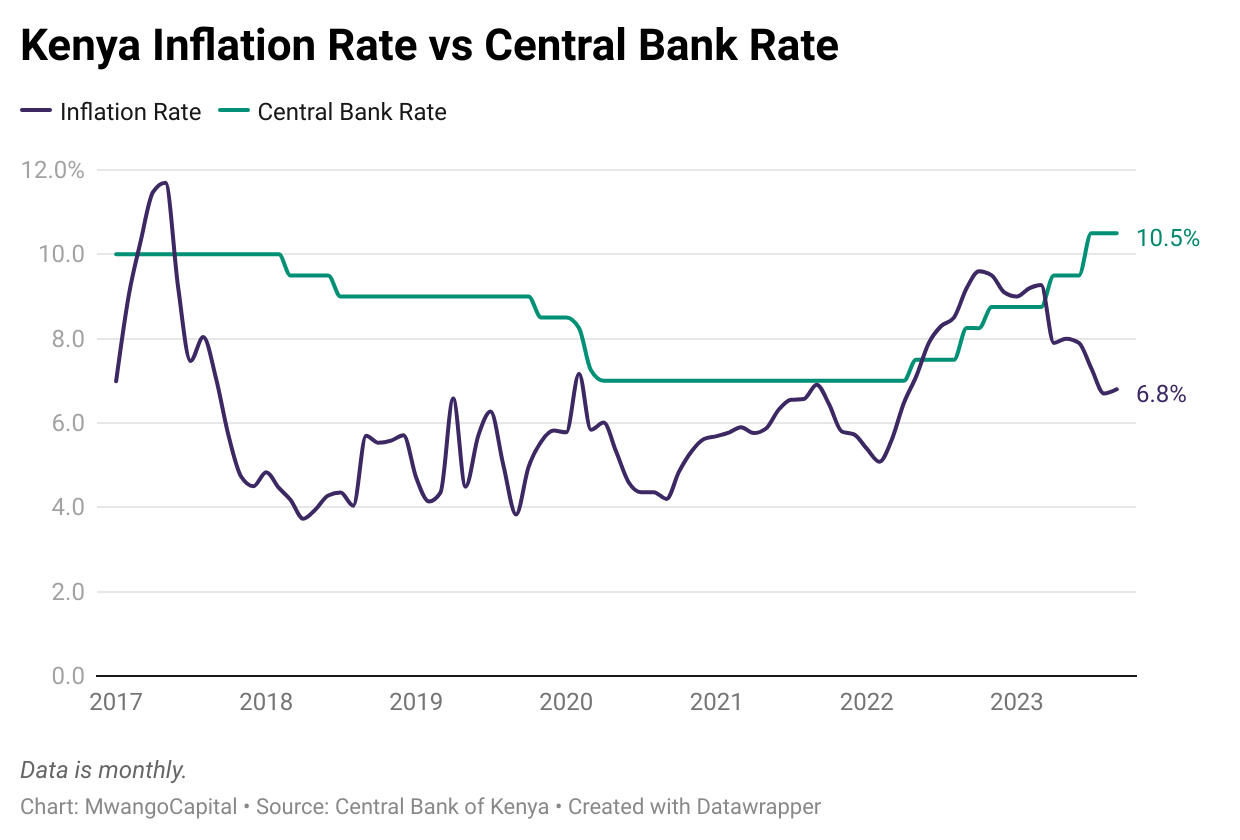

The Monetary Policy Committee (MPC) of the Central Bank of Kenya met on 3rd October 2023, electing to retain the Central Bank Rate (CBR) at 10.50% This is the second time, the CBR is being held at 10.5% following the June 2023 hike.

15-Year High: Kenya’s banking sector NPL ratio closed August 2023 at a 15-year high of 15.0% from 14.9% in June 2023. Increases in NPLs were especially noted in manufacturing, mining, real estate & building, and construction sectors. Dr. Kamau Thugge says the rising NPLs are an “issue of concern”.

“The NPLs are an issue of concern to us. We are keeping a very close eye on it. The NPLs have increased from roughly 14.2% in August of last year to currently 15%. The banks are provisioning for it and we are engaging those banks that have high NPLs just to make sure they are making enough provisions and making sure they have a plan on how to address the NPLs.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

FX Reserves: CBK foreign exchange reserves stand at USD 6,901M (3.70 months of import cover) as at October 5th, 2023 from USD 6,939 as at September 28th, 2023. Dr. Kamau Thugge says the decline is due to debt service payments. He also indicated possible use of the reserves towards redemption of the upcoming June 2024 USD 2.0B Eurobond payment, if need be.

"We are actually building our war chest to address the issue of the Eurobond. If necessary, we will be able to use our international reserves to make sure that there's absolutely no doubt about the government being able to pay for this Eurobond."

Central Bank of Kenya Governor, Dr. Kamau Thugge

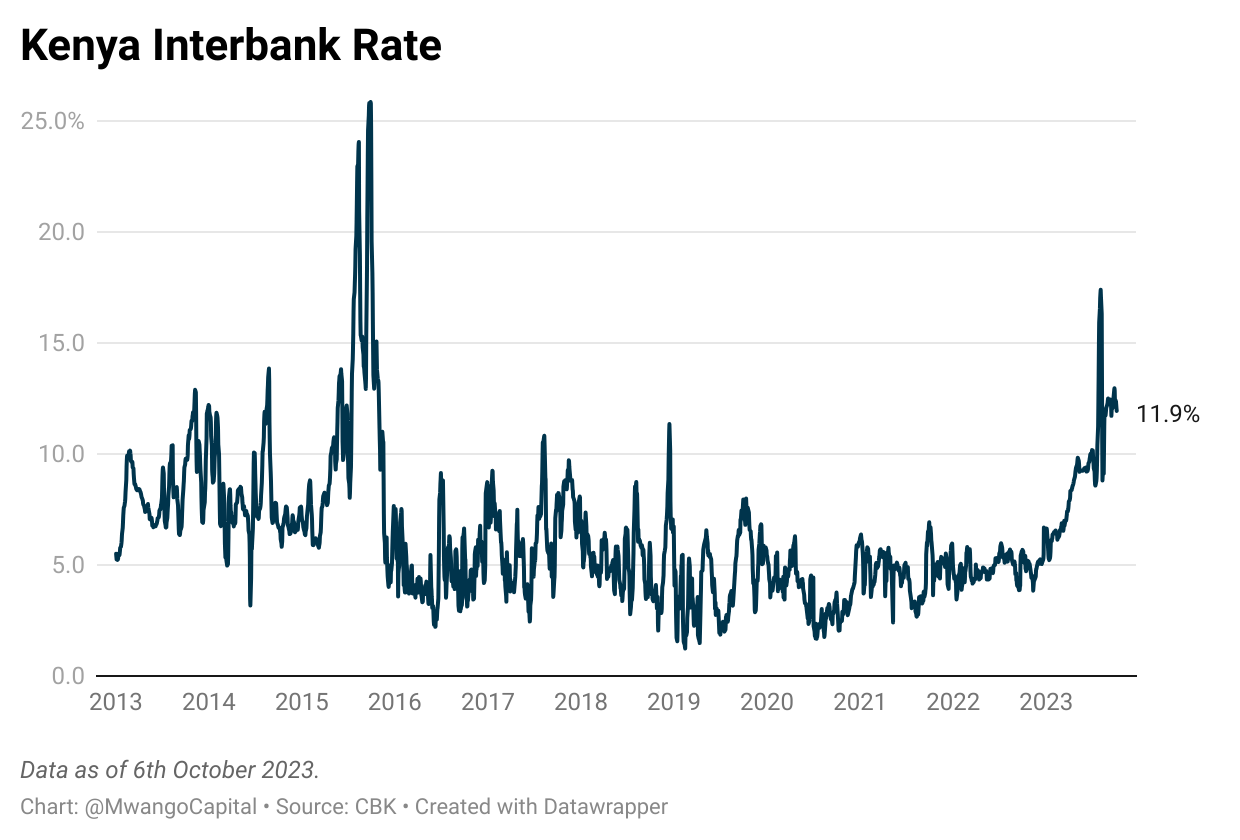

Interest Rate Corridor: The CBK MPC also issued an update on the progress of the new policy framework that introduced an interest rate corridor around the CBR set at ± 250 basis points:

“The MPC noted that interbank market activity has increased while volatility in interbank interest rates had reduced. Additionally, spreads in the interbank interest rates have narrowed with improved liquidity distribution.”

Policy Rate Decision: The Monetary Policy Committee of the Central Bank of Kenya (CBK) elected to retain the Central Bank Rate (CBR) at 10.50% with the expectation of inflation remaining within the CBK’s 5% +/- 250 basis points (bps) target band supported by lower food prices.

“The decision to hold suggests that the central bank is comfortable inflation will remain within the 2.5-7.5% target in the short term, despite the currency coming under depreciation pressure. This is also a reprieve for the economy which is taking a strain from a tight policy environment.”

Bloomberg Africa Economist, Yvonne Mhango

Goldman Sachs’ Commentary: This is what Bojosi Morule and Andrew Matheny had to say about Kenya’s MPC decision:

“We think Kenya’s monetary tightening cycle has now ended and that rates will ultimately be cut to neutral, which we estimate at 8-9% in nominal terms. That said, external pressures, driven by an unfavourable global backdrop, have challenged Kenya’s ability to meet its substantial foreign financing needs, materialising in persistent FX depreciation pressures (17% year-to-date) and a drag on international reserves.”

Deals, Mergers, and Acquisitions

ICA to take up shares in Telkom: Last week, Kenya’s government announced changes to Telkom Kenya’s shareholding that resulted in Infrastructure Corporation of Africa LLC (ICA) of the United Arab Emirates as the telco’s new majority shareholder. This was the outcome of a process to identify a new investor to acquire 60% of Telkom’s shareholding from Jamhuri Holdings Limited. The ICA offer includes capital injection to fund Telkom’s critical infrastructure and the overall upgrade of the company's capabilities as well as settle some outstanding liabilities.

Centum Sells Sidian Stake: National Treasury CS in the week approved the acquisition of 38.9% of the issued share capital of Sidian Bank by Pioneer General Insurance Limited (20.0%), Wizpro Enterprises (15.0%), and African Limited (3.91%). The transaction now reduces Centum’s shareholding in Sidian to 44.5%.

Last year, Centum’s agreement with Access Bank for the sale of its entire 83.4% stake in Sidian Bank was terminated since not all conditions of the Share Purchase Agreement had been met by the long stop date of the transaction.

KQ- AirBaltic Agreement: Kenya Airways(KQ) and airBaltic announced an interline agreement that is expected to boost connectivity and give customers more travel options between Africa and the Baltic countries. Under the agreement, KQ will extend its reach in Europe via Amsterdam, Paris, and Dubai while airBaltic passengers will be able to book a through ticket to Nairobi and enjoy seamless connections to Kenya Airways destinations across Africa.

Asky Airline Enters Kenyan Market: Asky Airlines officially started flying between Nairobi and Lomé on October 1st, 2023. The airline will fly a Boeing 737 Max three times a week from Nairobi to Lomé and vice versa. Before joining Kenya, Asky had introduced direct flights to Johannesburg and Luanda.

Q2 2023 GDP and BOP Reports

The Kenya National Bureau of Statistics in the week released the Q2 2023 GDP Report and the Q2 2023 BOP and International Trade Report. Here are the key highlights:

Economic Growth: In the second quarter of the year, the economy grew by 5.4% compared to 5.2% in Q2 2022, driven by a rebound in Agriculture which grew by 7.7%.

Sectoral Growth: Agricultural activities grew by 7.7% primarily on account of favourable weather conditions. The accommodation and food services sector grew by 12.2% while the Information and communication sector went up by 6.4%. Financial and insurance, electricity and water and manufacturing sectors increased by 13.5%, 0.8% and 1.5% respectively.

Kenyan Shilling: The Kenyan Shilling depreciated against the Euro, US Dollar, and Sterling Pound by 20.2%, 18.0% and 17.0%, respectively. Similarly, the shilling depreciated against the Ugandan shilling and the Tanzanian shilling in Q2 2023. The shilling appreciated against the South African Rand. In the quarter, the CBR was revised upwards to 10.50% as at June 2023.

Inflation Trajectory: Inflation rose from an average of 7.15% in Q2 2023 to 7.94% in Q2 2023 primarily due to higher food and energy prices.

Capital Markets: The volume of shares traded at the NSE decreased by 41% from 358M in June 2022 to 211M in June 2023. The NSE 20 share index declined by 38 points to 1,575 points in June 2023 from 1,613 points recorded in June 2022.

Balance of Trade: Total exports increased by 9.6% to KES 249.2B with the import expenditure decreasing by 1.6%. This resulted in the narrowing of the trade deficit from KES 429.8B in Q2 2022 to KES 397.8B in Q2 2023.

Foreign Debt: The stock of external public debt rose from KES 4,186.5B at the end of June 2022 to KES 5,306.6B at the end of June 2023, representing a 26.8% increase.

Current Account Deficit: The deficit narrowed by 32.8% from KES 206.3B in Q2 2022 to KES 138.7B in Q2 2023.

International Merchandise Trade: The volume of trade grew by 1.3% to KES 896.2B in Q2 2023 from KES 884.7B in Q2 2022.

Remittances: Remittances from Kenyans living abroad increased by 16.8% to KES 140.5B in Q2 2023 from KES 120.3B in Q2 2022.

Access the reports here and here.

Markets Wrap

NSE: In Week 40 of 2023, Sanlam was the top-performing stock, up 17.7% to close at KES 7.70. Sasini was the worst-performing stock, down 9.96% to close at KES 21.70. The NSE 20 index fell by 1.2% to 1,490.98 points, the NSE 25 fell by 0.8% to 2,454.85 points, and the NASI index fell by 1.62% to 93.49 points. Equity turnover rose to KES 729.2M from KES 54.1M prior week while bond turnover was down 81.6% to KES 8.9B from KES 48.3B prior week.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 14.8734%, 14.9778%, and 15.1867% respectively. The total amount on offer was KES 24B with the CBK accepting KES 27.2B of the KES 33.1B bids received, to bring the aggregate performance rate to 138.11%. The 91-day and 364-day instruments recorded 714.53% and 31.59% performance rates, respectively.

Treasury Bonds: Across the tap sale of FXD1/2023/002 and FXD1/2016/010 treasury bonds, total bids received at face value were KES 2.6B and KES 815.0M respectively. The CBK accepted bids totalling KES 2.6B and KES 763.2M respectively bringing the weighted average rate of accepted bids to 17.5% and 17.9%, respectively. On aggregate, the performance and acceptance rates were 34.5% and 34%%, respectively.

Eurobonds: In the week, yields rose across the 6 outstanding papers.

KENINT 2028 rose the most week-on-week, up by 91.7 bps to 14.015%, while KENINT 2048 rose the least, rising by 45.4 basis points to 12.83%. The average week-on-week change stood at 65.33 bps.

KENINT 2024 rose the most on a year-to-date (YTD) basis, appreciating by 574.2 bps while KENINT 2048 rose the least at 200.6 bps.

Prices were mixed, with KENINT 2027 recording the most losses week-on-week at 3.8% to 74.902. KENINT 2024 fell the least at 0.1% to 92.708. YTD, KENINT 2034 fell the most at 17.1%, while KENINT 2024 was the only bond whose price appreciated, rising by 0.2%. The average price change week-on-week and YTD was -2.7% and -10.5%, respectively.

Market Gleanings

📉 | Stanbic Kenya PMI | The Stanbic Bank Kenya Purchasing Managers Index (PMI) fell back into contraction territory in September, after signalling an upturn in operating conditions for the first time in seven months in August. The index dropped from 50.6 to 47.8, indicating a moderate deterioration in the private sector economy. Output, new orders and employment all declined in September as firms faced higher costs for fuel, raw materials and imported goods. Input prices rose at the second-fastest rate in the survey's near-decade history with selling charges also being raised sharply.

✅ | GS Outlook on Kenya | In its Emerging Markets Sovereign Credit Monitor, Goldman Sachs, while flagging the high external financing requirements facing the country, has also acknowledged Kenya’s reform under the IMF and attractive valuations:

“Here, concerns around the country’s high external vulnerabilities (especially its 2024 USD bond) in a ‘higher for longer’ rates world continue to weigh on spreads. To us however, there are a number of reasons to remain constructive on Kenya’s credit: the first is linked to the continued reform momentum under its IMF programme, and the second is related to its valuations, which we now think offer a more compelling risk/reward (Exhibit 4). Finally, our forecast for the Fed to cut the policy rate towards the end of next year suggests that the global backdrop will eventually improve before Kenya’s external funding constraints become binding.”

📝 | Ruto Reshuffles Cabinet | President William Ruto last week reshuffled his Cabinet, Principal Secretaries and ambassadors in a major shakeup. In a statement released by the State House on Wednesday, October 4, 2023, the president made the following key changes:

Prime Cabinet Secretary Musalia Mudavadi will now also handle the Foreign Affairs docket.

Rebecca Miano, who was previously the EAC, Arid and Semi-Arid Lands (ASALS) and regional development CS, was moved to the Trade docket.

Alfred Mutua was named the new Tourism CS

Moses Kuria who previously held the Trade docket, was appointed as the new Public service CS