👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s Dec 2024 monetary policy decision, the race to acquire Bamburi Cement, and Stanbic Kenya's PMI for November 2024.Please help us improve our service delivery to you by filling out the survey in the link below.

CBK Cuts Rates

Spurring Growth: The Central Bank of Kenya (CBK) has, in the week, reduced the Central Bank Rate (CBR) from 12.00% to 11.25%, signaling a strategic shift towards a more accommodative monetary policy aimed at reviving economic activity amidst slowing growth. By easing the cost of borrowing, the CBK intends to encourage credit uptake by businesses and consumers, particularly at a time when inflation remains stable within the target range of 5±2.5%. The decision aligns with global trends, where central banks in major economies are gradually reducing rates to support growth amid subdued inflationary pressures. This policy move also reflects the MPC's confidence in the current economic fundamentals, including a stable exchange rate and declining inflationary risks, driven by improved food supply and reduced fuel prices.

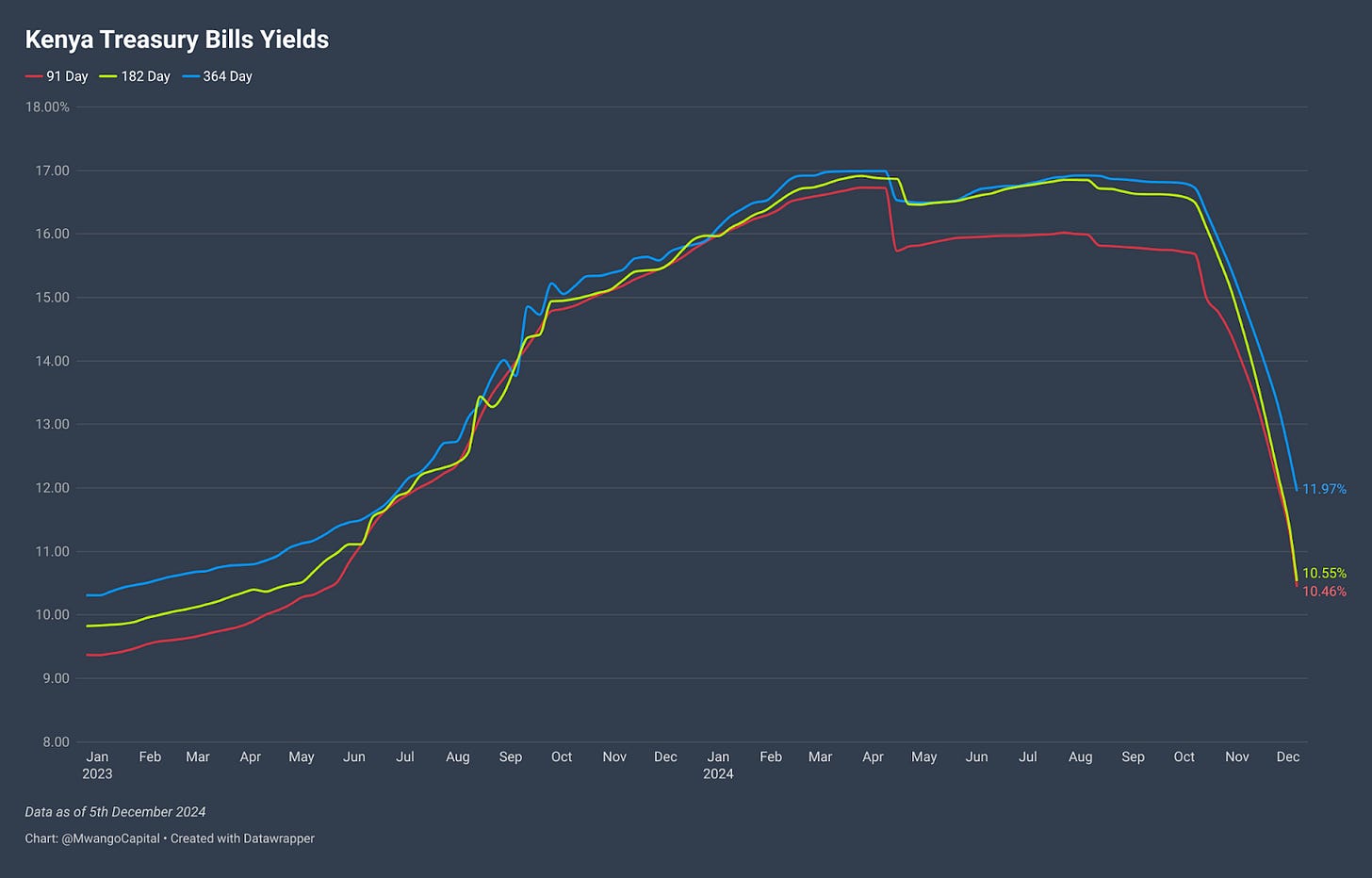

Will Banks Follow Suit? While the MPC's rate cut creates an enabling environment for lower lending costs, the effectiveness of this measure depends heavily on the responsiveness of commercial banks. The Committee noted that while short-term rates on government securities have adjusted downward in line with the CBR, banks have yet to reduce their lending rates proportionately. This lag risks undermining the intended stimulus to the private sector, particularly for SMEs and other key drivers of economic growth. By urging banks to align their rates with the lower CBR, the CBK is pushing for a more inclusive transmission of monetary policy benefits to businesses and households.

“It's in the interest of the banks to lower their lending rates. I think if they continue on this path, it's a no-win for anyone. It's a no-win for the banks, and the economy will not be able to perform. On the other hand, if they do lower these rates and stimulate economic activity, this is a win for everybody. The banks will make more profits, and the economy will benefit from more credit. The economy will become more active...All we are asking is for the banks to be fair and to act in the same way that they were quick to raise lending rates when the policy rate and treasury rates were increasing. They should equally reduce their lending rates.”

Central Bank of Kenya Governor, Kamau Thugge

Inflation Outlook: The rate cut comes against the backdrop of a projected slowdown in Kenya’s economic growth, with GDP expected to grow at 5.1% in 2024, compared to 5.5% in the first half of 2023. Sluggish global growth, persistent geopolitical tensions, and domestic structural challenges weigh on the growth outlook. However, CBK’s intervention is expected to support key sectors, particularly agriculture and services, which have shown resilience amid external shocks.

CBK expects overall inflation to remain below the midpoint of the target range, aided by stable food and fuel prices, favourable weather conditions, and a steady exchange rate. Here is what Churchill Ogutu, Economist at IC Asset Managers, had to say about the MPC's decision to implement a 75bps cut:

“The direction of travel ahead of this meeting was never in contention, expectations were broadly for a cut, although the 75bps cut decision was higher than market expectations. Over and above the disinflation trend and KES stability, global concerns may have tipped the policymakers towards some constraints. Nonetheless, the tone of the MPC statement was less bullish on growth prospects, largely on the anemic private sector credit growth, and hence the policymakers leaned towards higher-than-expected cut to revive growth. Refreshingly, the survey conducted ahead of the meet showed that inflationary expectations have been anchored, but market pricing seems to be at divergence. Whereas T-bill rates have adjusted accordingly, seems like lending rates are yet to catch up. Uncharacteristically, though pretty much doubling down, the CBK Governor emphasized that banks' should respond accordingly to the signalling effect from the reduced benchmark rate. It is another thing altogether whether banks will respond accordingly.”

IC Asset Managers Economist, Churchill Ogutu

New MPC Members: CBK also welcomed Ms. Isis Nyong’o, Dr. Kemboi Kipruto, Dr. Freshia Mugo, and Mr. Jared Osoro as new members of the Monetary Policy Committee following their appointment on 22 November 2024.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Savannah Clinker Bows Out of Bamburi Race

Withdrawal of Offer: During the week, Savannah Clinker Limited withdrew its competing offer to acquire Bamburi Cement, a move approved by the Capital Markets Authority (CMA). The decision followed the arrest and indictment of Benson Ndeta, Savannah Clinker's chairman and main shareholder, on charges including defrauding ABSA Bank of USD 35M. This situation prompted the financier of the offer to seek additional due diligence, and the CMA declined a request to extend the offer period by 60 days. As a result, shareholders who had accepted Savannah's offer had until December 5, 5 pm to reconsider their decision. Those who did not change their decision will remain shareholders of Bamburi Cement.

Approval for Amson’s Group: Tanzanian conglomerate Amson’s Group secured the necessary approvals from the Ministry of Mining, Blue Economy, and Maritime Affairs, as well as the COMESA Competition Commission, for its proposed acquisition of Bamburi Cement. Through its Kenyan subsidiary, Amsons Industries Kenya, the conglomerate made a KES 23.9B offer in July to buy a 100% stake in the cement manufacturer. As the last trading day of Bamburi shares before suspension approached, Amsons expressed confidence in finalizing the acquisition smoothly and delivering value to shareholders. The result of the buyout offer is expected to be published by December 20. Trading for Bamburi Cement shares was suspended at 9 AM on December 6, 2024, to facilitate reconciliation. Before the suspension, Bamburi shares closed down 16.46% at KES 47.20.

Markets Wrap

NSE This Week: In Week 49 of 2024, Olympia led the top gainers, rising by 10.5% to close at KES 3.40, while Kenya Power was the worst performer, dropping 21.9% to close at KES 3.54. The NSE 20 declined by 1.6% to 1,831.0 points, while the NSE 25, NSE 10, and NASI indices gained by 2.5%, 3.0%, and 3.3%, closing at 3,139.1, 1,204.7, and 115.2 points, respectively. Equity turnover fell by 24.0%, totaling KES 1.9B, while bond turnover rose to KES 38.0B, up from KES 27.9B the previous week.

Treasury Bills and Bonds: Treasury bills were oversubscribed in the week with an overall subscription rate of 176.3%, down from 211.1% the previous week. Investors placed bids worth KES 42.3B, out of which KES 42.2B was accepted, resulting in an acceptance rate of 99.7%. Yields on the three treasury bill tenors continued to decline, dropping by 233.1 basis points, 250.9 basis points, and 192.9 basis points, closing at 10.46%,10.55%, and 11.97% for the 91-day, 182-day, 364-day bills.

The Central Bank of Kenya (CBK) successfully issued reopened 10-year and 20-year Treasury Bonds (FXD1/2023/010 and FXD1/2018/020), receiving KES 71.3B in bids, with KES 53.4B accepted at an average rate of 14.691%. This issuance raised KES 8.6B in net borrowing after KES 44.8B in redemptions.

Eurobonds: Last week, yields on Kenya's six outstanding Eurobonds declined across the board, with the KENINT 2027 recording the sharpest drop of 39.30 basis points to 7.142%, followed by the KENINT 2028, which fell 35.90 basis points to 8.129%. The average week-on-week yield decrease was 36.10 basis points.

Market Gleanings

🔺| Stanbic Kenya PMI | The Stanbic Bank Kenya Purchasing Managers Index (PMI) rose to 50.9 in November from 50.4 in October, marking the fastest expansion in six months. This improvement was driven by a strong rebound in sales, particularly in the services and retail sectors, as increased consumer spending and travel supported growth. However, input costs surged due to higher taxes, leading to the sharpest rise in selling prices in nine months. Despite rising workloads, job creation remained muted, with most firms maintaining stable workforce levels. Business confidence softened further, with only 8% of surveyed firms optimistic about growth in the coming year.

📈| M-PESA Hits 34M Subscribers | Safaricom's M-PESA has achieved a new milestone, reaching 34 million customers in Kenya as of November 2024. The platform has evolved to offer a comprehensive range of services, including credit, savings, investments, insurance, and merchant solutions, supporting over 1.5 million businesses and a network of 300K agents. Recent innovations, such as the Daraja API, which has enabled more than 40K integrations, and the M-PESA Ratiba standing order solution, which saw over 1 million opt-ins in its first month.

🏨| AKFED to Increase Stake in TPS Eastern Africa | The Aga Khan Fund for Economic Development (AKFED) is set to increase its stake in TPS Eastern Africa, the parent company of Serena Hotels, by acquiring an additional 2.42% of shares, raising its ownership to 67%. This follows a previous stake increase in 2022 when AKFED converted a USD 14.5M loan into shares to help the company recover from the impact of the Covid-19 pandemic. The new purchase, involving 6.85 million shares from the Aga Khan University Foundation (AKUF), has received regulatory approval. AKFED has also applied for an exemption from making a full takeover offer, stating it does not intend to acquire the remaining shares.

💰| Kenya to Launch USD 3.86B Diaspora Bond | Kenya is set to launch a diaspora bond to raise USD 3.86B with technical support from the World Bank’s Multilateral Investment Guarantee Agency (MIGA). Prime Cabinet Secretary Musalia Mudavadi noted that the funds will finance key infrastructure projects, including a new terminal at Jomo Kenyatta International Airport, the expansion of the road to Uganda, and the extension of the standard-gauge railway.

🌍| Access Bank’s Africa Expansion Plan | Nigeria’s Access Bank has confirmed its interest in acquiring Standard Chartered’s assets in Botswana, Uganda, and Zambia, as part of its ambitious strategy to position itself among Africa’s top five banking giants. Meanwhile, in Kenya, Access Bank is in the process of acquiring NBK Bank from KCB Group, a deal expected to close by Q1 2025.

🤑| Govt Proposes Fees for Accessing Health Data | Medical researchers and students may soon face fees to access health data under proposed regulations in the Digital Health (Health Information Management) Regulations, 2024. If approved, independent researchers will pay KES 30,000 to access data from SHA-accredited facilities. PhD students will pay KES 20,000, Master’s students KES 5,000, and undergraduates and middle-level college students KES 500.

🏦| Parliament Proposes Extended Deadline for Bank Capital Requirements | Kenya’s parliamentary finance committee has proposed extending the deadline for commercial banks to meet new capital requirements from three years to eight. The Central Bank of Kenya (CBK) had proposed a tenfold increase in minimum capital from KES 1B to KES 10B by 2027, a move aimed at strengthening banks against financial risks. However, the committee warned that the shorter timeline would strain smaller banks, which may need to pursue mergers or capital markets for funding. As of FY 2023, only 14 of Kenya’s 39 banks had KES 10.0B or more in core capital.

🇪🇹| Ethiopia Transfers 10 State Firms to Sovereign Fund | Ethiopia has transferred ownership of 10 state-owned companies, including Ethiopian Electric Power, Ethiopian Railway Corp., and the Development Bank of Ethiopia, to its sovereign wealth fund, Ethiopian Investment Holdings (EIH), to improve management and financial stability.EIH, which already manages 27 companies, including Ethiopian Airlines and Ethio Telecom, aims to strengthen the balance sheets of these enterprises to enhance borrowing capacity.

🇳🇬| Nigeria Returns to the Eurobond Market | Nigeria has successfully returned to the Eurobond market after more than two years, pricing USD 2.2B in bonds with maturities in 2031 (6.5-year) and 2034 (10-year). The issuance attracted strong investor demand, with order books surpassing USD 9B. The 6.5-year bond was priced with a coupon of 9.625%, while the 10-year bond offered a coupon of 10.375%.

✍️| Key Appointments |

Kengen: Kenya Electricity Generating Company PLC (KenGen) has appointed Alfred Agoi Masadia as the new Chairman of the Board. He succeeds Migos Ogamba, who is now Cabinet Secretary for Education. Agoi was the MP for Sabatia Constituency from 2013 to 2022.

CBK: The Central Bank of Kenya has welcomed 4 new external members to the Monetary Policy Committee (MPC) effective November 22, 2024. The new members are Isis Nyong’o, Dr. Kemboi Kipruto, Dr. Freshia Mugo, and Jared Osoro.

I&M Bank: I&M Group PLC has announced the appointment of Ms. Brenda Wangari Mugo to its Board as an Independent Director, with effect from 29th November 2024. She previously served as Executive Principal, Head of Financial Institutions at Standard Chartered Bank Nairobi, and as Vice President – Head of Financial Institutions East Africa at Citibank N.A. Kenya.