First-Ever Domestic Bond Buyback

This buyback targets three bonds with an outstanding value of KES 185.05B

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s first domestic bond buyback, CBK’s continued easing cycle, and KenGen’s H1 2024/25 results.CBK Initiates First-Ever Domestic Treasury Bond Buyback

The Central Bank of Kenya (CBK) has announced the country’s first-ever treasury bond buyback, allowing investors to sell back select bond issues worth KES 50B before maturity. This initiative, set to run from February 7 to February 17, 2025, targets three specific bonds—FXD1/2022/003, FXD1/2020/005, and IFB1/2016/009—with a total outstanding value of KES 185.05B. The government aims to strategically manage its debt maturity profile by employing this voluntary buyback strategy. This approach is expected to reduce refinancing pressure in April and May 2025, when the targeted bonds are set to mature, offering bondholders an early exit option through a multi-price reverse auction.

Funding for the Buyback: To facilitate the buyback, CBK is also raising KES 70B through two re-opened infrastructure bonds. The auction for these bonds is scheduled for Wednesday, February 12, 2025, with settlement set for Monday, February 17, 2025. The proceeds from this issuance will likely support the buyback settlement. Investors participating in the buyback must submit their bids electronically via the CBK’s DhowCSD platform before 10:00 AM on February 17, 2025. The buyback auction will take place on the same day, and successful bidders will receive payments in cash on February 19, 2025.

Eligibility and Bid Requirements: Eligibility for the buyback is limited to investors with unencumbered holdings in the targeted bonds as of February 17, 2025. Those with pledged holdings must cancel any contracts at least five days before the buyback deadline. Minimum bid amounts for non-competitive bids are set at KES 50,000, with a maximum of KES 50M per CDS account per tenor, while competitive bids require a minimum of KES 2M per CDS account per tenor. Successful bidders will receive confirmation via the DhowCSD Investor Portal.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

CBK’s Fourth Consecutive Rate Cut

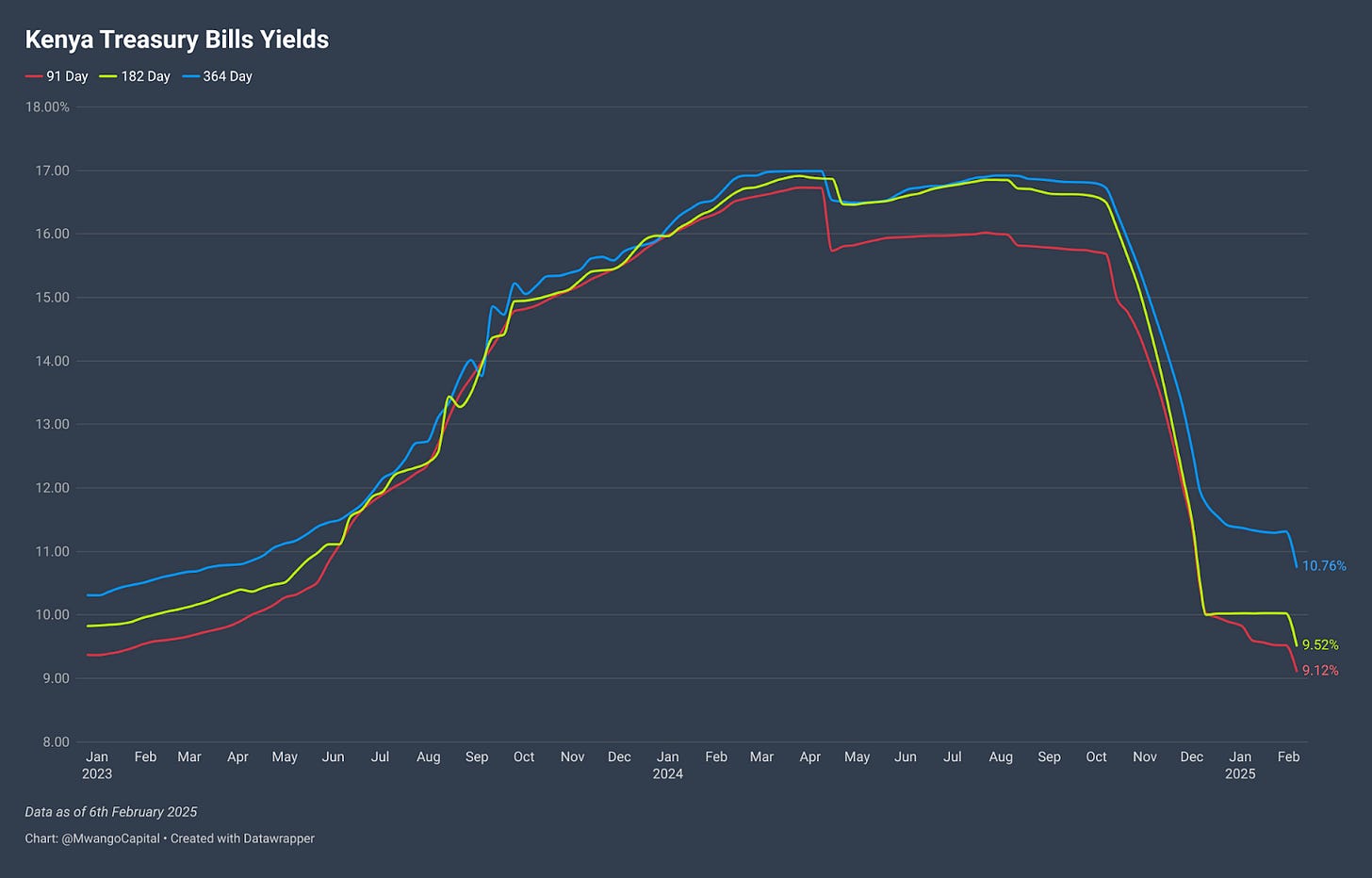

Easing Cycle Continues: The Central Bank of Kenya (CBK) has lowered the Central Bank Rate (CBR) by 50 basis points to 10.75%, marking the fourth consecutive reduction since August 2024. This brings the policy rate back to levels last seen in October 2023, signaling a continued easing cycle aimed at reviving domestic credit growth. The cumulative 225 basis points reduction raises key questions about the effectiveness of monetary transmission, given the persistent rigidity in lending rates.

"Since August, when we started to lower the CBR rate, we have lowered the CBR rate by 175 basis points. And then including the 50 basis points from yesterday, that’s 225 basis points...There is no reason why the lending rates to the private sector should not come down."

Banks Under Pressure: Despite significant easing, banks have not adjusted their lending rates proportionally, citing elevated deposit rates and risk considerations. The CBK has responded by launching on-site inspections across five banks, ensuring compliance with the Banking Sector Charter. The regulator aims to enforce risk-based credit pricing, but structural impediments—such as high-risk premiums and liquidity preference by banks—could limit the speed and extent of rate pass-through.

"We are saying let’s do some on-site inspection of the banks just to make sure... If it’s true that the cost of mobilizing funds has not changed, well and good. But if it has, that reduction should be passed on to consumers and borrowers, and should not be used to pad the profits of the commercial banks."

Capital Flight: Market participants have raised concerns about the pace of monetary easing, questioning whether rapid rate cuts could trigger capital outflows. CBK Governor Kamau Thugge has downplayed these fears, arguing that local bond yields remain attractive relative to global markets, and the stability of the exchange rate reduces the likelihood of speculative outflows.

"We actually are not that much concerned... Interest rates on our bonds are still relatively high. And if you take into account the fact that we have a fairly stable exchange rate, those interest rates are still very high and should not result in an outflow of capital."

Other Key Takeaways from the Post-MPC Briefing:

Speculation about Treasury taking over debt issuance from CBK remains unresolved, with the final debt management strategy set for parliamentary submission by February 15.

CBK will continue using reverse repos and other monetary tools to align interbank rates with the new 10.75% policy rate.

The recent freeze on US foreign aid is unlikely to impact Kenya’s forex reserves or exchange rate stability due to strong remittance inflows.

CBK has written to banks, including the 13 with core capital below KES 3B, requiring them to submit detailed plans on how they will meet the phased capital targets—starting with an increase of KES 2B in 2024 and ultimately reaching KES 10B by 2027.

Kenya remains committed to maintaining an IMF-supported program, but the structure of future engagements is still under discussion.

Markets Wrap

NSE This Week:

Home Afrika (+47.8%) led the gainers, climbing to KES 1.02, followed by Uchumi (+35.7%) and Standard Group (+27.6%). Eveready (+24.0%) and HF Group (+19.4%) rounded off the top five.

Limuru Tea (-8.8%) was the worst performer, dropping to KES 301.00, while Kenya Power (-7.9%), Sanlam (-7.9%), Kakuzi (-7.8%), and BOC Kenya (-7.0%) also struggled.

Markets remained positive—NASI edged up 0.97% to 129.5, NSE 20 gained 1.48% to 2,194.5, NSE 10 added 2.13% to 1,345.5, and NSE 25 rose 2.12% to 3,508.7.

Equity turnover jumped 21.5% to KES 2.72B, while bond turnover surged 38.8% to KES 38.91B. Foreign investors remained heavy sellers, with net outflows of KES 957.3M, making up 39.48% of total turnover.

Investors now await EABL’s dividend (21 Feb) and KCB’s FY results (12 March).

Uganda and Dar es Salaam Securities Exchange:

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 296.6%, a significant increase from 56.09% the previous week. Investors placed bids totaling KES 71.2B, out of which KES 59.74B was accepted, reflecting an 84% acceptance rate. Yields on the 91-day, 182-day, and 364-day T-bills declined by 41, 51, and 56 basis points to 9.1156%, 9.5190%, and 10.7581%, respectively.

Eurobonds: Last week, yields on Kenya’s six outstanding Eurobonds declined, with the KENINT 2028 bond experiencing the sharpest drop of 29.40 basis points to 8.499%. This was followed by the KENINT 2031 bond, which fell by 19.2 basis points to 9.697%. On average, Eurobond yields decreased by 17.88 basis points week-on-week.

Market Gleanings

⚡| KenGen H1 2024/25 Results | KenGen reported its Half-Year 2024/25 results, with revenue declining by 3.6% to KES 27.5B despite a 1.9% increase in electricity sales to 4,291 GWh. Operating profit rose by 49% to KES 6.6B, driven by a 14% reduction in operating expenses to KES 17.7B. Profit after tax increased by 79% to KES 5.3B, while income tax expenses grew by 42% to KES 2.66B. Earnings per share rose by 78% to KES 0.80, with no interim dividend declared.

📄| Fitch Affirms Kenya’s ‘B-’ Rating | Fitch Ratings has reaffirmed Kenya’s ‘B-’ credit rating with a stable outlook, citing strong growth prospects and improved monetary policy management. The agency notes that external pressures have eased following the successful Eurobond issuance in February, but Kenya still faces high debt servicing costs and revenue shortfalls. While socio-political tensions have subsided, fiscal challenges persist, with concerns over public debt sustainability and external financing needs. Fitch projects Kenya’s GDP to grow by 5.1% in 2025.

🟢| KPC Eyes NSE Listing | The government is exploring the possibility of listing Kenya Pipeline Company (KPC) on the Nairobi Securities Exchange (NSE) through an Initial Public Offering. Treasury Cabinet Secretary John Mbadi made the announcement while receiving an interim dividend cheque of KES 3B from KPC for the half-year ending December 2024. This brings KPC’s total dividend payout to the National Treasury to KES 10.5B over the past year. The CS also noted that the Treasury would support plans to wind down Kenya Petroleum Refinery Ltd (KPRL) and integrate it into KPC.

💰| KRA Customs Hits Record | Kenya Revenue Authority’s (KRA) Customs and Border Control recorded a historic KES 82.55B in tax collections for January 2025, surpassing its target by KES 8.12 billion with a 110.9% performance rate. This marks a 27% year-on-year growth, significantly outpacing the 4.8% growth recorded in the first half of the financial year. Additionally, non-petroleum tax collections grew by 11.6%, while petroleum taxes surged by 55.9%, driven by increased fuel volumes.

📶| Safaricom Ethiopia Q3 FY25 | Safaricom Ethiopia posted a 40% year-on-year increase in total revenue to KES 6.7B in Q3 FY25, with service revenue rising 79% to KES 6.3B. Mobile data revenue saw a 93% jump to KES 4.8B, while voice and messaging revenues grew by 28% and 115%, respectively. M-PESA revenue declined by 74% to KES 9.8M, but the number of M-PESA users more than tripled from 3.1M to 10.8M over the past year.

📊| Stanbic Kenya PMI Slips to 50.5 | The Stanbic Bank Kenya PMI slipped to 50.5 in January 2025 from 50.6 in December, marking the fourth consecutive month of expansion but at the weakest pace since October. Output and new orders grew at a slower rate, while staffing levels declined slightly after three months of growth. Input costs remained high due to increased taxes on imported materials, leading to a continued rise in output prices, though at a slower pace. Business confidence remained subdued, with future activity expectations among the weakest on record.

💰| Equity and IFC Launch $20M Facility | Equity Bank Kenya and the International Finance Corporation (IFC) have introduced a USD 20M Risk Sharing Facility to expand financial access in 14 underserved counties, including refugee-hosting areas like Turkana and Garissa. Announced in Kakuma, the initiative aims to provide credit to businesses and individuals within these communities. This is the first global risk-sharing facility focused on financial inclusion for refugees and their host populations.

🟢| Shri Krishana Overseas Plans NSE Listing | Kenyan packaging firm Shri Krishana Overseas Limited (SKL) has announced plans to list on the Nairobi Securities Exchange's (NSE) Growth Enterprises Market Segment (GEMS), pending regulatory approvals. GEMS offers a streamlined listing process for SMEs, providing access to capital with more flexible requirements compared to the NSE's main board.

⚖️| COMESA Probes Airtel Mobile Commerce | The COMESA Competition Commission (CCC) has launched an investigation into Airtel Mobile Commerce for potential violations of International Money Transfer (IMT) regulations in Malawi, Kenya, and Uganda. The probe focuses on alleged misleading consumer practices, including discrepancies in displayed vs. actual charges, undisclosed intermediaries, and inconsistent exchange rates. The CCC has invited affected consumers to submit relevant information by February 28, 2025.

🇺🇬| Uganda Holds Rate at 9.75% | The Bank of Uganda maintained its benchmark interest rate at 9.75%, citing stable inflation and economic recovery, but warned of risks from global uncertainties. Annual inflation rose to 3.6% in January from 3.3% in December, driven by higher transport costs, but is expected to stabilize around the 5% target. The economy grew 6.7% in Q1 of the 2024/25 fiscal year, up from 6.2% in the previous quarter, supported by manufacturing and construction.