👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Stanbic Holdings' FY24 results, Eurobond 2027 buyback results, and the Stanbic PMI for February 2025.Stanbic Holdings FY 2024 Results

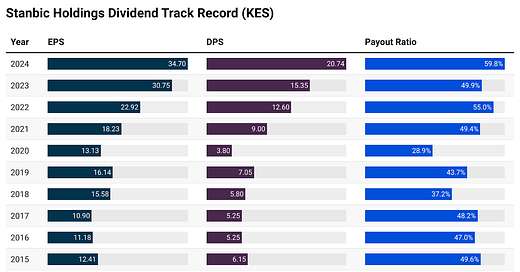

Dividends Up 35.1%: Stanbic Holdings became the first bank to report FY24 results, delivering a strong performance with earnings per share surging by 12.8% year on year to KES 34.70. This was supported by a 51.8% decrease in loan loss provisions to KES 3.5B, which helped offset a 5.1% drop in net interest income to KES 24.3B. Despite non-interest revenue remaining subdued at KES 15.4B (-1.7%), net profit surged by 14.5% to KES 13.6B. Shareholders stand to benefit from an increased dividend payout, with the total dividend surging by 35.1% to KES 20.74 per share, translating to a 12.5% dividend yield.

“Our impairments went down by 50%, which is a credit to our client relationships, our origination capabilities, and our monitoring efforts—staying close to our clients in difficult environments. Of course, there is more to the story behind these numbers. In 2023, we had certain names that were problematic. We took impairments on them and increased our coverage ratio to just over 60%. We have kept it there while resolving these cases. The 2024 number includes a currency adjustment because the currency has appreciated. Since 45% of our NPLs are in foreign currency, this resulted in a 700 million currency adjustment in the 13,099 figure.”

Stanbic Bank CFVO, Dennis Musau

Improved Asset Quality: Stanbic Bank Kenya, the group’s primary subsidiary, maintained strong asset quality, with gross non-performing loans contracting by 14.5% to KES 22.6B. This improvement brought the bank’s non-performing loan ratio down to 9.1%, significantly better than the industry average of 16.4%. The bank also strengthened its liquidity position, with the liquidity ratio surging by 10.0 percentage points to 50.5%, providing ample room for lending growth. Additionally, capital adequacy improved, with the total capital-to-risk-weighted-assets ratio surging by 1.8 percentage points to 18.4%, reinforcing the bank’s financial stability.

“Net interest margin, despite our efforts to protect customers, was reduced by 29 basis points—from 5.997% to 5.68%. Cost-to-income ratio ticked up to 44.6%. I’m very happy with that. Last year, it was 43.4%. If I flatten revenue year-on-year, that number would have been 40.9%. So, I’m very happy with the efficiency improvements we’re making. The credit loss ratio is the story of the year. We’ve managed our credit impairments well. A lot has been said about market stagnation and persistent NPLs. I’ll show you more details, but at 1.16%, our credit loss ratio is something we are very proud of. We aim to keep it below 2%, and 1.16% is well within that target.”

Stanbic Bank CFVO, Dennis Musau

Rising Interest Expenses: Total Interest income surged by 37.8% to KES 52.3B, but interest expenses rose at a faster pace, surging by 105.7% to KES 25.4B. This resulted in a compression of net interest margins to 5.7%, while the cost-to-income ratio increased slightly to 44.5%. The bank’s asset management division surged to KES 2.5B in assets under management in the first six months since its launch. While SBG Securities recorded KES 20M in profit after tax for the period, down 87%.

“If you look at the gross interest income, it went up by 27%. Rates were rising, repricing was happening, especially on market-linked instruments, and that came through. However, interest expense went up by 93%, which demonstrates two things: A difficult funding environment. A deliberate decision to protect our customers, especially those in the lower LSM, from high interest rates. We delayed some of the cost-of-funding transfers to our customers to shield them. You will see the impact of this much later in the credit impairments because we didn’t just make the money and lose it on the balance sheet. That explains the 5.1% decline you see.”

Stanbic Bank CFVO, Dennis Musau

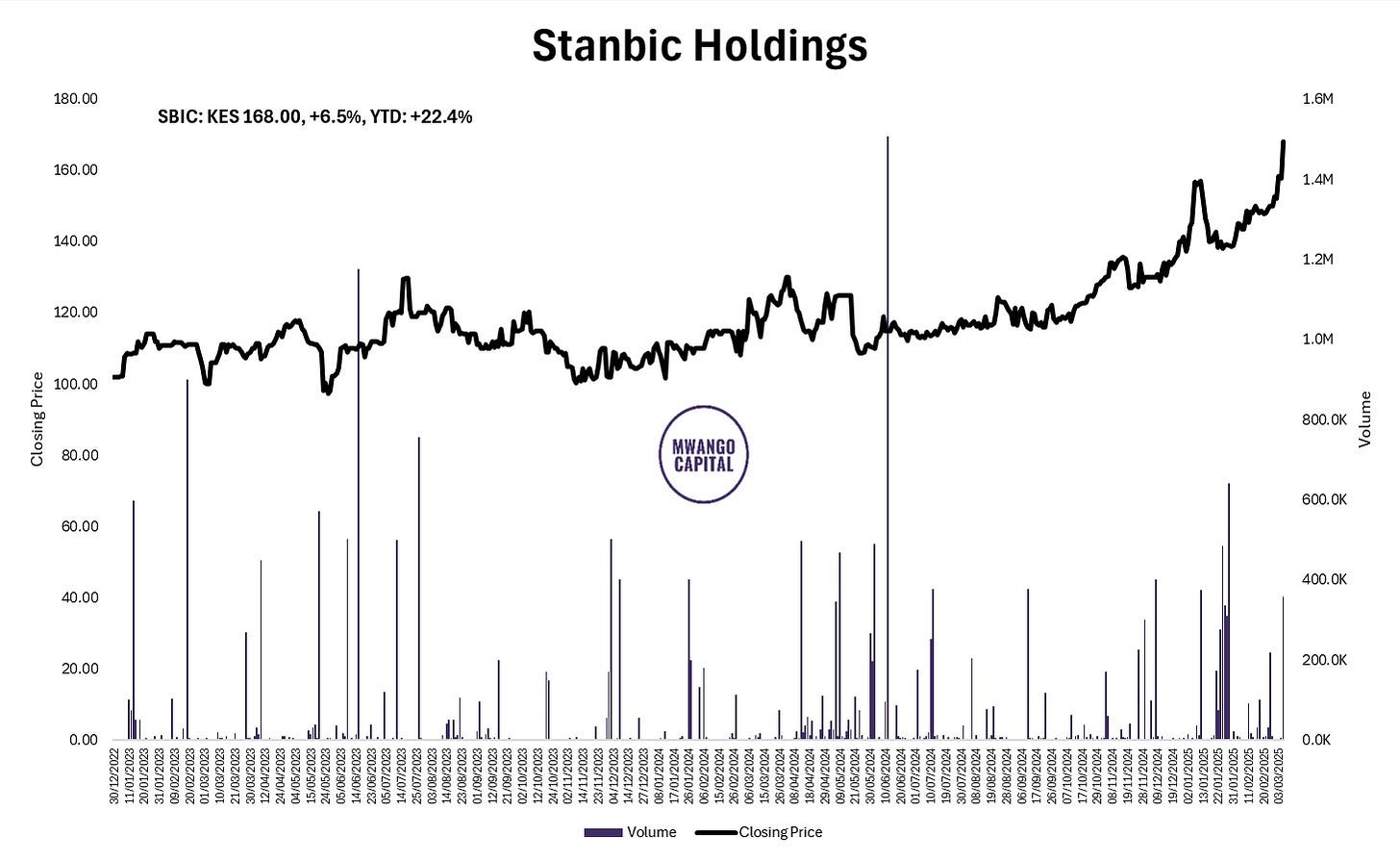

Share Price Reaction: On the back of the results released on 4th March, the share price at the Nairobi Securities Exchange appreciated by 6.5% in the following trading day action to close at KES 168.00.

Stanbic Holdings' CEO warned about the growing risk posed by the ongoing cuts in U.S. development funding and its potential impact on the region:

"Our biggest issue is going around supporting programs around international development. USAID is a massive problem for us — it’s almost a billion dollars for Kenya, $843 million this year. That’s a bigger challenge. How does the sovereign finance healthcare programs — malaria programs, HIV programs — what are we going to do for the jobs of many people in our market? That’s where we see a bigger concern for us. How we deal with this gap in development finance — that’s where we don’t have a clear view... Our impact as Stanbic is not as high in terms of our clients, but we believe there’s no upside — only a massive downside. That’s how we see it from Kenya... Obviously, if you think about Uganda and other countries, the conversation in South Sudan is materially complex. It’s a billion dollars for South Sudan, and everything runs on UN support — 80 percent comes from the US government. That’s the model you’re going to see."

Stanbic Holdings CEO, Joshua Oigara

The Rest of March: Here is the earnings calendar for the rest of March:

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Markets Wrap

NSE Weekly Recap:

EA Portland Cement (+13.4%) surged to KES 38.00, while Olympia Capital (-9.2%) fell to KES 3.16, leading the week's gainers and losers.

Markets extended gains—NASI (+1.20%) at 133.7, NSE 20 (+1.64%) at 2,337.9, NSE 10 (+0.92%) at 1,379.5, and NSE 25 (+1.35%) at 3,643.5.

Equity turnover jumped 37.8% to KES 2.49B, while bond turnover increased 7.1% to KES 56.25B.

Foreign investors remained net sellers, offloading KES 607.9M, contributing 37.60% of total turnover.

Investors now focus on KCB’s FY results (12 March) and Sanlam’s FY results (13 March).

Uganda and Dar es Salaam Securities Exchange:

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 210.7%, down from 152.3% the previous week. Investors placed bids totaling KES 50.6B, out of which KES 42.5B was accepted, reflecting an 84% acceptance rate. Yields on the 91-day, 182-day, and 364-day T-bills declined by 1.4, 8.9, and 0.3 basis points to 8.923%, 9.151%, and 10.497%, respectively.

Treasury Bonds: The Central Bank of Kenya (CBK) successfully raised KES 35.2B from the reopened 25-year bond (FXD1/2018/25), surpassing its KES 25B target due to strong investor demand. The bond auction saw an oversubscription of KES 47B, reflecting a sustained appetite for long-term securities amid falling interest rates. Investors secured the bond at a discount, paying KES 100.37 per KES 100 unit, factoring in accrued interest. The bond offers a 13.4% coupon rate with an implied yield of 13.8%. Of the funds raised, KES 27.6B will go toward redemptions, while KES 7.5B represents fresh borrowing for the government.

Eurobonds: Last week, yields on six of Kenya’s seven outstanding Eurobonds increased, led by the KENINT 2028 bond, which rose 32.80 basis points to 8.239%. The KENINT 2034 bond followed, climbing 27.0 basis points to 9.731%, while the KENINT 2027 bond declined 1.70 basis points to 6.943%. On average, Eurobond yields increased 22.07 basis points week-on-week.

Market Gleanings

📊| Stanbic PMI February 2025 | The Stanbic Bank Kenya PMI rose slightly to 50.6 in February 2025, up from 50.5 in January, marking the fifth straight month of expansion. Output growth accelerated to its fastest pace since November 2024, supported by improved demand, better cash flow, and new product launches. New orders increased for the fifth consecutive month, while employment rebounded to a four-month high, though modestly. Input costs softened, rising at the slowest pace in four months due to moderate purchase price increases. However, business sentiment hit one of its lowest levels on record, reflecting concerns over the economic outlook and rising competition.

💰| Eurobond Buyback Falls Short by $320M | Kenya’s Eurobond buyback saw investors sell back USD 580M of the USD 900M bond maturing in 2027, leaving the government with USD 320M still on the books. The Treasury had planned to retire the entire bond early using proceeds from a new USD 1.5B Eurobond issued at 9.5% interest. The remaining USD 320M will continue to be serviced until maturity in 2027, adding to the country’s rising debt costs. The settlement is set for March 2025.

🔺| CMA Suspends Trade Sense License | The Capital Markets Authority (CMA) has suspended Trade Sense Limited’s Money Manager license for 90 days, effective March 3, 2025, due to non-compliance with regulatory requirements. CMA cited failures in governance, financial compliance, Anti-Money Laundering protocols, and operational standards, which undermine investor protection and market confidence. The suspension follows ongoing engagements since 2023 to address breaches. During this period, CMA will review whether to lift or extend the suspension.

🟢| KRA Waives KES 140B in Penalties | The Kenya Revenue Authority (KRA) has waived KES 140B in tax penalties, interest, and fines under its ongoing Tax Amnesty Program, benefiting over 1.9 million taxpayers. The initiative, reintroduced through the Tax Procedures (Amendment) Act 2024, allows taxpayers to clear outstanding tax debts accrued before December 31, 2023, without financial penalties. Taxpayers have until June 30, 2025, to settle dues.

📶| MTN Uganda FY24 Results | MTN Uganda posted a USH 641.5B profit after tax in 2024, up from USH 493.1B in 2023, with a 20.2% profit margin. Revenue grew 18.9% to USH 3.172T, driven by 12.7% growth in voice revenue (USH 1.3T), 30.5% growth in data revenue (USH 811.8B), and 22.8% growth in fintech revenue (USH 947.5B). MoMo transactions rose 26.6% to USH 4.3B, while total assets declined slightly to USH 4.67T. MTN has proposed a final dividend of USH 8.5 per share, totaling USH 190.3B.

🛫| Kenya Airways’ Debt to Government | The Auditor General’s report has revealed that Kenya Airways' debt to the government has reached KES 55.4B, with KES 10B loaned in FY 22/23. The airline’s total loans, including interest and penalties, now stand at KES 43B, while the government has paid KES 12.3B for a defaulted foreign loan. However, no formal repayment plan exists for the full amount.

⚡| Kenya Power Opposes Wayleave Charges | Kenya Power has raised concerns over proposals to include wayleave charges in electricity bills, warning that this could increase costs for consumers by up to 30%. The company highlighted that while the strengthening of the Kenya Shilling has led to lower pass-through costs, including forex and fuel charges, the potential introduction of wayleave fees as a pass-through cost would undermine these gains.

⬇️| Guardian Bank Lowers Base Lending Rate | Guardian Bank has reduced its base lending rate from 16% to 15.50% per annum, effective March 3, 2025, for new facilities and April 3, 2025, for existing facilities. The final interest rate will vary based on individual customer risk profiles.

🇨🇩| DRC Offers U.S. Exclusive Mineral Access | The Democratic Republic of Congo (DRC) has proposed an exclusive minerals deal with the U.S., offering access to its vast reserves of cobalt, copper, and uranium in exchange for military assistance against the M23 rebels, allegedly backed by Rwanda. Congo is requesting a meeting between Presidents Tshisekedi and Trump to discuss the deal.