👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover the 2022/23 Budget and Kenya's Insurance Industry.First off, our weekly business news in memes brought to you by Safaricom PLC:

FY 22/23 Budget

Context: The 2022/23 budget comes under the background of an electioneering period, inflationary concerns occasioned by geopolitical upheaval, and an economy smarting from a pandemic - as recorded from the 7.6% 2021 GDP growth - essentially a rebound from 2020's 0.3% slump.

Budget Highlights:

Revenue vs Expenditure: Tax collection is projected to reach KES 2.14T. Total spending is expected to reach KES 3.3T, around 23.9% of GDP. Recurrent expenditure amounts to KES 2.2T, development expenditure is KES 715.5B, while the equitable share to counties is projected at Ksh 370B. Treasury will have to plug a KES 846B hole to fund the 2022/23 budget.

Source: Deloitte Kenya

National Debt: Projections show Total Debt Service rising 17.2% YoY to KES 1.36T. The Treasury proposes a change from a debt ceiling to a debt anchor of 55% of GDP.

August Elections: Treasury proposes KES 21.7B to IEBC for preparation for the General Elections.

Motor vehicles: Exemption from VAT of inputs and raw materials used in the manufacture of passenger motor vehicles and of locally manufactured passenger motor vehicles from VAT.

Insurance: Motorcycles and three-wheelers used by fare-paying passengers have to take insurance for their passengers.

Tax resolution: Commissioner to issue a decision on objection by a taxpayer within one cycle of 60 days from the date of receiving a valid objection by the taxpayer.

Finance Bill Proposals:

Income Tax: Introduction of 15% tax on gains from financial derivatives.

VAT: Removal of zero-rating on maize, wheat, and cassava flour.

Tax Appeals Tribunal: Taxpayers who lose in the tax tribunal and want to appeal have to deposit 50% of the amount in contention in a special CBK account pending determination.

Capital Gains: Any capital gains arising from the sale of property and shares not listed at the NSE will have an applicable tax rate of 15% from the current 5%.

Betting: Excise tax on betting to rise from 7.% to 20.0%. A 15% excise duty on advertisement of alcoholic beverages, betting, and gaming on various media.

Mwango Takeaway: The elephant in the room is the KES 846B budget deficit whose funding will necessitate more public borrowing essentially accelerating the debt spiral. For individuals and firms, running costs in the coming financial year depend on how Parliament handles the Finance Bill.

Find our coverage of the budget here, a copy of the finance bill here, and the budget statement here.

Britam Back to Profits

Headline Growth: In FY 2021, gross earnings from premiums and fund management fees grew 12.8% to KES 32.5B. This translates to an 8.1% growth in net earned revenue to KES 25.7B. Investment income came grew 15.6% pushing total income up 33.4% to KES 40.2B.

Profitability: Operating expenses (OPEX) dropped 0.2% to KES 38.9M. The company rebounded to a positive Profit Before Tax position of KES 1B from a KES 9.6B loss in 2020. Profit after tax grew to KES 72M from a KES 9.1B loss in the previous year.

No Dividend: Britam recorded an Earnings Per Share of KES 0.02 {2020: KES -3.62]. There will be no dividend payment for the year, just as was the case in 2020. Britam last paid a Dividend of KES 0.25 per share [KES 631M] on FY 2019 results.

Sale of Equity Group Stake

Details: The insurer is at the tail end of the sale of its 6.7% stake in Equity Group Holdings (EGH) to the International Finance Corporation (IFC). The sale will involve the disposal of 166.4m EGH shares [4.409% of EGH share capital] shares by Britam Holdings, and another 88.8m EGH shares [2.298% of EGH share capital] by Britam Life Assurance Company (Kenya) Limited. The transaction’s longstop date is Apr 29, 2022.

How it Squares Out:

Britam - It will be exiting its most successful investment in Kenya.

Equity - the transaction will make IFC EGH’s second-largest shareholder after Arise B.V.

IFC - By virtue of IFC’s status as EGH’s largest lender, with KES 21.8B in lent funds as at Dec 2020, the move significantly increases IFC’s debt and equity exposure in EGH.

Kenya RE 2021 FY Results

Highlights: Operating expenses edged up 6.6% to KES 2B. Net claims shrank 15.4% to KES 11.4B as the insurer’s asset base grew 4.8% to KES 55.8B. Gross Premiums Written grew 9.8% to KES 20.3B.

Muted PAT Growth: Total Income declined 7% to KES 23.2B as investment income shrank 14% to KES 895M. Profit Before Tax narrowly edged up 0.4% to KES 4B, while net income grew marginally by 0.8% to KES 2.9B.

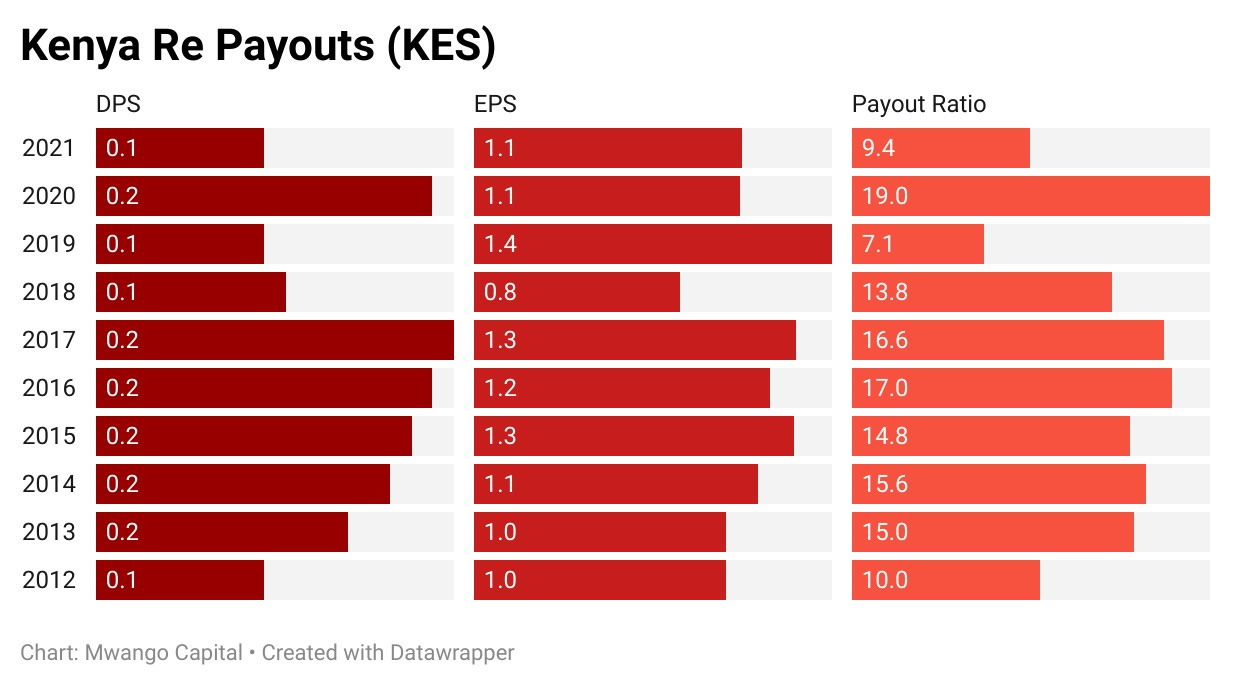

Shareholder Returns: Earnings Per Share were KES 1.06 [2020: KES 1.05]. The Board recommended a dividend of KES 0.10 per share, translating to a 9.4% payout ratio. This will be a KES 280M payment out of KES 2.9B net income.

Kenya March PMI Report

Verdict: Kenya’s Purchasing Managers’ Index came in at 50.5 for March, compared to 52.9 in February. The month-on-month decline is attributed to a drop in demand occasioned by soaring input costs.

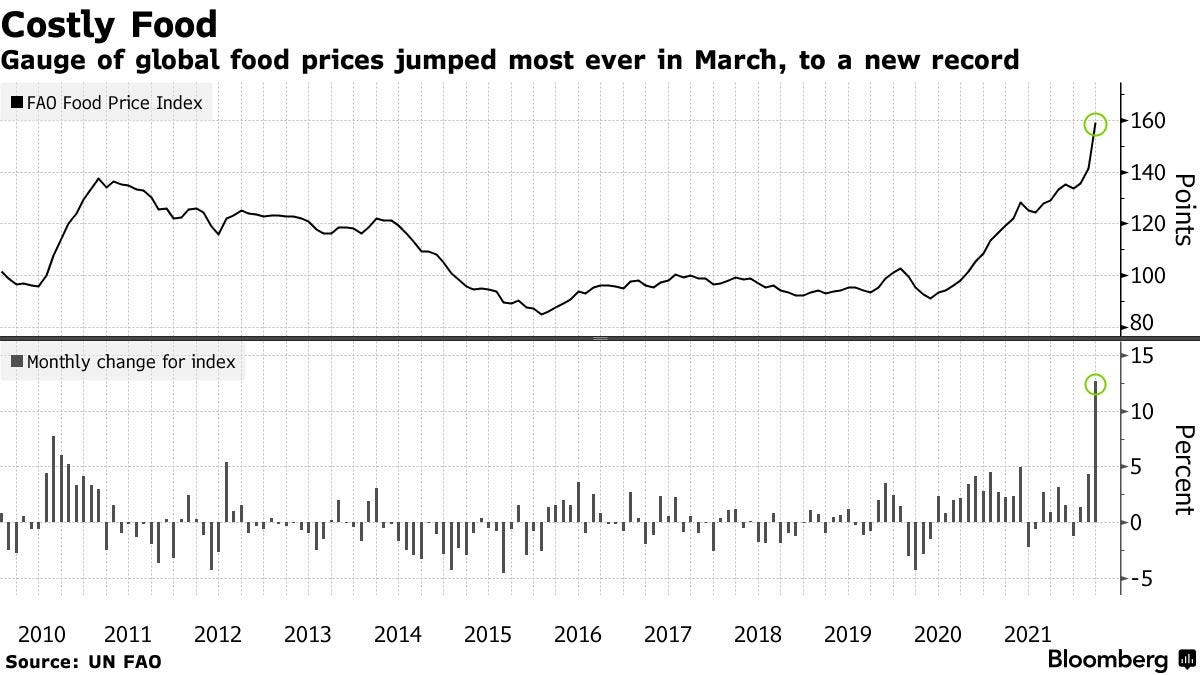

Input Costs: Input costs rose sharply at a rate last witnessed in Jan 2014 at the inception of the PMI. Increases in prices of materials including fuel have been a result of the Russia-Ukraine conflict which has distorted supplies and commodity flows.

What Else Happened This Week?

💰 Payments Interoperability: CBK on Friday announced mobile money merchant interoperability by Safaricom, Telkom, and Airtel. The current implementation covers Till Numbers with the regulator looking to operationalize Paybill and agent interoperability in subsequent phases. [CBK]

🏦 NCBA NPLs: At least f5 bank client accounts contribute to 60% [KES 26.4B] of the KES 44.34B in Non-Performing Loans that the Group printed in the financial year ended Dec 2021. [The Standard]

⛽ Fuel Subsidy: KES 34.4B was earmarked for the subsidy in the current financial year in the Supplementary Appropriation Bill, 2021 that the President assented to earlier this week. Oil Marketing Companies have been at odds with the government over payments. [YouTube]

🛢️ Projections Revised: The Central Bank revised its current account projections to 5.9% of GDP from 5.2% on higher international oil prices. [Business Daily]

📱 Millicom Exits Tigo Tanzania: Multinational telecom group Millicom disposed of its interest in Tigo Tanzania for a $100M net cash consideration. The move sees Millicom exit all business operations in Africa. [Millicom]

🌐 Fibre Craze: Kenya Pipeline Corporation (KPC) joins a list of companies engaging in the fiber optic cable business with its recent announcement of the commercialization of its fiber optic cables. [Twitter]

🤝 Compensation Updates: President Kenyatta this week assented to the Kenya Deposit Insurance (Amendment) Bill 2020 that unlocks a KES 500K ceiling - up from KES 100K - in maximum compensation a depositor can get from a collapsed bank. In the insurance sector, the Policyholders Compensation Fund will compensate policyholders of Resolution Insurance to a maximum of KES 250K per policy. [Business Daily]

Interest Rate Watch

Zimbabwe: The Reserve Bank of Zimbabwe hiked its Policy Rate to 80% from the prevailing 60% on rising inflation. Annual inflation came in at 72.7% from 66.11% a year earlier. [Bloomberg]

Tanzania: The Bank of Tanzania announced changes to Treasury Bonds Coupon Rates effective Apr 13. Previously issued Treasury Bonds will be unaffected. [BoT]