Safaricom Ethiopia Officially Launched

The company switched on its mobile telecommunications network and services in Addis Ababa last week

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Safaricom Ethiopia's official launch, the government buying out Helios' stake in Telkom, and SBM Bank's woes and its commitment to the local banking market.First off, enjoy our weekly business news in memes brought to you by Mwango Capital:

Safaricom Ethiopia Officially Launched

All Systems Go! Last week, Safaricom, officially launched its Ethiopian subsidiary, Safaricom Ethiopia. The service is available across 11 cities with a total population of just under 5M people, equivalent to 4% of Ethiopia’s total population. So far, Safaricom Ethiopia has 200,000 customers with 650 staff - 450 of whom are locals. The company has spent KES 36.2B in capital expenditure, an equivalent of 12.1% and 53.7% of Safaricom's FY 22 revenue and net profit, respectively.

“For two decades, Safaricom PLC has combined the power of technology and our innovative spirit to solve customer and societal challenges. Led by our Purpose to Transform Lives, we have deepened digital and financial inclusion in Kenya by connecting people to people, people to opportunities and people to information. With these lessons and experiences, we look forward to positively impacting the people of Ethiopia with a sustainable and quality mobile network that will be a vital launch pad for nationwide digital telecommunications services to over 118 million Ethiopians.”

Safaricom PLC CEO, Peter Ndegwa

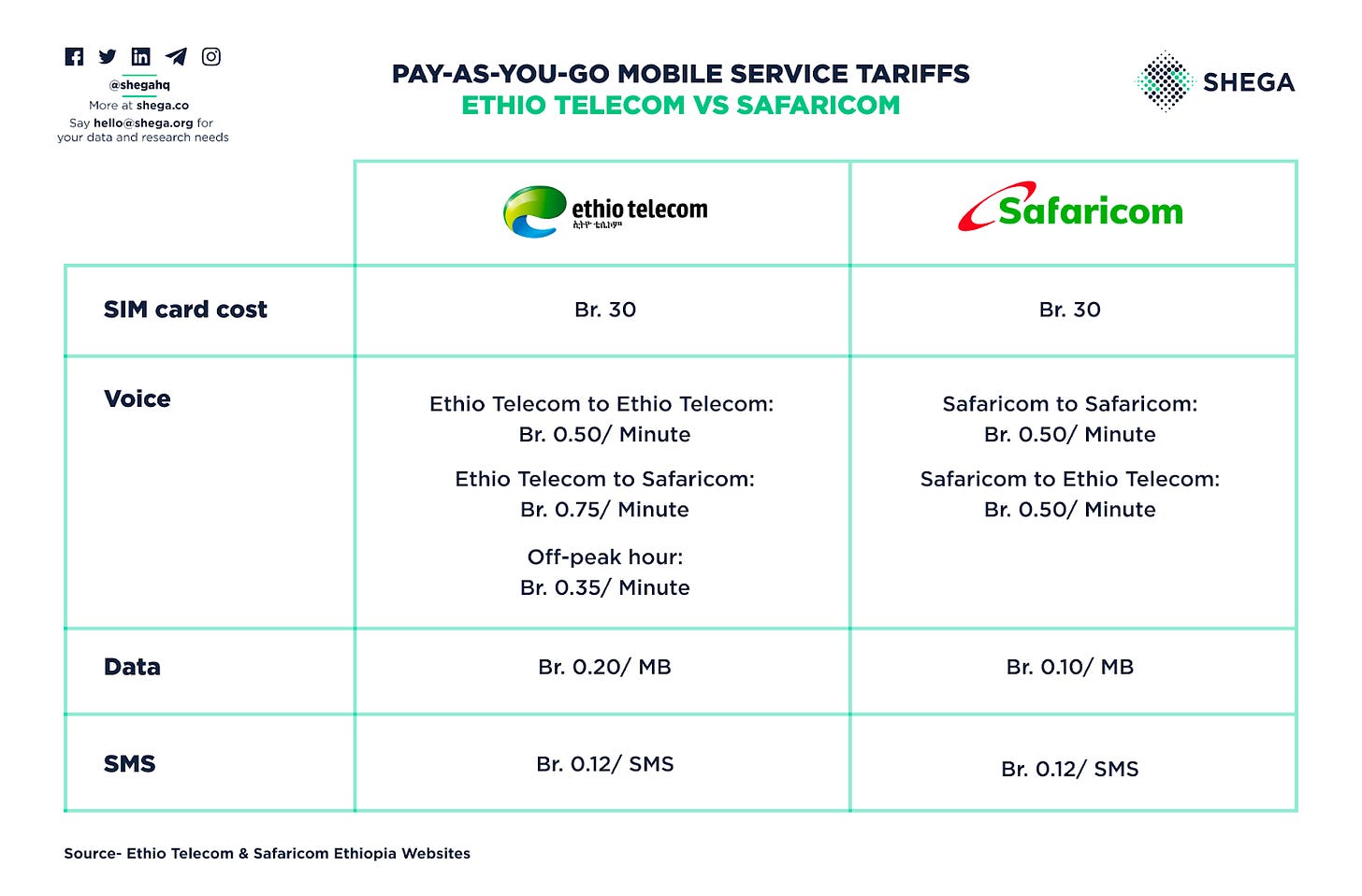

Mobile Data Play: Safaricom’s data offering is 50% cheaper than Ethio Telecom’s, the largest variation in the Pay-As-You-Go mobile service tariffs in a head-to-head comparison between Ethio Telecom and Safaricom Ethiopia. Data shows Ethiopia’s cheapest 1GB data plan costs $0.80, while in Kenya, the number is $0.24, against a smartphone penetration rate of just over 44% and 54.5%, respectively. In Ethiopia, 75% of people who live in the areas covered by mobile broadband networks have not yet used mobile internet services, presenting a niche for mobile data products when this group eventually comes online. However, there will be no unlimited packages from Safaricom Ethiopia:

“I am not a fan of unlimited offers. Unlimited packages put a lot of strain on the network, slowing it down for everybody. We won’t be offering unlimited packages for the next two or three years. We would have very generous offers but not unlimited”

Safaricom Ethiopia CEO Anwar Soussa

Mobile Money License: Safaricom Ethiopia was awarded a mobile money license to operate its flagship product M-PESA. In May 2021, Ethio Telecom, the state-owned firm responsible for telecommunications, launched Telebirr, a mobile money service. Here is how Telebirr is doing.

Mobile Market Landscape: The entry of Telebirr presented a digital alternative to traditional bank payment methods. In the period to September 2022 since its inception, Telebirr has transacted $824.01M across 23.9M total customers. Despite Telebirr’s head start in the market, there is a broad scope for mobile money coverage in the country with only 15% of Ethiopians having access to a bank account.

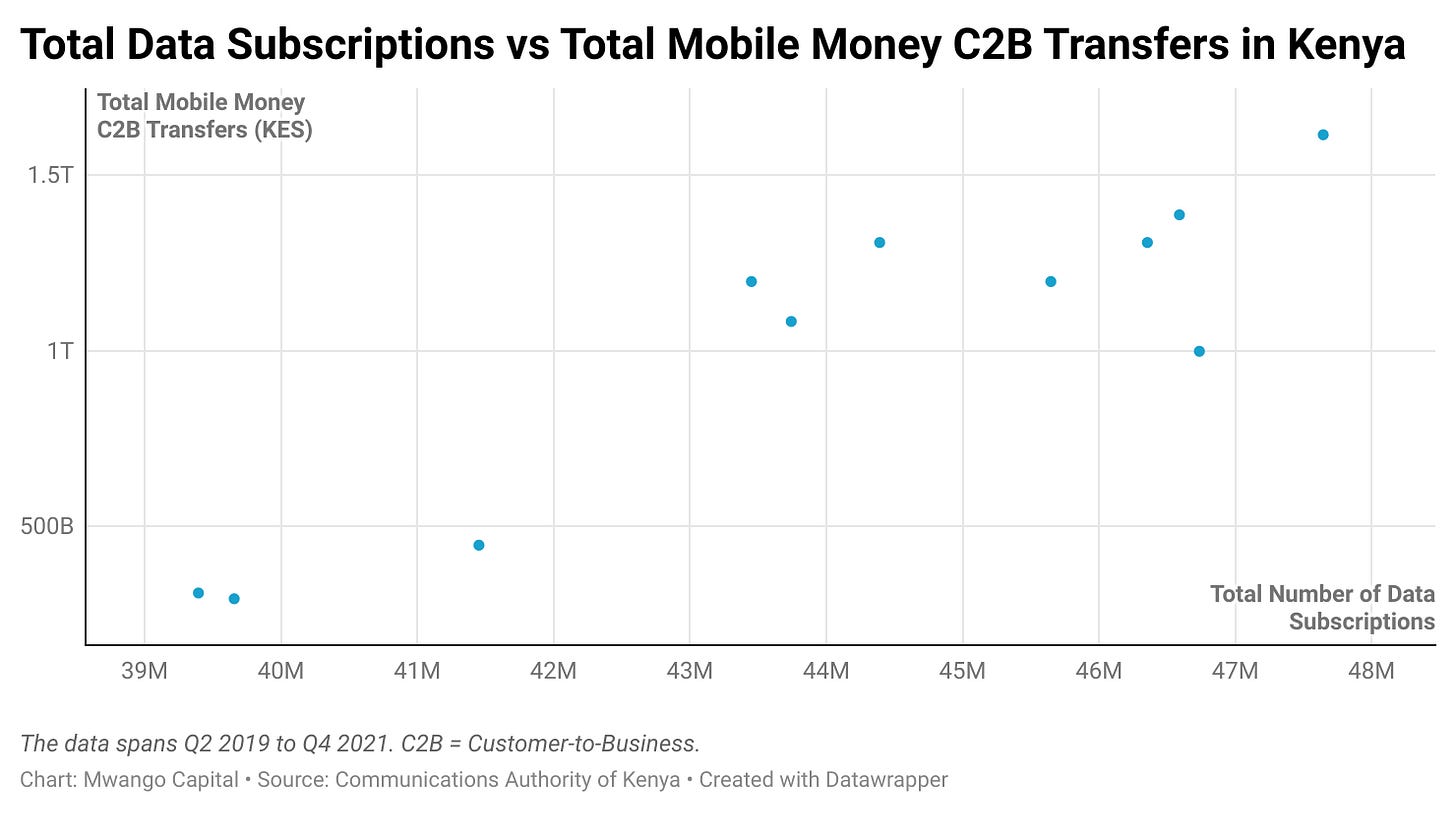

Mobile Money and Mobile Data Nexus?: A linear regression model that takes the number of data subscriptions as the dependent variable and the value of Customer-to-Business (C2B) transfers as the independent variable through Q2 2019 to Q4 2021 in Kenya shows that 79% of the variation in the number of data subscriptions could be explained by the value of C2B transfers. With 25.6M data and internet users, every Telebirr user is at face value a mobile and data internet user with Ethio Telecom. On balance, the interplay between mobile money and mobile data will be a key thematic area going forward.

Market Impact: Safaricom stock closed at KES 24.75 at the Nairobi Securities Exchange last week, down 0.8% from the previous week.

Telkom Fully Gov’t-Owned

The Hot Story: Telkom Kenya is now fully government-owned after UK-based PE fund, Helios Partners, sold its 60% stake to the government. The government acquired the 71.2M shares for KES 6.1B. The government paid out the amounts in the last week to the inauguration of President Ruto.

About Telkom: Telkom is the third largest telecom operator in Kenya with a 1.8% market share in the domestic voice market as of June 2022, after Safaricom (66.1%) and Airtel Kenya (31.9%). Its CEO is Mugo Kibati while its chairman is Eddy Njoroge. The deal values Telkom Kenya at KES 10B [Safaricom: KES 1.1T].

About Helios: Helios Investment Partners is an Africa-focused PE fund that was launched in 2004. They acquired the 60% stake from France’s Orange in June 2016 through its wholly-owned local subsidiary Jamhuri Holdings Limited. During this time, the Kenyan government also increased its holding from 30% to 40%. The value of the transaction was never disclosed but some sources estimated it to be around KES 50B. This would mean Helios made a KES 44B loss on this investment. For context, Orange paid USD 390M in 2007 to acquire 51% of Telkom Kenya.

Helios’ Exit Spree: Helios has been on an exit spree recently, having made around 6 exits now around Africa in the last 12 months including this one from Telkom Kenya. The others are:

The sale of a 49% stake in GBfoods Africa to its partner and co-shareholder, GBfoods SA, in September 2021.

Sale of a 27% stake in Vivo Energy to Vitol Group in November 2021.

Sale of a 25% stake in Axxela, a Nigerian gas distributor, to Sojitz in March 2022.

A partial exit from Interswitch in May 2022.

OVH Energy BV, a JV between Vitol & Helios, sold its stake in OVH Energy Marketing Ltd in September 2022.

These exits are likely to be part of the process to boost its fundraising for a new fund it is launching soon.

In 2015, it exited Equity Bank Group, earning KES 52B from the sale of its 20% stake in the bank.

SBM to Stay Put

Legal Challenges: Former owners of Fidelity Bank are petitioning the High Court to declare the 2017 buyout of the bank by SBM Holdings null and void on the grounds of a forced deal that had them accepting a negative valuation of the bank. The directors are suing CBK and SBM Holdings for KES 2.5B.

Background: SBM Holdings entered Kenya in 2017 after acquiring Fidelity Bank. SBM injected capital into Fidelity and renamed the bank SBM Bank Kenya. In August 2018, SBM Bank Kenya acquired certain assets and assumed 75% of the value of deposits of Chase Bank Kenya which was then in receivership. The transaction increased SBM's market share from 0.23% to 2.4%.

Liabilities: Last month, in a statutory demand, Afrasia Bank gave SBM Bank 3 weeks to settle a claim of $7.5M (+$16.645K interest) it had deposited in defunct Chase Bank 6 years ago.

SBM Here to Stay: SBM Bank Kenya's parent, SBM Holdings, in a communique, has ruled out exiting the Kenya market and has assured its Kenya stakeholders of its commitment to the local banking market. In its home country Mauritius, SBM Holdings is the second-largest listed banking and financial services group with a market capitalization of KES 645.5B ($5.34B).

Debt Markets

T-bills: In the T-bills market, the market-weighted average interest rates for the 91-day, 182-day, and 364-day T-bills were 9.036%, 9.639%, and 9.905%, respectively. Out of KES 24B offered, CBK accepted KES 19.058B in bids translating to an acceptance rate of 79.4% compared to 27.7% in the previous auction. Investors maintained their short-term preferences, with the 91-day T-bills having KES 10.757B accepted out of the KES 4B on offer.

T-bonds: In the T-bonds market, the total bids received in the reopened sale of FXD1/2017/10 and FXD1/2020/15 treasury bonds were KES 18.8B out of a target amount of KES 40B, bringing the performance rate to 47%.The CBK accepted KES 15.1B in bids bringing the acceptance rate to 37%. At the Nairobi Securities Exchange, the value of total bonds traded fell 9.3% week-on-week to KES 13.6B from KES 15B last week.

What Else Happened This Week

🗒️ GMC Ban Lifted: The Cabinet last week vacated its decision on November 8, 2012, prohibiting the open cultivation of Genetically Modified Crops (GMCs), effectively lifting the ban on GMCs. The decision is part of the government's medium to long-term response to the ongoing drought that is ravaging some parts of the country. The move has elicited mixed reactions with neighbour Tanzania stepping up vigilance on GMCs. Tanzania and Uganda currently have bans on GMCs.

👨💼 Oigara to Stanbic? Standard Bank Group Limited's Kenyan unit, Stanbic Bank Kenya, is in talks to hire Joshua Oigara, the immediate former Group Chief Executive Officer (CEO) of KCB Group, as its CEO. Stanbic Bank posted a Return on Equity of 8.6% and a 37% year-over-year increase in Net Income to KES 4.79B in H1 2022.

📈 Stanbic’s PMI: The Purchasing Managers’ Index for September rose sharply from 44.2 in August to 51.7 in September. Output levels returned to growth for the first time since February, and expansions were seen in the agriculture, wholesale & retail, and services categories.

💸 Britannia Acquires Kenafric: In a regulatory filing, India's biggest cookie manufacturer, Britannia Industries Ltd, has acquired a controlling stake (51%) in Kenafric Biscuits Limited for a consideration of KES 137.8M. Britannia has also acquired all the shares of Catalyst Britania Brands, the investment company owning the Britania brand in Kenya, for KES 21.4M. Following the move, Kenafric Group recalled 100 (30%) of the Britania Foods Limited workers put on temporary redundancy 2 years ago.

🛑 Massmart's Planned Exit: South African retailer Massmart Holdings has started staff consultations about closing its Game Stores in East and West Africa after it failed to find domestic buyers. Earlier this year, Massmart’s and Walmart Inc.’s Boards of Directors reached an agreement in principle regarding Walmart's acquisition of the outstanding shares of Massmart for a price of ZAR62 per share, a 53% premium to the 90-day volume weighted share price as at close of market on August 22, 2022. Game Stores has branches in Nigeria (5), Ghana (4), Kenya (3), Uganda (1), and Tanzania (1).

🏦 Stranded Depositors: Last week, FCB depositors lined up to withdraw cash, but the bank was only processing withdrawals of less than KES 10,000 a day and had placed restrictions on cheque clearance. The bank witnessed unprecedented withdrawals which forced it to limit its cut down on some services. The regulator has not commented in an official capacity on the matter.

Interest Rate Watch

🇸🇱 Sierra Leone: The Monetary Policy Committee (MPC) of the Central Bank of Sierra Leone raised its key interest rate by 100 basis points to 17% in a bid to curb inflation that reached 28.15% in August 2022 compared to 29.47% in July.

🇺🇬Uganda: The Bank of Uganda last week raised its key benchmark interest rate by 100 basis points to 10%, citing rising inflation occasioned by drought and a weakening currency. In September 2022, annual headline inflation for Uganda rose by one percentage point to 10% from 9% in August 2022.

🇬🇭 Ghana: The Bank of Ghana hiked its key interest rate by 250 basis points to 24.5%, its biggest rate hike since 2017. Inflation in Africa's second-largest cocoa producer stood at 33.9% as of August 2022 and the Ghana cedi has fallen 71.3% year-to-date.