👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Safaricom's HY2025 results, Kenya’s new tax bills and the Kenya agricultural sector half-year earnings.Safaricom HY 2025 Results

Devaluation Impact: Last week, Safaricom Plc reported an 18% decline in net profit for the first half of the financial year, primarily driven by the sharp devaluation of the Ethiopian birr. The telco’s bottom line dropped to KES 28.1B from KES 34.2B a year earlier. The company attributed this decline to a KES 33.8B impact from the birr's depreciation and cited capex creditors, lease agreements, and foreign-denominated borrowings as the key impact areas. Since June, the Ethiopian birr has weakened significantly, depreciating by 106.3%, from ETB 57.7 to 119.0 per US dollar by the end of September.

The group’s service revenue grew 13.1% year-on-year to KES 179.9B, mainly driven by M-Pesa, mobile data, and fixed data. Overall customer numbers rose by 7.8% to 52.01 million, with one-month active customers increasing by 10.8% to 39.75 million. Group capital expenditure reached KES 58.68B, with KES 27.91B invested in expanding operations in Ethiopia.

Kenyan Operations: Safaricom's operations in Kenya saw solid growth across key service lines in the first half of the financial year.

EBITDA increased by 13.7% year-on-year (YoY) to KES 102.9B, while EBIT grew 18% YoY to KES 79.2B, and net income rose 14.1% YoY to KES 47.5B, driven by strong performance in voice, messaging, M-Pesa, mobile data, and fixed services.

Voice revenue grew 4.8% YoY to KES 40.55B, with subscriber usage increasing 7.6% YoY. M-Pesa posted a 16.6% YoY growth in revenue, reaching KES 77.22B, with total transaction value up 10.7% YoY to KES 20.85T.

Mobile data revenue surged 20.2% YoY to KES 35.55B, driven by increased customer numbers, device penetration, and targeted content offers. Fiber-to-the-home (FTTH) penetration increased, with FTTH customers growing 17.8% YoY to 262.85k, contributing to Safaricom's 36.4% broadband market share as of June 2024, according to the Communications Authority.

Ethiopian Operations: Safaricom Ethiopia reported KES 4.1B in service revenue during the first half of the financial year, excluding the IAS 29 impact, with over 6 million active three-month customers. Mobile data accounted for 77.8% of total service revenue, generating KES 3.22B from 3.5 million one-month active data users, each consuming an average of 6.6GB. Voice and messaging revenues were KES 0.52B and KES 0.04B, respectively. M-Pesa, which now has 8.31 million registered customers, contributed KES 24.4M in revenue, supported by 3.2k active agents and 6.7k Lipa na M-Pesa merchants. The company has adjusted its break-even target in Ethiopia to the 2027 financial year, citing the impact of currency reforms.

“Our network currently covers 46% of the population and we are working to meet our licence obligation of 55% cover by June 2025. Despite the impact of foreign exchange regime reforms, we remain optimistic about the commercial success of this venture even as we increase our customer acquisition efforts and continue to innovate to deliver value to our customers. We are also growing M-PESA penetration in Ethiopia by expanding our product propositions to ease payments and improve the general financial well-being of our customers.”

Safaricom CEO, Peter Ndegwa

Revised Guidance: Safaricom has updated its financial guidance for the full year 2025, with Safaricom Kenya now expecting EBIT in the range of KES 155B to 158B up from KES 149B to 152B, and capital expenditure (CapEx) unchanged between KES 52B and 55B. Safaricom Ethiopia anticipates an EBIT loss of KES 58B to 61B up from KES 43B to KES 63B, with CapEx projected at KES 28B to 31B up from KES 21B to KES 24B. On a consolidated basis, the Group forecasts EBIT of KES 94B to 100B and total CapEx between KES 80B and 86B. These figures exclude the impact of IAS 29.

Share Price Reaction: Safaricom closed the week’s trading session down 6.6% w/w to close at KES 15.65 and trading 21.7M shares worth KES 27.9B. The stock is up 12.6% year to date.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence.

Learn more: KMRC website.

Earnings Wrap

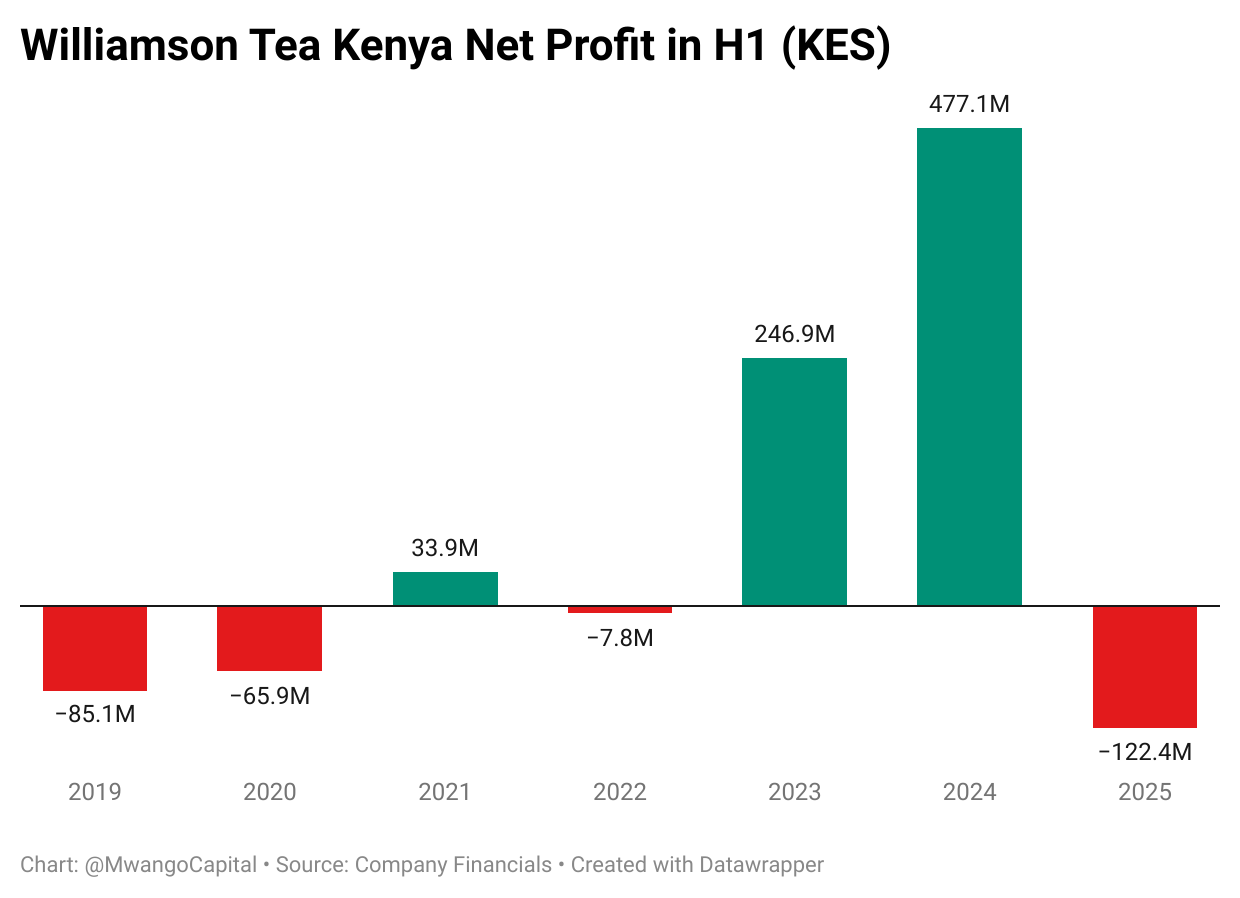

Williamson Tea Reports Major Losses: Williamson Tea Kenya's half-year results to September 30, 2024, underscore substantial financial strain. Revenue fell by 11.9% YoY to KES 2.0B, while the company reported an operating loss of KES 216.9M, reversing from a profit of KES 437.7M in the prior year. This shift pushed the operating margin from 19.4% to -10.9%. PAT swung to a loss of KES 124.1M from a profit of KES 461.3M, compressing the net margin from 20.5% to -6.3%. EPS sharply declined to KES (6.58) from KES 25.47. No interim dividend was declared as the company contends with oversupply in the Kenyan tea market and subdued global demand. Management has prioritized cost control and new customer acquisition to navigate ongoing market challenges.

Kapchorua Tea's Mixed Performance: Kapchorua Tea Kenya's half-year performance for the period ending September 30, 2024, was mixed. Turnover increased by 17.3% YoY to KES 1.1B, showing some revenue resilience despite tough conditions. However, the company recorded an operating loss of KES 5.1M, a sharp fall from the KES 273.1M profit in HY 2023, compressing the operating margin significantly. PAT dropped by 91.6% to KES 18.2M from KES 218.1M, resulting in a steep net margin decline. EPS fell to KES 2.33 from KES 27.88 a year earlier. No interim dividend was declared. Both Williamson Tea and Kapchorua Tea offered similar commentary:

“The outlook for the company remains poor with the supply of Kenyan tea continuing to outstrip global demand. Management remains focused on securing new customers and controlling costs in a market depression that is likely to continue for this financial year.”

MTN Uganda's Strong Growth: MTN Uganda's nine-month results to September 2024 demonstrated robust growth, driven by a strategic emphasis on data and fintech services. Service revenue climbed 20.1% YoY to UGX 2,307.9B ($633.11M), bolstered by a 30.1% increase in data revenue to UGX 585.8B ($159.16M) and a 23.5% rise in fintech revenue to UGX 686.4B ($186.44M). Voice revenue grew 13.7% to UGX 941.7B ($255.87M). EBITDA rose by 22.3% to UGX 1,205.5B ($330.39M), pushing the EBITDA margin to 51.7%. Despite a 2.9% increase in capex to UGX 297.9B ($81.68M), PAT surged 29.6% to UGX 459.4B ($124.83M). The board declared an interim dividend of UGX 7.5 per share ($0.002), totaling UGX 167.9B ($45.62M), payable on December 16, 2024.

Kenya’s New Tax Bills

New Bills, Old Proposals: The government has introduced four Bills (The Tax Laws Amendment Bill 2024, The Tax Procedures (Amendment) Bill 2024, The Public Finance Management (Amendment) Bill 2024 Bill, and The Business Laws Amendment Bill 2024). The Bills have reintroduced several tax measures from the previously rejected Finance Bill 2024. These bills aim to raise KES 162 billion (about 0.9% of GDP), less than half the revenue goal of the original Finance Bill. Bowmans has analyzed the potential impacts of these new proposals.

Beneficial Proposals:

Increased Non-Taxable Benefits: Raising the tax-free limit for employee benefits and pension contributions supports higher net pay for employees.

Deductible Health and Housing Contributions: Allowing deductions for contributions to the Social Health Insurance Fund, Affordable Housing Levy, and post-retirement medical funds boosts disposable income for employees.

Interest Mortgage Relief: Increasing the deductible limit for mortgage interest supports homeownership by reducing taxable income.

Pension Income Exemption: Tax-exempt pension income encourages long-term savings through registered schemes.

Tax Amnesty Extension: Extending the tax amnesty to June 2025 motivates taxpayers to settle dues without penalties.

Delayed Excise Duty Payment: Shifting payment deadlines for alcohol excise duty alleviates cash flow constraints for manufacturers.

Capital Gains Tax Incentives: A 5% capital gains tax for investments certified by the Nairobi International Financial Centre Authority attracts significant foreign investment.

VAT Exemption for Business Transfers: Exempting VAT on business transfers reduces transaction costs but limits sellers from claiming related input tax deductions.

Disadvantageous Proposals:

Significant Economic Presence Tax: Replacing the 1.5% digital service tax with a higher 3% tax rate increases the burden on non-resident digital service providers.

Digital Platform Withholding Tax: A new 5% withholding tax on payments to residents and 20% on non-residents could increase compliance burdens and costs for digital service operators.

Tax on Goods Supplied to Public Entities: Imposing withholding tax on payments for goods (0.5% for residents, 5% for non-residents) could reduce supplier profit margins.

Interest Tax on Infrastructure Bonds: Introducing a 5% withholding tax on interest earned from infrastructure bonds could reduce their investment appeal.

Income Tax on Family Trusts: Removing the tax exemption for registered family trusts may decrease their use for estate planning.

Tax on Transfer of Immovable Property to Family Trusts: Making gains from such transfers taxable may reduce the popularity of family trusts.

Specific VAT Changes:

Tourism Sector: Removing VAT exemptions for tour vehicles, entry fees to national parks, and tour operator services could make tourism more expensive and reduce competitiveness.

Aviation Sector: Imposing VAT on aircraft acquisitions and spare parts raises operational costs, potentially pushing the sector to use older, less safe equipment and diminishing Kenya's attractiveness as a maintenance hub.

Manufacturing Sector: Eliminating VAT exemptions for investment goods valued at KES 2 billion or more may deter large-scale manufacturing investments.

Minimum Top-Up Tax: Imposing this tax on multinational groups ensures they meet a minimum 15% effective tax rate, aligning with global anti-base erosion rules.

Further analysis by Julians Amboko can be found here.

Moody’s Commentary: Moody's has noted that Kenya's fiscal outlook is set for potential improvement with the new tax measures and fresh IMF support. The proposed Tax Laws Amendment Bill 2024 aims to raise KES162 billion (0.9% of GDP), helping stabilize government finances after President Ruto’s earlier rejection of a larger 2024 Finance Bill. In addition, the recent $606 million IMF disbursement and a possible $1.5 billion loan from the UAE will bolster external funding. With easing inflation, a stable currency, and the Central Bank cutting rates by 100 basis points, domestic borrowing costs are declining, enhancing Kenya’s debt affordability and credit profile.

“If the new tax measures are fully implemented, the increased revenue would help Kenya meet its fiscal targets and ensure continued support from multilateral creditors….The additional revenue collection would ease spending pressure from the carry-over of approximately KES200 billion of expenditures from fiscal 2024 (ending 30 June 2024) that were excluded in the first supplementary budget for fiscal 2025. Unpaid bills and expenditure carry-overs from fiscal 2024 were KES219 billion, or 1.3% of GDP, of which only KES68 billion was included in the supplementary budget. Increased confidence about Kenya's fiscal trajectory would support its credit profile, particularly against the backdrop of increasing international reserves and a decline in domestic borrowing costs”

Budget FY 2024/25: The Treasury last week also released the final Budget Review & Outlook Paper (BROP) 2024 as the journey to the Finance Bill 2025 gathers pace. As analyzed by Julians Amboko, Kenya's final 2025/26 budget shows significant upward adjustments compared to the mid-September draft. The total budget has been increased by KES 171.3B to KES 4.329T, with development spending up by KES 141.5B to KES 804.7B and recurrent expenditure rising by KES 20.2B to KES 3.077T. Transfers to counties grew by KES 10.0B to KES 442.7B. On the revenue side, total revenue, including AIA, is up KES 101.7B to KES 3.517T, driven by KES 57.9B more in ordinary revenue and KES 17.9B in tax revenue. The fiscal deficit widened by KES 70.0B to KES 759.4B, with external borrowing increased by KES 47.0B to KES 213.7B and domestic borrowing up KES 23.1B to KES 545.8B, highlighting greater financing needs.

Musings from Ndii and the Treasury CS: At various events last week including the NCBA Economic Forum, Treasury Cabinet Secretary John Mbadi and President’s Council of Economic Affairs Chair David Ndii shared their perspectives on Kenya’s economic landscape. Here are a few relevant quotes we took from each:

On domestic interest rates:

“....the more fundamental and important one is if we are talking about an inflation anchor around 3% then clearly that enables us to start thinking about our entire yield curve being in single digit territory. Yeah, probably with 90-day T-Bills around 5% and hopefully with a sort of medium-term boards not much more above 10%, if at all. That's why we think that we should be going. And that's why it's so important to be able to anchor that inflation.”

Council of Economic Affairs Chair, David Ndii

Any relief soon for Kenyan workers?

“When are people going to see relief? I want to make reference to something I said before. When you're in an IMF program, you are in the receivership. There's no relief. You're not going to get relief when you come out of receivership. When companies are in receivership, what do they do? They cut costs, they lay off people, the turnaround is costly and it is difficult. The question is, many countries don't do it. The reason why many countries have remained where they are, and they are in cycles of macroeconomic crisis, is because they don't bite. They take Panadol for their headaches and don't deal with the, whatever, an IMF program is just a palliative. What we want to do is the structural things that we are doing. And that's why we titled this thing Navigating Turbulence. Sure, we can't keep going back to the question of how much relief we provide at this point in time. At this point in time. Zero.”

Council of Economic Affairs Chair, David Ndii

On the need for the IMF program

“Every country which gets into an IMF program hopes to get out of it at the earliest opportunity. It's simple..To my mind, this conversation is that we have reached that fork in the road where we have to decide whether we get stuck in concessional financing—IDA, PRGF, which is the business we do with those people—or whether we should go where middle-income countries are, which is the market. We are a frontier market. Should we be looking to go to an emerging market and be subject now to market discipline? What we have to do there is to have the macros that bring down our credit sovereign ratings, which improve our creditworthiness, so we can afford to be a market country. But of course, there are many people, including those in these institutions, who are cautious. That's a very big paradigm shift. And there are many people on these shores who are afraid of losing sight of the shore. So yes, we are having a conversation, but it's an internal conversation as to whether, one, we have turned the corner. Do we need a funded IMF program? Do we need the IMF stamp of approval in the markets, or can the markets actually trust our fundamentals and our capacity to steer our economy? And when do we get the escape velocity to achieve independence? I have my position, but obviously, the final decision is above my pay grade.”

Council of Economic Affairs Chair, David Ndii

On Taxing IFBs:

“Sometimes we tax the lower income earners much more than we tax high-income earners because of unfair tax practices. For example, I'll give you another one: infrastructure bonds. Infrastructure bonds, we know, were exempted from tax to motivate Kenyans with money. You are earning 18 percent from a bond and you are paying zero tax. Yet someone who earns very little money by selling fruits on the roadside pays tax. Is that fairness? It is not. There are taxes that we must discuss. Sometimes you may have a tax system that is so friendly to high income earners and unfriendly to low income earners”

Treasury Cabinet Secretary, John Mbadi

Markets Wrap

NSE This Week: In Week 45 of 2024, Unga led the week’s top gainers rising 17.2% to close at KES 17.70, while HF Group was the worst performer, dropping 12.9% closing at KES 3.84. The NSE 20 went up by 1.2% to 1,927.5 points. The NSE 25, NSE 10, and NASI indices all closed in the red, with the NSE 25 down 0.1% to 3,187.4 points, the NSE 10 slipping 0.1% to 1,237.1 points, and the NASI dropping 1.7% to 115.6 points. Equity turnover increased by 93.9% to KES 2.2B, while bond turnover went down to KES 26.2B from KES 27.9B the previous week.

Treasury Bills and Bonds: Treasury bills were oversubscribed for the sixth consecutive week, with an overall subscription rate of 409.8%, up from 259.03% the previous week. The 91-day paper returned a 6x oversubscription, receiving bids worth KES 27.4B against KES 4.0B offered. Investors placed bids worth KES 98.4B, out of which KES 53.7B was accepted, resulting in an acceptance rate of 54.6%, higher than the previous week’s 45.3%. Yields on the three treasury bill tenors saw a decline, dropping by 51.6 basis points, 68.3basis points, and 52.0 basis points, closing at 13.45% for the 91-day, 13.84% for the 182-day, and 14.45% for the 364-day bills.

Across the primary market, the Central Bank of Kenya released auction results of the November 2024 treasury bond sale featuring the re-opened FXD1/2023/10 and FXD1/2022/15. Investors placed bids worth KES 33.0B (132.2% subscription rate), out of which, KES 25.7B was accepted (102.7% acceptance rate).

Eurobonds: Last week, yields declined across all six outstanding papers on a week-on-week basis. The KENINT 2028 saw the largest drop, falling by 13.8 basis points to 9.53%, followed closely by the KENINT 2048, which decreased by 13.1 basis points to 10.07%. Overall, the average week-on-week yield change was a decrease of 12.2 basis points.

Market Gleanings

📈| Stanbic Bank Kenya PMI | Kenyan firms saw a slight improvement in operating conditions at the start of Q4 2024, as the PMI rose from 49.7 in September to 50.4 in October. Activity and employment grew modestly, with job numbers increasing for the first time in three months. Purchasing efforts also accelerated, leading to the largest inventory growth since August 2023. While new orders and output expanded slightly, gains were constrained by ongoing cash flow issues, rising costs, and political uncertainty. Confidence in future growth improved, but sentiment remained lower than historical trends.

🚩| Carbacid’s BOC Kenya Bid Uncertain | Carbacid Investments' KES 1.2B bid to acquire BOC Kenya remains uncertain despite the Capital Markets Tribunal dismissing opposition from former chairman Ngugi Kiuna. With BOC shares now trading at KES 81, significantly higher than the original offer of KES 63.50 per share, the Board of Carbacid, in its latest annual reports, says that it is conducting an internal review to determine the next steps amid concerns that the initial agreement may lapse.

💰| Stanchart Secures USD 350M Deal | Standard Chartered Plc has partnered with the UK’s development finance institution, British International Investment (BII), to increase trade between Africa and South/Southeast Asia. The partnership includes a USD 350M financing deal aimed at helping small businesses facing working capital challenges, particularly in sectors like food, agriculture, healthcare, and technology. Since 2013, Standard Chartered and BII have facilitated USD 10B in trade across over 10 countries in Africa and South Asia.

🇸🇴| US Forgives Somalia’s Debt | The U.S. has forgiven USD 1.14B of debt owed by Somalia through a bilateral agreement, according to US Ambassador Richard Riley. This debt relief adds to the USD 1.2B in development, economic, security, and humanitarian assistance the US has provided to Somalia this fiscal year. The agreement follows the debt relief process set in March by the Paris Club, a group of wealthy creditor nations.

💼| Key Appointments |

The Kenya National Chamber of Commerce and Industry (KNCCI) has appointed Ahmed Farah as its new CEO, succeeding Patrick Nyangweso. Farah, the former country director for TradeMark Africa in Kenya, holds a master’s degree in international development from the University of Manchester and a bachelor’s in commerce from Kenyatta University.

Millicent Ngetich has been appointed as the Company Secretary for Standard Group PLC, Sasini PLC, Sameer Africa PLC, and Nairobi Business Ventures. She is a corporate lawyer with over 15 years of experience in corporate governance, legal advisory, policy development, and risk management.