👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover the KENINT 2024 Eurobond tender offer, the 50 bps hike by the Central Bank of Kenya, and amendments to the retirement benefit regulations.This week's newsletter is brought to you by:

Co-operative Bank of Kenya. Get access to proper healthcare and prioritize your family's well-being through Co-op Bancassurance Intermediary.

Kenya Announces Buyback of its USD 2B Eurobond

Buyback + Fresh Issuance: Kenya has initiated a tender offer for its KENINT 2024 (6.875% coupon), which is due to mature on June 24th, 2024, from February 7th to 14th, 2024, aiming to buy back the notes at face value (USD 1,000 per USD 1,000 principal). At the same time, Kenya is going to market this week by issuing new US dollar-denominated notes meant to fund the tender's execution. The maximum tender amount will be set after pricing the new notes, with allocation priorities favouring investors participating in the tender offer. This dual strategy demonstrates Kenya's proactive debt management, aiming to optimise its debt portfolio by potentially reducing costs and extending maturities:

“Notably, the preferred choice of the tender is an ‘any-and-all offers’ absent the dearth of targeted tender amount at the commencement of the offer. With the rule of thumb attached to any-and-all offers, seemingly GoK is potentially eyeing to buyback between 30.0% and 100.0% of the outstanding USD 2.0B. This implies at the very least, a USD 600.0M buyback and doubles the USD 300.0M guidance as announced by President Ruto during his State of the Nation Address in November 2023. We believe this aggressiveness reflects the re-access to the international markets by SSA issuers.”

IC Asset Managers Economist, Churchill Ogutu

At What Rates? Kenya's entrance into the global bond market is fortified by the recent success of Ivory Coast and Benin in their dollar bond issuances which signalled robust investor appetite for Sub-Saharan African debt instruments. Ivory Coast attracted USD 8B in bids for a USD 2.6B issuance, with bonds maturing in 2033 (7.875%) and 2037 (8.5%), underscoring a triple oversubscription and showcasing demand for sustainable and conventional bonds, which will join the JPMorgan EMBI Index. Benin's 2037 dollar bond was six times oversubscribed, raising USD 750M at an 8.375% yield, indicating high interest in emerging-market assets. As Kenya prepares to launch its bond, details on tenor, amortisation, and size remain anticipated, with investor focus on the forthcoming coupon rates against the backdrop of successful regional precedents.

“I expect a smaller (USD 500-750M) bond sale to show that Kenya has market access, which should facilitate a return to market later in the year if additional funds are needed.”

REDD Intelligence Senior Analyst, Mark Bohlund

“We are chasing Benin's 7.96% & Cote d'Ivoire's 7.625% & 8.25% but we don't have macros as favourable as theirs. Also, they have their currencies anchored on the Euro & that goes a long way, we don't have such a safety net. But the thing is we must close at sub-10%, by any means...So high 9s it is.”

Business Redefined Host, Julians Amboko

‘B' Rating: The S&P Global Ratings maintained Kenya's 'B' rating, amidst its Eurobond repurchase and new issuance strategy, reflecting the nation's tightrope walk between economic vigour and fiscal strain. This rating decision, grounded in the context of a negative outlook, underscores the precarious balance Kenya must maintain between leveraging its economic strengths, such as robust GDP growth and a diversified economy, against the backdrop of significant external refinancing pressures and fiscal vulnerabilities. The next rating review is set for Feb 23rd, 2024, with potential adjustments based on economic performance and fiscal measures:

“Our outlook on Kenya remains negative, indicating a one-in-three chance of a downgrade. We could lower the rating if external refinancing pressures continue to mount, or if we see limited progress on fiscal consolidation, further raising the government's already high debt and interest costs.”

Market Reaction: On Wednesday last week, the market reacted to the unveiling of the tender offer - with the yield on KENINT 2024 plummeting by more than 500 basis points (bps) in Wednesday’s trading session to close the trading day at 9.419% from 14.288% in the previous trading day. As of the end of last week, the yield closed at single-digit at 9.834%, marking a staggering 414.4 bps decline week-on-week and a notable 269.6 bps fall year-to-date.

Samurai Bond Issuance: The National Treasury announced this week that Kenya is also launching a $500 million Samurai bond in collaboration with Nippon Export and Investment Insurance (NEXI) to bolster its fiscal strategy. This issuance, split into two USD 250M phases and set for completion by June 2024, aims to finance the 2024/25 fiscal year. Facing over USD 3.5B in foreign debt maturing this year, including the critical USD 2B Eurobond, the Samurai bond provides Kenya with a strategic tool to navigate its substantial debt repayment and external interest obligations.

You can find the Tender Offer Memorandum here and the Preliminary Offering Circular here.

CBK Tightens More

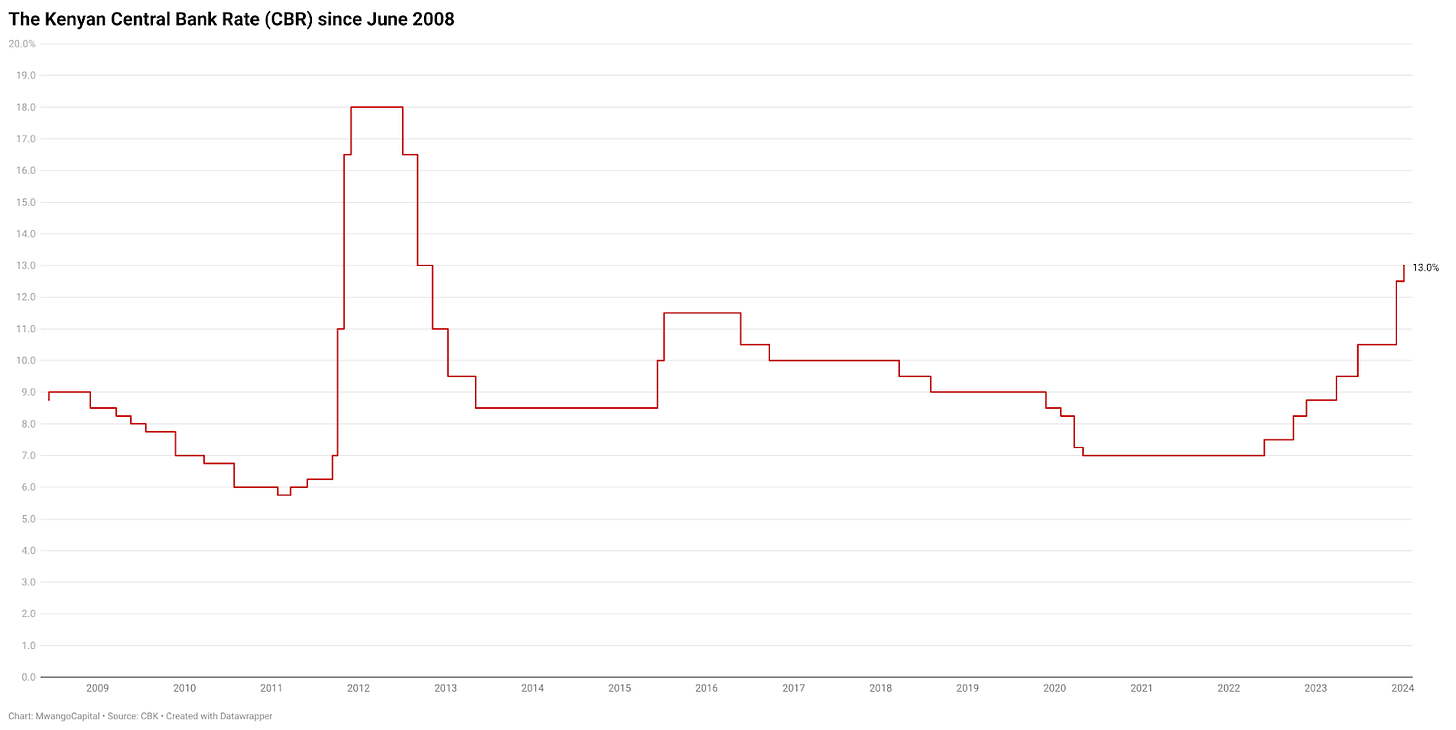

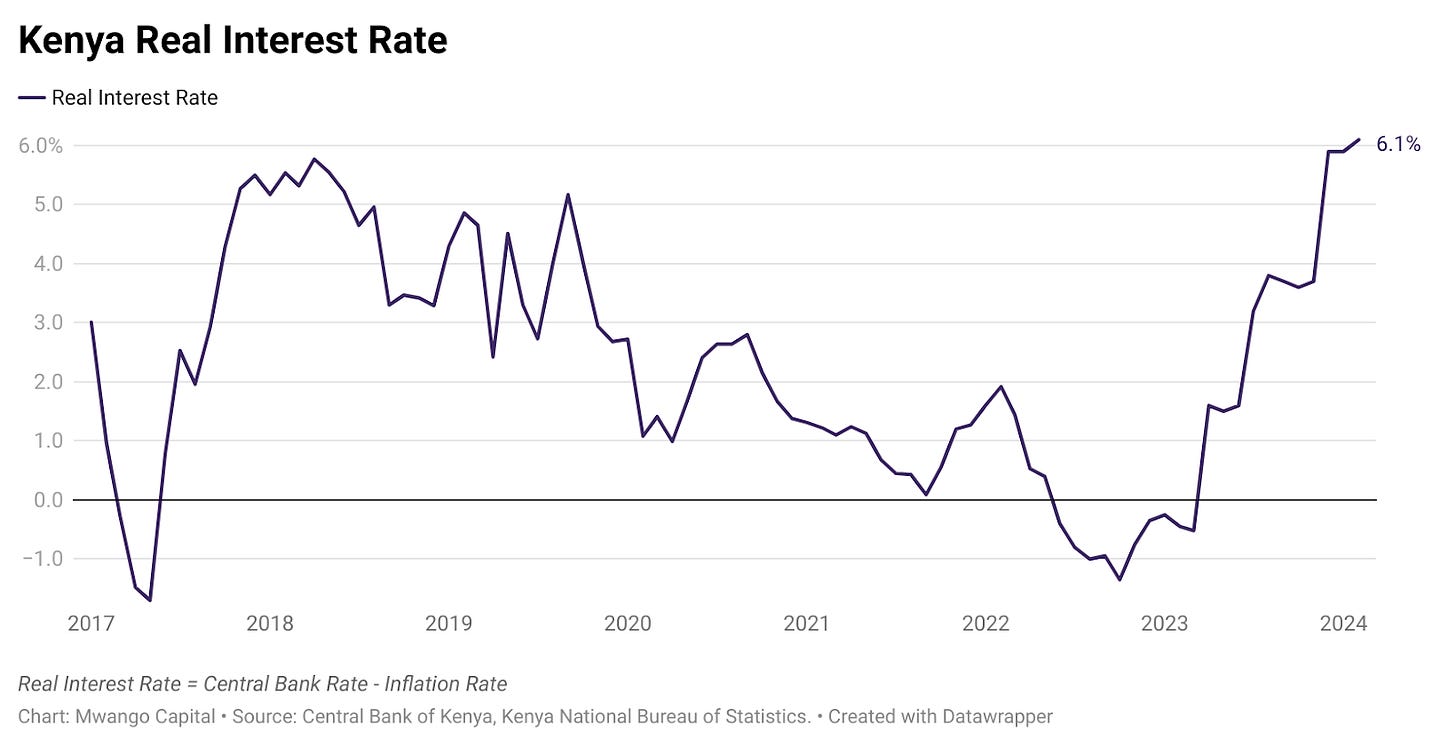

50 bps Hike in CBR: In a decisive move to tackle inflation and stabilise the national currency, the Central Bank of Kenya (CBK) announced a significant interest rate hike last week, elevating the Central Bank Rate (CBR) by 50 basis points to an 11-year peak of 13.0%. Consensus expectations were for a pause so this reflected a surprise (Goldman Sachs and Standard Chartered expected a 150 and 200 basis point hike respectively). The hikes are meant to combat inflation (January 2024's inflation rate registering at 6.9%, a slight increase from December 2023’s 6.6) and to support the Kenyan Shilling which has seen significant depreciation in the last year or so. Asked about the rising NPLs are a result of the hikes, the CBK governor had this to say:

“Of course, we also note that the NPLs have actually been declining for three months in a row now, starting in November, when they were 15.3% in January, they are 14. 8%. We continue to keep an eye on them, but we are also convinced that stabilising inflation and stabilising the exchange rate at this time is the most critical thing that we can do in order to have a stable macroeconomic environment, which actually is the one that encourages both domestic as well as foreign investments.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Focus on the FX Rate: In December 2023, the MPC hiked the base rate by 200 bps - an action that was taken ostensibly to mitigate the continued depreciation of the Kenya Shilling. Year-to-date, the Kenya Shilling has depreciated by 1.6% to the US Dollar, and 27.3% over the last one year. Here is what the Governor had to say on the exchange rate at the MPC press briefing:

"It is my view now that the exchange rate has overshot the equilibrium rate. I am of the view that the current rate is not consistent with macroeconomic fundamentals - and therefore I can’t give you a specific rate, but we do believe with the actions we have taken and expected flows, the fx rate should stabilise and move to that rate that is consistent with strong macroeconomic fundamentals.” So there could be scope for the Central Bank to support the exchange rate going forward. I do expect this [USD/KES] stability [of the last few days] to continue.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

More Dollars to the Rescue: The CBK governor sees more incoming dollar inflows that might help stem the slide in the shilling:

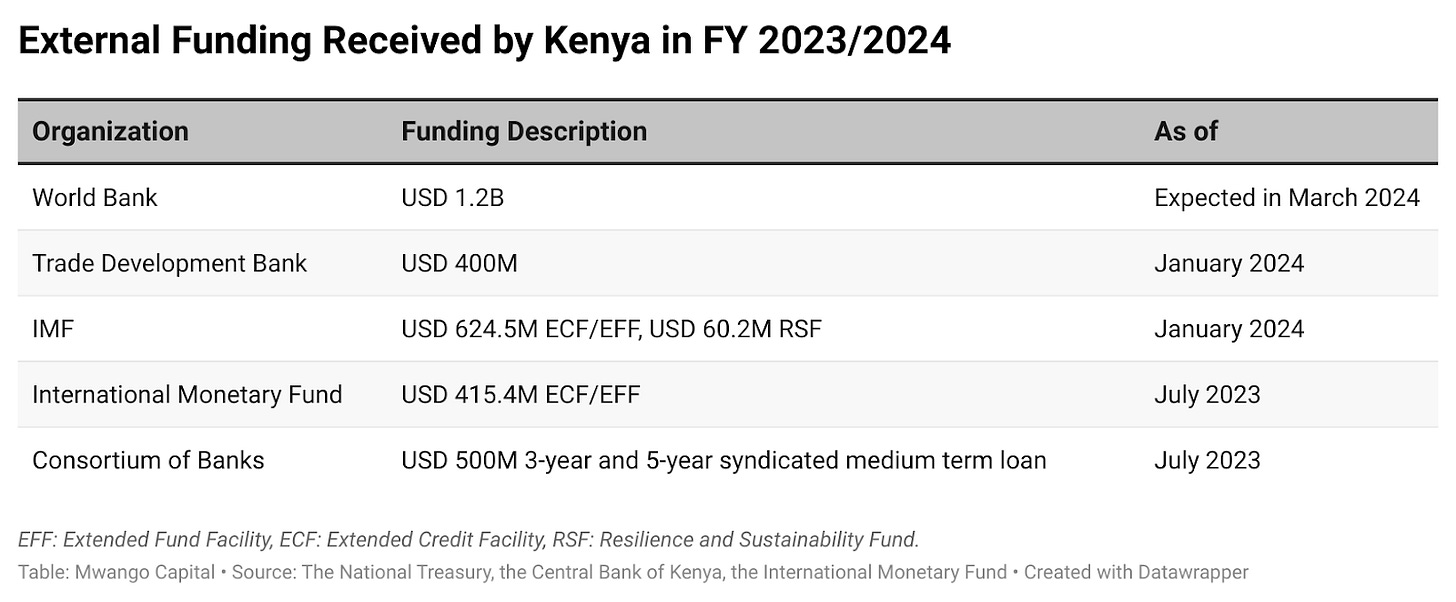

“We do believe that some of the actions that we have taken as the MPC - the increase in the CBR by 50 bps should serve to strengthen the exchange rate. But there are also other developments we believe will support the exchange rate - first, the disbursements we have received from our development partners - the IMF and the TDB - almost USD 400M in the last two months. We are also expecting some disbursements from the World Bank in March, at least USD 1.2B. We have seen interest in the IFB, we have seen significant interest from foreigners in the IFB so we expect FX to come in from the IFB purchase. Finally, some countries in Africa have accessed the international markets, and there is no reason Kenya can’t access international capital markets. We have engaged with our arrangers on accessing the international capital markets to issue a Eurobond to repay the maturing Eurobond [KENINT 2024].”

Dead Cat Bounce? The shilling has lately been strengthening relative to the dollar, and the tide started turning on 25th January, when the local unit hit an all-time low of 163 units to the dollar, but went on to gain ground to settle at 159.50 currently, representing an appreciation of 2.1%. Goldman Sachs had some interesting things to say about the recent appreciation run of the Kenya Shilling against the US Dollar:

"Since the drivers of the recent currency strengthening and subsequent stabilisation are not obvious to us at this time, we think the risk of further depreciation pressures remains elevated at least as long as international market access remains constrained."

High Demand for the IFB: Further, the apex bank also introduced changes in the publication of the exchange rates - shifting from the indicative rate provided by major interbank market players to the weighted average rate of all interbank FX transactions executed on the previous day. Still, on matters FX, the Governor pointed out the IFB/2024/8.5 currently on auction up to the 14th of February had recorded significant foreign interest as evidenced in the forex flows into the country:

"We are in the process of issuing the infrastructure bond and we have seen significant foreign interest in purchasing the infrastructure bond & therefore we expect also forex to come in from those from the purchase of the infrastructure bond."

Central Bank of Kenya Governor, Dr. Kamau Thugge

Salient Macro Data: In December 2023, private sector credit growth was at 13.9% in local currency terms - up 70 basis points from November, with the manufacturing and transport sectors recording robust growth at 20.9% and 20.8%, respectively. Exports of goods edged 2.2% lower in 2023 as compared to a 9.3% growth in 2022, while imports fell by 10.6% from a 7.3% growth in 2022. The current account deficit in 2023 is estimated at 3.9% of Gross Domestic Product (GDP) [2022: 5.0%], and is projected to settle at 4.0% of GDP in 2024. Across the banking sector, the Non-Performing Loans (NPL) ratio was 14.8% in December 2023 from 15.3% in October 2023.

“We are concerned by non-performing loans and what impact rising rates will have on them. Of course, we note the NPLs have been declining 3 months in a row starting November 2023 at 15.3% to 14.8% in January 2024. We continue to keep an eye on them but we are also convinced stabilising inflation and stabilizing the exchange rate is the most critical thing we can do in order to have a stable macro environment that encourages both domestic and foreign investments.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Across the Region: The Bank of Uganda held its Monetary Policy Committee meeting last week on the 6th, and the MPC elected to hold the CBR at 9.5%, with the MPC citing the need to anchor inflation around the target in the medium term as risks to the outlook for inflation tilt to the upside.

You can find the entire press release here and a link to the MPC press briefing here.

Markets Wrap

NSE: In Week 6 of 2024, TransCentury was the top-performing stock, up 8.9% to close at KES 0.49. Sasini was the worst-performing stock, down 8.9% to close at KES 20.0. The NSE 20 gained 0.3% to close at 1,516.5 points, the NSE 25 rose by 0.3% to close at 2,415.5, and the NASI index decreased by 1.1% to close at 91.2 points. Equity turnover rose by 19.6% to KES 1B from KES 839.45M the prior week while bond turnover closed the week at KES 22.4B compared to the prior week’s KES 22.7B.

Treasury Bills: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 16.5038%, 16.6331%, and 16.8574% respectively. The total amount on offer was KES 24B with the CBK accepting KES 48.7B of the KES 51.1B bids received, to bring the aggregate performance rate to 213.00%. The 91-day and 364-day instruments recorded 867.62% and 69.68% performance rates, respectively.

Eurobonds: In the week, yields fell across the 6 outstanding papers.

KENINT 2024 fell the most week-on-week, down by 414.40 bps to 9.834% while KENINT 2034 rose the least, depreciating by 8.80 basis points to 9.848%. The average week-on-week change stood at -10.78 bps.

KENINT 2032 rose the most on a year-to-date (YTD) basis, appreciating by 53.30 bps while KENINT 2024 rose the least at -269.60 bps.

Prices rose across the board week-on-week, with KENINT 2027 rising the most at 2.0% to 93.842. Year-to-date, KENINT 2048 fell the most, depreciating by 3.5% to 80.225, while KENINT 2024 was the only paper that appreciated at 1.5% to 98.928.

Deals, Mergers, and Acquisitions

KQ - Air Europa Agreement: Kenya Airways last week signed a code share agreement with Air Europa, Spain’s third-largest carrier. This partnership will enable passengers from both airlines to enjoy more convenient travel options to Europe and the United States. Specifically, Air Europa passengers can now fly to Nairobi from Amsterdam, while Kenya Airways guests can travel to Madrid, Palma de Mallorca, New York, and Miami.

Naivasha SEZ USD 146M investment: Turkish Ceramic Granite and Tile SEZ Ltd, a Turkish firm specialising in manufacturing building materials, is set to inject over USD146M into the 1,200-acre Naivasha Special Economic Zone (SEZ), a move that is expected to create employment for more than 960 Kenyans. The company is currently in the process of transferring USD 5M in first-phase equity to the Kenya Commercial Bank, following a sales agreement with Turkey Halkbank.

Japan - Kenya Agreements: Kenya and Japan recently signed a series of agreements that could unlock nearly KES 99B in investments in green energy and automobile assembly. The deals include the Meru Wind Farm Energy project, which will receive an investment of KES 15B, and the Isiolo Solar Energy initiative, which will receive KES 8B. Additionally, the Thika Kenya Vehicle Manufacturing project will receive an initial investment of KES 800M, while the Menengai Geothermal Plant and Electrified Vehicles Promotion will receive an investment of KES 75B.

Madaraka Express Gets New Wagons: Last week Kenya received 50 new freight wagons for the Madaraka Express freight service, with an additional 250 wagons expected to arrive this month from China. Notably, 20 of the new wagons are equipped with power plugins, facilitating the transport of refrigerated containers, and is expected to open up new business avenues for horticultural exports.

Tanzania Credit Carbon Projects: The Tanzanian government is poised to register carbon trade projects worth USD 1B upon completion of the planned schemes’ registration. The government had received 35 applications for carbon trade projects by the end of December 2023. Between 2018 and 2022, carbon trade projects implemented in various local councils have already contributed TZS 32B to the government’s revenue.

Multichoice - Canal Plus: South Africa’s MultiChoice Group rejected a takeover offer from Canal Plus, deeming it a significant undervaluation. Canal Plus had offered USD 5.55 per share for every MultiChoice share it did not already own, valuing the deal at 31.7 billion rand. However, MultiChoice’s board emphasised that a recent valuation placed its share price above the proposed offer. Canal Plus, initially holding 31.67%, increased its stake to 35% after the announcement.

Markets Gleanings

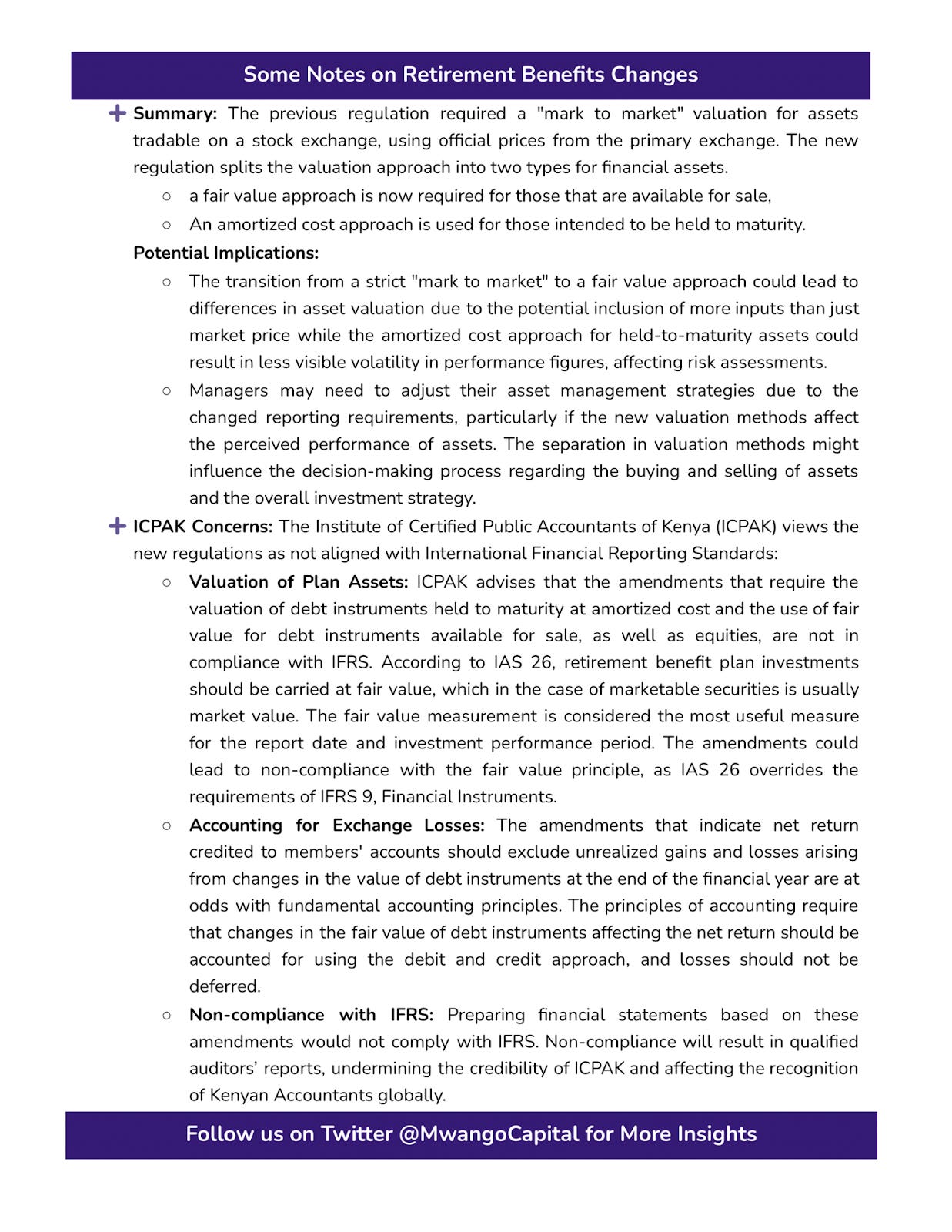

📃| RBA Issues Guidance | The Retirements Benefits Authority (RBA) recently announced amendments to retirement benefit regulations effective 21st December 2023.

📉| Falling Chinese Imports | In 2023, Kenya’s imports from China fell by 1.11% to USD 7.87B from USD 7.96B in 2022, according to data from Chinese customs. The decline contrasts with the previous years, when Kenya’s imports from China grew steadily, reaching a peak of USD7.96B in 2022. This aligns with CBK’s report of a 14.9% decrease in non-food imports in the 12 months to October 2023.

👍| NSE’s Hybrid Fixed Income Market | The Nairobi Securities Exchange (NSE) has received approval from the Capital Markets Authority (CMA) to operationalize a hybrid fixed-income market, which will combine both onscreen and over-the-counter (OTC) trading of fixed-income securities, such as bonds. The hybrid market will require mandatory reporting of OTC trades by licensed entities to eliminate settlement risks.

🏦| DTB Adopts Common Reporting Standards | Diamond Trust Bank (DTB) has implemented the Common Reporting Standard (CRS) regulations, as mandated by the Tax Procedures Act 2023. This international initiative requires financial institutions to collect and report information on customers' tax residency. As part of this compliance, DTB will be reviewing all accounts and may contact customers for additional information if needed to establish their tax residency accurately.

📊| Stanbic Bank Kenya Jan 2024 PMI | The latest Stanbic Bank Kenya PMI showed a near-stabilisation of business conditions in Kenya in January 2024, as the index rose to a five-month high of 49.8, up from 48.8 in December. The improvement was driven by slower declines in output and new orders, as well as an increase in employment, mainly of temporary workers.

🏛️| CMA Licences More Players + ILAM Fahari Delisting | Last week, the Capital Markets Authority (CMA) licensed VCG Asset Management as a fund manager and NCBA Bank as a REIT Trustee, boosting the financial and real estate sectors. ILAM Fahari I-REIT will delist from the NSE main segment on February 12, 2024, after a resolution by unitholders and approval by the CMA.

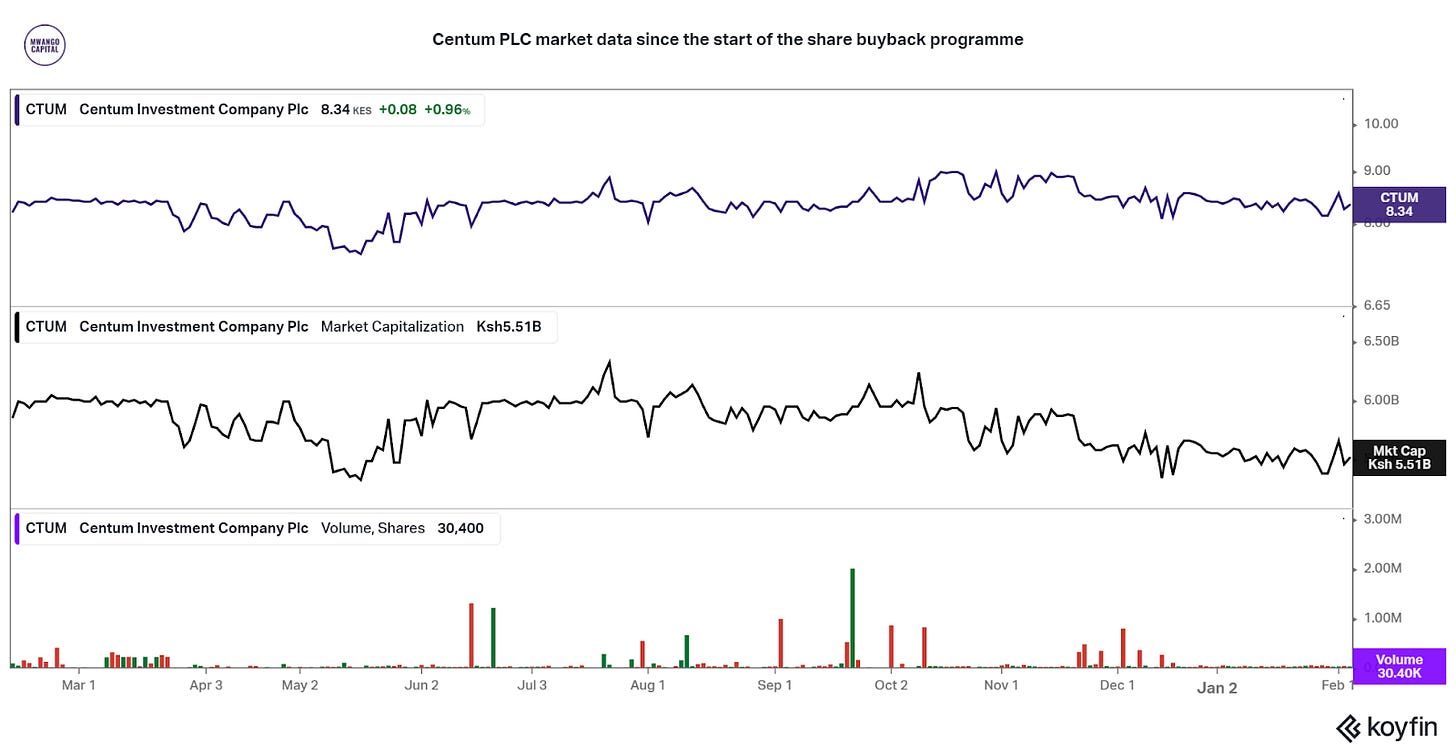

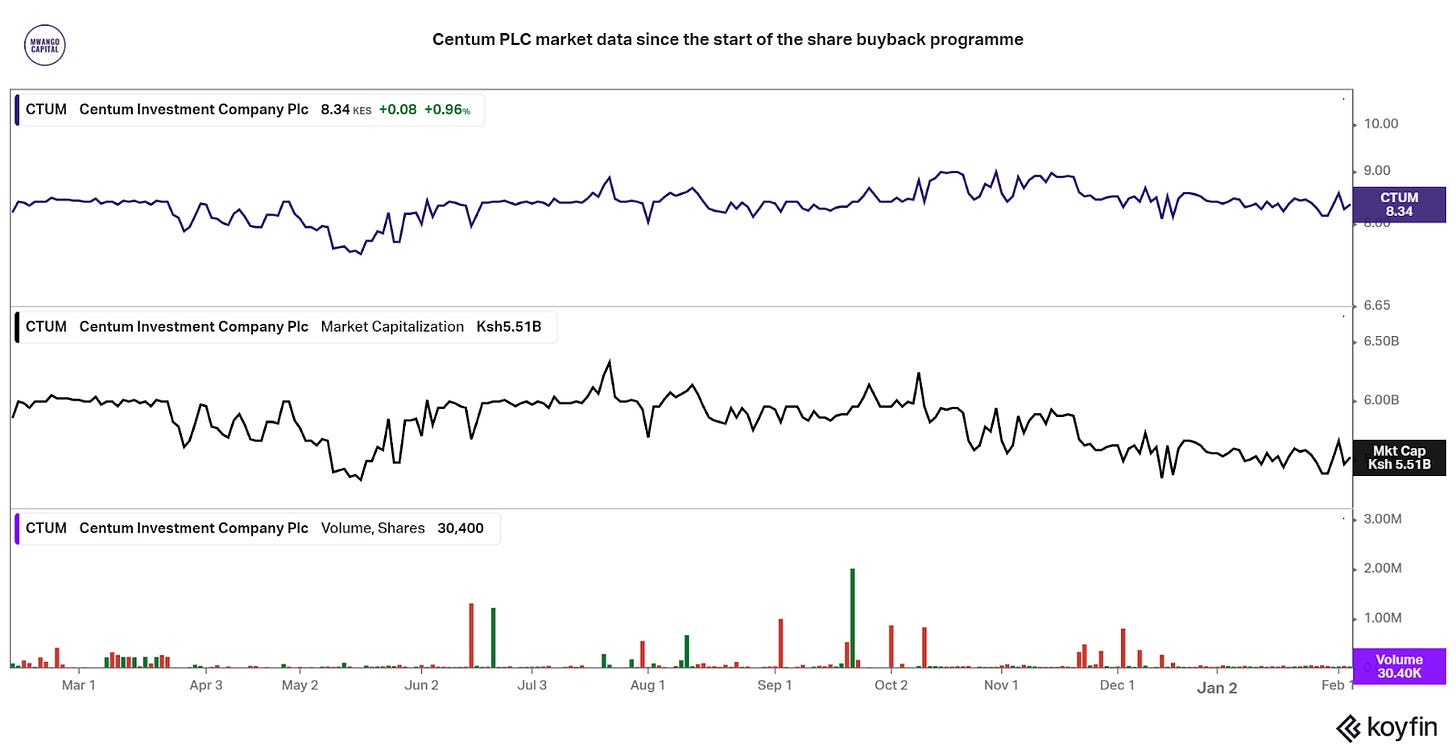

📈| Kibunga Ups Centum Stake |: Dr. John Kibunga Kimani, a billionaire investor and a major shareholder in Kakuzi Plc and Nation Media Group, has acquired more shares in Centum Investment Company Plc, raising his stake to 6.8%. Dr. Kimani bought an extra 10.8 million shares worth KES 90.7M in December 2023, making him the third-largest individual shareholder after Centum CEO James Mworia and businessman Chris Kirubi.