Safaricom Holds Dividend for Third Year

The company's earnings per share rose to KES 1.74 from KES 1.57 in the previous year

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Safaricom PLC's FY 2025 results, Stanbic Bank Kenya's Q1 2025 results, and the Stanbic Kenya PMI for April 2025.Safaricom FY 2025 Results

Total Revenue at KES 388B: Safaricom posted an 11.2% year-on-year increase in group revenue to KES 388.7B for FY25, with Kenya contributing approximately 98.1% of the total. In the Kenyan business, service revenue rose 10.5% to KES 364.3B, while EBIT increased by 13.0% to KES 158.1B.

Overall, group EBIT rose 29.5% to KES 104.1B. Group net income (including minority interest) increased 7.3% to KES 45.8B, while net income attributable to shareholders grew by 10.8% to KES 69.8B. Earnings per share rose to KES 1.74 from KES 1.57 in the previous year.

“We’ve seen resilience in our connectivity and financial services businesses… Mobile data grew 12.3%, driven by 4G customer growth and higher usage. M-PESA continued to recover from pricing adjustments, and fixed revenue also grew double digits. This reflects a strong foundation in our core segments despite a tough environment.”

Safaricom PLC CEO, Peter Ndegwa

M-PESA and Credit Activity: M-Pesa revenue grew 15.2% to KES 161.1B, making up 44.2% of total group revenue [FY 2024: 40%]. M-PESA transaction volumes rose 29.5% to 37.2 billion, while the total value transacted increased modestly by 1.6% to KES 38.3T. Credit products disbursed KES 2.2T (+21.4% y/y) to 13.1 million customers.

Fuliza remained the leading product, contributing KES 4.1B in revenue from KES 986.1B disbursed, with 7.9 million customers (+12.0%). Despite strong growth in usage and disbursement, credit revenue rose by only 5.1% to KES 8.1B.

"The credit portfolio is on a recovery path… We enhanced our credit limits as part of our response to customer needs, and this drove higher utilization. We also rolled out merchant lending products and have seen very good progress… This is one area where we see great potential for growth as we work together with our partners to meet the growing needs of our customers."

Safaricom PLC CFO, Dilip Pal

Safaricom in Ethiopia: The Ethiopian unit delivered strong user growth but remains in the investment phase. Active customers over 90 days more than doubled to 8.8 million, while one month data users rose by 165% to 5.28 million. Average data usage per user climbed to 6.5GB (+53.1%).

Safaricom also launched M-PESA in Ethiopia during the FY 2024, reaching 2.4 million active users and processing KES 20.6B across 164.6 million transactions. The company expanded its network to 3,141 sites, achieving 50% population coverage. However, the business remains unprofitable, with KES 25.7B in losses attributed to equity holders of the parent company.

“We have taken quite a lot of measures to cushion the impact of depreciation… renegotiating foreign-denominated contracts, onboarding ETB-based vendors, reducing expatriate numbers… and an industry-wide price increase in voice and data. These measures will go a long way in ensuring the future sustainability of Ethiopia's business performance.”

Safaricom PLC CFO, Dilip Pal

Ethiopia Revenue Driven by Data: Ethiopia’s revenue was largely driven by mobile data, which contributed KES 6.7B of the KES 8.90B in service revenue before inflation adjustments. Voice and messaging remain low contributors at KES 1.38B (KES 1.18B adjusted for IAS 29 impact) and KES 82.0M, respectively, despite a doubling in active users and a sharp rise in usage per subscriber.

Monthly voice minutes rose 80.4% to 127.3 per user, and SMS volumes increased 54.0% to 17.9 per user. M-PESA, while active in volume terms, generated only KES 12.5M in revenue for the year.

Growth in Wealth Offerings: The Ziidi Money Market Fund grew to KES 7.45B in assets under management (AUM) as of March 2025, up from KES 2.85B in January. Total AUM across all wealth offerings reached KES 9.6B, supported by 631,000 active customers.

However, revenue from these products remains limited, standing at KES 50M for the year. In the insurance segment, the company issued 411,000 LMM policies and reported a total sum assured of KES 3.3B, with KES 76M in gross premiums written.

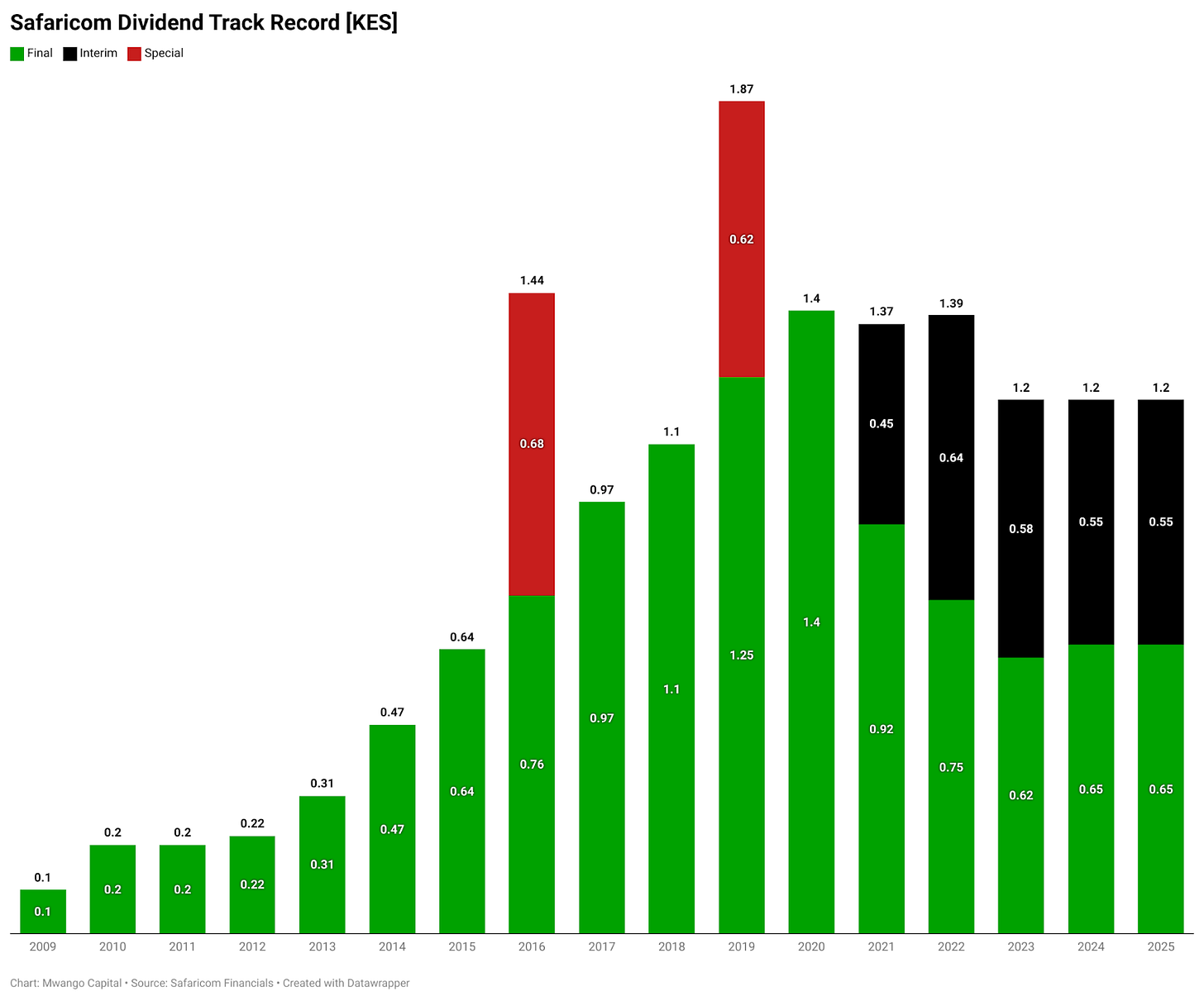

Dividend Maintained: The board recommended a final dividend of KES 0.65 per share, bringing the full-year dividend to KES 1.20, the same level as the past two financial years. The final dividend will be paid on or about 31st August 2025 to shareholders registered as of 31st July.

FY26 Guidance and Capital Allocation: Safaricom expects FY26 Group EBIT to range between KES 144–150B, with Group capex projected at KES 72–78B. Kenya is expected to contribute EBIT of KES 170–173B and absorb KES 54–57B in capex, while Ethiopia is forecast to post an EBIT loss of KES 23–26B with capex of KES 18–21B. Management plans to maintain investment in both markets, with Ethiopia continuing to weigh on earnings as the business scales.

Find our analysis of the results here.

This week's newsletter is brought to you by The Kenya Mortgage Refinance Company. First-time homebuyer? Confused about repayments? KMRC can help! Get the info you need to navigate homeownership finances with confidence. Learn more: KMRC website.

Stanbic Bank Kenya Q1 2025

PAT Down 16.6%: Stanbic Bank Kenya reported a 16.6% year-on-year decline in profit after tax to KES 3.3B, marking its first quarterly profit contraction since 2020. The decline was mainly driven by an 8.9% drop in total interest income to KES 11.0B and a 27.2% reduction in non-interest revenue to KES 2.8B, primarily due to a 59.0% decrease in foreign exchange income to KES 978M from KES 2.4B in Q1 2024.

Interest expenses declined by 24.6% year-on-year to KES 4.2B, supported by lower cost of customer deposits. Operating expenses rose 25.5% to KES 4.6B, outweighing cost savings and limiting profitability.

Shift to Government Securities Supports Interest Income: Stanbic Bank increased its allocation to government securities, with holdings rising 92.5% year-on-year to KES 81.0B. This repositioning was driven by attractive yields in the market and contributed to a 127.9% increase in interest income from government securities to KES 3.0B. The shift helped cushion the impact of declining interest income from loans and advances, particularly as income from loans and advances dropped 22.2% to KES 7.2B from KES 9.2B in Q1 2024.

Total assets declined by 8.4% to KES 450.1B, with the loan book contracting by 4.6% to KES 244B and customer deposits falling 5.0% to KES 337.6B.

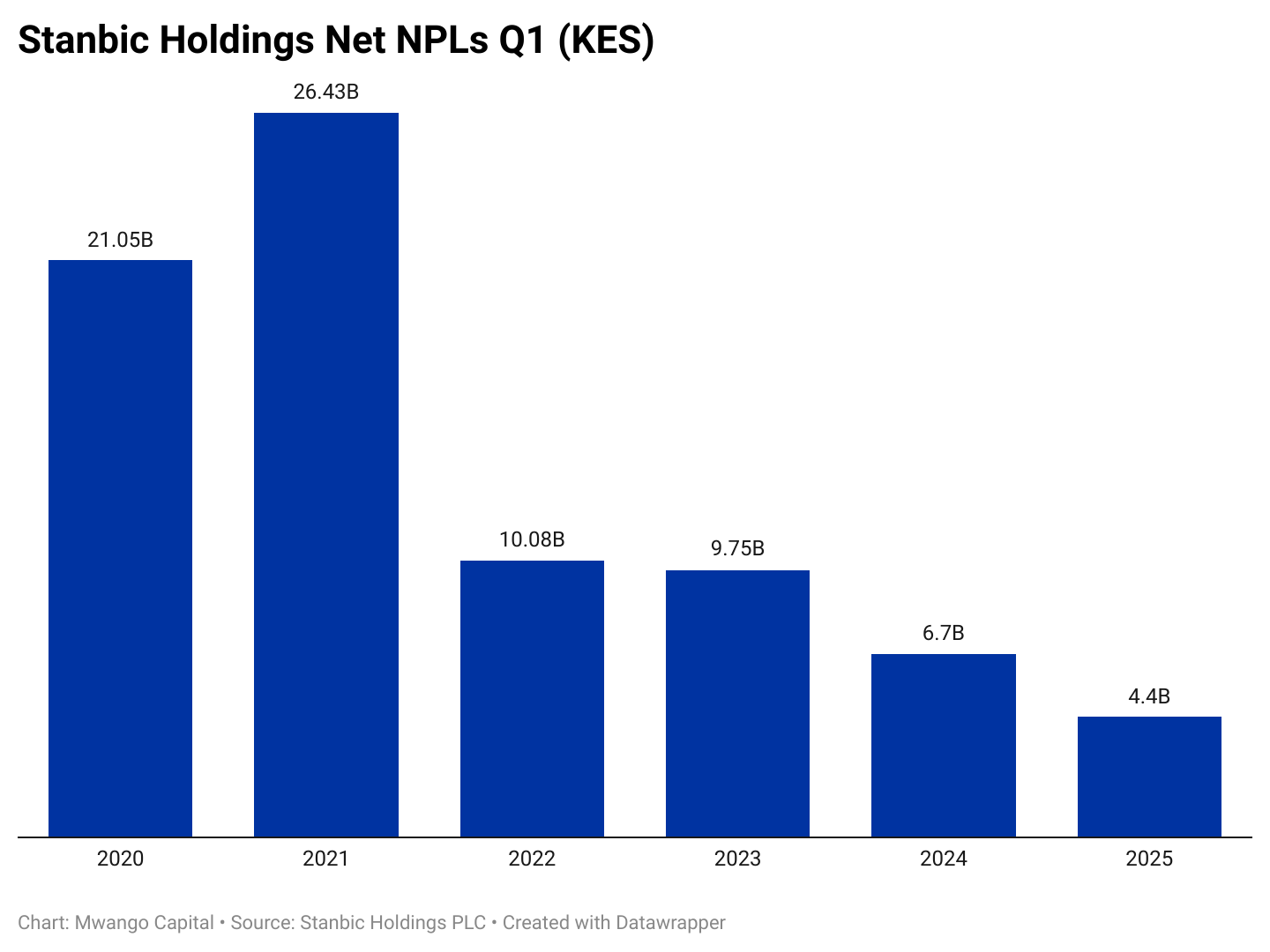

Asset Quality Benefits from Currency Impact: Gross NPLs decreased by 5.3% to KES 22.9B, supported by the currency impact on foreign currency-denominated exposures as the Kenya shilling strengthened compared to Q1 2024. Loan loss provisions declined by 24.8% to KES 855.5M. Net non-performing loans fell 34.3% to KES 4.4B, reflecting improved asset quality.

Despite this, earnings per share declined to KES 19.54 from KES 23.43 in the same period last year, weighed down by softer income performance.

Find our analysis of the results here.

Markets Wrap

NSE Weekly Recap: Week 19 (2–9 May 2025)

Top gainer: Kenya Re +9.9% to KES 1.78

Top loser: Sanlam –20.3% to KES 5.88

NASI up 1.0% to 126.9

Market cap: KES 1.99T (+1.0%)

Equity turnover rose 36.9% to KES 1.79B

Bond turnover down 8.5% to KES 35.7B

Net outflow: KES 40.9M

Treasury Bills: Treasury bills were oversubscribed last week, with a subscription rate of 219.45%, up from 76.56% the previous week. Investors submitted bids totaling KES 52.7B, and the Central Bank of Kenya (CBK) accepted KES 50.7B out of the KES 24B on offer. Yields on the 91-day and 182-day T-bills declined by 2.43 and 1.80 basis points to 8.3815% and 8.601%, respectively, while the yield on the 364-day T-bill remained increased by 0.4 basis points at 10.0098%.

Treasury Bonds: The CBK’s re-opened 20-year bond FXD1/2012/020 received KES 54.39B in bids against KES 30B offered, with KES 43.52B accepted at an average yield of 13.65%. Proceeds will cover KES 14.23B in redemptions and raise KES 29.29B in new borrowing.

Eurobonds: Last week, yields on Kenya’s seven outstanding Eurobonds declined, led by the KENINT 2031 bond, which dropped by 29.30 basis points to 9.760%. The KENINT 2028 bond followed, falling 19.50 basis points to 8.465%. On average, Eurobond yields declined by 16.53 basis points week-on-week.

Market Gleanings

📉| Kenya’s GDP Growth Slows to 4.7% | According to the Kenya National Bureau of Statistics’ (KNBS) 2025 Economic Survey, Kenya’s real GDP grew by 4.7% in 2024, down from 5.7% in 2023, with agriculture expanding 4.6% versus 6.6% previously. Growth was also seen in financial services (7.6%), real estate (5.3%), and transport (4.4%), while construction and mining contracted by 0.7% and 9.2%, respectively. Nominal GDP rose to KES 16.2T from KES 15.0T, with agriculture contributing 22.5% of output. GDP per capita increased to KES 309,460, while private consumption rose 8.9% to KES 12.5T.

📊| Stanbic Kenya PMI Rises to 27-Month High | Private sector activity in Kenya improved in April, with the Stanbic Bank Kenya PMI increasing to 52.0 from 51.7 in March. This was the highest reading since January 2023 and reflected stronger growth in new orders, which rose at the fastest pace in over three years. The services, agriculture, and construction sectors recorded robust gains, while manufacturing and retail saw weaker performance. Businesses increased input purchases and hired more staff, mostly on a temporary basis.

🟢| HF Group Proposes ESOP with 4.5% Shareholder Dilution | HF Group has proposed the creation of an Employee Share Ownership Plan (ESOP) to be tabled at its AGM on 28 May 2025. The scheme involves issuing 94.27 million new ordinary shares over five years, increasing the firm’s nominal share capital from KES 9.99 billion to KES 10.47 billion. If approved, the ESOP will dilute current shareholders by about 4.5 percent, within the 5 percent limit set in the proposal. The new shares will rank equally with existing ordinary shares.

🤝| Mergers and Acquisitions |

Del Monte Kenya Acquires Mananasi Fibre: The Competition Authority of Kenya has approved the full acquisition of Mananasi Fibre Limited by Del Monte Kenya. Mananasi Fibre specializes in converting pineapple plant waste into commercial products, while Del Monte is primarily involved in pineapple cultivation and processing. The deal gives Del Monte direct access to a waste-to-product solution for its agricultural by-products.

Pollman’s Tours Acquisition: The Competition Authority of Kenya has cleared the proposed acquisition of a 100% stake in Pollman’s Tours and Safaris Limited by Europe-based Africa Travel Investments Limited. Pollman’s, which offers guided safaris and travel packages globally, will now be under the ownership of Africa Travel, which has no existing operations in Kenya.

⛽| KRA Collects KES 2.11T | The Kenya Revenue Authority (KRA) collected KES 2.11T between July 2024 and April 2025, achieving 96.5% of its KES 2.19T target and marking a 6.1% increase from the KES 1.99T collected in the same period of FY 2023/24. Domestic taxes rose 4.7% to KES 1.39T, while customs revenue grew 9.1% to KES 722.7B. Agency revenue surged 37.1% year-on-year to KES 205.5B, exceeding target by 11.8%. Exchequer revenue stood at KES 1.91T, up 3.6% with a performance rate of 95.0%.

📆| Earnings Release Delays |

TPS Eastern Africa: TPS Eastern Africa PLC (Serena Hotels) has announced a delay in publishing its audited financial statements for the year ended 31 December 2024, citing ongoing restatements of prior-year accounts. The delay stems from a review by newly appointed auditor KPMG Kenya, focusing on corrections related to lease accounting under IFRS 16. The results, initially due by 30 April 2025, are now expected on or before 14 May 2025.

TransCentury PLC: TransCentury PLC has announced a delay in the release of its audited financial statements for the year ended 31 December 2024. The company attributed the postponement to delays in finalizing the audit of one of its subsidiaries, which contributes to the consolidated group results. The results are now expected to be published by 31 May 2025.

⛽️| KRA Mandates eTIMS for Fuel Stations | The Kenya Revenue Authority (KRA) has extended the rollout of the Electronic Tax Invoice Management System (eTIMS) to the petroleum sector, requiring all fuel stations to adopt the system by June 30, 2025. The eTIMS Fuel Station System allows integration with forecourt controllers, POS systems, and other software to capture and transmit tax invoices in real time. Fuel stations may opt for self-integration or work with a certified third-party integrator.

☕| Sasini Posts KES 113M HY Loss | Sasini PLC posted a net loss of KES 113.1M for the half year ended March 2025, an increase from the KES 37.7M loss recorded in the same period last year. Revenue declined marginally by 1.1% to KES 2.96B, while gross profit fell 9% to KES 570.2M. The Group cited higher production costs, adverse weather, lower tea prices, and disruptions in global shipping as key contributors to the softer performance. The coffee segment remained the only profitable division. Finance income turned negative, registering a loss of KES 10.5M compared to a gain of KES 106.3M in HY 2024.

🇳🇬| Nigeria Clears USD 3.4B IMF Loan | Nigeria has repaid the USD 3.4B loan it received from the International Monetary Fund (IMF) during the Covid-19 pandemic, effectively removing itself from the IMF’s debtors list. Finance Minister Wale Edun confirmed that the loan was settled according to the agreed terms. Despite the repayment, Nigeria will continue to make annual payments of about USD 30M in Special Drawing Rights charges.

🇹🇿| BoT Raises Cap on Non-Competitive Bids | The Bank of Tanzania has increased the limit for non-competitive bids in government securities auctions from TZS 50 million to TZS 500 million per auction. The change is aimed at broadening investor participation and improving pricing efficiency. Non-competitive bids will continue to be submitted through Central Depository Participants and allotted at the weighted average price (WAP) derived from competitive bids.