Stanbic's Interim Dividend Up 60%

Board of Directors declares an interim dividend of KES 1.84 per share

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Stanbic Holdings' H1 2024 results, CBK's lowering of rates, and Centum’s extension of its share buyback programme.Stanbic Bumps Up Interim Dividend

Asset Base Grows 30%: Stanbic Holdings became the first bank to release H1 2024 results, with total assets expanding by 30% year-on-year to reach KES 498B, driven by growth in the deposit base which was up by a considerable 39% to KES 360B. The loan book grew 28.4% to KES 361.4B, accounting for 72.6% of the asset base [H1 2023: 73.2%]. Net interest income increased by 4.2% to KES 12.6B, while non-interest income declined by 15.1% to KES 7.6B. In sum, revenue for the operating period totaled KES 20.1B, a 4.0% decline, largely driven by lower non-interest income. Operating expenses fell by 6.8% to reach KES 8.1B (40.4% of total revenue).

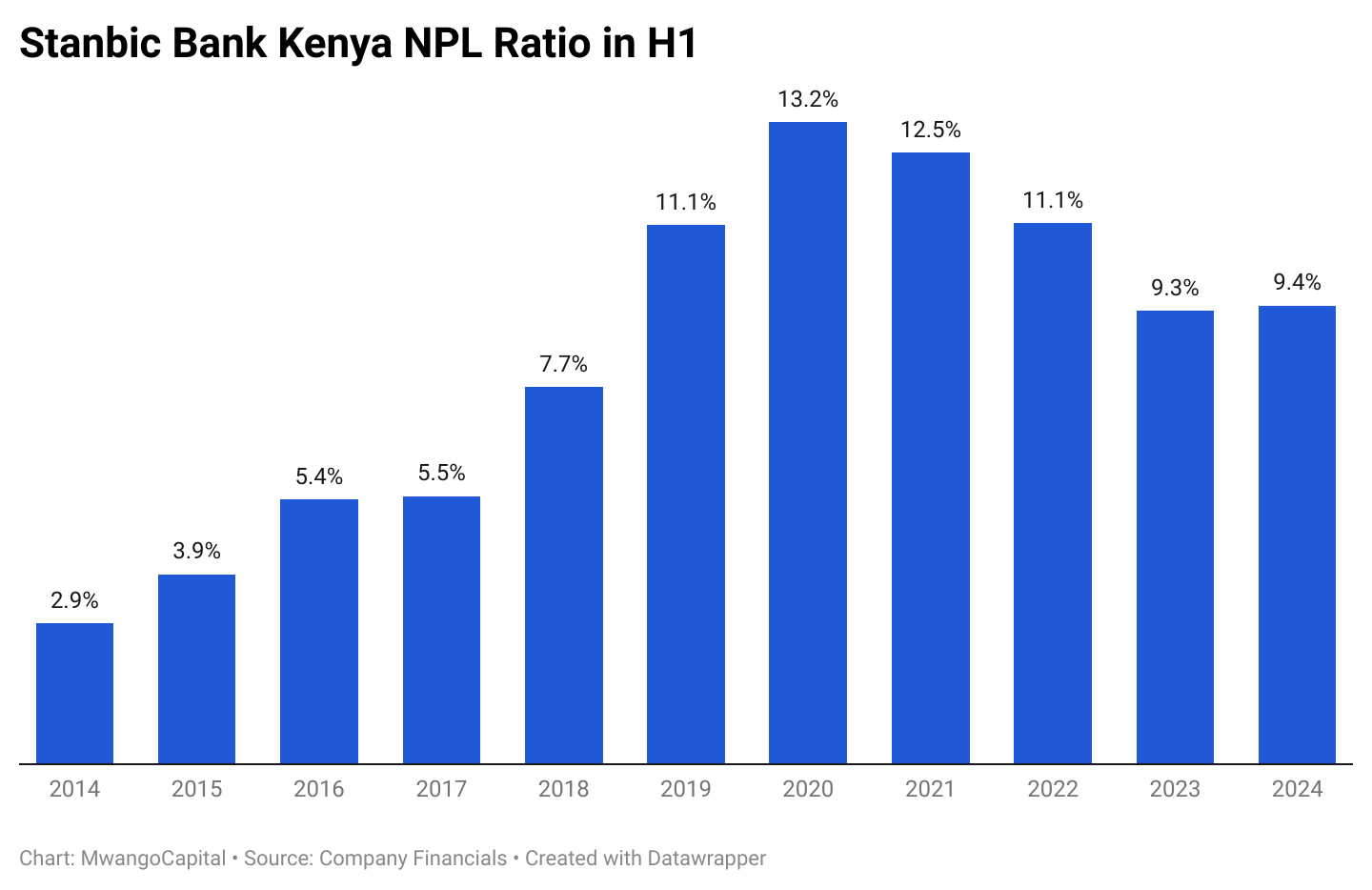

Asset Quality: Gross Non-Performing loans (NPLs) closed at KES 24.3B, equivalent to 6.7% of the loan book [H1 2023: 8.5%]. The NPL ratio closed H1 2024 at 9.4%, up from 9.3% in H1 2023, albeit a decline from the 9.5% recorded in H2 2023. Loan loss provisions fell by 21.7% to reach KES 1.9B, equivalent to 0.5% of the loan book [H1 2023: 0.8%].

Interim Dividend Bump: Earnings Per Share (EPS) grew by 2.3% to KES 18.25 with the Board of Directors declaring an interim dividend of KES 1.84 per share [H1 2023: 1.15], representing a 60% growth. The earnings yield was 15.6%.

Find our analysis here, the results here, and the presentation here. We expect results from Equity Group and the Co-operative Bank of Kenya in the coming week.

CBK Lowers Rates

CBR Cut by 25bps: The Central Bank of Kenya (CBK) has lowered the Central Bank Rate (CBR) by 25 basis points to 12.75%, marking the first rate cut since April 2020. This decision comes as inflation declined to 4.3% in July 2024 compared to 4.6% in June 2024 and 7.3% in July 2023 driven by improved food supplies, reduced electricity prices, and stable fuel costs. The CBK's action aligns with global monetary trends where major central banks are reducing interest rates in response to easing inflationary pressures. This is what the CBK Governor had to say on the lowering of the rates at the MPC press briefing:

“Now that we have lowered the Central Bank Rate to 12.75%, what we’ll do is in a sense inject more liquidity into the financial system to make sure that the interbank rate comes down to around that 12.75% rather than the 13%. I think that way we can have that transmission of lower rates into the commercial banks.”

Central Bank of Kenya Governor, Dr. Kamau Thugge

Surging Banking Sector NPLs: The banking sector, however, faces challenges, with the non-performing loans (NPLs) ratio rising to 16.3% as of June 2024, compared to 16.1% in April 2024, 15.5% in February 2024, 14.8% in December 2023, and 15.3% in October 2023. This upward trend indicates increasing credit risk within the sector, partly driven by economic pressures affecting borrowers. CBK estimates the current account deficit at 3.7% of GDP for the 12 months to June 2024.

Across the Region: Last week, the Bank of Uganda (BOU) lowered the CBR by 25 bps to 10.00%. Notably, annual inflation in July 2024 for Uganda was up 4.0% compared to 4.3% for Kenya.

Find CBK’s press release here, the post-MPC press briefing here, and a thread with key takeaways from the MPC press briefing here. Find BOU’s press release here.

Markets Wrap

NSE: In Week 32 of 2024, Eaagads led the market, rising 18.1% to KES 14.00, while Sanlam was the worst performer, dropping 12.2% to KES 5.62. All indices were red with the NSE 20, NSE 25, NSE 10, and NASI falling by 1.5%, 1.0%, 1.4%, and 1.2% to close at 1,633.7, 2,743.6, 1,062.6, and 102.1 points, respectively. Equity turnover surged by 57.6% to KES 1.9B, while bond turnover dropped to KES 10.62B from KES 21.92B the previous week.

Treasury Bills and Bonds: The weighted average interest rate of accepted bids for the 91-day, 182-day, and 364-day were 15.81%, 16.71%, and 16.91% respectively. The total amount on offer was KES 24B with the CBK accepting KES 34.3B of the KES 39.3B bids received, to bring the aggregate performance rate to 163.74%. The 91-day and 364-day instruments recorded 313.73% and 74.36% performance rates, respectively.

Eurobonds: In the week, yields rose week-on-week across the 5 outstanding papers with KENINT 2028 rising the most, up 42.20 bps to 11.260%, followed by KENINT 2031 at 29.40 bps to 11.319%. KENINT 2048 recorded the least week-on-week growth at 18.60 bps to 11.425%, and the average week-on-week change stood at 26.52 bps.

Mergers, Deals, and Acquisitions

Amstel - KAL Joint Venture: The Competition Authority of Kenya has approved the establishment of a joint venture between Amstel Trading Company Limited and Kingsbourne Assets Limited unconditionally. Amstel, incorporated in Kenya, imports photocopy paper from paper mills in Indonesia, which are affiliates of Kingsbourne Assets Limited (KAL). KAL, incorporated in the British Virgin Islands, is an investment holding company with expertise in the manufacturing and sale of pulp and paper products through its affiliates in Indonesia but has no operations in Kenya.

Mobius Bites the Dust: Mobius Motors Kenya has announced its decision to enter voluntary liquidation after 13 years of operation. The company cited mounting debts and a multi-million shilling tax dispute with the Kenya Revenue Authority (KRA) as key factors behind this decision. Founded in 2011 Mobius Motors aimed to build affordable cars for the African market.

Acorn Seeks to Raise KES 2.8B: Student hostel developer Acorn Holdings is looking to raise KES 2.8B for its development and investment real estate investment trusts (REITs) by February 2025 to fund new properties. The capital raise, combining an open market offer and a rights issue, began in April, targeting KES 1.9B for the Acorn Student Accommodation I-REIT and KES 810M for the D-REIT.

Adani and Africa50 to Invest in Kenya: The National Treasury has approved a KES 158.24B Public-Private Partnership (PPP) deal with India's Adani Energy Solutions and Africa50 to enhance Kenya's electricity transmission network. The projects, costing USD 1.22B, aim to address Kenya's aging and overstretched power infrastructure, which has led to frequent outages, especially in the western region.

Devki to Set up Steel Factory: Devki Group of Companies has acquired 500 acres of land in Taita Taveta County to set up a KES 10.3B steel factory, barely two years after establishing one in Kwale County. Devki Chairman Narendra Raval announced that the project will be completed within eight months and will prioritize local job opportunities. It is expected to require over 100,000 metric tons of iron ore per month.

Market Gleanings

🏦| Centum Extends Buyback | Centum Investment has announced the extension of its share buyback programme, initially approved in February 2023, to its next Annual General Meeting scheduled for September 20, 2024. The program, authorized to repurchase up to 10% of the company's issued and paid-up share capital, will continue under the same conditions, including a maximum purchase price of Kes. 9.03 per share.

📝| Supplementary Budget I Assented | On August 5, 2024, President William Ruto signed the Supplementary Appropriation Bill for the 2024/2025 financial year into law following its passage by the National Assembly on July 31, 2024. The new law includes key allocations such as KES 20B to support farmers, KES 120.7B for education reforms, and KES 16.2B for health sector reforms. FY 2024/2025 expenditure has been reduced by KES 145.7B, consisting of KES 40B for recurrent expenditure and KES 105B in development expenditure.

This week, President William Ruto's new Cabinet was sworn in at State House in Nairobi, with senior state officials and the families of the new Cabinet Secretaries in attendance. President Ruto had gazetted their appointments on Wednesday, following approval by the National Assembly.

🧾| Zero-Based Budgeting Drive | President William Ruto has announced that Kenya will transition to zero-based budgeting starting in the 2025/26 financial year, moving away from the current incremental budgeting system. This shift means that each new financial year’s budget will start from scratch, requiring all expenses and revenue lines to be justified anew, rather than building on the previous year's allocations.

📄| Price Control Bill | The Essential Goods Amendment Bill 2024 aims to introduce changes that will enable the National Treasury to regulate the prices of essential commodities, ensuring their affordability and availability for low-income Kenyans. The Bill empowers the National Treasury Cabinet Secretary to set minimum and maximum prices for essential goods such as maize, wheat, rice, cooking fat, and sugar.

💸| CBK to Launch New Notes | The Central Bank of Kenya has announced changes to the denominations of Kenyan currency banknotes. The changes affect the KES 50, KES 100, KES 200, KES 500, and KES 1,000 banknotes. Among other changes, the new banknotes will bear the signatures of the CBK Governor, Dr. Kamau Thugge, and the National Treasury PS, Dr. Chris Kiptoo, the year of print (2024), and new security threads with color-changing effects specific to each denomination.

📉| Stanbic Kenya PMI | The Stanbic Bank Kenya PMI for July revealed a sharp decline in business activity, with the index dropping to 43.1 from 47.2 in June, marking the most significant deterioration since April 2021. Protests and political instability disrupted the private sector with manufacturing being the only sector to post a rise in output. Despite marginal increases in input and output prices, inflation rates remained softer compared to 2023.

🇪🇹| Ethiopia’s Spending Boost | Ethiopia has earmarked USD 5.9B in additional spending to cushion the cost-of-living impact of economic reforms aimed at securing support from the International Monetary Fund (IMF). The country recently unlocked over USD 20B in financing from the IMF and World Bank after agreeing to several conditions, including allowing its currency to float against the dollar, which is expected to cause a sharp rise in inflation.

💱| Jubilee launches Money Market Fund | Jubilee Asset Management Limited has launched the Jubilee Money Market Fund (USD) that invests in USD-denominated sovereign and corporate short-term and floating-rate debt securities. The minimum initial investment is USD 1,000, with a minimum top-up amount of USD 500. As of July 31, 2024, the Fund size was USD 1.5M across 15,461 units.

🇬🇭| Ghana Launches Gold Refinery | Ghana, Africa’s leading gold producer, has inaugurated its first commercial gold refinery in Accra. The Royal Ghana Gold Refinery, a joint venture between India’s Rosy Royal Minerals and Ghana’s central bank, can process 400 kilograms of gold per day.