Lipa Later Acquires Sky Garden

BNPL Tech Firm Lipa Later Acquires e-commerce platform Sky Garden

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Lipa Later's acquisition of Sky Garden, MTN Uganda's Q3 2022 results, and the Hustler Fund's uptake.First off, enjoy our weekly business news in memes brought to you by the Mwango Capital:

Lipa Later Acquires Sky Garden

The Acquisition: Founded in 2018, Buy Now, Pay Later (BNPL) consumer credit tech company Lipa Later has acquired Sky Garden, a leading e-commerce platform in East Africa. Lipa Later intends to integrate Sky Garden into its platform across Rwanda, Uganda and Nigeria markets.

“Guided by our objective to empower African businesses and consumers to do more by enabling e-commerce, financial inclusion and shopping all on one centralized and fully integrated platform, our plan has always been to venture into e-commerce with unique value propositions for our consumers. Sky Garden has done an incredible job and checks all these boxes. Lipa Later is no stranger to the e-commerce industry, having already established a strong presence in the online payment and finance sectors. This acquisition has greatly accelerated our plans of redefining the shopping experience for consumers.”

Lipa Later CEO, Eric Muli

Lifeline: Sky Garden’s future was uncertain in October and announced an impending shutdown after it failed to close a financing round. Founded in 2017, Sky Garden raised $4M in its Series A round last year and has raised a gross amount of $6M in the run-up to the acquisition.

“Last month, we saw no other option than to file for insolvency. Today, I’m happy to see Sky Garden to the next level. Through this acquisition, the vision of Sky Garden will continue to live on while retaining jobs and businesses on our platform.”

Sky Garden CEO, Martin Majlund

Lipa Later Funding: Earlier this year in January, Lipa Later raised $12M in its pre-series A funding with participants including Cauris Finance, Lateral Frontiers VC, GreenHouse Capital, SOSV IV LLC, Sayani Investments, and Axiam Financial Services. The firm pointed out the financing would be applied towards the expansion of current markets and entry into new markets including Tanzania, Ghana and Nigeria.

Africa Expansion: At the start of the year, Lipa Later operated in Kenya, Uganda and Rwanda, but has since expanded to Tanzania, Nigeria and South Africa, bringing its total addressable market to 442.4M - a third of Africa’s population.

Lami Technologies Partnership: In October, Lipa Later announced a partnership with insurance technology firm Lami Technologies in which consumers would access reliable and affordable insurance against all products purchased through the Lipa Later platform.

Hustler Fund Uptake

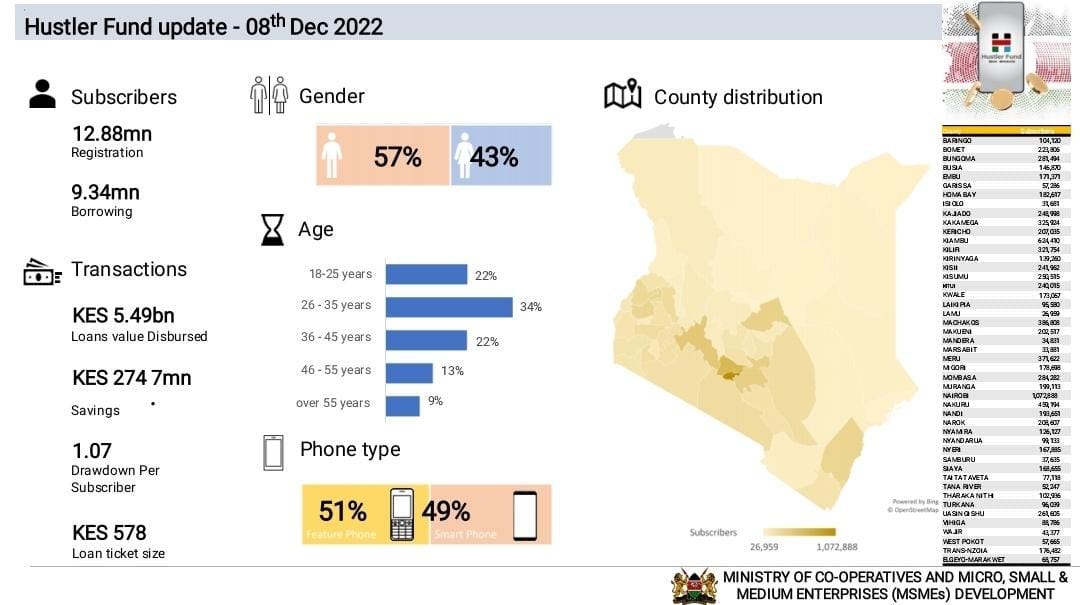

KES 5B Disbursements: As of December 8, the total value of loans disbursed through the Hustler Fund was KES 5.49B. 12.88M people had registered on the platform, out of which, 72.5% or 9.88M borrowed a loan. The average loan ticket size was KES 578 with savings totalling KES 274.7M.

Geographic Distribution: Across the country, Nairobi had the highest subscribers at 1.1M, followed by Kiambu and Nakuru at 621.4K and 490K, respectively. Here is how the Hustler Fund dataset compares with data from CBK’s November 2022 FinAccess Household Survey across counties.

MTN Uganda Q3 Results

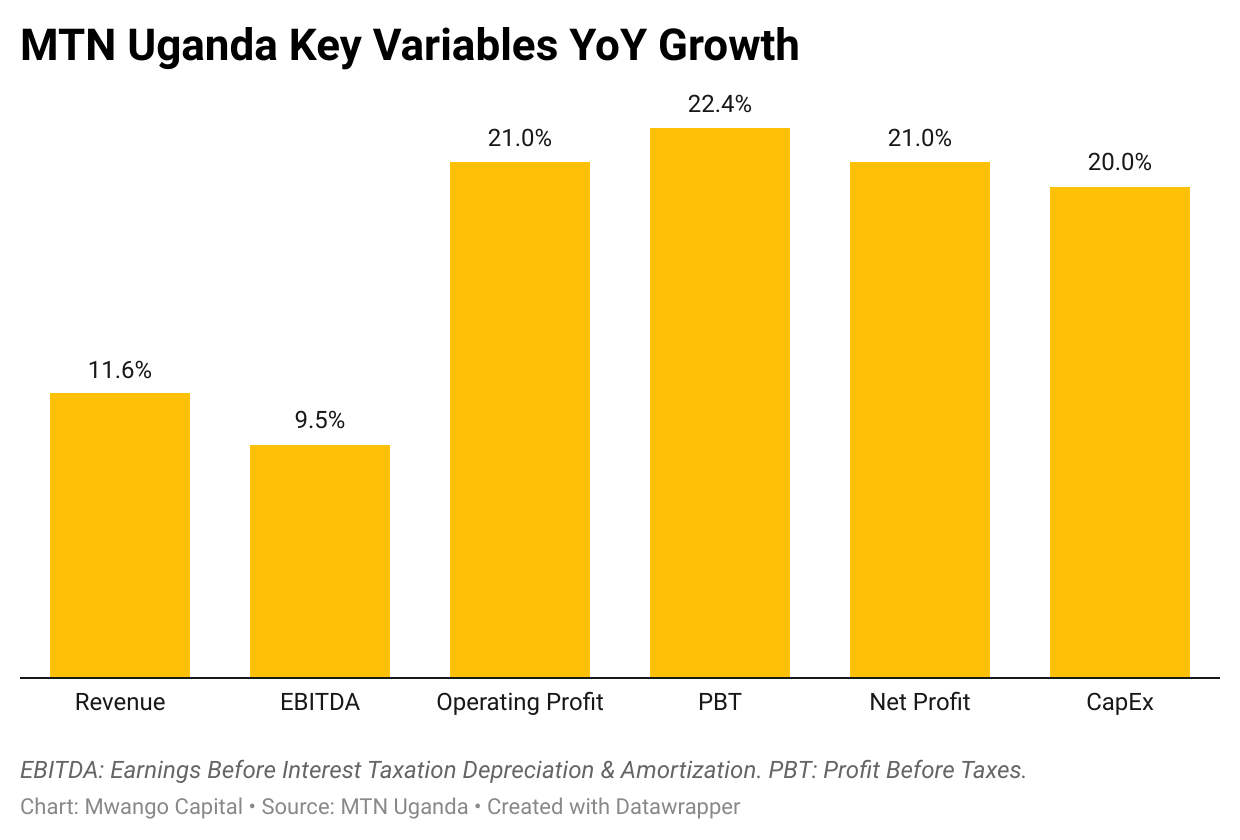

Operational Highlights: In the nine months to September 30 2022, mobile subscribers increased 9.2% year-on-year to 16.7M. Data subscribers rose 28.8% to reach 6.1M [2021: 4.7M] while active fintech users edged 19.4% higher to 10.6M [2021: 8.9M], equivalent to 63.5% of the mobile subscriber base.

Revenue Mapping: Data and Fintech revenue rose 29.8% and 23.3% to USH 369.2B ($100M) and USH 470.4B ($127.5M) and accounted for 22.1% and 28.2% of service revenue, respectively. Service revenue was up 11.5% to UGX 1.7T ($451.8M).

Net Income Up 21%: EBITDA rose 9.5% to UGX 852.5B ($231M) while operating profit rose 21% to USH 554.3B ($150.2M). Net Income for the period grew 21% to reach USH 292.7B ($79.3M) [2021: USH 241.9B ($656M)].

Capital Expenditure: CapEx for the period increased by 20% to USH 276.7B ($74.9M) to bring the Capex Intensity to 16.5% [2021: 15.3%] against a Net Profit Margin of 17.4% [2021: 16.1%].

Find our analysis of the results here.

H1 2022 Economic Update

Highlights: In H1 2022, Gross Domestic Product (GDP) increased 6% year-on-year with the country’s main forex earner, the Agriculture sector, contracting by 1.5% to contribute 20% of GDP. The contraction in Agriculture shaved off 30bps in GDP growth. The World Bank expects the economy to expand by 5.5% in 2022 and 5.2% on average in 2023-24.

Inflation: The report points out that the Russia-Ukraine war coupled with the long drought in East Africa has put pressure on food and fuel prices. Headline inflation started to rise from 5.1% in February 2022 to reach 9.6% in October before retreating to 9.5% in November. This remains above the 2.5% - 7.5% range prescribed by the Central Bank of Kenya (CBK).

Fiscal Deficit: In FY 2021/22, total revenue increased to 17.3% of GDP [FY 2020/21: 15.7%]. Low execution of both recurrent and development expenditures saw the fiscal deficit reach 6.2% of GDP which is well below the 8.2% target [FY 2020/21: 8.1%].

Savings Drive: According to the World Bank, the mandated contribution rate to the National Social Security Fund (NSSF) is extremely low with the average contribution at less than 1% of the average private sector wage. The Bank has proposed an amendment to the NSSF 2013 Act to allow higher contributions while containing administrative costs to generate better returns.

Access the full report here.

Mergers & Acquisitions

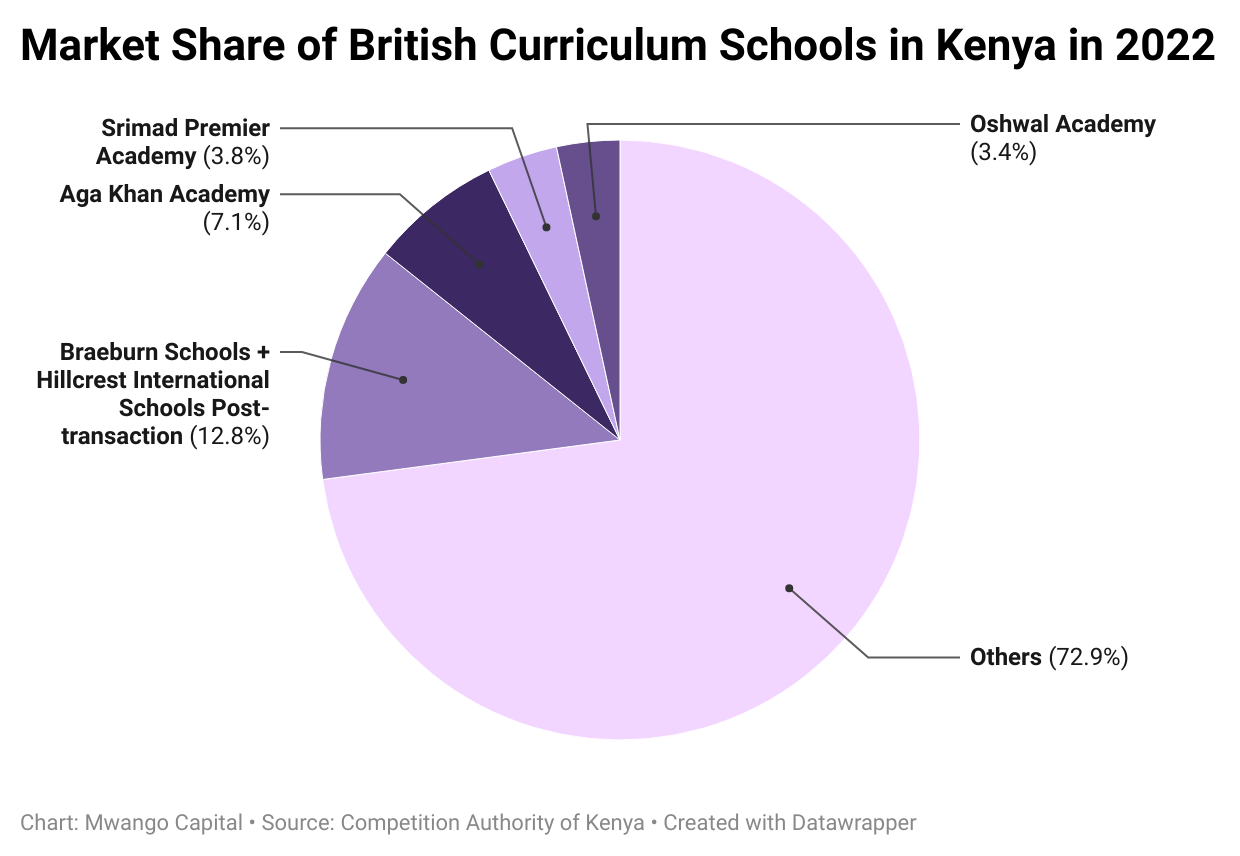

Braeburn Acquires Hillcrest: The Competition Authority of Kenya (CAK) has approved the acquisition of the business and certain assets of Hillcrest Investments Limited by Braeburn schools Limited on condition Braeburn retains 97% of Hillcrest’s 180 employees. The transaction will see Braeburn’s market share in the British Curriculum Schools market rise to 12.8% from 10.2%, currently.

Ascent Acquires Acme Containers: The CAK has unconditionally approved the acquisition of 75% of the issued share capital of Acme Containers Limited by Ascent Capital Holdings Africa II Ltd. In the current market structure of the plastic products market, Blowpast Limited, Ashut Limited, Kenpoly Manufacturing, and General Plastics together control 82% of the market. The other players, including Acme, control 18%.

Debt Markets

T-bills: In the short-term public debt markets last week, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.327%, 9.796%, and 10.245% compared to 9.275%, 9.752%, and 10.225% in the previous auction, respectively. The total amount on offer was KES 24B with the CBK accepting KES 19.1B of the KES 23.3B bids received. The performance and acceptance rates were 97.1% and 79.4%, respectively.

Bond Market: Across the re-opened FXD1/2008/20 and FXD1/2022/25 bonds, total bids received at cost were KES 17.3B and KES 13.2B. The CBK accepted KES 17.3B and KES 7.1B bringing the weighted average rate of accepted bids to 13.8% and 14.4%, respectively. On aggregate, the performance and acceptance rates were 76.4% and 60.8%, respectively.

Eurobond Market: In last week’s market action, yields for KENINT 2024 rose the highest by 64.7 bps to 12.1%. Increases were modest across other outstanding papers, with the KEINT 2032, KENINT 2048, KENINT 2034, and KENINT 2028 rising 9.9bps, 7.3bps, 3.5bps and 1.9bps to 10%, 10.5%, 9.2% and 9.8%. Yields on the KENINT 2027 were down 7.7bps to 9.4%. Bar KENINT 2027 whose price rose 0.3% and KENINT 2028, whose price remained flat, other papers recorded price drops.

What Else Happened This Week

🔻 Safaricom Slashes Data Costs: Safaricom has reviewed the pricing of its monthly plans, reversing a price increase implemented in July 2021 following excise duty adjustment on airtime and telephone services from 15% to 20%. The reversal will see prices fall by an average of 4.8% across the board with the cheapest plan retailing at KES 1000 from KES 1,050 previously.

🔙 CBK Reintroduces Fees: The CBK last week announced the reintroduction of charges for transactions between mobile money wallets and bank accounts. The charges had been waived on March 16, 2020, as part of emergency measures to encourage the use of mobile money during the COVID-19 pandemic.

📈 Stanbic Bank November PMI: The Stanbic Bank Kenya Purchasing Managers' Index reading for November reached a 10-month high of 53.0 [October: 51.4]. Output and new orders rose at the fastest pace since May and employment growth reached a 2-year high.

🧾 Africa Oil Tax Appeal: On November 30, The High Court of Kenya ruled that Africa Oil’s appeal with regard to the VAT assessment was partly successful, putting the total VAT the company owes at KES 2.3B ($18.7M). The firm said KRA’s appeal regarding corporate income tax is not expected to have a material cash flow impact on the company.

💰 IFC Lends to Airtel: IFC is set to provide 6 of Airtel Africa subsidiaries notably the DRC, Kenya, Madagascar, Niger, Congo, and Zambia with local currency (LCY) loans totalling $194M with an 8-year tenor. Separately, the Uganda Communications Commission (UCC) has allowed Airtel Uganda’s May request to delay its listing by 1 year due to unfavourable market conditions.

🛠️ Ghana Debt Restructuring: Ghana is negotiating a $9B swap of domestic debt swap to ease a crunch in payments as the government engages with the IMF in talks for up to $3B in credit. Africa’s largest gold producer is set to exchange domestic bonds as of December 1 2022 for a new set of 4 new bonds maturing in 2027, 2029, 2032, and 2037.

Interest Rate Watch

🇰🇪 Kenya: Following rate hikes by the United States Federal Reserve and the CBK, NCBA has adjusted its lending rates upwards. The lending rate on KES-denominated facilities has increased from 10% to 11% p.a while that of USD-denominated facilities has risen from 9% to 10% p.a.

🇺🇬 Uganda: The Monetary Policy Committee (MPC) of the Bank of Uganda maintained the key benchmark rate at 10% at the meeting held on December 7. Annual Headline inflation in Uganda eased to 10.6% in November [October: 10.7%].