👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a succinct summary of key capital markets and business news items from East Africa.This week, we cover Silicon Valley Bank's fall, Stanbic FY 2022 results, and Kenya’s telecoms sector in Q2 2022/2023.First off, enjoy a dose of our weekly business news in memes:

The SVB Fall And its Implications on Africa

What happened? California banking regulators closed Silicon Valley Bank on Friday 10th March and appointed the FDIC as receivers. This is one of the fastest falls of a regulated US bank in recent times and the first failure of a regulated bank in the US in over 20 years. Poor risk management and a high-interest rate environment have influenced cash outflows from the bank and made it difficult and expensive to raise liquidity. It is also worth noting that they operated without a Chief Risk Officer for 8 months at a time when markets were very volatile and choppy.

Source: New York Times

What next? The FDIC swung into action and assured insured depositors of access to funds from Monday 13th March. However, 89% of the bank's deposits are uninsured. The speed at which FDIC and regulators swung hints at massive contagion efforts to insulate the US banking system and in particular the Silicon Valley tech ecosystem where a lot of fintechs and neobanks were being nurtured. The road to modern banking now seems to favour legacy banks and it's not looking pretty for US fintech as a good number of such startups banked with Silicon Valley Bank.

Impact on African Startups: There will be repercussions of this felt in the African tech ecosystem with SVB Capital, the investment arm of Silicon Valley Bank, having been an investor in startups across the world including Africa-focused fintech Chipper Cash. SVB Capital led the Series C round of Chipper Cash of $100M in May 2021. Silicon Valley Bank has been one of the preferred banks in the Silicon Valley ecosystem which has been courting a number of African startups and entrepreneurs. With insured amounts capped at $250K, a good number of startups might get caught up in a liquidity crunch.

“This will impact all startups regardless of whether you have funds with SVB or not. This is because most VCs and LPs also banked with SVB therefore asking for a capital injection from your existing investors is going to be even more challenging, coupled with the already difficult raising environment. For us, we are now looking to diversify our banking counterparties as it is becoming apparent that you shouldn’t have all your eggs in one basket."

Ndovu Co-founder & CEO Ndovu Radhika Bhachu

Stanbic 2022 Results

Highlights: Total Assets grew by 21.6% year-on-year to reach KES 400B. The loan book expanded by 16.4% to reach KES 266.8B, accounting for 66.7% of the balance sheet compared to 69.7% in FY 2021. Customer Deposits grew by 19.5% to reach KES 304.3B, accounting for 76% of the bank’s liabilities. The Loan-to-Deposit ratio was slightly down in the year to 87.7% from 90.1% in FY 2021.

Revenue Mix: Net Interest Income grew by 31.8% to reach KES 18.9B, while Non-interest Revenue was up 23.7% to reach 13.1B to account for 59.1% and 41.9% of total income, respectively, compared to 57.5% and 42.5% in FY 2021. Total income for the period was up 28.4% to KES 32.1B. In the Kenyan unit, income from foreign exchange trading expanded by 36.8% to reach KES 8.6B to account for 67.3% of Non-Interest Revenue as compared to 60.3% in FY 2021.

Dividend Up 40%: Net Profit for the year recorded a growth of 25.7% to KES 9.1B and the Board of Directors recommended a final dividend of KES 12.6 per share [2021: KES 9]. The dividend payout ratio stands at 55% as compared to 49.4% in FY 2021.

South Sudan Operations: In Q3 2022, the Bank of South Sudan, in a letter on 2nd June 2022, threatened to revoke the licence of the South Sudan unit due to the bank operating as a branch of Stanbic Bank Limited Kenya instead of operating as a subsidiary.

“We are currently considering various options including revocation of Stanbic Bank license because we don’t want the bank to continue as a branch anymore, but rather transform into a subsidiary as soon as possible because the bank has been operating as a parallel central bank in South Sudan.”

Bank Of South Sudan Governor, Moses Deng

Here is what Stanbic Bank CEO Joshua Oigara had to say about the South Sudan operation in last week’s FY 22 Results briefing:

“We do not have a stalemate, we are a licensed bank and will continue to have an opportunity in South Sudan that is commensurate. We continue to engage the regulators on the matter.”

Stanbic Bank Kenya CEO, Joshua Oigara

We hosted the Chief Value and Finance Officer for Stanbic Bank Dennis Musau on Mwango Spaces and below is a link to the recording.

More Acquisitions: Africa’s largest lender by assets Standard Bank Group is planning to acquire a lender in Kenya by 2025 as it aspires to be among the top three banks in the country.

“We have aspirations to be a top three bank in Kenya. Number six is not acceptable. Within 12 months we would have identified and would have started having negotiations with someone.”

Standard Bank East Africa Regional Chief Executive, Patrick Mweheire

More Bank Earnings: Standard Chartered Bank Kenya is set to report on the 14th of this month, Equity Group and Absa Bank Kenya on the 15th, while Co-operative Bank Kenya and KCB Group are set to report on the 16th.

Kenya’s Telecoms Sector in Q2 2022/2023

Mobile Services: Total mobile (SIM) subscriptions rose by 0.9% year-on-year to reach 65.7M; out of which 98% or 64.4M were prepaid and 2% or 1.3M were postpaid. Mobile money subscriptions expanded by 9.7% to reach 38.6M. In terms of market share, Safaricom accounted for 96.8% of total mobile money subscriptions, while Airtel Money and T-Kash accounted for 3.1% and 0.1%, respectively.

Wananchi Loses Market Share: Safaricom had 372.9K fixed data subscriptions, up 26.8%, to represent a market share of 46.1% as compared to 36.8% in December 2021. On the other hand, Wananchi Group saw its subscriptions fall 9.7% to 229.1K, representing 28.7% of the market share as compared to 31.1% in December 2021.

Cyber Threats Abound: The total number of cyber threats detected was up 1.9X to 249.9M as of December 2022. Cyber threat advisories rose by 17.7% to reach 3.6M. Advisories issued on malware were up 33.3% to 84.2K while those on system vulnerabilities edged higher by 18.5% to reach 3.4M.

Weekly Capital Markets Wrap

The NSE: In Week 10 of 2023, Flame Tree was the top gainer, up 13.8% week-on-week to KES 1.24, while Total was the top loser, down 13.5% to KES 19.15. The NSE 20 and NSE 25 indices fell by 1.6% and 4.3% to 1,608.4 and 2,997.3 points, respectively while the NSE All Share Index fell 6.6% to 117.9 points. Equity turnover was up 50.5% to KES 1.5B while bonds turnover was down 11.2% to KES 8.5B.

T-Bills: In the short-term public debt markets, the weighted average interest rate of accepted bids for the 91-Day, 182-Day, and 364-Day instruments were 9.742%, 10.216%, and 10.747% respectively. The total amount on offer was KES 24B with the CBK accepting KES 32.2B of the received bids. The acceptance rate was 134.1%.

T-Bonds: The total amount on offer on IFB1/2023/017 was KES 50B, and the total bids received at cost were KES 59.8B to bring the performance rate to 119.54%. The CBK accepted KES 50.9B or an acceptance rate of 101.75%. The weighted average rate of accepted bids was 14.399%.

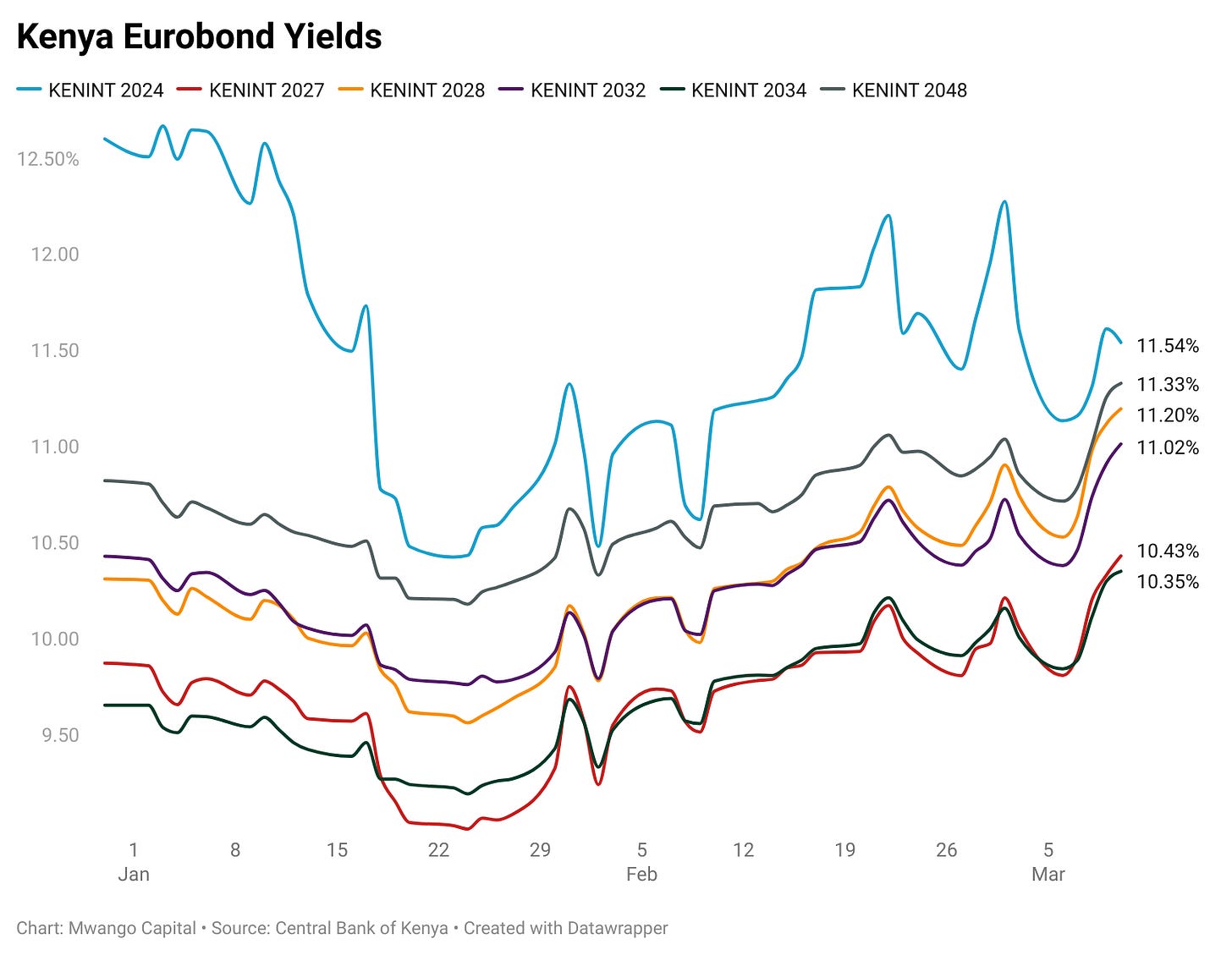

Eurobonds: Last week, the yields were mixed on a week-on-week basis across all 6 outstanding papers.

KENINT 2024 recorded the largest fall, declining by 6.1 basis points (bps) week-on-week to 11.544%.

All instruments except KENINT 2024 were up on a year-to-date basis. KENINT 2024 was down by 105.9bps while KENINT 2028 was up the most, rising by 88.6 bps to 11.198%.

KENINT 2024 led price gains year-to-date, rising 2.2% to 94.573. On a week-on-week basis, prices were mixed, with the KENINT 2024 leading price gains at 0.2%, while KENINT 2048 had the most price depreciation at -4.1% to 74.539.

Other Market Gleanings

🫴🏾 | Phase I of EABL Tender Offer | In the first phase of the tender offer for shares in EABL by Diageo Plc that opened on 6th February 2023 and closed on, 1,480 shareholders tendered 122M shares, exceeding the intended purchase quantum of 118M shares. The Second and Final Phase of the offer is set to run between 7th March 2023 and close on 17th March 2023. The results of this phase will be announced on 11th April 2023.

🚢 | Cargo Consolidation | As of March 1st, 2023, the KRA has instituted a new taxation policy for Consolidated Cargo, shifting from a per kilogram basis to a per transaction basis. Prior to this directive, Consolidated Cargo was taxed at a rate of KES 200 per kilogram. Consequently, for tax assessment cargo will be deconsolidated upon importation.

“KRA is taking measures to address issues of concealment and undeclared. KRA remains committed to facilitating trade through its Customs & Border Control Department and is committed to ensuring that everyone pays their fair share of taxes.”

⛽ | Dollar-Occasioned Fuel Shortages? | Here is what the Chairperson of the Petroleum Outlets Association of Kenya Chair said on reports of a looming fuel crisis occasioned by US Dollar shortages.

“There’s no need for alarm or panic; manageable hitches in payment modes logistics with some OMCs notwithstanding. There’s enough stocks to last the country over 16 days & more vessels are scheduled to discharge.”

💵 | Oil Procurement Restructuring | Trade CS Moses Kuria was on CNN Arabic last week and he touched on government efforts around oil trade which are directed to ease the pressure on foreign currency.

“So we’re trying to restructure the way we transact oil between the GCC and Kenya so that we can ease the pressure on our foreign currency. But also, to have Kenya as a gateway through our special economic zones in Mombasa and Lamu for the GCC majors like ADNOC, Aramco to use Kenya as a gateway or as a logistics point to supply for the rest of Africa.”

Cabinet Secretary for Trade, Moses Kuria

🧾 | Kenya’s First Oil Import Tender | Kenya last week issued its first oil import tender under a government-to-government contract that would see the winner supply products for nine months and get paid every six months.

“The bids opened yesterday and the government is in the course of reviewing them. By doing that we will alleviate the pressure by removing a third of the demand for dollars in the market.”

EPRA Director General, Daniel Kiptoo

A petition was last week filed in the High Court of Kenya at Kerugoya under a Certificate of Urgency challenging the international Oil Import Tender floated for the supply of petroleum products into the country. The petitioners are challenging the tendering system which gives international suppliers a 100% market share of all the petroleum products consumable in Kenya.

“The tender documents and tender agreement dated 1st March 2023 anchored therein has sought to exclude any other marketing company from participating in the bidding process thus violating Article 227 of the Constitution of Kenya 2010.”

🌽 | Kenya-Zambia Maize Deal | The two countries are set to sign an MoU that will see Kenya import maize surplus from Zambia to mitigate the current drought. The arrangement will also see Kenyan farmers get allocated at least 20K hectares of land for large-scale farming. As of 2020, the total arable land as a percentage of the total land area stood at 5.1% and 10.2% for Zambia and Kenya, respectively.