👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover CBK's rate cut, the Treasury's approval of Access Bank's takeover, and the launch of East Africa's first regional stock index..CBK Cuts Rate to 10%

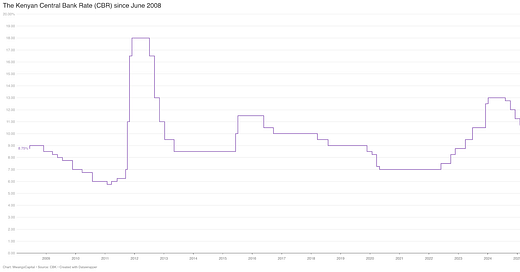

75 Bps Cut: Last week, the Central Bank of Kenya (CBK) reduced the Central Bank Rate (CBR) by 75 basis points, lowering it from 10.75% to 10.00%. This marks the fifth consecutive rate cut since August 2024 and brings the CBR to its lowest level since May 2023. The CBK’s decision is aimed at stimulating lending by commercial banks to the private sector and boosting economic activity, while also maintaining exchange rate stability.

Interest Rate Corridor Narrowed: Along with the CBR reduction, the CBK also decided to narrow the width of the interest rate corridor from ±150 basis points to ±75 basis points around the CBR. This change is intended to bring greater stability to the interbank rate and align it more closely with the CBR. Additionally, the Discount Window rate has been adjusted to 75 basis points above the CBR. These adjustments aim to improve liquidity management within the banking system and foster a more predictable environment for both banks and borrowers.

Banking Sector: The ratio of non-performing loans (NPLs) in the banking sector increased to 17.2 percent in February 2025, up from 16.4 percent in December 2024. This rise is mainly attributed to higher NPLs in the real estate, personal and household loans, trade, construction, and manufacturing sectors. Commercial bank lending to the private sector grew by 0.2 percent in March 2025, recovering from a 1.3 percent contraction in February.

Key takeaways from the CBK’s post-MPC briefing:

Currency Manipulation Allegations: The CBK emphasized that the exchange rate is market-driven and reflects supply and demand. Kenya recorded strong exports and travel inflows, as well as improved capital inflows. The CBK only intervenes to smooth out volatility, not to manipulate the shilling.

On the IMF Program: Kenya remains in talks with the IMF for a successor program. Discussions will continue at the Spring Meetings, and while the facility size is still under discussion, the government is likely pursuing normal access rather than exceptional access.

Impact of US tariff on Kenya’s exports: The CBK noted that the 10% tariff on Kenyan exports, which total approximately USD 650M annually, could lead to a decline in export earnings of up to USD 100M. However, the impact on Kenya’s USD 122B economy, exchange rate, and external position is expected to be minimal.

Bank Supervision Progress: CBK has inspected 13 out of 38 banks since February to assess compliance with the directive to lower loan charges under the approved risk-based credit pricing model. Inspections will be completed by June, with findings shared with bank boards. Penalties will be imposed on banks found in violation of the directive.

Capital Requirement Compliance Update: The CBK reported that 22 out of 24 banks submitted their capital compliance plans by the April 1st deadline. Two foreign subsidiaries requested an extension but are expected to meet the capital requirements.

This week’s newsletter is brought to you by Arvocap Asset Managers.

𝐅𝐮𝐧𝐝𝐬 𝐏𝐞𝐫𝐟𝐨𝐫𝐦𝐚𝐧𝐜𝐞 | 𝟑𝐫𝐝 𝐉𝐮𝐧𝐞 𝟐𝟎𝟐𝟒 - 𝟑𝟏𝐬𝐭 𝐌𝐚𝐫𝐜𝐡 𝟐𝟎𝟐5

📊 10 months. Multiple funds. One mission—growing your wealth with purpose.

At Arvocap, our funds are more than investment vehicles—they're designed to align with your vision, your pace, and your dreams.

Here’s a glimpse into how our nest of funds has performed over the last 10 months:

💰 Almasi Fixed Income Accumulation Fund

For the steady builder who values consistency and compounding.

📈 Thamani Equity Fund

For bold investors ready to tap into the growth of Kenya’s stock market.

🌍 Africa Equity Special Fund

For those betting on Africa’s giants and long-term continental prosperity.

🎯 Ngao Income Fund

Decide how and when your income comes to you—flexible, efficient, and tailored to your lifestyle.

💼 Arvocap Money Market Fund

Your premier cash management tool—secure, accessible, and smart.

And that’s just the beginning.

🚀 We offer a broader range of expertly managed funds, each crafted to meet unique investment needs and goals.

🔗 Visit www.arvocap.com or call us today to explore the full list and find the fund that’s right for you.

Access Bank Gets Green Light for NBK Takeover

Access Bank has secured all necessary regulatory approvals to acquire 100% of National Bank of Kenya (NBK), including its subsidiary, NBK Bancassurance Intermediary Limited. The boards of KCB Group and Access Bank approved the deal on March 20, 2024, with the Central Bank of Kenya granting approval on April 4, 2025, and the National Treasury giving its final nod on April 10, 2025. This acquisition will elevate Access Bank Kenya from Tier 3 to Tier 2 in market classification, enhancing its position in Kenya’s banking sector. For KCB Group, the deal offers a strategic exit from NBK, a non-core asset that has faced persistent capital adequacy and profitability issues since its 2019 acquisition.

Ahead of the transaction, KCB Group's loan book shrank by 9.6% year-on-year to KES 990.4B in FY 2024, partially due to the reclassification of NBK balances to other assets and liabilities in line with IFRS 5, pending the conclusion of its divestiture. The Group’s non-performing loan (NPL) ratio climbed to 19.2%, with KCB Kenya at 21.8% and NBK at a concerning 33.7%. Under conditions set by the Competition Authority of Kenya, Access Bank is required to retain at least 80% of NBK’s staff for a minimum of one year after the deal is finalized. The acquisition marks a strategic step in Access Bank’s regional expansion.

Earnings Wrap

Sameer Africa Profit Hits 11-Year High

Sameer Africa reported a net profit of KES 259.9M in 2024, up 460.9% year-on-year—the highest in 11 years. The gain was largely due to an unrealized foreign exchange gain of KES 83.6M, following the strengthening of the Kenya Shilling against the US Dollar. Net finance income stood at KES 68.8M, reversing a loss of KES 140.8M in 2023. Revenue declined slightly by 0.26% to KES 389.5M, while total assets rose 2.5% to KES 1.5B.

Operating profit dropped 14% due to higher expenses and a tax provision in a foreign subsidiary. The Group cleared all borrowings, reducing interest expenses. Shareholders’ equity increased 56% to KES 736M. No dividend was declared for the year.

Jubilee Health Insurance Doubles Profit in 2024

Jubilee Health Insurance posted a 107.6% jump in profit after tax to KES 910.5M in 2024, driven by higher premiums and investment income. Insurance revenue rose 32.2% to KES 13.5B, while net investment income grew 47.7% to KES 944.7M. The insurance service result swung to a profit of KES 546.7M from a loss of KES 36.5M in 2023, as insurance service expenses rose at a slower pace (+25.7%) than revenues.

Markets Wrap

NSE Weekly Recap: Week 15 (4 - 11 April 2025):

Sanlam Kenya (+20.3%) surged to KES 10.35, while Unga Group (-15.2%) dropped to KES 23.20, leading the gainers and losers.

Markets showed slight positive movement—NASI (-3.60%) at 126.8, NSE 20 (-2.64%) at 2,166.3, NSE 10 (-3.92%) at 1,291.3, and NSE 25 (-3.29%) at 3,420.1.

Equity turnover decreased by 22.6% to KES 1.6B, and bond turnover rose by 81.3% to KES 64.9B.

Foreign investors made up 42.90% of total turnover, with KES 692.8M in trades.

Treasury Bills: Treasury bills were oversubscribed last week, recording a subscription rate of 223.9%, up from 169.5% the previous week. Investors placed bids totaling KES 53.7B, with the Central Bank of Kenya (CBK) accepting KES 43.5B out of the KES 24B on offer. Yields on the 91-day, 182-day, and 364-day T-bills declined by 12.9, 14.1, and 15.5 basis points to 8.501%, 8.894%, and 10.232%, respectively.

CBK Raises KES 12.6B in Tap Sale: The Central Bank of Kenya received bids worth KES 13.24B in the latest tap sale of the 15-year FXD1/2020/015 bond, against an advertised amount of KES 10B. It accepted KES 12.59B at an average yield of 13.662%, with the adjusted average price at 97.0749. The bond carries a coupon rate of 12.756%.

Eurobonds: Last week, yields on the seven outstanding Eurobonds rose, led by the KENINT 2028 bond, which gained 105.00 basis points to 11.596%. The KENINT 2031 bond followed, climbing 81.10 basis points to 11.564%. On average, Eurobond yields increased by 54.67 basis points week-on-week.

Market Gleanings

🏛️| East Africa launches Regional Index | The East Africa Securities Exchange Association (EASEA) has launched the EAE 20 Share Index, the region’s first cross-border stock market index, tracking the top 20 publicly listed companies by market cap across Kenya, Tanzania, Uganda, and Rwanda. The index aims to enhance market transparency, attract regional and international investors, and serve as a benchmark for East African market performance. Kenyan companies featured include Safaricom, KCB Group, Equity Group, Co-op Bank, and Absa Kenya.

📉| DTB, KCB Cut Lending Rates | KCB became the first bank to lower lending rates following the Central Bank of Kenya’s 75bps rate cut to 10.00%, reducing its base lending rate by 0.75% from 14.6% to 13.85% p.a., effective April 11 for new loans and May 11 for existing ones. DTB followed with a reduction of up to 0.35% p.a., effective April 15 for new loans and May 1 for existing ones, bringing its total cut since January to 1.96%, depending on customer risk profiles.

🏘️| KRA Rolls Out Digital Rental Tax System for Landlords | KRA has launched the Electronic Rental Income Tax System (eRITS) on the Gava Connect platform, making landlords among the first to be included in a broader digital tax system. The platform allows landlords earning between KES 288K and KES 15M annually to file and pay rental income tax—currently set at 7.5% of gross revenue—monthly. eRITS is accessible via eCitizen or through system integration and aims to streamline compliance. KRA collected KES 14.4B in rental taxes in the year to June 2024.

₿| Kenya Unveils First Crypto Law | Kenya has published the 2025 Virtual Asset Service Providers Bill, setting the stage for the country's first regulatory framework for cryptocurrencies. The Bill assigns oversight to the Central Bank of Kenya (CBK) and Capital Markets Authority (CMA). The proposed law targets money laundering, tax evasion, and illicit financial flows, following Kenya’s grey-listing by the FATF. It mandates licensing, local operations, and stricter KYC/AML measures, with penalties of up to KES 10M for non-compliance.

💰| World Bank Ties $750M Kenya Funds to Reforms | The World Bank has signaled it will release additional financing to Kenya only after the country fully implements agreed economic reforms, including fiscal consolidation, anti-corruption measures, and digital procurement systems. The lender, which disbursed USD 1.2B to Kenya last year, is currently in talks for a potential USD 750M but stressed that progress depends on maintaining sound macro-fiscal policies.

📉| KRA Lowers Fringe Benefits Tax | The Kenya Revenue Authority has set the fringe benefit tax and deemed interest rate at 9% for April to June 2025—the lowest level since January 2023. The move follows CBK’s recent benchmark rate cut and affects benefits like low-interest staff loans. A 15% withholding tax on the deemed interest must be remitted within five working days.

⚡| Kenya Power to Connect 150K Under AfDB Project | Kenya Power will connect 150,000 new customers across 45 counties under Phase VI of the Last Mile Connectivity Project (LMCP), funded by the African Development Bank. Excluding Nairobi and Mombasa, the rollout targets households and MSMEs, alongside major grid upgrades including new substations and thousands of kilometres of power lines. Since 2015, LMCP has connected over 746,000 customers, with this latest phase aiming to accelerate access to electricity by 2030.

🇸🇴| Somalia Secures USD 306.5M Debt Relief | Somalia has signed a USD 306.5M debt relief agreement with the Arab Monetary Fund, marking another key step in its efforts to rebuild its economy and regain access to international financial systems. The deal, signed in Kuwait, restructures Somalia’s outstanding debt to the AMF. It follows last year’s cancellation of 99% of the country’s debt to Paris Club creditors.