Satrix ETF Set for NSE Debut

The fund will trade in KES, and reinvest rather than distribute income

👋 Welcome to The Mwango Weekly by Mwango Capital, a newsletter that brings you a summary of key capital markets and business news items from East Africa.This week, we cover Kenya’s first equity-based ETF listing, KRA’s record tax collections, and key Q1 2025 economic shifts, including a stronger shilling and rising external debt.Satrix MSCI World ETF Set for NSE Debut

Global ETF to List on NSE: This Wednesday, July 16, 2025, the Nairobi Securities Exchange (NSE) will list the Satrix MSCI World Feeder ETF (ticker: SXKWDM), introducing Kenya’s first equity-based exchange-traded fund and only its second ETF overall. Managed by Satrix, South Africa’s leading index-tracking fund provider and a Sanlam Group subsidiary, the ETF offers local investors exposure to over 1,300 large- and mid-cap stocks across 23 developed markets via the iShares Core MSCI World UCITS ETF.

With an initial allocation of 6 million units, the fund will trade in Kenyan shillings, carry an annual total expense ratio of 0.35%, and reinvest rather than distribute income. Currently valued at approximately KES 72.8B (R18.2B), the ETF allows for local access without the need for foreign exchange approvals and forms part of Satrix’s broader strategy to expand across African markets following previous moves into Namibia.

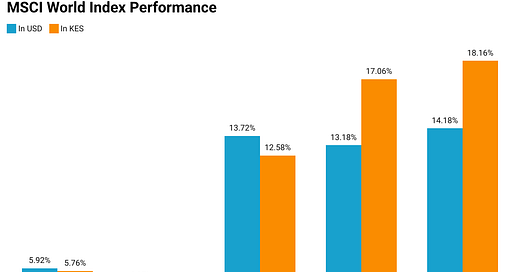

High U.S. and Tech Exposure: The MSCI World Index is composed of the most liquid and well-capitalized names from developed markets, with 71% weighted toward the United States and sector allocations skewed to information technology (24.9%), financials (17.2%), and industrials (11.5%). Key holdings include Microsoft, Apple, Nvidia, Amazon, Alphabet, and JPMorgan Chase, companies that anchor global equity performance. As of May 2025, the ETF delivered a 12-month return of 18.6% in Kenyan shillings and 17.1% in U.S. dollars terms, highlighting both global market strength and favorable currency effects.

For Kenyan investors, the listing provides a cost-efficient, single-trade solution for global diversification with the added benefit of spreading currency and sector exposure beyond domestic markets. Nonetheless, the fund’s aggressive risk profile and offshore orientation bring exposure to geopolitical shifts, foreign exchange volatility, and potential liquidity constraints, factors that reward a long-term, globally diversified investment mindset.

KRA Performance in FY 2024/25

Record Collections: The Kenya Revenue Authority (KRA) collected KES 2.571T in FY 2024/25, a 6.8% increase over KES 2.407T collected in FY 2023/24 (FY 2023/24: 11.1%, FY 2022/23: 6.6%).

While the growth rate eased, the KES 164B absolute increase reflects continued revenue momentum driven by stronger second-half performance (+9.1% vs +4.5% in H1). Growth in FY 2024/25 was supported by improved customs collections (KES 879.3B, +11.1%), exchequer revenue (KES 2.323T, +4.5%), agency revenue (KES 248.3B, +34.9%), and domestic taxes (KES 1.688T, +4.8%).

Since FY 2021/22, KRA has added over KES 540B in new revenue, underlining the impact of sustained economic recovery, tax base expansion, and digital enforcement tools such as eTIMS.

Key Tax Heads:

PAYE: Up 3.3% year-on-year to KES 560.963B. The modest growth was dampened by increased use of adjustment vouchers to offset liabilities and recent policy changes that reclassified NHIF and Housing Levy deductions as pre-tax allowances rather than tax reliefs.

Domestic VAT: Up 4.2% year-on-year to KES 327.336B. The increase was driven by intensified compliance efforts, including stricter VAT registration, enhanced verification of returns, and the full rollout of the Electronic Tax Invoice Management System (eTIMS).

Corporation Tax: Up 9.9% year-on-year to KES 304.833B. This strong performance was underpinned by earnings growth in key sectors such as ICT, manufacturing, financial services, real estate, and trade, along with the application of KES 28.622B in adjustment vouchers.

Domestic Excise: Down 5.8% year-on-year to KES 69.385B. The decline reflects weaker remittances from beer and tobacco manufacturers, which fell by 13.9% and 8.9% respectively, following the rollback of the 15% excise duty that had boosted prior year collections.

Betting Taxes: Up 22.4% year-on-year to KES 18.933B. This sharp rise was supported by the full integration of 141 licensed betting firms into KRA systems, enhancing real-time tracking and compliance across the sector.

Adjustment Vouchers: Up 100% year-on-year to KES 49.673B. The surge reflects expanded taxpayer use of approved vouchers to offset tax obligations, with the largest allocations applied to Corporation Tax (KES 28.622B), PAYE (KES 10.422B), and Domestic VAT (KES 6.510B).

Other Notable Items:

Tax Amnesty: Up in FY 2024/25 with 3,512,835 taxpayers benefiting and waivers totaling KES 95.645B. Voluntary declarations brought in KES 29B by 116,144 taxpayers, a significant rise compared to 2.6M beneficiaries and KES 43.9B collected in FY 2023/24.

Taxation of the Digital Economy: Up 32% year-on-year to KES 14.3B. Growth is supported by expanded registration of non-resident digital platforms and a performance rate of 112%.

Tax Base Expansion: KES 24.9B collected through onboarding of 1.2M new taxpayers and the implementation of the Electronic Rental Income Tax System (eRITS), strengthening the formalization of rental income.

Debt Collection: Up 36.6% year-on-year to KES 141.261B, reflecting intensified recovery efforts compared to KES 103.390B the previous year.

Alternative Dispute Resolution (ADR): KES 15.296B recovered through 970 resolved cases, while litigation contributed an additional KES 65.09B.

Anti-Corruption Measures: KES 6.8B recovered through 821 whistleblower cases reported via iWhistle. Internally, 45 staff-related integrity cases were pursued.

Kenya’s Q1 25 Economic Highlights

The Kenya National Bureau of Statistics recently released economic data for the first quarter of 2025. Below are some key highlights:

Economic Growth: Kenya’s real GDP grew by 4.9% in Q1 2025, matching the growth rate recorded in the same quarter of 2024. All sectors posted positive growth, with agriculture expanding by 6.0% due to favourable weather. Strong performances were also noted in ICT (5.8%), trade (5.4%), real estate (5.3%), financial services (5.1%), and public administration (6.5%). Mining rebounded with 10.0% growth, while construction rose by 3.0%. Growth in accommodation and food services slowed sharply to 4.1% from 38.1% in Q1 2024, partly due to fewer visitor arrivals.

Currency Performance: The Kenyan Shilling strengthened across all major currencies in Q1 2025 compared to Q1 2024. It appreciated by 16.3% against the Euro, 14.2% against the Pound Sterling, and 13.6% against the US Dollar. Gains were also recorded against the Japanese Yen (15.9%) and South African Rand (11.7%). Regionally, the Shilling rose 16.7% against the Tanzanian Shilling and 9.6% against the Ugandan Shilling.

External Debt Rises on Higher Multilateral Lending: The stock of external debt held by the general government rose slightly from KES 5.41T in March 2024 to KES 5.48T in March 2025. Loans from multilateral, bilateral, commercial banks, and suppliers’ credit accounted for 76.4% of the total, with multilateral debt increasing by 8.4% to KES 2.88T. Loans from bilateral sources fell to KES 1.00T from KES 1.07T, while commercial debt declined by 32.3% to KES 291.9B. The stock of debt securities rose slightly to KES 1.29T, driven by an increase in International Sovereign Bonds from KES 943.3B to KES 972.3B. Meanwhile, non-resident holdings of government bonds dropped by 7.6% to KES 314.6B.

Trade Volumes Shrink as Exports and Imports Decline: Kenya’s total trade volume dropped from KES 980.5B in the first quarter of 2024 to KES 929.0B in the first quarter of 2025. Exports fell by 6.9% to KES 276.7B, while imports declined by 4.5% to KES 652.3B, narrowing the trade deficit slightly from KES 385.9B to KES 375.5B. Export earnings from Africa declined by 10.1% , with notable drops in shipments to Egypt, Ethiopia, South Sudan and DRC. Exports to Asia declined by 17.7% to KES 66.1B, largely due to reduced tea and jet fuel shipments. Exports to Europe fell by 10.4%, while earnings from the Americas dropped to KES 21.3B from KES 23.6B.

On the import side, Asia accounted for 68.3% of the total import bill, rising to KES 445.6B, mainly due to increased shipments from China, Saudi Arabia, and UAE. Imports from Europe declined to KES 83.4B, while imports from America fell by 22.5% to KES 50.5B. Imports from Africa also dipped to KES 66.9B, with Tanzania, South Africa and Eswatini recording notable reductions.

Current Account Deficit Widens on Lower Inflows: Kenya’s current account deficit widened to KES 66.6B in the first quarter of 2025 from KES 42.1B in the same period of 2024. This was mainly driven by a KES 45.5B decline in net inflows within the secondary income account, which fell to KES 230.9B. The merchandise trade deficit improved slightly to KES 306.1B from KES 313.3B, reflecting a larger decline in imports relative to exports. The services account posted a surplus of KES 82.3B, down from KES 83.8B, while the net primary income deficit narrowed from KES 89.0B to KES 73.8B, supported by lower debt servicing.

Diaspora Remittances: Total remittances declined to KES 161.0B in the first quarter of 2025, down from KES 180.9B in the same period of 2024, an 11.0% reduction.

Find the GDP report here and the balance of payments report here.

Markets Wrap

Below are some NSE highlights from week 27:

Market Performance: The Nairobi Securities Exchange closed lower in Week 28, with the NSE All Share Index slipping 1.31% to 159.1, while the NSE 20 and NSE 25 indices fell 4.05% and 1.17%, respectively. Market capitalization declined 1.36% to KES 2.50T. Equity turnover dropped sharply by 44.8% to KES 2.06B, while bond turnover was also down 32.3% to KES 31.99B. Foreign investor participation stood at 45.1% of total turnover (KES 929.98M), with a net inflow of KES 26.7M driven by strong net buying on Wednesday and Friday.

Kapchorua Tea led the week's gainers with a 14.4% rise to KES 321.50, followed by EA Portland Cement (+13.3%) and Olympia Capital (+11.7%). Sameer Africa was the top loser, shedding 12.0% to close at KES 5.42, while Crown Paints fell 8.7% and Longhorn Publishers declined 7.2%.

Last week in Corporate Actions & Announcements

Shri Krishna Overseas (SKL) Ltd announced that it will list by introduction on the Nairobi Securities Exchange (NSE) on Thursday, July 24, 2025.

Olympia Capital announced plans to increase its authorised share capital from KES 250M to KES 2.5B by creating 450M new ordinary shares at KES 5 each, subject to shareholder approval at the AGM on August 1, 2025.

BAT Uganda declared a final dividend of UGX 210 per share (totaling UGX 10.3B), to be paid on July 30, 2025, to shareholders on record as of July 25, following approvals at its 25th AGM held on July 3.

Sanlam Life Insurance appointed Jacqueline Karasha as CEO and Principal Officer effective June 1, 2025. She previously served as the Chief Sales Officer at Sanlam Life.

Treasury Bills: Treasury bills were undersubscribed last week, with a subscription rate of 94.9%, up from 90.9% the previous week. Investors submitted bids totaling KES 22.78B, and the Central Bank of Kenya (CBK) accepted KES 22.75B out of the KES 24B on offer. Yields on the 91-day and the 182-day T-bills declined by 0.33 and 0.96 basis points to 8.1421%, 8.4404% respectively while the 364-day T-bill increased by 0.84 basis points to 9.7218%.

FY 2025/26 First Bond: The government’s first bond auction of the new fiscal year saw strong investor demand, raising KES 66.7B against a KES 50B target—an oversubscription rate of 153.8%. The Central Bank received bids worth KES 76.9B for the two reopened bonds. The 20-year FXD1/2018/20 was allocated at a yield of 13.899%, while the 25-year FXD1/2018/25 cleared at 14.348%, up from 13.803% in its March 2025 reopening.

Eurobonds: Yields on six of Kenya’s seven outstanding Eurobonds declined last week, with the KENINT 2048 leading the drop, falling by 26.90 basis points to 10.451%. The KENINT 2028 followed, with its yield down 24.70 basis points to 8.044%, while the KENINT 2027 held steady at 6.979%. On average, Kenya’s Eurobond yields fell by 21.97 basis points week-on-week.

Market Gleanings

🗳️| Readying for 2027 Elections | President William Ruto has re-gazetted the appointment of Erastus Edung Ethekon as Chairperson of the Independent Electoral and Boundaries Commission (IEBC), along with six commissioners, following a High Court ruling that declared the previous gazette notice unlawful due to a breach of existing court orders. The court upheld the nomination process but directed the President to issue a fresh gazette notice. The new appointments, effective for a six-year term, will pave the way for the IEBC to oversee preparations for the 2027 General Election.

🔺| Trump Threatens 10% Tariff for Nations Backing BRICS | President Trump has responded swiftly and aggressively to growing BRICS interest, warning that any country aligning itself with the "Anti-American policies" of the bloc will face an additional 10% tariff. No exceptions. His remarks, posted on Truth Social just two hours ago, come barely two months after Kenyan President William Ruto stated in an April 2025 interview with China Daily that Kenya was assessing the possibility of joining BRICS. At the time, Ruto emphasized the strategic value of South-South cooperation and the potential benefits Kenya could leverage from BRICS membership. The sharp US reaction underscores how geopolitical lines are hardening as more countries in the Global South weigh pivoting away from Western-dominated alliances.

🛑| Nairobi–Mombasa Expressway PPP Halted | Kenya’s infrastructure PPP landscape saw mixed outcomes on July 2, 2025. The KES 468B ($3.6B), 419km Nairobi–Mombasa Expressway (Usahihi Express) suffered a major setback after the PPP Directorate rejected its Project Development Report, stating it "did not meet the relevant criteria and should be abandoned." Initially approved in December 2023 under a Privately Initiated Proposal (PIP) by Ever Strong Capital, the project may still be resubmitted under the PPP Act. In contrast, the 231km Nairobi–Nakuru–Mau Summit Highway PPP progressed, with two PIPs submitted by the CRBC–NSSF Consortium and Shandong SDRBI approved to enter the Project Development Phase. The highway forms a vital part of the Northern Corridor and Trans-African Highway network, supporting regional trade and connectivity.

🏍️| C&G Expects Motorbike Sales to Rebound | Car & General (C&G) is optimistic about a recovery in Kenya’s motorbike market following a slowdown last year, largely driven by a flood of repossessed second-hand units and reduced consumer spending. The company projects gradual growth in sales from the current 4,000 to 8,000 units per month before eventually hitting 15,000. The rebound is attributed to a decline in second-hand supply, Kenyans adjusting to new deductions such as the housing levy, and renewed demand for boda boda transport. C&G also sees potential in the electric motorbike segment, where it leads in e-bike distribution and aims to expand its footprint through a partnership with ARC Ride. However, the firm notes battery costs remain a major hurdle despite ongoing battery-swap solutions.

(Source: KBC)

🤝| Jubilee Plans Merger of Its Life and Health Insurance Units in Uganda | Jubilee Holdings is set to consolidate its Ugandan insurance operations, with Jubilee Health Insurance Company of Uganda Limited merging into Jubilee Life Insurance Company of Uganda Limited. The proposed amalgamation approved by both boards. If approved, Jubilee Life will become the unified entity offering both health and life insurance services.

🔴| StanChart Takes $217M Hit on Africa Exits | Standard Chartered recorded a USD 232M loss in 2024 from business disposals, with USD 217M of that linked to its operations in Africa. The bulk of the losses came from Zimbabwe at USD 172M, followed by USD 26M in Angola and USD 19M in Sierra Leone. These losses were primarily due to the recycling of foreign exchange translation losses into the profit and loss statement.

📄| KRA Now Requires Certificate of Origin for All Imports | Starting July 1, 2025, all goods imported into Kenya must be accompanied by a Certificate of Origin, following changes introduced under the Finance Act 2025. Previously limited to preferential trade arrangements, the requirement now applies to all consignments and must be issued by a recognized authority in the exporting country. Non-compliance may lead to seizure or forfeiture of goods, though a grace period runs until September 30, 2025, during which importers must commit in writing to full compliance.

🏭| Govt Halts Sugar Milling Over Cane Shortage | The government has ordered a three-month suspension of sugar milling in parts of Western Kenya starting July 14, 2025, due to a severe shortage of mature sugarcane. Affected factories include Nzoia, Butali, Mumias, Busia Sugar, and West Kenya’s Naitiri and Olepito units. The Kenya Sugar Board said the shutdown aims to curb losses from immature cane harvesting. At the same time, a new 4% Sugar Development Levy took effect on July 1, charged on the ex-factory price for local sugar and the Cost, Insurance, and Freight (CIF) value for imports, with KRA handling collections.

📄| CMA Grants Takeover Exemption in Sanlam Kenya Rights Issue | The Capital Markets Authority has granted Hubris Holdings and Sanlam Allianz Africa an exemption under Regulation 5 of the Takeover Regulations, allowing them to acquire up to 66.7% of Sanlam Kenya without triggering a mandatory takeover offer. The exemption follows their underwriting of untaken rights in the insurer’s recent KES 2.5B rights issue, which raised their combined stake from 62.30% to 71.47%. Any further acquisition up to 71.47% remains subject to separate approvals under the Insurance Act.

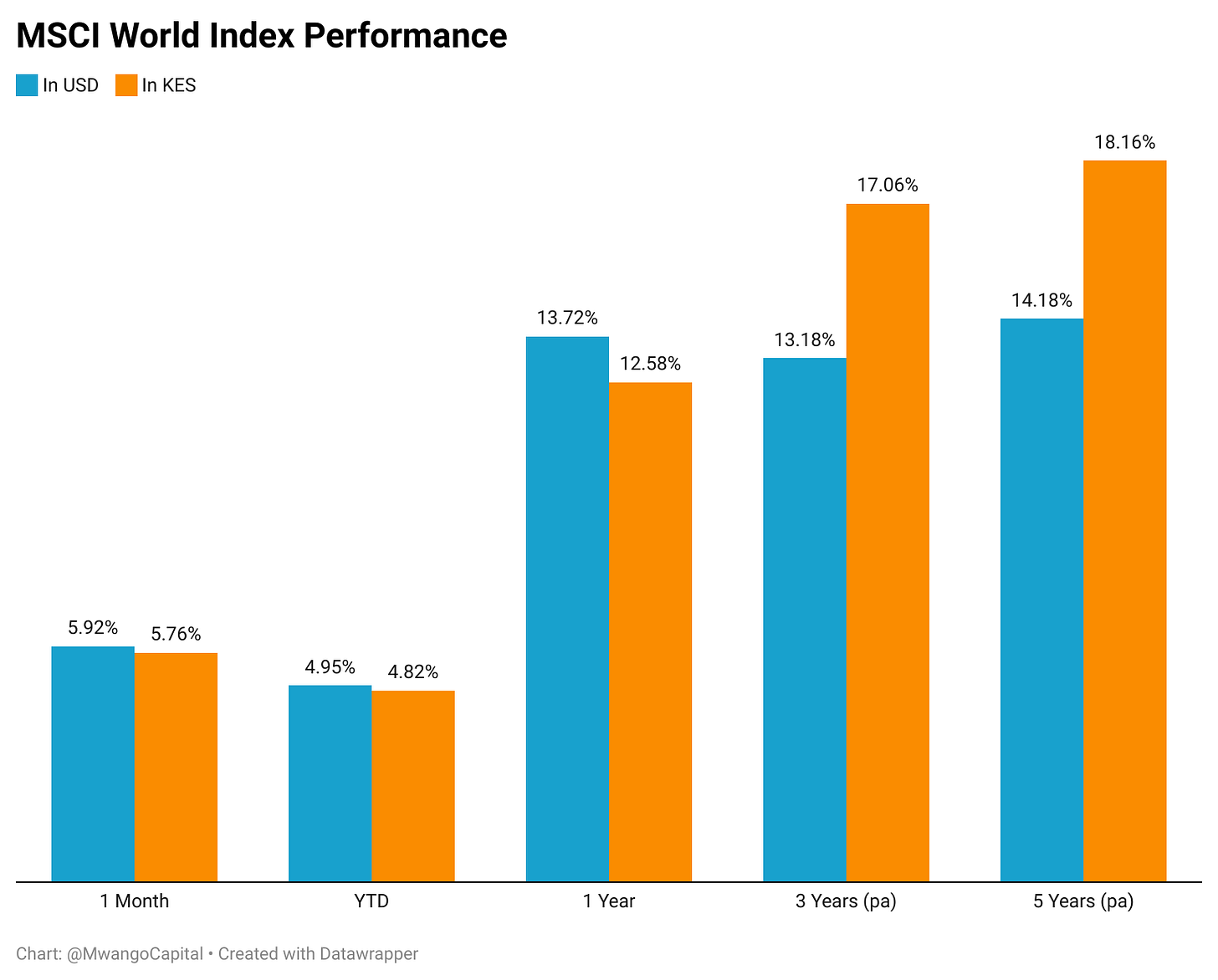

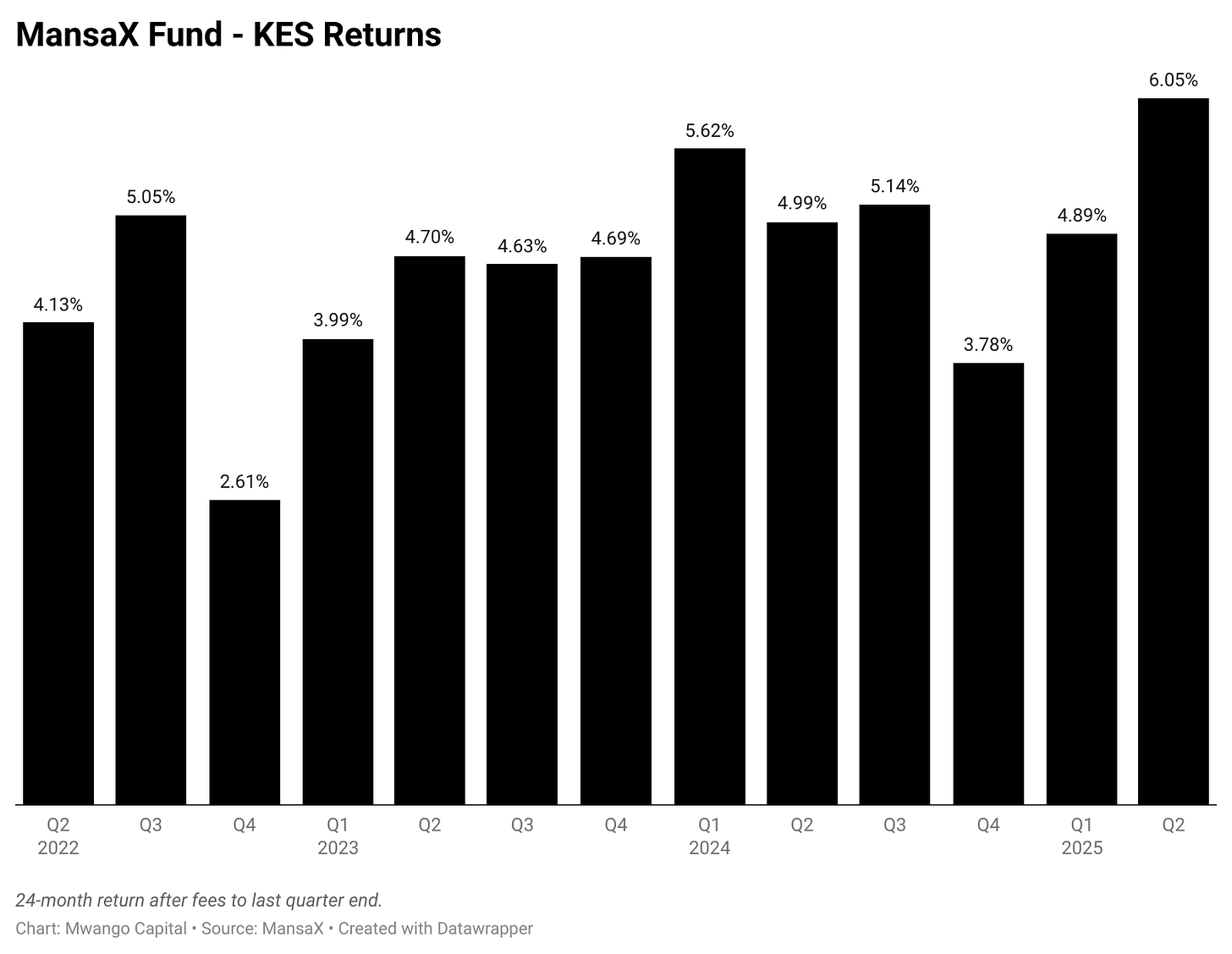

📊| Mansa-X Funds H1 2025 Returns | Mansa-X Special Fund KES posted a net return of 6.05% in Q2 2025, pushing its H1 2025 return to 10.94% and translating to a 6-month annualised net return of 21.88%. The fund’s assets under management grew by 27.3% (KES 17.76B) to close the quarter at KES 65.05B. Meanwhile, the USD-denominated fund returned 3.47% in Q2, bringing its H1 net return to 6.61% an annualised rate of 13.22%. Its AUM rose by 19.5% (USD 15.43M) to USD 78.8M.

🇪🇹| CBE Capital Executes First Trades on Ethiopian Securities Exchange | CBE Capital has executed Ethiopia’s first-ever inter-broker trades of government Treasury Bills, marking a key milestone at the official launch of the Ethiopian Securities Exchange (ESX). The investment bank also traded shares of Wegagen Bank and Gadaa Bank—the two companies listed on the exchange—during the first day of trading. The transactions mark a major step in the operationalization of Ethiopia’s capital markets following years of planning and reform.